Jack Delano AT&SF Railroad locomotive shops, San Bernardino, CA 1943

So predictable one must wonder what Xi was/is thinking. A lot of money is being lost in China, and much of it by mom and pop. They’re not going to like it.

• Iron Ore Goes From Boom To Bust In Just Three Weeks (BBG)

Don’t say there wasn’t any warning. Iron ore’s gone from boom to bust in the space of just three weeks, fulfilling predictions for a slump in prices that were jacked up to unsustainable levels by a short-lived speculative frenzy in China. The SGX AsiaClear contract for June settlement in Singapore sank as much as 3.5% to $48.64 a metric ton in Singapore [..] It’s collapsed 12% this week, the most since December, after losing 11% the week before. In Dalian, iron ore futures plunged on Friday to the lowest since February as steel in Shanghai headed for the biggest weekly loss on record.

Iron ore and steel are buckling once again after widespread predictions that the trading frenzy in China that had propelled prices upward in April wouldn’t endure as regulators clamped down and the rallies themselves induced higher production. Iron ore stockpiles at ports in China have expanded to near 100 million tons, while mills produced more steel than ever in March. Lower steel prices erode mills’ margins, cutting their ability to restock on iron ore, according to China Merchants Futures. “As steel profits have dropped sharply recently, the desire to replenish iron ore stocks is not strong,” said Zhao Chaoyue, an analyst at China Merchants, said in a note on Friday. “Supplies of steel are recovering as demand weakens. Steel prices remain vulnerable.”

Among those that foresaw a retracement, Goldman Sachs said on April 22 that iron ore’s rally was unsustainable, and a tight steel market in China was a “temporary distraction” from fundamentals. Days later, Fitch said the surge in steel prices wouldn’t last. And at the end of last month, Brazil’s Itau Unibanco said iron would soon drop by $10, describing the speculation as a short-term issue. Spot iron ore with 62% content delivered to Qingdao fell 0.9% to $55.05 a dry ton on Thursday, according to Metal Bulletin. Prices have sunk 22% since they peaked at more than $70 last month.

Read more …

China’s commodity casino starts to spread its losses…

• With $100 Billion In Debt, Glencore Emerges As The Next Lehman (ZH)

One week ago, in a valiant attempt to defend the stock price of struggling commodity trading titan Glencore, one of the company’s biggest cheerleaders, Sanford Bernstein’s analyst Paul Gait (who has a GLEN price target of 450p) appeared on CNBC in what promptly devolved into a great example of just how confused equity analysts are when it comes to analyzing highly complex debt-laden balance sheets. In the clip below, starting about 2:30 in, CNBC’s Brian Sullivan gets into a heated spat with Gait over precisely how much debt Glencore really has, with one saying $45 billion the other claiming it is a whopping $100 billion. The reason for Gait’s confusion is that he simplistically looked at the net debt reported on Glencore’s books… just as Ivan Glasenberg intended.

However, since Glencore – like Lehman – is first and foremost a trading operation, one also has to add in all the stated derivative exposure (something we did ten days ago), in addition to all the unfunded liabilities, off balance sheet debt, bank commitments and so forth, to get a true representation of just how big, or rather massive, Glencore’s true risk is to its countless counterparties. Conveniently for the likes of equity analysts such as Gait and countless others who still have GLEN stock at a “buy” rating, Bank of America has done an extensive analysis breaking down Glencore’s true gross exposure. Here is the punchline:

“We consider different approaches to Glencore’s debt. Credit agencies, such as S&P, start with “normal” net debt, i.e. gross debt less cash and then deduct some share (80% in the case of S&P of “RMIs” – Readily Marketable Inventories. These are considered to be “cash like” inventories (working capital) in the marketing business. At the last results, RMIs were about US$17.7 bn. Giving full credit for RMIs plus a pro-forma for the equity raise and interim dividend we derive a “Glencore Adjusted Net Debt” of c. US$28 bn.

On the other hand, from discussions with our banks team, we believe the banks industry (and ultimately regulators) may look at the number i.e. gross lines available (even if undrawn) + letters of credit with no credit for inventories held. On this basis, we estimate gross exposure (bonds, revolver, secured lending, letters of credit) at c. $100 bn. With bonds at around $36 bn, this would still leave $64 bn to the banks’ account (assuming they don’t own bonds).”

Read more …

Never listen to people predicting black swans.

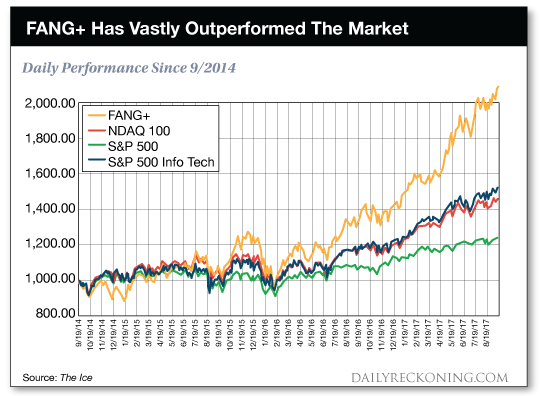

• China Bubble Set To Rock Global Markets (CNBC)

For the moment, the following is the shock NOT heard ’round the world … at least not yet. Rampant speculation in China’s commodities markets could very well be the next “black swan” event that rocks global markets and possibly the global economy. Though very little attention has been paid to this recent action, speculative excesses in China’s commodity markets have taken traders and investors on a wild ride, which may likely soon spill over to the rest of the world. Trading volumes and volatility have been so extreme they make the recent swings in Shanghai and Shenzhen’s stock markets look mild by comparison. Chinese speculators have driven up, and then down, the prices of everything from iron ore to steel, and from soybeans to egg futures.

Prices in most of these commodities have fallen back to earth after massive, but relatively brief, spikes in prices. But, that’s not to say more damage hasn’t been done to China’s already fragile market system and economy. One truly astonishing feature of this bout of speculation is that the average holding period of a commodity futures contract was just three hours in April, according to Bloomberg. That makes other speculative trading episodes look like long-term investing. It also suggests a massive appetite for risk, which in and of itself, is potentially destabilizing, both in China and, by extension, elsewhere in the world. Why do we care? Well, first of all, the recent rebound in commodity prices, here at home, and the affiliated rebound in raw materials stocks, could have been driven, at least in part, by those very speculative excesses in China.

It also means that the rebound in inflation expectations could be a false signal, which on its face, reads as an indicator of a rebound in demand for raw materials, or a sign that the global economy could be stabilizing and re-accelerating. That’s the type of false signal that could convince the Fed that inflation is accelerating, causing them to mistakenly raise rates. While that hasn’t happened yet, it is a risk that bears watching. The “fake-out breakout” also could have suggested that supply of, and demand for, raw materials is coming back into balance in a world burdened by a commodity glut. That, too, appears to be have been a diversion. There is still more cotton, more copper, more steel and more soybeans than the world demands. The market-based signaling matrix appears to be broken thanks to this bout of speculative excess.

This is the Wild Wild East of markets these days. After speculating excessively in real estate a few years ago, in stocks last year, driven by heavy margin buying and then a crash, Chinese investors and traders have quickly moved on to commodities. These rolling bubbles are making the Chinese economy more and more unstable and more susceptible to a much-feared “hard landing” in the economy. That has implications for the Mild Mild West, where growth has been hard to come by and could be upended by another deceleration in Chinese economic activity.

Read more …

Yup. China again.

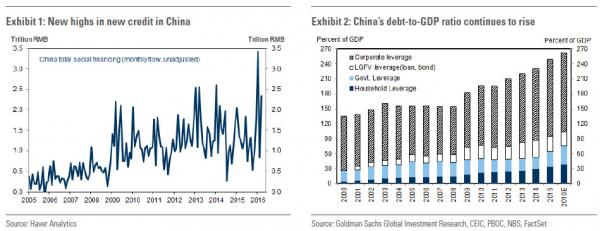

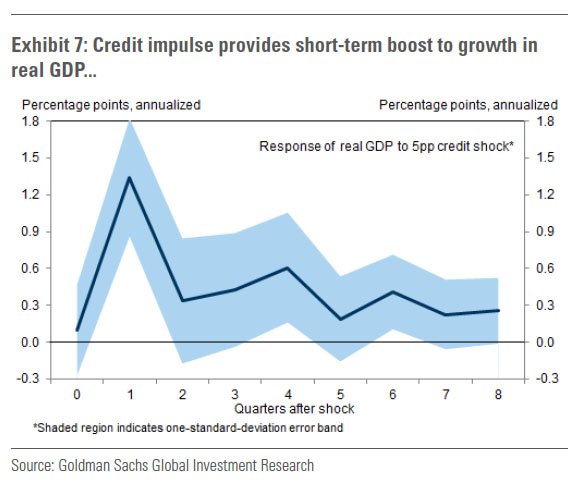

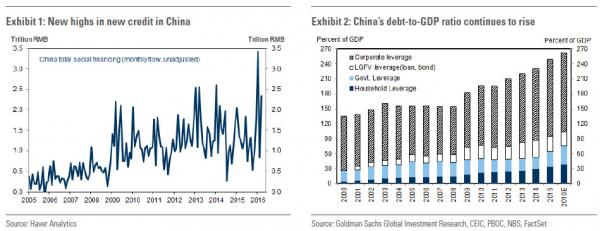

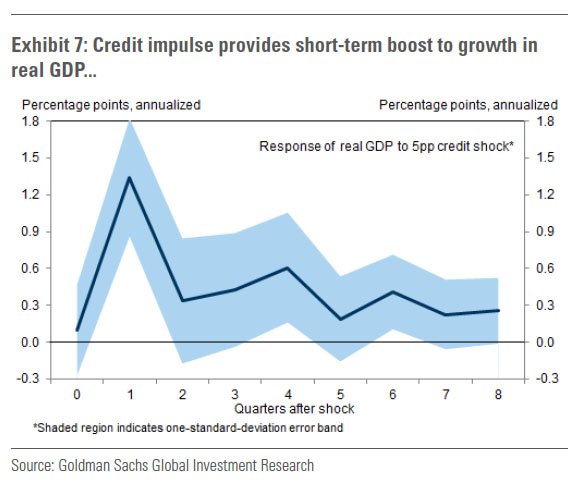

• The Biggest Source Of Global Growth In 2016 Is About To Hit A Brick Wall (ZH)

After issuing a record $1 trillion in combined bank and shadow loans in the first quarter which just like during the financial crisis provided a short-term boost to global growth (while sending China’s debt/GDP to all time highs), China’s dramatic debt issuance binge is about to hit a brick wall. According to MarketNews, Chinese bank loan growth is expected to slow sharply in April compared with March as the pillar of bank lending, mortgage loans, slowed as the property market cooled. Citing bank officials, the news service said that robust first-quarter lending almost depleted their resources, making it difficult to find good targets to lend to, which also hurt loan growth. It also means that suddenly the credit impulse that drove both Chinese and global growth for the past two months is about to evaporate.

How big is the drop? Sources familiar with the loan number told MNI that combined new loans in April by the Big Four state-owned banks were more than halved from March’s level. As a reminder, the Big Four banks lent out CNY402 billion in March, according to the People’s Bank of China. While there is no preview of how bit (or small) the combined TSF number will be, it is safe to assume it will be a far smaller total than the CNY2.34 trillion in total social financing that flooded the Chinese economy in March. The slowdown mainly came from moderating mortgage growth, which has been the key driving force behind loan growth so far this year. In the city of Shanghai, mortgage loans hit a record high of CNY36.1 billion in March, beating the previous record of CNY34.6 billion set in January, according to PBOC data.

The PBOC said the country’s total outstanding mortgage loan was up 25.5% y/y at the end of March, much faster than the 14.7% of average outstanding loan growth. But that mortgage strength in the first quarter failed to continue into April as property sales growth slowed sharply on government tightening measures. According to Essence Securities, new residential house sales in tier one cities, namely Beijing, Shanghai, Guangzhou and Shenzhen, fell 21.2% on month in April and only edged up 0.5% from a year ago, including a 38.6% m/m and 30.8% y/y plunge in the city of Shenzhen, which leads the current round of property rebound. But if April was bad, May was a disaster: “it appears the situation is even worse into May. Shenzhen saw house sales in the first week of May plummet another 49% when compared with the previous week, dragging year-to-date sales into a 1% drop in terms of floor space.”

Read more …

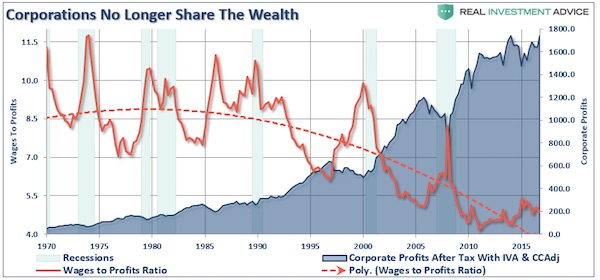

More on the Rew report. It warrants attention, lots of it. It paints the real picture of America. And that’s with Pew’s perhaps somewhat distorting definition of ‘middle class’, which includes 3-person households with incomes of up to $125,000. This may be statistically correct if you try hard enough, but an awful lot of people living on $40,000 or less will not agree.

• Middle Class Shrinks In 9 Of 10 American Cities As Incomes Fall (AP)

In cities across America, the middle class is hollowing out. A widening wealth gap is moving more households into either higher- or lower-income groups in major metro areas, with fewer remaining in the middle, according to a report released Wednesday by the Pew Research Center. In nearly one-quarter of metro areas, middle-class adults no longer make up a majority, the Pew analysis found. That’s up from fewer than 10% of metro areas in 2000. That sharp shift reflects a broader erosion that occurred from 2000 through 2014. Over that time, the middle class shrank in nine of every 10 metro areas, Pew found. The squeezing of the middle class has animated this year’s presidential campaign, lifting the insurgent candidacies of Donald Trump and Bernie Sanders.

Many experts warn that widening income inequality may slow economic growth and make social mobility more difficult. Research has found that compared with children in more economically mixed communities, children raised in predominantly lower-income neighborhoods are less likely to reach the middle class. Pew defines the middle class as households with incomes between two-thirds of the median and twice the median, adjusted for household size and the local cost of living. The median is midway between richest and poorest. It can better capture broad trends than an average, which can be distorted by heavy concentrations at the top or bottom of the income scale.

By Pew’s definition, a three-person household was middle class in 2014 if its annual income fell between $42,000 and $125,000. Middle class adults now make up less than half the population in such cities as New York, Los Angeles, Boston and Houston. “The shrinking of the American middle class is a pervasive phenomenon,” said Rakesh Kochhar, associate research director for Pew and the lead author of the report. “It has increased the polarization in incomes.”

Read more …

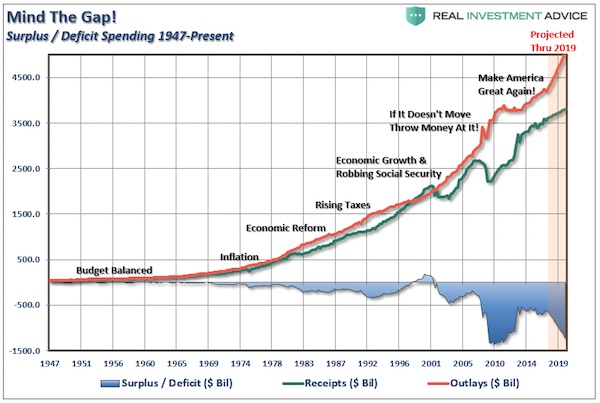

‘We spend money we don’t have and blithely mortgage the future with a wink and a nod. Screw the next generation..’ [..] ‘Nobody here gives a rat’s a** about the future and who’s going to pay for all this stuff we vote for. That’s the next generation’s problem. It’s all about immediate publicity, getting credit now, lookin’ good for the upcoming election.’

• Congressman X: ‘Screw The Next Generation’ (DM)

A new book threatens to blow the lid off of Congress as a federal legislator’s tell-all book lays out the worst parts of serving in the House of Representatives – saying that his main job is to raise money for re-election and that leaves little time for reading the bills he votes on. Mill City Press, a small Minnesota-based ‘vanity press’ publisher describes ‘The Confessions of Congressman X’ as ‘a devastating inside look at the dark side of Congress as revealed by one of its own.’ ‘No wonder Congressman X wants to remain anonymous for fear of retribution. His admissions are deeply disturbing.’ The 84-page exposé is due in bookstores in two weeks, and Washington is abuzz with speculation about who may be behind it.

The book, a copy of which DailyMail.com has seen, discloses that the congressman is a Democrat – but not much else. The anonymous spleen-venter has had a lot to say about his constituents, however. Robert Atkinson, a former chief of staff and press secretary for two congressional Democrats, took notes on a series of informal talks with him – whoever he is – and is now publishing them with his permission. ‘Voters claim they want substance and detailed position papers, but what they really crave are cutesy cat videos, celebrity gossip, top 10 lists, reality TV shows, tabloid tripe, and the next f***ing Twitter message,’ the congressman gripes in the book. ‘I worry about our country’s future when critical issues take a backseat to the inane utterings of illiterate athletes and celebrity twits.’

Much of what’s in the book will come as little surprise to Americans who are cynical about the political process. ‘Fundraising is so time-consuming I seldom read any bills I vote on,’ the anonymous legislator admits. ‘I don’t even know how they’ll be implemented or what they’ll cost.’ ‘My staff gives me a last-minute briefing before I go to the floor and tells me whether to vote yea or nay. How bad is that?’ And on controversial bills, he says, ‘I sometimes vote “yes” on a motion and “no” on an amendment so I can claim I’m on either side of an issue.’ ‘It’s the old shell game: if you can’t convince ’em, confuse ’em.’

Read more …

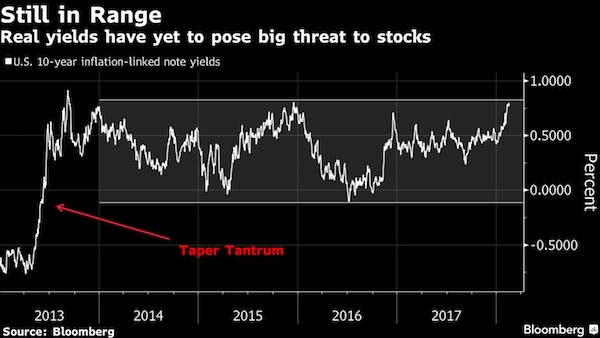

“There is no evidence that 0% is better than 3%. Show me the evidence.”

• Nassim Taleb Compares Monetary Policy to Novocaine (BBG)

Nassim Taleb, distinguished scientific advisor at Universa Investments and New York University professor of risk engineering, discusses monetary policy. He speaks with Erik Schatzker from the SALT Conference in Las Vegas, Nevada on “Bloomberg Markets.”

Read more …

As Taleb says in the video above, Yellen is a very smart person but one who’s only recently found out that she’s stuck.

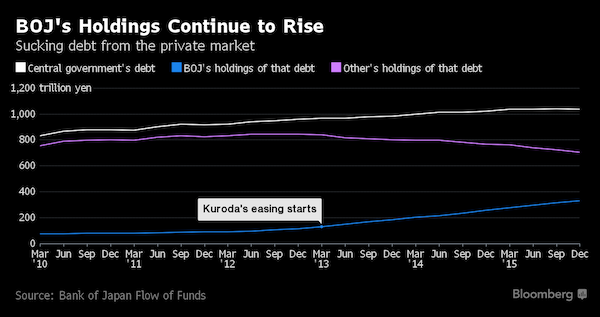

• Yellen Says Won’t Completely Rule Out Negative Rates (R.)

Fed Chair Janet Yellen said on Thursday that while she “would not completely rule out the use of negative interest rates in some future very adverse scenario,” the tool would need a lot more study before it could be used in the United States. Yellen, in responses to written questions from U.S. Congressman Brad Sherman following her February testimony on Capitol Hill, said the Fed plans to raise interest rates gradually, given its expectations that the economy will continue to strengthen and inflation will move back up to the Fed’s 2% goal. She also said that if the economy unexpectedly takes a turn for the worse, the Fed will adjust its stance. Central banks in Europe and Japan have used negative interest rates to try to stimulate their economies, and Yellen said the Fed is attempting to learn as much as it can from their experiences. Before using negative rates at home, she said, policymakers would need to consider a number of issues, “including the potential for unintended consequences.”

Read more …

Charles revisits a theme Nicole and I talked a lot about in the past: “.. in effect, anyone “owning” a home with high property taxes is leasing the property from the local government for the “right” to gamble that a new housing bubble is underway.” As Nicole puts it: “..renting is paying somone else to carry the risk of owning..”.

• Dear Homeowner, What Exactly Do You “Own”? (CH Smith)

We’re constantly told ours is an ownership society in which owning a home is the foundation of household wealth. The concept of ownership may appear straightforward, but consider these questions: 1. If the house is mortgaged, what does the homeowner “own” when the bank has the senior claim to the property? 2. If the homeowner owes local government $13,000 a year in property taxes, what does the homeowner “own” once they pay $260,000 in property taxes over 20 years? The answer to the first question: the homeowner only “owns” the homeowners’ equity, the market value of the home minus the the mortgage and closing costs. In a housing bubble, homeowners’ equity can soar as the skyrocketing value accrues to the homeowner, as the mortgage is fixed (in conventional mortgages). But when bubbles pop and housing prices return to reality-based valuations, the declines also accrue to the homeowner’s equity.

If the price declines below the mortgage due the lender, the homeowners’ equity vanishes and the property is underwater. The property may still be worth (say) $400,000, but if the mortgage(s) total $400,000, the owner owns nothing but the promise to pay the mortgage and property taxes and the right to claim a tax deduction for the mortgage interest paid. To answer the second question, let’s consider an example. In areas with high property taxes (California, New Jersey, New York, Illinois, etc.), annual bills in excess of $10,000 annually are not uncommon. If we take $13,000 annually as a typical total property tax in these areas (property taxes can include school taxes, library taxes, and a host of special assessments on top of the “official” base rate), the homeowner “owns” the obligation to pay local tax authorities $130,000 per decade for the right to “own” the house.

In states without Prop 13-type limits on how much property taxes can be raised, there is no guarantee that property taxes won’t jump higher in a decade, but for the sake of simplicity, let’s assume the rate is unchanged. In 20 years of ownership, the homeowner will pay $260,000 in property taxes.Let’s compare that with the rise in their homeowners’ equity. Since home values are high in high-tax regions, let’s assume a $400,000 purchase price with an $80,000 down payment and a conventional 4% 30 year mortgage of $320,000. In 20 years of mortgage and tax payments, the homeowners paid about $197,500 in interest to the bank (deductible from their income taxes), and about $170,000 in mortgage principle, leaving them total homeowner’s equity of the $80,000 down payment and the $170,000 in principle, or a total of $250,000. Since they paid $260,000 in property taxes in the period, have they gained anything?

If we look at the property as merely leased from the local government for the annual fee of $13,000, then was “ownership” a good deal for the local government or for the homeowner? If the homeowner subtracts the lease fee (i.e. property taxes) from their equity, they are underwater by $10,000. The real estate industry answer is that “ownership” is great because the skyrocketing appreciation accrues to the homeowner. If the house doubles in value from $400,000 to $800,000 in a decade, who cares about the $130,000 in property taxes paid? If we subtract this $130,000 lease fee, the homeowner would still pocket a hefty profit: $800,000 sales price minus the $400,000 purchase price, the $130,000 in property taxes, the costs of 10 years of maintaining the home and the selling commission and closing fees. So in effect, anyone “owning” a home with high property taxes is leasing the property from the local government for the “right” to gamble that a new housing bubble is underway.

Read more …

Greece has a major payment to the ECB coming in July. Something will be found, but it will not be advantageous to Athens.

• IMF Under Pressure From Germany Over Greece (WSJ)

In Europe’s battle with the IMF over Greece, Germany has a way to win. Germany, Europe’s dominant economic power, is leaning heavily on the IMF to accept hypothetical assurances that Greece’s debt burden will be addressed in the future if needed, rather than the definite and far-reaching debt relief that the IMF wanted, according to people familiar with the talks. Berlin believes the IMF will have to accept what’s on offer, even if IMF staff are unhappy about it, these people say. The IMF is also under heavy European pressure to accept Greek austerity policies that are less specific than the cuts the IMF wanted. An accord hasn’t been reached yet, and some warn it could take several weeks. The IMF’s Achilles’ heel: Its board is controlled by Germany, other European Union countries, and the U.S., none of whom want a new crisis over Greece.

That power reality weakens the IMF’s threat to pull out of the Greek bailout if it is unsatisfied. The EU currently faces multiple challenges that threaten to unravel the 60-year-old project of European integration, including the U.K.’s referendum on leaving the bloc, the migration crisis, and the rise of EU-skeptic populist parties. Germany and other European governments have no appetite for another round of brinkmanship over Greece like in 2015, and want a deal in coming weeks that settles Greece’s future—at least for now. Any deal is nevertheless likely to include some important concessions to the IMF. German Finance Minister Wolfgang Schäuble -who until recently adopted the hard-line stance in public that Greece needs no debt relief at all- has already permitted discussions to start this week about how eurozone loans to Greece might be restructured in the future.

A deal, which many European officials are now confident of reaching in late May or early June, is expected to include a promise by Germany and other eurozone countries to keep Greece’s debt burden below a certain threshold. That promise would entail easing the terms of Greece’s loans “if necessary.” Crucially for Berlin, however, any decision to restructure the loans would be delayed until 2018—after Germany’s 2017 elections. Mr. Schäuble and his boss, Chancellor Angela Merkel, are determined to avoid, for now, any material change to Greece’s bailout plan that would force them to hold an awkward debate in Germany’s parliament, the Bundestag, according to people familiar with their thinking.

An accord on Greek debt and austerity would allow Athens to stay afloat this summer, when large bonds fall due. But it is unlikely to resolve the country’s seven-year-old debt crisis. Participants in the troubled bailout are braced for further drawn-out negotiations in coming years about Greece’s fiscal and other overhauls. The main source of this year’s re-escalation of the Greek debt saga is Germany’s insistence that it cannot release any further bailout funds unless the IMF agrees to resume its own lending to Athens. IMF lending has been in limbo since last July, when IMF staff stated that “Greece’s public debt has become highly unsustainable.”

Read more …

One day perhaps more people will start to understand this. Germany is blowing up the eurozone. And the EU. The Q1 2016 growth announced today more than doubled, and that just makes it that much worse.

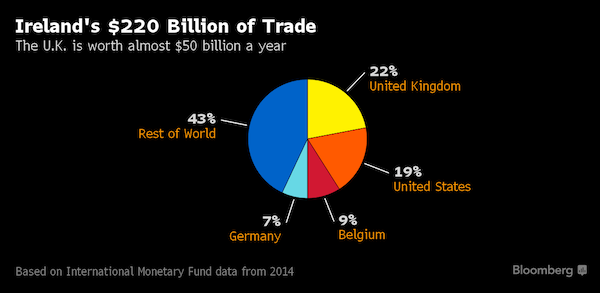

• The German Current Account Surplus Requires Deficits Elsewhere (Harrison)

With the periphery’s downturn came austerity and internal devaluation. And this has meant two adjustments. First, the EU as a whole has moved from a roughly balanced external position to a net creditor position as the German and Dutch export-led model is forced onto the periphery via internal devaluation used to achieve export competitiveness. Second, the Germans and Dutch have been forced to turn elsewhere to maintain their mercantilist trading stance. And they have found willing buyers in Asia and the emerging markets writ large.

The thing to realize about multilateral trade is that the imbalances do not necessarily build up as bilateral imbalances between two countries. Rather, imbalances build multilaterally, with some countries – particularly the reserve-currency holding US – taking on the net debtor position. And we see that now, with the UK showing record trade deficits at the same time Germany is sporting huge surpluses. The IMF faults Germany for the surplus. Martin Wolf faults Germany for this too. Irrespective, there is no mechanism in the current global currency system to correct these imbalances except through balance of payments crisis and the rise of protectionist populist politicians.

And so my conclusion here is that these imbalances will only shift in a crisis – like the one we experienced within the eurozone. Except next time, the crisis will be global. It would be nice to think that world leaders would understand that dangerous imbalances are building that feed a populist and violent political response. Alas, there is no indication that the Germans or any other net surplus country gets this. And while the Swiss and the Dutch are small trading nations, Germany is a global behemoth. Like China, it will attract negative attention when the economy turns down. And the Germans will get the blame when the trade barriers go up. Right now, it seems only a matter of when not if.

Read more …

In which the Economist is found short of ideas.

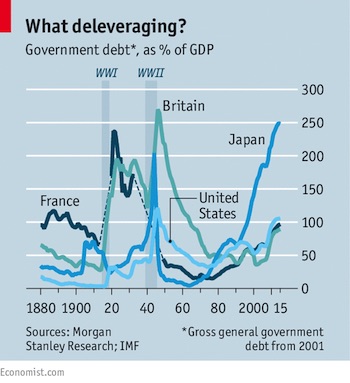

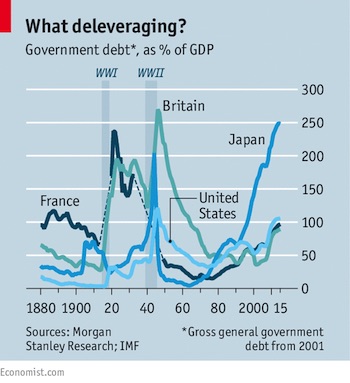

• Ideas For Reducing The Debt Burden (Economist)

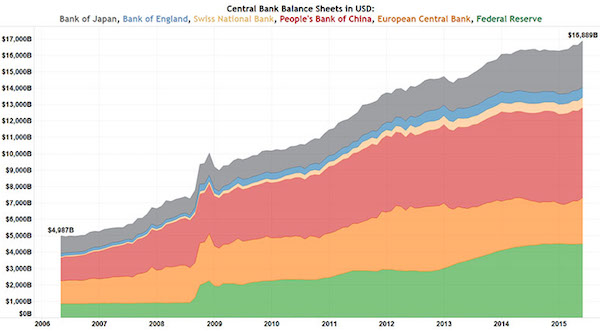

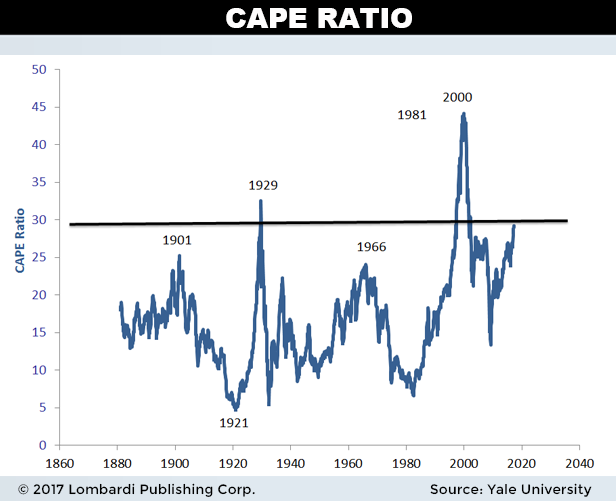

DEBT levels grew spectacularly in the rich world from 1982 to 2007. When the financial crisis broke, worries about the ability of borrowers to repay or refinance that debt caused the biggest economic downturn since the 1930s. It could have been worse. The danger was that, as private-sector borrowers scrambled to reduce their debts, the resulting contraction in credit would drive the world into depression. Fortunately, this outcome was averted. First, the governments of rich countries allowed their debts to rise, offsetting the reduction in private debt. In addition, emerging markets (notably China) continued to borrow. So there was no global deleveraging; quite the reverse. Central banks also helped, slashing interest rates to zero and below.

Although lower policy rates have not always resulted in cheaper borrowing costs (in Greece, for example), debt-servicing costs have fallen in most developed countries. Although this approach has staved off disaster, it has not got rid of the problem, as a research note from Manoj Pradhan, an economist at Morgan Stanley, makes clear. “High debt forces interest rates to stay low, which encourages yet more debt,” Mr Pradhan writes. Central banks dare not push interest rates up too quickly for fear of causing another crisis; hence the stop-start nature of the Federal Reserve’s statements on monetary policy. The developed world seems stuck with sluggish growth and low rates. In health terms, the disease is chronic, not acute.

A lurch into another global crisis, Mr Pradhan reckons, would require three ingredients. First, the assets financed by the debt build-up would need to fall sharply in price or prove uneconomic. Second, the debtors would have to be concentrated in big, globalised economies. Lastly, global investors would have to be heavily exposed to the debt in question. All this was the case in 2007-08, as debt secured by American housing turned bad, raising doubts about the health of the Western banking system. This time round the debtors are in different places. Some of them are emerging-market governments and commodity producers. But, except for China, none of these is crucial to the world economy. And China’s debts are mainly in domestic hands, rather than widely dispersed in the portfolios of international banks, pension funds and insurance companies.

Read more …

“..more than 50 million people in Africa are acutely threatened by famine..”

• ‘Death Awaits’: Africa Faces Worst Drought in Half a Century (Spiegel)

Herdsman Ighale Utban used to be a relatively prosperous man. Three years ago, he owned around a hundred goats. Now, though, all but five of them have died of thirst at a dried-up watering hole, victims of the worst drought seen in Ethiopia and large parts of Africa in a half-century. Utban, a wiry man of 36 years, belongs to a nomadic people known as the Afar, who spend their lives wandering through the eponymously named state in northeastern Ethiopia. “This is the worst time I’ve experienced in my life,” he says. On some days, he doesn’t know how to provide for himself and his seven-member family. “We can no longer wander,” Utban says, “because death awaits out there.” For now, he’ll have to remain in Lii, a scattered little settlement in which several families have erected their makeshift huts. Lii means “scorching hot earth.”

Since time immemorial, shepherds have wandered with their animals through the endless expanses of the Danakil desert. They live primarily off of meat and milk, and it was always a meagre existence. But with the current drought, which has lasted for over a year, their very existence is threatened. “First the livestock die, then the people,” Utban says. The American relief organization USAID estimates that in Afar alone, over a half million cattle, sheep, goats, donkeys and camels have perished. Reservoirs are empty, pastures dried up, feed reserves nearly exhausted. With no rain, grass no longer grows. Many nomads are selling their emaciated livestock, but oversupply has led to a 50% decline in prices. Currently, millions of African farmers and herders are suffering similar fates to Utban’s. The UN estimates that more than 50 million people in Africa are acutely threatened by famine.

After years of hope for increased growth and prosperity, the people are once again suffering from poverty and malnutrition. The governments of Malawi, Mozambique, Zimbabwe, Lesotho and Swaziland have already declared states of emergency, and massive crop losses have caused food prices to explode in South Africa. Particularly hard stricken are the countries in the southern part of the continent as well as around the Horn of Africa, Somalia, Djibouti, Eritrea and especially Ethiopia. Meteorologists believe the natural disaster is linked to a climate phenomenon that returns once every two to seven years known as El Niño, or the Christ child, a disruption of the normal sea and air currents that wreaks havoc on global weather patterns. The El Niño experienced in 2015-2016 has been particularly strong.

Read more …

Summing it up. Europe doesn’t send help to relieve the conditions refugees live in. They send policemen instead. 200 of them.

• Europol To Send Experts To Greek Islands To ‘Identify Terrorists’ (Kath.)

Europol, the European Union’s law enforcement agency, is soon to deploy 200 officers to refugee centers on the Greek islands and mainland to help identify potential terrorists. The officers, specially trained experts in immigration and terrorism, will not be in charge of border protection but will examine individuals deemed to be suspicious. After several weeks of reduced inflows of migrants from neighboring Turkey, Thursday saw an increase in arrivals with 130 people arriving on Greek shores in one day, amid growing concerns about the fate of an agreement between Turkey and the European Union to curb migration.

The total number of migrants in Greece on Thursday stood at 54,542, according to the spokesman for the government’s coordinating committee for refugees, Giorgos Kyritsis. Of this total, nearly 10,000 are living in squalid conditions at a makeshift camp near the village of Idomeni close to the border with the Former Yugoslav Republic of Macedonia. Kyritsis said the Idomeni camp would be evacuated but did not specify when. The situation at the camp is tense and local residents are running out of patience, with the head of the Idomeni community on Wednesday lodging a legal suit against Citizens’ Protection Minister Nikos Toskas for a “complete absence of state control” at the camp.

Read more …

Oh my, what a surprise.

• EU Mission ‘Failing’ To Disrupt Mediterranean People-Smugglers (BBC)

The EU naval mission to tackle people smuggling in the central Mediterranean is failing to achieve its aims, a British parliamentary committee says. In a report, the House of Lords EU Committee says Operation Sophia does not “in any meaningful way” disrupt smugglers’ boats. The destruction of wooden boats has forced the smugglers to use rubber dinghies, putting migrants at even greater risk, the document says. Operation Sophia began in 2015. It was set up in the wake of a series of disasters in which hundreds of migrants died while trying to cross from Libya to Italy. The EU authorised its vessels to board, search, seize and divert vessels suspected of being used for people smuggling.

The report states that “the arrests made to date have been of low-level targets, while the destruction of vessels has simply caused the smugglers to shift from using wooden boats to rubber dinghies, which are even more unsafe”. It says that there are also “significant limits to the intelligence that can be collected about onshore smuggling networks from the high seas. “There is therefore little prospect of Operation Sophia overturning the business model of people smuggling,” the document concludes. It adds that the mission is still operating out in international waters, and not – as originally intended – in Libyan waters.

Read more …