Salvador Dali Remorse – Sphinx Embedded in the Sand 1931

Lots of wet panties, male and female, today in anticipation of Michael Cohen’s testimony. Of course, it’s been leaked, full text is here. A few quotes:

I may once again be in a party of one, but I think it’s awfully weak, it’s grasping for stuff rather than conveying it. First, there’s the inevitable Assange link:

In July 2016 [..] Mr. Stone told Mr. Trump that he had just gotten off the phone with Julian Assange and that Mr. Assange told Mr. Stone that, within a couple of days, there would be a massive dump of emails that would damage Hillary Clinton’s campaign. Mr. Trump responded by stating to the effect of “wouldn’t that be great.”

Anything related to Assange, whether from Mueller or Cohen, lacks credibility as long as he can’t defend himself against it. And Trump merely says: wouldn’t that be great? Not exactly the stuff of collusion or conspiracy.

Just as inevitable in smear campaigns: Trump the racist.

Mr. Trump is a racist. The country has seen Mr. Trump court white supremacists and bigots. You have heard him call poorer countries “shitholes.” While we were once driving through a struggling neighborhood in Chicago, he commented that only black people could live that way. And, he told me that black people would never vote for him because they were too stupid.

Calling a country a shithole is not racist. The policies that have created a situation in which many shithole countries are populated by black people stem from many decades of US/Europe policies that predate Trump. The rest is not racist either, if you look closer. Perhaps Trump is a bit racist, like so many Americans. But Cohen’s prepared words don’t show that.

Also: Trump doesn’t tell the full truth about his wealth. But Michael Cohen always has…

It was my experience that Mr. Trump inflated his total assets when it served his purposes, such as trying to be listed among the wealthiest people in Forbes, and deflated his assets to reduce his real estate taxes.

Gee, lock him up. I don’t get it. There’s so much wrong with Trump, but politics and media have singled out Russia collusion, and then failed to prove a thing about it, and now they switch to ‘racist conman’, with the weakest of accusations. I swear, they might as well all be working for the Donald.

• Michael Cohen Testimony: Trump A ‘Racist’, ‘Cheat’ And ‘Conman’ (G.)

Michael Cohen is to accuse Donald Trump of being a “conman” and a “cheat” who had advanced knowledge that a longtime adviser was communicating with WikiLeaks during the 2016 campaign, according to opening testimony he will deliver to Congress on Wednesday. Cohen’s prepared remarks, confirmed by the Guardian, include a series of explosive allegations about the presidential campaign. The president’s former lawyer, who will publicly testify before the House oversight committee on Wednesday, will state that Trump was told by Roger Stone that WikiLeaks would publish emails stolen from the Democratic National Committee and Hillary Clinton’s campaign.

“In July 2016, days before the Democratic convention, I was in Mr Trump’s office when his secretary announced that Roger Stone was on the phone. Mr Trump put Mr Stone on the speakerphone,” Cohen’s opening statement reads. “Mr Stone told Mr Trump that he had just gotten off the phone with Julian Assange and that Mr Assange told Mr Stone that, within a couple of days, there would be a massive dump of emails that would damage Hillary Clinton’s campaign. Mr Trump responded by stating to the effect of ‘wouldn’t that be great.’” The remarkable allegations by Cohen go further than what has been made public thus far by the special counsel investigation into potential collusion between the Trump campaign in Moscow.

Cohen will also suggest his instructions to lie to Congress about a possible Trump Tower deal in Moscow during the 2016 campaign came from the president – albeit not directly. “In conversations we had during the campaign, at the same time I was actively negotiating in Russia for him, he would look me in the eye and tell me there’s no business in Russia and then go out and lie to the American people by saying the same thing,” Cohen will say. “In his way, he was telling me to lie.” “Mr Trump did not directly tell me to lie to Congress. That’s not how he operates,” he will add.

Humor me and please read this. It’s so confusing that you almost forget it’s also complete madness.

• 3 Days That Will Decide Brexit – March 12-14th Will Seal Britain’s Fate (Exp.)

In a dramatic statement to the House of Commons, Mrs May confirmed that she will put her Withdrawal Agreement – including whatever additional assurances she has secured from Brussels – to a “meaningful vote” by March 12. If that fails, MPs will be offered two separate votes the following day – one on a no-deal Brexit, and the other on requesting an extension to the two-year Article 50 negotiation process to delay EU withdrawal beyond March 29. The sequence of votes will be proposed in an amendable motion tabled by the Prime Minister for debate and vote in the Commons on Wednesday. To uproar in the Commons, Mrs May told MPs: “They are commitments I am making as Prime Minister and I will stick by them, as I have previous commitments to make statements and table amendable motions by specific dates.”

Deputy Political Editor for Sky News Beth Rigby tweeted of Mrs May’s speech: “This really is a big shift. “May has finally played her cards and sided with the Europhile wing of her party .. “Vote for her deal (March 12) Vote for no-deal (March 13) Vote for delay (March 14) .. “Only yesterday she refused to even acknowledge there might have to be a delay to Brexit.”

Mrs May has declared a meaningful vote will take place by March 12, where MPs will vote on her Brexit deal. Should this deal not be voted through, on March 13, MPs will then be offered two separate votes by March 13 on whether the UK leaves with no deal or delays Brexit beyond March 29. The delay will then be voted on March 14, when a motion would be brought forward on whether Parliament wishes to seek a short limited extension to Article 50. If the House votes for an extension, this extension will have to be approved by the House with the EU and then necessary legislation will be brought forward to change the exit date.

[..] In her statement to MPs following a Cabinet meeting with senior colleagues at 10 Downing Street, Theresa May said she wanted to set out “three further commitments” to the Commons. She said: “First, we will hold a second meaningful vote by Tuesday, March 12 at the latest. “Second, if the Government has not won a meaningful vote by Tuesday, March 12, then it will – in addition to its obligations to table a neutral amendable motion under Section 13 of the EU Withdrawal Act – table a motion to be voted on by Wednesday March 13 at the latest, asking this House if it supports leaving the EU without a Withdrawal Agreement and a framework for a future relationship on March 29.

“So the United Kingdom will only leave without a deal on March 29 if there is explicit consent in the House for that outcome. “Third, if the House, having rejected the deal negotiated with the EU, then rejects leaving on March 29 without a Withdrawal Agreement and future framework, the Government will on March 14 bring forward a motion on whether Parliament wants to seek a short, limited extension to Article 50.” The Prime Minister also said she still believes she will be able to secure a deal: “I’ve had a real sense from the meetings I’ve had, and the conversations I’ve had in recent days, that we can achieve that deal. “It’s within our grasp to leave with a deal on March 29 and that’s where all of my energies are going to be focused.”

Scared yet? Because that’s the idea.

• UK Economy Could Be 9% Weaker Under No-Deal Brexit – Government (G.)

The government has issued a bleak warning over a no-deal Brexit, estimating the UK economy could be 9% weaker in the long run, businesses in Northern Ireland might go bust and food prices will increase. In an official document only published after repeated demands by the former Conservative MP Anna Soubry, the government also revealed it was behind on contingency planning for a third of “critical projects” in relation to business and trade. The latest no-deal notice states:

• The economy would be 6%-9% smaller over the next 15 years than it otherwise might have been, in the event of no deal, in line with Bank of England forecasts. • The flow of goods through Dover would be “very significantly reduced for months”. • With 30% of food coming from the EU, prices are likely to increase and there is a risk that panic buying might create shortages. • Only six of the 40 planned international trade agreements have been signed.

The document was published just hours after Theresa May was forced to promise two key votes, allowing MPs the option to reject no deal and to potentially delay Brexit for a short period, following pressure from remain-minded cabinet ministers. The prime minister set out a timetable that includes a vote on her Brexit deal by 12 March; if that fails, a vote the following day to support no deal, and if that also fails, a vote on 14 March on extending article 50. The delay is likely to further agitate the Tory party’s Eurosceptics, with Brexiter ministers including Andrea Leadsom and Liz Truss expressing their frustration over the issue in cabinet on Tuesday morning. Speaking in the House of Commons on Tuesday, May did not specify the length of any delay, saying only that she would prefer it to be the shortest possible. An extension beyond the end of June would involve the UK taking part in the European parliament elections.

[..] The no-deal notice said customs checks alone could cost businesses £13bn a year and that it was impossible to predict the impact of new tariffs. It said this was partly because the government’s communications to businesses and individuals about the need to prepare for no deal had not been effective. [..] The EU, which would treat the UK as a third country in the event of no deal, could impose tariffs of 70% on beef exports, 45% on lamb and 10% on cars, it said. “This would be compounded by the challenges of even modest reductions in flow at the border.”

Absolutely fabulous.

• The UK Doesn’t Have The Right Pallets For Exporting To The EU (BI)

The UK government is due to hold emergency talks with industry leaders on Tuesday after discovering that the country doesn’t have the right pallets to continue exporting goods to the European Union if it leaves without a deal next month. Under strict EU rules, pallets – wooden or plastic structures that companies use to transport large volumes of goods – arriving from non-member states must be heat-treated or cleaned to prevent contamination and have specific markings to confirm that they meet standards. Most pallets that British exporters are using do not conform to the rules for non-EU countries, or “third countries,” as EU member states follow a much more relaxed set of regulations.

The Department for Environment, Food, and Rural Affairs last week told business leaders that the UK would not have enough EU-approved pallets for exporting to the continent if it leaves without a withdrawal agreement next month. That means UK companies would be competing for a small number of pallets that meet EU rules, and those that miss out would be forced to wait for new pallets, which could take weeks to be ready. DEFRA has arranged for a conference call on Tuesday morning to discuss the pallet shortage, with 31 days until Brexit day on March 29. “It is the tiny, procedural, mundane-seeming stuff that will absolutely trip people up,” one industry figure briefed by Theresa May’s government told Business Insider, adding that the country was “not even remotely ready” for a no-deal Brexit.

Chavez is the guy US intelligence have been chasing for so long, and still trying to get at after his death.

Got to love the man quoting world literature. Also because in the next article, Nomi Prins does the same.

• The War on Venezuela is Built on Lies (Pilger)

Travelling with Hugo Chavez, I soon understood the threat of Venezuela. At a farming co-operative in Lara state, people waited patiently and with good humor in the heat. Jugs of water and melon juice were passed around. A guitar was played; a woman, Katarina, stood and sang with a husky contralto. “What did her words say?” I asked. “That we are proud,” was the reply. The applause for her merged with the arrival of Chavez. Under one arm he carried a satchel bursting with books. He wore his big red shirt and greeted people by name, stopping to listen. What struck me was his capacity to listen. But now he read. For almost two hours he read into the microphone from the stack of books beside him: Orwell, Dickens, Tolstoy, Zola, Hemingway, Chomsky, Neruda: a page here, a line or two there. People clapped and whistled as he moved from author to author.

Then farmers took the microphone and told him what they knew, and what they needed; one ancient face, carved it seemed from a nearby banyan, made a long, critical speech on the subject of irrigation; Chavez took notes. Wine is grown here, a dark Syrah type grape. “John, John, come up here,” said El Presidente, having watched me fall asleep in the heat and the depths of Oliver Twist. “He likes red wine,” Chavez told the cheering, whistling audience, and presented me with a bottle of “vino de la gente.” My few words in bad Spanish brought whistles and laughter. Watching Chavez with the people, la gente, made sense of a man who promised, on coming to power, that his every move would be subject to the will of the people. In eight years, Chavez won eight elections and referendums: a world record. He was electorally the most popular head of state in the Western Hemisphere, probably in the world.

See? Like Pilger and Chavez, Nomi talks about literature. No space here to do this justice, please go read it. Key point: unlike the poor(er), the rich don’t live off the rewards of labor, but of that of wealth.

• Survival of the Richest (Nomi Prins)

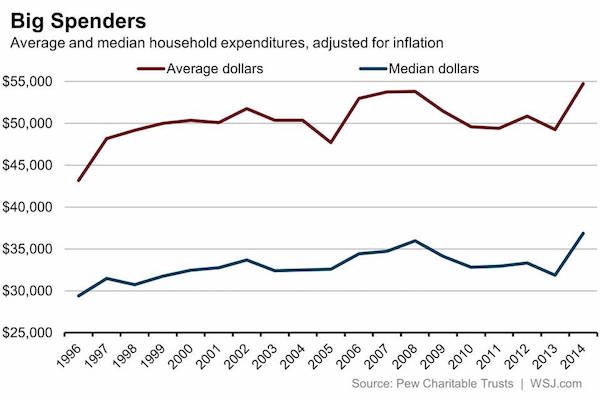

In George Orwell’s iconic 1945 novel, Animal Farm, the pigs who gain control in a rebellion against a human farmer eventually impose a dictatorship on the other animals on the basis of a single commandment: “All animals are equal, but some animals are more equal than others.” In terms of the American republic, the modern equivalent would be: “All citizens are equal, but the wealthy are so much more equal than anyone else (and plan to remain that way).” Certainly, inequality is the economic great wall between those with power and those without it. As the animals of Orwell’s farm grew ever less equal, so in the present moment in a country that still claims equal opportunity for its citizens, one in which three Americans now have as much wealth as the bottom half of society (160 million people), you could certainly say that we live in an increasingly Orwellian society.

Or perhaps an increasingly Twainian one. After all, Mark Twain and Charles Dudley Warner wrote a classic 1873 novel that put an unforgettable label on their moment and could do the same for ours. The Gilded Age: A Tale of Today depicted the greed and political corruption of post-Civil War America. Its title caught the spirit of what proved to be a long moment when the uber-rich came to dominate Washington and the rest of America. It was a period saturated with robber barons, professional grifters, and incomprehensibly wealthy banking magnates. (Anything sound familiar?) The main difference between that last century’s gilded moment and this one was that those robber barons built tangible things like railroads.

Today’s equivalent crew of the mega-wealthy build remarkably intangible things like tech and electronic platforms, while a grifter of a president opts for the only new infrastructure in sight, a great wall to nowhere. In Twain’s epoch, the U.S. was emerging from the Civil War. Opportunists were rising from the ashes of the nation’s battered soul. Land speculation, government lobbying, and shady deals soon converged to create an unequal society of the first order (at least until now). Soon after their novel came out, a series of recessions ravaged the country, followed by a 1907 financial panic in New York City caused by a speculator-led copper-market scam.

To fully grasp the nature of inequality in our twenty-first-century gilded age, it’s important to understand the difference between wealth and income and what kinds of inequality stem from each. Simply put, income is how much money you make in terms of paid work or any return on investments or assets (or other things you own that have the potential to change in value). Wealth is simply the gross accumulation of those very assets and any return or appreciation on them. The more wealth you have, the easier it is to have a higher annual income.

Tyler got his hands on a piece by Michael Every at Dutch Rabobank.

• Hey Yellen, It Was Trump Who Was Right (Every)

Rabo are already predicting a US recession in 2020, which will drag many down with it, and as the OECD now warns that swollen corporate debt piles, which central banks have so encouraged, is of ever lower quality and potentially more dangerous than it was back in 2008. 54% of investment grade bonds are now BBB-rated, up from 30% in 2008. The OECD argues “In the case of a downturn, highly leveraged companies would face difficulties in servicing their debt, which in turn, through higher default rates, may amplify the effects…Any developments in these areas will come at a time when non-financial companies in the next three years will have to pay back or refinance about USD4 trillion worth of corporate bonds. This is close to the total balance sheet of the US Federal Reserve.”

Guess what guys? China is right ahead of you on that curve – which is why it is trying to find another whale to nuke ASAP: things are looking truly ugly given many firms can’t even pay the interest on their debt, let alone the principle. And guess what else? That OECD and China warning sounds like an admission of the Minsky debt dynamic that you might have thought all central banks would have to have learned the lessons of post-GFC. Apparently not, however – because they think they already know everything. As former Fed Chair Yellen mocked yesterday, Trump doesn’t understand what the Fed’s dual mandates of price stability and stable employment are. That might well be true.

But was it the Fed or Trump who publicly called out how dangerous continuous Fed rate hikes are in a debt-laden, Minsky-teetering financial system where the yield curve is still inverted 9bps on 1s-5s even after a pause? I think Yellen will find it was Trump who was right and the Fed who was forced into a humiliating and frankly incongruous policy U-turn. So much expertise! Trump also made a similar intervention over oil prices overnight, and once again they dipped, though are opening up strongly this morning in Asia. [..] easy policy in the UK; ultra-easy policy in China; promises of more easing in Japan; an ECB U-turn to come(?); and the Fed on hold and stopping QT soon at least. And that’s with bullish markets and reasonable global growth – just wait until things head south: if all you have is a nuke, everything looks like a whale.

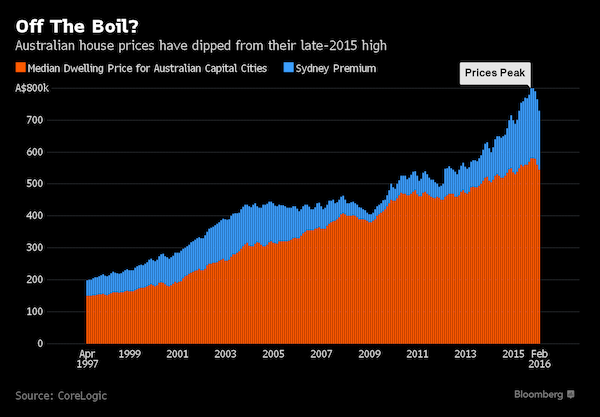

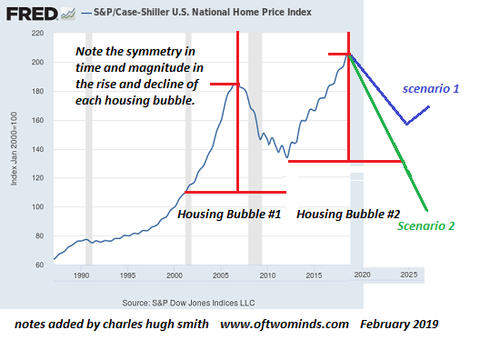

Every bubble that bursts ends up below its starting level. Nicole had these graphs, Tulip, South Sea etc., that showed just that. This graph doesn’t quite do that.

• Now that Housing Bubble #2 Is Bursting…How Low Will It Go? (CHS)

There are two generalities that can be applied to all asset bubbles: 1. Bubbles inflate for longer and reach higher levels than most pre-bubble analysts expected 2. All bubbles burst, despite mantra-like claims that “this time it’s different” The bubble burst tends to follow a symmetrical reversal of very similar time durations and magnitudes as the initial rise. If the bubble took four years to inflate and rose by X, the retrace tends to take about the same length of time and tends to retrace much or all of X. If we look at the chart of the Case-Shiller Housing Index below, this symmetry is visible in Housing Bubble #1 which skyrocketed from 2003-2007 and burst from 2008-2012.

Housing Bubble #1 wasn’t allowed to fully retrace the bubble, as the Federal Reserve lowered interest rates to near-zero in 2009 and bought $1+ trillion in sketchy mortgage-backed securities (MBS), essentially turning America’s mortgage market into a branch of the central bank and federal agency guarantors of mortgages (Fannie and Freddie, VA, FHA). These unprecedented measures stopped the bubble decline by instantly making millions of people who previously could not qualify for a privately originated mortgage qualified buyers. This vast expansion of the pool of buyers (expanded by a flood of buyers from China and other hot-money locales) drove sales and prices higher for six years (2012-2018).

As noted on the chart below, this suggests the bubble burst will likely run from 2019-2025, give or take a few quarters. The question is: what’s the likely magnitude of the decline? Scenario 1 (blue line) is a symmetrical repeat of Housing Bubble #2: a retrace of the majority of the bubble’s rise but not 100%, which reverses off this somewhat higher base to start Housing Bubble #3. Since the mainstream consensus denies the possibility that Housing Bubble #2 even exists (perish the thought that real estate prices could ever–gasp–drop), they most certainly deny the possibility that prices could retrace much of the gains since 2012.

More realistic analysts would probably agree that if the current slowdown (never say recession, it might cost you your job) gathers momentum, some decline in housing prices is possible. They would likely agree with Scenario 1 that any such decline would be modest and would simply set the stage for an even grander housing bubble #3. But there is a good case for Scenario 2, in which price plummets below the 2012 lows and keeps on going, ultimately retracing the entire housing bubble gains from 2003.

Interesting how Europe smears Putin wherever it can, except where it counts.

• Russia’s Share Of European Gas Market Surges To Almost 37%, Dwarfing LNG (RT)

Russia’s state-run energy major Gazprom said its share of sales of natural gas in the European Union has increased to 36.7 percent last year, rising over two percent against 34.2 percent in 2017. “In 2018, according to preliminary data, the share of gas supplies to the EU countries and Turkey has reached an all-time high and totaled 36.7 percent,” the director general of Gazprom Export Elena Burmistrova said at Gazprom’s Investor Day event, taking place in Singapore. Burmistrova added that Gazprom’s gas exports to Europe last year amounted to record 201.8 billion cubic meters, and is expected to significantly grow by 2035 due to the increasing demand.

According to a member of Gazprom’s management committee, Oleg Aksyutin, the company saw no threat to Gazprom’s business in the European market from global producers of liquefied natural gas (LNG), including the US. The company’s gas exports to Europe are reportedly three times more than the amount of LNG shipped to Europe by all global producers combined. Though the share of LNG shipments have been growing, it still makes up only 13 percent of the entire gas market, according to Burmistrova. The executive added that prices for natural gas saw a significant surge. “In 2018, in accordance with linked fuel prices, the average price of Gazprom gas increased by 24.6 percent to $245.5 for 1,000 cubic meters,” she said, stressing that in 2016 it stood at $167.

When it comes to China, one of the world’s biggest energy consumers, Gazprom is planning to become the country’s biggest supplier as soon as 2035, with the company’s share expected to reach 13 percent of Chinese overall consumption by the same year.

It’s completely insane that any western country would have to do a Hunger Survey. Don’t fall for thinking it’s normal.

• UK Hunger Survey To Measure Food Insecurity (G.)

The government is to introduce an official measure of how often low-income families across the UK skip meals or go hungry because they cannot afford to buy enough food, the Guardian can reveal. A national index of food insecurity is to be incorporated into an established UK-wide annual survey run by the Department for Work and Pensions (DWP) that monitors household incomes and living standards. Campaigners, who have been calling for the measure for three years, said the move was “a massive step forward” that would provide authoritative evidence of the extent and causes of hunger in the UK. They say food insecurity is strongly linked to poverty caused by austerity and welfare cuts and is driving widening health inequality.

Food insecurity is generally defined as experiencing hunger, the inability to secure food of sufficient quality and quantity to enable good health and participation in society, and cutting down on food because of a lack of money. The decision, which took campaigners by surprise, was revealed at an informal meeting on Tuesday attended by the DWP, the Office for National Statistics, Public Health England and the Scottish and Welsh governments, as well as a number of food poverty charities. Ministers have for years resisted calls to bring England into line with the US and Canada by measuring food insecurity. Critics said this was to avoid shedding unwanted light on the impact of welfare policy and the public health consequences of being unable to eat regularly or healthily.

Why the hunger? Here’s why: we feed ourselves with plastics and poison.

• Glyphosate Found In 95% Of Wine And Beer (Ind.)

A new study has shown that traces of a commonly-used and possibly cancerous weed killer can be found in the majority of wine and beer. Researches tested five wines and 15 beers from the US, Asia and Europe for traces of pesticide glyphosate. The research found that of the 20 samples, 19 (95 per cent) contained particles of the chemical, including products labelled as organic. The US Public Interest Research Group, which conducted the study, said the levels of the pesticide aren’t necessarily dangerous, but are still concerning. In 2015, the World Health Organisation’s International Agency categorised glyphosate as “probably carcinogenic to humans”, leading the state of California to add it to its list of chemicals that can cause cancer, which makes companies responsible for providing warnings to potential consumers.

The findings of the study coincide with the beginning of a class action lawsuit against Bayer, which acquired Monsanto last year. The suit claims that Roundup caused thousands of plaintiffs to develop non-Hodgkins lymphoma, a type of blood cancer. The first plaintiff, Ed Hardeman, testified this week, alleging that his use of the chemical on his 56 acres of land caused him to develop cancer aged 66. [..] Bayer has not commented on the results of the study, but the researchers are calling for glyphosate to be banned unless it can be proven safe.

The earth’s weather system is far too complex to draw conclusions from a sunny day. The only things we can say about the climate must be based on long-term stats. This kind of article doesn’t help one bit, it merely points out the author literally doesn’t know what he’s talking about.

• Am I The Only One Who’s Terrified About The Warm Weather? (G.)

They were everywhere in London on the weekend. The people in short sleeves or sandals. The ones with sunglasses ostentatiously hanging from the front of their shirts or balanced on top of their heads. The beer gardens and riverside pubs of the capital were heaving; corner shops ran out of ice-cream. Outside it was 17C (62F). Monday was another warm day, without a cloud in the sky, and in the late afternoon the light took on a magical, honey-coloured hue. It brought to mind one of those summer evenings you remember from childhood, when you’d be in the park all day and your parents let you stay out until bedtime, and you felt like you were doing something deliciously naughty just by being there.

Except it isn’t early summer: it’s February. And the entire developed world has not so much been doing something slightly naughty as systematically attacking the global ecosystem over a period of decades, and that’s how we go into this mess. We should try to hold on to this fact as young, posh men the nation over develop a strange delusion that anyone would want to see their elbows; this is not supposed to be happening. Less than a month ago, there was video footage of extreme cold weather coming out of Chicago. Forks supported in midair by suddenly frozen noodles, water poured from kettles instantly freezing on its way to the ground: you know the sort of thing.

OK, that was on the other side of the world, and was extreme and terrifying enough. But at least it was terrifying in the right direction. On Monday, though, the temperature hit 20.3C in Ceredigion, west Wales: the highest February temperature ever recorded in Britain and the first time the thermometer had breached 20C in winter. The BBC weather account tweeted it out with a gif of the sunshine icon and the same excitable breathlessness with which Springwatch would announce it had found a new type of vole. My response contained a single word, repeated seven times. It began with F.