Office of War Information ‘How to identify danger classes’, Newark 1942

Debt Rattle Jan 21 2014

I got a few complaints about the Daily Links disappearing from the front page, so I’ll put them back up there, as well as inside the daily Debt Rattles, where they’ll come with excerpts and my commentary. No problem!

Of course there is a grain of truth in saying optimism is a great force in economies, even in life itself. If only we think positive … But that doesn’t mean blind optimism is to be recommended. And now that we find ourselves in a situation in which stock markets have been – temporarily, they’ll be back – decoupled from the real economy (it’s hard to see how that could still be denied), there’s plenty of room for blinders out there. If you focus on financial markets alone, and you don’t read about what goes on in the streets, unemployment, foodstamps, you may well have the idea that things are going well. If you also believe newfound profits will lift the real economy like that tide does with all boats, what’s there to worry about? Recovery!

The reality is that “rich” real economies are still very far removed from any kind of normality (when compared to past circumstances), but stock markets are setting records almost daily. A few question marks would seem fitting. Unfortunately, many people’s eyes are so filled with dollar signs there’s no place left for the occasional question mark. The optimism gets to feed on itself. Some would call this irrational exuberance. Others call it animal spirits, and use that as a badge of honor.

Optimism that feeds on itself easily becomes a mere figment of the imagination. Moreover, without a recovery in the real economy, which is impossible without a very serious debt reduction, optimism will become a trap. And because overall indebtedness is only rising, and because it is that additional debt, not an actual recovery, that allows the for the markets to rise and optimism to spread, many will get trapped. The biggest among them will once again be bailed out with public funds, the smaller will lose their shirts.

• Investor Animal Spirits Spread to Companies Worldwide (Bloomberg)

Mergers and acquisitions are surging, with $130 billion in takeover offers already announced this year. And enterprises from Microsoft to Volkswagen are readying plans to step up capital spending after companies have squirreled away a record amount of cash to protect against a new financial crisis. “The animal spirits are coming back,” said Mark Zandi, chief economist for New York-based Moody’s. “This is going to be a good year” for capital expenditures and hiring.

Behind the projected upturn: increased confidence in the durability of expansion following faster U.S. and global growth late last year, the need to replace aging and out-of-date equipment, and a waning of what Zandi calls “existential fears,” including concerns about a breakup of the euro region.

A comeback is critical for the global economy and financial markets. Strategists at Goldman Sachs. and Credit Suisse are forecasting the fastest worldwide growth since 2011 and continued gains for equities – predicated partly on optimism spreading from investors to companies.

[..] A sharp increase in wealth has helped convince executives the expansion has momentum, said Vincent Reinhart, chief U.S. economist for Morgan Stanley in New York. Household net worth increased by $6.3 trillion in the first three quarters of 2013 to $77.3 trillion, thanks to rising equity and home prices.

Larry Elliott at the Guardian approaches the animal spirits as a thought experiment: what if they’re wrong? Policymakers will be stuck, since they have no other instruments left than blunt QE. Social fabrics will threaten to tear, since they’re already greatly stretched and have had no chance to recuperate. And Larry doesn’t even mention debt as a factor.

• The next crisis could be here soon (Guardian)

Financial crises come round every seven years on average. There was the stock market crash of 1987, the emerging market meltdown in the mid-1990s, the popping of the dotcom bubble in 2001 and the collapse of Lehman Brothers in 2008. If history is any guide, the next crisis should be coming along some time soon.

The fact that the financial markets are betting on global recovery becoming more firmly established over the next two years doesn’t really signify much. Investors refused to heed warnings that tech stocks were wildly over-valued around the turn of the millennium. Ben Bernanke rubbished the idea that the US sub-prime mortgage market was an accident waiting to happen, and refused to countenance the idea that a problem in American real estate might have global ramifications.

So let’s conduct a thought experiment. Assume that the IMF, the World Bank and the financial markets are all wrong when they say the US is now set for a period of robust growth, that Europe is on the mend and that China can make the transition to a less centrally planned economy without a hard landing.

There are reasons (cash-rich companies, more than half a decade of ultra-stimulative economic policies, the plentiful supply of new scientific breakthroughs) for thinking that the consensus is right, and that the outlook for several years is of steady, sustained growth. But imagine for a moment that the consensus is wrong and that the global economy remains subject to the familiar seven-year rhythm.

In those circumstances, three questions need to be asked. The first is where the crisis is likely to originate, and here the smart money is on the emerging markets. [..] The second question is how policy would respond if a second shock occurred well before the global economy had recovered from the first. [..] The final question, highlighted by yesterday’s study of the global jobs market from the International Labour Organisation, is what sort of impact a second recession would have on already stretched social fabrics.

China’s volatile situation continues to fester. Maybe the government would like to do something about shadow finance, but its measures only draw more people into it. What the leverage is in the shadow markets is impossible to tell, but a question mark or two are certainly warranted. If Communist Party officials convince themselves they must attack shadow banks or lose their political powers, there could a economic warfare. If they don’t, there could be a great big credit crunch as leverage percentages become untenable.

• China Crunch Escalates as Money Funds Rival Shadow Banks (Bloomberg)

A doubling in China’s money-market funds in the past six months is draining bank deposits and raising the risk of financial failures during cash crunches, according to Fitch Ratings.

The assets under management of such plans surged to a record 737 billion yuan ($122 billion) on Dec. 31 from 304 billion yuan on June 30 [..] Yu’E Bao, managed by Tianhong Asset Management Co. and sold online by Alibaba Group Holding Ltd., offers an annualized return of 6.7%, compared with the 3% official one-year savings rate. Some funds are offering higher rates, with news portal Eastmoney.com marketing a product that targets 10%.

Looking for animal spirits? Look no further. Chinese financial markets are a de facto casino, and everyone expects to win. The house always wins, of course, but who knows where the house is?

• Seven Chinese IPOs Halt Trading After More Than 44% Share Rally (Bloomberg)

Seven of the eight Chinese companies that started trading in Shenzhen today were halted for a second time after gains exceeded limits set by the city’s exchange. [..] The Shenzhen Stock Exchange warned today of the risks in “blindly” speculating in IPOs. China, the world’s largest market for new share sales in 2010 with a record $71 billion raised, had the first IPO since October 2012 last week as policy makers drafted rules aimed at tightening supervision.

“It’s hard to change Chinese investors’ habit of speculatively trading in new shares,” said Wei Wei, an analyst at West China Securities Co. in Shanghai. “Unless there’s an example of a debut company falling below its offer price, the practice won’t be stopped.”

Trading in shares of the seven companies were suspended as stock prices reached the threshold of a 44% move from their IPO prices, the level that’ll trigger suspension until three minutes before close on first-day trading by the Shenzhen exchange.

A Bloomberg editorial calls on France to “reform” its economy, in the same vein that the IMF and World Bank “reform” them. Diminish benefits, fire people, less government spending, the works. Whether that is truly the best thing France can do? Join the global rat race and compete with China for cheap trinkets and cheap wages? Why not (re-)introduce the Franc and make sure they can produce as much of what they need as possible domestically? They can trade for other currencies by selling wine and cheese and nuclear power. Would that really be that much worse as a choice?

• France Needs an Economic Revolution (Bloomberg)

It began with an article in the London financial press bemoaning France’s “failed socialist experiment” — which so piqued the French ambassador that he posted a 10-point rebuttal on his embassy website. British and French politicians and commentators piled on.

France, Ambassador Bernard Emie rightly protested, is not a desert of mediocrity, abandoned by creative people: It has world-class infrastructure and companies, and the food and wine aren’t bad, either. Yet his response ignored the larger truth in the British column: The French economic model has reached a point of self-harm that is driving away wealth and talent.

In a piece on trickle down economics (hasn’t that been fully discredited yet?!), Guardian writer Alex Andreou quotes Robert Reich: “There’s simply not enough purchasing power in the rest of the economy.” The full quote includes: “When so much of the purchasing power, so much of the economic gain, goes to the very top,” but that is a given. The significance of the fact that there’s already not enough purchasing power left in the real economy will still take a while to sink in. Animal spirits, don’t you know.

• Trickle-down economics is the greatest broken promise of our lifetime (Guardian)

It is not so much that the supply-side principle “if you build it, they will come” is no longer true. It is more that we appear to have passed a tipping point, where so much wealth has been concentrated at the top, they no longer need bother to “build” anything. In short, it has become more economically efficient to buy countries’ economic policy than to create value in order to sell it on. If one can control government to favour the richest, while raising barriers for new entrants, thus increasing their share of the pie exponentially, what is the incentive to grow the pie?

This applies to both companies and individuals. Small business gets clobbered by taxes and business rates, while big business turns around and says to the state: “This is how much tax I fancy paying this year, take it or leave it”. The rich no longer create jobs, through a process of consolidation, takeover and merger, they actually destroy them. Zero-hours contracts are the way of the future; in a society that is hungry, desperate and devoid of political engagement or unionism, why would anyone offer terms and conditions that give individual workers any standing?

And yet, the realisation must dawn soon – one hopes – that this model is unsustainable because its effects are uncontrollable. The more unequal we become as a society, the faster the top’s earnings diverge from the bottom’s. “When so much of the purchasing power, so much of the economic gain, goes to the very top,” Bill Clinton’s former labour secretary Robert Reich explains in the film Inequality For All. “There’s simply not enough purchasing power in the rest of the economy.”

Tyler Durden explains where exactly US unemployment is located. Not with old people, but with the young. Just so you know, and never forget again. Who are those fast growing numbers of Americans not in the labor force? Not the over 55. In fact, they are coming back. They have no choice.

• The Collapse in the Labor Force is NOT Due to Demographics (Zero Hedge)

… To truly end any speculation that the plunge in the labor force is due to “old people”, defined as workers 55 and over, retiring, here is a chart (which in an update of a post we did first in October 2012 and it took the rest of the media world only 14 months to catch up) of the cumulative job gains broken down by “young”, or those 16-54, vs “old”, those 55 and over.

Spot something wierd?

It seems that the “old” age worker group – that which is supposed to be bleeding workers to retirement – has had zero job losses since the start of the Depression in December 2007, while it was the “younger” workers who according to the BLS’ Household Survey, have hit the labor cliff and seen their number collapse, dropping as much a 6 million, and only slowly rising, with another 3.5 million jobs left to catch up before pre-recession levels are met.

In fact drilling down in the “young” worker category reveals that the most impacted group of workers is those in their prime working years: Americans aged 25-54.

And just to put the final nail in the coffin of this silly debate, first here is the Labor Force Participation rate by “old” workers, or those most prone to retirement, and where the Fed is now desperate to scapegoat the collapse in the Labor Force, compared to all other age groups. The chart, which shows that the “55 and over” worker group has now normalized its participation rate to pre-crisis levels, speaks for itself.

… and second: the employment to (civilian non-institutional) population ratio. The only recovery, if one may call it that, is for old workers.

So enough with all this “they are retiring” bullshit …

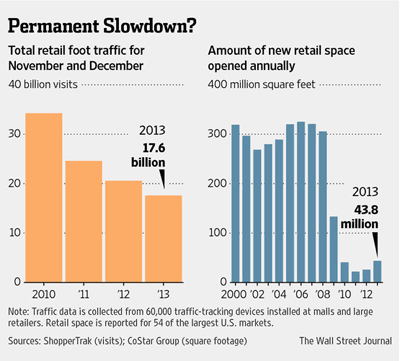

Jim Quinn hammers in Durden’s nail a bit more. First with a by now commonly known graph of US retail, then with the dark future of a GDP that depends for 70% on consumers, and will be further destroyed by the fact that, to use that Robert Reich quote, “There’s simply not enough purchasing power in the rest of the economy.”

• The Retail Death Rattle (Jim Quinn)

The entire economic recovery storyline is a sham built upon easy money funneled by the Fed to the Too Big To Trust Wall Street banks so they can use their HFT supercomputers to drive the stock market higher, buy up the millions of homes they foreclosed upon to artificially drive up home prices, and generate profits through rigging commodity, currency, and bond markets, while reducing loan loss reserves because they are free to value their toxic assets at anything they please – compliments of the spineless nerds at the FASB.

GDP has been artificially propped up by the Federal government through the magic of EBT cards, SSDI for the depressed and downtrodden, never ending extensions of unemployment benefits, billions in student loans to University of Phoenix prodigies, and subprime auto loans to deadbeats from the Government Motors financing arm – Ally Financial (85% owned by you the taxpayer). The country is being kept afloat on an ocean of debt and delusional belief in the power of central bankers to steer this ship through a sea of icebergs just below the surface. [..]

The media continues to peddle the storyline of on-line sales saving the ancient bricks and mortar retailers. Again, the talking head pundits are willfully ignoring basic math. On-line sales account for 6% of total retail sales. If a dying behemoth like JC Penney announces a 20% decline in same store sales and a 20% increase in on-line sales, their total change is still negative 17.6%. And they are still left with 1,100 decaying stores, 100,000 employees, lease payments, debt payments, maintenance costs, utility costs, inventory costs, and pension costs. Their future is so bright they gotta wear a toe tag.

It’s been well known for a while in the energy field that California has “great” shale potential. But the biggest state in the union also has increasing drinking water problems. The Sacramento government seems very tempted to give it a try anyway. Can’t these people read? We’ve said it here at the Automatic Earth a thousand times: the main role of governments in a crisis is to make bad things worse. Fracking in California will turn out to be a freaking disaster.

• California Water Crisis May Stop Fracking Boom (Oilprice.com)

[..] California is sitting atop the largest tight oil formation in the United States. The Bakken in North Dakota and the Eagle Ford in Texas may be leading the resurgence in U.S. oil production, but the reserves sitting in California’s Monterey Shale dwarf those of its more notable counterparts. The interest in the Monterey Shale is heating up, with the legislature passing a controversial law last year to put in place the state’s first regulations over hydraulic fracturing. The Director of the California Department of Conservation claims the “regulations include the strongest and most comprehensive public protections of any oil- and gas- producing state,” while still allowing the industry to move forward with drilling.

The Monterey Shale holds an estimated 13.7 billion barrels of unproven technically recoverable oil resources – about three times the reserves believed to be in the Bakken formation in North Dakota. [But] safely tapping them will be incredibly difficult, Deborah Gordon at the Carnegie Endowment for International Peace outlines in an important new report several significant obstacles that may prevent a Bakken-like bonanza in California.

Chief among them is water scarcity. California suffered its driest year ever in 2013, with recordkeeping dating back to 1895. 2014 will mark the third consecutive year of severe drought. [..] To make matters worse, much of the oil and gas reserves in the Monterey Shale are situated in the Central Valley, a huge agricultural region that grows much of the nation’s fruits and vegetables. Farmers are already feeling the bite of water limits, and the state is no stranger to fights over water between farmers, landowners, industry, and even neighboring states.

Finally, Bitcoin. Like is the case with so many issues today, politicians simply don’t understand it. But what does that matter if only they could tax it?! At least the Finns gave it some serious thought.

• Bitcoin Judged Commodity in Finland After Failing Money Test (Bloomberg)

Bitcoin doesn’t meet the definition of a currency or even an electronic payment form in Finland, where the central bank has instead decided to categorize the software as a commodity. “Considering the definition of an official currency as set out in law, it’s not that. It’s also not a payment instrument, because the law stipulates that a payment instrument must have an issuer responsible for its operation,” Paeivi Heikkinen, head of oversight at the Bank of Finland in Helsinki, said. “At this stage it’s more comparable to a commodity.”

Finland is the latest country to try to come to grips with the advent of virtual currencies that aren’t controlled by any central bank or government. As regulators in Europe warn of the risks associated with using such software as a substitute for real money, authorities are struggling to design frameworks to protect consumers and businesses from potential losses they have no legal means of recouping.

[..] “Virtual currency is not legal tender — if it was, VAT would definitely not be due,” Her Majesty’s Revenue and Customs [in the UK] said in an e-mailed response to questions. The issue is “complex” and not being legal tender doesn’t mean “VAT will automatically be due” on virtual currencies.

Update: This just in. Data from 104 million (!) credit cards is alleged to have been leaked.

• Tens of thousands of South Koreans flood banks after data leak (Straits Times)

Tens of thousands of South Koreans flooded banks and call centres Tuesday to cancel credit cards following the unprecedented theft of the personal data of at least 20 million people. Since Monday, more than 1.15 million victims of the country’s largest-ever leak of private financial information have cancelled their credit cards permanently or requested new ones, according to the Financial Supervisory Service (FSS).

The panic has its roots in the arrest earlier this month of an employee from personal credit ratings firm Korea Credit Bureau, on charges of stealing and selling data from customers of three credit card firms while working as a temporary consultant. On Sunday financial regulators announced that at least 20 million people – in a country of 50 million – had been victims of the data theft.

This article addresses just one of the many issues discussed in Nicole Foss’ new video presentation, Facing the Future, co-presented with Laurence Boomert and available from the Automatic Earth Store. Get your copy now, be much better prepared for 2014, and support The Automatic Earth in the process!

Home › Forums › Debt Rattle Jan 21 2014 – Animal Exuberance