Jack Allison Street scene, NYC: shiny shoes and “dancing on the water” Summer 1938

Debt Rattle Jan 20 2014

China growth numbers (well, estimates) are in, and guess what, opinions are all over the place. It’s better than some estimates and worse than others, but still the lowest this century. Word is that this is the result of changing government policies, but there definitely is lower global demand for Chinese products too.

• China growth slowest in 14 years, tipped to slow further (InvestmentWeek)

The Chinese economy grew by 7.7% in 2013, the latest figures from the country have revealed, its slowest rate for 14 years. The economic superpower, which is expected to take over from the US as the world’s largest economy in the next decade according to some analysts, saw growth fall in 2013 as the country’s ruling party seeks to convert the economy to a more sustainable model.

Growth of 7.7% is the slowest pace of growth since 1999, matching 2012’s reading and far lower than the 9.3% it saw in 2011. However, the growth rate was higher than its government’s own target of 7.5%.

China is seeking to move from an investment-led economy to one powered by domestic consumption, but this re-balancing is weighing on growth in the near term.

The latest figures from the country also revealed China’s growth rate slowed to an annual rate of 7.7% in the October-to-December quarter, down from 7.8% in the previous three months.

Zero Hedge has a look behind the scene in China, and points out that despite all the talk about the growth being above the government target, the financial industry feels quite queasy, not in the least because the numbers come from Beijing:

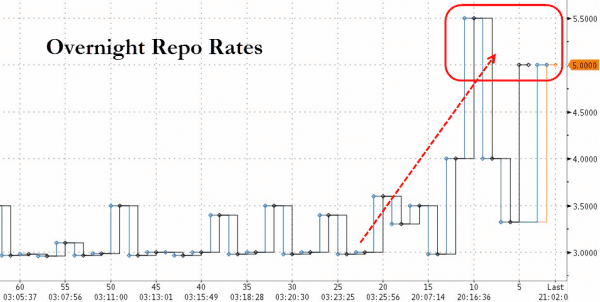

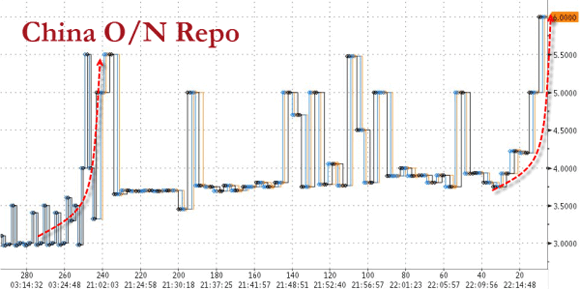

• Chinese Money Markets Spooked Despite Slight Beat (And Miss!) In GDP (Zero Hedge)

Chinese overnight repo rates were already on the rise (several trades at 5.5%: 200bps above Friday’s close) as contagion concerns over wealth management product default spreads and the Chinese Business Climate Index tumbled to its lowest since June 09. Equity futures were sliding also with JPY strength and the Shanghai Composite was testing down towards the 1-handle once again.

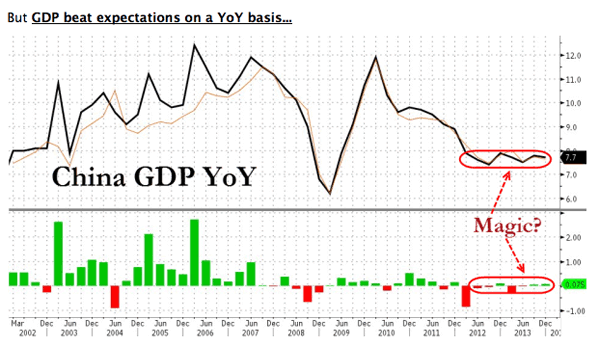

Then, amid the glorious nashing of spreadsheets and in the face of missed manufacturing and services PMIs, Chinese GDP (according to the Chinese government) came in at a better-than-expected 7.7% YoY (7.6% exp.) and handily above the all-too-crucial-to-hit 7.5% target GDP growth – but in keeping with the Schrodinger plan missed QoQ expectations (+1.8% vs +2.0% exp.). Industrial production also miraculously met expectations of 9.7% perfectly; and (shocker) Retail Sales perfectly matched expectations of 13.6% YoY.

For a sense of just how well “managed” (or how well “trained” the analysts are) the Chinese economy is – by that we mean goal-seeked –

• US Q4 GDP “guess” at 3.3% has a +/-0.4% error… (about a 13% standard error)

• China’s Q4 GDP “guess” at 7.6% had a +/-0.1% error… (about a 1.3% standard error)So does that mean China is 10-times better at Central Planning?

Deutsche Bank reports a “surprise” pretax loss, legal costs are said to be the main culprit.

• Deutsche Bank Posts Shock $1.56 Billion Loss In Q4 (Bloomberg)

Europe’s biggest investment bank by revenue, reported a surprise fourth-quarter loss, hurt by legal costs and accounting charges. The shares fell as much as 5.3%.

The pretax loss was 1.15 billion euros ($1.56 billion), on 528 million euros in litigation-related expenses as well as costs tied to its reorganization and charges to adjust credit, debt and funding valuations, the Frankfurt-based firm said yesterday in a statement. The average estimate of six analysts surveyed by Bloomberg was for a 628.5 million-euro pretax profit. The bank announced results 10 days ahead of schedule.

But it seems that nothing is ever what it seems anymore; Bloomberg had this a few days ago:

• The Accounting Wizardry Behind Banks’ Strong Earnings (Bloomberg)

Wells Fargo reported a personal-best $5.6 billion in fourth-quarter earnings today, overtaking JPMorgan Chase as the most profitable U.S. bank. JPMorgan reported $5.3 billion in fourth-quarter income and $17.9 billion for all of 2013, not too shabby for a year in which the bank spent $23 billion on legal settlements.

Upon further review, however, these profits don’t look quite as robust. More than 31 percent of JPMorgan’s 2013 earnings, or $5.6 billion, and about 10 percent of Wells Fargo’s, $2.2 billion, weren’t really earned last year. That money came instead from the banks’ so-called loan-loss reserves, an accounting accrual that’s kind of like a rainy-day fund.

Lenders set aside that cash during and shortly after the financial crisis to cover future losses in case the U.S. economy got worse and consumers couldn’t pay their credit card bills, mortgages, and other loans. But collections on most consumer loans have never been better—banks tightened lending standards, plus people went back to work—so the banks are using that money to bump up earnings.

Meanwhile, revenue growth has been on a steady decline, which means those nice-looking earnings are a result of tapping those reserves and cost-cutting, says Josh Rosner, an industry analyst with research firm Graham Fisher in New York. “At some point you run out of reserves to release, and you can’t cut more costs without cutting loans,” he says.

Phoenix Capital looks at “failed” stimulus measures. I don’t think they’ve really failed, because as I’ve often said, I don’t believe QE was ever meant to stimulate the economy, and as an instrument to transfer wealth from the public to the private sector, and transfer debt the opposite way, it is a resounding success.

• The Complete and Total Failure of Central Banks to Create Growth (Phoenix Capital)

The Central Bank rig of the last five years appears to finally be ending. Since the Great Crisis erupted in 2007-2008, Central Banks around the world have resorted to two primary tools in their efforts to reflate the system:

1) Lowering interest rates

2) Quantitative Easing or QERegarding #1, since 2007, Central Banks have cut interest rates an incredible 520 times. One could write a multi-volume book on the consequences of this, however, painting in broad strokes lower rates do the following:

1) Punish savers and others whom depend on fixed income for retirement

2) Continue to concentrate asset ownership in the hands of the elite who can leverage up at near zero rates to acquire more

3) Continue to encourage poor investment

4) The mispricing of assets across the board as rates no longer reflectIn the US, the Fed has now kept interest rates at zero since late 2008. The end result is that housing is once again in a bubble (home prices relative to disposable income is in fact high than in 2007) while economic growth remains anemic (GDP has not expanded at 3%+ for a single year since 2007) and employment continues to fall (the employment ratio or percentage of Americans of working age who are gainfully employed remains at levels last seen in the early ’80s.

The second most popular monetary tool employed by the world’s Central Bank is Quantitative Easing or QE. If you’re unfamiliar with this concept, it works as follows: Central Banks print money; They use this money to buy assets (usually sovereign bonds or mortgage backed securities) Doing this provides liquidity to those financial institutions that own the assets the Central Bank buys. QE also allows the Government to run a massive deficit as the Central Bank becomes the de facto buyer of sovereign debt.

The entire concept of QE is based on the idea that the best means of fighting an economic contraction is monetary easing. The Fed does this to attempt to smooth the troughs from contractions. The only problem is that QE doesn’t work. In fact, I cannot find a single instance in which it has in history.

In other news, Obama signs a deal that will keep another debt ceiling fight off the table until September, buy simply once again raising the debt ceiling, rinse and repeat.

• Safe from shutdown: Obama signs trillion-dollar budget (RT)

It takes just the richest 85 people in the world to get the same net worth as the poorest 50%. Whoever thinks that’s a good thing, good luck. The other 99% of you, do something about it if you don’t like it.

• Richest 85 people have same wealth as 3.5 billion poorest (Metro UK)

Your children are the future, but also the present: they’re entities meant to unload your losses on, so you can keep on pretending all’s fine with your life, you’re not an abject failure, and there’s a functioning government in Washington. What a disgrace …

• Student Loans, the Next Big Threat to the U.S. Economy? (Bloomberg)

Student loans today are one of the only deteriorating pockets of consumer credit, with balances and delinquency rates rising to record highs even as a strengthening economy allows Americans to reduce total borrowing. Outstanding student debt topped $1 trillion in the third quarter of 2013, and the share of loans delinquent 90 days or more rose to 11.8 percent, according to the Federal Reserve Bank of New York. By contrast, delinquencies for mortgage, credit card, and auto debt all have declined from their peaks.

While buried in debt, those same students will have a lot more extreme weather to deal with:

• Major El Nino events likely to double in next century (The Age)

The worst El Nino weather events, which are linked to devastating natural disasters and reduced Australian rainfall, will double with dangerous climate change, research has found. In a study published on Monday in the journal Nature Climate Change, an international team of researchers, including Australian scientists, for the first time predict ”extreme” El Nino events will occur once every 10 years – instead of every 20 years as in the previous century – as the planet continues to warm due to human activity.

El Nino is a natural climatic event that occurs when water temperatures in the Pacific Ocean periodically rise, shifting rainfall patterns. A lead author of the study, Dr Wenju Cai from CSIRO, said the further the warming in the east Pacific stretched, and the higher the temperatures reached, the more extreme the El Nino.

The researchers used 20 climate models to project the impact on extreme El Nino frequency of global greenhouse emissions continuing at current high rates. They concluded that total occurrences of El Nino would remain largely unchanged but extreme events will occur twice as often between 1991-2090 as they did in the previous hundred years.

So maybe it’s a good thing for you that they probably won’t be able to afford a new Kalashnikov with all that debt:

• Kalashnikov to sell 200,000 rifles in US, Canada (RT)

Perhaps you should get one to protect yourself from your own kids and other students….

Home › Forums › Debt Rattle Jan 20 2014