Jean-Michel Basquiat Self Portrait 1982

Nap/Macgregor

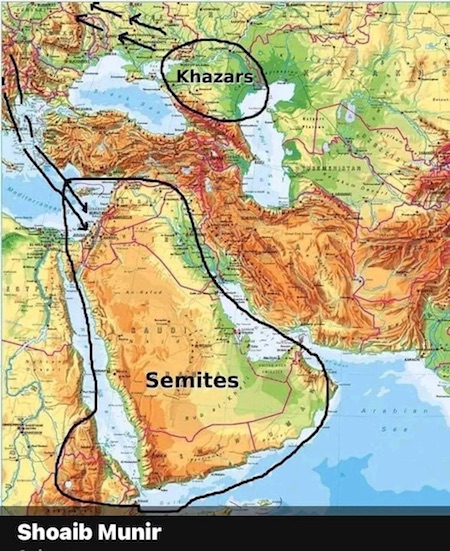

Dr. Areilla Oppenheim from the Hebrew University of Jerusalem, did the first extensive DNA study in 2001 on Israelis and Palestinians, and concluded that emigrants on ships to Palestine before it became Israel were 40% Mongolian and 40% Turkish. There was no Semitic blood…

Ray McGovern: They Killed JFK, Will We Let Them Kill Peace?

Nap/Wilkerson

This is quite incredible. This is Col. Lawrence Wilkerson, former chief of staff to Colin Powell when he was Chairman of the Joint Chiefs of Staff and Secretary of State, who predicts the ultimate outcome of Israel's behavior will be the country's destruction.

He compares it to… pic.twitter.com/w6FNRMvetl

— Arnaud Bertrand (@RnaudBertrand) November 23, 2023

Macgregor

Nap Celente

WATCH FULL VIDEO: Is #Israel committing genocide in #GAZA, and is #GenocideJoe a fair name for @POTUS? https://t.co/ApfzEoXKC6 pic.twitter.com/YdmCZT14Vo

— Gerald Celente (@geraldcelente) November 23, 2023

Joe Lauria: “Is it any coincidence that a 4-day ceasefire allowing cameras to show food trucks delivering aid to Gazans coincides with the 4-day Thanksgiving holiday, when Americans often debate politics and won’t be confronted with images of genocide and deprivation as they overeat? The killing will resume when they go back to work on Monday.”

Actress Melissa Barrera is fired from the next Scream film sequel for daring to speak for the persecuted #Palestinians – “I’d rather be excluded for who I include, than be included for who I exclude.”

If you think the pope is pro-Palestinian, wait until you meet Jesus.

“..Hamas baited a trap for Israel which the government of Israeli Prime Minister Benjamin Netanyahu predictably rushed into.”

• Hamas is Winning the Battle for Gaza (Scott Ritter)

When Hamas launched its October 7 attack on Israel, it initiated a plan years in the making. The meticulous attention to detail that was evident in the Hamas operation underscored the reality that Hamas had been studying the Israeli intelligence and military forces arrayed against it, uncovering weaknesses that were subsequently exploited. The Hamas action represented more than sound tactical and operational planning and execution—it was a masterpiece in strategic conceptualization as well. One of the main reasons behind the Israeli defeat on October 7 was the fact that the Israeli government was convinced that Hamas would never attack, regardless of what the intelligence analysts charged with watching Hamas activity in Gaza were saying. This failure of imagination came about by Hamas having identified the political goals and objectives of Israel (the nullification of Hamas as a resistance organization by undertaking a policy built on “buying” Hamas through an expanded program of work permits issued by Israel for Palestinians living in Gaza.)

By playing along with the work permit program, Hamas lulled the Israeli leadership into complacency, allowing Hamas’ preparations for their attack to be carried out in plain view. The October 7 attack by Hamas was not a stand-alone operation, but rather part of a strategic plan possessing three main objectives—to put the issue of a Palestinian state back on the front burner of international discourse, to free the thousands of Palestinian prisoners held by Israel, and to compel Israel to cease and desist when it came to its desecration of the Al Aqsa Mosque, Islam’s third holiest place. The October 7 attack, on its own, could not achieve these outcomes. Rather, the October 7 attack was designed to trigger an Israeli response which would create the conditions necessary for Hamas’ objectives to reach fruition. The October 7 attack was designed to humiliate Israel to the point of irrationality, to ensure that any Israeli response would be governed by the emotional need for revenge, as opposed to a rational response designed to nullify the Hamas objectives.

Here, Hamas was guided by the established Israeli doctrine of collective punishment (known as the Dahiya Doctrine, named after the West Beirut suburb that was heavily bombed by Israel in 2006 as a way of punishing the Lebanese people for Israel’s failure to defeat Hezbollah in combat.) By inflicting a humiliating defeat on Israel which shattered both the myth of Israeli invincibility (regarding the Israel Defense Forces) and infallibility (regarding Israeli intelligence), and by taking hundreds of Israelis hostage before withdrawing to its underground lair beneath Gaza, Hamas baited a trap for Israel which the government of Israeli Prime Minister Benjamin Netanyahu predictably rushed into.

“South Africans do know a thing or two about apartheid. They, like other critics of Israel, better be extra wary moving forward.”

• Gaza: A Pause Before The Storm (Pepe Escobar)

While the world cries “Israeli genocide,” the Biden White House is gushing over the upcoming Gaza truce it helped broker, as though it’s actually “on the verge” of its “biggest diplomatic victory.” Behind the self-congratulatory narratives, the US administration is not remotely “wary about Netanyahu’s endgame,” it fully endorses it – genocide included – as agreed at the White House less than three weeks before Al-Aqsa Flood, in a 20 September meeting between Israeli President Benjamin Netanyahu and Joe “The Mummy” Biden’s handlers. The US/Qatar-brokered “truce,” which is supposed to go into effect this week, is not a ceasefire. It is a PR move to soften Israel’s genocide and boost its morale by securing the release of a few dozen captives. Moreover, the record shows that Israel never respects ceasefires.

Predictably, what really worries the US administration is the “unintended consequence” of the truce, which will “allow journalists broader access to Gaza and the opportunity to further illuminate the devastation there and turn public opinion on Israel.” Real journalists have been working in Gaza 24/7 since October 7 – dozens of whom have been killed by the Israeli military machine in what Reporters Sans Frontieres calls “one of the deadliest tolls in a century.” These journalists have spared no effort to go all the way to “illuminate the devastation,” a euphemism for the ongoing genocide, shown in all its gruesome detail for the entire world to see. Even the UN Relief and Works Agency for Palestine (UNRWA), itself relentlessly attacked by Israel, revealed – somewhat meekly – that this has been “the largest displacement since 1948,” an “exodus” of the Palestinian population, with the younger generation “forced to live through traumas of ancestors or parents.”

As for public opinion all across the Global South/Global Majority, it “turned” long ago on Zionist extremism. But now the Global Minority – populations of the collective west – are watching raptly, horrified, and bitter that in just six weeks, social media has exposed them to what mainstream media hid for decades. There will be no turning back now that this penny has dropped. The South African government has paved the path, globally, for the proper reaction to an unfolding genocide: parliament voted to shutter the Israeli embassy, expel the Israeli ambassador, and cut diplomatic ties with Tel Aviv. South Africans do know a thing or two about apartheid. They, like other critics of Israel, better be extra wary moving forward.

Anything can be expected: an outbreak of foreign intel-conducted “terra terra terra” false flags, artificially induced weather calamities, fake “human rights abuse” charges, the collapse of the national currency, the rand, instances of lawfare, assorted Atlanticist apoplexy, sabotage of energy infrastructure. And more. Several nations should have by now invoked the Genocide Convention – given that Israeli politicians and officials have been bragging, on the record, about razing Gaza and besieging, starving, killing, and mass-transferring its Palestinian population. No geopolitical actor has dared thus far. South Africa, for its part, had the courage to go where few Muslim and Arab states have ventured. As matters stand, when it comes to much of the Arab world – particularly the US client states – they are still in Rhetorical Swamp territory.

They simply want all hospitals gone, make the strip unlivable.

• IDF Knew Real Hamas HQ While Lying About al-Shifa (CN)

Although corporate news media have made it clear they don’t buy the Israel Defense Forces (IDF) claim that al-Shifa Hospital has been a cover for a Hamas command and control center and weapons armory, Western media have failed to report a much bigger story. The IDF and the Israeli government already knew when they launched their propaganda campaign about al-Shifa that Hamas had no military command and control facility hidden there because it had already found the complex kilometers away. As Consortium News reported last week, for 15 years the Israelis claimed Hamas was operating its primary command and control base from a tunnel underneath al-Shifa. After the Israeli bombing campaign against Gaza began in October, the Israeli military amplified that message to press its contention that by hiding the Hamas high command, al-Shifa Hospital had lost its immunity from military operations under the law of war, and could now legitimately be taken over by force.

On Nov. 11, IDF spokesman Richard Hecht declared that al-Shifa was the “main hub of Hamas activity;” Newsweek reported the IDF regarded al-Shifa Hospital as “Hamas’s main command post” and the Times of Israel headlined “Hamas leaders again hiding under hospital”. The crescendo of Israeli propaganda about al-Shifa being a “human shield” for Hamas came with a long report published by The New York Times on Nov. 14. It was based on interviews with eight present and former intelligence and defense officials, describing a vast military command complex under al-Shifa with multiple levels. But something quite unexpected had happened during this new round of press stories on al-Shifa that completely demolished the entire IDF story line: the IDF had gained control of the real Hamas command and control center in an area where the Hamas leadership had previously had their above-ground offices in the Al Atatra neighborhood, in the extreme northwest of Beit Lahiya city, 8.5km away from al-Shifa.

After that office building was demolished, the IDF discovered a major tunnel facility that was quite certain had been the central headquarters for the Hamas high command — the command and control center for the entire war. As the IDF leaked to The Jerusalem Post in a story published Nov. 14, the discovery was made “several days ago” of a tunnel with an elevator that reached thirty meters underground, compared with only five meters underground in other tunnels. Furthermore it had been equipped with oxygen, air conditioning and more advanced communications than seen anywhere else. That major IDF discovery, made on or before the Nov. 11 false stories about al-Shifa, threatened to undermine the Israeli political campaign to justify the IDF’s takeover and destruction of Gaza’s hospitals on the grounds that they were “human shields” for Hamas.

Al-Shifa Hospital was the centerpiece of that campaign, based on the claim that it was hiding the high command of Hamas in a tunnel underneath it. Obviously the IDF and the extreme right-wing Israel government would want to stop all further publicity about the discovery of the actual Hamas high command’s underground base. No story about the discovery of the real Hamas high command bunker has been published inside Israel or elsewhere in the nearly two weeks since the detailed Jerusalem Post piece on Nov. 14. Somehow the Israeli government and media have been able to completely suppress the discovery of the Hamas headquarters, despite the fact that a number of foreign news media have offices in Tel Aviv and the story is still available on the internet.

“..the boats will carry 4,500 people from 40 countries, “including anti-Zionist Jews.”

• 1,000 Boats To Leave Türkiye For Gaza In New ‘Freedom Flotilla’ (Palinfo)

Approximately 1,000 boats have gathered in Türkiye on Wednesday before heading toward Gaza in an attempt to break the Israeli blockade in a similar attempt from over a decade ago. In an interview with Turkish news website Haber7, Volkan Okçu, one of the organizers of the protest, indicated the boats will carry 4,500 people from 40 countries, “including anti-Zionist Jews.” Among the 1,000 vessels would be 313 boats filled with Russian activists, and 104 filled with Spanish activists, he said. Only 12 Turkish vessels will join the flotilla, he told Haber7. However, Okçu said in a later tweet that he expected the number of Turkish vessels to be much higher.

The activist indicated to Haber7 that the flotilla is scheduled to leave Turkish coasts on Thursday. The maritime convoy is set to make a first stop in Cyprus before continuing toward the Israeli port of Ashdod. Some participants in the flotilla will also reportedly take their spouses and children on board.

“Hitler sought to radicalise Muslims for jihad against the British and French colonial powers, as had the Kaiser in the First World War.”

• How Zionists Rewrote the History of The Second World War (McCrae)

The truth about the relationship between the Third Reich and the Jews is more complicated than the induced horror of a trip to Auschwitz. Robert Oulds, in his masterpiece, World War II: the First Culture War (2023), describes what happened in Palestine, a less-known yet dramatic theatre of the Second World War. In the 1930s Hitler had supported a Jewish homeland, as was already emerging since the Balfour Declaration of 1917. But the Holy Land around Jerusalem was keenly contested. The British had suppressed the Arab Revolt of 1936 to 1939, but Palestine and the wider Middle East were volatile.. Hitler sought to radicalise Muslims for jihad against the British and French colonial powers, as had the Kaiser in the First World War. As Oulds explains: ‘Hitler planned to use Crete as a steppingstone to reach Cyprus and from there take Palestine from the British and Zionists who were in the process of colonising the Mandate.’

The Zionist paramilitary organisation, the Stern Gang, sought cooperation with the Nazis, to liberate Palestine from British control, but their overtures were coolly received. Hitler favoured the Arab nationalists. Meanwhile, twelve thousand Palestinians, mostly but not exclusively Christian, had volunteered to serve in the British army. According to Oulds, ‘the Nazis admired Islam because its adherents were prepared to sacrifice their lives for their cause. Furthermore, as the Nazis were opponents of Judeo-Christian heritage, they thought that Islam could be a useful tool in undermining the traditions which the National Socialists despised.’ Ironically, this was similar to the aim of the Frankfurt School, whose Cultural Marxist professors were predominantly of the Jewish intelligentsia targeted by Hitler.

Muslims, particularly from the Caucasus, Bosnia and the Crimean Tatars, were recruited to the Waffen SS. The Grand Mufti of Jerusalem helped the Germans in this regard. However, Hitler’s Middle-Eastern endeavour was unsuccessful. Zionists showed little gratitude to the British for the initiation of the Jewish state. The Stern Gang killed about two hundred servicemen, many of whom had fought bravely in the North African desert against Rommel’s army. In 1946, ninety-one people died in the bombing of the King David Hotel in Jerusalem, site of the British administrative headquarters. Twenty-eight lives were lost, including five British soldiers, in an attack on the El Kantara to Haifa express train in 1947. Other violent campaigns of terror and ethnic cleansing were waged by other Jewish terrorist organisations, including the Haganah, Irgun, and Lehi.

“And just like that the J6 Committee’s violent insurrection narrative has crumbled..”

• How the Democratic Party Faked an American Insurrection (Robert Bridge)

“Truth and transparency are critical,” Johnson said in a prepared statement. “This decision will provide millions of Americans, criminal defendants, public interest organizations, and the media an ability to see for themselves what happened that day, rather than having to rely upon the interpretation of a small group of government officials.” Democrats, however, who have milked the ‘insurrectionist’ narrative for everything it is worth, predictably chafed at the release, calling it a ‘risk to national security.’ “It is unconscionable that one of Speaker Johnson’s first official acts as steward of the institution is to endanger his colleagues, staff, visitors, and our country by allowing virtually unfettered access to sensitive Capitol security footage,” said New York Democrat Rep. Joseph Morelle, who sits on the Committee on House Administration. “That he is doing so over the strenuous objections of the security professionals within the Capitol Police is outrageous. This is not transparency; this is dangerous and irresponsible.”

For almost two years, Democrats, who managed to cherry-pick the most suggestive scenes of the footage, portrayed January 6th as everything from another September 11 to a second Pear Harbor. Last year, Alexandria Ocasio-Cortez (AOC), the photogenic member of the Democrat’s radical progressive wing, was shown visibly upset after having to “relive” the events of the Capitol riot. “I am so angry. Having to relive that footage,” she sobbed, rubbing her forehead. “I know it’s not just me. This is everyone.” “These attacks killed people, traumatized people and for any of you right-winger Trump loyalists, he sent his own people to jail, and promised his own people that he would pardon them.” The inconvenient truth, however, is that only one person was killed on the day of the Capitol riot – unarmed Air Force veteran and avid Trump supporter, Ashli Babbitt, who was shot by a police officer.

Now, Republicans are demanding justice be served and that the incarcerated protesters be immediately set free. “And just like that the J6 Committee’s violent insurrection narrative has crumbled,” said conservative commentator Charlie Kirk over X (formerly Twitter). “The Capitol Police facilitated the protesters passage through the building…the vast majority of J6ers should be immediately released.” However, with the Democrats still in control of Washington, D.C., together with the FBI, the Justice Department and other administrative offices, the Republicans will have to wait until November 4th – and possibly longer if they lose their White House bid – before any real justice is meted out. Meanwhile, federal officials have said there is no evidence that law enforcement officials helped coordinate the attacks.

“If you are asking whether the violence at the Capitol on January 6 was part of some operation orchestrated by FBI sources or agents the answer is emphatically no,” FBI Director Christopher Wray told Rep. Clay Higgins (R-La.) during a House Committee hearing. Higgins was questioning Wray about two Greyhound buses he said dropped off FBI agents dressed as Trump supporters at the Capitol on January 6, referring to the vehicles as “ghost buses.” Whatever the case may be, the fresh revelations were a silver lining in a shitstorm that has been following Donald Trump, who hopes to win back the White House next November despite multiple legal woes. “Congratulations to Speaker of the House Mike Johnson for having the Courage and Fortitude to release all of the J6 Tapes, which will explicitly reveal what really happened on January 6th!” Trump wrote on Truth Social Friday.

“Buying a ticket to the Trump Circus could really backfire for Zelensky..”

• Zelensky Weighing Trump Peace Plan: ‘Time to Wrap This Conflict Up’ ? (Sp.)

In a recent interview with US media, Ukrainian President Volodymyr Zelensky signaled a belated interest in a peace proposal pitched earlier this year by former US President Donald Trump. In June, before a failed Ukrainian counteroffensive and a renewed Russian offensive, Zelensky had appeared incredulous at the suggestion of a negotiated settlement. In May, Trump claimed he “would have that war settled in one day, 24 hours” if he were president, saying he would sit down with both Zelensky and Russian President Vladimir Putin, both of whom “have their weaknesses.” The following month, as Ukraine was preparing to launch a highly anticipated counter-offensive, Zelensky told a US newspaper he “couldn’t understand” Trump’s statement, noting that in the four years Trump was in the White House, he didn’t secure the return of Crimea – by then part of the Russian Federation following its secession from Ukraine – or the Donbass – then governed by the autonomous People’s Republics that had not yet been recognized by Moscow – to Ukrainian control.

However, the Ukrainian counteroffensive fell flat on its face, failing to secure all but the most meager of territorial gains for Ukraine at an appalling human and materiel cost, and now Russian forces have launched their own operations aimed at pushing Ukrainian forces out of claimed Russian territories. Speaking with a US television news outlet on Tuesday, Zelensky said he was “ready” to hear Trump’s proposal. “Let’s speak with him and give him this possibility to show what steps [are] of his peace formula,” Zelensky said. “He can share it with me,” the Ukrainian leader said. “Yes, we can stop this war if we will give Russia Donbass and Crimea, to my mind that our country will not be ready for that such [a] peace plan. That is not [a] peace plan.” However, earlier this month, Zelensky told another US news outlet that he would only need “24 minutes” to explain to Trump “that he can’t manage this war … he can’t bring peace because of Putin.”

The US has already funneled more than $113 billion in aid to Kiev since Russia’s special operation began in February 2022, according to US government statistics, and Biden has called on Congress to approve a massive $61.4 billion aid bill. On Monday, US Secretary of Defense Lloyd Austin traveled to Kiev and declared the US would “continue to stand with Ukraine” and “will continue to support Ukraine’s urgent battlefield needs and long-term defense requirements.” Michael Shannon, a political commentator and Newsmax columnist, told Sputnik on Wednesday that Zelensky’s shift toward Trump was a risky intervention into US domestic politics that could seriously backfire. “It’s beginning to look like Zelensky’s blank check for US financial and military support has been returned for insufficient funds. The attitude on the part of the Biden administration and the left has been changing from ‘fighting to the last Ukrainian’ to ‘maybe it’s time to wrap this conflict up,’” Shannon told Sputnik.

“You can see evidence of this change in the coverage of the diplomatic portion of the conflict,” he noted. “The Regime Media is discussing negotiations without the previous preconditions. Zelensky can read the room and may be thinking that listening to Trump will signal an openness to alternative outcomes for the war.” However, Shannon also floated the opposite possibility: that Zelensky sees this maneuver as a ploy to provoke the White House into doubling down on support for Ukraine. “Or, it could be that Zelensky knows Trump is absolutely toxic to the Biden administration and he hopes that by meeting with Trump it will make a negotiated peace at this time anathema to the administration,” he explained. “Call it a ‘diplomatic bank shot’ if you will. A very risky bank shot. Zelensky would have been smarter to continue to ignore Trump.”

Not much left to celebrate..

• 2004, 2014, 2022: What Is Ukraine Celebrating? (Oncan)

The catalyst for the Maidan coup, as it is now known, was the suspension of the association process with the EU by the Ukrainian government on November 21, 2013. Allegations of corruption further fueled pro-Western actions. A symbolic moment occurred on December 8 of the same year when the Lenin statue in Kiev was demolished, signaling a transformative shift for Ukraine. The activists leading the Maidan protests were primarily figures associated with Ukraine’s Western-backed ultra-nationalist and neo-Nazi movements. The Social-Nationalist Party, founded in 1991 and later renamed Svoboda (ironically meaning “Freedom”), played a significant role in the 2014 protests through its youth organization, Ukrainian Patriot.

Notably, neo-Nazi figure Andrey Biletskiy, founder of Trizub (established in 2002 and later transformed into the Azov Battalion), symbolizes the character of the Maidan regime, having been imprisoned for demolishing the Lenin statue in 2011 but subsequently released to enter parliament after the coup. Dmitry Yarosh, the founder of Praviy Sektor and a manager of Trizub, emerged as a leading figure in neo-Nazi organizations during and after the Maidan protests. Yarosh further gained influence as the chief advisor to the Chief of General Staff of Ukraine. The United States, a major international supporter of the Maidan protests, was notably represented by Victoria Nuland, who, as the Assistant Secretary of State for European and Eurasian Affairs, distributed cookies to Ukrainian activists during the ongoing protests. Nuland’s involvement in shaping the post-coup administration, coupled with the claim that the USA spent $5 billion on Ukraine over two decades, highlighted the significant U.S. role.

The strong U.S. support for the Maidan coup also found expression in the appointment of Hunter Biden, the son of then-U.S. Vice President Joe Biden, to the board of directors of Burisma, Ukraine’s largest energy company. Following the coup, the ultra-nationalist government’s initial actions aimed to erase the Soviet past, suppress Russian cultural presence, and undertake moves against Russians in the country. The Ukrainian administration implemented measures such as banning the Russian language in public spaces, erecting statues of Nazi collaborators (particularly Bandera), designating their birthdays as public holidays, equalizing the status of Red Army veterans and members of Nazi collaborator organizations, official affiliation of neo-Nazi groups with the Ukrainian army, and the banning, persecution, and killing of members of the Communist Party and socialist organizations.

Russians, predominantly located in the east of the country, formed anti-fascist unions and engaged in Anti-Maidan actions to protect against attacks. This resistance led to the establishment of the Federal State of Novorossiya, comprising the Donetsk and Lugansk People’s Republics. Despite the Minsk protocol signed by Ukraine, Russia, Donetsk, Lugansk, and OSCE representatives for a ceasefire, Ukrainian forces persisted in their attacks. A protracted war ensued, exacerbated by the special military operation launched by Russia.

Make peace you fools.

• Dems Fear Ukraine Might Not ‘Survive’ Until 2024 as House Halts Funding (Sp.)

The crisis in the Middle East, the possibility of a government shutdown, and the election of a new House speaker have shifted Washington’s attention away from Ukraine, with officials in the Pentagon and civilian agencies sending increasingly desperate warning signals that they’re running out of cash to sink into NATO’s proxy war against Russia. White House officials and Democratic lawmakers lobbying for the extension of US economic and military assistance to Ukraine have sounded the alarm over GOP House Speaker Mike Johnson’s perceived foot-dragging in setting up a vote on the issue. Citing recent attempts to include Ukraine funding into omnibus, must-pass funding measures, Democratic lawmakers pointed out that the next stopgap funding bill won’t be coming until late January or early February of 2024, and expressed fears about whether Kiev can hold out for that long.

“I don’t know that Ukraine can survive until February of 2024,” Democratic Senator Chris Murphy told Beltway media this week. “My sense is they start to run short of ammunition in the next several weeks.” “We have to bear down, get this done and get this supplemental passed soon because the brave Ukrainians who are fighting as winter is coming are looking at losing the supplies they’ve needed for ammunition, for missiles, for drones, for defense, for armor, and we cannot possibly afford to abandon Ukraine,” his colleague, Democratic Senator Chris Coons concurred. Johnson and his conservative Republican colleagues in the House of Representatives torpedoed President Joe Biden’s proposed $105 billion all-in-one funding bill this month containing money for Ukraine, Israel, cash for US brinksmanship with China in the Pacific, and the border crisis, instead pushing through a stopgap measure preventing a government shutdown and assuring funding for government services, but not a cent more.

The bill passed the Senate, and President Biden reluctantly signed it, despite earlier threats by the White House to veto the measure. For the Pentagon and US civilian agencies tasked with doling out cash to Kiev, Johnson’s reluctance to tee up a vote on Ukraine poses a real danger, with US military officials warning earlier this month that there was only about $1 billion remaining in the Ukraine war chest, and a USAID administrator revealing that its funds for direct budgetary support were all gone. “Without further appropriations, the government of Ukraine would need to use emergency measures such as printing money or not paying critical salaries, which could lead to hyperinflation, and severely damage the war effort,” USIAD assistant administrator Erin McKee said in congressional testimony earlier this month.

Senior White House aides informed media that part of the administration’s problem with Johnson is that it “does not yet have a clear read” on the politician’s negotiating style, and expressed concerns that the speaker may not be as malleable as his predecessor, Kevin McCarthy to backroom side deals (which helped culminate in McCarthy’s ouster).

“Ukrainian prisons are currently holding at least a few brigades of deserters. Their motive is clear: fear of death..”

• Ukraine Has No One Left to Fight Because of Desertion (Sp.)

The botched counteroffensive has caused the Kiev regime a serious shortage of human resources for mobilization, not to mention growing questions from Kiev’s Western allies and donors as to what they are actually providing money and weapons for. In 2021, the Prosecutor General’s Office of Ukraine initiated 117 criminal cases for desertion. Another 2,028 cases were classified as “unauthorized leaving of a military unit or place of service,” meaning that individuals left their units with the intention of returning. In addition, there were 33 cases of self-inflicted injuries.In the first nine months of this year, 4,638 soldiers deserted from the Ukrainian Armed Forces, 10,940 temporarily left service, and there were 161 cases of self-harm. Deserters face sentences of five to eight years in prison. In some instances, these cases often end with a pretrial agreement and a suspended sentence.

Ukrainian prisons are currently holding at least a few brigades of deserters. Their motive is clear: fear of death. Local media reported that a Russian missile destroyed several dozen soldiers in their barracks. One survivor fled, taking his rifle with him. His friends say he surrendered as a PoW. Nevertheless, he was sentenced to eight years in prison. Another soldier left his position after it was shelled, but returned later. He was sent to a military psychiatrist. He did not fully recover, disappeared again, then was arrested and sentenced to 2.5 years in prison. Another deserter admitted in court that he feared for his life during the attack on Liman. According to him, the operation was poorly planned and lacked fire support. Sentence: five years. Some try to flee abroad. In July, a deserter was caught on the border with Romania. He was also sentenced to five years.

They are also sent to penal battalions. This is not widely publicized, but it happens. At the front, however, they only trust those who surrendered at the first opportunity, and now they are only assigned to construction work. Officers are punished for the desertion of subordinates. Therefore, if a soldier declares that he would rather go to jail than face bullets, he will be kept in the rear. However, fatigue from the fighting is mounting for everyone. Losses are enormous and finding replacements are problematic. Many combat units are 30-40 percent short of personnel. Almost everywhere, there are hidden desertions. Soldiers, sergeants, and officers feign illness and try to stay at headquarters and in rear units – anything to avoid the front lines. And then “psychologists” rush to help, complaining that many people live by the principle “see no evil, hear no evil,” so the state should intensify propaganda.

Reminder: Von der Leyen “negotiated” with Bourla on WhatsApp (or a similar app) , because she was not required to save such talks.

• Pfizer Sues Poland Over Covid-19 Vaccine (RT)

US pharmaceutical giant Pfizer has escalated its feud with Poland over excess Covid-19 vaccine doses that were ordered under a massive contract with the European Union, filing a lawsuit to demand payment for 60 million jabs that Warsaw didn’t need. The case was filed this week in Brussels, demanding 6 billion zloty ($1.5 billion) for the vaccines that Poland’s government declined after it stopped taking delivery of the jabs in April 2019. Warsaw was locked into buying its share of Covid-19 inoculations under a controversial contract that the European Commission signed with Pfizer in 2021 on behalf of EU nations. The bloc wound up ordering 1.1 billion doses under the contract, saddling EU states with a vaccine glut as the Covid-19 pandemic waned.

The EU prosecutor’s office announced an investigation of the procurement process amid allegations of corruption and secret backroom dealings. Polish officials questioned the role of European Commission President Ursula von der Leyen in making the deal. Von der Leyen admitted to privately communicating with Pfizer CEO Albert Bourla for weeks during the contract negotiations, but the European Commission said last year that her text exchanges with the executive could not be found. The first hearing in Pfizer’s lawsuit is scheduled to take place on December 6. The company offered earlier this year to give the EU more time to complete its minimum vaccine purchases under the binding contract, but it insisted that it eventually be paid for the full number of doses to which the bloc committed. Poland refused to sign on to a revised EU agreement with the drugmaker.

Polish Health Minister Katarzyna Sojka told broadcaster TVN24 on Wednesday that there is some hope of resolving the Pfizer lawsuit “in a positive way.” She noted that Warsaw is not alone in the issue, as other EU states will face similar lawsuits. Pfizer decided to go forward with the lawsuit “following a prolonged contract breach and a period of discussions in good faith between the parties,” a company spokesman told Politico. Millions of Poles refused to receive Covid-19 vaccines, and Warsaw halted deliveries of the jabs as an influx of Ukrainian refugees in early 2022 strained the government’s finances.

“The situation is especially dire in the Eurozone’s two largest economies, Germany and France..”

• Eurozone Economy ‘Stuck In The Mud’ – Economist (RT)

The lingering economic downturn in the Eurozone signals that the region may plunge into a recession by the end of the year, Bloomberg reported on Thursday, citing economists and private-sector activity surveys. According to S&P Global, the purchasing managers’ index (PMI) in the region continued to shrink in November, plunging to 47.1 points, the sixth consecutive monthly reading below 50 – the threshold separating contraction from growth. The same trend was seen in both manufacturing and services. “The Eurozone economy is stuck in the mud,” Hamburg Commercial Bank chief economist Cyrus de la Rubia told the news outlet. According to the expert, everything points to “a second consecutive quarter of shrinking GDP” after a 0.1% drop in gross domestic product in the previous quarter, which would constitute a technical recession.

The situation is especially dire in the Eurozone’s two largest economies, Germany and France, de la Rubia said, noting that both are “in the grip of considerable weakness.” While Germany’s contraction somewhat eased in November and private-sector activity shrank at a slower pace than in the previous month, the country remains “in recession territory” and its economy may return to growth no sooner than next year, the analyst predicted. The state of affairs in France, meanwhile, was even worse, with the country’s PMI little changed at 44.5. Both manufacturing and services are suffering from weak demand, while the surge in unused business capacity triggered the first decline in private-sector employment in three years. This put the country’s economy “in a kind of a dead-end,” according to another economist at Hamburg Commercial Bank, Norman Liebke. Inflation in both France and Germany remained far above target levels and is unlikely to decrease sufficiently enough to stop weighing on their economies in the short term, de la Rubia said.

They didn’t choose, the Federal Constitutional Court made the choice for them.

• Germany to Choose Lifeline for Its Embattled Economy Over Ukraine Aid (Sp.)

The German Finance Ministry has announced a freeze on almost all new spending approvals for 2023, permitting only current liabilities and exceptional new obligations, after a Federal Constitutional Court ruling questioned the legality of several hundred billion euros in special funds. Berlin is facing a tough choice between financial support for German businesses and continuing to waste money on the “failed project” that is NATO’s proxy war against Russia in Ukraine. As “Ukraine fatigue” percolating throughout the West increasingly pulls the rug from under Kiev’s hopes for continued financial and military assistance being funneled to it, another blow might have been dealt to Europe’s efforts to sustain aid for the regime, the WSJ noted.

German Finance Minister Christian Lindner announced a freeze on public spending for the rest of the year on Monday. Applicable to almost the entire budget for 2023, the decision was made due to “the need to review the overall budgetary situation for the federal budget,” as per a statement from the ministry. The move came in the wake of a bombshell ruling by the Federal Constitutional Court last week. The judicial ruling stated that the €60 billion (over $65 billion) earmarked for the pandemic response cannot be repurposed for other initiatives, like advancing green manufacturing practices or boosting solar energy production. The court said Berlin was bound by the country’s constitutionally enshrined fiscal rules that limit budget deficits to 0.35% of gross domestic product in normal times.

The implications of the move are such that Chancellor Olaf Scholz’s government is now facing a dilemma. The increasingly unpopular Scholz Cabinet had been counting on a flood of spending on “green-energy projects and technology,” along with multibillion-euro-worth subsidies to construct chip-making plants, the WSJ underscored. Now, Berlin will either have to go ahead with painful budget cuts or raise taxes, or even both. But most importantly, in the short term, Berlin will need to decide whether priority shall be given to boosting Europe’s collective defense, and directing more aid to the Kiev regime, or “cushioning the impact of surging energy prices and inflation on businesses and households,” the outlet said. Nevertheless, Berlin will continue supporting a €50 billion four-year Brussels budget package for Ukraine for next year, according to cited German sources conferring with the bloc’s officials on November 17.

There are reasons why it’s been used for centuries. Don’t throw it away, because you will get a lot of disadvantages.”

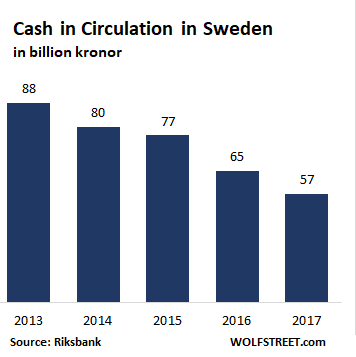

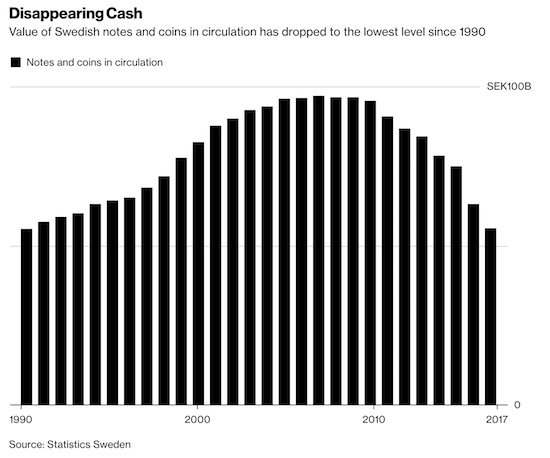

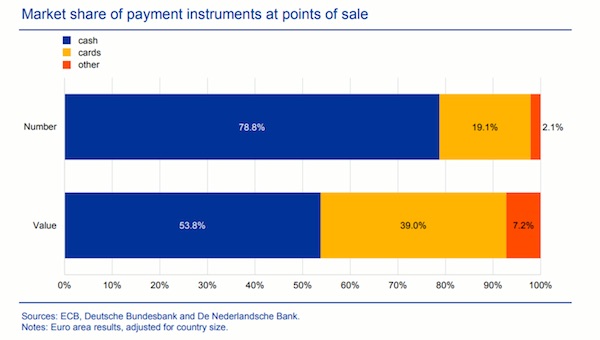

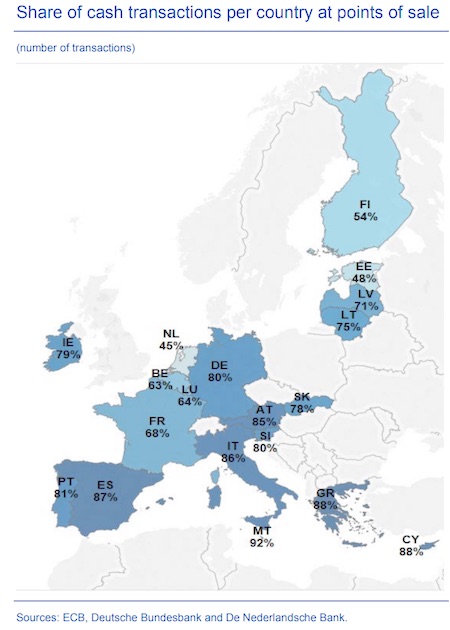

• Stark Warning Against UK Following Sweden By Going Cashless (Exp.)

Britain should not follow Sweden towards becoming a cashless society, the leader of a Scandinavian grassroots movement has warned. Björn Eriksson, a former president of international police organisation Interpol, set up his campaign group to fight against the ditching of notes and coins in Sweden. And in a warning to the UK against going cashless, he said: “My message would be keep the two systems side by side. “It’s true that it costs more to have a system of cash running parallel with a digital system, but look upon it as an insurance. “There are reasons why it’s been used for centuries. Don’t throw it away, because you will get a lot of disadvantages.” Mr Eriksson launched Kontantupproret – Cash Rebellion – in 2015 due to concerns that some people were being cut adrift by the decline of cash in Sweden.

He said: “It just happens that I tried to be more modern and suddenly I could see there is something curious with this. “Everybody seems to be happy, nobody’s talking about those left aside. And that was more or less the starting point.” He said those affected include pensioners, women fleeing abusive relationships, the disabled, refugees, voluntary organisations, small businesses and people living in the north of the country where internet coverage can be a problem. Just eight percent of people in Sweden used cash for their most recent payment, according to a 2022 survey by the country’s central bank, down from 39 percent in 2010. But Britain is not that far behind with figures from UK Finance showing 14 percent of transactions last year used notes and coins.

Banks are vanishing from high streets up and down the country with 5,753 branches shutting their doors since January 2015, figures from consumer group Which? show. And some shops, cafes, restaurants and other venues across the UK will now only accept plastic. In Sweden, many banks have stopped handling cash altogether and Mr Eriksson said it is increasingly difficult to pay with notes and coins in shops. He said: “If you take foods you still have the possibility but notice it’s very easy to pay with digital means, maybe you have five places where you can do it in a shop, while if you have cash it’s a long line and you have to wait and then you can use your cash. “If you want to have a cup of coffee in Stockholm and you walk from the Parliament to the Central Station, for example, there is nowhere you could get your cup of coffee because they have a little sign saying we are cashless.”

Are they trying to blow up the union?!

• European Lawmakers Vote For Abolition Of Member State Vetoes (RMX)

European lawmakers approved plans on Wednesday to remove the national veto for EU member states in the latest attempted power grab by Brussels to wrestle control away from national governments. A total of 291 MEPs supported the proposal put forward by the “Verhofstadt Group,” a group of MEPs led by the arch-federalist Guy Verhofstadt to amend the European Union treaties in favor of greater centralization and limiting the sovereignty of member states. The vote was only narrowly passed with a majority of just 17 after a faction of conservative parliamentary groups expressed considerable opposition to the move.

In the plenary debate on the matter on Tuesday, Verhofstadt claimed that veto rights had been used by member states disillusioned with the European Union’s trajectory to “blackmail” the bloc, a thinly veiled jibe at Hungarian Prime Minister Viktor Orbán, who has refused to sanction the European Union’s proposed amendments to the bloc’s collective budget to further finance the Ukrainian war effort. In response, a former co-rapporteur to the Verhofstadt Group, Polish MEP Jacek Saryusz-Wolski, accused federalists in the European Parliament of attempting “to transform the EU into a superstate,” continuing his opposition to the plans outlined in a recent interview with Remix News.

The public is not supposed to notice that a putsch is about to take place, that the European Union as a community of sovereign states is being abolished and a superstate is being created without any consent of the people, says Polish MEP Jacek Saryusz-Wolski Saryusz-Wolski resigned from the working committee led by Verhofstadt in protest at the development of the plan that would further politicize the European Commission, give Eurocrats sole competency over several issues including the environment, education, and public health, and remove the need for unanimity among member states in key policy areas. The Polish MEP called the move “a silent putsch with communist roots.”

Vice Chairman of the European Conservatives and Reformists (ECR) group Rob Roos, contrasted the vote on Wednesday with the Dutch election being held on the same day, posting on X: “Today the festival of democracy takes place in the Netherlands, but in Strasbourg our democracy is being buried. “A European Parliament majority just voted for the abolition of the Netherlands’ veto in many areas. Vote for a party that defends our veto!” he added. The resolution in reality changes little. It gives an insight into the consensus of the parliament but treaty change ultimately remains a matter upon which unanimity among member state governments is required.

“OpenAI defines AGI as autonomous systems that surpass humans in most economically valuable tasks..”

Better listen to Elon, and not let Bill Gates run away with it.

• OpenAI Researchers Warned Board of AI Breakthrough Ahead of CEO Ouster (R.)

Ahead of OpenAI CEO Sam Altman’s four days in exile, several staff researchers wrote a letter to the board of directors warning of a powerful artificial intelligence discovery that they said could threaten humanity, two people familiar with the matter told Reuters. The previously unreported letter and AI algorithm were key developments before the board’s ouster of Altman, the poster child of generative AI, the two sources said. Prior to his triumphant return late Tuesday, more than 700 employees had threatened to quit and join backer Microsoft in solidarity with their fired leader. The sources cited the letter as one factor among a longer list of grievances by the board leading to Altman’s firing, among which were concerns over commercializing advances before understanding the consequences. [..]

After being contacted by Reuters, OpenAI, which declined to comment, acknowledged in an internal message to staffers a project called Q* and a letter to the board before the weekend’s events, one of the people said. An OpenAI spokesperson said that the message, sent by long-time executive Mira Murati, alerted staff to certain media stories without commenting on their accuracy. Some at OpenAI believe Q* (pronounced Q-Star) could be a breakthrough in the startup’s search for what’s known as artificial general intelligence (AGI), one of the people told Reuters. OpenAI defines AGI as autonomous systems that surpass humans in most economically valuable tasks. Given vast computing resources, the new model was able to solve certain mathematical problems, the person said on condition of anonymity because the individual was not authorized to speak on behalf of the company.

Though only performing math on the level of grade-school students, acing such tests made researchers very optimistic about Q*’s future success, the source said. Reuters could not independently verify the capabilities of Q* claimed by the researchers. Researchers consider math to be a frontier of generative AI development. Currently, generative AI is good at writing and language translation by statistically predicting the next word, and answers to the same question can vary widely. But conquering the ability to do math — where there is only one right answer — implies AI would have greater reasoning capabilities resembling human intelligence. This could be applied to novel scientific research, for instance, AI researchers believe.

Unlike a calculator that can solve a limited number of operations, AGI can generalize, learn and comprehend. In their letter to the board, researchers flagged AI’s prowess and potential danger, the sources said without specifying the exact safety concerns noted in the letter. There has long been discussion among computer scientists about the danger posed by highly intelligent machines, for instance if they might decide that the destruction of humanity was in their interest. Researchers have also flagged work by an “AI scientist” team, the existence of which multiple sources confirmed. The group, formed by combining earlier “Code Gen” and “Math Gen” teams, was exploring how to optimize existing AI models to improve their reasoning and eventually perform scientific work, one of the people said.

Altman led efforts to make ChatGPT one of the fastest growing software applications in history and drew investment – and computing resources – necessary from Microsoft to get closer to AGI. In addition to announcing a slew of new tools in a demonstration this month, Altman last week teased at a summit of world leaders in San Francisco that he believed major advances were in sight. “Four times now in the history of OpenAI, the most recent time was just in the last couple weeks, I’ve gotten to be in the room, when we sort of push the veil of ignorance back and the frontier of discovery forward, and getting to do that is the professional honor of a lifetime,” he said at the Asia-Pacific Economic Cooperation summit. A day later, the board fired Altman.

Sea angel

https://twitter.com/i/status/1727792704078168321

Support the Automatic Earth in wartime with Paypal, Bitcoin and Patreon.