Edgar Degas Danseuse au Tutu Vert 1887

Excellent. We need many more alternative voices in the debate. Thinking of posting the whole letter, but it’s an editor’s nightmare, looks as if the “i” on his keyboard is AWOL half the time.

Geert Vanden Bossche, DMV, PhD, independent virologist and vaccine expert, formerly employed at GAVI and The Bill & Melinda Gates Foundaton.

• Mass Vaccinaton Amidst A Pandemic Creates An Irrepressible Monster (VDB)

As stated, I am not against vaccinaton. On the contrary, I can assure you that each of the current vaccines have been designed, developed and manufactured by brilliant and competent scientsts. However, this type of prophylactc vaccines are completely inappropriate, and even highly dangerous, when used in mass vaccinaton campaigns during a viral pandemic. Vaccinologists, scientsts and clinicians are blinded by the positve short-term efects in individual patents, but don’t seem to bother about the disastrous consequences for global health. Unless I am scientfcally proven wrong, it is difficult to understand how current human interventons will prevent circulating variants from turning into a wild monster.

Racing against the clock, I am completing my scientfc manuscript, the publicaton of which is, unfortunately, likely to come too late given the ever increasing threat from rapidly spreading, highly infectous variants. This is why I decided to already post a summary of my fndings as well as my keynote speech at the recent Vaccine Summit in Ohio on LinkedIn. Last Monday, I provided internatonal health organizatons, including the WHO, with my analysis of the current pandemic as based on scientfcally informed insights in the immune biology of Covid-19. Given the level of emergency, I urged them to consider my concerns and to initate a debate on the detrimental consequences of further ‘viral immune escape’. For those who are no experts in this feld, I am attaching below a more accessible and comprehensible version of the science behind this insidious phenomenon.

While there is no tme to spare, I have not received any feedback thus far. Experts and politcians have remained silent while obviously stll eager to talk about relaxing infecton preventon rules and ‘springtme freedom’. My statements are based on nothing else but science. They shall only be contradicted by science. While one can barely make any incorrect scientfc statements without being critcized by peers, it seems like the elite of scientsts who are currently advising our world leaders prefer to stay silent. Sufcient scientfc evidence has been brought to the table. Unfortunately, it remains untouched by those who have the power to act. How long can one ignore the problem when there is at present massive evidence that viral immune escape is now threatening humanity? We can hardly say we didn’t know – or were not warned. In this agonizing leter I put all of my reputaton and credibility at stake. I expect from you, guardians of mankind, at least the same. It is of utmost urgency. Do open the debate. By all means: turn the tide!

The key queston is: why does nobody seem to bother about viral immune escape? Let me try to explain this by means of a more easily understood phenomenon: Antimicrobial resistance. One can easily extrapolate this scourge to resistance to our self-made ‘antviral antbiotcs’. Indeed, antibodies (Abs) produced by our own immune system can be considered self-made antviral antibiotcs, regardless of whether they are part of our innate immune system (so-called ‘natural’ Abs’) or elicited in response to specifc pathogens (resulting in so-called ‘acquired’ Abs). Natural Abs are not germ-specifc whereas acquired Abs are specifcally directed at the invading pathogen. At birth, our innate immune system is ‘unexperienced’ but well-established.

It protects us from a multtude of pathogens, thereby preventing these pathogens from causing disease. As the innate immune system cannot remember the pathogens it encountered (innate immunity has no so-called ‘immunological memory’), we can only contnue to rely on it provided we keep it ‘trained’ well enough. Training is achieved by regular exposure to a myriad of environmental agents, including pathogens. However, as we age, we will increasingly face situatons where our innate immunity (often called ‘the frst line of immune defense’) is not strong enough to halt the pathogen at the portal of entry (mostly mucosal barriers like respiratory or intestnal epithelia). When this happens, the immune system has to rely on more specialized effectors of our immune system (i.e., antgen-specifc Abs and T cells) to fght the pathogen.

So, as we grow up, we increasingly mount pathogen-specifc immunity, including highly specifc Abs. As those have stronger affinity for the pathogen (e.g., virus) and can reach high concentratons, they can quite easily outcompete our natural Abs for binding to the pathogen/virus. It is precisely this type of highly specifc, high affinity Abs that current Covid-19 vaccines are inducing. Of course, the noble purpose of these Abs is to protect us against Covid-19. So, why then should there be a major concern using these vaccines to fight Covid-19? Well, similar to the rules applying to classical antimicrobial antibiotcs, it is paramount that our self-made ‘antviral antibiotcs’ are made available in suffficient concentraton and are tailored at the specifc features of our enemy

This is what the above article addresses. The variants don’t arise despite the vaccines, but because of them.

• UK Covid-19 Variant Has Significantly Higher Mortality Rate Than Others (RT)

The strain of Covid-19 originally discovered in Kent, South East England, is associated with a much higher risk of fatality, according to new research carried out by the universities of Exeter and Bristol. A study published on Wednesday in the British Medical Journal (BMJ) says that the B117 variant, often referred to as the ‘British’ or ‘Kent’ strain, is 30-100 percent more deadly than other Covid-19 variants in circulation. “Coupled with its ability to spread rapidly, this makes B117 a threat that should be taken seriously,” said Robert Challen, a researcher at Exeter University, who co-led the research. Challen’s team found that the new variant caused 227 deaths in a sample of 54,906 patients, while 141 people died in a sample of the same number of people who had been infected with other Covid-19 strains.

Leon Danon, a senior author of the study and a professor at the University of Bristol, said that “there is a real concern that other variants will arise with resistance to rapidly rolled out vaccines,” and stated that monitoring new variants must be “a key part of the public health response in the future”. Researchers had already estimated that the virus’s mutations meant it was 53 percent more contagious. The strain was first identified in September 2020 along with hundreds of other variants, but it wasn’t until the English lockdown in November that scientists realised it probably associated with surging infection rates in Kent and England’s South East as case numbers decreased in other parts of the country.

“..science has shown “schools can remain fully open safely.”

• Scientists Accuse CDC Of Misinterpreting Their Research (F.)

A group of researchers whose work has been cited by the Centers for Disease Control and Prevention is accusing the agency of ignoring their positive findings about low transmission rates in schools and putting out overly stringent school reopening guidelines. The four researchers—Dr. Tara Henderson and Dr. Daniel Johnson of the University of Chicago, Dr. Monica Gandhi of the University of California-San Francisco and Dr. Tracy Tracy Beth Hoeg of the University of California-Davis—labeled the guidelines released last month by the CDC “harmful” in a Tuesday USA Today op-ed, arguing that science has shown “schools can remain fully open safely.”

The researchers say the CDC, which on its website cites one of their studies showing minimal transmission in Wisconsin schools with high community positivity rates, ignored their research, as well as findings from the broader scientific community that have highlighted the low risks associated with Covid-19 for children and the lack of science mandating 6-feet of distance between children wearing masks. “Although the guidance cites the work performed across Wisconsin districts performed by our group,” the researchers said, the CDC guidance does not “take that data and new analyses from that dataset into account.”

They argue keeping schools closed or even partially closed is “unwarranted, is harming children, and has become a human rights issue,” and sought to dispel fears about the impact of variants, arguing Switzerland and Belgium have demonstrated that K-12 schools can remain fully open safely even after the U.K. variant becomes the dominant strain. “President Joe Biden ran on a campaign indicating that science and data would guide his policy,” the researchers wrote. “As we approach the anniversary of the first Covid-19 shut down, this approach is needed more than ever, especially when it comes to schools.”

A study published Tuesday on the partial reopening of public schools in New York City found students did not have a higher prevalence of Covid-19 compared with the general community. Though the transmission rate was higher among teachers and staff, just 191 of the 36,000 students and staffers in schools quarantined after a school virus exposure tested positive for the virus (a 0.5% transmission rate).

This is scarier than the virus.

• Digital Health Pass: IBM and Moderna to Capitalize on COVID Reset (MPN)

IBM is partnering with Covid-19 mRNA vaccine maker Moderna to track vaccine administration in real time through its various blockchain, Artificial Intelligence, and hybrid cloud services. According to a company press release, the collaboration will “focus on exploring the utility of IBM capabilities in the U.S.,” such as a recently unveiled pilot program for a Covid-19 Digital Health Pass in the State of New York, which effectively deputizes private businesses to enforce government-imposed Covid-19 regulations. New York Governor Andrew Cuomo announced the initiative, billed as the “Excelsior Pass,” during his 2021 State of the State Address in January and the program’s initial phase was tested at the Barclays Center during an NBA game, followed by another test at Madison Square Garden for an NHL game on March 2.

According to the state’s official website, the trial runs were designed to maximize “return on investment and saving development time” before submitting the “wallet app” to the Google and Apple app stores. “The Excelsior Pass will play a critical role in getting information to venues and sites in a secure and streamlined way,” said Cuomo, who in February rolled out the state’s reopening guidelines for sports and entertainment venues, which would pave the way “to fast-track the reopening of these businesses and getting us one step closer to reaching a new normal.” Built on IBM’s Digital Health Pass technology, the QR code-based health data tracking app is only one of multiple blockchain ledger applications the company will leverage as part of its partnership with Moderna.

Others include their Blockchain Transparent Supply and Food Trust services, which use the open-source Hyperledger technology to share supply-chain and food sourcing “credibility” data respectively with enterprise customers. IBM’s Blockchain World Wire cross-border payment processing service rounds out the blockchain ecosystem that will serve to “enhance” supply chain visibility and “real-time” vaccine management and administration. Using what have already become clichéd industry buzzwords like “transparency,” “trust,” and even “privacy,” IBM’s Digital Health Pass marketing literature describes the mass tracking app as a “smart way to return to society” that allows people to “return to the activities and things they love.”

Oh sure.

• 2 Separate Studies Debunk Theory That Vitamin D Protects Against Covid-19 (RT)

Two separate non-peer-reviewed studies looking into the use and effectiveness of Vitamin D against Covid infection have both reached the same conclusion: there’s no clear benefit to using supplements. In the first study, researchers examined a database of nearly 450,000 mostly white people of European ancestry to understand whether giving them vitamin D supplements would lower the probability of contracting Covid-19. The researchers, from 10 separate universities in Canada, Israel, Japan, Italy and the UK, looked at genetic markers that would leave people predisposed to vitamin D deficiencies. They concluded that “vitamin D supplementation as a means of protecting against worsened Covid outcomes is not supported by genetic evidence,” they wrote in the study.

“Other therapeutic or preventative… avenues should be given higher priority for Covid-19 randomized controlled trials.” In the second study debunking vitamin D’s usefulness against Covid, researchers from the Aristotle University of Thessaloniki in Greece examined data on vitamin D deficiency from 24 European countries and compared it to data on Covid infections, recoveries and deaths. The researchers, who did not include data from people living in nursing homes, looked at how vitamin D deficiency rates varied across European nations and compared that data to infection rates.

They concluded that the “prevalence of vitamin D deficiency was not significantly associated with either the number of infections, recoveries or mortality rate of Covid-19” across Europe. The two new studies contradict a preprint study released in mid-February by researchers at the University of Barcelona. It suggested that giving high doses of vitamin D to Covid patients in hospital could cut deaths by 60 percent. The Lancet, a leading medical journal in the UK, has since removed the paper from its server after concerns were expressed over the methodology used to support its conclusion.

Odd mix of anti-vaxxers.

• France Faces Challenge To Persuade Millions Of Vaccine Sceptics (Sky)

As much of the world desperately seeks COVID vaccines, there is evidence in France that millions of people are reluctant to have a jab. The most recent polls suggest around half of the adult population may refuse a vaccination – leading health professionals to worry about public safety long term. Vaccine scepticism is high in many European countries and in few places more than France where so-called “anti-vax” websites and platforms have drawn thousands of followers. One of the most active sites is run from a tiny French village by Marie Werbregue who believes her daughter and others developed autism from childhood vaccines – a claim widely disputed by the medical profession and pharmaceutical companies.

She tells us: “I have never, ever been scared of COVID. I know for a fact that it’s simply a nasty flu and that’s not what scares me.” She states she will not have a coronavirus vaccine and when challenged that could put others at risk she says: “If one uses the logic that the vaccine is effective, how does an unvaccinated person affect the life of a vaccinated person? “Let’s say that I get the vaccine, I take the risks. I have the right to choose, when it concerns my life. I’m not going to risk my life, or even die for someone else. Why should I make this sacrifice?” While Marie Werbregue’s view, and her outspoken positions on vaccines and big pharma companies represent an extreme position in France, there is plenty of evidence millions of people lack confidence in inoculations and historically have been much more reluctant to have them.

French health sociologist Dr Caroline De Pauw speaks to us from the University of Lille and says that fear and scepticism are rooted in past health scares especially over the hepatitis B vaccine in the 1990s. “At the time there was the scandal that linked the vaccine with cases of multiple sclerosis. And suddenly, a link was made which has since been denied by all health authorities, including independent medical authorities, because of links with the pharmaceutical industry. “And France has trouble going beyond this issue of hepatitis B and links with the pharmaceutical industry.”

[..] Even many medical professionals have refused to receive the AstraZeneca vaccine. And you don’t have to approach too many members of the public to hear the doubts. One man in Lille told us: “I’m against it, especially when we see so much pushback and that even nursing staff do not want to be vaccinated. “There is only a quarter of nursing staff in France who have accepted it, and that raises questions. So, ordinary people like me, we also ask ourselves questions.”

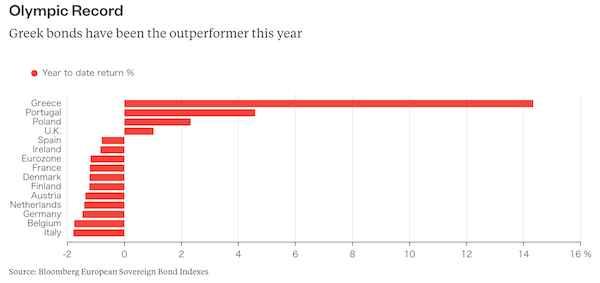

One more effect of the American Rescue Plan. They can’t let the euro rise too much.

• ECB To Signal Faster Money Printing To Combat Yield Rise (R.)

The European Central Bank is likely to signal faster money printing on Thursday to keep a lid on borrowing costs but it will stop short of adding firepower to its already aggressive pandemic-fighting package. Concerned that a steady rise in borrowing costs could derail the bloc’s recovery from a pandemic-fuelled recession, ECB policymakers meeting on Thursday will be keen to calm markets and recommit to rock-bottom rates until well into the recovery. But converting that commitment into specific policy action will be a delicate balancing act. The ECB cannot appear to micro-manage bond yields since that would tie its hands in the future and invite accusations it is shielding governments from market forces.

The euro zone’s central bank will also be keen not to overstate the rise in yields, which are still low by most standards, with the German yield curve, the benchmark for the 19-country bloc, still in negative territory up to 20 years. Having already committed to “maintaining favourable financing conditions”, however, it cannot ignore the rise in borrowing costs, which has not been matched by improving economic prospects and mostly mirrors a move in U.S. Treasuries. Policymakers have already approved all the firepower needed to combat the rise in yields, so technically no decision is required. The ECB still has a 1 trillion euro quota to buy bonds through next March, with flexibility to tailor volumes to market conditions.

“..the White House is preparing a series of devastating cyberattacks on Russia..”

• Putin Warns Against US ‘Retaliation’ For SolarWinds Hack (ZH)

Russian President Vladimir Putin has reacted fiercely to the contents of a report in the The New York Times this week that cited unnamed senior admin officials to say the White House is preparing a series of devastating cyberattacks on Russia as ‘retaliation’ for the SolarWinds hack. A spokesman for the Russian presidency, Dmitry Peskov, told reporters on Tuesday that the “alarming information” would constitute a “pure international cybercrime” and is thus condemned under international law. “The Russian state has never had anything to do with cybercrimes and cyberterrorism it is being accused of,” Peskov emphasized. Specifically addressing the NY Times report further, Peskov added, “the fact that the newspaper doesn’t rule out that the American state could be involved in cybercrime, is definitely of great concern to us.”

Amazingly, the anonymous Biden admin officials revealed to the Times that a “series of clandestine actions across Russian networks” are expected to start within the next three weeks. The cyber-operations will by design seek to get Putin and Russian intelligence’s attention while being concealed from the broader public when it occurs, the NYT report said. Detailing the Kremlin’s condemnation and warning against any such cyber espionage, US News & World Report writes: “He spoke in response to a series of claims from U.S. officials, including Secretary of State Antony Blinken and FBI Director Christopher Wray, that they are considering harsh punishments on Russia for the attack, including overt sanctions and some form of covert salvos in the cyber realm. Wray hinted at the action in testimony before Congress this month, saying the U.S. was preparing cyber “joint sequenced operations.”

It’s not just Twitter.

• Russia Begins Slowing Down Twitter, Warns It Could Block Service Altogether (RT)

Twitter users in Russia are about to find it takes longer to share their thoughts online, as authorities start slowing the service’s connection speeds amid a row over illegal content hosted by the US-based social media giant. Communications regulator Roskomnadzor issued a statement on Wednesday morning announcing the decision, which it says is because Twitter “does not remove content that incites minors to commit suicide, contains child pornography or information about the use of drugs.” The watchdog claims it has sent more than 28,000 requests for posts, links and publications to be deleted or blocked on the platform. However, at present, “3,168 pieces of content containing prohibited information… remain not deleted.”

These reportedly include more than 2,500 calls for children to kill themselves and 450 involving child pornography. Accusing the network of failing to adhere to Russian laws, Roskomnadzor said that “the latest vivid example was the demonstrative disregard for the requirements of the regulator to remove calls to minors to commit mass suicide.” Unlike other social networks, officials claim, “Twitter did not delete the materials.” If the company continues to refuse to comply with the requests, Moscow says, “these measures will continue in line with regulations, up to the point of blocking” the service.

Anton Gorelkin, a member of the Russian Parliament’s information policy committee said that the assembly supported the move, and that “it is a pity that Russian users have become hostages to decisions by Twitter.” But, justifying the slowdown, he said, “the state simply has no other tools to influence the violator.” Senator Alexander Bashkin added that other social media sites should take notice, claiming that “this will act as a wake up call for YouTube and other networks that make gains at the expense of law and order in Russia.”

These suits are a decade (too) late.

• Facebook Seeks Dismissal Of Antitrust Lawsuits (F.)

Facebook asked a judge Wednesday to dismiss two landmark antitrust lawsuits against the company, teeing up what is expected to be a protracted legal battle that could result in the social network being broken up if it loses. Facebook is facing two lawsuits in U.S. District Court in Washington D.C., one from the Federal Trade Commission and one from 48 state attorneys general, alleging the company squashed competition through anticompetitive acquisitions of WhatsApp and Instagram. Facebook argued in a filing the FTC doesn’t have the authority to challenge acquisitions already approved by the agency, adding that it isn’t a monopoly because the government “cannot establish that Facebook has increased prices or restricted output” without losing market share.

Facebook argued the state lawsuit was grounded in “public policy concerns” instead of antitrust law, pointing to the states’ argument that Facebook froze out competing services that could have offered better privacy protections. Both lawsuits call for remedial action, such as forcing the company to potentially sell off Instagram or WhatsApp and requiring it to get prior approval before future mergers and acquisitions. “Antitrust laws are intended to promote competition and protect consumers. These complaints do not credibly claim that our conduct harmed either,” Facebook said in a blog post.

The FTC and state lawsuits represent the most significant regulatory action Facebook has ever faced. The social giant has been under fire from both parties in recent years following privacy mishaps in the Cambridge Analytica scandal and a growing concern that Facebook’s has too much control over political speech and information due to its sheer size. In October, House Democrats released a report concluding that Facebook and Google wield “monopoly power” and asked Congress to consider legislation breaking them up. House Republicans didn’t sign onto the final report and instead released their report opposing “onerous and burdensome regulation.”

Yeah, we’re not the only victims. Looking for alternatives.

• Google, Ad Tech, and the Gutting of the News Publishers (WS)

Other news publications have filed for bankruptcy without ever specifying the real reason for the losses. Big publishers like the New York Times and the Wall Street Journal have gutted their staff without specifying the real reason – the company that is the real reason. But separately, the bad boy of news publishing, Rupert Murdoch’s News Corp, which owns the Wall Street Journal among many other publications, officially broke the omertà about the existential issue for publishers: Google’s total dominance in multiple layers at the core and all over internet advertising. And its abuse of power in that arena.

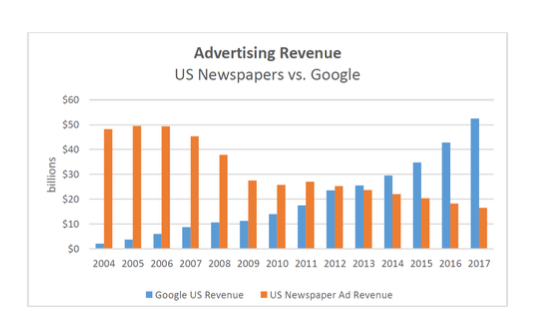

Last year, it was reported that News Corp complained to antitrust authorities in the US and other countries that Google was abusing its power and sucking revenues out of the stream that should be going to publishers. And I see what Google is doing to publishers every day on my own site. The US Justice Department filed an antitrust lawsuit against Google in October last year, a decade behind the curve, after much of the damage had already been done. The New Media Alliance, which advocates for news publishers, repeated some industry data – a bitter but well-known dose of reality for publishers – in its latest missive of February 21, concerning the antitrust lawsuit:

“News publisher ad revenues have plummeted dramatically over the last two decades; between 2005 and 2018, news organizations saw their ad revenue fall by 70 percent. During that same period, Google’s ad revenue increased from approximately $6 billion to $116 billion, and Google’s market capitalization increased from approximately $100 billion to $1 trillion.” Since the endpoint of this data in 2018, the situation has continued on the same trajectory: Google siphoning out more money that should have gone to publishers, more publishers collapsing, more publishers losing more money and laying off more people, and Google’s advertising revenues rising 26% to $147 billion, and its market cap rising another 40% to $1.4 trillion.

I have seen this for years on my own site: Every year, ad revenues per million Google ads served declined. Via the Google empire, you need to get more and more traffic and serve more and more Google ads, and overall revenues from Google ads might still decline.

We try to run the Automatic Earth on donations. Since ad revenue has collapsed, you are now not just a reader, but an integral part of the process that builds this site. Thank you for your support.

Microeconomics concerns things that economists are specifically wrong about, while macroeconomics concerns things economists are wrong about generally.

~P.J. O’Rourke

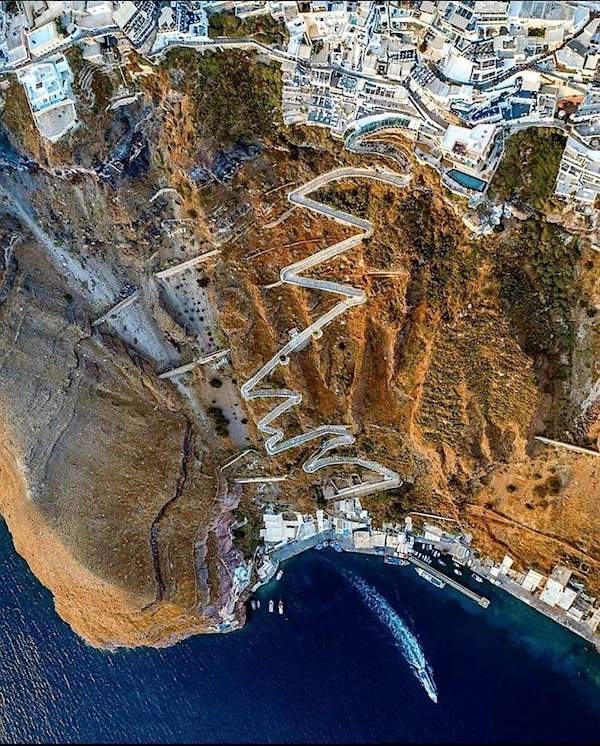

Santorini bird’s eye

Support the Automatic Earth in virustime. Click at the top of the sidebars to donate with Paypal and Patreon.