Théodore Géricault Prancing Grey Horse 1812

“..spending increased at three times the pace of revenue growth..”

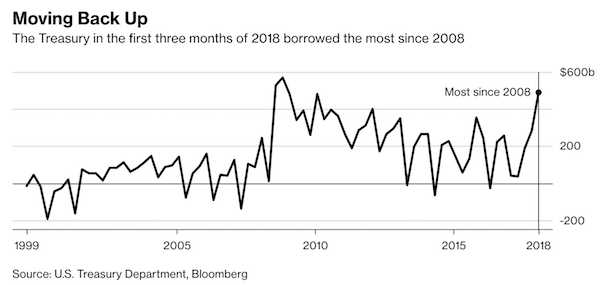

• The US Just Borrowed $488 Billion, a Record High for the First Quarter (BBG)

U.S. Treasury Secretary Steven Mnuchin said he’s unconcerned about the bond market’s ability to absorb rising government debt after his department said it borrowed a record amount for the first quarter. “It’s a very large, robust market — it’s the most liquid market in the world, and there is a lot of supply,” he said in a Bloomberg TV interview on Monday. “But I think the market can easily handle it.” Earlier on Monday the Treasury said net borrowing totaled $488 billion from January through March, a record for that period and about $47 billion more than it had previously estimated, according to a statement released in Washington. The end-of-March cash balance was $290 billion, compared with an initial estimate of $210 billion.

“By definition supply and demand will equate,” Mnuchin said. “I’m not concerned about that. I think that there are still a lot of buyers for U.S. Treasuries,” he said when asked about the risks of reduced demand for Treasuries and increased supply. The Treasury’s debt-management plans were complicated earlier this year by a political fight that was resolved when lawmakers agreed to suspend the federal debt limit in a two-year budget agreement in February. The U.S.’s need to issue more Treasuries is expected to grow as the fiscal picture deteriorates. The budget deficit widened to $600 billion halfway through the fiscal year, as spending increased at three times the pace of revenue growth in the October-to-March period, according to Treasury figures released earlier this month.

Tax and spending measures approved by Congress and President Donald Trump are expected to push the budget gap to $804 billion in the current fiscal year, from $665 billion in fiscal 2017, and then surpass $1 trillion by 2020, according to the Congressional Budget Office. In an accompanying statement about the state of the economy, the Treasury said Monday that tax changes are “poised to underpin near-term consumption and investment” and “the stage is set for a pick-up in growth over the near term.”

The debt keeps the economy going.

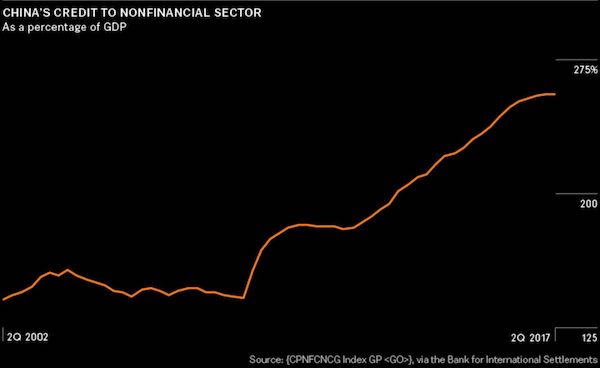

• The Global Debt Addiction: China’s Out of Control Debt (GT)

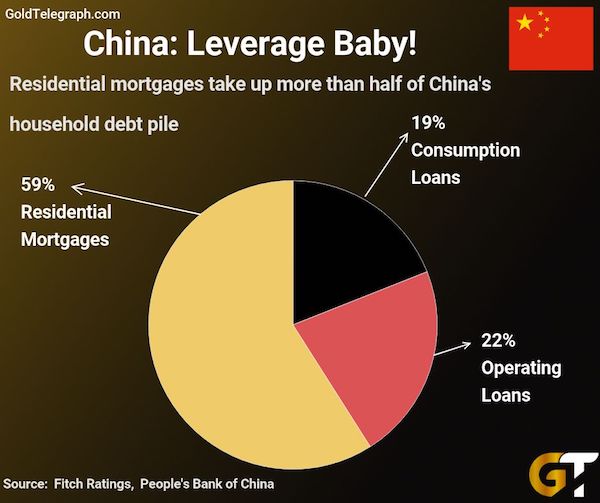

China has developed a craving for consumer goods, the more luxurious, the better. Along with most other countries, China’s credit boom and spending spree are being followed by out-of-control debt. While household debt is spiraling, the Chinese government is pushing to double the size of the economy by 2020 (setting this goal in 2010). This ambitious project will almost certainly entail more lending and increased debts. There is a question as to exactly how much more debt China can handle. China’s debt has been rising steadily, from 141 percent of GDP in 2008 to 256 percent of GDP in 2017. This type of rapidly-increasing debt level has frequently been the precursor of a hard economic fall, and the world is watching China carefully.

While countries such as the U.S. and the U.K. also have large debt-to-GDP ratios, the difference is that both are high-income countries, while China has only reached middle-income status, with only $15,400 in household purchasing power. This is a quarter of the household purchasing power of the US. Getting out of debt on China’s low level of income will be far more difficult than in higher-income nations. [..] China’s economic growth has encouraged widespread home buying and mortgage debts as property prices soar. Mortgage debt has increased by 25 percent in two years. People who have bought during the economic boom are now facing monthly mortgage payments that equal up to half of their monthly income.

Household budgets are stretching to the breaking point. This has forced many to curtail spending elsewhere and putting off other necessary big purchase items. This at a time when the government is encouraging greater consumer consumption.

“Austerity is for the good times, not the bad times.”

• Governments Are Nothing Like Households (Coppola)

Politicians like to describe government as like a household. When you’ve borrowed too much, you cut your spending so you can pay off debt, don’t you? You might be able to get a better-paid job, which helps you to pay it off faster. But you still budget to reduce your debt over time. Going on a spending spree means tightening your belt later. Similarly, if government borrows too much, there must be austerity to pay it down. Stands to reason, doesn’t it? People understand this reasoning. It is politically popular, especially when times are hard. In March 2009, when the U.S. was in the deepest recession since the 1930s, John Boehner, former Speaker of the House of Representatives, said on CBS News that “it’s time for government to tighten their belts and show the American people that we ‘get it.’”

“Government is like a household” can even win elections. At the height of the financial crisis in 2008, David Cameron, then leader of the U.K.’s Conservative party, wrote this in the (now defunct) News of the World: “This [Labour] government has maxed out our nation’s credit card—and they want to keep on spending by getting another. We believe we need to get a grip, be responsible and help families now in a way that doesn’t cost us our future.” He became the U.K.’s Prime Minister in May 2010. Keynesian economists such as Paul Krugman argue that instead of trying to reduce public deficits in a recession, government should increase spending, helping businesses to grow and providing employment. Government debt will rise, of course, but the government can run fiscal surpluses to pay it down when growth returns. Austerity is for the good times, not the bad times.

But this message has not been heard. In the name of “living within our means,” “balancing the books” and “paying down the debt,” governments on both sides of the Atlantic have pursued austerity policies ever since the Great Recession. The terrible story of Greece shows us that harsh austerity is the wrong medicine for a poorly-performing, highly indebted economy. But Greece is merely the worst example. Many Western countries have suffered deep and lasting damage, both from the Great Recession itself and from premature attempts to reduce public deficits.

“..bitcoin units have no intrinsic value” – but currencies “such as the U.S. dollar, the euro, and the Swiss france . . . have no intrinsic value either.”

• St. Louis Fed: Bitcoin is ‘Like Regular Currency’ (Fortune)

The Federal Reserve Bank of St. Louis has provided some high-profile validation for a core premise of Bitcoin and other cryptocurrency. A blog post this week based on an earlier Fed research paper said that “bitcoin units have no intrinsic value” – but added that currencies “such as the U.S. dollar, the euro, and the Swiss france . . . have no intrinsic value either.” The post, titled “Three Ways Bitcoin is Like Regular Currency,” doesn’t precisely endorse Bitcoin or cryptocurrency. In another recent report, the St. Louis Fed was critical of Bitcoin’s inefficiency. Cryptocurrency has also become rife with scams since its surge in value last year, and may constitute a global risk because it enables clandestine money laundering, capital flight, and tax evasion.

But the St. Louis Fed has provided a credible rebuttal to one of the most widespread and misguided criticisms of cryptocurrency: That, because it isn’t tied to a particular real-world commodity, it should have a monetary value of zero. As Fed researchers point out, since decoupling from the gold standard in the early 1970s, almost all global reserve currencies rely on nothing but trust to function as a media of value exchange. In the case of the dollar, that’s mostly trust in the U.S. government and economy. For Bitcoin and other cryptocurrencies, it’s trust in computer code and, at least to some extent, developers.

Surprisingly, the Fed’s new statement also echoes one of the predominant arguments that cryptocurrency fans use to disparage government-backed currency – though in a rather roundabout way. The post argues in part that “there’s a limited supply” of both cash and Bitcoin. The libertarian boosters at the heart of the crytpocurrency movement have often argued that Bitcoin is better than government currency because central banks can devalue national currencies through inflation, while Bitcoin has a strictly fixed supply. Though the Fed’s post points out that it doesn’t actually print cash – in the sense of physical notes – it acknowledges its ability to expand the money supply.

Concessions will be forthcoming.

• US Extends Tariff Exemptions For European Union And Other Allies (CNBC)

The May 1 deadline for steel and aluminum tariff exemptions for U.S. allies has been extended, the White House said. Instead, the White House has decided to postpone the decision on some allies, including the European Union, for 30 days to allow further discussions. Those extensions will affect the EU, Canada and Mexico. As for Argentina, Australia and Brazil, a senior White House official said agreements have been reached in principle, and they will also receive a 30-day extension so details can be finalized. South Korea’s exemption from tariffs is permanent because it agreed to quotas as part of a new trade deal. Administration officials have asked other countries what level of quotas they would agree to.

One person briefed by the administration told CNBC: “Quotas are an active part of the discussion with every country on the exemption list.” U.S. Trade Representative Robert Lighthizer is leading the process for country exemptions, except for the European Union, which Commerce Secretary Wilbur Ross is leading. The Department of Commerce is also spearheading the process for product exemptions. The National Security Council is overseeing the entire process. The May 1 deadline on the tariff exemptions was set in a presidential memorandum on the topic.

UK says they have a solution, but not what that is.

• Brexit Talks At Risk Of Collapse Over Irish Border (G.)

The EU’s chief Brexit negotiator has warned that talks are at risk if the UK does not soften its red line on the Irish border issue. Speaking to reporters on his third visit to Ireland since the referendum, Michel Barnier said he was “not optimistic” and “not pessimistic” but “determined” that the two sides can break the current impasse on talks. He repeated recent declarations that unless Britain came up with fresh thinking on how to avoid a hard border by the June EU council summit, further talks were in danger of collapsing. “Until we reach this agreement and this operational solution for Northern Ireland, a backstop [solution], and we are ready for any proposal … there is a risk, a real risk,” he said.

But he hinted that the UK would not have to come up with the final deal for Ireland, describing the June summit as “a stepping stone” to the October deadline for the wider Brexit deal to be completed. The Irish prime minister, Leo Varadkar, said Britain’s “approach to negotiations will need to change in some way” if there is to be agreement over the issue. Appearing alongside Varadkar and his deputy, Simon Coveney, Barnier said the EU was “absolutely united” on the Irish question but wanted to work with the UK to find a practical solution. Coveney warned that there would be “difficulties” at the next EU council summit in June in progressing to wider Brexit talks unless the UK commited to wording for a “backstop” solution for the Irish border.

It would be fun.

• South Korea President Says Trump Deserves Nobel Peace Prize (R.)

South Korean President Moon Jae-in said U.S. President Donald Trump deserves a Nobel Peace Prize for his efforts to end the standoff with North Korea over its nuclear weapons program, a South Korean official said on Monday. “President Trump should win the Nobel Peace Prize. What we need is only peace,” Moon told a meeting of senior secretaries, according to a presidential Blue House official who briefed media. Moon and North Korean leader Kim Jong Un on Friday pledged at a summit to end hostilities between their countries and work toward the “complete denuclearization” of the Korean peninsula. Trump is preparing for his own summit with Kim, which he said would take place in the next three to four weeks.

The Trump administration has led a global effort to impose ever stricter sanctions on North Korea and the U.S. president exchanged bellicose threats with Kim in the past year over North Korea’s development of nuclear missiles capable of reaching the United States. In January, Moon said Trump “deserves big credit for bringing about the inter-Korean talks. It could be a resulting work of the U.S.-led sanctions and pressure”. Trump’s predecessor, Barack Obama, won the 2009 Nobel Peace Prize just months into his presidency, an award many thought was premature, given that he had little to show for his peace efforts beyond rhetoric.

Even Obama said he was surprised and by the time he collected the prize in Oslo at the end of that year, he had ordered the tripling of U.S. troops in Afghanistan. As well as Obama, three U.S. presidents have won the Nobel Peace Prize: Theodore Roosevelt, Woodrow Wilson, and Jimmy Carter. Moon’s Nobel Prize comment came in response to a congratulatory message from Lee Hee-ho, the widow of late South Korean President Kim Dae-jung, in which she said Moon deserved to win the prize, the Blue House official said. Moon responded by saying Trump should get it.

Nothing leaks like Washington.

• Leaked Questions Reveal What Mueller Wants To Ask Trump About Russia (G.)

Robert Mueller, the special counsel investigating Russian interference in the US election, wants to ask Donald Trump about contact between his former election campaign manager Paul Manafort and Russia, the New York Times reported on Monday. The paper said it had obtained a list of nearly 50 questions that Mueller, investigating Russian meddling in the 2016 presidential election, wants to put to the US president. More than half relate to potential obstruction of justice. “What knowledge did you have of any outreach by your campaign, including by Paul Manafort, to Russia about potential assistance to the campaign?” is one of the more dramatic questions published by the Times.

The pointed reference to Manafort breaks tantalising new ground, since there was no previous evidence linking him to outreach to Moscow. Benjamin Wittes, a senior fellow at the Brookings Institution thinktank in Washington, tweeted: “This is very interesting – strong evidence that there are still collusion threads that are not yet public.” Manafort and his deputy, Rick Gates, pleaded not guilty last October to a 12-count indictment accusing them of conspiring to defraud the US by laundering $30m from their work for a Russia-friendly political party in Ukraine. a dramatic insight into the special counsel’s mind and make clear that Trump is a subject, not a mere witness, in the investigation. It is not yet known whether the president will agree to be interviewed.

One batch of questions relates to alleged coordination between the Trump election campaign and Moscow. Donald Trump Jr’s June 2016 meeting at Trump Tower in New York with a Russian lawyer who promised damaging information about rival Hillary Clinton is naturally under scrutiny. Mueller wants to ask when Trump became aware of the meeting; Trump Jr claimed his father did not know about it in advance.

Set up a program to bring peace to Central America. Kick out the CIA. They will stop coming.

• First Members Of Migrant ‘Caravan’ Enter US Seeking Asylum (R.)

The first eight members of a “caravan” of Central American migrants entered U.S. territory to seek asylum on Monday, after a month-long journey through Mexico that drew the wrath of President Donald Trump. The eight women and children walked through a door into the San Ysidro port of entry on the bidding of a customs and border patrol officer, a Reuters witness said, hours after Vice President Mike Pence promised they would be processed in line with U.S. law. About three quarters of claims by Central American asylum seekers are ultimately unsuccessful, resulting in detention and deportation.

Medium or well-done?

• That Collapse You Ordered…? (Kunstler)

I had a fellow on my latest podcast, released Sunday, who insists that the world population will crash 90-plus percent from the current 7.6 billion to 600 million by the end of this century. Jack Alpert heads an outfit called the Stanford Knowledge Integration Lab (SKIL) which he started at Stanford University in 1978 and now runs as a private research foundation. Alpert is primarily an engineer. At 600 million, the living standard in the USA would be on a level with the post-Roman peasantry of Fifth century Europe, but without the charm, since many of the planet’s linked systems — soils, oceans, climate, mineral resources — will be in much greater disarray than was the case 1,500 years ago.

Anyway, that state-of-life may be a way-station to something more dire. Alpert’s optimal case would be a world human population of 50 million, deployed in three “city-states,” in the Pacific Northwest, the Uruguay / Paraguay border region, and China, that could support something close to today’s living standards for a tiny population, along with science and advanced technology, run on hydropower. The rest of world, he says, would just go back to nature, or what’s left of it. Alpert’s project aims to engineer a path to that optimal outcome. I hadn’t encountered quite such an extreme view of the future before, except for some fictional exercises like Cormac McCarthy’s The Road. (Alpert, too, sees cannibalism as one likely byproduct of the journey ahead.)

Obviously, my own venture into the fictionalized future of the World Made by Hand books depicted a much kinder and gentler re-set to life at the circa-1800 level of living, at least in the USA. Apparently, I’m a sentimental softie. Both of us are at odds with the more generic techno-optimists who are waiting patiently for miracle rescue remedies like cold fusion while enjoying re-runs of The Big Bang Theory. (Alpert doesn’t completely rule out as-yet-undeveloped energy sources, though he acknowledges that they’re a low-percentage prospect.) We do agree with basic premise that the energy supply is mainly what supports the way we live now, and that it shows every evidence of entering a deep and destabilizing decline that will halt the activities necessary to keep our networks of dynamic systems running.

A question of interest to many readers is how soon or how rapid the unraveling of these systems might be. When civilizations crumble, it tends to fast-track. The Roman empire seems to be an exception, but in many ways it was far more resilient than ours, being a sort of advanced Flintstones economy, with even its giant-scale activities (e.g. building the Coliseum) being accomplished by human-powered work.

Never again.

• Are Our Online Lives About To Become ‘Private’ Again? (BBC)

In May, tough new privacy laws are being introduced across Europe, offering EU consumers far greater control over their data and large fines for firms which break the rules. It is worth pausing to think about how we got to this point. To begin to understand, we must remember that data can easily be copied, shared and collected from multiple sources. Whenever we use digital devices – everything from web browsers, to phones, loyalty cards and CCTV cameras – we create data that allows advertisers, insurers, the police and others to understand aspects of our lives. Only its availability and the ingenuity of its handler limits what it can tell us. This is very different to a traditional commodity that can be bought and sold: a house, for example.

If you sell your house, the buyer might come to understand something of your personality, perhaps through a taste for high-spec kitchens and red carpets. Beyond that, the potential insight into your life is limited – your diaries and photo albums will have moved with you. With data, it is more complicated. Once you sign up for an online service, constant and often seamless data collection starts. Minimal understanding and agreement are often sufficient for this collection to begin: clicking “I agree” to terms and conditions you may or may not have read can be enough. It’s as if, rather than handing over a clean and tidy house, you have invited the buyer to move in with you and start taking notes: how you behave, whom you talk to, who visits you and who spends the night.

Many people never have a clear understanding of how the data they produce is shared, collected and interpreted. It can be combined with data from other sources, and investigated in unpredictable and unforeseen ways to gain in-depth knowledge about our lives, preferences, and likely future behaviours. This knowledge can be used to influence us in subtle but powerful ways. The advertisements, news, and friends we encounter online are often the result of this nudging. And, unlike a house, the data can be copied again and again at little to no cost, reaching an unlimited number of people. It is clear that the risks to privacy with data are substantial. Recognising this, additional safeguards are being introduced.

The damage being done to Britain is unbelievable.

• Food, Clothes, A Mattress And Three Funerals. What Teachers Buy For Children (G.)

In 2014 Gemma Morton, the headteacher of a large secondary school, told Education Guardian her school had helped to pay for the funeral of a student whose family couldn’t afford it, even after they had sold their car. Three years on, she has helped to pay for two more funerals. “When a child dies, nobody’s saved for it,” says Morton. “There is literally nowhere for families to go apart from the people they already know, and most of them are poverty-struck too.” Over the past few years, as austerity has deepened, more schools and individual teachers are bailing out disadvantaged families because they simply can’t say no. The latest government figures show 100,000 more children propelled into poverty in just 12 months.

There are 4.1 million children – nearly a third of the entire child population – living in households on less than 60% of the average income. At Gill Williams’s primary school in the north-west of England, local supermarkets deliver bread and fresh vegetables three times a week, which are placed in the playground for parents to help themselves. There is rarely a crumb left. Williams says it is not so much that poverty is more severe, but that it has spread. “It’s everybody. Your average family is like that now.” The core group of those needing support in her school is three times larger than when she became a head 10 years ago.

Evidence of hungry children is clear, say teachers. “You notice kids borrowing money from friends to buy food, kids falling asleep, kids saying they’ve got a tummy ache, and they didn’t have breakfast because Mummy didn’t have anything in,” says Morton. She has also seen children taking scraps from the school bins. Heads in poor catchments notice a difference when they attend meetings at other schools. “If you go and see kids in two different areas, they’ll be noticeably different heights,” says Morton.

Home › Forums › Debt Rattle May 1 2018