DPC Station at foot of incline, American Falls, Niagara Falls 1890

There’s one way left only in which spending today can increase: debt must increase too: “..in 2004, a typical household in the lower third had $1,500 left over after expenses. By 2014, such households were $2,300 in the red.”

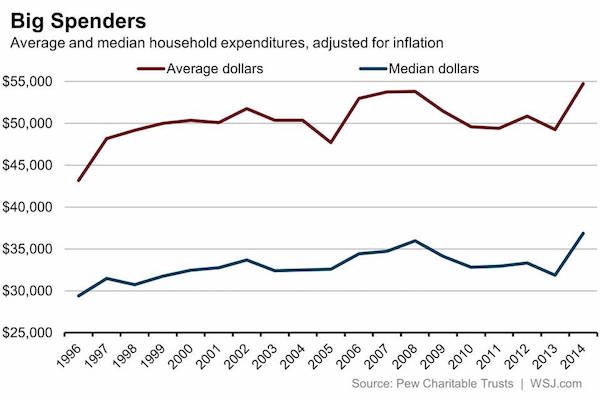

• Americans Are Spending Again – But With Less Income (WSJ)

U.S. household spending has fully recovered since the latest recession, but income hasn’t, squeezing budgets and pushing many lower-income families into the red, according to a Pew Charitable Trusts report out Wednesday. “The lack of financial flexibility threatens low-income households’ financial security in the short term and their economic mobility in the long term,” the report said. Pew tracked inflation-adjusted expenditures and incomes of working-age Americans, ages 20 to 60, from 1996 to 2014. The results show the downturn and recovery for spending in the aftermath of the 2007-09 recession but also highlight stagnating incomes (including wages, government benefits and transfers, pensions, child support and other sources).

The study helps illustrate broader economic themes, including a slow recovery underpinned by steady job creation and rising consumer spending, alongside paltry wage growth and growing income inequality. Pew found that as of 2014, median income before taxes had fallen by 13% from a decade earlier, while expenditures had increased by nearly 14%. That left families across the income spectrum with fewer funds for savings and investment in things like education. Housing, transportation and food drove much of the rise in spending, leaving families with less financial wiggle room. Low-income families may not see much of an alternative to spending more on shelter, commuting costs and putting food on the table. Indeed, rent is now eating up nearly half of the income of low-income families, Pew found.

“That increase in the cost for shelter is a really important piece about why families at the bottom don’t feel financially stable,” said Erin Currier, director of the financial security and mobility project at Pew. “So many families are walking a financial tightrope—their core needs are getting more expensive and incomes aren’t rising to meet those costs.” That’s left many running a personal budget deficit despite spending less on restaurants, entertainment and other discretionary goods and services. Pew’s analysis found that in 2004, a typical household in the lower third had $1,500 left over after expenses. By 2014, such households were $2,300 in the red.

Cameron has to save face now because of the publicity on the topic.

• Britain Sacrifices Steel Industry To Curry Favour With China (AEP)

Britain’s special relationship with China is becoming more expensive by the day. It now threatens to destroy the British steel industry, a foundation pillar of our manufacturing economy. Britain is not alone. Most of Europe’s steel foundries are heading for annihilation under the current EU trade regime, with unthinkable consequences through the network of European and British supply chains. It is hard to pin down the exact moment when George Osborne’s love affair with China turned into a Faustian Pact. What we know is that the British government has for the last three years been blocking efforts by the EU to equip itself with the sort of anti-dumping weaponry used by Washington to confront China. The EU trade directorate has been rendered toothless by a British veto. So much for the canard that the UK has no influence in Brussels.

“The British are sacrificing an entire European industry to say thank you to China for signing up to the nuclear power project at Hinkley Point, and pretending it is about free trade,” said one official in Brussels bitterly. What they are blocking is a change to an EU regulation intended to beef up Europe’s ‘trade defence instruments’ (TDI), enabling it to respond much more quickly to Chinese dumping and too impose much tougher penalties. The British have cobbled together a blocking minority in the council, much to the annoyance of the French, Italians, Spanish, and Germans. The UK view is that the Commission mixed up good changes with bad changes, and that punitive tariffs merely hurt your own consumers, so you shoot yourself in the foot.

Yet the outcome is that it still takes Brussels 16 months to crank up full sanctions, twice as long as it takes the US. It is why the EU limits itself to a ‘Lesser Duty’ regime that often fails to reflects the full injury. While Washington has slapped penalties of 267pc on Chinese cold-rolled steel, the EU peashooter has so far managed just 13pc. Redcar has already paid the price for this ultra-free trade ideology, and Port Talbot is about to follow. There will eventually be little left if the current drift in trade policy is allowed to continue. China’s share of global steel output has risen from 10pc to 50pc over the last decade. It has installed capacity of 1.2bn tonnes a year that it can never hope to absorb as the construction boom deflates.

On OECD estimates it has built up 400m tonnes of excess capacity, twice the EU’s entire steel production. China’s unwanted steel is finding its way systematically into Europe, greased by export subsidies, tax breaks, cheap state credit, and the panoply of measures used by a mercantilist power to rig global trade. China has captured 45pc of the UK market for high fatigue rebar steel, from near zero four years ago. The price of hot rolled steel in Europe has fallen to $369 a tonne from an average of $650 from 2009 to 2013.

Are people ready to acknowledge the extent of China’s bubble? I doubt it.

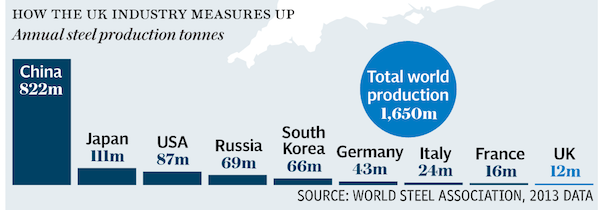

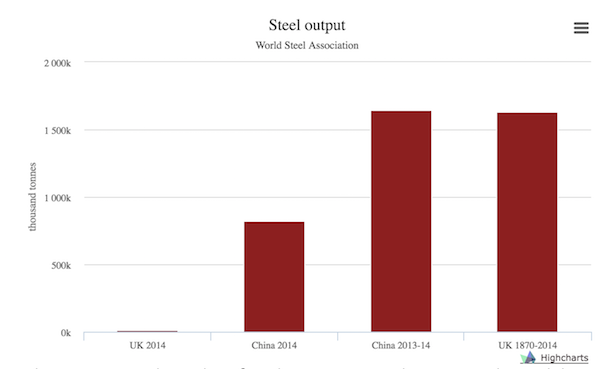

• China Produced More Steel In 2 Years Than The UK Did Since 1870 (Conway)

Here’s a nugget that goes at least some of the way towards explaining the current woes of the British steel industry: in the past two years alone China has produced more steel than the total cumulative output of the UK since the industrial revolution. Or consider this: at today’s rate of production, it would take 68 years for Britain to generate the steel China churns out of its mills in a single year. Take a moment to digest these facts, because you simply cannot understand the pressures faced by the British, or for that matter every country’s steel industry without considering China. Steel is, of course the critical ingredient in modern manufacturing and construction. If you are making something – anything – chances are you will need steel to make it with, whether that’s a car, a rail line, a can of food or a skyscraper.

And to start with, China was a positive story for Britain’s steel industry. As it expanded over recent decades it initially didn’t produce enough steel of its own to satisfy its seemingly limitless domestic appetite for steel – from Chinese construction to Chinese cities desperate to expand, to Chinese manufacturers pumping out goods around the world. It became an important destination for UK exports. However, gradually the country has built its own steel industry – and what an industry. Since 1980 China has gone from producing 5% of the world’s steel to making more than half of it – just over 800m tonnes.

But of course, this being Bloomberg and all, here comes the silver lining.

• China Ends This Quarter With The World’s Worst-Performing Stock Market (BBG)

China’s Shanghai Composite Index is closing out the first quarter as the world’s worst-performing global measure, down 15%, with a rebound in March failing to compensate for a terrible start to the year. Here are some key metrics that may show this month’s 12% recovery may extend into April, including growth in margin lending, a jump in the number of new investors and easing volatility. Leverage is increasing, suggesting individual investors are slowly regaining confidence after getting burned last year. The value of outstanding margin loans, the fuel for the 2015 boom, is up about 6% to about 874 billion yuan ($135 billion) since touching a 15-month low on March 16. A state-backed agency restarted offering some loans to brokerages to fund clients’ borrowed bets, signaling a loosening of policies put in place to stem the market rout.

Volatility is receding. Thirty-day price swings in the Shanghai gauge have plunged since soaring to a four-month high in February. Volatility began to rise at the start of January, when regulators introduced a circuit-breaker system meant to reduce wild market movements. The circuit breakers had the opposite effect – trading was suspended twice in the first week due to steep declines before the mechanism was shelved altogether. The ChiNext index re-entered a bull market this month, rebounding 20% from a February low. The small-cap gauge, dominated by technology and consumer companies, has become a leading indicator for the Shanghai index. It entered a bull market in October, a month before the large-cap gauge did, and lapsed into a bear market a week before the Shanghai gauge followed suit.

The number of new stock investors rose to a nine-month high of 535,000 in the week ended March 25, as a rebound in margin trading and a market recovery led more people to open trading accounts. Retail investors account for 80% of stock trading. While the valuation of the Shanghai Composite is almost down 40% from a June high, it’s still 15% pricier than the MSCI Emerging Market index, according to data compiled by Bloomberg. Almost 60% of the 240 Shanghai-listed companies with full-year earnings estimates compiled by Bloomberg have missed projections so far.

So far it was oil, steel, gas firms; now the banks start?!

• China Investment Bank Defaults On ‘Dim Sum’ Bond (FT)

A unit of Guosen Securities, China’s eighth-largest investment bank, has defaulted on a Kong Kong-traded renminbi bond, according to a document seen by the Financial Times, marking the first debt breach by a state-owned enterprise in China’s offshore bond market in nearly two decades. The technical default by Guosen’s Hong Kong affiliate puts at risk a Rmb38m ($5.9m) coupon payment due April 24 on Rmb1.2bn in “dim sum” bonds sold in 2014. Missing that payment would set a precedent for the offshore units of Chinese SOEs, whose creditors widely assume the onshore parent will always stand behind its affiliates, according to analysts. The default was unexpected because Guosen’s onshore unit is by all appearances in rude health. With the city government of Shenzhen as its largest shareholder, Guosen Securities was fourth on the league table for stock and bond underwriting in 2015, according to AsiaMoney.

The Shenzhen-listed brokerage earned net profit of Rmb14.2bn in 2015, up 188% from a year earlier, according to a filing in January. It ranked eighth among mainland brokerages by assets at the end of 2014, according to industry association figures. Like other Chinese securities companies, Guosen benefited from a surge in stock trading commissions during China’s equity market roller coaster last year. But its offshore unit, Guosen Securities (HK) Financial Holdings, has struggled to gain a foothold in Hong Kong’s capital markets, where foreign and mainland banks compete on a more level playing field. A special purpose vehicle owned by Guosen (HK) issued the bonds in April 2014 at an interest rate of 6.4%.

It may already be too late to sell.

• China’s Little Emperors Prop Up Aussie Housing Market (BBG)

Han Fantong, an accountant, beat almost 60 other bidders to buy a three-bedroom home in Melbourne in November for A$930,000 ($709,000). He had an advantage – full funding from his parents back in China. Han, 32, an Australian permanent resident, bought the house on 688 square meters (7,400 square feet) of land in Ringwood East, about 30 kilometers (19 miles) east of Melbourne’s business district, after a five-month search. His parents sold a 23-year-old two-bedroom apartment in Beijing for 8.1 million yuan ($1.2 million) to help pay for the property, he said by phone. “It comes as a tradition in China to buy a home for a son to establish a family,” said Han who lives in the house with his 29-year-old wife Chen Junyang. “Without my parents, it would still be difficult for us to bear the large mortgage loans.”

Han is among scores of buyers who with the backing of relatives in China are underpinning a housing market in Australia that’s coming off the boil. More than half the buyers of Chinese origin are supported financially by relatives residing in the world’s second-largest economy, according to McGrath, Australia’s only listed real estate agency. The firm’s China desk has assisted in sales worth A$140 million since it was established in September 2013. Such demand, whether from permanent residents or overseas buyers, has triggered community concern that locals are being priced out of Australia’s property market. The government has responded to the unease with tighter scrutiny of foreign investment that critics say may deter much-needed offshore capital.

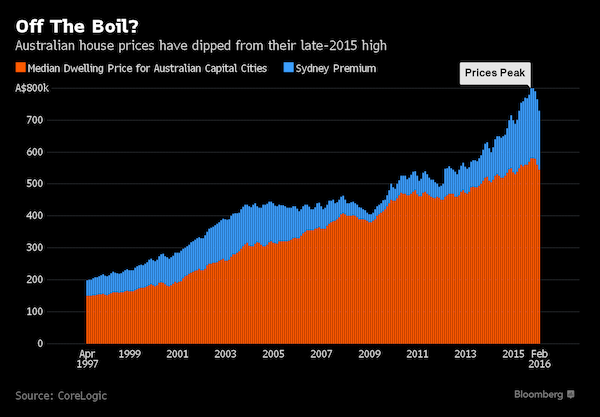

“Chinese buying in Sydney and Melbourne has stepped up from say where it was five years ago, but publicity around that has created a perception which has run ahead of reality,” said Shane Oliver at AMP Capital Investors in Sydney. “The Chinese demand – both from mainland China and Chinese Australians – is propping up the market and boosting construction.” [..] Purchases by foreigners, many with a connection to China, helped drive an almost 55% jump in home prices across Australia’s capital cities in the past seven years as mortgage rates dropped to five-decade lows. The median Sydney home price reached a record A$800,000 in October, according to research firm CoreLogic data. It has since fallen after a regulatory clampdown led to a slowdown in mortgages to landlords and the first increase in borrowing costs in five years.

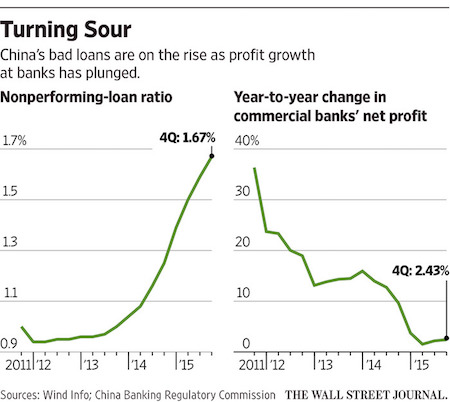

And that’s just official numbers. As is 1.67% in bad loans, which “..could be as high as 8.1% this year; other analysts have projected even higher estimates.” That’s perspective.

• China’s Largest Banks Post Lowest Annual Profit In A Decade (WSJ)

China’s biggest banks posted their lowest annual profit growth in a decade, as bad loans mount in an ailing economy that is pushing lenders toward riskier avenues of expansion. Three major banks that reported 2015 results on Wednesday said they wrote off 142 billion yuan ($21.85 billion) in irrecoverable debt last year, 1.4 times the volume in 2014, an indication that their customers—many of them state-owned industrial companies—are struggling to repay loans. Profits for the three banks were nearly flat, compared with industry growth rates of close to 40% just three years ago. Banks are building ever-larger capital buffers to cover bad loans as Chinese companies flounder under a severe overhang of real-estate inventory and excess industrial capacity.

The prevalence of bad loans means booming business for asset-restructuring companies—state-owned “bad banks” set up to soak up and sell off soured debt—prompting conventional banks to explore ways to keep such deals for themselves. Net profit overall among commercial lenders rose 2.4% last year, compared with 9.6% a year earlier, according to figures put out recently by the China Banking Regulatory Commission. On Wednesday, China’s largest bank by assets, Industrial & Commercial Bank of China, posted 0.5% profit growth to 277.1 billion yuan ($42.65 billion) for 2015. “The operating results were achieved on top of a high base in light of mounting growth-related difficulties,” ICBC said in its annual report. “The larger the total profit, the harder the growth will be.”

[..] Industrywide, nonperforming loans rose to 1.67% of total loans last year from 1.25% in 2014, the China Banking Regulatory Commission said. Investment bank China International Capital estimated the true ratio could be as high as 8.1% this year; other analysts have projected even higher estimates. Credit is souring so fast that commercial lenders are having a hard time expanding capital provisions to keep pace. Two years ago, China Construction Bank was setting aside a buffer that was more than twice the size of its bad loans. Last year, that ratio had fallen to 1.5 times, it said Wednesday. Slowing profit growth has forced many Chinese banks, especially midsize lenders, to invest aggressively in shadow-banking assets such as trust and wealth-management products. Such holdings, termed “investment receivables,” are opaque cocktails of high-yield assets that could jeopardize liquidity should banks need to offload them if markets turn turbulent, analysts say.

They have no choice. No major or even minor oil producer does.

• Saudi Aramco Expanding Oil and Gas Projects Even With Low Prices (BBG)

Saudi Arabian Oil Co. is pressing ahead with an expansion of the Khurais oil field despite lower crude prices and plans to double its production of natural gas over the next 10 years, the company’s chief executive officer said. The world’s biggest oil exporter, known as Saudi Aramco, won’t cancel any oil, gas or refining projects, Amin Nasser told reporters during a conference in Al-Ahsa in eastern Saudi Arabia. Aramco is also studying a possible expansion of the country’s largest oil refinery, Ras Tanura, which has a capacity of 550,000 barrels a day, he said. “Until now all of our downstream and upstream projects are continuous,” Nasser said. “No project in our programs got canceled.”

[..][ Khurais oil field’s expansion is due to be complete in 2018, Nasser said. Aramco was seeking to add 300,000 barrels a day to the field’s production to reach a capacity of 1.5 million barrels a day, the company’s former CEO Khalid Al-Falih said in October 2013. Ghawar oil field, the world’s biggest, has been producing for 70 years and will keep pumping oil for “many years to come,” Nasser said at the conference. Sixty% of Saudi Arabia’s crude oil output comes from Ghawar, Abdul Latif Al-Othman, governor of the Saudi Arabian General Investment Authority, said at the same event. Aramco has made a “promising” shale gas discovery at the Jafurah field in the Al-Ahsa region and is assessing and appraising the area for future production, Nasser said. The company plans to double its gas production to 23 billion cubic feet a day over 10 years, he said. Aramco will also keep exploring for oil and gas in the Red Sea area, he said.

Anything our former Oil Drum colleague Robert Rapier writes is still worth a read.

• The World’s Largest Public Oil And Gas Companies (Rapier)

The past two years have been a wild ride for investors in the world’s biggest publicly traded oil companies. Compared with their high-water marks in mid-2014, Big Oil shares are down about 25% and earnings have collapsed. The big irony: even as oil prices have halved, Big Oil is still getting bigger. In July 2014 U.S. oil production was 8.75 million barrels per day, according to the Energy Information Administration. Nearly a year (and a 50% price dip) later, U.S. oil output had grown to 9.69 million bpd, its highest level in 45 years. U.S. production has since declined by more than half a million bpd to 9.07 million bpd, but global production continues to rise. From 92.4 million bpd in 2014, global oil production is up to 94.8 million bpd. A unique aspect of the recent surge is that most of the gains have not come from OPEC’s national oil companies.

While Saudi Arabia’s national oil company, Saudi Aramco, remains the world’s undisputed production leader, Western and Russian companies have added far more production over the past few years. The biggest contributor to new global oil production has been the U.S., where the shale oil boom added more than 4 million bpd of new production since 2010. In total, about two dozen countries expanded their oil production over the past five years, including Saudi Arabia, Canada, United Arab Emirates, Iraq, Kuwait and Russia. On a corporate basis, many of the companies responsible for the production increase are on our list of the World’s 25 Largest Public Oil and Gas Companies. Russian companies dominate the top of the list, which is based on the most recently published production data, accounting for more production than any other region.

Russia has been a major producer of oil and gas for decades, and when privatization took place in the 1990s a handful of extremely large companies were created that rival many of the world’s national oil companies. The U.S. has seven companies in the top 25, more than any other country, led by ExxonMobil, which is the world’s third largest public oil and gas producer. Many may not realize that China is among the world’s Top 5 oil producing countries. But PetroChina, which went public in 2007, produces almost as much oil as does ExxonMobil, and is but one of the three Chinese companies in the Top 25. European countries are well-represented on the list, as four of the world’s six integrated “supermajors” are headquartered in Europe. The largest of this group is BP , still ranked as the 5th largest oil and gas producer in the Top 25, despite its many divestments since the Deepwater Horizon disaster.

Where wicked witch of the west Blythe Masters enters the blockchain.

• Bitcoin Technology’s Next Big Test: Trillion-Dollar Repo Market (WSJ)

Depository Trust & Clearing Corp., a firm at the center of Wall Street’s trading infrastructure, is about to give the technology behind bitcoin a big test: seeing whether it can be used to bolster the $2.6 trillion repo market. DTCC said in a statement Tuesday that it will begin testing an application of blockchain, the digital ledger originally used to track ownership and payments of the cryptocurrency bitcoin, to help smooth over problems in the crucial but increasingly illiquid corner of short-term lending markets known as repurchase agreements, or “repos.” Repos play a critical role in the financial system by keeping cash and securities circulating among hedge funds, investment banks and other financial firms.

DTCC, an industry-owned utility that helps settle trades in the repo market and elsewhere, wants to apply blockchain technology to the market, so that lenders and borrowers can keep track of securities and cash flowing between firms in real time. To test blockchain’s ability to improve repo trading, DTCC has tapped Digital Asset Holdings, a startup run by former J.P. Morgan executive Blythe Masters. Earlier this year, DTCC invested in the firm focused on blockchain applications, along with a range of banks including J.P. Morgan, Goldman Sachs Group Inc., and others. Typically in repos, money-market funds lend cash to brokers in exchange for bonds and an agreement to buy back the securities later at an agreed-upon rate.

During the financial crisis however, problems in the repo markets were singled out for their role in the demise of Bear Stearns and Lehman Brothers. Now, big banks have been shying away from facilitating some repo trades due to new regulations that curtail the firms’ ability to take risks. Murray Pozmanter, managing director and head of clearing services at DTCC, said in an interview the new arrangement with Digital Asset should help because the ledger would provide a way for all firms to agree on trade terms more quickly. Currently, he said, traders have to process two legs of each trade separately: one for the borrower to deliver securities in exchange for cash, and the other in which DTCC unwinds the trade. While the trade is in motion but not yet completed, the banks involved can take on risk.

Banks will be robots. Is that a good thing?

• Growth Of Fintech Forecast To Spur Almost 2 Million Banking Job Cuts (FT)

European and US banks will cut another 1.7m jobs in the next decade as financial technology companies stalk profitable growth areas such as lending and payments, a new report by Citigroup has predicted. The 108-page Citi note takes a forensic look at where “fintech” companies are deploying their resources, how much business they have already won and the consequences for the traditional banking industry. The job cuts — equal to more than 30% of the staff the banks currently employ — come on top of the 730,000 jobs that Citi says US and European banks have already shed from their peak staffing levels. “Obviously the biggest take out will happen in countries that have been through a crisis or are tech savvy,” said Ronit Ghose, one of the authors of the report.

In the US, investment banks clearly have selectively cut a lot of people but US consumer banks haven’t cut as much … in Europe there s been little progress on branch headcount as well. The catalyst for the job cuts is twofold. One factor is the new technologies that enable banks to do more online and less in branches. The other is the financial imperative for banks to be leaner as they deal with an onslaught of new competition in their most profitable niches. High quality global journalism requires investment. Citi’s research found that lending stood out as a key battleground, accounting for 46% of the $19bn in private funding that flowed into fintech during the past six years. The next biggest was payments, accounting for 23% of the investment in fintech.

Lending and payments are both lucrative activities for banks, and losing out on market share is particularly painful when low interest rates are crippling banks’ profitability and low loan demand has made it almost impossible for them to increase revenue. “So far most of the market value in fintech has been created by companies that are embedded in the still relatively new ecosystem of ecommerce,” the report noted. “For banks in many countries, this is an opportunity lost rather than a loss of existing earnings.”

Very interesting investigation.

• The Bribe Factory – How The West Corrupts The Middle East (SMH)

A massive leak of confidential documents has for the first time exposed the true extent of corruption within the oil industry, implicating dozens of leading companies, bureaucrats and politicians in a sophisticated global web of bribery and graft. After a six-month investigation across two continents, Fairfax Media and The Huffington Post can reveal that billions of dollars of government contracts were awarded as the direct result of bribes paid on behalf of firms including British icon Rolls-Royce, US giant Halliburton, Australia’s Leighton Holdings and Korean heavyweights Samsung and Hyundai. The investigation centres on a Monaco company called Unaoil, run by the jet-setting Ahsani clan. Following a coded ad in a French newspaper, a series of clandestine meetings and midnight phone calls led to our reporters obtaining hundreds of thousands of the Ahsanis’ leaked emails and documents.

The trove reveals how they rub shoulders with royalty, party in style, mock anti-corruption agencies and operate a secret network of fixers and middlemen throughout the world’s oil producing nations. Corruption in oil production – one of the world’s richest industries and one that touches us all through our reliance on petrol – fuels inequality, robs people of their basic needs and causes social unrest in some of the world’s poorest countries. It was among the factors that prompted the Arab Spring. Fairfax Media and The Huffington Post today reveal how Unaoil carved up portions of the Middle East oil industry for the benefit of western companies between 2002 and 2012. In part two we will turn to the impoverished former Russian states to reveal the extent of misbehaviour by multinational companies including Halliburton. We will conclude the three-part investigation by showing how corrupt practices have extended deep into Asia and Africa.

The leaked files expose as corrupt two Iraqi oil ministers, a fixer linked to Syrian dictator Bashar al-Assad, senior officials from Libya’s Gaddafi regime, Iranian oil figures, powerful officials in the United Arab Emirates and a Kuwaiti operator known as “the big cheese”. Western firms involved in Unaoil’s Middle East operation include some of the world’s wealthiest and most respected companies: Rolls-Royce and Petrofac from Britain; US companies FMC Technologies, Cameron and Weatherford; Italian giants Eni and Saipem; German companies MAN Turbo (now know as MAN Diesal & Turbo) and Siemens; Dutch firm SBM Offshore; and Indian giant Larsen & Toubro. They also show the offshore arm of Australian company Leighton Holdings was involved in serious, calculated corruption.

A point I’ve written a lot about. All our major institutions select for sociopaths (a term I’m more comfortable with in the context than psychopath).

• Pathocracy: The Rise Of The Political Psychopath (Whitehead)

Twenty years ago, a newspaper headline asked the question: “What’s the difference between a politician and a psychopath?” The answer, then and now, remains the same: None. There is no difference between psychopaths and politicians. Nor is there much of a difference between the havoc wreaked on innocent lives by uncaring, unfeeling, selfish, irresponsible, parasitic criminals and elected officials who lie to their constituents, trade political favors for campaign contributions, turn a blind eye to the wishes of the electorate, cheat taxpayers out of hard-earned dollars, favor the corporate elite, entrench the military industrial complex, and spare little thought for the impact their thoughtless actions and hastily passed legislation might have on defenseless citizens.

Psychopaths and politicians both have a tendency to be selfish, callous, remorseless users of others, irresponsible, pathological liars, glib, con artists, lacking in remorse and shallow. Charismatic politicians, like criminal psychopaths, exhibit a failure to accept responsibility for their actions, have a high sense of self-worth, are chronically unstable, have socially deviant lifestyle, need constant stimulation, have parasitic lifestyles and possess unrealistic goals. It doesn’t matter whether you’re talking about Democrats or Republicans. Political psychopaths are all largely cut from the same pathological cloth, brimming with seemingly easy charm and boasting calculating minds. Such leaders eventually create pathocracies—totalitarian societies bent on power, control, and destruction of both freedom in general and those who exercise their freedoms.

Once psychopaths gain power, the result is usually some form of totalitarian government or a pathocracy. “At that point, the government operates against the interests of its own people except for favoring certain groups,” author James G. Long notes. “We are currently witnessing deliberate polarizations of American citizens, illegal actions, and massive and needless acquisition of debt. This is typical of psychopathic systems, and very similar things happened in the Soviet Union as it overextended and collapsed.” In other words, electing a psychopath to public office is tantamount to national hara-kiri, the ritualized act of self-annihilation, self-destruction and suicide. It signals the demise of democratic government and lays the groundwork for a totalitarian regime that is legalistic, militaristic, inflexible, intolerant and inhuman.

So why do we keep doing it over and over again? There’s no shortage of dire warnings about the devastation that could be wrought if any one of the current crop of candidates running for the White House gets elected. Yet where the doomsayers go wrong is by ignoring the damage that has already been inflicted on our nation and its citizens by a psychopathic government.

We should be thankful Russia has such patience.

• Russia Vows ‘Totally Asymmetrical’ Response To US Troop Build-Up In Europe (RT)

Russia’s envoy to NATO has vowed a “totally asymmetrical” response if the alliance stands by a plan to deploy new armored units to eastern Europe. Citing Russian “aggression” as a pretext, the US has announced “continuous troop rotations” starting 2017. “We are not passive observers, we consistently take all the military measures we consider necessary in order to counterbalance this reinforced presence that is not justified by anything,” Moscow’s permanent representative at the alliance Aleksandr Grushko said in an interview with TV channel Rossiya-24 on Wednesday. “Certainly, we’ll respond totally asymmetrically.” Grushko has not elaborated further on his statement, but said that Russia’s actions would correspond to its “understanding of the extent of the military threat, would not be extremely expensive, but also highly effective.”

“As of today, assessing as a whole what that the US and NATO are doing, the point at issue is a substantial change for the worse in the security situation,” he said. The comments from Russia’s NATO envoy fell shortly after the Pentagon announced a plan to increase its troop presence in “the European theater” of up to three fully-manned Army brigades by the end of 2017, one armored, one airborne and one Stryker brigade. “This Army implementation plan continues to demonstrate our strong and balanced approach to reassuring our NATO allies and partners in the wake of an aggressive Russia in Eastern Europe and elsewhere,” Air Force Gen. Philip M. Breedlove of the US European Command said. “This means our allies and partners will see more capability – they will see a more frequent presence of an armored brigade with more modernized equipment in their countries.”

The first such rotational armored brigade combat team would arrive in Europe in February next year. Each of the brigades will be on nine-month rotations and bring their own equipment to use for exercises across Europe. NATO also wants to enhance Europe’s current equipment and replace it with “the most modern the Army has to offer.” At the same time, the older gear would become a core of the earlier unveiled “Army pre-positioned stocks”, which NATO would keep in Belgium, the Netherlands and Germany. [..] “Reading these materials makes your hair stand on end, because of how some experts discuss with aplomb that if NATO had not taken measures, our [Russia’s] tanks would have already be in Tallinn and Riga,” Grushko said.

Positive feedback. Accelerating returns.

• Sea Levels Set To ‘Rise Far More Rapidly Than Expected’

Sea levels could rise far more rapidly than expected in coming decades, according to new research that reveals Antarctica’s vast ice cap is less stable than previously thought. The UN’s climate science body had predicted up to a metre of sea level rise this century – but it did not anticipate any significant contribution from Antarctica, where increasing snowfall was expected to keep the ice sheet in balance. According to a study, published in the journal Nature, collapsing Antarctic ice sheets are expected to double sea-level rise to two metres by 2100, if carbon emissions are not cut. Previously, only the passive melting of Antarctic ice by warmer air and seawater was considered but the new work added active processes, such as the disintegration of huge ice cliffs.

“This [doubling] could spell disaster for many low-lying cities,” said Prof Robert DeConto, at the University of Massachusetts Amherst, who led the work. He said that if global warming was not halted, the rate of sea-level rise would change from millimetres per year to centimetres a year. “At that point it becomes about retreat [from cities], not engineering of defences.” As well as rising seas, climate change is also causing storms to become fiercer, forming a highly destructive combination for low-lying cities like New York, Mumbai and Guangzhou. Many coastal cities are growing fast as populations rise and analysis by World Bank and OECD staff has shown that global flood damage could cost them $1tn a year by 2050 unless action is taken. The cities most at risk in richer nations include Miami, Boston and Nagoya, while cities in China, Vietnam, Bangladesh and Ivory Coast are among those most in danger in less wealthy countries.

The new research follows other recent studies warning of the possibility of ice sheet collapse in Antarctica and suggesting huge sea-level rises. But the new work suggests that major rises are possible within the lifetimes of today’s children, not over centuries. “The bad news is that in the business-as-usual, high-emissions scenario, we end up with very, very high estimates of the contribution of Antarctica to sea-level rise” by 2100, DeConto told the Guardian. But he said that if emissions were quickly slashed to zero, the rise in sea level from Antarctic ice could be reduced to almost nothing. “This is the good news,” he said. “It is not too late and that is wonderful. But we can’t say we are 100% out of the woods.” Even if emissions are slashed, DeConto said, there remains a 10% chance that sea level will rise significantly.

A good Yanis article.

• Europe Is Too Important To Be Left To Its Clueless Rulers – Varoufakis (Tel.)

It is eight months since Varoufakis resigned as Greece’s finance minister, in the wake of the historic referendum when the Greek people voted to reject the demands of the country’s creditors, the so-called ‘troika’. It was the result that Varoufakis and the Greek prime minster Alexis Tsipras had been campaigning for. But within 24 hours Tsipras had performed a volte-face, accepting the troika’s terms. Varoufakis resigned. A politician without office, Varoufakis now spends his time writing, giving speeches and campaigning to reform Europe from the grass roots up. In February he launched Diem25, a pan-European umbrella group, aiming to pull together left-wing parties, protest movements and ‘rebel regions’ from across the continent, with the object, as he puts it, to ‘shake Europe – gently, compassionately, but firmly’, and bring ‘democracy back to EU decision making.’

He has published a new book, And the Weak Suffer What They Must?, a detailed historical analysis of the origins of Europe’s financial crisis. Its basic thesis is that the eurozone is not the route to shared prosperity it was intended to be but “a pyramid scheme of debt with countries such as Greece, Ireland, Portugal and Spain at its bottom”. Its conclusion, put bluntly, is that Europe “is too important to be left to its clueless rulers”, and that the eurozone must be “fully recalibrated” if Europe is to avoid a “postmodern” repetition of the 1930s, with financial chaos, the rise of fascism, and the spectre of conflict.

He has recently returned from Abu Dhabi, talking to business leaders at the Global Financial Markets Forum. For every 15 lectures he gives for free, he gets paid for one, he says, ‘but that’s good enough’. And the self-described ‘erratic Marxist’ is a popular draw among bankers and financial institutions. ‘I say to them exactly what I say to a left-wing audience,’ he says. ‘For some reason bankers like my analysis of the euro and global crisis. They’ve had enough of people telling them what they think they want to hear, because that hasn’t worked very well for them in the last seven or eight years. The fact they want me to talk to them is a sign of how deep this crisis is.’

At least at first glance, a great story. Let’s hope they win some golds too.

• Refugees Run For Rio Olympic Dream Team (AFP)

High up in Kenya’s rugged Ngong Hills, refugees sprint around an athletics track in intensive training they hope will see them selected for a unique team for the Rio Olympics. Hand-picked from Kenya’s vast refugee camps – including Dadaab, the biggest in the world — to join the training camp just outside the capital Nairobi, the athletes here have their eyes set on racing in Rio de Janeiro in August. “It will be a very great moment for me and the rest of the refugees, who will be so proud for having produced one of their own who has gone to the Olympics,” said 22-year-old Nzanzumu Gaston Kiza, who fled Democratic Republic of Congo after his relatives were massacred in ethnic clashes. Here at Ngong, a high altitude running track some 2,400 meters (7,875 feet) above sea level, some 40 kilometres (25 miles) southwest of Nairobi, athletes from across eastern Africa are chasing the dream of the Olympics.

Amid a world record number of people forced from their homes and their countries, the International Olympic Committee (IOC) this month announced the creation and funding of Team Refugee Olympic Athletes (ROA) to compete in Rio under its flag. The team, expected to include between five to 10 athletes from across the world, is part of the IOC’s “pledge to aid potential elite athletes affected by the worldwide refugee crisis”. “Team ROA” will march just before the hosts Brazil enter the Olympic Stadium at the opening ceremony – carrying the Olympic flag and anthem – a position likely to be given enormous cries of support. While countries may field their own teams, the refugees are unable to return home safely to take part – and instead will run under the Olympic flag. “We want to send a message of hope for all refugees in our world,” IOC president Thomas Bach said when plans for the team were announced.

International law no longer has any meaning. Welcome to Europe.

• Austria To Tighten Asylum Rules (P.)

Austria is to introduce procedures at its borders to speed up asylum applications and limit the influx of refugees into the country, the government announced Wednesday. From May, authorities will determine “within hours” if an applicant can provide sufficient reason not to be sent back to a safe third country of origin, Austrian Interior Minister Johanna Mikl-Leitner and Defense Minister Hans Peter Doskozil said. “We will not accept any more asylum applications, unless we have to because of certain criteria like Article 8 of the human rights convention,” Mikl-Leitner said, referring to an article that grants asylum seekers, among other things, the right to stay in a country where they have a partner or children.

The announcement followed news that legal experts commissioned by the Austrian government found that a cap of 37,500 refugees allowed to apply for asylum per year, introduced by Vienna at the beginning of the year, was incompatible with international law. As of the end of March, 15,000 asylum applications had been submitted in Austria this year, according to the country’s interior ministry.

This will not stop. It may move from one spot to another, but it will continue no matter what. Such is the despair.

• Refugee Arrivals To Greece Rise Sharply Despite EU-Turkey Deal (Reuters)

Arrivals of refugees and migrants to Greece from Turkey rose sharply on Wednesday, just over a week since the European Union and Turkey struck a deal intended to cut off the flow. Greek authorities recorded 766 new arrivals between Tuesday morning and Wednesday morning, up from 192 the previous day. Most arrived on the northeastern Aegean island of Lesvos. Italy reported an even larger jump in arrivals on Tuesday, when officials there said 1,350 people – mostly from Africa – were rescued from small boats taking the longer migration route over the Mediterranean as the weather warmed up. The EU Commission said on Tuesday that the flows in the last week had reduced, with only 1,000 people arriving from Turkey on Greek islands, compared to an average of 2,000 a day in the last couple of months.

It was not clear why numbers had dropped, but the Aegean Sea had been hit with bad weather and gale force winds, making the journey from Turkey on small rubber boats even more dangerous. Under the deal in effect since March 20, migrants and refugees who arrive in Greece will be subject to being sent back once they have been registered and their individual asylum claim processed. The returns are to begin from April 4. More that 51,000 refugees and migrants, among those Syrians, Afghans, Iraqis and other fleeing conflict in the Middle East and Asia, are currently stranded in Greece following border closures across the Balkans. Nearly 6,000 people remain stuck at the country’s biggest port of Piraeus port near Athens, having arrived there on ferries from Greek islands close to Turkey before the deal.

Scores have found shelter in passenger waiting lounges while hundreds more sleep in the open, either in flimsy tents or on blankets spread on the dock. Queues for the few portable toilets are long, and scuffles have broken out in recent weeks over mobile phone chargers and food distribution. International rights group Human Rights Watch has described conditions at the port, including basic hygiene, as “abysmal” and says the situation is akin to a “humanitarian crisis.”