James McNeill Whistler Nocturne: Blue and Silver – Chelsea 1871

It’s all just one giant distortion.

• Global Bond Markets Have Become Grotesquely Distorted – Jim Grant (ZH)

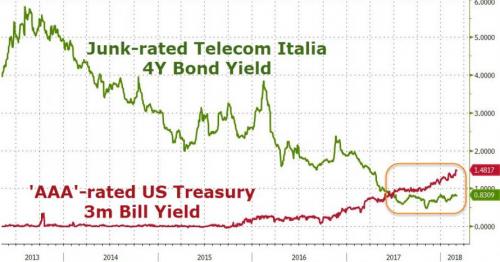

Jim Grant, the world’s most famous interest rate observer, ventured on CNBC this week to expose and explain the utterly farcical world of financial markets (and in particular, risk assets) and how grotesquely distorted global bond markets have become. He began with an example… “As an example of where the world is mispricing interest rates… look to Italy, which is having a big [potentially disruptive] election on Sunday… …there is a speculative grade Italian security, Telecom Italia, the 5 1/4’s of 2022 are trading at 0.61 percent, that is a junk bond with a zero handle.” This bond traded with almost a 6 handle just 5 years ago… Thank you Mr Draghi. But it doesn’t stop there, Grant warns…

“…and since interest rates are critical in the pricing of financial instruments, these distortions preceded the uplift in all asset values.. and the manifestation of this manipulation is in many ways responsible for what we are now seeing in the markets.” These distortions and the chaotic aftermath of their withdrawal are exactly what current Fed Chair Powell warned of in 2013… “[W]hen it is time for us to sell, or even to stop buying, the response could be quite strong; there is every reason to expect a strong response. So there are a couple of ways to look at it. It is about $1.2 trillion in sales; you take 60 months, you get about $20 billion a month. That is a very doable thing, it sounds like, in a market where the norm by the middle of next year is $80 billion a month. Another way to look at it, though, is that it’s not so much the sale, the duration; it’s also unloading our short volatility position.

“I think we are actually at a point of encouraging risk-taking, and that should give us pause. Investors really do understand now that we will be there to prevent serious losses. It is not that it is easy for them to make money but that they have every incentive to take more risk, and they are doing so. Meanwhile, we look like we are blowing a fixed-income duration bubble right across the credit spectrum that will result in big losses when rates come up down the road. You can almost say that that is our strategy.”

But history merely rhymes.

• From Currency War To Trade War To Shooting War (Rickards)

Currency wars do not exist all the time; they arise under certain conditions and persist until there is either systemic reform or systemic collapse. The conditions that give rise to currency wars are too much debt and too little growth. In those circumstances, countries try to steal growth from trading partners by cheapening their currencies to promote exports and create export-related jobs. The problem with currency wars is that they are zero-sum or negative-sum games. It is true that countries can obtain short-term relief by cheapening their currencies, but sooner than later, their trading partners also cheapen their currencies to regain the export advantage. This process of tit-for-tat devaluations feeds on itself with the pendulum of short-term trade advantage swinging back and forth and no one getting any further ahead.

After a few years, the futility of currency wars becomes apparent, and countries resort to trade wars. This consists of punitive tariffs, export subsidies and nontariff barriers to trade. The dynamic is the same as in a currency war. The first country to impose tariffs gets a short-term advantage, but retaliation is not long in coming and the initial advantage is eliminated as trading partners impose tariffs in response. Despite the illusion of short-term advantage, in the long-run everyone is worse off. The original condition of too much debt and too little growth never goes away. Finally, tensions rise, rival blocs are formed and a shooting war begins. The shooting wars often have a not-so-hidden economic grievance or rationale behind them.

The sequence in the early 20th century began with a currency war that started in Weimar Germany with a hyperinflation (1921–23) and then extended through a French devaluation (1925), a U.K. devaluation (1931), a U.S. devaluation (1933) and another French/U.K. devaluation (1936). Meanwhile, a global trade war emerged after the Smoot-Hawley tariffs (1930) and comparable tariffs of trading partners of the U.S. Finally, a shooting war progressed with the Japanese invasion of Manchuria (1931), the Japanese invasion of Beijing and China (1937), the German invasion of Poland (1939) and the Japanese attack on Pearl Harbor (1941). Eventually, the world was engulfed in the flames of World War II, and the international monetary system came to a complete collapse until the Bretton Woods Conference in 1944.

We’re going to be watching this unfold until it’s too late.

• Central Banks Are The Agents Of Baby Boomers (G.)

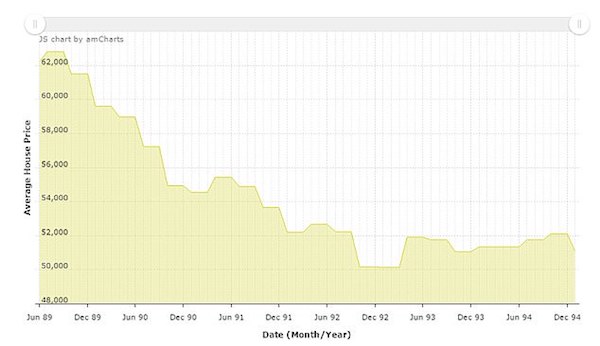

The greatest threat to our economy comes from its ageing population. With the baby-boomer generation making up a large proportion of society, we find ourselves in a situation where public policy is mostly geared towards shoring up the gains made by boomers over the past 40 years, and industrial disputes are driven by an ageing union membership most worried about its pension entitlements. It is a problem that Britain shares with its continental cousins, the US and Japan, now that all are struggling with a situation where a fifth of their populations is aged over 65 and the proportion is rising fast. Ageing populations have many effects on an economy, not least the desire among those nearing retirement age to save excessively.

Each country’s baby boomers pursue the holy grail of wealth slightly differently, but in the main, property and pensions are the twin pillars supporting decades of retirement. When wealth is your goal, there is one evil monster that needs slaying, and that is inflation. This is one of the main reasons that since the 1990s the Bank of England is under instruction to keep inflation anchored around 2%. A recent blog by economists at the Bank has caused a stir by arguing that far from the baby-boomer savings glut being a passing phase – or at least a situation that will fade as the boomers die off – it will be with us for decades to come.

They argue that boomers have shown that they want to keep saving even as they move into their 80s and 90s, to fund possible extra health and care costs, and to pass on the maximum amount of wealth they can to their heirs. Some academics have argued that boomers will be forced to spend more than they save in later life to pay for health and long-term care, but that doesn’t appear to be happening. The $100 trillion of savings sloshing round the global financial system just keeps growing. This is not just because people in young nations such as Indonesia and India are starting to build up savings, but because older Brits, Germans and Swedes are doing the same when there had been an expectation that they would switch to spending.

[..] The Bank of England blog argues that the persistent glut of savings in stocks, bonds and property will maintain the trend of the past 30 years – of an excess of money chasing too few investment opportunities. And if older savers resist spending some of their pension, demand for goods is lower than expected, and inflation stays low. Central banks, in seeking to maintain a 2% inflation target, are the agents of baby boomers. It is their savings and wealth that are protected, not those of the young, who have much less, if any.

This is not typical for Osborne or the UK. ‘Saving’ the economy by making the poor, poorer, is widely accepted.

• Osborne’s Austerity Has Left UK Social Fabric In Tatters (Pettifor)

There is growing consensus among economists that Osborne’s post-crisis austerity programme deepened and lengthened Britain’s post-crisis recession, causing public and private investment to fall further and real wages to decline. Making large reductions to government spending is itself a major reason why the economy has been so slow in recovering. (Consider the multiplier effect where an injection of public money helps generate income and tax revenues.) In his first budget (June 2010) Osborne told parliament: “We are on track to have debt falling and a balanced structural current budget by the end of this parliament” (ie March 2015).

He slashed welfare as promised, but the economy slowed further. While employment revived, jobs have been recast as part-time, temporary and insecure. As a result, productivity stalled. These declines will cause permanent damage to the British economy. Convinced that a chancellor should “never let a crisis go to waste”, Osborne used the opportunity to shrink the state, as cuts to government spending tore into welfare provision and public services. Real spend per head of population fell, and the real spend per head was particularly felt by the vulnerable citizen, as the population grew older and more fragile. Under his watch, total managed expenditure was cut in real terms by £14bn (2016-17 prices).

These cuts were made worse by a 3-4% rise in population, and by the increasing needs of an ageing population. Public sector net investment was allowed to fall from £60bn in 2010 to £35bn in 2016. It caused intense suffering to small and large firms and suppliers, many of which went and are going bust, laying off staff. The insistence on balancing the current budget also hurt millions of individuals innocent of the causes of the crisis.

Oxymoron self-immolation.

• How America’s Clean Coal Dream Unravelled (G.)

High above the red dirt and evergreen trees of Kemper County, Mississippi, gleams a 15-story monolith of pipes surrounded by a town-sized array of steel towers and white buildings. The hi-tech industrial site juts out of the surrounding forest, its sharp silhouette out of place amid the gray crumbling roads, catfish stands and trailer homes of nearby De Kalb, population: 1,164. The $7.5bn Kemper power plant once drew officials from as far as Saudi Arabia, Japan and Norway to marvel at a 21st-century power project so technologically complex its builder compared it to the moonshot of the 1960s. It’s promise? Energy from “clean coal”. “I’m impressed,” said Jukka Uosukainen, UN director for the Climate Technology Centre and Network, after a 2014 tour: “maybe using coal in the future is possible”.

Kemper, its managers claimed, would harness dirt-cheap lignite coal – the world’s least efficient and most abundant form of coal – to power homes and businesses in America’s lowest-income state while causing the least climate-changing pollution of any fossil fuel. It was a promise they wouldn’t keep. Last summer the plant’s owner, Southern Company, America’s second-largest utility company, announced it was abandoning construction after years of blown-out budgets and missed construction deadlines. “It hit us hard,” said Craig Hitt, executive director of the Kemper County Economic Development Authority. Some 75 miners, roughly half living inside Kemper County, have already been affected in a region where unemployment is 7.1% compared to a national average of just 4.1%. “It was going to be the biggest project in the history of the county, possibly in the state of Mississippi,” Hitt said.

Instead, this year, Kemper County was home to one of the first large coalmining layoffs of the Trump era. It’s failure is also likely to have a profound impact on the future of “clean coal”. “This was the flagship project that was going to lead the way for a whole new generation of coal power plants,” said Richard Heinberg, senior fellow at the Post Carbon Institute. “If the initial project doesn’t work then who’s going to invest in any more like it?” [..] a review by the Guardian of more than 5,000 pages of confidential company documents, internal emails, white papers, and other materials provided anonymously by several former Southern Co insiders, plus on- and off-record interviews with other former Kemper engineers and managers, found evidence that top executives covered up construction problems and fundamental design flaws at the plant and knew, years before they admitted it publicly, that their plans had gone awry.

“If you were to speak about an arms race, then an arms race began exactly at the time and moment the U.S. opted out of the Anti-Ballistic Missile Treaty..”

• Putin’s Megyn Kelly Interview (ZH)

NBC’s Megyn Kelly has tried to establish herself as the US media’s preeminent “Putin whisperer” since confronting the Russian president last year over allegations he sanctioned interference by hacking groups in the 2016 US presidential election. In a formal interview with the Russian president, Kelly asked the Russian leader about the latest development in the ongoing controversy, Mueller’s indictment of 13 Russians and 3 Russian entities for election meddling. Ignoring that the indictment stated that the alleged activities of the trolls at the Internet Research Agency had no impact on the outcome of the election, Kelly insisted on pressing the Russian president about why Russia hadn’t acted to prosecute the men – including Yevgeniy Prigozhin, a wealthy Russian businessman.

Putin pointed out that no formal requests had been made by the US government, and no effort to share the incriminating information had been made. “I have to see first what they’ve done. Give us a document, give us an official request” Putin said in the NBC interview adding that “We can not respond to that if they do not violate Russian laws.” Kelly responded by listing some of the allegations, before Putin insisted that they shouldn’t be presented to him personally – but to Russia’s general prosecutor. “This has to go through official channels, not through the press, or yelling and hollering in the United States Congress,” Putin said. The broadcast aired a day after Putin grabbed headlines in Western media by revealing that Russia had recently finished testing a range of nuclear weapons that were capable of evading US anti-ballistic missile batteries, showing animated footage and digital representations of the missiles’ capabilities striking Florida which prompted an uproar at the US State Department.

Meanwhile, even though Russia has repeatedly criticized the US and NATO for installing anti-ballistic missile shields in Eastern Europe that Russia says more closely resemble offensive missile batteries, Putin pushed back against questions about whether the US and Russia were entering a new Cold War. The Russian leader said anybody spreading these accusations are more concerned with propaganda than accurate representations of the relationships between the two countries. “My point of view is that the individuals that have said that a new Cold War has started are not analysts. They do propaganda.” Repeating a claim that has been made by many Russian officials, Putin said the arms race between the US and Russia began when George W Bush withdrew from the anti-ballistic missile treaty in 2002. “If you were to speak about an arms race, then an arms race began exactly at the time and moment the U.S. opted out of the Anti-Ballistic Missile Treaty,” he said.

Never a good idea for a party that losses big in elections to be in government; what are elections for? The SPD is so divided now it could turn its back on Merkel at literally any moment over the nexy 4-5 years.

• Germany’s SPD Votes For Coalition Handing Merkel Fourth Term (G.)

Germany’s Social Democratic party has agreed to form another “grand coalition” government with the conservative CDU, ending months of political uncertainty in Europe and guaranteeing Chancellor Angela Merkel a fourth term in office. Sunday’s announcement by the party’s leadership ends almost six months of uncertainty in German politics, the longest the country has been without a government in its postwar history. A majority of 66.02% members of 463,723 eligible SPD members voted in favour of renewing the constellation that has governed Germany for the last four years, its treasurer, Dietmar Nietan, confirmed at the party’s headquarters in Berlin.

“We now have some clarity”, said the Social Democrats’ caretaker leader, Olaf Scholz, a contender for the role of finance minister, speaking at the Willy Brandt House. “The SPD will enter into government”. The leadership of the SPD had initially ruled out joining Merkel in government in the wake of historically disappointing results at federal elections in September last year. But the collapse of talks to form an unorthodox “Jamaica” coalition between Merkel’s conservatives, the pro-business Free Democrats and the Green party forced the German centre-left back to the negotiating table, where it managed to secure a surprising victory in getting the chancellor to cede control of the influential finance ministry.

“..to borrow that €3 billion on behalf of its creditors, the Greek state added €816 million in interest payments to its debt repayments for 2025. Germany’s cost for rolling over the same sum, on the same day, was a mere €63 million…”

• Europe’s Band-Aid Ensures Greece’s Debt Bondage (Varoufakis)

The big moment, it is said, will come in August, when Greece will be pronounced a “normal” European country again. Recently, in preparation for the government’s return to the money markets – from which it has been effectively excluded since 2010 – Greece’s public-debt authority has been testing the waters with a long-term bond issue. Unfortunately, all the happy talk about impending “debt relief” and a “clean exit” from Greece’s third “bailout” obscures an uglier truth: the country’s debt bondage is being extended to 2060. And, by ossifying Greece’s insolvency, while pretending to have overcome it, Europe’s establishment is demonstrating its dogged refusal to address the eurozone’s underlying fault lines. This augurs ill for ALL Europeans.

For an EU country to be considered “normal,” it should be subject to the scrutiny facing countries that were never bailed out. That means the standard twice-yearly checks of compliance with the EU’s Stability and Growth Pact, as performed by the European Commission under the so-called European Semester procedure. Nevertheless, for countries like Ireland or Portugal, a tougher “post-program surveillance” procedure was designed following their bailouts: quarterly checks conducted not only by the European Commission but also by the European Central Bank.

It is plain to see why Greece’s road will be much bumpier than Ireland’s or Portugal’s. The ECB had already begun purchasing Irish and Portuguese debt in the secondary markets well before these countries’ bailout exit, as part of its “quantitative easing” program. This enabled the Irish and Portuguese governments to issue large quantities of new debt at low interest rates. Greece was never included the ECB’s quantitative easing program, for two reasons: its debt burden was too large to service in the long term, even with the help of ECB-sponsored low interest rates, and the ECB was under pressure, mainly from Germany, to wind down the program. Moreover, the post-program surveillance procedure does not give the “troika” of official creditors the leverage over Greece that they desire.

In celebrating Greece’s “clean exit,” while retaining its iron grip on the Greek government and withholding debt restructuring, Europe’s establishment is once again displaying its skill at inventing neologisms. Until 75% of Greece’s public debt is repaid – in 2060, at the earliest – the country, we are told, will be subject to “enhanced surveillance” (a term with unfortunate echoes of “enhanced interrogation”). In practice, this means 42 years of quarterly reviews, during which the European Commission and the ECB “in collaboration with the IMF” may impose new “measures” on Greece (such as austerity, fire sales of public property, and restrictions on organized labor). In short, the next two generations of Greeks will grow up with the troika and its “process” (perhaps under a different name) as a permanent fixture of life.

The celebration of Greece’s return to normality began a few weeks ago with the government’s oversubscribed €3 billion issue of its first seven-year bond in years. What the revelers failed to note, however, was that, to borrow that €3 billion on behalf of its creditors, the Greek state added €816 million in interest payments to its debt repayments for 2025. Germany’s cost for rolling over the same sum, on the same day, was a mere €63 million. Will Greece’s income rise by a similar amount between now and 2025 to make this sustainable?

“The agricultural feed companies, the chemical companies, the pharmaceutical companies that provide the antibiotics fed en masse to factory-farmed animals, the equipment manufacturers that sell cages and tractors – they all benefit.”

• Modern Food Farming Puts UK Wildlife Species At Risk Of Extinction (Ind.)

Some of Britain’s favourite wildlife is at risk of becoming extinct unless there is a new, 21st-century agricultural revolution, experts are warning. Species from hedgehogs to skylarks and birds of prey are being wiped out – in part by companies with vested interests in “destructive” factory farming, it was claimed on World Wildlife Day, which takes place today. The “alarming” declines in wildlife will threaten not just the richness of the planet but also our ability to grow food, according to the RSPB. After scientists warned last year that the world is facing a sixth mass extinction, turtle doves are on the brink of being wiped out, the latest survey figures show. Numbers of grey partridges, corn buntings and tree sparrows have dropped by at least 90 per cent in 40 years, leaving them all at risk of vanishing from Britain.

Earlier this month, a new report revealed that the number of hedgehogs in the countryside had more than halved since 2000. Nearly two-thirds of Britain’s skylarks and lapwings have disappeared, the European bird census showed, while Birdlife International says 95 per cent of turtle doves have vanished in 20 years. Just days after Environment Secretary Michael Gove unveiled plans to reward farmers who care for the environment, ornithologist Philip Lymbery warned of a culture among government policymakers and scientists of blaming biodiversity declines on climate change – instead of tackling those with “vested interests” in “disastrous” modern farming practices – because it was easier to avoid blaming anyone.

Mr Lymbery, head of charity Compassion in World Farming (CiWF), said changes in farming in the past half-century to drastically and artificially push up quantities of food produced were destroying species from nightingales to butterflies and peregrines. “I’m worried that policymakers and some scientists duck the issue by blaming all the things damaging nature on climate change,” he told The Independent. [..] “The agricultural feed companies, the chemical companies, the pharmaceutical companies that provide the antibiotics fed en masse to factory-farmed animals, the equipment manufacturers that sell cages and tractors – they all benefit. “It’s not the average farmer who benefits from industrial agriculture. And it needs to change.”

Hollywood mirrors international charities like Oxfam. Pedophilia rules both.

• Three Billboards In Hollywood, California (TAM)

Just days before the first Academy Awards ceremony since Hollywood was hit with allegations of rampant sexual harassment, assault, and pedophilia, a Los Angeles street artist made a bold statement just a few miles from the Dolby Theater where the Oscars will be held. Sabo, a conservative-leaning artist who has previously tagged the city with art referencing former President Obama’s drones, purchased three billboards, echoing the sentiment of a Academy Award-nominated film, Three Billboards Outside Ebbing, Missouri, which tells the story of a mother who seeks accountability for her daughter’s rape and murder, which police in her small town have failed to solve. In the film, the mother purchases three billboards that read:

“RAPED WHILE DYING”

“AND STILL NO ARRESTS?”

“HOW COME CHIEF WILLOUGHBY?”

In Sabo’s version, the billboards plastered in Hollywood read:

“AND THE OSCAR FOR BIGGEST PEDOPHILE GOES TO…”

“WE ALL KNEW AND STILL NO ARRESTS”

“NAME NAMES ON STAGE OR SHUT THE HELL UP!”

Kevin Spacey’s career went down in flames last year amid the fallout of widespread allegations of abuse by now-scorned producer Harvey Weinstein. Anthony Rapp accused the actor of making advances on him in 1986, when Rapp was only 14. Other accusations against Spacey followed, including some others that alleged Spacey attempted to take advantage of the victims when they were under the age of 18. Further, Corey Feldman, who has long warned of predatory, pedophilic behavior in Hollywood, revealed several of his accused abusers last year, citing John Grissom, former talent manager Marty Weiss, and Alphy Hoffman, who was the son of a high-power producer and ran the trendy Soda Pop Club, where Feldman claims widespread harassment took place in the 1980s.

Feldman claimed there were six abusers total, saying one is an A-list actor who might kill him. He has previously said his fellow child star, Corey Haim, now deceased, received worse abuse than he did. In a 2011 appearance on Nightline, Feldman said: “[T]he No. 1 problem in Hollywood was and is and always will be pedophilia…that’s the biggest problem for children in this industry… It’s the big secret.”