Marc Chagall Blue lovers 1914

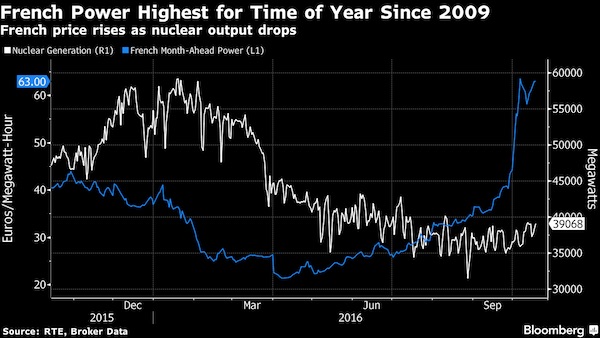

Euro declines below 99 US cents for the first time in two decades.

Europe wholesale natural gas price up 30% just this morning.

George Webb $12 million a month to Zelensky

Breaking down Ukraine – let’s start with Zelensky’s $35M mansion in Sunny Isles, FL built by Kolomoisky and Pinchuk. $1.3B in the bank!! pic.twitter.com/wnh7yNg2w8

— George Webb – Investigative Journalist (@RealGeorgeWebb1) March 1, 2022

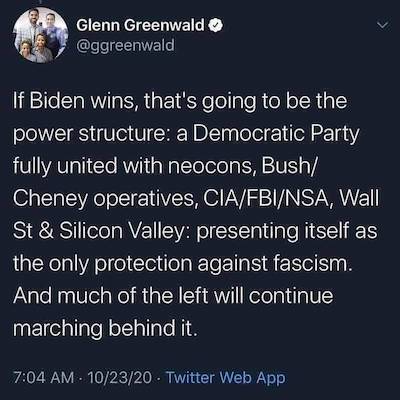

Note the date

Cologne

After Prague, Cologne. Massive demonstration in Germany against the Olaf Scholz's government. They demand the lifting of sanctions against Russia and neutrality in the conflict in Ukraine. Demonstration censored by European media. pic.twitter.com/PHw2LYl1Il

— RadioGenova (@RadioGenova) September 4, 2022

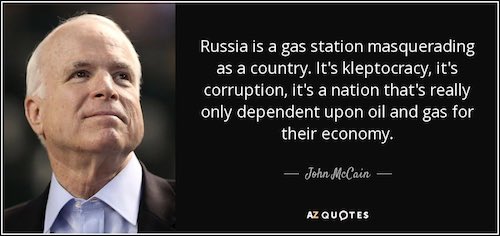

This should be in the MSM, not just RT. This guy is a hawk, but sees the west cannot win.

• ‘Better To Negotiate Now Than Later’ For Ukraine, Retired US General Says (RT)

Sustaining the conflict in Ukraine is becoming increasingly difficult for NATO, so Kiev must think about negotiating with Moscow, retired US Army brigadier general Mark T. Kimmitt has said in an opinion piece for the Wall Street Journal. Washington’s latest military aid package to Kiev last month included “older and less advanced”systems, which “may indicate that battlefield consumption rates have outpaced production to a point where excess inventories provided to Ukraine are nearly exhausted,” Kimmitt pointed out in his article on Thursday. Dealing with “dwindling stocks of leading-edge weapon systems” in NATO countries would likely mean a prolonged conflict between Ukraine and Russia. Such a scenario could result in “more pressure from supporting nations, sustained inflation, less heating gas, and falling popular support” in the West, he wrote.

Kimmitt, who served as assistant secretary of state for political-military affairs in 2008-09, suggested four ways to speed up the resolution of the conflict, which has now been underway for six months. The first option is to “dig deeper” into NATO stockpiles and send arms to Kiev that have so far been withheld by members due to their own national defense requirements, the retired general suggested. That’s something EU countries may be willing to do as it’s “better to use these weapons in Kherson than Krakow,” he added. The US and its European allies could also try ramping up production of the systems that are required by the Zelensky government, Kimmitt said, acknowledging that such a move would unlikely have an immediate effect on the situation on the ground.

The third option is “to step up the conflict” by providing Ukraine with longer-range systems, such as ATACM missiles, F-16 jets, and Patriots, and “broaden the rules of engagement to attack targets in Crimea and possibly Russia,” he wrote. However, the retired general warned that such escalation would definitely face a “response from Moscow” and create the risk of conflict spilling into Europe. The final available solution, according to Kimmitt, is for Ukraine to “push for an interim diplomatic resolution without (or with) territorial concessions.” “There is little incentive to negotiate” at the moment, but Ukrainian President Vladimir Zelensky “must recognize that diminishing resupplies would have a disastrous effect on his army, not merely for battlefield operations but for the message of declining outside support it would send to the people of Ukraine,” he insisted. “Beginning the diplomatic resolution would be distasteful, and perhaps seen as defeatist, but as there is little chance of climbing out of the current morass, it may be better to negotiate now than later,” the retired general said.

“Russia has acquired “priceless experience” of dealing with the West in recent years and will use it to “conduct dialogue… in such a way that our interests are by no means hurt.”

• West And Russia Will Eventually Strike A Deal – Kremlin (RT)

The crisis between Russia and the West will inevitably be resolved at the negotiating table, according to Kremlin spokesman Dmitry Peskov. He warned, however, that Moscow will be ready to defend its interests when that moment arrives. Western nations “have made too many mistakes and will have to pay for them,” he said on the Rossiya 1 TV Channel. “Any confrontation is followed by détente and any crisis situation is resolved at the negotiating table… this is what will happen this time as well,” the spokesman for Russian President Vladimir Putin said, adding that it’s unlikely to occur “soon.” When such talks materialise, Moscow will not hesitate to defend its interests, Peskov added. Russia has acquired “priceless experience” of dealing with the West in recent years and will use it to “conduct dialogue… in such a way that our interests are by no means hurt.”

The Kremlin official listed what he sees as Western errors, citing Germany’s “horrible”decision to send weapons to Ukraine for use against Russian soldiers. He also criticized European nations for supporting a government that allows “Nazis” to openly demonstrate their symbols and stage torchlit processions, calling it “no less horrible.” Peskov also blamed the energy crisis in Europe on “absurd” decisions by European politicians, who have refused to service equipment sold by Western firms to Gazprom. The Russian state energy giant “spent decades” earning its reputation of a reliable natural gas supplier, and has so far done nothing to tarnish it, the Kremlin spokesman claimed. “This is not Gazprom’s fault, this is fault of those politicians, who have taken the decision on sanctions,” he said, referring to the Russian company’s recent decision to indefinitely suspend gas transit through its Nord Stream pipeline, due to technical issues.

In Germany, the world is upside down. Isn’t there a Brothers Grimm story about that?

Kim Dotcom:

“How to end the war in Ukraine. Germany can end the war in Ukraine single-handedly. The US cannot afford a proxy war with Russia if Germany backs out of sanctions against Russia. Let’s be honest: Russia is not a threat to Germany. It wants good relations with Europe.”

• Russia Is Unreliable Energy Partner – Germany (RT)

German Chancellor Olaf Scholz claimed on Sunday that Russia cannot be considered a reliable energy supplier, and accused Moscow of breaching its contractual obligations. Speaking at a news conference with party leaders from the Greens and pro-business FDP, he said Moscow was always a reliable energy partner “even during the Cold War,” but that the rule no longer applies. According to the chancellor, the impact of the Ukraine conflict and related sanctions is being keenly felt in Germany, but Berlin will continue to support Kiev against Russia. Scholz expects Germany to pass through a rough period, but expressed his confidence that the nation will cope with the energy crunch during the upcoming winter season.

Germany is grappling with natural gas supply problems via Nord Stream 1, which has been entirely shut down since August 31. The natural gas pipeline under the Baltic was operating at 40% of capacity from June onwards, providing some 67 million cubic meters per day. The initial supply reduction occurred due to the delayed return of gas turbines after scheduled maintenance in Canada, resulting from Ottawa’s sanctions against Russia. In July, supplies through the pipeline dropped to 20%, as the remaining turbines required an overhaul. Earlier this week, supplies were entirely halted for a scheduled three-day maintenance break, and Gazprom later announced an indefinite shutdown, after an engine oil leak was found in the turbine.

Several EU politicians have accused Moscow of using gas exports as a geopolitical weapon, a claim denied by the Kremlin. Earlier this week, Moscow said only Western sanctions are preventing Nord Stream 1 from working at full capacity. This comes after repeated warnings from Gazprom CEO Alexey Miller that sanctions would obstruct Siemens Energy from carrying out maintenance of the pipeline’s equipment.

“The latest agreement, which brings total relief to almost 100 billion euros since the start of the Ukraine war, was hammered out overnight into Sunday by Germany’s three-way ruling coalition..”

It’s not enough. Go talk to Putin..

• Germany Announces €65 Billion Inflation Relief Package Amid Energy Crisis (F24)

The German government on Sunday unveiled a new multi-billion euro plan to help households cope with soaring prices, and said it was eyeing windfall profits from energy companies to help fund the relief. German businesses and consumers are feeling the pain from sky-high energy prices, as Europe’s biggest economy seeks to extricate itself from reliance from Russian supplies in the wake of Moscow’s invasion of Ukraine. Rapid measures to prepare for the coming cold season will ensure that Germany would “get through this winter,” Chancellor Olaf Scholz said at the unveiling of the €65 billion package. The latest agreement, which brings total relief to almost 100 billion euros since the start of the Ukraine war, was hammered out overnight into Sunday by Germany’s three-way ruling coalition of Scholz’s Social Democrats, the Greens, and the liberal FDP.

Among the headline measures are one-off payments to millions of vulnerable pensioners and a plan to skim off energy firms’ windfall profits. The government’s latest relief package came two days after Russian energy giant Gazprom said it would not restart gas deliveries via the Nord Stream 1 pipeline on Saturday as planned after a three-day maintenance. The government had made “timely decisions” to avoid a winter crisis, Scholz said, including filling gas stores and restarting coal power plants. But preventative measures, including a drive to reduce consumption, have done little to break a sharp increase in household bills.

The latest announcement follows two previous relief packages totalling 30 billion euros, which included a reduction in the tax on petrol and a popular heavily subsidised public transport ticket. But with the expiration of many of those measures at the end of August and consumer prices soaring, the government has been under pressure to provide new support. Inflation rose again to 7.9 percent in August, after falling for two straight months thanks to previous government relief measures. The take-off in energy prices is expected to push inflation in Germany to around 10 percent by the end of the year, its highest rate in decades.

“..12 billion euros (or 6% of GDP) will be spent on power subsidies this year..”

• Greece Unfazed By European Energy Concerns (K.)

Most of Europe is bracing for a tough winter. The war continues to rage in Ukraine and the Kremlin has transformed it into an energy weapon aimed at sinking European economies into recession and creating political upheaval, to Russia’s benefit. New, more transmissible variants of the coronavirus are expected to bring a resurgence of the pandemic and climate change is exacerbating the energy crisis, testing Europe’s mostly aged infrastructure and standing in the way of emissions reduction targets. These factors together paint a rather bleak picture of what the new normal looks like – and to top it all off, the European Commission is a deer caught in the headlights.

President Emmanuel Macron has told the French to prepare for sacrifices (for many these will be greater than for others) and called on his ministers not to succumb to the sirens of populism. Berlin has introduced a radical energy savings plan with cutbacks in private consumption and is reintroducing mandatory testing and masks as of October 1 to manage the pandemic. And concern about the recession – which is a threat to even the most advanced economies – is widespread. Greece appears to be the exception to all this. The messages it is sending is that it is protected from all sides, its economy is booming and Covid-19 is no longer a real problem. Greece, according to this relaxed narrative, is fine, and everything is under control. This is far from true, however. There’s a lot of care being given to subsidies, but the attitude is relaxed where everything else – the big and important issues – is concerned.

Take, for example, the government’s policy on energy: 12 billion euros (or 6% of GDP) will be spent on power subsidies this year, €2 billion of which will come from the budget; everyone will benefit, rich and poor, main residences and holiday homes. No effort is being made to contain electricity consumption, which is simply the right thing to do right now, given that natural gas supplies – and, as a result, power production capabilities – are far from guaranteed. Nothing is being done to bolster transportation and distribution networks either, even though energy from renewable sources can be produced but not adequately transported and what transport networks we do have leak 17% of their load in the process – double the European average.

Next year, you’re on your own…

• Greek Power Subsidy Cap As Of 2023 (K.)

The government plans to put an end to the high state subsidies in 2023 that have up to now covered between 85% and 94% of the electricity rate hikes. As there are no resources to keep subsidizing such high energy costs for households and businesses the government will change the mix of support measures. With the coverage of up to 94% of the increases, some households reached the point of zero bills, while others also secured small refunds. It is impossible to continue such a policy in 2023, government sources say, as the same fiscal conditions will not exist. Inevitably, the government will have to proceed to subsidy cuts, as the budget cannot sustain such spending for such a long period of time.

Alternate Finance Minister Thodoros Skylakakis told Skai Radio on Friday that in 2023 Greece should replace gas (which has very high rates) with other fuels, save energy, and protect the most vulnerable households and businesses. According to sources, the government seems to reject income criteria at this stage as it is an imperfect tool and socially unfair for employees and pensioners, given that tax evasion and concealment of taxable material are on the rise. However, a ceiling on electricity consumption will be considered, as it is no longer in the interest of households to use electricity for heating, given that oil is now significantly cheaper. As Skylakakis mentioned, today gas costs as if oil were at 500 euros per barrel, or gasoline at €6-7 per liter.

The exorbitant rates of natural gas are passed on to electricity bills, since 30-40% of electricity is produced from gas. Based on the above, the margins are frighteningly tight for 2023. According to initial calculations, the surplus from taxes will reach €1.5 billion next year, but this amount will have to finance other previously announced measures, such as the abolition of the solidarity levy for civil servants and pensioners, which entails some €470 million. At the same time, pensioners will get their first raise after many years.

Elections in 9 months. This is where Erdogan’s most dangerous.

• Turkey Likely To Face Bankruptcy, Report Claims (K.)

Turkey’s economy is on the verge of bankruptcy, according to a report submitted by economic experts to opposition leader Kemal Kilicdaroglu, Turkish newspaper Hurriyet reports. The report was prepared with the involvement of officials of Kilicdaroglu’s Republican People’s Party (CHP), Hurriyet says. The report says the difficulty in paying off Turkey’s debt will emerge after the presidential and parliamentary elections, set for June 2023 and claims it is quite likely that payments will be stopped. “Because of the chaos the present government will leave behind, the new government faces the risk of failure in its economic policy,” the report says. The report also says that the Turkish state will have difficulty in paying wages and pensions. The report’s authors say that the support of foreign banks and other financial institutions is necessary for Turkey to avoid bankruptcy.

“To cope with this crisis situation, demand reduction will be even more important than storage..”

• Full Gas Storage Not Enough For EU To Last Through Winter – Reuters (RT)

Fully-stocked gas storage facilities may not be sufficient to sustain European countries during the upcoming heating season, Reuters reported on Wednesday, citing analysts. According to Aurora Energy Research’s calculations, the bloc’s storages can only provide enough gas for up to 90 days of average demand. Modeling by data intelligence firm ICIS also shows that the region’s reserves may run dry by March. Analysts therefore agree that gas consumption should be slashed in order to avoid shortages. “To cope with this crisis situation, demand reduction will be even more important than storage,” Simone Tagliapietra, a senior fellow at the Bruegel think-tank, was cited as saying.

ICIS data shows that, if consumption is reduced 15% below the five-year average each month, the bloc may still have 45% of gas reserves left come spring if Russia continues supplying gas to the region at its current volumes, and 26% if Russia stops deliveries in October. Moreover, the EU’s failure to save gas this winter would affect next year’s storage levels. According to the Oxford Institute of Energy Studies, if Russia cuts gas flows and EU depletes its storages during the upcoming heating season, next year’s storages will be emptied as early as November, before the heating season is even in full swing. “The storage is the safety net, but a very significant demand reduction is what we need as a priority in this crisis,” Matthias Buck, Europe director for Agora Energiewende, told the news outlet.

All police forces are.

• UK Police Preparing For Unrest This Winter – Times (RT)

UK police fear a sharp rise in certain categories of crime and a risk of civil unrest this winter amid a cost of living and energy crisis, the Sunday Times reports, citing a leaked national strategy paper. The document compiled by police chiefs warns that “economic turmoil and financial instability”may lead to an increase in offenses such as shoplifting, burglary, vehicle theft, online fraud and blackmail. More children are likely to join drug gangs and more women may become subject to sexual exploitation. Contingency planning is reportedly underway to deal with the possible fallout from the cost of living crisis. “Prolonged and painful economic pressure”could create a risk of “greater civil unrest,”similar to the London riots of 2011, the paper is quoted as saying.

Police themselves may also be affected. “Greater financial vulnerability may expose some staff to higher risk of corruption, especially among those who fall into significant debt or financial difficulties,” the paper said. The gloomy forecast was revealed the day before the UK finds out the name of its new prime minister. Both candidates, Foreign Secretary Liz Truss and former chancellor Rishi Sunak, have pledged to take decisive action to address soaring energy costs. While Sunak has promised targeted support for the poorest in society, frontrunner Truss has not revealed the details of her strategy. Civil servants have been busy with contingency planning. According to the Financial Times, Whitehall officials are now compiling stocks of carbon paper to reproduce documents in a worst-case scenario of winter blackouts.

The Daily Mail has reported that this winter could see people told not to cook until after 8pm and not to use washing machines or dishwashers between 2pm and 8pm as part of energy rationing. Pubs may be ordered to close at 9pm and schools could switch to three-days weeks. The energy crisis in Europe has been exacerbated by sanctions on Moscow over the Ukraine conflict and a decrease in Russian natural gas supplies. While the UK is not directly dependent on Moscow for fuel, it is still suffering. The typical annual household fuel bill is expected to rise to around £3,500 from October, three times higher than last year. According to the Bank of England’s latest report, inflation will soar to 13% in October and from the fourth quarter of this year, the UK is projected to enter recession.

A rare sane voice.

“Ukrainian propaganda” should be stopped “under the aegis of the UN and media organizations.”

• Kiev Spreading ‘Propaganda By Fear’ – French Ex-presidential Candidate (RT)

A former presidential candidate in France has accused Ukrainian leader Vladimir Zelensky of using ‘war propaganda’ as a tool to obstruct the peace process. Veteran politician Segolene Royal also called on the UN and media associations to fight against such tactics. Royal’s suggestion, that some of the “war crimes” Kiev blames on Russian troops were part of ‘propaganda,’ has made her a target for widespread criticism. Speaking to BFMTV earlier this week, Royal said that “everyone knows that there is war propaganda by fear.” As an example, she cited the alleged shelling of a maternity hospital in Mariupol – the story which made headlines in Western media in early March. Zelensky blamed Russia for the incident that, as local authorities claimed, killed three people, including a child.

The Russian military denied targeting the medical facility and insisted the whole thing was a “completely staged provocation” by the Ukrainian side. “You can imagine that if there had been any victim, any baby with blood, in the age of cell phones we would have seen [their photos],” Royal stressed. The authenticity of the photos presented by Kiev as proof of the claimed Russian attack were questioned by many online. Marianna Vyshemirskaya, one of the pregnant women featured in the images that appeared on the front pages of many major outlets, later claimed that there had been no Russian airstrike on the hospital. She insisted that she told AP journalists about this, but they decided not to mention it in their reportage. Royal, who used to be a long-term partner of France’s former president Francois Hollande, also commented on the events of April in the town of Bucha near Kiev, after which Zelensky claimed that negotiations with Russia became impossible.

Ukrainian authorities accused the Russian forces of multiple atrocities against civilians in the town, including the rape of children. Moscow firmly denied the allegations of war crimes, insisting it was “yet another provocation” by Kiev. “The stories of child rape for seven hours under the eyes of the parents: but it’s monstrous to go and spread things like that only to interrupt the peace process,” the veteran French politician stated, without elaborating She also claimed that Zelensky used accounts of alleged torture of Ukrainian soldiers by Russian troops – which Moscow also vehemently denies – not only to impede any peace process but also to “remobilize” troops. She argued that as “there’s been enough horror of war and casualties” and that “Ukrainian propaganda” should be stopped “under the aegis of the UN and media organizations.” s

Google translate.

“Fantastic profits are now being made from renewable energy. The billions are pouring into Paris. Europe can change that by saying: “You get a price that is still profitable, but we skim everything between that and the market price.”

• Mayor Of Antwerp: ‘Belgium Is Bankrupt, We Are The New Greece’ (AD)

The mayor of Antwerp, Bart De Wever, says Belgium is bankrupt. “We are the new Greece,” he says on Belgian television. “This is of course not a crisis that Putin has caused, but that Europe has brought on itself by phasing out its own primary energy production this century.” “In America people are not in this shit. They have done the opposite of what we have done. They are now exporters of oil and gas, but they certainly weren’t twenty years ago. Climate standards are not of much use if all your companies go to America and China to produce, then you are bankrupt and the climate is not yet saved. This is the green dogmatics. People should start realizing this,” says De Wever in the Flemish current affairs program De Zevende Dag.

“Oil, gas and coal were no longer allowed. No investments were allowed in reserves. Germany does not have a single LNG terminal (a terminal for liquefied natural gas, ed.). The dumbest countries, Germany and Belgium, have phased out nuclear energy in parallel. We have pushed away all energy sources, making ourselves dependent on Putin. Now we hang on to it.” “The biggest power tool has to come from Europe. Von der Leyen is on the right track when she says that non-gas-related energy production must be decoupled from price. Fantastic profits are now being made from renewable energy. The billions are pouring into Paris. Europe can change that by saying: “You get a price that is still profitable, but we skim everything between that and the market price.” That would mean an injection of billions and billions for our country, which you can then give to the consumer.”

We could once have made a lot of profit with the nuclear power plants, now those assets are being given away The previous government, of which De Wever’s party was part, decided that the Belgian nuclear centers Tihange 2 and Doel 3 should close. “It’s a purple-green law. We now have a purple-green government. That is a recipe for catastrophe.” Yet he co-approved that law. “I was lonely then. Elio Di Rupo (ex-Prime Minister of Belgium, ed.) then exclaimed in parliament: “On which planet do the N-VA live, given that they are in favor of nuclear energy?” I cannot be caught not being consistent in positions . I have been defending nuclear energy since the 1980s.” Prime Minister Alexander De Croo says the country is “in an economic war situation”. “Everything has to be on the table,” it sounds.

According to De Croo, the nuclear power plants can only be restarted within five years. Arranging the necessary permits takes a lot of time. De Wever thinks that reaction is ‘a bit late’. “As beggars, we must now appear in Paris. We could once have made a lot of profit with the nuclear power plants, now those assets are being given away. I think it is a bit cheap that people now realize that it is not all that simple.” According to De Wever, it is time ‘for bitter truths’. “This country is bankrupt,” it sounds. “Look at our debt, government spending and deficit. It is worse than in Southern Europe. That has to do with policy. This government has done nothing about it. I have said before that in the next economic shock we will be the new Greece. Unfortunately that is now. Mr De Croo can say a lot, but he can’t do anything. There are no buffers.” s“Especially in the coming budget discussion, it will have to be looked at exactly what can be done”, continues De Wever. “We have many energy-intensive companies in Flanders. They are very vulnerable. In the port of Antwerp, certain factories in the petrochemical port are already shut down.”

“..our progress as human beings from a standard of living perspective is entirely the result of our exploitation of carbon-based fuels..”

• The Truth About Carbon-Based Fuels (Denninger)

Carbon-based fuels are the reason for modern society. Carbon-based fuels have been responsible for lifting every single area of the world out of privation and dependence on the whims of weather and vagaries of wandering consumers of vegetable material (otherwise known as “meat”) one region at a time — without exception. As the use of carbon-based fuels has been further-refined (e.g. from trees to coal to oil to natural gas) the lift in living standards has been dramatically increased, again without exception anywhere in the world. Not one single subset of society has ever moved forward on any other basis in human history. Ever. To obtain nuclear power, for example, one must exploit carbon-based fuels.

You need them to dig up the rock, separate the uranium, isotopically separate the U-235 from the U-238, produce the zirconium cladding for fuel pins (which also requires digging up rock in size and processing said earth), producing the steel for the containment building and pressure vessel, welding it all together, producing all the copper wiring (more digging, smelting, etc.) for the control systems and more. Not one single scintilla of harnessed nuclear energy would have ever been produced without carbon-based fuels. Indeed, without carbon-based fuels the smelting of the lead required for the first reactor pile shielding would have been impossible. To obtain lithium for a battery you must also exploit carbon-based fuels. One half-million pounds of earth must be dug out of the ground and processed to produce one such battery. This is before a single watt-hour of energy goes into it — that’s just to produce the empty pack.

When it wears out, and all things do, you must do that again. We do not use carbon-based fuels because we’re pigs. We use them because they are wildly less-expensive, easy to package, emit enormous amounts of energy for their mass and volume by comparison to all other means of energy storage other than nuclear, are thus easy to transport to where they’re needed compared against all others and can be stored without material degradation for significant periods of time. That means they’re both reliable and have predictable cost structures and the alternatives are not. Without predictable cost structures nobody can produce anything that has a lead time because there’s no way to price it on a forward basis and nobody will buy anything for delivery in the future if they do not know the price.

Whether we like to admit it or not, our progress as human beings from a standard of living perspective is entirely the result of our exploitation of carbon-based fuels. To reduce or replace them with something that has lower density, is more-difficult transport (or is even impossible to transport or store), is higher cost or has unpredictable reliability and forward cost will directly and ratably destroy our standard of living by the difference in contribution that carbon-fuels make and that which is not made up by a stable, reliable and cost-predictable alternative.s

“..made the President look like he was giving a stump speech from Dante’s Inferno. Indeed, it almost had that High Chancellor Adam Sutler look from V for Vendetta..”

• Biden’s Use of the Marines Violated Federal Policies and Regulations (Turley)

President Joe Biden’s speech in Philadelphia has produced sharply different responses from the media. On CNN, it was praised as a rallying cry for patriots. On conservatives sites, it was denounced as hateful and divisive. For many of us, however, the optics was a glaring distraction with the intense red background and prominently placed Marines framing the President. The use of the Marines and the Marine band raised concerns given the clearly political purpose of the speech. Indeed, the networks did not view the speech as an address to the nation and refused to give the White House primetime slots. While White House press secretary Karine Jean-Pierre assured the media that “it’s not a political speech,” it was unabashedly political from calls to get the vote out to direct attacks on “MAGA Republicans” and Donald Trump.

That again raised the legal questions over the use of the Marines in such a speech. Even CNN flagged the concern over the use of the Marines and CNN chief White House correspondent Kaitlan Collins stated the obvious that “it was a very political speech.” The optics of the speech instantly became a source of Internet chatter with the weird red background that made the President look like he was giving a stump speech from Dante’s Inferno. Indeed, it almost had that High Chancellor Adam Sutler look from V for Vendetta. (The comparison ultimately did not end with just the optics. Sutler warned his inner circle that “every day…brings us closer to November” and “I want this country to realize that we stand on the edge of oblivion. I want every man, woman and child to understand how close we are to chaos…to remember why they need us!”).

However, it was the use of the Marine guards that most stood out — framing the President as he declared Trump supporters to be a threat to democracy . Biden denounced “MAGA Republicans” thirteen times as well as repeated references to his past and possible future political opponent, Donald Trump. The speech was obviously political, as noted by CNN’s Collins, as a “full frontal attack” on his political opponents. The United States has long drawn a line between the work of federal employees in public service and the use of such employees for political purposes. The Hatch Act was passed in 1939 to curtail the political activities of civilian federal employees. The Marine Corps expressly forbids personnel from being used or participating in such political events.

“Active duty members will not engage in partisan political activities, and all military personnel will avoid the inference that their political activities imply or appear to imply DoD sponsorship, approval, or endorsement of a political candidate, campaign, or cause.” The other services have also drawn a bright line against such appearances. Army officials, for example, stress that their rules bar such involvement because “actual or perceived partisanship could undermine the legitimacy of the military profession and department.” In Department of Defense Directive 1344.10 the long list of prohibited involvement in political events include: “Attend partisan political events as an official representative of the Armed Forces, except as a member of a joint Armed Forces color guard at the opening ceremonies of the national conventions of the Republican, Democratic, or other political parties recognized by the Federal Elections Committee or as otherwise authorized by the Secretary concerned.”

Not even human?!

• ‘Never Seen’ Before: Embalmers Find Numerous Long, Fibrous Clots (ET)

Mike Adams, who runs an ISO-17025 accredited lab in Texas, analyzed clots in August and found them to be lacking iron, potassium, magnesium, and zinc. Adams’s lab uses inductively coupled plasma mass spectrometry (ICP-MS), triple quadrupole mass spectrometer, and liquid chromatography-mass spectrometry, usually testing food for metals, pesticides, and glyphosate. “We have tested one of the clots from embalmer Richard Hirschman, via ICP-MS. Also tested side by side, live human blood from an unvaccinated person,” Adams told The Epoch Times. He found that the clots are lacking key elements present in healthy human blood, such as iron, potassium, and magnesium, suggesting that they are formed from something other than blood.

Adams is joining analytic forces with more doctors and plan to invest out of their own pocket in equipment in order to further determine their composition and probable causation. The string-like structures differ in size, but the longest can be as long as a human leg and the thickest can be as thick as a pinky finger. Richard Hirschman, a licensed funeral director and embalmer in Alabama, recalled that he has been in the trade since the tragedy of 9/11. “Prior to 2020, 2021, we probably would see somewhere between 5 to 10 percent of the bodies that we would embalm [having] blood clots,” Hirschman told The Epoch Times. “We are familiar with what blood clots are, and we’ve had to deal with them over time,” he said. He says that now, 50 percent to 70 percent of the bodies he sees have clots.

“For me to embalm a body without any clots, kind of like how it was in the day, prior to all of this stuff … It’s rare,” Hirschman said. “The exception is to embalm a body without clots,” he noted. [..] “Notice that the key elemental markers of human blood such as iron are missing in the clot (which is just at 4.4 percent of blood). Similar story with magnesium, potassium, and zinc. These are clear markers for human blood. Live human blood will always have high iron, or the person would be dead. These clots have almost no iron, nor magnesium, etc.,” Adams told The Epoch Times. Wade Hamilton, a cardiologist who is familiar with clots, told The Epoch Times: “The fact that the magnesium, potassium, and iron are very low in the samples could suggest that they are not the usual post-mortem clots, that in fact there was no blood flow in these vessels.

These structures raise but do not totally answer some interesting questions.” “The combination of the low electrolytes and the novel very strong string-like structures suggests that these areas where the string-like structures are seen in the blood vessels did not receive circulation. They are not ‘normal’ post-mortem findings according to experienced embalmers bent on obtaining total body vascular access from one site, which because of the unusual ‘clots,’ they were unable to do,” he added.

Koko

Koko the gorilla’s last message to humanity pic.twitter.com/mdQUmLL6jd

— Historic Vids (@historyinmemes) September 4, 2022

the third-tallest and second-heaviest living bird, the cassowary, during its breeding season, lays bright green or pale green-blue eggs

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.