Harris & Ewing Kids, police motorcycles with sidecars, and streetcar, WashingtonDC 1922

I’m going to step into uncharted territory, a for lack of a better word philosophical theme that I’ve long had on my mind but can’t quite figure out completely yet, and I would like you to tell me how much of it you recognize, or that maybe I’m a total fool for looking at things the way I do. You see, I often have this notion that we are living in our own past; not even our present, and certainly not our future.

It’s a feeling that creeps up on me a lot when I do my daily perusing of the financial press. It makes me think: wait a minute, that whole financial world is dead, because if you would subtract all the debt from all the assets, there would be nothing left, or at the very minimum not nearly enough to keep it going at anything like the size it had until recently, and which it needs to continue functioning (you can’t just chop off a third or half or more off a system and expect it to keep working).

Sure, it’s being kept ‘alive’ – though there’s a lot of virtual world in there – by adding more debt to the existing debt and by hiding much of that existing debt from prying eyes, but that doesn’t solve any of the fundamental problems, that’s all just lipstick on the zombie pig. And it can only lead to problems growing worse, certainly for the weaker segments of our societies.

And if the world of finance is broke, so must the economy at large be, and hence the entire model of society we live in. Which I think about on a regular basis when I see all these people live in their increasingly identical homes and get in their increasingly identical cars on their way to do increasingly identical jobs in increasingly identical offices or retail buildings. Sometimes I think perhaps the lack of variety itself is a sign of death, or dying. In any case, I wonder why all these people keep doing what they do. Don’t they have the same notion that I have that it’s really over, this model, maze, matrix, they live in, that perhaps they should take a step back and look at themselves?

I think they don’t. But I also still don’t think that makes me the crazy one. I see it as evidence that the manipulation and propaganda or whatever you call it, is doing its job, and the job is easy, because people don’t want to reflect on the fact that everything they’ve ever known, and that they’ve built their entire existence around, is not just crumbling but effectively already gone. People don’t like change, and certainly not the kind that threatens to make things ‘worse’. Whatever ‘worse’ may actually mean in this context, it could be an unfounded fear and it would make little difference to their attitude.

And it’s by no means just the financial world that looks like a bankrupt remnant of our past. Our energy resources, too, are dwindling. Over a somewhat longer timeframe, but what difference does that make? There’s very little doubt left that we hit peak conventional oil in the last decade, and it’s all downhill and harder and in the end less from there.

Shale is a pipedream, wind and solar can’t keep the grid running; these things, like the debt situation, look so obviously threatening to our way of life you’d think we’d be looking hard at seriously adapting that way of life. But we don’t, we just want to substitute one energy source with another, even though they’re hugely different and to a large extent incompatible.

We’re so addicted to the comfortable feeling of having all rooms in our homes heated or cooled, and to taking our own little transport units the same half hour drive to work and back every single day that we’d rather not think about why we do it than change our ways. Even as it’s glaringly obvious that our ways must and will stop at some point. We’re not going to find some new magical mystery energy source, and besides, both our own legacy of profligate energy use and the 2nd law of thermodynamics tell us it wouldn’t be all that magical anyway.

The consumption of energy is a potentially very destructive force, as physics clearly states. Which should really teach us that we need to be very careful about using it, burning it, and building our societies in ways that necessitate for us to use more of it all the time. Even if burning more of it makes us feel more comfortable in the short run.

Which leads to the third issue to give me the feeling that we live in our past: the damage we’ve done by using the planet’s energy resources to abandon over the past 150 years or so (an arbitrary number), to our living environment. There are many kinds of energy consumption related pollution that various sizes of ecosystems won’t be able to clean up in hundreds of years or more. Pesticides, insecticides, plastic oceans, nuclear waste we have no storage solutions for, the list is so absolutely endless it’s no use trying to name all individual items.

And then there’s the impact of methane, CO2 and other substances, which scores of people, for all sorts of reasons, seek to deny. While the principle is dead simple, even if the earth’s ecosystem is far more complex than we are smart enough to comprehend: increase the amount of these substances in the atmosphere – and soil, and oceans -, and temperatures will rise. Again, basic physics.

A world of violent storms and heatwaves, of crop losses and flooded nations, a world which at the same time will have far less energy available to deal with these issues, and no money/credit to speak of to buy that energy with. That looks like a pretty accurate picture of the world that we – or is that our children? – will live in.

The bright side is there’ll be far less of them, and per capita energy consumption will come down something big. The dark side is they will be fully unprepared, because we will have chosen to live in our past until our future caught up with it. For anyone wanting to emphasize how clever we are as a species, please explain what is so smart about this hitting the wall at 100 miles an hour thing. Or, alternatively, your instinctive denial of it.

For the rest of you, please tell me if you ever have the same feeling I do when you look around where you live, that you’re really looking at a society that has already died. See, I think that perhaps the longer we insist on pretending this is our future, not our past, and that everything is fine and/or easily solvable, the further and the more violently we’ll be thrown back into that past.

And they still have the audacity to say they expect 3.5% growth in Q2. I think 2-2.5% will initially be announced in a few weeks, and then go down in subsequent prints.

• U.S. Economy Shrank -2.9% in First Quarter, Most in Five Years (Bloomberg)

The U.S. economy contracted in the first quarter by the most since the depths of the last recession as consumer spending cooled. Gross domestic product fell at a 2.9% annualized rate, more than forecast and the worst reading since the same three months in 2009, after a previously reported 1% drop, the Commerce Department said today in Washington. It marked the biggest downward revision from the agency’s second GDP estimate since records began in 1976. The revision reflected a slowdown in health care spending.

Consumers returned to stores and car dealerships, companies placed more orders for equipment and manufacturing picked up as temperatures warmed, indicating the early-year setback was temporary. Combined with more job gains, such data underscore the view of Federal Reserve policy makers that the economy is improving and in less need of monetary stimulus. The first-quarter slump is “not really reflective of fundamentals,” said Sam Coffin, an economist at UBS Securities LLC in New York and the best forecaster of GDP in the last two years, according to data compiled by Bloomberg. “For the second quarter, we’ll see some weather rebound and a return to more normal activity after that long winter.”

This is how sad America has become.

• For Most American Families, Wealth Has Vanished (Yahoo!)

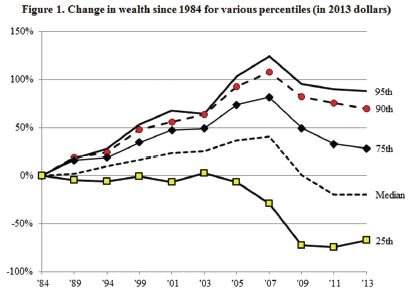

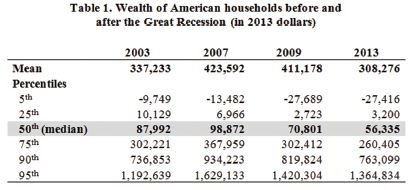

If you’re a typical family, you’re considerably poorer than you used to be. No wonder the “recovery” feels like a recession. A new study published by the Russell Sage foundation helps explain why many families feel like they’re falling behind: They actually are. The study, which measures the average wealth of U.S. households by income level, reveals a startling decline in wealth nationwide. The median household in 2013 had a net worth of just $56,335 — 43% lower than the median wealth level right before the recession began in 2007, and 36% lower than a decade ago. “There are very few signs of significant recovery from the losses in wealth suffered by American families during the Great Recession,” the study concludes. Not surprisingly, lower-income households have lost a larger portion of their wealth than those with higher incomes, as the following chart from the study shows:

Wealth generally comes from two types of assets: financial holdings and real estate. Financial assets have more than recovered ground lost during the recession, thanks largely to a stock-market rally now in its sixth year. The S&P 500 index, for instance, has hit several new record highs this year and is up more than 25% from the peak it reached in 2007. Home values, however, are still about 18% below the peak reached in 2006, according to the S&P/Case-Shiller index.

Since wealthier households tend to hold more financial assets, they’ve benefited the most form the stock-market recovery, which itself has been assisted by the Federal Reserve’s super-easy monetary policy. Fed policy has been intended to help typical homeowners and buyers too, by pushing long-term interest rates unusually low and, in theory, goosing demand for housing. But a housing recovery is taking much longer to play out than the reflation of financial assets. That’s part of the reason the top 10% of households have held onto more of their wealth than the other 90% during the past 10 years. Here’s how different income groups have fared since 2003:

The Russell Sage data is based on surveys, and differs in a few important ways from data gathered by the Federal Reserve, which paints a rosier picture. The Fed’s numbers, derived from banking data, show that total net worth plunged during the recession but hit new highs in 2012, and is now nearly 20% higher than the prerecession peak. Since the Fed’s numbers aren’t broken down by income level, they don’t show whether more wealth has been concentrated among a smaller number of rich households. The Sage numbers fill in that blank and do show that the top 10% of households control a larger portion of the nation’s total wealth than they used to. They also show, however, that every income group is still behind where it used to be, on average.

” … the full economic losses on the vastly over-priced junk bonds are never realized by investors and issuers due to the Fed’s post-crash reflation maneuvers”

• The Junk Bomb Ticking Beneath The S&P 500 (Stockman)

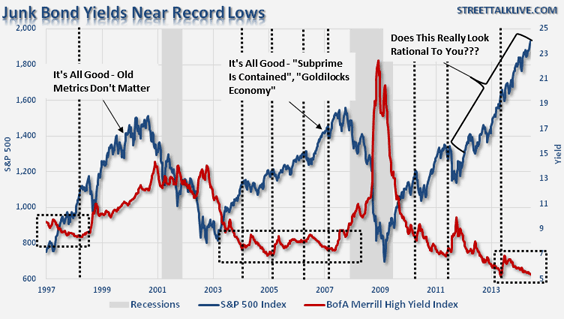

Lance Roberts’ weekend review provides a solid reminder that the Fed’s happy talk and the market’s giddy heights are dangerous illusions. But this particular chart in his presentation drives the message home loud and clear.

The Fed has become a serial bubble machine over the last two decades, and cheap debt is the driving force. Note that before each cyclical peak of the S&P 500 that junk bond yields plunge into new cyclical lows as measured by the dotted boxes. And during each of the three bubble cycles shown here the boxes dip lower in absolute terms, meaning that junk bonds and risk have been increasingly mis-priced owing to central bank financial repression. Thus, with the Merrill high yield index nearing an all-time low yield of 5%, the implication is astonishing. Namely, that with the CPI having just clocked in at 2.1% y/y, the real yield on junk bonds is barely 3%! Yet history proves losses can reach double digits when the bubbles crashes.

During the 2008-2009 meltdown, for example, yields rose from 7% to 23%, implying devastating losses for speculators on leverage and bond funds managers subject to redemption. Needless to say, those categories encompassed most of the bond holders at the time. And that’s the evil of the Fed’s financial repression at work. It creates a frenzied scramble for yield that results in a double deformation. First, debt gets way too cheap, causing companies to borrow wildly in order to fund financial engineering maneuvers such as massive stock buybacks, LBO’s and cash M&A deals. That massive inflow of debt-based share buying, in turn, drives the stock market into its final blow-off phase as is evident in the chart.

But secondly, the full economic losses on the vastly over-priced junk bonds are never realized by investors and issuers due to the Fed’s post-crash reflation maneuvers. Rather than avoid bubbles or pricking them once they begin inflating uncontrollably, the Fed’s policy every since Greenspan has been to keep its head in the sand until the bubble crashes on its own weight. It then flood the financial markets with liquidity to prevent the resulting wring-out of debt and speculative excess from running its course. Nothing could be more perverse than this morning after monetary flood syndrome. It allows speculators to front-run the central bank’s now predictable monetary expansion. Instead of incurring losses, they scoop up busted securities for cents on the dollar and ride out the bubble reflation as the Fed cranks up the printing presses.

Many people around the world would like such a deal.

• $4,750 Plus Three Years Is Price of Debt-Free Life (Bloomberg)

On a balmy June evening in Dublin, with pubs overflowing, Brodrick O’Neill is inside the Ashling Hotel learning how to declare personal bankruptcy. “It’s a no-brainer,” said O’Neill, 52, a former taxi driver who still owes his bank about €80,000 ($109,064) after selling his house. “What else can I do? I’m broke.” Bankruptcy is increasingly becoming the route of choice for some Irish individuals trying to cope with the legacy of the worst real-estate crash in Western Europe. Under new laws that made the process easier, borrowers can exit bankruptcy after three years with a clean financial bill of health instead of 12 years previously. After the deepest recession since at least the 1940s, with unemployment still near 12%, many people are still crushed under the weight of debt.

Household borrowing in 2012 was 198% of income, compared with 123% in Spain, 132% in the U.K. and 98% in the euro region, according to Eurostat, the European Union’s statistics office. Along with central bank pressure, the prospect of a flurry of bankruptcies and insolvency is forcing banks to negotiate just as borrowing costs fall to record lows for the government. The yield on benchmark 10-year bonds was 2.38% today compared with a peak of 14.2% in July 2011. “Bankruptcy is a game-changer,” said Ross Maguire, 45, a Dublin-born lawyer who helped set up New Beginning, which shepherds people through the process. He had spoken to about 150 people, including O’Connor. “Banks are forced to do deals.”

About 66,000 mortgages on family homes were permanently restructured by the end of April through agreements such as extensions to the term of the loans, the Finance Ministry said on June 12, citing figures from six of the country’s biggest banks. That’s an increase of 21,000 from the end of September. About 13,000 mortgages on rental properties were restructured, up by a third from September. In all, about 142,000 borrowers, or a quarter of the total, are behind with their payments, the Finance Ministry said. Dublin courts have declared 132 bankruptcies so far this year, compared with eight in all of 2008. [..] New Beginning charges debtors €3,500 to take them through bankruptcy, with €1,000 going to the organization and the rest earmarked for legal and government fees. U.S. President Abraham Lincoln was bankrupt twice, Maguire tells his attentive audience. Walt Disney and Henry Ford were also bankrupts, he says. “That’s how the world works,” he said. “If a fella falls down, you are allowed to start again.”

It works until it doesn’t.

• Flipping For The Fed (Stockman)

It still may be recalled that 2012-2013 was the time of the Fed’s housing liquidity flood – when hedge funds and LBO shops swooped in to buy busted mortgages with cheap money from the Fed/Wall Street. And once the party got started and prices in some formerly devasted markets like Phoenix, Los Vegas and much of California and Florida started soaring by 20-40% after March 2012, it appears that local flippers did not waste much time climbing aboard the fast train. Redfin has some stunning figures out on profits during 2013 from house flipping in about 30 major markets. The short answer is that it beats working and makes a mockery of saving! In the combined markets, the average 2013 flip netted a gain of $90,000 or just shy of 2X the median household income.

But San Francisco turned out to be in a league of its own. There the average house flipper gained just under $200,000—which is to say, a better payday than the total annual earnings of 95% of households in America. And in these blessed precincts it seem that a Fed triple whammy was at work. On top of the 2% Wall Street money and 3.3% home mortgage funding that drove real estate cap rates to rock bottom in September 2012, and therefore elevated valuation ratios to the nosebleed section of history, San Francisco benefited two more ways. First, from windfalls out of the screaming market for social media, biotech and cloud stocks; and then because the vast flow of winnings from that eruption unleashed a follow-on tsunami of venture capital pursing the next Facebook, Twitter or WhatsApp.

In effect, the massive eruption of housing purchasing power evident in San Francisco is in large part fueled by an inflow of capital from Wall Street, not the sustainable earnings of its employed population. Stated differently, tens of thousands in silicon valley are getting paid in options gains and venture capital “burn rate” money, which is being channeled back into a roar housing casino. There are exceedingly few cases were housing asset prices have ever been so utterly divorced from the recurring incomes of the resident population. Nevertheless, San Francisco is just the outlier that illustrates the massive deformations caused by the Fed’s financial repression and wealth effects policies. One year flip gains of $150k, $125k and $100k in Boston, Los Angelo’s and Washington DC, respectively, are powerful evidence of the Fed’s folly.

What a mess. What a man.

• Abe Declares End of Deflation (Bloomberg)

Prime Minister Shinzo Abe said the deflation that wiped out much of Japan’s growth the past 15 years and so stunted the economy that it slipped to No. 3 behind China, has ended and will be thwarted by new government policies designed to encourage business expansion. “Through bold monetary policy, flexible fiscal policy and the growth strategy we have reached a stage where there is no deflation,” Abe, 59, said in an interview yesterday at the prime minister’s official residence in Tokyo. With the first sales tax rise since 1997 that took effect in April, “this was an extremely difficult time for management of the economy, but I believe we were somehow able to overcome it.”

Abe was speaking before his cabinet endorsed the most specific measures yet to deliver on his growth strategy – the third part of a campaign to end declines in consumer prices and stoke investment. The government plans corporate-tax cuts, trade liberalization, reduced barriers for agricultural land consolidation, special zones of lighter regulation and the study of casinos as a way of spurring record numbers of tourists.

• Abe Misses With ‘Third Arrow’, Again (CNBC)

Japan Prime Minister Shinzo Abe’s revamped economic growth strategy unveiled on Tuesday fell short of its hype, failing to provide critical details on how the proposed reforms would be employed. “We were provided with the reform path but we’re still light on an implementation timeline, so it’ll be a case of wait-and-see for the detailed implementation and how that might unfold,” Matthew Hegarty, equities analyst at Perennial International told CNBC on Wednesday. Structural reforms, the “third arrow” in Abe’s radical strategy to revive the economy or Abenomics, are seen as critical for putting Asia’s second largest economy on a sustainable growth path. However, unlike the first two “arrows” of monetary stimulus and fiscal spending, the third arrow has yet to be deployed in earnest.

Abe’s latest plan, which builds upon a growth strategy he first unveiled last June, called for corporate tax rate cuts, a bigger role for women and foreign workers and easing long-standing regulations in areas such as agriculture and health care. But there was nothing new to the measures, analysts say, many of which were featured in the plan’s final draft presented earlier in the month. “This is the second attempt for Abenomics – and maybe this one looks a little more promising at the onset,” said Lars Peter Hanson, a professor at the University of Chicago. “(But) it’s one thing to announce these principals. Until we fully understand how they are going to be executed and carried out with specificity, it’s hard to have full confidence in it.”

Blow it all on candy!

• 3 Japan Public Pension Funds Buying Stocks Ahead Of Asset Review (Reuters)

Three Japanese “semi-public” pension funds aggressively bought Tokyo stocks in recent weeks, market sources said, acting before a review of their asset allocation policies is complete. The funds’ buying helped Japanese shares to rally more than 10% in just over a month – though one source said the buying may come to a halt before month-end, posing the threat of a near-term correction to the market.All three funds declined to comment on whether they bought shares in the last two months. The three pension funds – the Pension Fund Association for Local Government Officials, the Federation of National Public Service Personnel Mutual Aid Association and the Private School Mutual Aid System – manage a combined 29 trillion yen ($284 billion) of assets.

The funds will be merged into the 129 trillion yen ($1.26 trillion) Government Pension Investment Fund (GPIF), the biggest pension fund in the world, in October next year. A market source, who was briefed on the matter, said the three semi-public pension funds transferred money to portfolio managers in May, requesting them to finish buying up shares before end-June. Data from the Tokyo Stock Exchange also pointed to heavy buying by public accounts since May. Buying by trust banks, which manage a large proportion of public pension funds, soared to 687.3 billion yen in May, the most since March 2009, when there was a whisper of buying by public accounts to prop up the market as share prices hit 25-year lows.

You can’t very well tell them not to lie, it’s what central bankers do. If they didn’t, they’d be out of a job.

• Forward Guidance: Making It Up As You Go Along (Choudhry)

The banking industry likes superfluous language. There’s “quantitative finance” for example, which (given that finance is already a quantitative subject) is a bit like saying “aerial flight” or “wet swimming”. And then there’s “forward guidance”. What, as opposed to backward guidance? I mean, what other type of guidance is there? Last summer the Bank of England decided it wanted to import the U.S. Federal Reserve’s forward guidance policy. In short this went along the lines of “we’ll link future moves in the base rate to other external market indicators, so that as these other indicators move then so will base rates. Thus by keeping an eye on these indicators you will know when to expect interest rates to rise”. Simple, eh? The BoE decided to link its base rate expectation to the level of unemployment. At the time, for me it was like watching England play football. You know, the bit in the game when the manager makes some inexplicable substitution and everyone in the stands cries, “what on earth is he doing?!”.

That’s what I thought of the BoE’s forward guidance policy, which stated that when unemployment reached 7%, the Bank might think about raising rates. As the Bank’s econometric model predicted that this level would not be reached until 2016, one could safely conclude that rates were staying put until then. There were the usual caveats. What on earth? The level of unemployment is a function of so many varied and diverse causal factors that to suggest that one could safely predict its future level reflects the mind of a charlatan. Many factors drive the employment rate, and some of them (seasonal, sentiment, external like euro zone health, etc etc) have nothing to do with monetary policy and are outside one’s control. Why would one link the base rate movement to that? It’s completely nonsensical.

Don’t worry, there’s plenty of hidden debt left there.

• China Local Debt Growth Slows as Economic Expansion Cools (Bloomberg)

China’s chief auditor said growth in local government debt slowed, a sign that tighter scrutiny on borrowing and an economic slowdown have curbed credit. Outstanding debt for nine provinces and nine cities grew 3.79% from the end of June last year through March, 7%age points slower than the pace in the first half of 2013, according to a report delivered by Liu Jiayi, head of the National Audit Office, at a National People’s Congress meeting yesterday. The report was posted on the office’s website. A slower pace of debt growth would help ease financial risks in local borrowings that surged 67% to 17.9 trillion yuan ($2.9 trillion) as of June 2013 from the end of 2010. The government is trying to protect its 7.5% target for gains in gross domestic product this year without reviving a credit boom that’s evoked comparisons to the runup to Japan’s lost decade.

“Local government debt is still high as measured by its share of GDP,” said Liu Li-Gang, chief Greater China economist at Australia & New Zealand Banking Group Ltd. in Hong Kong. Regional authorities would need to sell stakes in state-owned companies to reduce debt levels, said Liu, who previously worked at the Hong Kong Monetary Authority and World Bank. The local-debt accumulation poses risks to central government finances, Moody’s Investors Service said in a January report. The nine audited provinces had 821 million yuan in overdue liabilities as of March 31, after borrowing 57.9 billion yuan during the nine preceding months to repay maturing debt, according to Liu’s report. Four cities raised a combined 15.7 billion yuan by using government guarantees or collateral that wasn’t allowed, Liu said.

The office didn’t identify the provinces or cities it audited. A media officer for the agency declined to elaborate when reached by phone today. “The slowdown in the pace of debt accumulation is a major success of policy makers,” Dariusz Kowalczyk, a senior economist at Credit Agricole SA in Hong Kong, said in an e-mail. “On the other side of the coin, it explains strong downward pressure on growth, given that local government debt finances much of infrastructure investment.”

The walls of Jericho.

• China Ting Says Borrowers Defaulting on Entrusted Loans (Bloomberg)

China Ting Group, a garment maker, said two borrowers defaulted on entrusted loans it made through Ningbo Bank Corp. and Bank of Communications Ltd. The stock fell. Zhongdou Group Holdings Ltd. and Hangzhou Zhongdou Shopping Centre Co. failed to make interest payments on schedule on loans worth 160 million yuan ($26 million), China Ting said in a Hong Kong exchange filing yesterday. Entrusted loans, advances between companies arranged through banks, are part of China’s shadow banking system that regulators are seeking to rein in. Some of the entrusted funds, which totaled 8.2 trillion yuan as of the end of 2013, were being directed to industries that face lending curbs from the government, according to the People’s Bank of China. “Ningbo Bank Corp. confirms that they have commenced legal proceedings in respect of their loan arrangements with Zhongdou Group,” and Bank of Communications is prepared to take action, China Ting said. [..]

China’s 10 largest lenders reported overdue loans reached 588 billion yuan at the end of 2013, a 21% increase from a year earlier to the highest level since at least 2009. The rise in late payments portends more losses on soured loans for banks in coming months as China’s slowing economy crimps companies’ earnings. The number of entrusted loans made by publicly traded companies rose 43% from 2012 to 397 cases in 2013, the central bank said in its 2014 financial stability report. China’s aggregate financing, the broadest measure of new credit that includes bank lending and less-regulated products like entrusted loans, fell to 1.4 trillion yuan in May from 1.55 trillion yuan in April, according to the central bank.

• Why Is Dubai’s Stock Market Crashing?

The Dubai Financial Market has been taking a beating for weeks, and news of firings at Arabtec, the United Arab Emirates’ largest listed builder, caused a new round of panic yesterday. Shares in the stock exchange fell 6.7%, to 4,009.01, leaving them down 25% from their May peak. It was the end of a long bull market: Since June 2012, shares in the emirate had climbed 250%. Dubai has been looking like a property bubble for a little while now. The emirate has led consulting firm Knight Frank’s Global House Price Index for 12 months, and while growth has slowed in the past quarter, it still was up 27.7% for the year ended in March. Reuters reported that real estate deals in Dubai “jumped 38% in the first quarter to some 61 billion dirhams ($16.6 billion).”

If the symbol of the last boom, which ended brutally in 2008, was a network of islands built out of dredged sand in the shape of a world map – still unoccupied – the symbol of this one is a plan, announced in 2012, to build a complex that includes the world’s largest mall, along with 100 hotels (especially since a different mall in Dubai already holds the title of world’s biggest).

Draghi’s starting to look a whole lot like Abe.

• Draghi’s Monetary Blitz Has Failed To Lift Euro Zone (MarketWatch)

The build-up was intense. The hype was overwhelming. The anticipation was growing. But the actual performance? So far, very disappointing. I am not talking about England’s, or indeed Spain’s, progress in the World Cup, although I easily could be. I am referring to Mario Draghi’s monetary blitz that was meant to lift the euro-zone economy off the rocks of recession and deflation. So far, it does not appear to be working. True, it is still too early for many of the measures the European Central Bank unveiled after its council meeting earlier this month to have any impact on the real economy.

But two of the key objectives were to bring down an overvalued euro and to lift confidence. There has been precious little sign of either. In fact, the exchange rate has hardly moved, confidence is still falling, and prices are still heading closer to full-blown deflation. The result? Negative interest rates and targeted loans are not going to get the euro zone out of trouble. The ECB only has one weapon left to counter that — full-blown quantitative easing, along similar lines to the programs already launched in the U.S., Japan and the U.K. Plan A hasn’t worked, so it will have to switch to Plan B. Expect it to pull the trigger before the end of the year.

Let’s recall all cars.

• Nissan, Honda And Mazda In Mass Recall Over Faulty Airbags (Independent)

Japanese carmakers Nissan, Honda and Mazda have recalled close to three million vehicles citing faulty airbags that could potentially explode and send pieces flying inside the car. Honda is set to recall two million vehicles, affecting at least 13 models, Nissan is recalling 755,000 cars worldwide, while Mazda Motor Corp added it would call back 159,807 vehicles. The automakers blamed a defect affecting both driver and passenger seat airbags that, if inflated and applied excessive pressure, could explode and send small metal pieces flying inside the car.

The airbags were made by Tokyio-based Takata Corp, the world’s largest supplier. Reacting to the recall, chief executive Shigehisa Takada said the company is working with safety regulators and car makers to strengthen its “quality control system”. The latest recall brings the total number of vehicles affected by faulty airbags to nearly 10 million in roughly five years, making it one of the biggest car recalls in history.

They were forced to, they’re the only source of real money left.

• Why Government Pension Funds Became Addicted to Risk (NY Times)

A public pension fund works like this: The government promises to make payments to its employees after they retire; it invests money now and uses those investments, and the returns on them, to make those promised payments later. Back when interest rates were high, this was fairly simple to do. Pension funds could buy bonds — ideally bonds that would mature around the time they would need the money to pay pensioners — and use the interest on those bonds to fund the payouts. In 1972, more than 70% of pension fund investment portfolios consisted of bonds and cash, according to a new analysis from the Pew Center on the States and the Laura and John Arnold Foundation.

But as interest rates began their long fall, pension funds faced a dilemma. Staying heavily invested in bonds would force governments either to set aside more cash upfront or to cut pension promises. So instead, pension funds radically changed their investment strategies, embracing investments that produce higher returns but also involve more risk. This shift has replaced an explicit cost with a hidden one: that lawmakers will have to divert more tax dollars into pension funds, cut back on benefits or both when stock market crashes cause pension fund asset values to decline. The shift began with pension funds’ adoption of portfolios consisting mostly of stocks, with only about a quarter of their investments in bonds.

Then, in the last few years, they rapidly expanded their use of “alternative” asset classes like hedge funds, private equity, commodities and real estate. As of 2012, the typical pension fund investment portfolio was about half stocks, a quarter bonds and cash, and a quarter alternative investments. The shift has allowed public pension funds to adjust to a sharp drop in bond interest rates. Between 1992 and 2012, the yield on 30-year Treasury bonds fell 4.75 percentage points; on average, large government pension funds cut their investment return targets by just 0.7 of a percentage point over that period.

And the shift has been, in one sense, a success: Pension funds continue to hit their target returns, on average. After the stock market crash of 2008-9, pension funds’ typical goals of annual returns around 8 percent were often criticized as unrealistic, but the National Association of State Retirement Administrators notes that public pension funds have earned annual returns of 9% on average over the last 25 years, despite falling interest rates and gyrating stock prices.

What a great idea for a net energy importer.

• U.S. Ruling Loosens Four-Decade Ban On Oil Exports (WSJ)

The Obama administration cleared the way for the first exports of unrefined American oil in nearly four decades, allowing energy companies to start chipping away at the longtime ban on selling U.S. oil abroad. In separate rulings that haven’t been announced, the Commerce Department gave Pioneer Natural Resources and Enterprise Products Partners permission to ship a type of ultralight oil known as condensate to foreign buyers. The buyers could turn the oil into gasoline, jet fuel and diesel. The shipments could begin as soon as August and are likely to be small, people familiar with the matter said. It isn’t clear how much oil the two companies are allowed to export under the rulings, which were issued since the start of this year. The Commerce Department’s Bureau of Industry and Security approved the moves using a process known as a private ruling.

For now, the rulings apply narrowly to the two companies, which said they sought permission to export processed condensate from south Texas’ Eagle Ford Shale formation. The government’s approval is likely to encourage similar requests from other companies, and the Commerce Department is working on industrywide guidelines that could make it even easier for companies to sell U.S. oil abroad. In a statement Tuesday night, the Commerce Department said there has been “no change in policy on crude oil exports.” Under rules imposed after the Arab oil embargo of the 1970s, U.S. companies can export refined fuel such as gasoline and diesel but not oil itself except in limited circumstances that require a special license. The embargo essentially excludes Canada, where U.S. oil can flow with a special permit.

The sanctions are a propaganda tool.

• Putin Pals Dealing With U.S. Firms Make Sanctions Useless (Bloomberg)

To see why U.S. economic sanctions against Russia are likely to have limited impact, follow the spending of a small Delaware-incorporated, Nasdaq-traded television company named CTC Media Inc. While CTC Media has a market capitalization of just $1.7 billion, it’s a good example of the way Russia’s economy has become so closely intertwined with U.S. business that it’s difficult to separate them. And once you unwind any of the string, one end is likely to lead, with twists and turns, to Russian President Vladimir Putin’s inner circle. The U.S. has issued five rounds of sanctions in response to Russia’s seizure of Crimea and its alleged backing of militants who have taken over part of Ukraine. The U.S. would be ready to issue further restrictions if Russia escalates tensions in Ukraine, Treasury Secretary Jack Lew said June 19 in Berlin.

The sanctions were designed to minimize harm to U.S. companies, which also leaves them open to some wide loopholes. Funds from U.S. firms flow legally through these gaps to companies linked to blacklisted entities or people. In CTC’s case, it is paying tens of millions of dollars to Video International, a Russian advertising firm part-owned by OAO Bank Rossiya. In March, the U.S. sanctioned the St. Petersburg bank and its largest shareholder, financier and media magnate Yury Kovalchuk, calling him Putin’s “personal banker.” “When somebody is on the sanctions list, American companies shouldn’t do business with them, period,” said David Kramer, a former U.S. assistant secretary of state and now president of Freedom House, a Washington-based non-profit that advocates for democracy and civil liberties. “This may not be a technical violation of the law, but it certainly is a violation of the spirit.”

Four days after Kovalchuk and his bank were sanctioned, CTC formed a compliance committee to ensure that its procedures comply with the U.S. restrictions, CTC spokesman Igor Ivanov said. The impact of sanctions is lessened because the U.S. has mostly targeted individuals rather than companies. For example, although Igor Sechin, chief executive officer of Russian oil giant OAO Rosneft, was sanctioned in April, his company is not. That approach enables Exxon Mobil to keep working with Rosneft. The U.S. oil company reached an agreement in May with Rosneft, extending a pact to build a plant to liquefy natural gas for export in eastern Russia. Sechin himself signed the agreement because the U.S. rules allow him to continue to act as signatory for the company. Exxon Mobil, through a 2011 deal with the state-run crude producer, owns drilling rights across 11.4 million acres of Russian land. The partnership gives Rosneft the ability to buy stakes in Exxon’s North American projects.

How scary does it have to get?

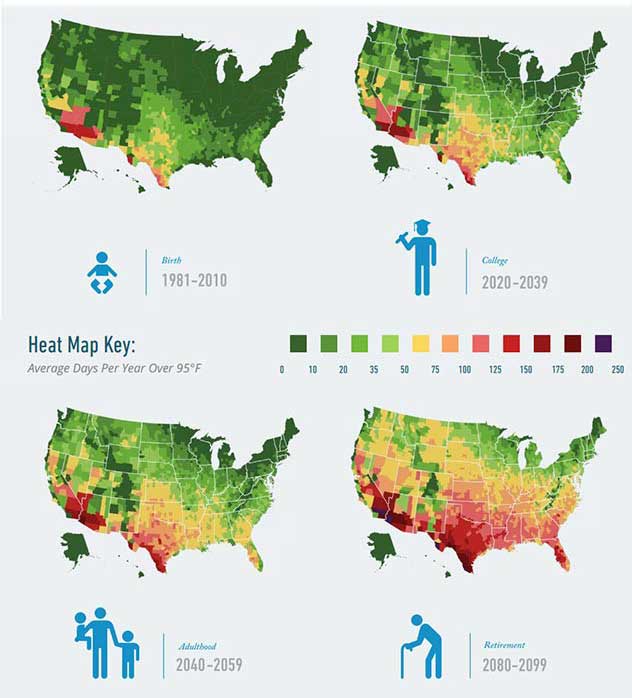

• A Heat More Deadly Than the US Has Ever Seen Is Forecast (Bloomberg)

It’s not the heat. It’s the humidity. And the U.S. is on a path to regularly experience a deadly combination of the two the likes of which have only been recorded once on planet Earth. That’s one of the findings in a report published today called “Risky Business,” commissioned by some of America’s top business leaders to put price tags on climate threats. For example, by the end of the century, between $238 billion and $507 billion of existing coastal property in the U.S. will likely be subsumed by rising seas, and crop yields in some breadbasket states may decline as much 70%.

But perhaps the biggest way Americans will physically experience global warming is, well, the warming. By 2050, the average American is likely to see between two and more than three times as many 95 degree days as we’re used to. By the end of this century, Americans will experience, on average, as many as 96 days of such extreme heat each year. The report breaks down “extremely hot” days by region to show what a child born in the past 20 years can expect to see over a lifetime.

Nice book, nice excerpt.

• All The Presidents’ Bankers: The Mid-1910s: Bankers Go To War (Nomi Prins)

On June 28, 1914, a Slavic nationalist in Sarajevo murdered Archduke Franz Ferdinand, heir to the Austrian throne. The battle lines were drawn. Austria positioned itself against Serbia. Russia announced support of Serbia against Austria, Germany backed Austria, and France backed Russia. Military mobilization orders traversed Europe. The national and private finances that had helped build up shipping and weapons arsenals in the last years of the nineteenth century and the early years of the twentieth would spill into deadly battle. Wilson knew exactly whose help he needed. He invited Jack Morgan to a luncheon at the White House. The media erupted with rumors about the encounter. Was this a sign of tighter ties to the money trust titans? Was Wilson closer to the bankers than he had appeared?

With whispers of such queries hanging in the hot summer air, at 12:30 in the afternoon of July 2, 1914, Morgan emerged from the meeting to face a flock of buzzing reporters. Genetically predisposed to shun attention, he merely explained that the meeting was “cordial” and suggested that further questions be directed to the president. At the follow-up press conference, Wilson was equally coy. “I have known Mr. Morgan for a good many years; and his visit was lengthened out chiefly by my provocation, I imagine. Just a general talk about things that were transpiring.” Though Wilson explained this did not signify the start of a series of talks with “men high in the world of finance,” rumors of a closer alliance between the president and Wall Street financiers persisted.

Wilson’s needs and Morgan’s intentions would soon become clear. For on July 28, Austria formally declared war against Serbia. The Central Powers (Germany, the Austro-Hungarian Empire, the Ottoman Empire, and Bulgaria) were at war with the Triple Entente (France, Britain, and Russia). While Wilson tried to juggle conveying America’s position of neutrality with the tragic death of his wife, domestic and foreign exchange markets were gripped by fear and paralysis. Another panic seemed a distinct possibility so soon after the Federal Reserve was established to prevent such outcomes in the midst of Wilson’s first term. The president had to assuage the markets and prepare the country’s finances for any outcome of the European battles.

Not wanting to leave war financing to chance, Wilson and Morgan kicked their power alliance into gear. At the request of high-ranking State Department officials, Morgan immediately immersed himself in war financing issues. On August 10, 1914, Secretary of State William Jennings Bryan wrote Wilson that Morgan had asked whether there would be any objection if his bank made loans to the French government and the Rothschilds’ Bank (also intended for the French government). Bryan was concerned that approving such an extension of capital might detract from the neutrality position that Wilson had adopted and, worse, invite other requests for loans from nations less allied with the United States than France, such as Germany or Austria. The Morgan Bank was only interested in assisting the Allies.

Home › Forums › Debt Rattle June 25 2014: We Live in Our Own Past

Tagged: Vancouver