Frank Larson Broadway Billboard Seven Year Itch 1955

As is the case with buybacks, this is all money that execs decide NOT to invest in a company (productivity, modernization, maintenance), but in its stock value.

• Global Dividends Hit Record Of $1.25 Trillion In 2017, More To Come (R.)

Global dividends rose 7.7% to an all-time high of $1.25 trillion (1 trillion euros) last year boosted by a buoyant world economy and rising corporate confidence, Janus Henderson said on Monday, predicting another record year ahead. The surge – the strongest since 2014 – was driven by increases in every region and almost every industry with record showings in 11 countries including the United States, Japan, Switzerland, Hong Kong, Taiwan and the Netherlands, the investment manager added. For 2018 Janus Henderson expects dividends to keep the same 7.7% growth rate to reach around $1.35 trillion, as corporate and economic growth remains strong even in more volatile financial markets. “Companies are seeing rising profits and healthy cash flows, and that’s enabling them to fund generous dividends.

The record payout last year was almost three-quarters higher than in 2009, and there is more to come,” Ben Lofthouse, Director of Global Equity Income at Janus Henderson, said. “The next few months are set fair, and we expect global dividends to break new records in 2018.” Adjusting for movements in exchange rates, special one-off dividends and other factors, global dividends rose 6.8% last year and are expected to rise another 6.1% in 2018. Janus said 2017’s dividend growth showed less regional divergence than in previous years, reflecting the broadly based global economic recovery, though Europe lagged behind. European dividends rose just 1.9% to $227 billion, weighed down by cuts from a handful of large companies in France and Spain, lower special dividends and a weak euro during the second quarter, when most dividends are paid, it said.

How can more debt not be good?

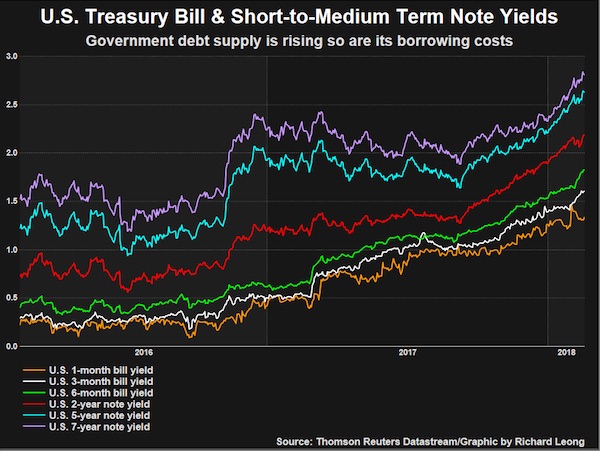

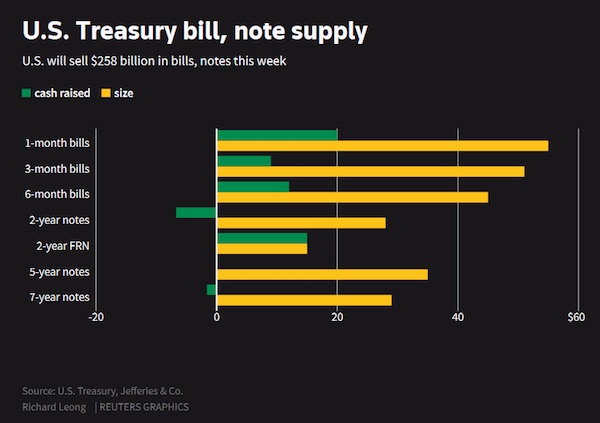

• Jittery US Bond Market Braces For Supply Wave (R.)

Bond investors, who have been on edge over signs of growing inflation and a possibly more aggressive Federal Reserve, will have their work cut out for them as the U.S. government seeks to sell $258 billion worth of debt this coming week. The Treasury Department began ramping up its debt issuance earlier this month to fund the expected growth in borrowing tied to the biggest tax overhaul in 30 years and a two-year federal spending package. Last year’s tax reform is expected to add as much as $1.5 trillion to the federal debt load, while the budget agreement would increase government spending by almost $300 billion over the next two years. Analysts worry the combination of a rising budget deficit, faster inflation and more Fed rate increases have ratcheted up the risk of owning Treasuries. Those concerns pushed benchmark 10-year Treasury yields up to 2.944%, a four-year peak last week.

Treasury bill and two-year yields have reached their highest level in more than nine years. The five-year Treasury yield is hovering at its highest levels in nearly eight years, while seven-year yield climbed to levels not seen since April 2011. The increase in U.S. yields may entice investors seeking steady income in the wake of the rollercoaster sessions on Wall Street and other stock markets this month, analysts said. [..] The heavy Treasury supply will kick off on Tuesday with $151 billion worth of bills including record amounts of three-month and six-month T-bills. The rest of the debt sales will spread over a holiday-shortened week with $28 billion of two-year fixed rate notes on Tuesday; $35 billion in five-year debt on Wednesday and $29 billion in seven-year notes on Thursday. The Treasury Department also plans to add $15 billion to an older two-year floating-rate issue.

Everything is debt. Imagine what would happen if it wasn’t there. Or soon won’t be.

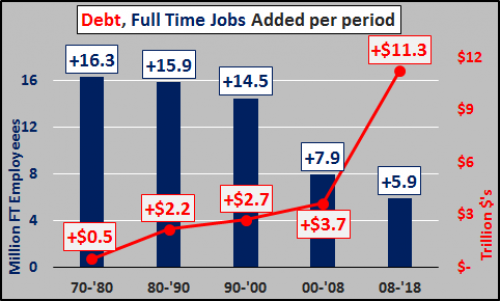

• How Did America Go Bankrupt? Slowly At First, Then All At Once (CH)

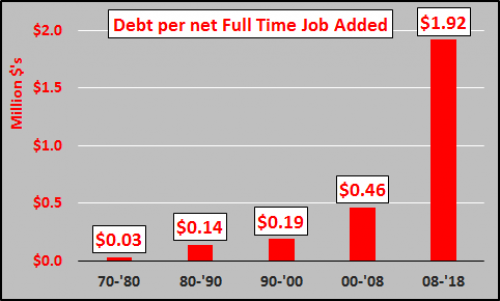

Clearly, debt has surged since 2000 and particularly since 2008 versus decelerating net full time jobs growth. The number of full time employees is economically critical as, generally speaking, only these jobs offer the means to be a home buyer or build savings and wealth in a consumer driven economy. Part time employment generally offers only subsistence level earnings. But if we look at the change over those periods highlighted, we get a clear picture. Full time jobs are being added at a rapidly declining rate while federal debt is surging in the absence of the growth of full time employees.

And if we look at the federal debt added per full time job added (chart below)…broken arrow…broken arrow!!! That is $1.92 million dollars in new federal debt per net new full time employee since 2008. Compare that to the $30 thousand per net new full time employee from ’70 to ’80…or $140 thousand from ’80 to ’90…and nearly quadruples the $460 thousand per from ’00 to ’08. Despite a far larger total population and after ten years of “recovery” since ’08, this is likely as good as it gets. We are likely at or very near the top of this economic cycle. This pattern is likely to carry forward over the next decade and economic cycle…likely with disastrous results.

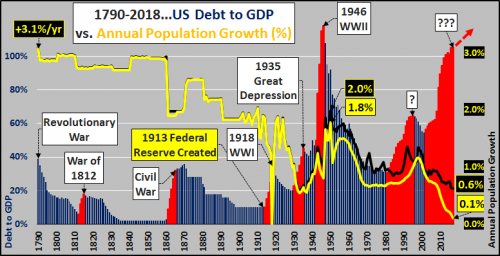

[..] US population growth has been decelerating since 1790 and debt to GDP rising (chart below). Originally, the combination of a relatively small population, high immigration, and high birth rates meant annual population growth in excess of 3% and relatively low debt to GDP. Over time, as the population grew, immigration slowed, and birth rates collapsed; US population growth tumbled. Since 1950 total annual population growth (black line in chart below) has decelerated almost 75% (from 2% to 0.6%) but more critically the annual population growth among the under 65 year old population has essentially ceased (as the yellow line in the chart shows) and more debt has been the resounding “solution”. Massive interest rate cuts to incent debt creation have been substituted for the decelerating organic growth.

About time.

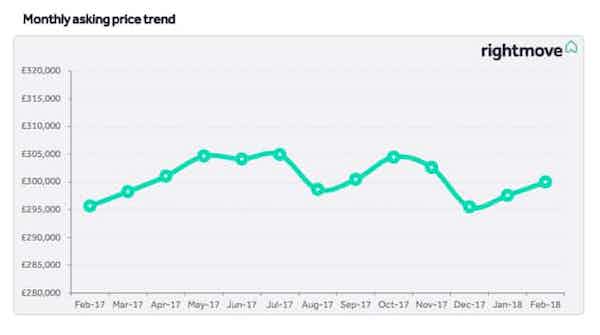

• London’s Housing Boom Is Over, Rightmove Says (BBG)

London’s property market has moved out of its boom phase and home sellers need to be more realistic about their price demands, according to Rightmove. The February report from the home-listing website shows that asking prices were down 1% from a year earlier, a sixth consecutive fall. They rose 4.4% on the month, reflecting the usual jump at the start of the spring season. While multiple reports point to a cooling in London housing, the damage is being limited by cautious sellers, who aren’t flooding the market in a panic to dump property. That means the long-running supply-demand imbalance in the city is providing some support to prices. “End-of-the-boom prices normally readjust more quickly if there is an over supply,” Miles Shipside, Rightmove director, said in the report. However, “some would-be sellers are holding back, preventing a glut of competition from forcing prices downward,” he said.

The capital’s housing market was the worst performing in the U.K. in 2017 and there’s little to suggest any upturn is in store. Brexit uncertainty has damped demand, while years of rampant inflation has pushed ownership out of reach for many. The mean asking price in London this month was almost 630,000 pounds ($885,000), more than 20 times average U.K. earnings. For those who need a fast sale, Shipside’s advice is to “sacrifice some of the substantial price gains of the last few years.” The average time to sell a property in London is now 83 days, up from 73 days a year ago. Nationally, asking prices increased 0.8% in February from January, though that was below the 10-year average for the time of year. The average price of 300,000 pounds is up 1.5% year-on-year. That compares with gains of about 6% seen less than two years ago.

But wait, this quotes Rightmove as well…

• Average Price Of Newly Marketed UK Home Rises Above £300,000 Again (G.)

The average price of a UK property coming on to the market has risen by more than £2,400 in a month to just over £300,000 amid evidence of “record” levels of house-hunting activity, according to Rightmove. The website, which tracks 90% of the UK property market, said the national average asking price for a home had increased by 0.8% during the past month, following the 0.7% rise it reported in mid-January. However, some sellers may be over-pricing their properties: the average time to sell has risen once again and is now 72 days, compared with 67 days a month ago and 55 during the summer of 2017. In London, the average has climbed to 83 days. Rightmove said that while it was the norm for new sellers’ asking prices to be buoyant at the start of a new year, “this first complete month in 2018 is seeing more pricing optimism than the comparable period in 2017”.

In general, however, sellers were not being over-ambitious or setting too high a price, it added. The website, which claims to display a stock of more than one million properties to buy or rent, said the average asking price now stood at £300,001, compared with £297,587 a month ago. It described January as its “busiest month ever”, with a record 141m website visits. In all the UK regions it tracks, the typical price of a newly-marketed property rose during the past month, with the exception of south-west England, where the figure slipped back slightly. Scotland saw the biggest monthly increase, at 5.1%, while the north-east and Wales managed 3.6% and 3.5%. However, on a national basis, the annual rate of price growth “remains subdued” at 1.5%, said the website.

Isn’t it?

• Ex-CIA Director Thinks US Hypocrisy About Election Meddling Is Hilarious (CJ)

Take off the terrorist’s mask, and it’s the CIA. Take off the revolutionary’s mask, and it’s the CIA. Take off the Hollywood producer’s mask, and it’s the CIA. Take off the billionaire tech plutocrat’s mask, and it’s the CIA. Take off the news man’s mask, and guess what? It’s the motherfucking CIA. CIA influence is everywhere. Anywhere anything is happening which could potentially interfere with the interests of America’s unelected power establishment, whether inside the US or outside, the depraved, lying, torturing, propagandizing, drug trafficking, coup-staging, warmongering CIA has its fingers in it. Which is why its former director made a cutesy wisecrack and burst out laughing when asked if the US is currently interfering in other democracies.

Fox’s Laura Ingraham unsurprisingly introduced former CIA Director James Woolsey as “an old friend” in a recent interview about Special Prosecutor Robert Mueller’s indictment of 13 alleged members of a Russian troll farm, in which Woolsey unsurprisingly talked about how dangerous Russian “disinformation” is and Ingraham unsurprisingly said that everyone should really be afraid of China. What was surprising, though, was what happened at the end of the interview. “Have we ever tried to meddle in other countries’ elections?” Ingraham asked in response to Woolsey’s Russia remarks. “Oh, probably,” Woolsey said with a grin. “But it was for the good of the system in order to avoid the communists from taking over. For example, in Europe, in ’47, ’48, ’49, the Greeks and the Italians we CIA-”

“We don’t do that anymore though?” Ingraham interrupted. “We don’t mess around in other people’s elections, Jim?” Woolsey smiled and said said “Well…”, followed by a joking incoherent mumble, adding, “Only for a very good cause.” And then they both laughed. They laughed about this. They thought it was funny and cute. They thought it was funny and cute that the very allegation being used to manufacture support for world-threatening new cold war escalations against a nuclear superpower was something they both knew the United States does constantly, usually through Woolsey’s own CIA. The US government’s own data shows that it has deliberately meddled in the elections of 81 foreign governments between 1946 and 2000, including Russia in the nineties. That isn’t even counting the coups and regime changes it facilitated, including right here in my home Australia in the seventies.

The US meddles constantly in other democracies, not “for a good cause” as Woolsey claims, but to advance the agendas of the loosely allied plutocrats, intelligence and defense agencies which comprise America’s permanent government. It does this not to improve or protect the lives of ordinary Americans, but to make the rich richer and the powerful more powerful, usually at the expense of the money, resources, homes, governments, livelihoods and lives of people in other countries. It does this with impunity and without hesitation.

Carmakers rule the country.

• German Carmakers In A Spin Ahead Of Diesel Ban Ruling (R.)

A court will decide on Thursday whether German cities can ban heavily polluting cars, potentially wiping hundreds of millions of euros off the value of diesel cars on the country’s roads. Environmental group DUH has sued Stuttgart in Germany’s carmaking heartland, and Duesseldorf over levels of particulate matter exceeding EU limits after Volkswagen’s 2015 admission to cheating diesel exhaust tests. The scandal led politicians across the world to scrutinize diesel emissions, which contain the matter and nitrogen oxide (NOx) and are known to cause respiratory disease. There are around 15 million diesel vehicles on German streets and environmental groups say levels of particulates exceed the EU threshold in at least 90 German towns and cities.

Local courts ordered them to bar diesel cars which did not conform to the latest standards on days when pollution is heavy, startling German carmakers because an outright ban could trigger a fall in vehicle resale prices, and a rise in the cost of leasing contracts, which are priced on assumed residual values. The German states concerned, where the carmakers and their suppliers have a strong influence, appealed against the decisions, leaving Germany’s federal administrative court – the court of last resort for such matters – to rule on whether such bans can legally be imposed at local level.

“The key question is whether bans can already be considered to be legal instruments,” said Remo Klinger, a lawyer for DUH. “It’s a completely open question of law.” Paris, Madrid, Mexico City and Athens have said they plan to ban diesel vehicles from city centers by 2025, while the mayor of Copenhagen wants to ban new diesel cars from entering the city as soon as next year. France and Britain will ban new petrol and diesel cars by 2040 in a shift to electric vehicles.

Big Brother is not worried.

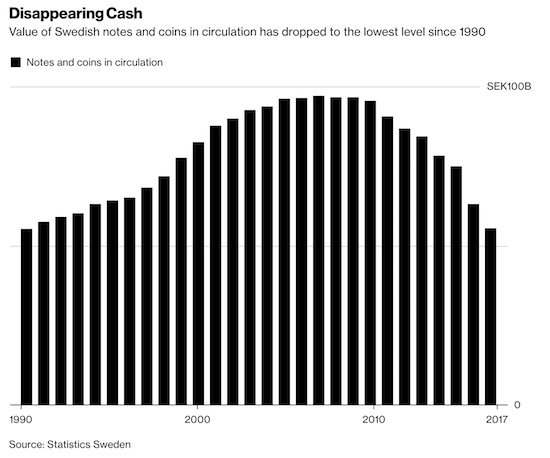

• Sweden Is Getting Worried About Its Cashless Society (BBG)

‘“No cash accepted” signs are becoming an increasingly common sight in shops and eateries across Sweden as payments go digital and mobile. But the pace at which cash is vanishing has authorities worried. A broad review of central bank legislation that’s underway is now taking a special look at the situation, with an interim report due as early as the summer. “If this development with cash disappearing happens too fast, it can be difficult to maintain the infrastructure” for handling cash, said Mats Dillen, the head of the parliamentary review. He declined to get into more details on what types of proposals could be included in the report. Sweden is widely regarded as the most cashless society on the planet. Most of the country’s bank branches have stopped handling cash; many shops, museums and restaurants now only accept plastic or mobile payments.

But there’s a downside, since many people, in particular the elderly, don’t have access to the digital society. “One may get into a negative spiral which can threaten the cash infrastructure,” Dillen said. “It’s those types of issues we are looking more closely at.” Last year, the amount of cash in circulation dropped to the lowest level since 1990 and is more than 40 percent below its 2007 peak. The declines in 2016 and 2017 were the biggest on record. An annual survey by Insight Intelligence released last month found only 25 percent of Swedes last year paid in cash at least once a week, down from 63 percent just four years ago. A full 36 percent never use cash, or just pay with it once or twice a year.

There is no such thing as one Europe. And the more the EU promotes the narrative, the more that will become obvious.

• Europe Is A Collection Of Filter Bubbles (BBG)

The EU can act in unison at times – for example, on Russia sanctions or, at least so far, on Brexit. But as French President Emmanuel Macron and German Chancellor Angela Merkel try for a closer union in the next few years, they will need to be mindful of the fact that there is no single narrative among the publics in different European countries on matters of economic importance. A recent paper for Bruegel, a Brussels-based think tank, vividly shows this by analyzing coverage of Europe’s recent financial crisis by four important centrist newspapers: Germany’s Sueddeutsche Zeitung, France’s Le Monde, Italy’s La Stampa and Spain’s El Pais. The total data set encompassed 51,714 news stories. The researchers fed them to a content analysis algorithm and then analyzed the results to construct generalized narratives. Their focus was on how blame for the crisis was attributed.

They found that only El Pais consistently attributed blame to Spain itself for its financial troubles during the euro crisis. “In Spain, the connection between the global financial crisis, the local housing bubble and the mismanagement of a previous period of impressive growth was more visible,” Porcaro explained to me. As one might expect, Sueddeutsche Zeitung blames the crisis on a departure from the traditional German social market economic model. Everyone except Germany seems to have contributed, according to the Munich paper — from greedy financial market players to financially imprudent Greeks to the ECB with its loose monetary policy. Le Monde, too, blamed the banks and speculators, but also German intransigence in handling the indebted southern Europeans.

And La Stampa focused on Italy’s role as a victim of circumstance, namely globalization and German-imposed austerity. Banks and financiers didn’t get much attention as culprits from the Italian newspaper, but the Italian political system and government did get some blame, as in Spain. Le Monde and La Stampa, according to the Bruegel paper, both “embrace a sense of desperation that goes far beyond purely economic considerations but calls into question the entire political system and social fabric.” It’s as if the euro area’s four biggest economies didn’t share a reality. The four quality dailies resemble the blind men in the Indian parable, feeling different parts of an elephant’s body, declaring the whole animal should look like a tree or a snake, then coming to blows when they can’t agree.

Home › Forums › Debt Rattle February 19 2018