Rembrandt van Rijn Christ and St Mary Magdalene at the Tomb 1638

There’s nonsense and then there’s nonsense. Staying in your home is now a “huge expansion of retirement options”: “We’ve seen a huge expansion of the types of retirement options people have. One is aging in place and retrofitting your house.”

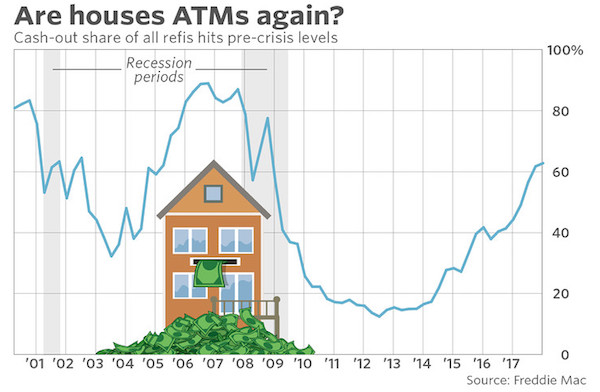

• US Homes Become ATMs Again (MW)

As interest rates rise, fewer households refinance their mortgages. And the refinances that do get done are often very different than those initiated during low-rate periods. “When rates are low, the primary goal of refinancing is to reduce the monthly payment,” wrote researchers for the Urban Institute in a recent report. “But when rates are high, borrowers have no incentive to refinance for rate reasons. Those who still refinance tend to be driven more by their desire to cash out.” “Cashing out” is shorthand for taking out a new mortgage that’s bigger than the remaining balance on the old one and using the money that makes up the difference for discretionary purchases.

As of the fourth quarter of last year, the share of all refinances that were cash-outs rose to the highest since 2008, according to Freddie Mac data. Rates have churned higher since the presidential election in late 2016, though they spent much of 2017 reversing the immediate post-election surge. It’s not clear whether the overall volume of cash-out refinances is rising. Right now they’re making up a bigger share of the pie because traditional lower-monthly-payment refis are plunging. Tapping into home equity is often a good way for owners to consolidate or manage other, more expensive, forms of debt like high-interest credit cards or bills for higher education.

“As people stay in their homes longer we see people reinvesting in their homes by using equity to update their homes and do repair work,” said Rick Sharga, executive vice president for Carrington Mortgage Holdings and an industry veteran. That’s especially true for older Americans, he added. “We’ve seen a huge expansion of the types of retirement options people have. One is aging in place and retrofitting your house.”

Housing markets need ever more private debt. So then does the overall economy.

• The Housing Crisis – There’s Nothing We Can Do… Or Is There? (Steve Keen)

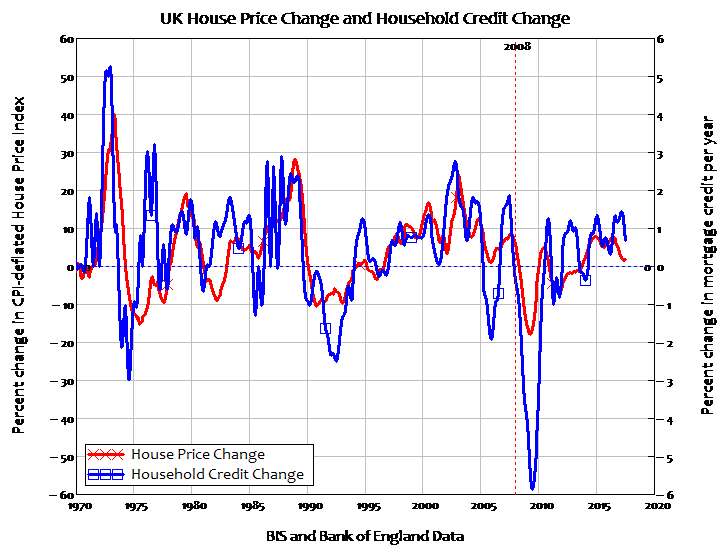

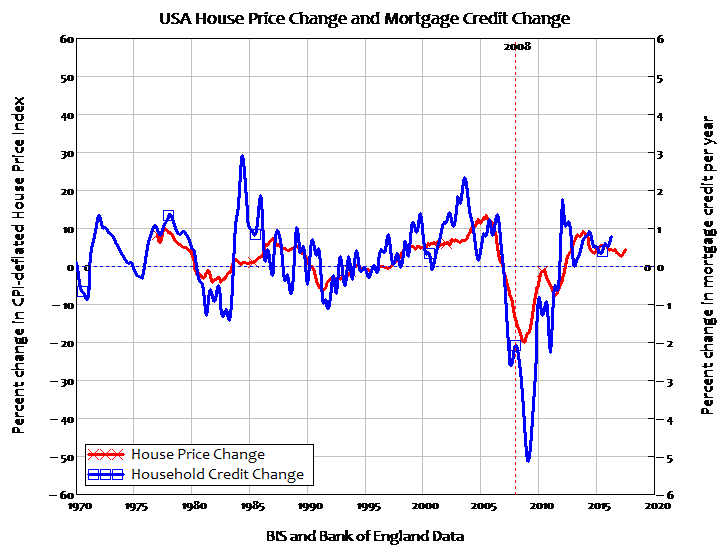

The supply side of the housing market has two main two factors: the turnover of the existing stock of housing, and the net change in the number of houses (thanks to demolition of old properties and construction of new ones). The turnover of existing properties is far larger than the construction rate of new ones, and this alone makes housing different to your ordinary market. The demand side of the housing market has one main factor: new mortgages created by the banks. Monetary demand for housing is therefore predominantly mortgage credit: the annual increase in mortgage debt. This also makes housing very different to ordinary markets, where most demand comes from the turnover of existing money, rather than from newly created money.

We can convert the credit-financed monetary demand for housing into a physical demand for new houses per year by dividing by the price level. This gives us a relationship between the level of mortgage credit and the level of house prices. There is therefore a relationship between the change in mortgage credit and the change in house prices. This relationship is ignored in mainstream politics and mainstream economics. But it is the major determinant of house prices: house prices rise when mortgage credit rises, and they fall when mortgage credit falls. This relationship is obvious even for the UK, where mortgage debt data isn’t systematically collected, and I am therefore forced to use data on total household debt (including credit cards, car loans etc.).

Even then, the correlation is obvious (for the technically minded, the correlation coefficient is 0.6). The US does publish data on mortgage debt, and there the correlation is an even stronger 0.78—and standard econometric tests establish that the causal process runs from mortgage debt to house prices, and not vice versa (the downturn in house prices began earlier in the USA, and was an obvious pre-cursor to the crisis there).

None of this would have happened – at least not in the UK – had mortgage lending remained the province of money-circulating building societies, rather than letting money-creating banks into the market. It’s too late to unscramble that omelette, but there are still things that politicians could do make it less toxic for the public. The toxicity arises from the fact that the mortgage credit causes house prices to rise, leading to yet more credit being taken on until, as in 2008, the process breaks down. And it has to break down, because the only way to sustain it is for debt to continue rising faster than income. Once that stops happening, demand evaporates, house prices collapse, and they take the economy down with them. That is no way to run an economy.

Yet far from learning this lesson, politicians continue to allow lending practices that facilitate this toxic feedback between leverage and house prices. A decade after the UK (and the USA, and Spain, and Ireland) suffered property crashes – and economic crises because of them – it takes just a millisecond of Internet searching to find lenders who will provide 100% mortgage finance based on the price of the property. This should not be allowed. Instead, the maximum that lenders can provide should be limited to some multiple of a property’s actual or imputed rental income, so that the income-earning potential of a property is the basis of the lending allowed against it.

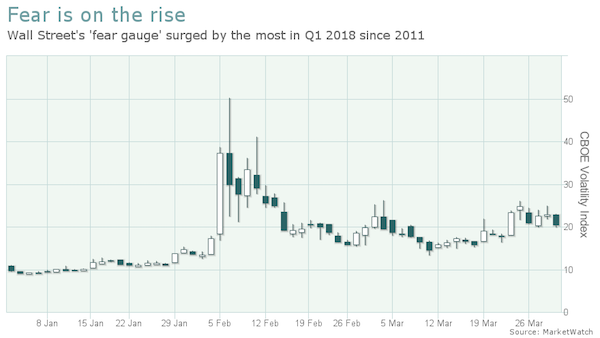

Fear is needed.

The Dow and the S&P 500 halted a record-setting streak of quarterly wins at nine, and the clearest reason why may be explained by the VIX index, widely known as Wall Street’s “fear gauge.” The Dow Jones Industrial Average posted a quarterly decline of more than 2.3%, snapping the longest streak of quarterly gains for the blue-chip average since an 11-quarter rally that ended in the third quarter of 1997. The S&P 500 index booked a 1.2% quarterly fall, ending its longest such stretch since the first quarter of 2015.

There are perhaps a host of reasons for the surcease of such a lengthy bullish run for the most prominent equity benchmarks: The Federal Reserve’s normalization of monetary policy, with the central bank lifting rates for the fifth time this month since December 2015; Intensifying uncertainty in the makeup and agenda of President Donald Trump’s administration, underscored by a number of high-profile departures; and the intensification of trade-war fears, after the president imposed duties on steel and aluminum imports and leveled more targeted tariffs at the world’s second-largest economy: China.

However, the surge in the Cboe Volatility Index VIX is perhaps the most correlated with the market’s downtrend. According to WSJ Market Data Group, the VIX posted its biggest quarterly rise, up 81% since it jumped in the third-quarter of 2011 following Standard & Poor’s historical downgrade of the U.S. credit rating and European debt-crisis jitters.

Rhyme and repeat.

• The S&P’s 200-DMA: Why It Ain’t No Maginot Line (Stockman)

For the last five years the S&P 500 has been dancing up its ascending 200-day moving average (200-DMA), bouncing higher repeatedly whenever the dip-buyers did their thing. Only twice did the index actually break below this seeming Maginot Line: In August 2015, after the China stock crash, and in February 2016, when the shale patch/energy sector hit the wall. As is evident below, since the frenzied peak of 2873 on January 26, the index has fallen hard twice—on February 8 (2581) and March 23 (2588). Self-evidently, both times the momo traders and robo-machines came roaring back with a stick-save which was smack upon the 200-DMA.

But here’s the thing. The blue line below ain’t no Maginot Line; it’s just the place where the Pavlovian dogs of Bubble Finance have “marked” the charts. And something is starting to smell. In fact, it’s starting to smell very much like an earlier go-round when Pavlov’s 200-DMA barkers had enjoyed a prolonged ascent – only to find an unexpected cliff-diving opportunity at the end. We refer to the nearly identical five year run-up to the March 2000 top at 1508 on the S&P 500. Back then, too, the 200-DMA looked invincible, and had only been penetrated by the August 1998 Russian bankruptcy and the Long Term Capital Management meltdown a month later.

Indeed, the bounce from the October 8, 1998 interim bottom of 960 was nearly parabolic, rising by 57% to the March 2000 top. That latter point might sound vaguely familiar. That’s because the rebound from the February 11, 2016 interim bottom (1829) to the January 26th top (2873) this year was, well, 57%!

This is going to cost Amazon.

• Trump Renews Amazon Attack, Says ‘Post Office Scam’ Must Stop (BBG)

President Donald Trump lit into Amazon.com Inc. for the second time in three days with a pair of Twitter messages that said the online retailer “must pay real costs (and taxes) now!” The president on Saturday claimed, citing reports he didn’t specify, that the U.S. Postal Service “will lose $1.50 on average for each package it delivers for Amazon” and added that the “Post Office scam must stop.” Amazon has said the postal service, which has financial problems stretching back for years, makes money on its deliveries. Amazon shed $53 billion in market value on Wednesday after Axios reported that the president is “obsessed” with regulating the e-commerce giant, whose founder and chief executive officer, Jeff Bezos, also owns the Washington Post newspaper.

Those losses were pared on Thursday, the final day of a shortened trading week, even as Trump tweeted that Amazon was using the postal service as its “Delivery Boy.” White House spokeswoman Lindsay Walters said on Thursday that while the president was displeased with the e-commerce giant, and particularly instances where third-party sellers on the site didn’t collect sales tax, there were no administrative actions planned against Amazon “at this time.” Still, Brad Parscale, who’s managing Trump’s 2020 presidential campaign, hinted in a tweet late Thursday that the administration may act to raise Amazon’s postal costs. “Once the market figures out that a single @usps rule change will crush @amazon’s bottom line we will see,” Parscale wrote.

Amazon.com and the Washington Post have been regular punching bags for Trump. In July, the president mused about whether the newspaper was “being used as a lobbyist weapon” to keep Congress from looking into Amazon’s business practices. He echoed that comment on Saturday, saying the Post “is used as a ‘lobbyist’ and should so REGISTER.” [..] While full details of the agreement between Amazon and the U.S. Postal Service are unknown – the mail carrier is independently operated, and strikes confidential deals with retailers – David Vernon, an analyst at Bernstein Research who tracks the shipping industry, estimated in 2015 that the USPS handled 40% of Amazon’s volume the previous year.

He estimated at the time that Amazon pays the postal service $2 per package, which is about half what it would pay UPS or FedEx. A sudden increase in postal rates would cost Amazon about $2.6 billion a year, according to a report by Citigroup from April 2017. That report predicted UPS and FedEx would also raise rates in response to a postal service hike. Citigroup also said that the “true” cost of shipping packages for the USPS is about 50% higher than its current rates, leading some editorial writers to conclude that Amazon was receiving the type of subsidy cited in Trump’s Thursday tweet.

Wait, wasn’t she supposed to be the anti-Trump?

• Senator Warren, In Beijing, Says US Is Waking Up To Chinese Abuses (R.)

U.S. policy toward China has been misdirected for decades and policymakers are now recalibrating ties, Senator Elizabeth Warren told reporters during a visit to Beijing amid heightened trade tensions between the world’s two largest economies. Warren’s visit comes as U.S. President Donald Trump prepares to implement more than $50 billion in tariffs on Chinese goods meant to punish China over U.S. allegations that Beijing systematically misappropriated American intellectual property. The Massachusetts Democrat and Trump foe, who has been touted as a potential 2020 presidential candidate despite rejecting such speculation, has said U.S. trade policy needs a rethink and that she is not afraid of tariffs.

After years of mistakenly assuming economic engagement would lead to a more open China, the U.S. government was waking up to Chinese demands for U.S. companies to give up their know-how in exchange for access to its market, Warren said. “The whole policy was misdirected. We told ourselves a happy-face story that never fit with the facts,” Warren told reporters on Saturday, during a three-day visit to China that began on Friday. “Now U.S. policymakers are starting to look more aggressively at pushing China to open up the markets without demanding a hostage price of access to U.S. technology,” she said.

A poisonous political climate.

• Yanis Varoufakis: ‘Greece Is A Debtors’ Prison’ (G.)

Yanis Varoufakis is back. He, of course, would say he never went away, but in Greece’s hurly-burly world of politics his is a name prone to triggering toxic reaction. Abroad, the shaven-headed economist is feted as the man who took on Europe’s establishment. At home, the former finance minister is seen, on both left and right, as a reckless incarnation of all that was wrong with Greece at the height of its struggle to remain in the eurozone. In Athens and Brussels, his confrontational style is still blamed for the price the debt-stricken country had to pay to be bailed out in the summer of 2015. Although his resignation now seems a long time ago, the sight of Varoufakis launching his own party in Greece has unleashed emotions that have run the gamut from enthusiasm to anger and disdain.

Media reaction has been cool; so, too, has that of politicians. None of which seems to bother him in the least. “Nobody believes the systemic media in Greece, and they’re all bankrupt,” he told the Observer with typical defiance, days after announcing his new venture in a packed Athens theatre. “To those who say I cost the country, and I’ve heard €30bn, €86bn, €100bn and even €200bn… I say I cost exactly zero. The troika [of creditors] cost Greece two generations and continue to impose cost.” At 57, in his leather bomber jacket and boots, Varoufakis clearly relishes his anti-establishment role and believes the birth of his European Realistic Disobedience Front, AKA MeRA25, is not a moment too late. Greece, almost nine years after the eurozone crisis erupted, is still condemned to being a debtors’ colony, he says.

[..] MeRA 25 has been working behind the scenes for a year now. Its plan is to contest the European elections in May 2019, although Varoufakis acknowledges Tsipras may elect to call a general election before that. After almost a decade under international surveillance, Athens will exit its third international rescue programme – the biggest sovereign bailout in global financial history – in August. With his popularity compromised under the weight of enforcing measures he once vehemently opposed, Tsipras may opt to capitalise on the success of finally exiting the programme and economic oversight. “We have travelled the whole country and held rallies in all major towns,” says Varoufakis, adding that politicians are already expressing interest in jumping ship.

Far from being saved, Varoufakis believes Greece’s future has been put on hold. If anything, he argues, it is in for an even tougher time because Europe has elected to tackle its debt problem by taking the “extend and pretend” approach of prolonging repayment timetables and condemning the country to decades of further austerity. More pension cuts and tax hikes loom, legislated by MPs at the behest of the EU and IMF. Short of measures to stop the rot, Varoufakis quips that he sees Greece becoming another Kosovo, “with beautiful beaches, only it’s a protectorate emptied of its young people. Every month 15-20,000 young Greeks leave. Everywhere I go, I meet them.”

Macron knows what’s best for you. He’s your big brother.

• Emmanuel Macron On France’s AI Strategy (Wired)

I want to create an advantage for my country in artificial intelligence, directly. And that’s why we have these announcements made by Facebook, Google, Samsung, IBM, DeepMind, Fujitsu who choose Paris to create AI labs and research centers: this is very important to me. Second, I want my country to be part of the revolution that AI will trigger in mobility, energy, defense, finance, healthcare and so on. Because it will create value as well. Third, I want AI to be totally federalized. Why? Because AI is about disruption and dealing with impacts of disruption. For instance, this kind of disruption can destroy a lot of jobs in some sectors and create a need to retrain people. But AI could also be one of the solutions to better train these people and help them to find new jobs, which is good for my country, and very important.

I want my country to be the place where this new perspective on AI is built, on the basis of interdisciplinarity: this means crossing maths, social sciences, technology, and philosophy. That’s absolutely critical. Because at one point in time, if you don’t frame these innovations from the start, a worst-case scenario will force you to deal with this debate down the line. I think privacy has been a hidden debate for a long time in the US. Now, it emerged because of the Facebook issue. Security was also a hidden debate of autonomous driving. Now, because we’ve had this issue with Uber, it rises to the surface. So if you don’t want to block innovation, it is better to frame it by design within ethical and philosophical boundaries. And I think we are very well equipped to do it, on top of developing the business in my country.

But I think as well that AI could totally jeopardize democracy. For instance, we are using artificial intelligence to organize the access to universities for our students That puts a lot of responsibility on an algorithm. A lot of people see it as a black box, they don’t understand how the student selection process happens. But the day they start to understand that this relies on an algorithm, this algorithm has a specific responsibility. If you want, precisely, to structure this debate, you have to create the conditions of fairness of the algorithm and of its full transparency. I have to be confident for my people that there is no bias, at least no unfair bias, in this algorithm.

I have to be able to tell French citizens, “OK, I encouraged this innovation because it will allow you to get access to new services, it will improve your lives—that’s a good innovation to you.” I have to guarantee there is no bias in terms of gender, age, or other individual characteristics, except if this is the one I decided on behalf of them or in front of them. This is a huge issue that needs to be addressed. If you don’t deal with it from the very beginning, if you don’t consider it is as important as developing innovation, you will miss something and at a point in time, it will block everything. Because people will eventually reject this innovation.

“..more than 150 US species have already become extinct while a further 500 species have not been seen in recent decades..”

• Conservationists Call For Urgent Action To Fix ‘America’s Wildlife Crisis’ (G.)

An extinction crisis is rippling though America’s wildlife, with scores of species at risk of being wiped out unless recovery plans start to receive sufficient funding, conservationists have warned. One-third of species in the US are vulnerable to extinction, a crisis that has ravaged swaths of creatures such as butterflies, amphibians, fish and bats, according to a report compiled by a coalition of conservation groups. A further one in five species face an even greater threat, with a severe risk of being eliminated amid a “serious decline” in US biodiversity, the report warns. “America’s wildlife are in crisis,” said Collin O’Mara, chief executive of the National Wildlife Federation. “Fish, birds, mammals, reptiles and invertebrates are all losing ground. We owe it to our children and grandchildren to prevent these species from vanishing from the earth.”

More than 1,270 species found in the US are listed as at risk under the federal Endangered Species Act, an imperiled menagerie that includes the grizzly bear, California condor, leatherback sea turtle and rusty patched bumble bee. However, the actual number of threatened species is “far higher than what is formally listed”, states the report by the National Wildlife Federation, American Fisheries Society and the Wildlife Society. Using data from NatureServe that assesses the health of entire groups of species on a sliding scale, rather than the case-by-case work done by the federal government, the analysis shows more than 150 US species have already become extinct while a further 500 species have not been seen in recent decades and have possibly also been snuffed out.

Whole classes of creatures have suffered precipitous drops, with 40% of freshwater fish species in the US now vulnerable or endangered, a third of bat species experiencing major declines in the past two decades and amphibians dwindling from their known ranges at a rate of about 4% a year. The true scale of the crisis is probably larger when species with sparse data, or those as yet unknown to science, are considered. “This loss of wildlife has been sneaking up on us but is now like a big tsunami that is going to hit us,” said Thomas Lovejoy, a biologist at George Mason University. Lovejoy was consulted on the study and said it “captures the overall degradation of American nature over recent decades, rather than little snapshots”.

The future of wildlife conservation?! in 2015, park guards shot dead more people than poachers killed rhinos.

• More Poachers Than Rhinos Killed In India Reserve (BBC)

A census in India’s Kaziranga National Park has counted 2,413 one-horned rhinos – up 12 from 2015. The Unesco World Heritage Site, in Assam state, is home to two-thirds of the world’s population of the species. The census is carried out every three years. It is an incredible conservation success story given the fact that there were only a few hundred rhinos in the 1970s, says the BBC’s South Asia editor Anbarasan Ethirajan. However, the conservation effort has not been without controversy. The government has in recent years given the park rangers extraordinary powers to protect the animals from harm – powers usually only given to soldiers intervening in civil unrest. About 150 rhinos have been killed for their horns since 2006, but in 2015, park guards shot dead more people than poachers killed rhinos.

[..] The census total given is an estimate, with authorities cautioning that the population could be bigger than that counted because some animals were concealed by tall grasses and reeds. This vegetation is usually burnt down to encourage its regeneration but this was hampered by unseasonal rains, said reports. It could mean the census is carried out again next year. Since its foundation in 1905, Kaziranga has had great success in conserving and boosting animal populations. As well as being a haven for one-horned rhinoceroses, the park was declared a tiger reserve by the Indian government, and is also home to elephants, wild water buffalo and numerous bird species. The endangered South Asian river dolphin also lives in the rivers that criss-cross the park.

Home › Forums › Debt Rattle Easter Sunday 2018