Salvador Dali Bay of Cadaques 1925

Jim Garrison in his book, “On the Trail of the Assassins.”

“I knew by now that when a group of individuals gravitated toward one another for no apparent reason…inexplicably headed in the same direction as if drawn by a magnetic field..as often as not the shadowy outlines of a covert intelligence operation were somehow becoming visible”

Elon AOC

Elon Musk and AOC finally worked out their differences.

The chemistry these two have is crazy. pic.twitter.com/4dYzYAinqa

— Maze (@mazemoore) November 23, 2022

“Since Putin’s gas hike was not enough to stir Americans into a blood ritual for total war, the liberal world order is throwing grocery prices into the mix.”

• The Fear of Fear Itself: The Gripping Truth Out of Ukraine (Butler)

Now we are asked to be afraid of Vladimir Putin weaponizing gas! We must act in defense of the Russian’s weaponizing food! And Vladimir Putin personally killed J.F.K. with a BB-Gun from the Texas book depository in Dallas. Did Russia’s leadership wake up one morning in 2014 and decide a NATO regime was needed in next-door Ukraine? Well, no. Were the Russians shelling people with Polish DNA in Kyiv for eight years? Certainly not. The EU, NATO, and the New York Times would have informed us of that. So why would Russia act the way she has recently? I see no one out there gazing with practical eyes on this situation. Oh, commodities and controlling them! Money! Tons and tons of money! That has to be it.

Some weeks back, Vladimir Putin’s government decided to allow the free passage of grain ships through the Black Sea out of southwestern Ukraine. The “food” was ostensibly headed to the starving people of Africa and Asia that Washington, London, and Brussels were berserk over. Even the United Nations has held that starving people worldwide need to blame Russia. I was reading a Voice of America report on recent UN meetings about the Ukraine/Black Sea shipments, and it reads like intel for Wall Street commodities brokers. And there’s the point. Food security worldwide is now the red-hot poker western elites are jabbing Russia with now. Since Putin’s gas hike was not enough to stir Americans into a blood ritual for total war, the liberal world order is throwing grocery prices into the mix.

For those in the dark or dizzied by all these events, and I am often with you, the accessible version is to simply call this World War III. Yes, we are already in it. But think about the sequence of recent events and their impact for proper clarity. First, Nord Stream was blown up. The next day a pipeline from Norway to Poland carrying much more expensive natural gas went into operation. A few days after this, the Poles demanded trillions in reparations from the Germans for WW2 grievances settled decades ago. The essentials that power economies and people are being weaponized, but the perpetrators hide in plain sight behind the media they own.

Retired U.S. Colonel Douglas MacGregor gave the best appraisal of the situation in a talk with Aaron Maté and Katie Halper. MacGregor, dubbed “America’s Greatest Warfighter,” is a war hero and former strategy advisor during the Trump administration. He says, in no uncertain terms, that Washington and London’s leaders are on a mission to destroy Germany and the German-Russian cooperative potential. I believe he is right on all counts, but he leaves off how the western elites (banksters) are profiteering from it all. This is a multiple-pronged strategy, not some haphazard knee-jerking.

“Russia refused to play by the rules..”

• It Was Never About Ukraine (Antiwar)

In his March 21 press briefing, State Department spokesman Ned Price told the gathered reporters that “President Zelenskyy has also made it very clear that he is open to a diplomatic solution that does not compromise the core principles at the heart of the Kremlin’s war against Ukraine.” A reporter asked Price, “What are you saying about your support for a negotiated settlement à la Zelenskyy, but on whose principles?” In what still may be the most remarkable statement of the war, Price responded, “this is a war that is in many ways bigger than Russia, it’s bigger than Ukraine.” Price, who a month earlier had discouraged talks between Russia and Ukraine, rejected Kiev negotiating an end to the war with Ukraine’s interests addressed because US core interests had not been addressed. The war was not about Ukraine’s interests: it was bigger than Ukraine.

A month later, in April, when a settlement seemed to be within reach at the Istanbul talks, the US and UK again pressured Ukraine not to pursue their own goals and sign an agreement that could have ended the war. They again pressured Ukraine to continue to fight in pursuit of the larger goals of the US and its allies. Then British prime minister Boris Johnson scolded Zelensky that Putin “should be pressured, not negotiated with.” He added that, even if Ukraine was ready to sign some agreements with Russia, the West was not.” Once again, the war was not about Ukraine’s interests: it was bigger than Ukraine. At every opportunity, Biden and his highest ranking officials have insisted “that it’s up to Ukraine to decide how and when or if they negotiate with the Russians” and that the US won’t dictate terms: “nothing about Ukraine without Ukraine.”

But that has never been true. The US wouldn’t allow Ukraine to negotiate on their terms when they wanted to. The US stopped Ukraine from negotiating in March and April when they wanted to; they pushed them to negotiate in November when they did not want to. The war in Ukraine has always been about larger US goals. It has always been about the American ambition to maintain a unipolar world in which they were the sole polar power at the center and top of the world. Ukraine became the focus of that ambition in 2014 when Russia for the first time stood up to American hegemony.

Alexander Lukin, who is Head of Department of International Relations at National Research University Higher School of Economics in Moscow and an authority on Russian politics and international relations, says that since the end of the Cold War Russia had been considered a subordinate partner of the West. In all disagreements between Russia and the US up to then, Russia had compromised, and the disagreements were resolved rather quickly. But when, in 2014, the US set up and supported a coup in Ukraine that was intended to pull Ukraine closer into the NATO and European security sphere Russia responded by annexing Crimea, Russia broke out of its post Cold War policy of compliance and pushed back against US hegemony. The 2014 “crisis in Ukraine and Russia’s reaction to it have fundamentally changed this consensus,” Lukin says. “Russia refused to play by the rules.”

“This black hole is now swallowing the entire Energy System of the country as you read this, and attracting dangerously some of the closest objects to its orbit such as Poland, the Baltic Bonsai Countries and the neighboring EU..”

• Black Holes And Digestive Systems, Or Why Hegemon Is Doomed (FMAN)

Ukraine is like a black hole. It swallows everything you throw at it… Billions of dollars in assistance, millions of tons of military material, and (I hope not) hundreds of thousands of lives of Khokhol and its Nazi buddies, especially if they allow the Clown-Zirkus to remain in power for much longer without a check. This black hole is now swallowing the entire Energy System of the country as you read this, and attracting dangerously some of the closest objects to its orbit such as Poland, the Baltic Bonsai Countries and the neighboring EU, all of them being steered directly to the void, in suicide mode, by their (brain disabled, dim-witted, deranged and psychopathic) ruling elites.

But what are really black Holes? You can ask yourself. From an astronomical standpoint, it is simply a star (of some mass) that, at the end of its life, collapses into a point (the singularity) due to the gravity produced by its own mass. This gravity is so intense that not even light can escape from it, hence the name “Black Hole”. They can achieve this state through a variety of processes, but the end result is always the same: something from which you cannot escape if you fall within its event horizon. And that is only defined by its mass, electric charge, and momentum. Whatever falls behind its event horizon is forever out of reach of observers on the outside.

There might be another (more convenient) meaning for this particular Ukrainian black hole. I read in my university days an anthology edited by Jerry Pournelle, where he said that Russians never use the term, because it has some eschatological connotations… some kind of biology-related obscenity. I don’t know if it is true, but I have to say that comparing Banderastan to the black hole at the end of the digestive system of some kind of mythological beast (let’s call it Hegemon) looks like much more pertinent in this case. This end has a particularly long and interesting list of possible denominations.

The beast, has an insatiable hunger, if allowed it would devour us all. The crazy psychopaths ruling elites in the West are feeding it as quickly as possible and as much as they can (wasting in the process the wealth, health and resources of those they govern) because they are also part of the parasites sucking the life and energy off the beast. The more they throw into the mouth, the more they suck out of it. The system works perfectly for them and, what is left, once processed and liberated of most of the real substance and value, is excreted through the blackhole at the end.

Max Keiser:

• I guess the good news about the FTX racketeering scandal is that it looks like it’ll take down several high profile media outlets, the entire ‘crypto’ farce and many scammy VC’s and banks.

• [NYTimes] @dealbook just indicted itself as being part of a criminal enterprise and participating in the FTX racketeering scandal.

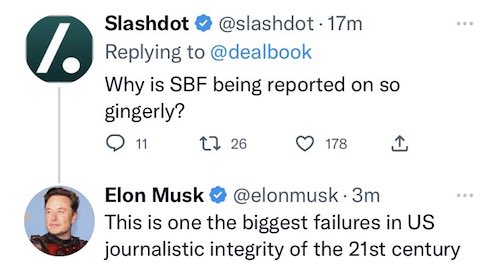

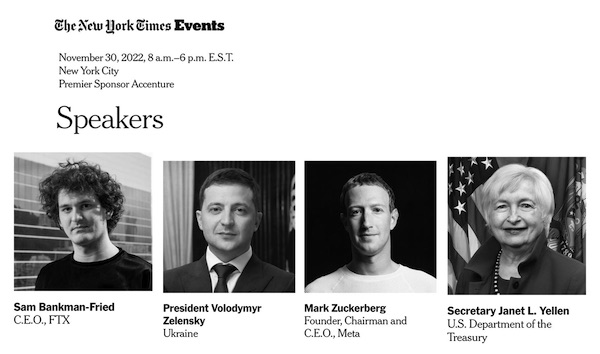

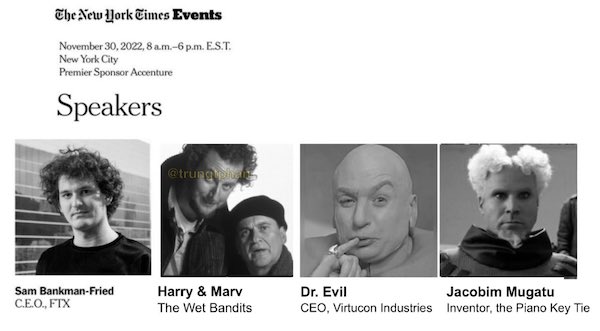

• New York Times Confirms SBF To Speak Alongside Zelensky, Yellen (ZH)

As we discussed last night, Sam Bankman-Fried has now demonstrated that he is both a pathological liar and a sociopath, the kind who in “explaining” to his employees how he stole billions (over $4 billion according to new FTX CEO John J. Ray) from the now bankrupt FTX, an act which left it insolvent and without liquidity, called it “loans” which were “generally” not used for “large amounts of personal consumption” (just “small amounts” used for such trivial items as $40 million penthouses and private jets). And the only reason we don’t officially call him a criminal just yet, is because he has not yet confirmed he used clienOutrage After New York Times Confirms SBF To Speak Alongside Zelenskyy, Yellent money from his exchange to fund his personal hedge fund, an act which would cost any other individual decades in jail… but not prominent democrats like SBF or Jon Corzine, of course.

Plus it’s the US legal system’s job to do that, not ours. Although we are growing increasingly skeptical this prominent Democratic donor will ever see the inside of a courtroom. It’s not just us: with much of the entire world demanding to know how this corpulent 30-year-old still has not been thrown in prison, or at least charged with a variety of crimes, the NYT just confirmed to the entire world what a farce the one-time paper of record has become, and how it is willing to whore itself out for clicks – not to mention prominent Democrat donors – because moments after SBF tweeted that he will be speaking with Andrew Ross-Sorkin moderated NYT “summit” on Nov 30… … Sorkin quickly confirmed as much.

And so, instead of being under arrest, SBF will instead be treated like a luminary alongside other such other Democrat icons as Zelenskyy (who according to some may have been intimately familiar with FTX fund flows in the past year) and of course the woman who along with Ben Bernanke and Jerome Powell, made it all possible by blowing the biggest asset bubble of all time: Janet Yellen. And while we are certain that the NYT – which we assume is done writing puff pieces on behalf of SBF after it became a laughing stock last week – would be quick to mercilessly cancel and expel from its “prestigious” conference anyone who had misgendered some post-op transsexual, it is willing to give this thieving pathological liar and sociopath a forum in which to profess his innocence to the entire world, and by association with other Democrat “celebrities”…

Europe is not where the brains are.

• EU Parliament Brands Russia ‘State Sponsor Of Terrorism’ (RT)

The European Parliament adopted a non-binding resolution designating Russia as a “state sponsor of terrorism” on Wednesday. In a strongly worded but largely symbolic document, MEPs also called on the European Union to further reduce diplomatic ties with Moscow and quickly adopt a ninth package of anti-Russia sanctions. Diplomatic relations with Russia should be cut “to the absolute minimum necessary” and Russian “state-affiliated institutions,” such as Russian cultural centers and diaspora organizations, should be closed and banned, the MEPs said. As the European Union cannot officially designate states as sponsors of terrorism at present, the parliament called on bloc members to put in place the necessary legal framework and to consider adding Moscow to the relevant list.

It also urged EU members to initiate “a comprehensive international isolation” of Russia and “to swiftly complete its work on a ninth sanctions package.” The resolution, which was supported by a vast majority of parliamentarians, accused Russia of conducting “deliberate attacks and atrocities” against Ukrainian civilians, of destroying critical infrastructure in the country, and of violating human rights. Therefore, it said, the European Parliament “recognizes Russia as a state sponsor of terrorism and as a state which uses means of terrorism.” Ukrainian President Vladimir Zelensky welcomed the resolution, tweeting that “Russia must be isolated at all levels and held accountable.”

In recent weeks, similar largely symbolic declarations were adopted by NATO’s Parliamentary Assembly and the Parliamentary Assembly of the Council of Europe. While Kiev has repeatedly urged the West to declare Russia a “state sponsor of terrorism,” only a few countries – including Estonia, Latvia, Lithuania and the Czech Republic – have heeded the call, and their actions have been limited to symbolic gestures. Those with the power to enforce anti-terrorism sanctions against other states, specifically the US, have so far refused to take such a step. In August, the Russian Foreign Ministry warned Washington that designating Russia as a state sponsor of terrorism would become “a point of no return” in bilateral relations.

“..Van Schaack said the US is “very interested in what the Europeans are doing,” adding that such a resolution “carries great weight.”

• Russia Is Not ‘State Sponsor Of Terrorism’ – US Ambassador (RT)

The US cannot designate Russia as a “state sponsor of terrorism” since it simply does not fit the relevant criteria, the US Ambassador-at-Large for Global Criminal Justice Beth Van Schaack told a briefing on Tuesday, while commenting on a similar initiative by European lawmakers. The EU parliament adopted a resolution calling Russia a “state sponsor of terrorism” on Wednesday. “The designation of a state sponsor of terror in terms of the way US law defines it is not a good match for Russia here,” Van Schaack told journalists. Washington is currently “exploring other potential designations” that would allow it to potentially imposed further sanctions on Moscow, the ambassador added. According to Van Schaack, such a label would not be necessary since the US is already “utilizing our sanctions to an incredible degree.”

The non-binding resolution by the EU parliament was supported by 494 MEPs while 58 voted against it and 44 abstained. The MEPs particularly stated that Russia’s attacks on “the civilian population of Ukraine [and] the destruction of civilian infrastructure” amount to “war crimes” and “acts of terror.” The document also called on Brussels to develop a relevant legal framework allowing it to officially designate entire nations as sponsors of terrorism, adding that it is currently not possible. The resolution also demanded what it called the “comprehensive international isolation” of Russia, including the further reduction of diplomatic relations and the swift adoption of a new round of sanctions. “Contacts with its official representatives at all levels (should) be kept to the absolute minimum necessary,” the document said.

On Tuesday, Van Schaack said the US is “very interested in what the Europeans are doing,” adding that such a resolution “carries great weight.” The EU parliament’s document adopted so far is largely symbolic as it does not impose any legal commitments on Brussels. On Wednesday, the Russian Foreign Ministry blasted any such designations as a way for the West to legitimize their “unilateral coercive measures” against their perceived adversaries. “A number of nations representing the ‘collective West’ use such labels as a ‘terrorist state,’ ‘terrorist regime’ or a ‘state sponsor of terrorism’ to designate those nations [they consider] ‘unwelcome’ and not fitting their warped perceptions of democracy,” Ivan Nechayev, the deputy head of the Russian Foreign Ministry’s Information and Press Department, told the Russian media.

“Everything is fine with the station. There is nowhere to generate electricity.”

• Huge Swathes Of Ukraine Without Power & Water (ZH)

Ukraine’s energy operator Energoatom has announced Wednesday emergency power shutdowns in effect across all regions of the country amid a new large wave of Russian airstrikes. Sirens have been sounding throughout the day across the country. President Volodymyr Zelensky in follow-up estimated that 10 million Ukrainians now lack access to electricity due to the attacks. “There are emergency shutdowns in addition to planned, stabilization ones,” he explained. “The elimination of the consequences of another missile attack against Ukraine continues all day.” Casualties have been reported in the eastern cities of Dnipro and Zaporizhzhia, and at least one person has been reported killed in Kiev.

Speaking of the renewed attacks on the capital, Mykhailo Podolyak, head of the Office of the Ukrainian President’s office said, “A new massive attack on infrastructure facilities is underway.” He described, citing recent anti-air defense systems acquired from Western countries, “While someone is waiting for World Cup results and the number of goals scored, Ukrainians are waiting for another score – number of intercepted Russian missiles. A new massive attack on infrastructure facilities is underway. In NASAMS, IRIS-T and Air Defense Forces we trust.” Kiev’s mayor, Vitali Klitschko, issued an emergency message on social media warning that ongoing Russian strikes are “Hitting one of the capital’s infrastructure facilities. Stay in shelters! The air alert continues.”

Also alarming is that the mayor in a follow-up message said that water services have been suspended in Kiev after the major strikes. While it’s not the first time that some war-hit parts of Ukraine have been left without electricity and water, the country is now in an extremely dire and urgent phase, having already seen an estimated half its national power infrastructure degraded or destroyed. Temperatures are quickly dropping, with the capital having witnessed its first snow earlier this month. Nuclear power generation is also being severely impacted: Several units were shut down at the Pivdennoukrainsk nuclear power plant in southern Ukraine due to a loss of power during Russian air raids across Ukraine, Ukraine’s nuclear energy firm Energoatom said. An Energoatom spokesperson said, “Everything is fine with the station. There is nowhere to generate electricity.”

“To stop these attacks requires a political solution. Ukraine will have to give up and find some agreement with Russia.”

• Ukraine – Lights Out, No Water And Soon No Heat (MoA)

Earlier today the Russian military shut down the Ukrainian electricity network. Previous attacks had limited the distribution capacity to some 50% of demand. Controlled blackouts over several hours per day allowed to give some electricity for a few hours to most parts of the country. The attack today created a much larger problem. Not only were distribution networks attacked but also so the elements that connect Ukraine’s electricity production facilities to the distribution network. All four nuclear power stations of Ukraine with their 15 reactors are now in shutdown mode. Kiev along with most other cities of Ukraine no longer has electricity. Moldavia is likewise effected as it received some 20% of its electricity from Ukraine. When the Ukrainian network shut down the only local thermal power plant shut down too. It is likely that it can be switched on again but that can be a complicate process.

Limited electricity imports from the European system into Ukraine may still be possible but that electricity would only be available in Ukraine’s western cities. Before today’s attack the Washington Post reported of the difficulties in repairing the network. As we ad explained before the Russian attacks are hitting the transformers that connect the national 330 kilovolt backbone network. These are hard to replace: “As the scope of damage to Ukraine’s energy systems has come into focus in recent days, Ukrainian and Western officials have begun sounding the alarm but are also realizing they have limited recourse. Ukraine’s Soviet-era power system cannot be fixed quickly or easily. In some of the worst-hit cities, there is little officials can do other than to urge residents to flee — raising the risk of economic collapse in Ukraine and a spillover refugee crisis in neighboring European countries….

Ukrainian Prime Minister Denys Shmyhal said that about half of the country’s energy infrastructure was “out of order” following the bombardment…. For weeks, Russian missiles have targeted key components of Ukraine’s electrical transmission system, knocking out vital transformers without which it is impossible to supply power to households, businesses, government offices, schools, hospitals and other critical facilities. During a briefing for reporters on Tuesday, Volodymyr Kudrytskyi, the head of Ukrenergo, the state-run power grid operator, called the damage to the power system “colossal.”… Russians, he said, were mainly targeting substations, nodes on the electrical grid where the current is redirected from power stations. The main components of these substations are autotransformers — “high-tech and high-cost equipment” that is difficult to replace….

A list of “urgent needs” from DTEK, the country’s largest private energy company, circulating in Washington, lists dozens of transformers along with circuit breakers, bushings and transformer oil…. But it is the autotransformers — the “heart” of the substations, in the words of Kudrytskyi — that are at the top of the Ukrainians’ list of needs and the key to keeping the country’s electrical grid functioning. The Ukrainians have tried to buy up every autotransformer they can find, going as far as South Korea to purchase them, but they still need to place orders for more to be built.“We try to collect everything around the world that they have now, and order more,” said Olena Zerkal, an adviser to Ukraine’s Energy Ministry. Any attempts to repair the network are useless as long as Russia continues to attack it. To stop these attacks requires a political solution. Ukraine will have to give up and find some agreement with Russia.

Ha ha ha. I bet Boris spoke the truth for once.

• Germany Rejects Boris Johnson Claims It Said Ukraine Should Fold To Russia (G.)

Germany has angrily dismissed claims by Boris Johnson that in the run-up to the Russian invasion of Ukraine it said it would be better for Ukraine to fold than to become embroiled in a long war. Johnson, interviewed by CNN, also claimed that the French president, Emmanuel Macron, was in denial about the threat of invasion, and that Italy, led at the time by Mario Draghi, said it could not help because it was so dependent on Russian hydrocarbons.A spokesperson for the German chancellor, Olaf Scholz, rejected the claims with a diplomatically phrased dig at Johnson. “We know that the very entertaining former prime minister always has a unique relationship with the truth; this case is no exception,” the official said. Miguel Berger, the German ambassador to the UK, backed the dismissal of Johnson’s account.

Johnson’s claims appear similar to comments from Andriy Melnyk, the former Ukrainian ambassador to Germany, who has said German politicians told him before the invasion that they expected Ukraine to be defeated within three days and so it was pointless to provide any help. Melnyk claimed on Twitter in March: “On 14 February we were warning German politicians: ‘Kyiv may be bombed in the coming days! We urgently need 12 thousand anti-tank rockets from Germany.’ In response: just mockery. So sad. So furious.” He later claimed that the German finance minister, Christian Lindner, was against supplying weapons to Ukraine or cutting Russia off from the international Swift banking payments. Melnyk told Frankfurter Allgemeine Zeitung that Lindner had told him with a smile that he thought Ukraine would collapse within a few hours and that he was ready to talk to a puppet regime that would be installed by Russia.

The German finance ministry denied the accusation. Macron was broadcast before the invasion making desperate pleas to Vladimir Putin to hold talks with Joe Biden. Johnson stressed in his interview that EU nations had later rallied behind Ukraine and were providing steadfast support, but he said that was not universally the case in the period before the invasion in February. “This thing was a huge shock … we could see the Russian battalion tactical groups amassing, but different countries had very different perspectives,” Johnson told CNN’s Richard Quest in Portugal. “The German view was at one stage that if it were going to happen, which would be a disaster, then it would be better for the whole thing to be over quickly and for Ukraine to fold,” he claimed, citing “all sorts of sound economic reasons” for that approach.

This should stop EU support right there and then, of course. First give us your billions, then we’ll read you your rights. And cut off your energy.

• EU Has ‘No Right’ To Get Tired Of Ukraine Conflict – Kiev (RT)

The European Union must cast aside all doubts about new anti-Russia sanctions and double down on slapping Moscow with new restrictions that would curb its missile industry, Foreign Minister Dmitry Kuleba said on Tuesday. Speaking at a regular briefing, Kuleba urged the EU to speed up the work on its ninth sanctions package, which he described as long overdue. “We are only hearing about an attempt to start serious work on its preparation. Such a situation is totally unacceptable,” the minister said. In the same vein, he called on his EU colleagues “to put aside any doubts or, as it is fashionable to say, ‘fatigue,’ and to start to quickly complete the ninth sanctions package.” “If the Ukrainians are not tired, then the rest of Europe, all the more, has neither the moral nor the political right to get tired,” Kuleba stressed.

He called on the EU to focus on sanctions impacting Russia’s capability to produce missiles, which are used by Moscow to conduct strikes on Ukraine’s critical infrastructure. Russia has been targeting Ukrainian energy facilities, including power stations, since October 10, after accusing Kiev of attacking Russian structures, including the strategic Crimean Bridge. Due to these strikes, Ukraine has been experiencing rolling blackouts, with authorities there saying that these attacks have knocked out about 40% of the nation’s energy infrastructure. On Tuesday, Politico reported that the EU has not officially started working yet on the ninth sanctions package against Russia. However, according to two of the outlet’s sources, the new measures may potentially focus on Russian individuals that can be linked to the Ukraine conflict.

The previous sanctions package was adopted by the EU in early October and sought to deprive Moscow of €7 billion ($7.2 billion) in revenues from the import of products which support the Russian economy, including steel products, various machinery, textiles and non-gold jewelry. Following the start of Russia’s military operation in Ukraine in late February, Western countries imposed sweeping new sanctions on Moscow, freezing around half of Moscow’s gold and foreign exchange reserves. According to Kremlin Press Secretary Dmitry Peskov, these assets “have been essentially stolen” by the West. Last week, Nikolay Patrushev, the secretary of Russia’s National Security Council, claimed that the US, which has supported the sanctions, is seeking to weaken and destroy Russia, and is using Ukraine as a “battering ram” to achieve that goal.

See? Just to make their point that you have “No Right’ To Get Tired Of Ukraine Conflict”, they cut off your gas…

• Ukraine Halts Russian Oil Transit To EU – Transneft (RT)

Kiev has stopped the operation of a section of the southern branch of the ‘Druzhba’ (Friendship) oil pipeline that transits Ukraine, RIA Novosti reported on Wednesday, citing Russian oil-exporting company Transneft. According to the report, oil transmission has been suspended for an indefinite period. “In Ukraine, the section [of Druzhba] has been stopped, from Brod to the Carpathians,” said Igor Demin, an adviser to the president of Transneft. He added that deliveries via the Belarusian section of the pipeline were continuing. Last week, Kiev stopped oil flows to Hungary through the Druzhba pipeline, explaining the suspension was linked to a Russian air strike that reportedly had hit a transformer station near the border with Belarus.

It stated that the service was suspended due to a “drop in voltage.” Kiev later announced plans to raise transit fees for Russian oil running through the pipeline to the EU, due to higher costs resulting from Russian air and missile attacks targeting the country’s energy infrastructure. Ukrainian oil transit fees have already been raised twice this year. The last hike, in April, reportedly brought the total increase on an annualized basis to 51%. Built in the 1960s, Druzhba is one of the longest pipeline networks in the world, which carries crude some 4,000km from Russia to refineries in the Czech Republic, Germany, Hungary, Poland and Slovakia.

We don’t believe you. But still, question: what did you pay?

• EU Claims To Have Fully Substituted Russian Gas (RT)

The European Union has entirely replaced Russian natural gas imports with LNG and pipeline gas from alternative reliable suppliers, Energy Commissioner Kadri Simson told a plenary session of the European Parliament on Wednesday. The bloc is due to debate a gas price cap proposal on Thursday to prevent sky-high costs for consumers. “Diversification, demand reduction, a common storage policy [and] our #RepowerEU actions are making a difference,” Simson tweeted after the session, adding: “But we need to stay vigilant.” The substitution of Russian pipeline gas came on the back of the increased purchases of liquefied natural gas (LNG) from the United States, experts told RIA Novosti. According to the European Commission, between January and August the total volume of gas imports from Russia, including LNG, decreased by 39 billion cubic meters (bcm).

During the same period, LNG supplies from the United States jumped by almost 80% in annual terms. Last year, Russia accounted for around 45% of the EU’s gas imports. According to the International Energy Agency, Moscow supplied 155 bcm to the bloc, while this year imports are expected to drop to a little over a third of that (around 60 bcm). Meanwhile, analysts from the research firm Kpler warned this month that replacing Russian pipeline gas supplies with LNG would result in significant costs for the EU. Unlike pipeline gas, which is usually supplied under long-term contracts, LNG is more often purchased on the spot market, and its cost tends to be many times higher. Meanwhile, increased purchases by the EU have been making it difficult for developing countries to buy LNG, as they are being now forced to compete on price with wealthier nations.

“Gold purchases by regulators more than quadrupled in the July-September period and totaled 399.3 tons..”

• China Secretly Hoarding Gold To Ditch Dollar – Media

Central banks across the world have stepped up their gold purchases after Russia’s overseas assets were frozen as part of sanctions this year, according to strategists cited by the Japanese business daily Nikkei Asia. Some $300 billion of Russian foreign reserves, and billions more from individuals and businesses, have reportedly been frozen by the US and its allies. The Kremlin has repeatedly slammed the seizures as “theft.” Gold purchases by regulators more than quadrupled in the July-September period and totaled 399.3 tons, according to data revealed in the November report of the World Gold Council. The figure marks a dramatic surge from 186 tons recorded in the preceding quarter, and 87.7 tons in the first quarter of this year. Meanwhile the year-to-date total surpasses any full year since 1967.

Emin Yurumazu, a Japan-based economist from Turkey, told the media that “anti-Western countries are eager to accumulate gold holdings on hand,” after nations saw how Russia’s overseas assets were frozen as part of sanctions. The central banks of Turkey, Uzbekistan and India previously said they had bought 31.2 tons, 26.1 tons and 17.5 tons, respectively. It is currently unclear which nations purchased the rest of the 300-ton total calculated in the industry group’s report. Some unidentified purchases are to be expected, but an unspecified slice of “this magnitude is unheard of,” Koichiro Kamei, a financial and precious-metals analyst, was cited by the agency as saying. “China likely bought a substantial amount of gold from Russia,” market analyst and former Japan director for the World Gold Council, Itsuo Toshima, said.

He explained that the People’s Bank of China likely purchased a portion of the Central Bank of Russia’s gold holdings of over 2,000 tons. The analyst noted that this is typical behavior from the Chinese monetary regulator, which did not disclose any gold purchases from 2009 to 2015, and then reported it had increased the reserves by 600 tons. The People’s Bank of China has not published any new reports on gold purchases since 2019. The gold-buying frenzy comes as part of the latest attempts made by central banks to protect their assets by reducing their exposure to the US dollar. China has been a dominant force in the current de-dollarization trend. According to data from the US Treasury Department, the nation sold $121.2 billion in US bonds between March and October.

Of course they talk. The US wants to know what Russia is thinking.

• NATO Contacts Claim Is Media ‘Invention’ – Moscow (RT)

Russia’s top military commander, Valery Gerasimov, did not communicate with Rob Bauer, the chair of NATO’s Military Committee, contrary to what some Western media outlets have claimed, the Russian Defense Ministry has stated. Reports about “typical” conversations between the two military officials and an agreement on the “safe passage of ships in the Black Sea” are “an invention from the start to the end,” a statement released on Wednesday said. Earlier in the day, the news outlet EurActiv, which specializes in covering EU affairs, cited a NATO source as saying that some Eastern European members of the alliance “raised their reservations” about alleged contact between Bauer and Gerasimov.

The source claimed that the two had regular exchanges aimed at deescalating the conflict, particularly in the Black Sea, and that the parties had agreed to “be careful” to avoid accidents. Unnamed members of the alliance questioned the practice, but others said Bauer was entitled to have his channel of communication with Russia. The Dutch admiral served as the chief of defense in his home country before becoming the chair of NATO’s Military Committee in June last year. The Military Committee is composed of the defense chiefs of all member states, while Bauer has the role of the topmost adviser on military strategy to the North Atlantic Council, NATO’s decision-making body. General Gerasimov heads the Russian General Staff, a position equivalent to that of a chief of defense in NATO states.

The EurActiv source claimed that the US, Türkiye, and nations in western and southern Europe “fortunately” countered the push by the UK, Eastern European, and Scandinavian members for “a zero-sum approach” in relations with Russia. Berlin’s role in the alliance has been reduced to virtually nothing, the outlet claimed. “Germans pay, give and don’t speak,” the source was quoted as saying. Nevertheless, NATO members were mostly on the same page in terms of supporting Ukraine, as long as it didn’t compromise their own national security, according to the same tip. The report said that applicants Finland and Sweden were unlikely to join the US-led bloc before June next year, when Türkiye holds national elections. Ankara blocked their accession, claiming that the two nations were not committed to fighting terrorist groups threatening Turkish national security.

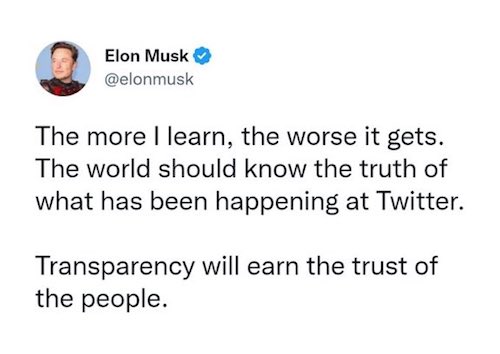

“Oddly, the advertisers are abandoning the platform as its user-base is growing to record highs…”

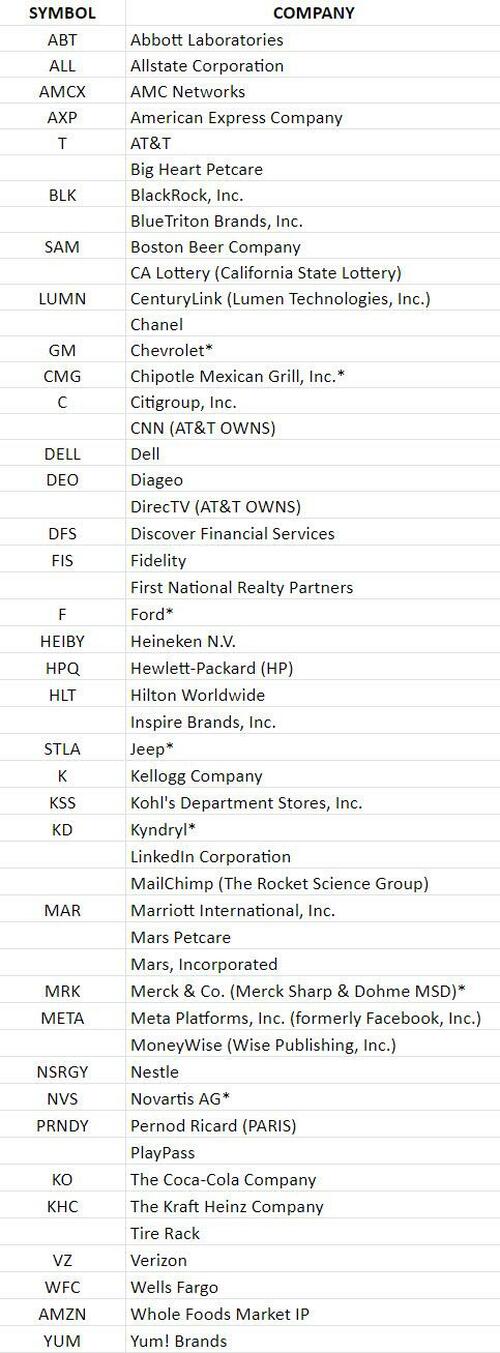

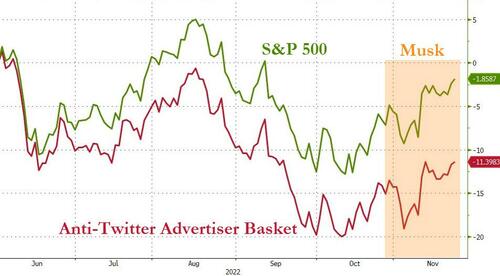

• Anti-Twitter Advertisers Have Been Under-Performing The Market For Months (ZH)

The last few months have seen a growing number of companies choosing to exercise their freedom of speech by choosing to abandon any advertising platforms that dare allow freedom of speech to virulently spread among its users. Since Elon Musk’s takeover of Twitter, the fearmongery and virtue-signal-ery has been turned up to ’11’ as the ‘woke-est’ of those companies have reportedly pulled hundreds of millions of dollars worth of advertising from the social media platform (despite Musk’s insistence that “Twitter’s strong commitment to content moderation remains absolutely unchanged.”) Oddly, the advertisers are abandoning the platform as its user-base is growing to record highs…

Twitter added 1.6M daily active users this past week, another all-time high pic.twitter.com/Si3cRYnvyD

— Elon Musk (@elonmusk) November 22, 2022

So, in an effort to quantify just how broke you can become if you go woke, we created the ‘woke advertisers’ basket. This is a market-cap weighted index of 34 stocks representing our best aggregation of the woke-est companies who have publicly claimed they are withdrawing/pausing their advertising on Twitter… and in most cases, have played the ‘virtue signal’ card while doing so over the “dangers” of being on such a “hate-filled” platform”.

Note: an * means the company has issued a statement or was publicly reported as stopping its ads on Twitter and subsequently confirmed. Otherwise, companies identified on this list are “quiet quitters”, based on a Media Matters analysis of Pathmatics data. These companies were previously advertising on Twitter, but then stopped for a significant period of time following direct outreach, controversies, and warnings from media buyers. Since the start of June, when US economic surprise data started to turn down and economic weakness began to be acknowledged – the companies that make up the basket of stocks that have decided to pull back from advertising on Twitter have been underperforming (-11.4% vs S&P -1.9%)…

Additionally, the anti-Twitter basket has significantly underperformed since 03/25 when Musk made his initial offer to buy Twitter (-17% vs S&P -11%) and also underperformed since Musk took over Twitter on 10/27 (+3.3% vs S&P +5.1%), even as the broad market has squeezed notably higher. Is the signaling of how virtuous they are by antagonizing Elon Musk merely a cover for extensive cost cutting and marketing budget reductions as the C-Suite sees recession imminent… Who knows? sBut we suspect that if things are about to shift from bad to worse in the global economy, these anti-Twitter companies are perhaps more likely to underperform (having shown their cards already).

“They broke the deal..”

• Elon Musk: Coalition of Political Groups Behind Lack of Moderation Council (ET)

Elon Musk said Tuesday that Twitter is lacking a moderation council because of the actions of a “large coalition of political and social activists.” The billionaire businessman took over the platform in October and promised shortly after that Twitter would be forming a “content moderation council” that had “widely diverse viewpoints” and that “no major content decisions or account reinstatements will happen before that council convenes.” However, the Tesla CEO said on Tuesday that the absence of a moderation council was due to a group of political and social activists who he claimed broke an agreement with him by encouraging companies to stop advertising on Twitter. Musk was responding to a Twitter user who accused him of penning a “completely fictional” tweet regarding the establishment of a moderation council.

“A large coalition of political/social activist groups agreed not to try to kill Twitter by starving us of advertising revenue if I agreed to this condition,” Musk wrote on Twitter on Tuesday. “They broke the deal,” he added. [..] Earlier this month, Musk claimed that Twitter’s revenue was declining because of “activist groups pressuring advertisers, even though nothing has changed with content moderation and we did everything we could to appease the activists.” “Extremely messed up! They’re trying to destroy free speech in America,” Musk said. The businessman later threatened to name and shame the advertisers who were boycotting the platform following his takeover of the site and despite his assurance that the platform would not become a “free-for-all hellscape” where anything could be said, “with no consequences.” “In addition to adhering to the laws of the land, our platform must be warm and welcoming to all,” Musk wrote in an open letter to advertisers in October.

Schwaub Schools Dr Urso

Peach Faced Lovebird Parrot on a Saguaro Cactus, Phoenix, Arizona

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.