Roy Lichtenstein Forget it! Forget me! 1962

What a good glass of wine can accomplish.

• Trump Says Agreed With EU To Work To Lower Trade Barriers (R.)

U.S. President Donald Trump said on Wednesday the United States and the European Union were kicking off talks aimed at lowering trade barriers as officials looked to head off a brewing trade war. “This was a very big day for free and fair trade, a very big day indeed,” Trump told reporters at the White House after meeting with European Commission President Jean-Claude Juncker. “We are starting the negotiation right now but we know very much where it’s going,” Trump said. Speaking with Juncker at his side, Trump said they had agreed in talks to “work together toward zero tariffs, zero non-tariff barriers, and zero subsidies on non-auto industrial goods.”

“We will also work to reduce barriers and increase trade in services, chemicals, pharmaceuticals, medical products, as well as soybeans; soybeans is a big deal,” he said, adding that Europe would also step up purchases of liquefied natural gas from the United States. “They are going to be a massive buyer of LNG,” Trump said. Trump said the talks would “resolve” both the hefty tariffs the United States had placed on imports of steel and aluminum from the EU and the tariffs Europe had slapped on U.S. goods in response. It was not clear whether the two sides made any progress on the contentious issue of possible U.S. tariffs on imports of automobiles from Europe. But Juncker said they had agreed not to impose any new tariffs while talks were taking place.

More to fight over.

• Republicans Begin Impeachment Proceedings Against Rosenstein (ZH)

House GOP members led by Freedom Caucus Chairman Mark Meadows (NC) have filed formal articles of impeachment against Deputy Attorney General Rod Rosenstein, according to a late Wednesday announcement by Meadows over Twitter. News of the resolution comes after weeks of frustration by Congressional investigators, who have repeatedly accused Rosenstein and the DOJ of “slow walking” documents related to their investigations. Lawmakers say they’ve been given the runaround – while Rosenstein and the rest of the DOJ have maintained that handing over vital documents would compromise ongoing investigations. Not even last week’s heavily redacted release of the FBI’s FISA surveillance application on former Trump campaign Carter Page was enough to dissuade the GOP lawmakers from their efforts to impeach Rosenstein.

In fact, its release may have sealed Rosenstein’s fate after it was revealed that the FISA application and subsequent renewals – at least one of which Rosenstein signed off on, relied heavily on the salacious and largely unproven Steele dossier. In late June, Rosenstein along with FBI Director Christopher Wray clashed with House Republicans during a fiery hearing over an internal DOJ report criticizing the FBI’s handling of the Hillary Clinton email investigation by special agents who harbored extreme animus towards Donald Trump while expressing support for Clinton. Republicans on the panel grilled a defiant Rosenstein on the Trump-Russia investigation which has yet to prove any collusion between the Trump campaign and the Kremlin. “This country is being hurt by it. We are being divided,” Rep. Trey Gowdy (R-SC) said of Mueller’s investigation. “Whatever you got,” Gowdy added, “Finish it the hell up because this country is being torn apart.”

Waking up?

• The Gray Lady Thinks Twice About Assange’s Prosecution (McGovern)

Well, lordy be. A lawyer for The New York Times has figured out that prosecuting WikiLeaks publisher Julian Assange might gore the ox of The Gray Lady herself. The Times’s deputy general counsel, David McCraw, told a group of judges on the West Coast on Tuesday that such prosecution would be a gut punch to free speech, according to Maria Dinzeo, writing for the Courthouse News Service. Curiously, as of this writing, McCraw’s words have found no mention in the Times itself. In recent years, the newspaper has shown a marked proclivity to avoid printing anything that might risk its front row seat at the government trough.

Stating the obvious, McCraw noted that the “prosecution of him [Assange] would be a very, very bad precedent for publishers … he’s sort of in a classic publisher’s position and I think the law would have a very hard time drawing a distinction between The New York Times and WikiLeaks.” That’s because, for one thing, the Times itself published many stories based on classified information revealed by WikiLeaks and other sources. The paper decisively turned against Assange once WikiLeaks published the DNC and Podesta emails. More broadly, no journalist in America since John Peter Zenger in Colonial days has been indicted or imprisoned for their work.

Unless American prosecutors could prove that Assange personally took part in the theft of classified material or someone’s emails, rather than just receiving and publishing them, prosecuting him merely for his publications would be a first since the British Governor General of New York, William Cosby, imprisoned Zenger in 1734 for ten months for printing articles critical of Cosby. Zenger was acquitted by a jury because what he had printed was proven to be factual—a claim WikiLeaks can also make. McCraw went on to emphasize that, “Assange should be afforded the same protections as a traditional journalist.”

Talk about waking up.

• Facebook Stock Drops 24%, $132 Billion In Lost Market Value (MW)

Facebook Inc. is evidently not bulletproof. The social-media behemoth’s stock lost roughly one-fifth of its value in the extended session Wednesday after its earnings report missed expectations on revenue and showed slowing user growth. Weak guidance also rattled investors. Facebook stock dropped about 7% immediately after the earnings report was released, then plummeted to a loss of more than 20% as a conference call with analysts progressed. Close to 34 million shares changed hands in the extended session, well above the average volume of 17 million shares for a regular trading session over the past month. Should the losses hold into Thursday’s regular session, Facebook would lose more than $100 billion in market capitalization and lose the stock’s gains for the year thus far.

As the after-hours session wrapped up, Facebook was trading at $173.50, down 20%. Facebook stock had recovered from a decline earlier this year in the wake of the Cambridge Analytica scandal, one of several controversies and warning signs that the company had managed to weather with little damage to its stock. But declining revenue and user growth, topped by a warning from executives that it will continue, seemed to end that run. “The guidance, it’s nightmare guidance,” GBH Insights head of technology research Daniel Ives said. “If you look at their forecast for the second half of the year in terms of user growth, and the expense profile, it refuels the fundamental worries about Facebook post-Cambridge Analytica.”

Why would Facebook want to be in China? To help Beijing spy?

• China Pulls Approval For Facebook’s Planned Venture (R.)

China has withdrawn its approval for Facebook Inc’s plan to open a new venture in the eastern province of Zhejiang, the New York Times reported on Wednesday, citing a person familiar with the matter. A Chinese government database showed that Facebook had gained approval to open a subsidiary, but the registration has since disappeared, according to checks made by Reuters. The move is a setback for Facebook, which has been struggling to gain a foothold in China, the most populous country in the world, where its website and messaging app Whatsapp remain blocked.

The incident also illustrates how difficult it can be for a U.S. company to navigate the government bureaucracy in a country where so many technology firms have tried and failed. “Terms like ‘The Great Firewall’” often gives outsiders the impression that the Chinese government is totally united on technology policy,” said Matt Sheehan, an expert on China-California relations and fellow at The Paulson Institute think tank. “In reality, within that Firewall are lots of competing fiefdoms and ongoing turf wars.” China’s decision comes amid escalating tensions with the United States after the world’s two largest economies imposed tariffs on each other’s imports.

It’s just 6 stocks.

• This Stock Market Isn’t As Strong As You Think – Rosenberg (CNBC)

Don’t be fooled. This market is weaker than it seems, according to David Rosenberg, chief economist and strategist at Gluskin Sheff. The S&P 500 is up more than 5% in 2018, recovering from a correction earlier in the year. The broad index was also just 1.9% removed from an all-time high reached in late January as of Tuesday’s close. However, Rosenberg notes that while momentum stocks are lifting the market, “many subsectors are well off their highs: Homebuilders. Autos. Banks. Insurance. Consumer products. Telecom. Media. Transports. Utilities. Pharma. And many more.” The S&P automobiles and components industry group is nearly 20% below its 52-week high, while insurance stocks are down 10.8% from their one-year high. The Dow transports index, meanwhile, is 6.5% below its one-year high.

“What has kept the market near record terrain are a mere six stocks — Alphabet, Apple, Amazon, Netflix, Microsoft and Facebook,” Rosenberg said in a note to clients Wednesday. “Strip out these six flashy stocks, and the overall market has done practically nothing year-to-date.” Through mid-July, Alphabet, Apple, Amazon, Netflix, Microsoft and Facebook had contributed nearly 80% to the S&P 500’s gains. These six names have been on fire this year. Netflix and Amazon are up 86% and 57% in 2018, respectively. Microsoft and Facebook have both risen more than 20% while Alphabet and Apple have jumped 19.8% and 14%, respectively. Rosenberg said such concentration in the stock market has not been seen since the late 1990s, just before the dot-com bubble burst. “We know from history how these cycles typically end.”

Jesse! So many graphs!

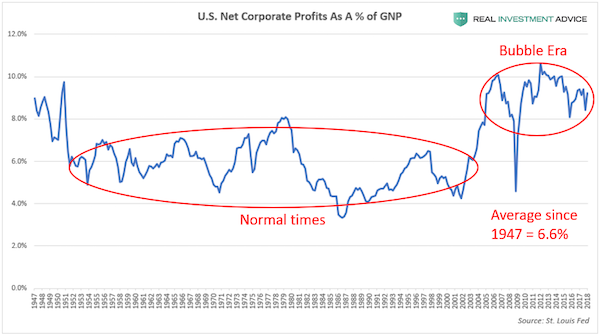

• US Household Wealth Is In A Bubble – Part 2 (Colombo)

While above-average corporate profitability may sound like a good thing when taken at face value, I view it as another worrisome sign because it’s further evidence of an economy and financial markets that are being juiced by cheap credit and financial engineering. Ultra-low interest rates help to boost corporate profitability by reducing borrowing costs. Cheap credit also gives consumer spending a strong boost, which has a significant effect on our economy that is heavily driven by consumer spending. Low interest rate environments allow the government (federal, state, and local) to borrow more cheaply in the bond market and use it to boost spending, which gives the overall economy a shot in the arm. In addition, artificially-inflated financial markets boost the profitability of the financial sector.

A major risk for the stock market is the mean reversion of corporate profitability, which is a nightmarish prospect when considering how overpriced stocks currently are relative to earnings. This mean reversion is likely to occur as the result of the ending of ultra-cheap credit conditions (when corporate bonds fall back to earth) and through increased competition, which is what Milton Friedman warned about. (Note: critics may try to rebut my assertions by claiming that U.S. corporate profitability is unusually high due to corporations earning a higher percentage of earnings overseas. I’ve accounted for this by using gross national product as the denominator instead of the more commonly used GDP.)

What is particularly alarming about the current U.S. stock market bubble is the fact that it’s driven by a very narrow group of stocks, which means that there isn’t a healthy breadth, or broad strength, behind the bull market. In general, tech stocks have been leading the way – in particular, a group of stocks known as FAANG, which is an acronym for Facebook, Apple, Amazon, Netflix, and Google. The chart below compares the performance of the FAANG stocks to the S&P 500 during the bull market that began in March 2009. While the S&P 500 is up approximately 300%, the FAANGs are up significantly more, with Apple rising by over 1,000%, Amazon rising more than 2,000%, and Netflix surging by over 6,000%.

Xi is cornered.

• Prepare for a Chinese Maxi-Devaluation (Rickards)

If Trump imposes 25% tariffs on Chinese goods, China could simply devalue their currency by 25%. That would make Chinese goods cheaper for U.S. buyers by the same amount as the tariff. The net effect on price would be unchanged and Americans could keep buying Chinese goods at the same price in dollars. The impact of such a massive devaluation would not be limited to the trade war. A cheaper yuan exports deflation from China to the U.S. and makes it harder for the Fed to meet its inflation target. Also, the last two times China tried to devalue its currency, August 2015 and December 2015, U.S. stock markets crashed by over 11% in a matter of a few weeks.

So, if the trade war escalates as I expect, don’t worry about China dumping Treasuries or imposing tariffs. Watch the currency. That’s where China will strike back. When they do, U.S. stock markets will be the first victims. Maybe you think that’s unlikely because it would be such an extreme reaction by China. But you have to put yourself in the shoes of China’s leadership. These aren’t academic issues to China’s leaders. They go to the heart of the government’s very legitimacy. China’s economy is not just about providing jobs, goods and services. It is about regime survival for a Chinese Communist Party that faces an existential crisis if it fails to deliver. The overriding imperative of the Chinese leadership is to avoid societal unrest.

If China encounters a financial crisis, Xi could quickly lose what the Chinese call, “The Mandate of Heaven.” That’s a term that describes the intangible goodwill and popular support needed by emperors to rule China for the past 3,000 years. If The Mandate of Heaven is lost, a ruler can fall quickly. Up to half of China’s investment is a complete waste. It does produce jobs and utilize inputs like cement, steel, copper and glass. But the finished product, whether a city, train station or sports arena, is often a white elephant that will remain unused. Chinese growth has been reported in recent years as 6.5–10% but is actually closer to 5% or lower once an adjustment is made for the waste.

The US is not export-driven.

• A Weak US Dollar Will Not Make America Great (Lacalle)

The US dollar has become the safest asset in the face of mounting evidence that the “beggar thy neighbor” policy and drowning structural problems in liquidity is coming to a close. The reality is that the US dollar is strengthening because of the evidence of a deeper slowdown in China and the massive imbalances built by some emerging economies in the past -large fiscal and trade deficits financed with the cheap inflow of dollars-. As the US economy improves and others face the saturation of past stimuli, it is only logical that the United States sees a high inflow of funds from abroad. And that is good. Keeps US treasury yields low, a high demand for bonds and equities, and a steady increase in capital investment into the US economy.

There are many who think that the US economy will not accept a strong dollar. Allow me to doubt it. The US only exports around 10% of GDP and less than 30% of the profits of the S & P 500 come from exports. In the past nine years, devaluing and lowering rates has hurt the middle class, savers, workers, and high productivity companies. Those that voted for the current administration to make a drastic change on the past mistakes. A devaluation policy hurts more Americans than it helps. Devaluation is simply stealing from your citizens’ savings and disposable income. A strong US dollar reduces inflationary pressures and keeps interest rates low. Both effects are positive for savers, workers, and families as the economy strengthens and wages improve.

Keep calm and….

• Britain Is Hoarding Food, Medicines And Blood In Case Of No-Deal Brexit (Ind.)

Theresa May has urged voters not to worry about Brexit, despite her government setting out plans to stockpile food, blood and medicine in case it goes badly. She said people should take “reassurance and comfort” from news of the plans, to be implemented if the UK crashes out of the EU without an agreement in March next year. The scenario is looking increasingly likely given deep divisions in the Conservatives over Ms May’s approach, her wafer thin commons majority and the EU’s on-going resistance to what the prime minister is proposing. It comes as The Independent launched a campaign to give the British people a Final Say in a referendum on whatever is proposed at the end of Brexit negotiations, with thousands flocking to sign a petition supporting the cause.

Ireland’s deputy prime minister accused the PM of “bravado” in talking up the dangers of a no-deal Brexit, while Tory insiders claim the PM is doing so to warn her rebellious MPs of the consequence of failing to back her unpopular Brexit plans. Ms May confirmed in a TV interview that plans for stocking up on essential goods are underway, in case imports from the EU are cut off by clogged ports or regulatory disputes. But, asked if it was “alarming” for people, the prime minister told Channel 5: “Far from being worried about preparations that we are making, I would say that people should take reassurance and comfort from the fact that the government is saying we are in a negotiation, we are working for a good deal. “I believe we can get a good deal, but, it’s right that we say – because we don’t know what the outcome is going to be – let’s prepare for every eventuality.”

Inevitable: a general election, a leadership challenge or a people’s vote.

• There Is No Majority In UK Parliament For Any Brexit Deal (Ind.)

Imagine you’re back at school and you can’t be bothered to do any work for the most important exams of your entire academic career. Alarmed by your indifference, your parents ask what you propose to do. Imagine how they would react if you told them you were thinking of having an extended summer holiday, to put off the moment of reckoning for as long as possible. Quite frankly, this is where our government now is in the Brexit negotiations. A longer than usual summer recess seems to be the best these great minds can come up with. The problem is we are not in school, Brexit is not homework and the bullies will do more than give us a bloody nose.

The EU is like the strict exam board of governors and appears to have no time for excuses or interest in making Theresa May’s sloppy government look good. It is a measure of May’s desperation that she said in Belfast last week that the EU was trying to achieve an “economic and constitutional dislocation” of our country. That kind of talk may play well with the hard-right Brexiteers who are too painfully holding her and her government hostage, but it doesn’t impress Brussels. May needs to realise that we can all see she is now merely playing for time and there are only a finite number of options open to her: a general election, a leadership challenge or a people’s vote.

[..] The plain truth is that there is no majority in parliament for any deal. The EU thinks the prime minister’s Chequers plan is too favourable to the UK, and the Brexiteers think it’s too favourable to Brussels. A Norway deal would mean accepting free movement and paying large amounts to Brussels; a Canada-style deal means the prospect of a hard border returning to the line on the map that separates Eire and Northern Ireland. Viewed through the lens of May’s parliamentary party, there is no consensus, no coming together on any of these options. Brexit is collapsing under the weight of its own contradictions.

“he exposed himself and shouted racial slurs..”

• US Lawmaker Pranked By Sacha Baron Cohen To Resign (AFP)

A US state lawmaker is resigning after a humiliating appearance on comedian Sacha Baron Cohen’s television show during which he exposed himself and shouted racial slurs. Jason Spencer, a Republican member of the Georgia House of Representatives, had been under pressure from his own party to step down following the embarrassing appearance on Cohen’s series “Who Is America?” Spencer, 43, finally announced on Wednesday that he planned to resign on July 31. He had already lost a primary in May but he could have remained in office until November. Spencer was one of several Republican figures pranked by Cohen on the Showtime series.

Others included former vice president Dick Cheney, who signed a “waterboarding kit” and former Republican vice presidential nominee Sarah Palin. In the episode of “Who Is America” with Spencer, Cohen pretends to be an Israeli anti-terrorism expert, Colonel Erran Morad, offering self-defense training. At one point, Spencer is persuaded to expose his buttocks and chase Cohen while yelling “USA” and racial slurs. Spencer, in a statement this week to The Washington Post, said Cohen “took advantage of my paralyzing fear that my family would be attacked.” Spencer told the Post he had received death threats after introducing a bill that would ban Muslim women from publicly wearing burqas. Palin, the former governor of Alaska, denounced the show as “evil, exploitive, sick ‘humor.'”

This has been a 10-year debate.

• Gene-Edited Plants And Animals Are GMO Foods – EU Top Court (G.)

Plants and animals created by innovative gene-editing technology have been genetically modified and should be regulated as such, the EU’s top court has ruled. The landmark decision ends 10 years of debate in Europe about what is – and is not – a GM food, with a victory for environmentalists, and a bitter blow to Europe’s biotech industry. It also marks a setback for UK scientists who took advantage of a legal grey area to of gene edited camelina crops, augmented with Omega-3 fish oils. Greenpeace said that the ruling meant the British government – along with Belgium, Sweden and Finland – was now obliged to “revoke” the green light for the trials until appropriate precautions had been taken.

In their ruling, the EU judges said: “Organisms obtained by mutagenesis are GMOs [genetically modified organisms] … It follows that those organisms come, in principle, within the scope of the GMO directive and are subject to the obligations laid down [therein].” The court sided with the French agricultural trades union, Confédération Paysanne, which brought the case, arguing that new and unconventional in vitro mutagenesis techniques were likely to be used to produce herbicide-resistant plants, with potential health risks. A study published in the journal Nature last week found that the gene-editing technology Crispr-Cas9 can cause significantly greater genetic distortions than expected, with potential “pathogenic consequences”. Gene editing alters the genomes of a living species by slicing genome strands in a bid to remove undesirable traits, without inserting foreign DNA.

Home › Forums › Debt Rattle July 26 2018