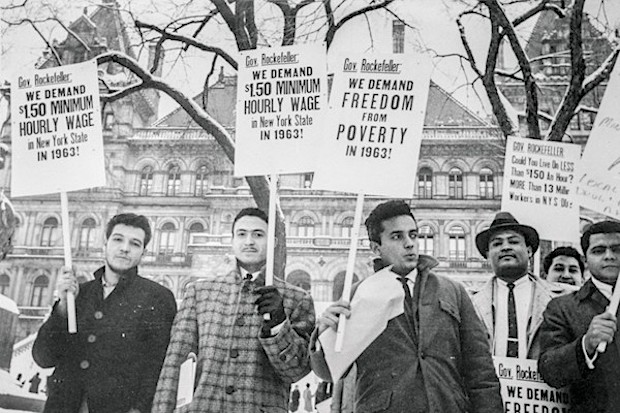

Bettmann/Getty Minimum Wage 1963

No, I didn’t watch the Dem convention. Never perform invasive surgery on myself either, for pretty much the same reason. But I did pick up a few tidbits. It all leaves a very elitist impression. Deplorables.

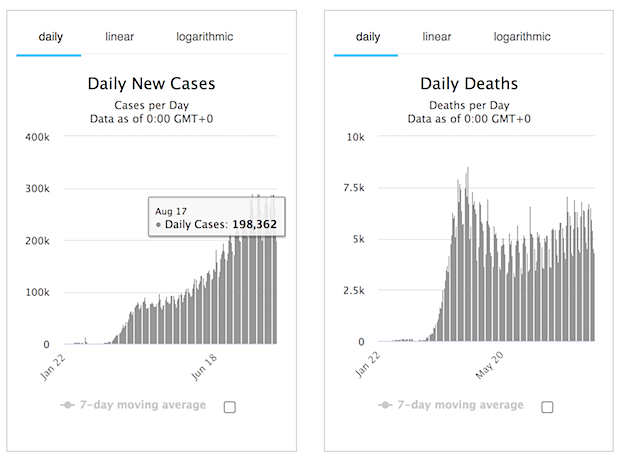

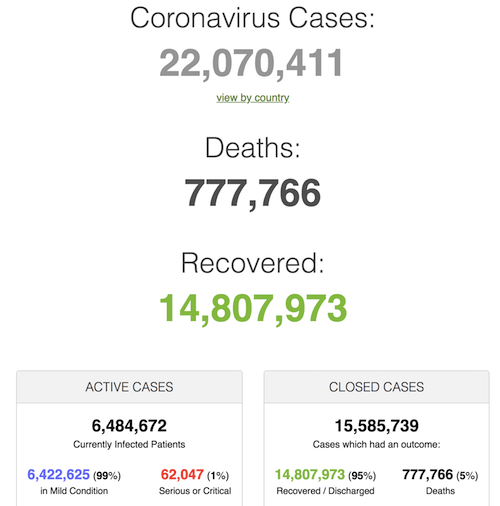

New global cases below 200,000, new deaths at 4,297. Not bad. Or is that just because it was Monday?

Several European countries are spiking in what is perhaps a second wave. Pretty lousy controls, which will lead to all kinds of renewed lockdowns. Unnecessary.

New cases only just above 40,000 in the US, it was 70,000 not long ago, with new deaths at “only” 589.

This sounds just plain dumb.

• Coronavirus Clusters Erupt At US Universities As Semester Begins (AP)

From the dorms at North Carolina to the halls of Notre Dame, officials at universities around the US scrambled on Monday to deal with new Covid-19 clusters at the start of the fall semester, some of them linked to off-campus parties and packed clubs. North Carolina’s flagship university cancelled in-person classes for undergraduates just a week into the fall semester Monday. The University of North Carolina at Chapel Hill said it will switch to remote learning on Wednesday and make arrangements for students who want to leave campus housing. “We have emphasised that if we were faced with the need to change plans – take an off-ramp – we would not hesitate to do so, but we have not taken this decision lightly,” it said in a statement after reporting 130 confirmed infections among students and five among employees over the past week.

UNC said the clusters were discovered in dorms, a fraternity house and other student housing. Before the decision came down, the student newspaper, The Daily Tar Heel, ran an editorial headlined “UNC has a clusterf*** on its hands”. The paper said that the parties that took place over the weekend were no surprise and that administrators should have begun the semester with online-only instruction at the university, which has 19,000 undergraduates. “We all saw this coming,” the editorial said. Outbreaks earlier this summer at fraternities in Washington state, California and Mississippi provided a glimpse of the challenges school officials face in keeping the virus from spreading on campuses where young people eat, live, study – and party – in close quarters.

The DNC pushed Bernie aside until he complied with the Biden “plan”. They do the same with AOC et al, without whom they may never have had control of the House. Instead, they have Republicans and billionaires speaking, along with has-beens like the Obamas and Clintons….

• Sixty Seconds to Self-Sabotage (Cut)

When the Democratic National Committee released its schedule for its big socially distanced convention this week, we learned that New York Rep. Alexandria Ocasio-Cortez, inarguably among the party’s most dynamic figures, would have just sixty seconds to address the nation. [..] the relegation of Ocasio-Cortez, who electrifies multiple parts of a Democratic base, to one meager minute, a segment that—unlike speeches by some other presenters—will be pre-recorded, isn’t just a snub. The failure of a major political party to showcase one of its most talented politicians, a young person whose communicative reach and facility positions her to be among its leaders deep into our future, is self-sabotage.

[..] Why will this convention not show off more of the historic number of women who enabled their party to retake the House in 2018? Most of them won’t be prominently featured, but former Ohio Republican governor John Kasich, who ran for governor as a Tea Partier and signed eleven laws (comprising 21 restrictions) on abortion, including a 20 week ban and the prohibition of rape crisis centers advising survivors about the option of abortion, will be. He also worked to rob Ohio’s public workers of the right to bargain collectively (voters later overturned this measure). Not only is Kasich getting a plum spot on Monday, he’s used his time in the Democratic sun to diss Ocasio-Cortez, telling Buzzfeed that just because she “gets outsized publicity doesn’t mean she represents the Democratic Party. She’s just a part, just some member of it.”

So John Kasich, Republican, feels that Ocasio-Cortez, Democrat, gets outsized attention, even as he–along with his fellow Republicans Susan Molinari (Remember her? No? Weird) and former Hewlett-Packard and eBay CEO Meg Whitman–will get more featured airtime than she at her party’s convention. But this convention seems driven to thumb its nose not only at individual politicians, but at the social movements that have transformed civic participation and changed public opinion across the nation during the course of the Trump administration. Remember those women who retook the House in 2018? A bunch of them were first time candidates who were open about how their entrance into politics was grounded in their fury about the ubiquity and pervasiveness of sexual harassment and assault in the wake of Donald Trump’s election and the #metoo movement.

But the party that profited from their electoral success has offered prime speaking spots to two multiply-accused harassers: former president Bill Clinton and former New York mayor Michael Bloomberg. That Bloomberg’s presidential campaign met its lethal end at the hands of Massachusetts senator Elizabeth Warren, who in a February primary debate detailed his history of workplace harassment, red lining, and support of stop-and-frisk policing, all in her allotted sixty seconds (she only had a minute; an eternity was in it) makes his featured presence an insult to Warren, and the many Democrats who were far more inspired by her campaign than by his. And listen, I get it, and assume everyone else does too: Bloomberg is speaking to the Democratic convention because the Democrats need his money (he shifted $18 million from his campaign to the Democratic National Committee in March).

But if organizers had been paying attention these past two years, they might have learned that that’s actually part of the structural thing about harassment and those who get away with it: too often, you need their money.

Matt Taibbi’s drinking game bingo card for the DNC

…and that attitude of trampling over the left leads to this… If you think BLM, Antifa, #MeToo are the only angry ones, you are mistaken.

• They’re Angry, Not Stupid: Why Trump is Likely to Win Again (Greene)

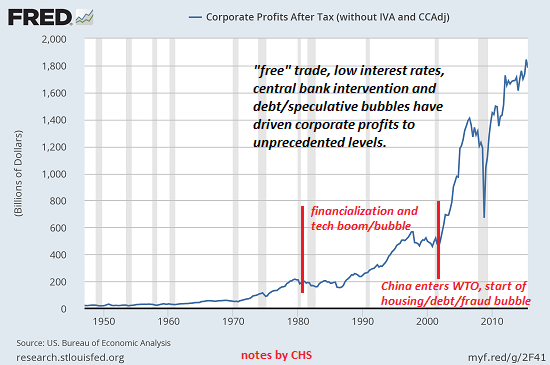

The candidate Barack Obama spoke to blue-collar America. He campaigned on change that would rejuvenate careers and restore dignity. Working Americans in the swing states doubted that Hillary Clinton even knew they existed. They saw Obama as a last hope and supported him enthusiastically in the 2008 primaries and later in the general election, but he soon proved to be a disappointment. He, too, fell in love with Silicon Valley and Wall Street and neglected the people who needed him most. And they punished him: he won fewer states in 2012 than he had in 2008. People like the alternate me felt cheated by a guy who rocked a Brooks Brothers suit and talked a great game, then gave the Tech and Finance sectors everything they wanted and more.

Educated people from the best schools trusted Big Tech outfits because educated people from the best schools ran them. Elites imagine each other to be virtuous because they imagine themselves that way. Technology giants were understood not as hardy sprouts but would be treated instead with princess-and-the-pea levels of delicacy, thanks to a superstitious fear that it might all be brought to grief by, say, forcing companies with hundreds of billions in share value to tolerate an employees’ union, offer a minimum wage adequate for a decent life, or pay tax proportional to their reliance on public goods.

No one bears greater responsibility for the lack of empathy toward Old-Economy workers that led to Donald Trump’s victory than big-name Tech darlings and the New Democrats who coddled them, then openly ridiculed their own voter base: the people Hillary foolishly nicknamed “Deplorables;” that is, the millions of disappointed Obama voters who would happily have voted blue if they’d had confidence that the party would respect them, welcome them, and acknowledge their needs. But the New Economy is a gated community, shut firmly to them, whose most strenuous boosters have been the Clinton, Bush, and Obama Administrations. Old-school, working-class Democrats are unwelcome in the party they built. No one wants them tracking mud through the salon.

Donald Trump defeated Hillary Clinton in the swing states the same way Barack Obama had: by characterizing her as disdainful toward blue-collar Americans. It was a potent message among those who once had seen decent wages in return for honest work, lately reduced to Walmart greeters and Uber drivers. Humiliated by a labor market in which they had nothing to trade, the former working class understood that they also had nothing to lose. Liberal democracy and its supporting institutions shed their veneer of sanctity when dead-end employees can aspire only to dead-end management gigs. Call them “associates” and “technicians” all you want; they know who they’ve become and what others think of them. They are why Trump won in the swing states; he was propelled to victory by disillusioned Obama voters.

I would have expected so much more from Bernie. Folds for the DNC twice in a row, and doesn’t volunteer to return any donations.

Can someone check how many times he said the same in 2016?! “Sanders called the 2020 election the most important in the modern history of the U.S.”

• Sanders: ‘The Future Of Our Planet Is At Stake’ In 2020 Election (JTN)

Former 2020 Democratic presidential candidate Sen. Bernie Sanders urged his supporters Monday to vote for nominee Joe Biden, imploring that the “future of our planet is at stake” and that the “price of failure” for not electing Biden would be “just too great to imagine.” “The future of our democracy is at stake. The future of our economy is at stake. The future of our planet is at stake,” Sanders said on opening night of the Democratic National Convention. “We must come together, defeat Donald Trump and elect Joe Biden and Kamala Harris as our next president and vice president. My friends, the price of failure is just too great to imagine.” Sanders called the 2020 election the most important in the modern history of the U.S.

“We need an unprecedented response, a movement, like never before of people who are prepared to stand up and fight for democracy and decency,” said Sanders, a democratic-socialist who finished second in the 2016 and 2020 Democratic presidential primaries. “Our campaign ended several months ago but our movement continues and is getting stronger every day. Many of the ideas we fought for, that just a few years ago were considered radical are now mainstream but let us be clear, if Donald Trump is re-elected, all the progress we have made will be in jeopardy,” he also [said].

Sanders named areas where Biden has moved the progressive agenda forward, such as raising the minimum wage to $15 an hour, making it easier for workers to join unions,” creating 12 weeks of paid family leave and funding universal pre-K for 3 and 4-year olds. “Joe will rebuild our crumbling infrastructure and fight the threat of climate change by transitioning us to 100 percent clean electricity over the next 15 years. These initiatives will create millions of good paying jobs all across the country,” Sanders said. “We are the only industrialized nation not to guarantee health care for all people. While Joe and I disagree on the best path to get to universal coverage, he has a plan that will greatly expand health care and cut the cost of prescription drugs. Further, he will lower the eligibility age of Medicare from 65 to 60,” added Sanders, who worked with Biden on his final campaign platform.

Bernie campaigner David Sirota has at least a little backbone.

• Democrats Seem All Too Willing to Surrender on Health Care Reform (Jac.)

On the eve of a Democratic National Convention taking place as millions lose health care coverage, the health care industry is launching a new ad campaign pressing Democrats to back off from the party’s already compromised health care promises. That pressure seems to be having its intended effect on Capitol Hill, as congressional aides say the party will not push the initiative if Joe Biden wins the presidency. The signs of retreat come as health care industry profits are skyrocketing and the industry’s campaign cash has flooded into Democratic coffers. The Partnership for America’s Health Care Future (PAHCF) — a front group created by health insurance, pharmaceutical, and hospital lobbying groups to oppose “Medicare for All” — announced on Friday that it is launching a new national ad campaign to persuade Democrats to abandon their plans to create a public health insurance plan.

The group said it will run ads during the Democratic National Convention (DNC) this week. PAHCF is led by a former Hillary Clinton aide and run out of the offices of a DC lobbying firm led by former top Democratic congressional aides. A substantial “public option” plan — which polls show is wildly popular — was the centerpiece of recent policy negotiations between supporters of former vice president Joe Biden and progressive Vermont senator Bernie Sanders, who had been pushing for a more expansive Medicare for All program. A draft of the party platform, approved by DNC members late last month, includes a pledge to pass a public option, or a government-run health insurance plan that would compete with private insurers.

Within twenty-four hours of the launch of the industry’s new ads, however, anonymous Democratic congressional sources were telling the Hill that Democrats likely won’t bother with the public option fight next year if Biden wins the election. Instead, they said, the party will work to tweak its 2010 health care law, the Affordable Care Act (ACA), which has done little to limit insurance or hospital costs and has failed to ensure universal coverage. To justify the preemptive retreat, Democratic congressional aides told the newspaper that the party’s moderate crop of 2020 Senate challenger candidates could make it harder to pass a public option. That assertion comes even though every single one of those candidates is currently campaigning in support of a public option, according to a TMI review of campaign statements.

The situation echoes the Democratic promises and subsequent surrender on a public option that marked the debate over health care more than a decade ago — only this time around, the health care crisis is an even more acute emergency. While most developed countries have managed to contain COVID-19, the pandemic is spiraling out of control in the United States, and an estimated 27 million people have lost their employer-based health insurance plans, according to the Kaiser Family Foundation.

And also recorded before Trump lost his brother?! Or wouldn’t she have cared? She did remember last night that she said it, right? Class? Grace? Where? We go low?

.. by contrast, “Joe knows the anguish of sitting at a table with an empty chair …

• Michelle Obama Speech Recorded Before Joe Biden Selected Kamala Harris (NYP)

There was one glaring omission from Michelle Obama’s 20-minute Democratic National Convention speech Monday night — Kamala Harris. That’s because the former first lady recorded her rousing speech before Joe Biden selected Sen. Harris of California as his running mate. The speech was delivered remotely like all others at the DNC because of the coronavirus pandemic, and The Associated Press reports it was filmed before Harris was named last week as Biden’s VP candidate, indicating the choice was so close to the vest and down to the wire that even the Obamas were not in the loop. In her speech, Michelle Obama eloquently praised Biden and emotionally denounced Trump’s policies.

“Donald Trump is the wrong president for our country. He has had more than enough time to prove that he can do the job, but he is clearly in over his head. He cannot meet this moment. He simply cannot be who we need him to be for us,” she said. “It is what it is,” Obama added, quoting Trump’s recent remark on coronavirus deaths. “Right now, kids in this country are seeing what happens when we stop requiring empathy of one another,” Obama said. “They watch in horror as children are torn from their families and thrown into cages, and pepper spray and rubber bullets are used on peaceful protesters for a photo-op.”

She said that by contrast, “Joe knows the anguish of sitting at a table with an empty chair, which is why he gives his time so freely to grieving parents. Joe knows what it’s like to struggle, which is why he gives his personal phone number to kids overcoming a stutter of their own. His life is a testament to getting back up, and he is going to channel that same grit and passion to pick us all up, to help us heal and guide us forward.”

The issue is not nearly as simple as some people would let you believe.

• Trump vs. Dems On Mail-in Voting (Chaffetz)

With less than three months until the 2020 election and no end in sight for the coronavirus pandemic, a new debate over mail-in voting has begun. Swirling and sudden concerns about the United States Postal Service (USPS) have arisen from Democrats who are wildly accusing President Trump of cheating and manipulating the Postal Service in his favor. Conveniently they forget to mention the president is more than an arms-length away from how we vote, and the Postal Service is not under the thumb of his control. Senate Democrats joined Republicans to unanimously install postal leadership — of which, one is an Obama appointee.

No doubt President Trump has expressed deep concerns about the validity of the ballots, and rightfully so. Sending out millions of ballots without authenticating the inbound ballots is ripe for massive fraud. Democrats have desperately been seeking to legalize “ballot harvesting” (the collection and submission of ballots by someone other than the voter and without authentication) and other nefarious activities. It must be noted elections in the United States are administered by counties and certified by states. In other words, per the United States Constitution, elections are run locally and not by the executive branch of the federal government. The president has simply sought fair elections.

Ironically, it is House Speaker Nancy Pelosi’s H.R. 1 that seeks to federalize elections and give the president power he doesn’t currently have now. Her solution would create the problem she inaccurately blames Trump for today. [..] The president of the United States does not control the operations of the Postal Service nor does he select or appoint the Postmaster General. The Board of Governors does both of these things. The Postal Regulatory Commission sets rates, service levels and decides on postal closings, not the president. The governors are appointed by a president and confirmed by the United States Senate. No more than five of the nine governors may be from the same political party.

Clickbait fodder.

• Trump Teases Upcoming Pardon For ‘Very Important’ Person (RT)

US President Donald Trump said he would soon hand out a pardon to a “very important” person. While the details were left shrouded in mystery, he ruled out both his former advisor Michael Flynn and NSA whistleblower Edward Snowden. “Doing a pardon tomorrow on someone who is very, very important,” Trump told reporters on board Air Force One on Monday, offering little elaboration other than to say it would not be Flynn – his first National Security Advisor – nor the famed whistleblower. Despite repeatedly calling Snowden a “traitor” over the years, Trump has hinted at giving the whistleblower a reprieve on more than one occasion in the last week, saying he may have been treated “unfairly” and that he would “look at” allowing him to return home.

With the president explicitly ruling him out for Tuesday’s pardon, however, it appears Snowden will have to remain in Moscow for some time longer, where he was given asylum after leaking a massive cache of purloined documents from the National Security Agency in 2013, revealing Washington’s sweeping domestic and global spying apparatus.

They’re starting a new competition.

• China’s Anti-Trump Election Meddling Raises New Alarm (Fox)

Director of National Intelligence John Ratcliffe told Fox News that China poses “a greater national security threat” to the United States “than any other nation,” detailing a web of threats that includes “election influence and interference.” Intelligence officials say they are increasingly concerned about interference in the U.S. election by China, adding to existing concerns about meddling by Russia that have been around since 2016, as well as the threat of meddling from Iran. “China poses a greater national security threat to the U.S. than any other nation – economically, militarily and technologically. That includes threats of election influence and interference,” Ratcliffe told Fox News in a statement.

While Russia was widely seen as favoring now-President Trump and generally seeking to sow chaos in America during the 2016 election, the difference with China is it is seen to be seeking a Trump loss in November. Yet congressional Democrats like House Speaker Nancy Pelosi and House Intelligence Committee Chairman Adam Schiff, who ever since 2016 have issued dire warnings about Russian meddling, have not been quite so vocal about China’s potential to interfere in the 2020 election. Pelosi, D-Calif., last week said the threats of interference from Russia and China are “not equivalent,” while urging the intelligence community to put out more information about Russian efforts, saying Moscow is “actively 24/7 interfering in our election.”

Ratcliffe said the threat from China is actually significant, and he is “committing the IC resources needed to fully understand the threat posed by China and provide U.S. policymakers with the best intelligence to counter China’s broad and deep malign activities.” “China is concerned that President Trump’s reelection would lead to a continuation of policies that they perceive to be ‘anti-China,’” Ratcliffe explained, noting that the intelligence community has briefed “hundreds of members of Congress” to raise their concerns about China “and its increased efforts to impact the U.S. policy climate in its favor.” “Fair and free elections are a bedrock of American democracy, and the IC remains vigilant against the various activities by China, as well as other threat countries and actors, which seek to affect our electoral process,” Ratcliffe said.

Great fundraiser, they said.

• Kamala Harris Reportedly Owes $1M In Bills From Failed Presidential Run (NYP)

Kamala Harris, named Tuesday to be Joe Biden’s running mate, still has more than $1 million in unpaid bills left over from her failed 2020 presidential bid, according to a report. The California senator raised about $39 million for her White House bid in 2019 and spent about $40 million, leaving her campaign with just $116,380 in the bank at the end of June, Bloomberg News reported on Wednesday, citing Federal Election Commission filings. Harris ended her campaign last December amid falling poll numbers and a lack of fundraising.

International law firm Perkins Coie LLP was still owed $523,883 at the end of June, while TorchStone Global LLC, a corporate and private security company, was owed $160,702, the report said. California political consulting firm SCRB Strategies had $92,4087 in outstanding invoices. Donors have contributed slightly more than $48,000 to her campaign this year. The report noted that the campaign can’t be shuttered until all debts are paid under federal law. And while Biden raised $26 million in a day after announcing her selection, his campaign can do little to retire Harris’ campaign debt. It can donate $2,000 and the Democratic National Committee can contribute $5,000. But Biden can ask his donors to send funds to Harris’ campaign.

Feel free to call this a failed society.

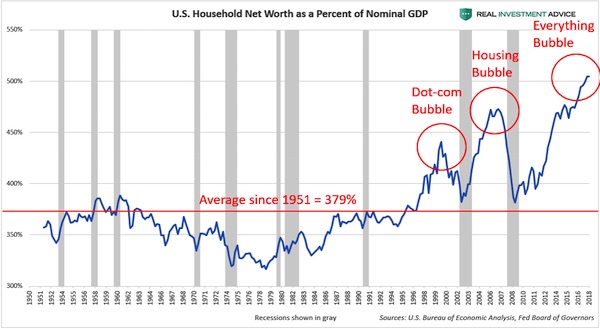

• Twelve US Billionaires Have a Combined $1 Trillion (Ineq.org)

For the first time in US history, the top twelve U.S. billionaires surpassed a combined wealth of $1 trillion. On Thursday August 13th, these 12 had a combined $1.015 trillion. This is a disturbing milestone in the US history of concentrated wealth and power. This is simply too much economic and political power in the hands of twelve people. From the point of view of a democratic self-governing society, this represents an Oligarchic Twelve or a Despotic Dozen. The Oligarchic Dozen are Jeff Bezos ($189.4b), Bill Gates ($114b), Mark Zuckerberg ($95.5b), Warren Buffett ($80b), Elon Musk ($73b), Steve Ballmer ($71b), Larry Ellison ($70.9b), Larry Page ($67.4b), Sergey Brin ($65.6b), Alice Walton ($62.5b), Jim Walton ($62.3b) and Rob Walton ($62b).

Since March 18th, the beginning of the pandemic, this Oligarchic Dozen have seen their combined wealth increase $283 billion, an increase of almost 40 percent. Elon Musk has been the biggest pandemic profiteer, seeing his wealth triple from $24.6 billion on March 18th to $73 billion on August 13, an increase of $48.5 billion or 197 percent. Amazon co-founder Jeff Bezos was worth $189.4 billion on August 13, up $76 billion or 68 percent since March 18th. Facebook CEO Mark Zuckerberg was worth $95.5 billion on August 13, up $40.8 billion or 75 percent since March 18th.

Big tech returns in 2008 recession…$MSFT: -44%$AAPL: -57%$GOOGL: -56%$AMZN: -45%$QQQ: -42%

Big tech returns YTD in 2020 recession…$MSFT: +34%$AAPL: +57%$GOOGL: +13%$AMZN: +71%$QQQ: +30%

Data via @ycharts

— Charlie Bilello (@charliebilello) August 17, 2020

The Sacklers took out many billions, then declared bankruptcy. Now they’re “willing” to contribute more to a settlement than the entire company is worth. Sick.

• US States Seek $2.2 Trillion From OxyContin Maker Purdue Pharma (R.)

U.S. states claimed they are owed $2.2 trillion to address harm from OxyContin maker Purdue Pharma LP’s alleged role in America’s opioid epidemic, accusing the drugmaker in new filings of pushing prescription painkillers on doctors and patients while playing down the risks of abuse and overdose. In filings made as part of Purdue’s bankruptcy proceedings that were disclosed on Monday, the states said Purdue, backed by the wealthy Sackler family, contributed to a public health crisis that has claimed the lives of roughly 450,000 people since 1999 and caused strains on healthcare and criminal justice systems. The filings cited more than 200,000 deaths in the U.S. tied directly to prescription opioids between 1999 and 2016.

In large states such as California and New York, claims alone totaled more than $192 billion and $165 billion, respectively. Forty-nine U.S. states, Washington, D.C. and various territories are making the claims. Oklahoma settled litigation with Purdue last year. Purdue filed for bankruptcy in 2019 under pressure from more than 2,600 lawsuits brought by cities, counties, states, Native American tribes, hospitals and others. The lawsuits said the company, and in some cases the Sacklers, used deceptive marketing and took other improper steps to flood communities with prescription opioids. The company and family have denied the allegations and pledged to help combat the opioid epidemic, including by providing addiction treatment drugs and overdose reversal medications under development.

[..] Purdue is only worth a bit more than $2 billion if liquidated. The company values a proposal to settle litigation, which includes providing addiction treatment and overdose-reversing drugs, at more than $10 billion. The Sacklers would contribute $3 billion and cede control of Purdue, with the company becoming a trust run on behalf of plaintiffs.

These well-meaning people are mightily confused about growth:

“In the absence of new forms of liquidity support and major debt relief, the world economy cannot possibly return to pre-pandemic levels of growth..”

I think that means to want to return there.

“..the dramatic decline in the cost of renewable energy represents an opportunity for a big investment push in zero-carbon energy infrastructure, which itself would help to redress energy poverty and unsustainable growth.”

More growth? Isn’t growth itself the problem then? Never mind, anyone who talks about sustainable growth is not a serious person in my book.

• The Need for Debt-for-Climate Swaps (PS)

In the absence of new forms of liquidity support and major debt relief, the world economy cannot possibly return to pre-pandemic levels of growth without risking severe climate distress and social unrest.Climate scientists tell us that in order to meet the targets outlined in the Paris climate accord, global net carbon-dioxide emissions must fall by about 45% by 2030, and by 100% by 2050. Given that the effects of climate change are already being felt around the world, countries urgently need to scale up their investments in climate adaptation and mitigation. But that will not be possible if governments are bogged down in a debt crisis. If anything, debt-service requirements will push countries to pursue export revenues at any cost, including by cutting corners on climate-resilient infrastructure and stepping up their own fossil-fuel use and extraction of resources.

This course of events would further depress commodity prices, creating a doom loop for producer countries. In light of these concerns, the G20 has called on the IMF “to explore additional tools that could serve its members’ needs as the crisis evolves, drawing on relevant experiences from previous crises.” One such tool that should be considered is a “debt-for-climate swap” facility. In the 1980s and 1990s, developing countries and their creditors engaged in “debt-for-nature swaps,” whereby debt relief was linked to investments in reforestation, biodiversity, and protections for indigenous people. This concept should now be expanded to include people-centered investments that address both climate change and inequality.

Developing countries will need additional resources if they are to have any chance of leaving fossil fuels in the ground, investing sufficiently in climate adaptation, and creating opportunities for twenty-first-century jobs. One source for such resources is debt relief conditioned on such investments. A policy tool of this type would not only put us on the path to recovery, but also could help to prevent future debt-sustainability problems that might emerge as more fossil-fuel holdings and non-resilient infrastructure become “stranded assets.” Moreover, the dramatic decline in the cost of renewable energy represents an opportunity for a big investment push in zero-carbon energy infrastructure, which itself would help to redress energy poverty and unsustainable growth.

I should read Stephanie Kelton’s book, right?!

• The Mathematical Model of Modern Monetary Theory (Steve Keen)

One Mathematical Model of Modern Monetary Operations

I confess immediately that I chose the title and subtitle for this post because their acronyms are palindromes. The subtitle is more accurate than the title, because this model considers only the monetary aspects of MMT: the Job Guarantee and inflation management components are not yet incorporated. But the monetary assertions of MMT remain in dispute in economic and political circles, so it is worth putting these into a mathematical model where their veracity can be tested. The primary stimulus for developing the model was the publication of Stephanie Kelton’s The Deficit Myth. Stephanie has written the book for non-technical readers, and she’s done a very good job: it’s a very easy read that explains why many conventional wisdoms about government spending are wrong.

But MMT is facing heavy resistance in political and economic circles, with my favourite to date being a motion before the US Congress, posted by Representative Kevin Hern, to resolve: “That the House of Representatives (1) realizes that deficits are unsustainable, irresponsible, and dangerous; and (2) recognizes— (A) that the implementation of Modern Monetary Theory would lead to higher deficits and higher inflation; and (B) the duty of the House of Representatives to condemn Modern Monetary Theory.”

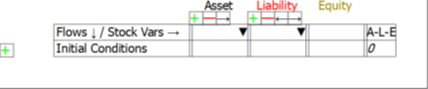

The objective of this series of posts is to allow the assessment of the first part of this motion—the assertion that “deficits are unsustainable, irresponsible, and dangerous”. The models in this post are built in the Open Source system dynamics program Minsky, whose unique feature is the capacity to build models of financial flows using what are called Godley Tables (in honour of Wynne Godley, the pioneer of stock-flow-consistent-modelling). These tables enforce the “law of accounting” that (see Figure 1, A blank Godley Table).

Once an account is flagged as an “Asset” for one entity, Minsky knows that it has to also be shown as a “Liability” for another entity. This makes it possible to take an integrated look at the financial system, which allows us to assess Hern’s motion from the perspective of the entire monetary system, and not just the Government’s view of it.

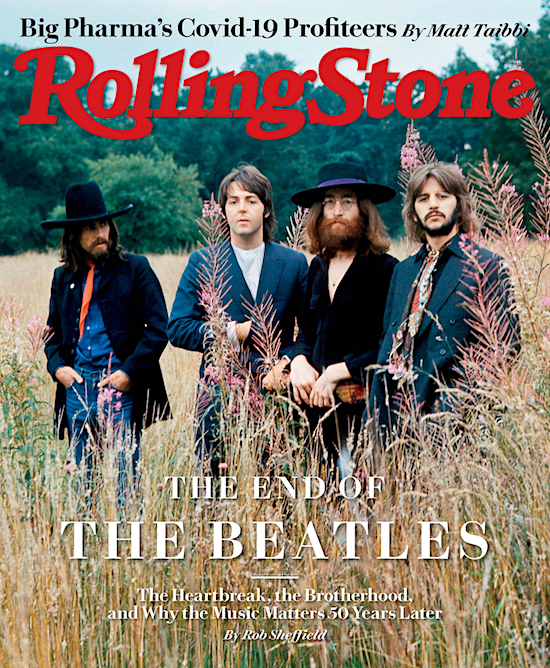

50 years later: ‘They broke up because Yoko sat on an amp!’

• And in the End (Rolling Stone)

It’s a miserable Monday morning in January 1969, and the Beatles are trying to get back to where they once belonged. The Get Back project sounded like a perfect idea: just the four lads and their instruments, ready to hit the studio, return to their roots, conjure up some great songs out of thin air. Just like they used to. John, Paul, George, and Ringo have booked a TV concert special for January 18th — their first live show in years. They’ll rehearse for a couple of weeks, eyeball to eyeball, summon up genius on the spur of the moment. They’ve done it many times before. They’ve never not done it. The good news: Paul showed up today, and so did Ringo. So did the camera crew — these sessions are being filmed, so the Beatles can show a half-hour clip of rehearsal footage before their TV performance.

So here they are on Monday morning, ready to dazzle the world with a blast of spontaneous Beatles brilliance. Or at least Paul and Ringo are. Hey, has anyone heard from John and Yoko? Or George? With George, there’s a slight complication: He quit the band. On Friday, with the cameras rolling, he was trying to teach them a new song, “All Things Must Pass.” John, strung out on his new heroin habit, sneered at George with open contempt. George finally stormed out, muttering, “See you around the clubs.” John doesn’t take this seriously. “I think if George doesn’t come back by Monday or Tuesday, we ask Eric Clapton to play in it,” he says. “The point is, if George leaves, do we want to carry on the Beatles? I do. We should just get other members and carry on.” But now it’s Monday and still no George. No John and Yoko. (No Clapton, for that matter.) Paul and Ringo kill time jamming on a current radio hit, “Build Me Up Buttercup.”

But everyone gathers to discuss the crisis, complaining bitterly about Yoko’s constant presence. Surprisingly, the one who sticks up for her is Paul. He’s a sucker for a love story — he’s Paul McCartney, for God’s sake. But he also knows how much this romance means to his oldest, closest mate, his most troubled and cruel and impossible friend. “It’s not that bad,” he insists. “They want to stay together, those two. So it’s all right. Let the young lovers be together.” Paul has to chuckle, thinking about how future generations will look back at this — the Beatles, the greatest of all rock & roll bands, the world’s most legendary creative team, falling apart over such a trivial spat. Even on a winter morning as gloomy as this one, Paul breaks into a laugh. “It’s gonna be such an incredible sort of comical thing, like in 50 years’ time, you know. ‘They broke up because Yoko sat on an amp!'”

We try to run the Automatic Earth on donations. Since ad revenue has collapsed, your support is now an integral part of the process.

Thank you for your ongoing support.

Dobbs/Nunes

‘Highly Unusual’: @DevinNunes questions why Kevin Clinesmith is set to make his first court appearance before a federal judge who is also in charge of the FISA court. #AmericaFirst #MAGA #Dobbs pic.twitter.com/djljmT1xBW

— Lou Dobbs (@LouDobbs) August 17, 2020

Support the Automatic Earth in virustime.