Roy Lichtenstein Femme d’Alger 1963

The Daily Mail ran 13 pages yesterday on the theme of Corbyn and Labour being terrorist apologists. No shame, no morals. In the same vein, I tried to find an objective piece on the Comey testimony, but couldn’t find one. The UK press has no faith in its voters, the US press has none in its Senate: the press draws the conclusions before anyone else can. The media cares little about credibility, it’s all echo chambers all the way down.

• UK Press Gang Up On Jeremy Corbyn In Election Day Coverage (G.)

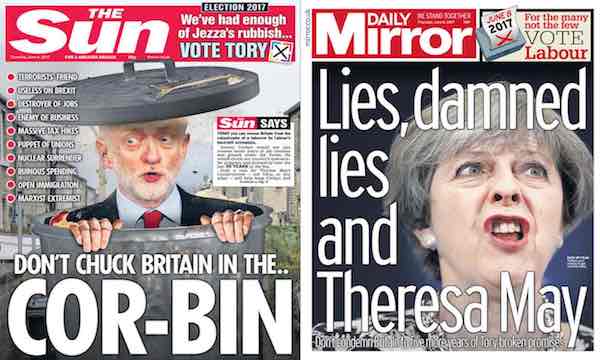

The Sun has urged its readers not to “chuck Britain in the Cor-bin” on its final front page before the country votes in the general election. The tabloid, owned by Rupert Murdoch’s News Corp, published an editorial on its front page under the headline “Don’t Chuck Britain in the Cor-bin” alongside 10 bullet points that described the Labour leader Jeremy Corbyn as a “terrorists’ friend”, “useless on Brexit”, “puppet of unions” and “Marxist extremist”. The article said readers could “rescue Britain from the catastrophe of a takeover by Labour’s hard-left extremists”. The Daily Mail front page roared, “Let’s reignite British spirit” on the back of a Theresa May speech and also promoted a feature inside called “Your tactical voting guide to boost the Tories and Brexit”.

The Daily Mirror reiterated its support for the Labour party with a front page headline of “Lies, damned lies, and Theresa May”, while the Daily Telegraph ran a story headlined “Your Country Needs You” based on an editorial by the prime minister that urged “patriotic” Labour supporters to vote Conservative. The Daily Express front page said: “Vote for May Today”. Meanwhile, the Times reported that the Conservatives had a seven-point in the final opinion poll before the election, and the Guardian covered May and Corbyn’s late attempts to win support from voters. Thursday’s front pages come after the Daily Mail devoted 13 pages to attacking Labour, Jeremy Corbyn, Diane Abbott and John McDonnell on Wednesday under the headline: “Apologists for terror”. The tabloid urged readers to support the Conservatives in an editorial on its first and second pages, but concentrated its fire on Labour’s leadership, compiling hostile anecdotes dating back to the 1970s.

“Instead of buying low and selling high, you’re buying high and crossing your fingers…”

• US Market Risk Is Highest Since Pre-2008 Crisis – Bill Gross (BBG)

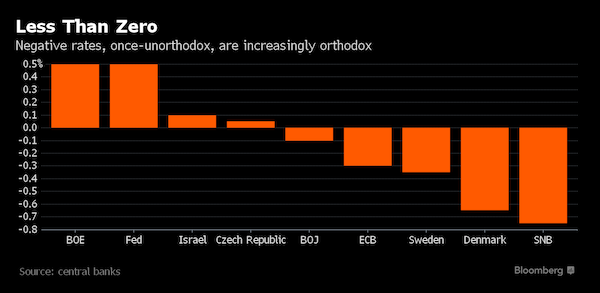

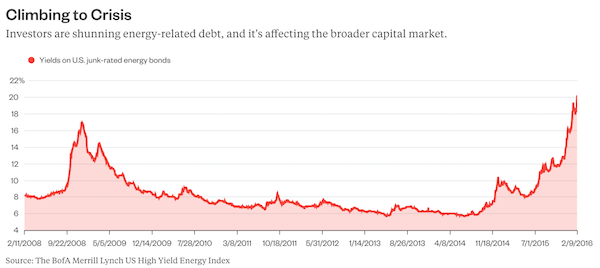

U.S. markets are at their highest risk levels since before the 2008 financial crisis because investors are paying a high price for the chances they’re taking, according to Bill Gross, manager of the $2 billion Janus Henderson Global Unconstrained Bond Fund. “Instead of buying low and selling high, you’re buying high and crossing your fingers,” Gross, 73, said Wednesday at the Bloomberg Invest New York summit. Central bank policies for low-and negative-interest rates are artificially driving up asset prices while creating little growth in the real economy and punishing individual savers, banks and insurance companies, according to Gross. The U.S. economy is expected to grow 2.2% this year and 2.3% in 2018, according to forecasts compiled by Bloomberg. Trump administration officials have said their policies will boost annual growth to 3%.

Despite being concerned about high asset prices, Gross said he feels required to stay invested and sees value in some closed-end funds. Examples he gave are the Duff & Phelps Global Utility Income Fund and the Nuveen Preferred Income Opportunities Fund. He also said he has about 2% to 3% in exchange-traded funds to get yield and add diversification. “They’re appetizers, not entrees,” he said in an interview outside the conference. Gross’s fund has returned 3.1% in the year through June 6, outperforming 22% of its Bloomberg peers. It has posted a total return of 5.4% since Gross took over management in October 2014 after he was ousted from PIMCO. ”If there’s a common factor it’s the expansion of credit,” Gross said on Bloomberg TV Wednesday. “And the credit that’s being generated by central banks. Money is being pumped out into the system and money that is yielding less than nothing seeks a haven not only in bonds that are under-yielding but in stocks that are overpriced.”

We know.

• Global Financial System More Leveraged Than 2008 – Paul Singer (BBG)

Billionaire investor Paul Singer said “distorted” monetary and regulatory policies have increased risks for investors almost a decade after the financial crisis. “I am very concerned about where we are,” Singer said Wednesday at the Bloomberg Invest New York summit. “What we have today is a global financial system that’s just about as leveraged – and in many cases more leveraged – than before 2008, and I don’t think the financial system is more sound.” Years of low rates have eroded the effectiveness of central banks to contend with downturns, Singer said at the event in an interview with Carlyle Group co-founder David Rubenstein. “Suppressive” fiscal, regulatory and tax policies have also exacerbated income inequality and led to the rise of populist and fringe political movements, he added. Confidence “could be lost in a very abrupt fashion causing conceivably a ruckus in bond markets, stock markets and in financial institutions,” said Singer, founder of hedge fund Elliott Management, which is known for being an activist investor.

Volatility is back.

• UK Housing Weakens Further as Market Emits ‘Ominous’ Signals (BBG)

While the general election had an impact on activity in May, damping buyer demand and new sellers coming to the market, RICS used its latest monthly report to highlight broader, and more damaging, risks. That includes the dearth of homes for sale, which has pushed up values in recent years, cutting off many potential first-time buyers. RICS Chief Economist Simon Rubinsohn said the report shows the issue of affordability may even worsen further.“Perhaps the most ominous signal is that contributors still expect house prices to increase at a faster pace than wages over the medium term despite the difficulty many first-time buyers are clearly having,” he said. On the shortage, “it’s hard to see this as anything other a major obstacle to the efficient functioning of the housing market.”

In May, RICS’s monthly price index fell to 17 – the lowest since August – from 23 in April, indicating modest price gains. A gauge for London, where prime properties have been under pressure, remained below zero for a 14th month. Nationally, the supply-demand imbalance means it’s a sellers’ market and recent reports show that any uncertainty about the election had little effect on U.K. asking prices, which according to Rightmove jumped 1.2% to a record in May. For some, it’s reminiscent of the overheating seen before the financial crisis.“Prices are too expensive,” Josh Homans at surveyors Valunation said in the RICS report. “Excessive” valuations are increasing and “we are now in a 2007 situation,” he said.

One of those must reads. Economics is all but dead, but not entirely yet.

• The Cost of Getting It Wrong (Claire Connelly)

What most of us have long believed about how the economy works is based on a set of fundamental myths, supported by a series of inappropriate and misleading metaphors, from which it is difficult to escape. The emotional investment we have made in these myths has allowed for levels of unemployment, underemployment, inequality and relative poverty which would have seemed incredible a generation ago. Somehow we have convinced ourselves of the following:

– Governments need taxpayers’ money to pay for things.

– Governments, like households, need to at least balance their budgets.

– Deficits are bad and government surpluses are good.

– Deficits paid for by printing money causes inflation.

– Surpluses set aside savings which can be spent in the future.

– Lower wages promote full employment.Wrong, wrong, all wrong. The federal government does not need taxpayers’ money. Actually, it is the other way around. The government issues the currency. We use it. Taxes help to control inflation and stop us spending too much. (It can also be used to control behaviour, as witnessed by taxes on cigarettes and alcohol). Professor Steve Keen says the government, and the public, have the most basic fundamentals of macroeconomics backwards. “Expenditure is what causes income,” he said. “Reducing expenditure also reduces income.” “Individuals can save (without a significant effect on national income), but if you extrapolate that to the whole economy, you are going to make a huge error.” Similarly, the economist says the idea that the government can save by paying down the national debt is misleading.

“Believing that government saving will increase employment or growth is like believing the Earth sits at the centre of the universe”, he says. All it does is destroy spending which would otherwise have created private sector incomes. “If you don’t understand where income comes from, then it means you don’t understand economics, or the economy.” “Individuals can save money by spending less than they earn but if everyone decides to do that, income falls by precisely as much as you try to save. If the government does the same thing, by saving money at a national level, you cause a recession.”

As solid as the Saudi grip on OPEC cuts: “Abu Dhabi’s Petroleum Ports Authority removed the ban on Wednesday – just one day after announcing it.”

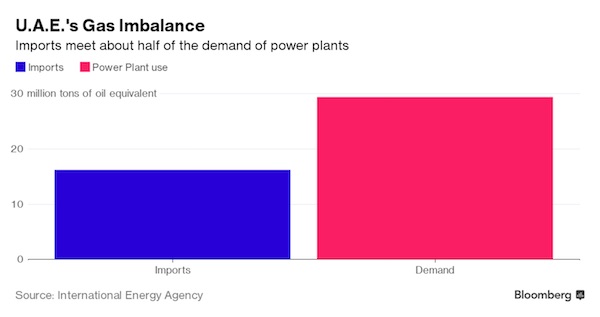

• The UAE Needs Qatar’s Gas to Keep Dubai’s Lights On (BBG)

When it comes to natural gas shipments, the United Arab Emirates needs Qatar more than Qatar needs the U.A.E. The U.A.E. joined Saudi Arabia in cutting off air, sea and land links with Qatar on Monday, accusing the gas-rich sheikhdom of supporting extremist groups. But the U.A.E., which depends on imported gas to generate half its electricity, avoided shutting down the pipeline supplying it from Qatar, which has the world’s third-largest gas deposits. Without this energy artery, Dubai’s glittering skyscrapers would go dark for lack of power unless the emirate could replace Qatari fuel with more expensive liquefied natural gas. Qatari natural gas continues to flow normally to both the U.A.E. and Oman through a pipeline, with no indication that supplies will be cut, according to a person with knowledge of the matter who asked not to be identified because the information isn’t public.

Qatar sends about 2 billion cubic feet of gas a day through a 364-kilometer (226-mile) undersea pipeline. Dolphin Energy, the link’s operator, is a joint-venture between Mubadala Investment, which holds a 51% stake, and Occidental Petroleum and Total, each with a 24.5% share. Since 2007, the venture has been processing gas from Qatar’s North field and transporting it to the Taweelah terminal in Abu Dhabi, according to Mubadala’s website. Dolphin also distributes gas in Oman. Apart from preserving gas shipments from Qatar, the U.A.E. on Wednesday actually eased efforts to isolate its smaller neighbor. The oil-port authority in Abu Dhabi, the U.A.E. capital, lifted restrictions on international tankers that have sailed to Qatar or plan to do so. Abu Dhabi’s Petroleum Ports Authority removed the ban on Wednesday – just one day after announcing it.

The Saudi-Qatar spat is growing and oil plunges? Huh?

• Oil Prices Drop More Than 4% On Surge In Stockpiles (CNBC)

U.S. crude prices plunged toward $46 a barrel on Wednesday after weekly government data left the oil market with virtually nothing to cheer. West Texas Intermediate futures dropped more than 4% as stockpiles of oil in the US surged by 3.3 million barrels in the week ended June 2, according to the Energy Information Administration. That confounded analysts’ estimates for a 3.5 million-barrel decline. WTI prices fell as far as $45.92, a four-week low, following the report. The drop below $47 was a “big deal” said John Kilduff at energy hedge fund Again Capital. The next level to watch is the March low just below $44 a barrel, struck after oil prices fell through a number of key technical levels, culminating in a flash crash to $43.76. The bad news kept on coming below the headline figure. Gasoline stocks also jumped by 3.3 million barrels, more than five times the expected increase. Inventories of distillate fuels like diesel and heating oil rose by 4.4 million barrels, 15 times the anticipated rise.

Author of “China’s Guaranteed Bubble”.

• China’s Top Property-Bubble Prophet Says Prices Set to Soar 50% (BBG)

China’s home prices could rise by another 50% in the nation’s biggest cities, as the latest measures to rein them in are likely to be eased by policy makers seeking to support the broader economy. So says Zhu Ning, deputy director of the National Institute of Financial Research at Tsinghua University in Beijing and author of “China’s Guaranteed Bubble: How Implicit Government Support Has Propelled China’s Economy While Creating Systemic Risk.” As measures to curb housing prices drag on growth in the second half and early next year, he says, the government will resort to its old playbook of dialing them back again to shore up expansion. “We’re living through a bubble,” Zhu said. “If we don’t engage in more meaningful reform, which we haven’t, we’re very likely to have a financial crisis or a burst of the bubble. It’s a matter of sooner or later.”

Real estate prices in major cities will surge again “by another 50% or so” after measures to rein them in are eased, said Zhu, without specifying a time. Because policy makers have previously imposed curbs only to ease them again, people see them as a bluff, he said. Last year 45% of new loans went to mortgages. Local authorities have boosted down-payment requirements, restricted purchases by non-residents, and capped the number of dwellings that a household can own. Since March, at least 26 cities have imposed resale lock-up periods, with Hebei’s Baoding city slapping a decade-long ban on some homes, according to Shanghai-based Tospur Real Estate Consulting.

Zhu said he arrived at the 50 percent estimate based on the average price appreciation after past curbs were lifted, an ever-stronger belief among buyers that housing prices will rise, China’s humongous supply of credit, and tighter controls on capital outflows. Over the past year, however, Zhu, who earned his doctorate in finance at Yale, said he’s had more doubts over whether the thinking of western-trained economists applies to a nation that’s proven naysayers wrong “with its might and its determination” for three decades. “Over the past 12 months my confidence has really been shaken,” he said, adding that a crisis remains probable. “Could China be the black swan that we’ve never seen before?”

Where would the EU be without creative accounting?

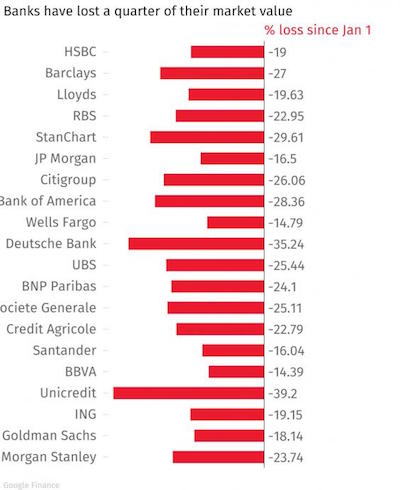

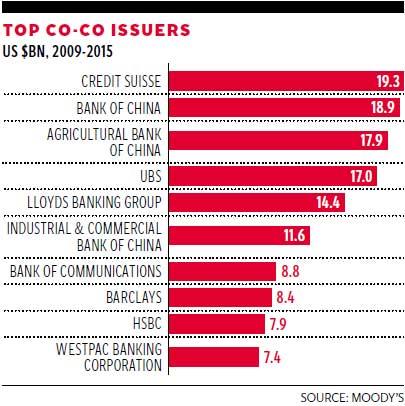

• Banco Popular Wipeout Leaves CoCo Bonds On The Drawing Board (BV)

Banco Popular’s wipeout has left CoCo bonds on the drawing board. The Spanish lender’s failure and rescue by rival Santander did not provide the expected test for bonds which convert into equity under stress: the securities were wiped out before they could be triggered. It’s still not clear whether the bonds work as intended. The collapse of Spain’s sixth-largest bank by assets marked the first big loss for investors in so-called contingent convertible bonds. The securities were created after the 2008 financial crisis to provide an extra buffer when banks are struggling. They permit lenders to preserve capital by suspending dividends, and convert into ordinary shares when capital ratios run low.

The Popular trauma has eased one fear: that investors would panic when a CoCo bond went down, creating a spiral of contagion to other lenders. Similar securities issued by other Spanish banks actually rose in value on June 7, suggesting that investors see Popular as an isolated case. Yet in another way, Popular’s bonds fell short. The securities are supposed to provide extra capital before a bank fails, allowing it to absorb losses over time without failing or requiring a government bailout. But regulators deemed Popular non-viable before any of the triggers in its bonds could blow. The CoCo bonds suffered the same fate as other, more senior bonds that only suffer losses when a bank goes bust.

Civil servants and jobs for life. It’s like talking about dinosaurs.

• A Reform Beyond Macron’s Grip: The Revolving Door of French Politics (BBG)

French President Emmanuel Macron has promised to change how politics is done in France, starting with the parliament to be elected beginning Sunday. Half of the 500-plus candidates for his young party are women. Half have never held office. They all had to apply online. But he isn’t taking the biggest step: requiring that anyone running for parliament resign from his or her government job. Unlike many other other developed countries, France allows bureaucrats to hold political office—multiple offices, in fact—without having to quit the civil service. And they have a guaranteed right to return. Should the bureaucrat-candidate lose an election, there’s a job for life waiting back at the Agriculture Ministry or the Ministry for Overseas Territories. And a pension at retirement.

Having lawmakers remain part of the civil service creates conflicts of interest, said Dominique Reynie, head of Fondapol, a political research institute. “You have lawmakers making funding decisions about institutions such as universities and hospitals where they are still officially employed,” he said. “We have a parliament that’s inbred.” Among the many beneficiaries of the system: Macron’s prime minister, Edouard Philippe, several others in the cabinet and fully 55% of the parliament that just finished its five-year term. Macron himself, though he’s never been in parliament, kept bureaucrat status through several government and private jobs until he resigned last year to start his political party.

[..] “France is one of the rare countries in Europe where a civil servant can serve an elected mandate without resigning, and with the certainty of going back to their job in case of failure,” said Luc Rouban, a professor at Sciences Po in Lille who has compiled a database of all 2,857 French members of parliament back to 1958. “The absence of professional risk encourages employees from the public sector to run for office.”

And that will make any agreements with the Troika impossible. All growth assumptions are wrong.

• OECD Puts Greek Growth At Just 1.1% This Year (K.)

The OECD has further doused hopes regarding Greek growth this year, forecasting an expansion of 1.1%, and stresses the need to implement reforms and for the national debt to be lightened. The Organization for Economic Cooperation and Development wrote in its annual report on the global economy published on Wednesday that “delays in reform implementation and reaching an agreement on debt relief would weigh on confidence, hampering investment,” while adjusting its Greek GDP forecast. The 1.1% growth it expects contrasts with the 2.7% growth the budget provides for, the recent European Commission estimate for 2.1% and even the 1.8% forecast included in the midterm fiscal plan the government voted for last month.

Still, the OECD says in its Global Economic Outlook that the economy will expand by 2.5%. It anticipates the primary budget surplus to slide from last year’s 3.8% of GDP, but no lower than 2.5% of GDP for the next few years. The report notes that the Greek economy is beginning to recover although uncertainty remains over the country’s growth prospects. Further progress in reforms is necessary for productivity and exports to grow, the OECD argues. It makes special reference to the reforms in the products markets and in the reduction of nonperforming loans, which could lead to more exports and investments. It also warns that “the expansion of exports depends largely on the pace of world trade growth. Geopolitical tensions among Greece’s neighbors and a renewed large influx of refugees would pose additional risks.”

Who does any of the parties involved think they’re fooling? A serious question.

• Athens To Seek Growth Package At Eurogroup Meeting (K.)

Ahead of yet another crucial Eurogroup on June 15, the government has its mind set on seeking a package of growth-inducing measures which it hopes may, finally, pry open the door that will ultimately put Greece on the road to recovery. Athens believes that securing such a package could work to bridge the difference between the country’s EUpartners, and lead to an agreement which could pave the way for Greece to access international markets. Speaking to reporters on Wednesday, government spokesman Dimitris Tzanakopoulos outlined three basic principles that should govern any proposal that comes Greece’s way at the meeting of the eurozone finance ministers. Firstly, he insisted that the proposal must specify, in the clearest possible way, what midterm debt relief measures Greece should expect.

Secondly, these measures should also allow all the institutions, including the ECB, to proceed with positive sustainability studies of the Greek debt. Finally, he said, a proposal must include specific measures that will boost growth. The government reckons that a growth-oriented agreement will prompt the IMF to positively revise its projections on the Greek economy, reduce its demands with regard to the Greek program, and open the way for an agreement. Athens believes the formula that is being promoted to get the Fund to join the Greek bailout will stipulate that it will not have to provide immediate funding. Instead, the IMF’s contribution will be placed in a fund of sorts, which will be made available at a later date, on the condition that the midterm debt relief measures are implemented.

Why have none of the other countries involved ever said a word?

• Greece Says Colombian Gangs Plundering Hospitals Europe-Wide (AP)

Greek authorities say Colombian organized crime rings were behind a string of heists targeting costly medical diagnostic equipment from hospitals in Greece and another 11 European countries. Police say three Colombian suspects have been identified in connection with last month’s four thefts in Greece. Four out of about a dozen stolen pieces of equipment, worth more than half a million euros, have been recovered in Colombia. There were similar thefts in the past four years in France, Germany, Italy, Austria, the Netherlands, Spain, Poland, Lithuania, Luxembourg, Croatia and the Czech Republic, Major-General Christos Papazafeiris said. Papazafeiris, head of security police for the greater Athens region, said Wednesday the stolen equipment had been mailed to Colombia, and was seized in cooperation with local authorities.

Airbnb is huge in Athens. Must cost the government a fortune in taxes. Why then liberalize laws even more?

• Greek Room Owners Threaten To Return Permits in Airbnb Challenge (K.)

Owners of rooms for rent are threatening to return their operating licenses to the state unless the government withdraws legal clauses that fully liberalize the short-term urban lease market where accommodation is advertised through platforms such as Airbnb and Homeaway. According to a statement by the Confederation of Greek Tourism Accommodation Entrepreneurs (SETKE), if the room owners do hand in their licenses they will be able to enjoy the special privileges of the short-term rental market, which, it argues, has created unfair competition at the expense of legal accommodation. In its statement it claims this will lead to the elimination of the tourism accommodation sector’s 30,000 small entrepreneurs. “Instead of withdrawing the semi-liberal status of the short-term urban lease market under the 2016 law, the government is fully liberalizing it with a 2017 law abolishing the quantitative and qualitative limitations and permitting the rental for tourism purposes of all properties of all owners year round without any income limits,” SETKE says.

The EU keeps thinking reality is whatever it wants it to be. The European Parliament President says: “The rules have to be the same for everybody.”. They’re not. They’re obviously different for Greece, and that’s not Greece’s doing.

• Bid For EU States To Stop Migrants, Refugees ‘Asylum Shopping’ (K.)

As Greece continues to struggle to host thousands of migrants, European Parliament President Antonio Tajani on Wednesday called for a common agreement from all European Union member-states on the implementation of asylum procedures aimed at stopping migrants traveling from one country to another “shopping for asylum status.” “At the moment the rules are not properly harmonized,” Tajani told reporters. “The rules have to be the same for everybody. Otherwise we will end up with people shopping for asylum status, which undermines our credibility.” He noted that many refugees who have been accepted in European countries as part of an EU relocation program have continued their journeys to more prosperous nations such as Germany or Sweden.

Latvia welcomed 380 refugees as part of the relocation program but most of those – 313 – have already moved on to Sweden or Germany, according to Agnese Lace from Latvia’s Center for Public Policy. She said low salaries, a lack of jobs and language barriers meant asylum seekers had little incentive to remain in the country. Meanwhile Andras Kovats of the Hungarian Association for Migrants said Hungary’s failure to support integration was pushing new arrivals abroad. In a related development, Nils Muiznieks, the Council of Europe’s commissioner for human rights, expressed concern at reports of collective expulsions of asylum seekers from Greece to Turkey. “I urge the Greek authorities to cease immediately the pushback operations and uphold their human rights obligation to ensure that all people reaching Greece can effectively seek and enjoy asylum,” Muiznieks said in a statement.