Fred Stein Ballfield NY 1946

Only real question: will they all fall together like dominoes?

• Global Property Bubble Is Ready To Pop (MF)

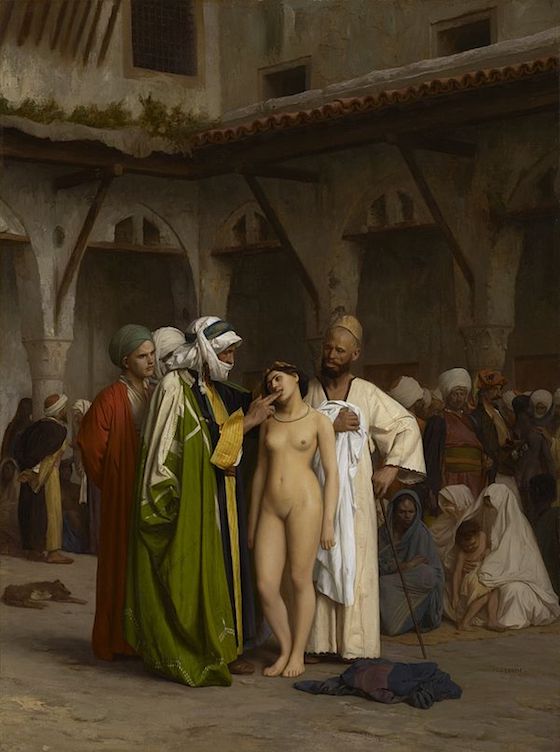

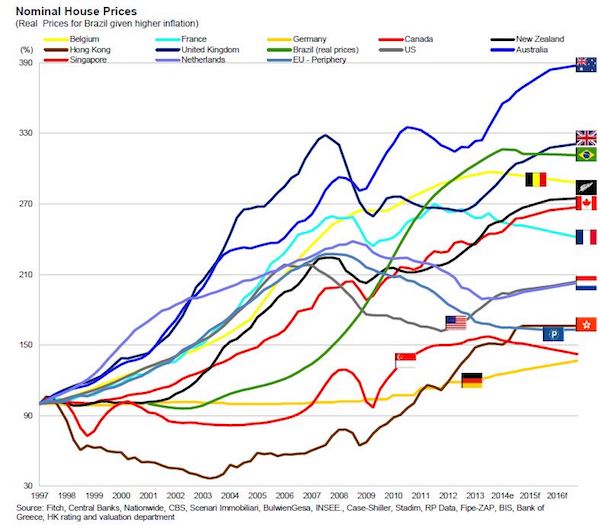

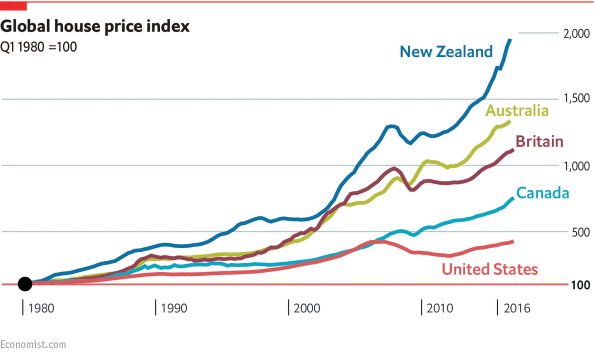

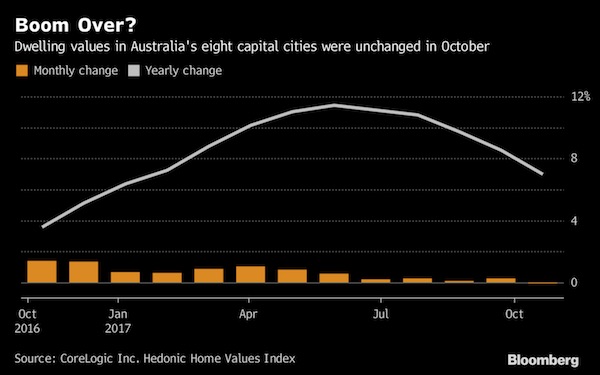

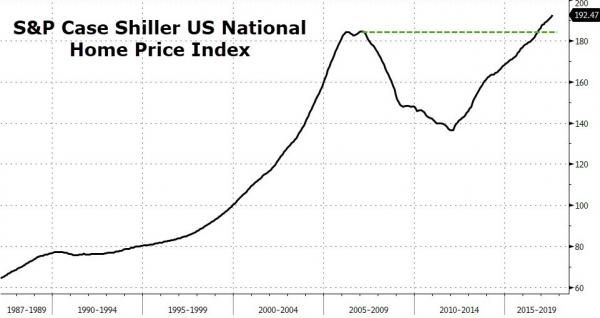

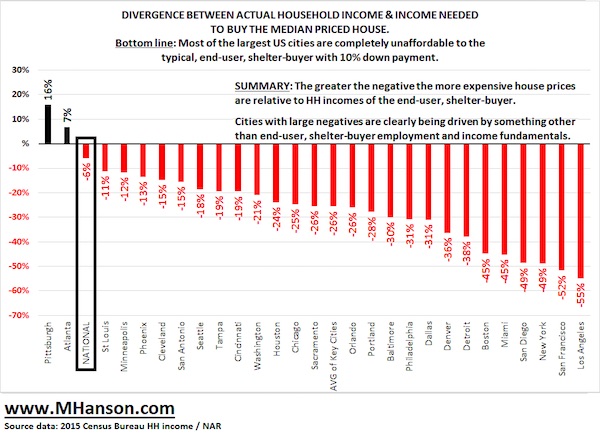

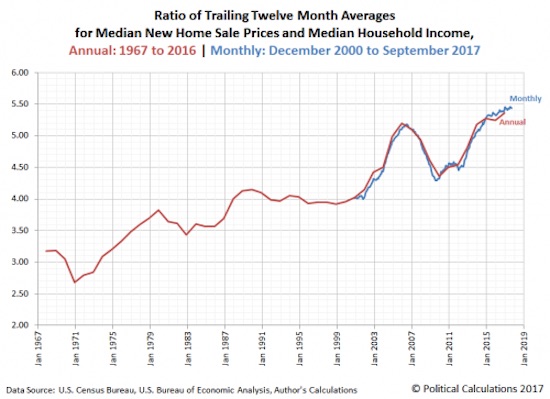

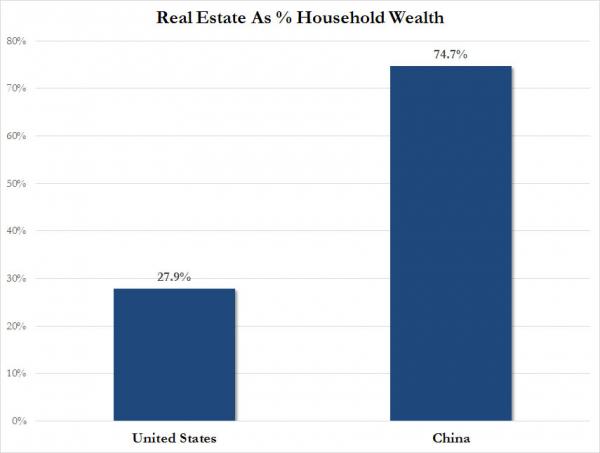

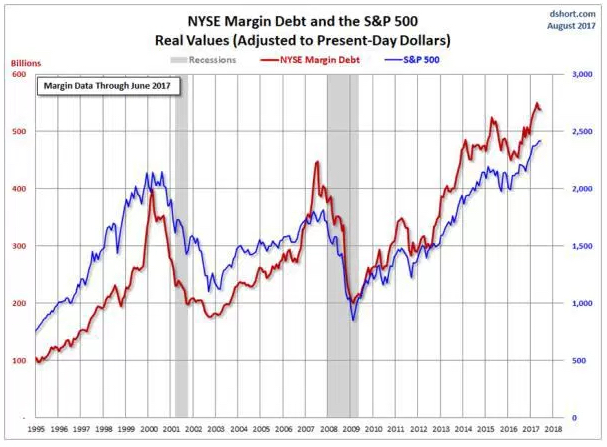

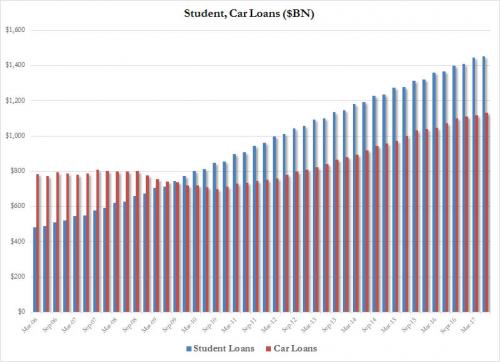

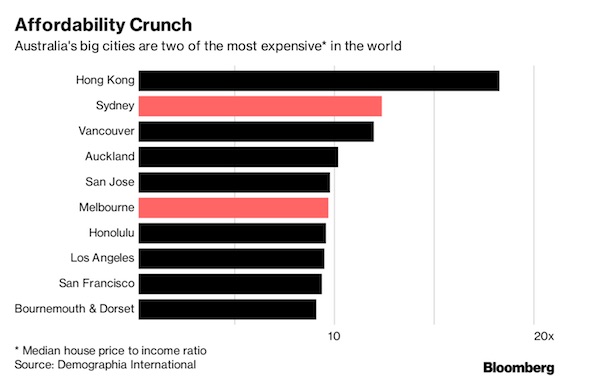

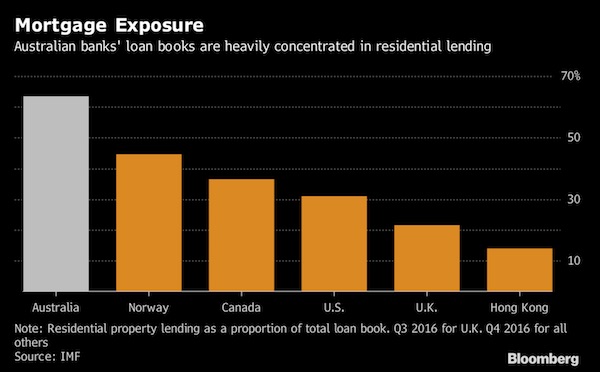

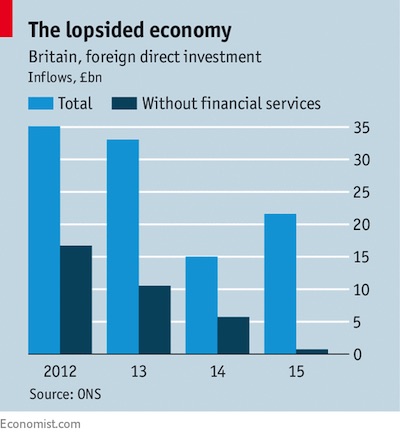

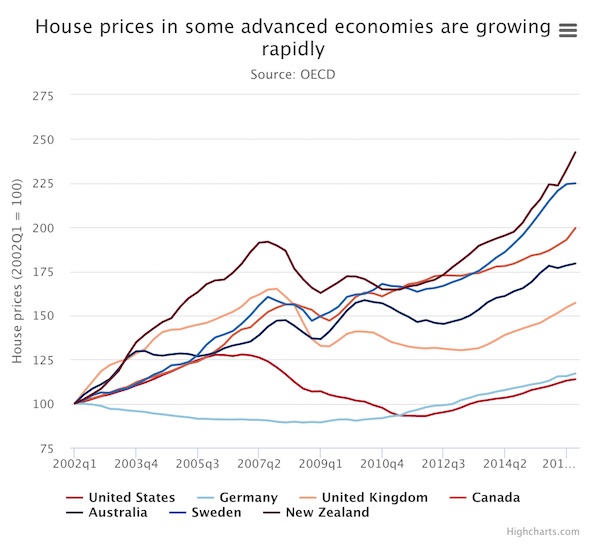

Ever since interest rates were slashed to near zero in the wake of the financial crisis, the world has gone property mad. Residential house prices from Abu Dhabi to Zurich have spiralled as hot money travelled the world looking for a home. For those who got in early it has been incredibly rewarding, even if – whisper it – stock markets have actually done far better. The global property bubble cannot blow much bigger. The best we can hope is that it deflates slowly… but it could burst. Property is still going crazy in China, where prices have been pumped up by yet another bout of government stimulus. Guangzhou, close to Hong Kong on the Chinese mainland, leapt a whopping 36% in the past 12 months, according to Knight Frank. Prices rose around 20% in Beijing and Shanghai, as well as in Toronto, Canada.

Seoul in South Korea continues to boom, as does Sydney and Stockholm, both up 10.7% over the last year. Berlin (8.7%), Melbourne (8.6%) and Vancouver (7.9%) are also performing strongly. In most other global cities, property is finally starting to slow. Hong Kong rose a relatively modest 5.3% while Singapore grew 4%, and thereafter price hikes trail away. Half of the 41 countries in the report grew by less than 2%, while nearly one in three saw prices fall, by up to 8.3%. Prime central London was the world’s raciest property market but is now leading the charge in the other direction, falling 6.4%. Former hotspots Zurich, Moscow and Istanbul fell 7% or more over the last 12 months. Cheap money has driven prices ever higher for eight years but is finally losing traction, as affordability is stretched again. Interest rates cannot go any lower and could start rising if the US Federal Reserve continues to tighten. Regulatory authorities are looking to rein in overheated markets, with China only the latest to tighten borrowing requirements. The glory days are over.

Investing in property has one major benefit over stocks and shares – you can leverage up borrowing money to fund your purchase. Thereafter, the advantages are all one way. First, you can trade stocks online within seconds, whereas offloading property can take months (longer in a market crash). You can invest small amounts, rather than the hundreds of thousands of dollars, pounds, euros, yen or renminbi you need to buy a decent property these days. If you buy an investment property you have the effort of doing up and maintaining it, finding tenants, and paying a host of local taxes. You don’t have any of that nonsense with stocks. Best of all, you can invest quickly and easily in a wide spread global stocks, sectors and markets.

Read more …

Greater fools and empty bags.

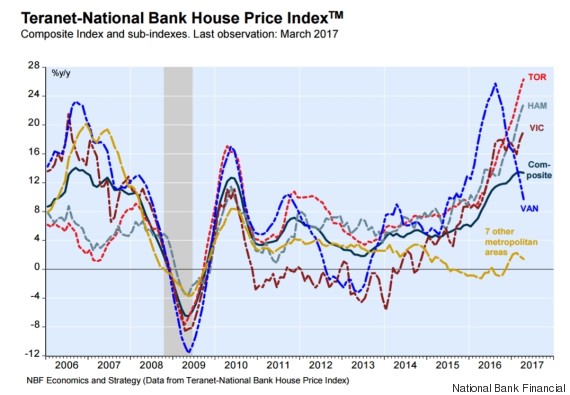

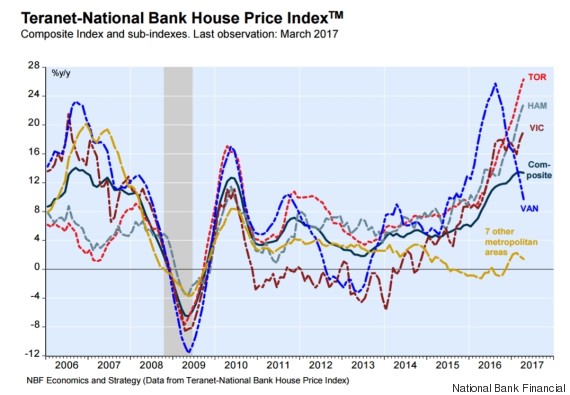

• 3 Cities Push Canada To Another Record On House Prices (HPo)

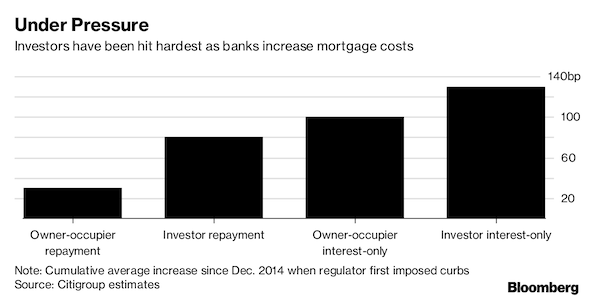

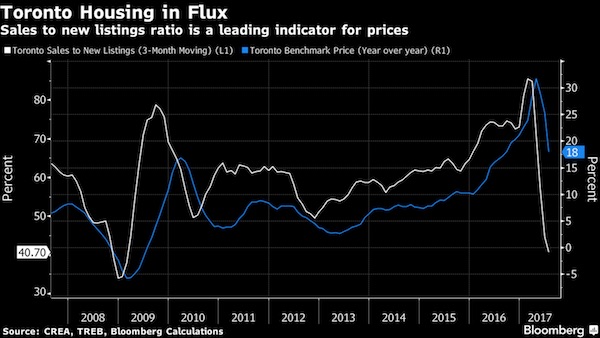

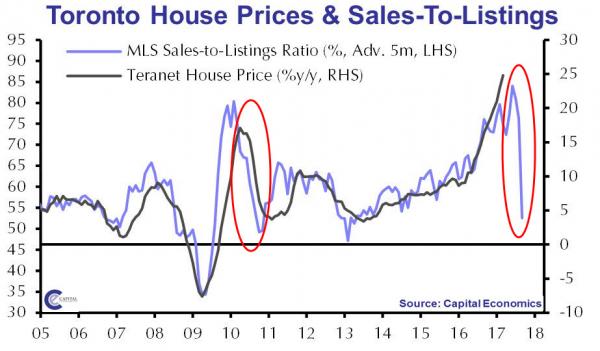

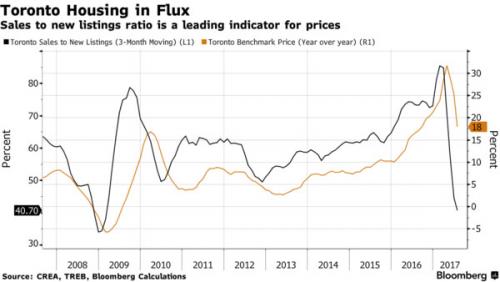

Home prices in Canada rose for the 15th straight month in a row in April, according to the Teranet-National Bank house price index, which once again hit its highest levels ever. But virtually all the strength seen over the past year came from just three cities — Toronto, Hamilton and Victoria. The index, which tracks repeat sales of single-family homes over time, found Toronto led the way, with the price index rising 2.6% in April. The city has seen prices jump 7.3% since the start of the year, and 26.3% in the past 12 months. Nearby Hamilton, which is experiencing spillover from Toronto’s housing boom, saw its price index rise 2% in April and 23% over the past year. Vancouver, which as recently as a year ago was showing the fastest price growth in the country, is now showing signs of slowing.

The price index fell 0.1% in April, and compared to a year ago, prices are up 9.7%, slower than the national average of 13.4%. Many market experts say Vancouver’s foreign buyer tax has pushed buyers to other cities, including to Victoria, where the price index rose 1.5% in April, and 19% over the past year. “Based on the cooldown in home sales that began early last year, we expect the Vancouver growth rate to fall much lower over the next few months,” wrote David Madani, senior Canada economist at Capital Economics. But Madani expects Toronto to experience a similar cooling. He noted that the city saw a sudden, 30% spike in new home listings in April. That’s “further evidence that the surge in house price inflation is close to a peak and will drop back sharply before the end of this year,” he wrote in a client note.

Read more …

So far not so bad. But if the next generation of the attack has no killswitch that can be triggered, anything is possible.

• Cyber Attack Aftershocks Disrupt Devices Across Asia (R.)

Asian governments and businesses reported some disruptions from the WannaCry ransomware worm on Monday but cybersecurity experts warned of a wider impact as more employees turned on their computers and checked e-mails. The ransomware that has locked up hundreds of thousands of computers in more than 150 countries has been mainly spread by e-mail, hitting factories, hospitals, shops and schools worldwide. While the effect on Asian entities appeared to be contained on Monday, industry professionals flagged potential risks as more systems came online across the region. Companies that were hit by the worm may be wary of making it public, they added.

“We’re looking at our victims’ profiles, we’re still seeing a lot of victims in the Asia-Pacific region. But it is a global campaign, it’s not targeted,” said Tim Wellsmore, Director of Threat Intelligence, Asia Pacific at cybersecurity firm FireEye. “But I don’t think we can say it hasn’t impacted this region to the extent it has some other regions.” Michael Gazeley, managing director of Network Box, a Hong Kong-based cybersecurity firm, said there were still “many ‘landmines’ waiting in people’s in-boxes” in the region, with most of the attacks having arrived via e-mail.

Read more …

Microsoft blames the NSA, and for good reason, but…

• Lessons From Last Week’s Cyberattack (Microsoft)

[..] this attack provides yet another example of why the stockpiling of vulnerabilities by governments is such a problem. This is an emerging pattern in 2017. We have seen vulnerabilities stored by the CIA show up on WikiLeaks, and now this vulnerability stolen from the NSA has affected customers around the world. Repeatedly, exploits in the hands of governments have leaked into the public domain and caused widespread damage. An equivalent scenario with conventional weapons would be the U.S. military having some of its Tomahawk missiles stolen. And this most recent attack represents a completely unintended but disconcerting link between the two most serious forms of cybersecurity threats in the world today – nation-state action and organized criminal action.

The governments of the world should treat this attack as a wake-up call. They need to take a different approach and adhere in cyberspace to the same rules applied to weapons in the physical world. We need governments to consider the damage to civilians that comes from hoarding these vulnerabilities and the use of these exploits. This is one reason we called in February for a new “Digital Geneva Convention” to govern these issues, including a new requirement for governments to report vulnerabilities to vendors, rather than stockpile, sell, or exploit them. And it’s why we’ve pledged our support for defending every customer everywhere in the face of cyberattacks, regardless of their nationality. This weekend, whether it’s in London, New York, Moscow, Delhi, Sao Paulo, or Beijing, we’re putting this principle into action and working with customers around the world.

We should take from this recent attack a renewed determination for more urgent collective action. We need the tech sector, customers, and governments to work together to protect against cybersecurity attacks. More action is needed, and it’s needed now. In this sense, the WannaCrypt attack is a wake-up call for all of us. We recognize our responsibility to help answer this call, and Microsoft is committed to doing its part.

Read more …

…Microsoft itself carries part of the blame as well. It doesn’t support XP, but does ask for a lot of money for patches.

• The World Is Getting Hacked. Why Don’t We Do More to Stop It? (NYT)

The attack was halted by a stroke of luck: the ransomware had a kill switch that a British employee in a cybersecurity firm managed to activate. Shortly after, Microsoft finally released for free the patch that they had been withholding from users that had not signed up for expensive custom support agreements. But the crisis is far from over. This particular vulnerability still lives in unpatched systems, and the next one may not have a convenient kill switch. While it is inevitable that software will have bugs, there are ways to make operating systems much more secure — but that costs real money.

While this particular bug affected both new and old versions of Microsoft’s operating systems, the older ones like XP have more critical vulnerabilities. This is partly because our understanding of how to make secure software has advanced over the years, and partly because of the incentives in the software business. Since most software is sold with an “as is” license, meaning the company is not legally liable for any issues with it even on day one, it has not made much sense to spend the extra money and time required to make software more secure quickly. Indeed, for many years, Facebook’s mantra for its programmers was “move fast and break things.”

[..] If I have painted a bleak picture, it is because things are bleak. Our software evolves by layering new systems on old, and that means we have constructed entire cities upon crumbling swamps. And we live on the fault lines where more earthquakes are inevitable. All the key actors have to work together, and fast. First, companies like Microsoft should discard the idea that they can abandon people using older software. The money they made from these customers hasn’t expired; neither has their responsibility to fix defects. Besides, Microsoft is sitting on a cash hoard estimated at more than $100 billion (the result of how little tax modern corporations pay and how profitable it is to sell a dominant operating system under monopolistic dynamics with no liability for defects).

At a minimum, Microsoft clearly should have provided the critical update in March to all its users, not just those paying extra. Indeed, “pay extra money to us or we will withhold critical security updates” can be seen as its own form of ransomware. In its defense, Microsoft probably could point out that its operating systems have come a long way in security since Windows XP, and it has spent a lot of money updating old software, even above industry norms. However, industry norms are lousy to horrible, and it is reasonable to expect a company with a dominant market position, that made so much money selling software that runs critical infrastructure, to do more.

Read more …

tick tick tick.

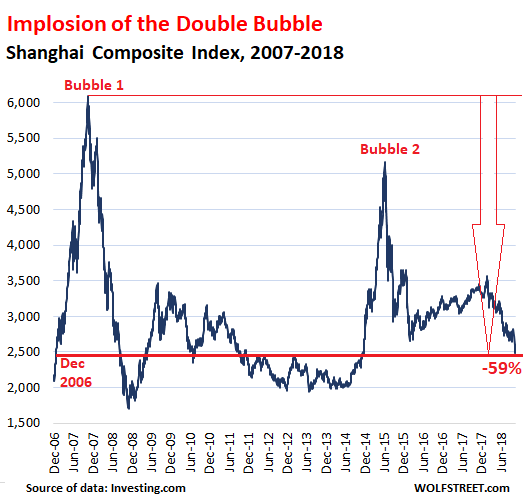

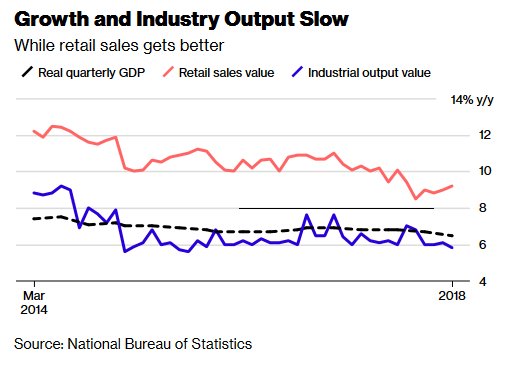

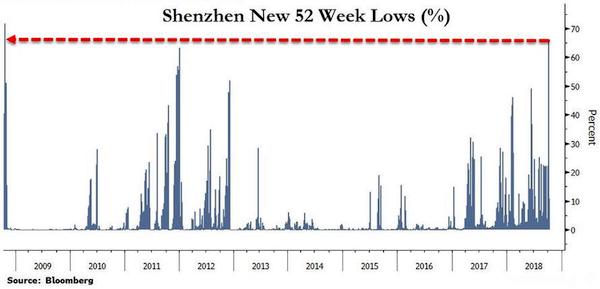

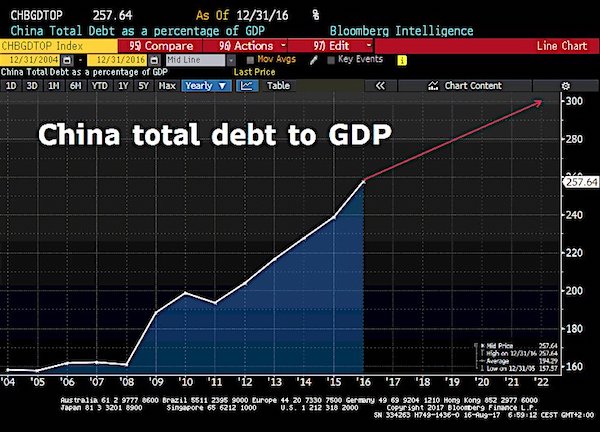

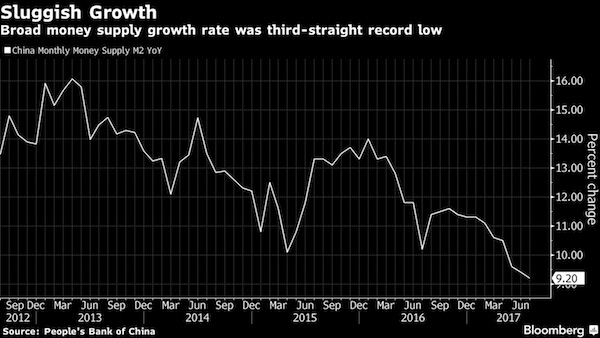

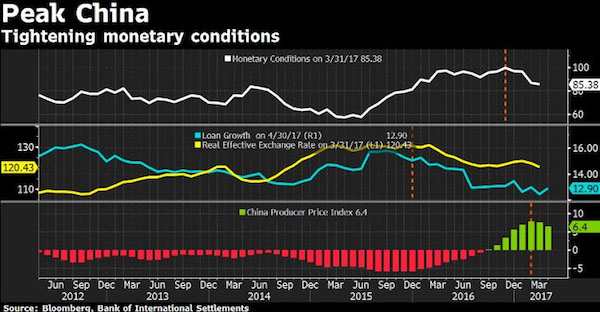

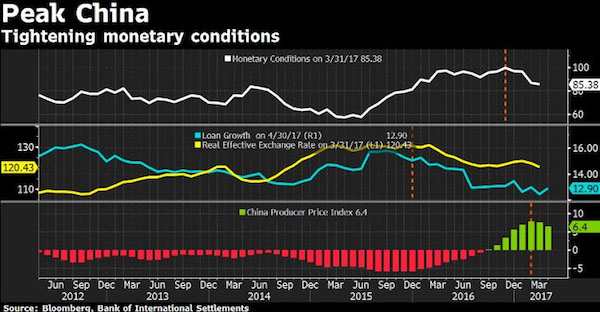

• Peak China: Chinese Data Misses Across The Board (ZH)

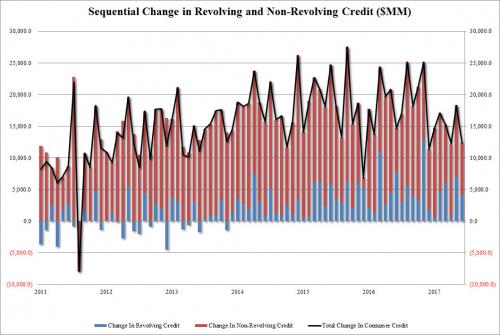

Following months of warnings that China’s economy is slowing down as a result of not only a collapse in China’s credit impulse but also tighter monetary conditions, as well as rolling over loan growth which has pressured both CPI and PPI – i.e., the global “reflation trade” – as the following chart from Bloomberg’s David Ingels shows…

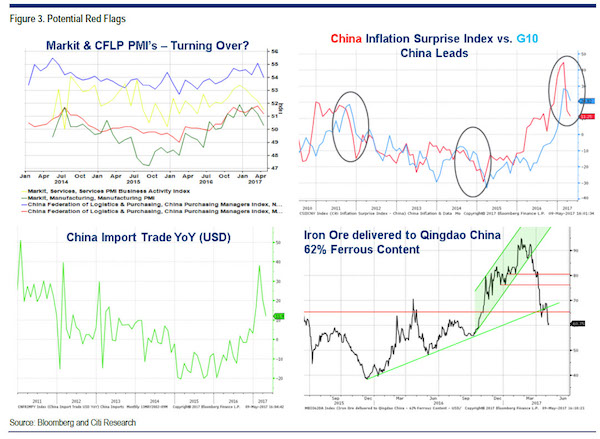

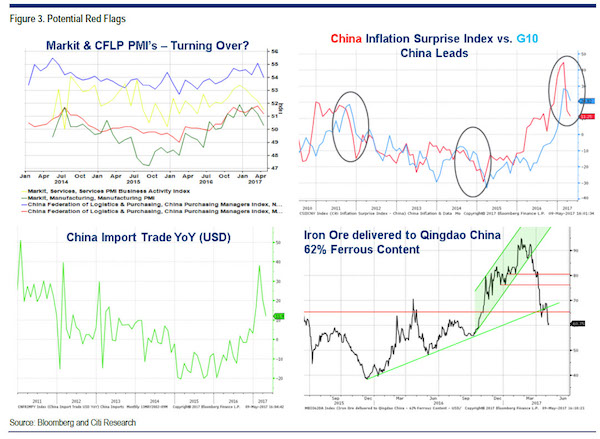

… and culminating over the weekend with a warning in no uncertain terms from Citi, which said that at least four key economic indicators are “starting to wave red flags” among which:

• The Markit PMI is starting to turn over

• China’s Inflation Surprise Index – a leading indicator to global inflation metric – has posted a recent sharp drop

• China’s import trade has likewise tumbled after surging recently

• Chinese Iron Ore imports into Qingado port have plunged

… moments ago China’s National Bureau of Statistics validated the mounting fears, when it reported misses across all key economic categories for the month of April, as follows:

• Retail Sales 10.7% Y/Y, Exp. 10.8%, Last 10.9%

• Fixed Asset Investment 8.9% Y/Y, Exp. 9.1%, Last 9.2%

• Industrial Output 6.5% Y/Y, Exp. 7.0%, Last 7.6%

• Industrial Production YTD 6.7% Y/Y, Exp. 6.9%, Last 6.8%

Read more …

Big meeting, Putin, Erdogan et al, but not India, US, Germany and more. Shaky.

• Why India Is Cool Towards China’s Belt And Road (SCMP)

It is one of the most imaginative and ambitious programmes ever to be rolled out by a government. It represents a broad strategy for China’s economic cooperation and expanded presence in Asia, Africa and Europe, and has been presented as a win-win initiative for all participating nations. But for India, the connotations of China’s Belt and Road Initiative” are somewhat different. A flagship programme and the most advanced component of the initiative, the China-Pakistan Economic Corridor (CPEC), passes through Pakistan-occupied Kashmir, a region that belongs to India and is under the control of Pakistan. As a country acutely conscious of its own sovereignty-related claims, China should have no difficulty in appreciating India’s sensitivities in this regard.

While investment in the Gwadar port, roads and energy projects is reported to have increased from US$46 billion to US$55 billion, CPEC lacks economic justification for China and its geopolitical drivers cause legitimate anxieties in India. The Belt and Road plan is a practical economic strategy for China’s objectives to connect the region, seek new growth engines for its slowing economy, utilise its surplus capacity, and develop and stabilise its western regions. It may also bring benefits to partner countries. However, it also has a strategic and political agenda which remains opaque. Apart from the CPEC, India also has misgivings about the manner in which the Belt and Road Initiative is being pursued in its neighbourhood. For instance, the development of ports under Chinese operational control as part of the Maritime Silk Road strategy has raised concerns in India which need to be addressed.

India has repeatedly conveyed its strong objections regarding the CPEC to China. The Belt and Road plan is a Chinese initiative rather than a multilateral enterprise undertaken after prior consultation with potential partner countries, and India has not endorsed it. There is an expectation in India that China will take India’s sensitivities into account while formulating its plans. Clearly, there is room for closer consultations between China and India on the objectives, contours and future directions of the Belt and Road. However, India has considered synergy-based cooperation on a case-by-case basis, where its interests for regional development converge with that of other countries, including China.

Read more …

India’s right, the Silk road is financed with Monopoly money.

• China’s Silk Road Summit: India Skips, Warns Of “Unsustainable Debt” (ZH)

Alas, the meticulously scripted plan to showcase China’s growing economic and trade dominance did not go off quite as smoothly as Xi had planned. First, just hours before the summit opened, North Korea launched its latest ballistic missile, provoking Beijing and further testing the patience of China, its chief ally. Ironically, the United States had complained to China on Friday over the inclusion of a North Korean delegation at the event. Then, in a sign that China’s rampant, credit-fuelled growth is making some just a little uncomfortable, some Western diplomats expressed unease about both the summit and the plan as a whole, seeing it as an attempt to promote Chinese influence globally according to Reuters. They are also concerned about transparency and access for foreign firms to the scheme.

Australian Trade Minister Steven Ciobo said Canberra was receptive to exploring commercial opportunities China’s new Silk Road presented, but any decisions would remain incumbent on national interest. Responding to criticism, Xi said that “China is willing to share its development experience with all countries” and added “we will not interfere in other countries’ internal affairs. We will not export our system of society and development model, and even more will not impose our views on others.” But the biggest surprise was India, the world’s fastest growing nation and the second most populous in the world, which did not even bother to send an official delegation to Beijing and instead criticised China’s global initiative, warning of an “unsustainable debt burden” for countries involved.

Indian foreign ministry spokesman Gopal Baglay, asked whether New Delhi was participating in the summit, said “India could not accept a project that compromised its sovereignty.” India is incensed that one of the key Belt and Road projects passes through Kashmir and Pakistan. The nuclear-armed rivals have fought two of their three wars over the disputed region, Reuters notes. “No country can accept a project that ignores its core concerns on sovereignty and territorial integrity,” Baglay said. Furthermore, he also warned of the danger of debt. One of the criticisms of the Silk Road plan is that host countries may struggle to pay back loans for huge infrastructure projects being carried out and funded by Chinese companies and banks. “Connectivity initiatives must follow principles of financial responsibility to avoid projects that would create unsustainable debt burden for communities,” Baglay said.

Read more …

Really, Brussels, Washington, you think it’s a good idea to let China buy up Greece? No security jiggers at all?

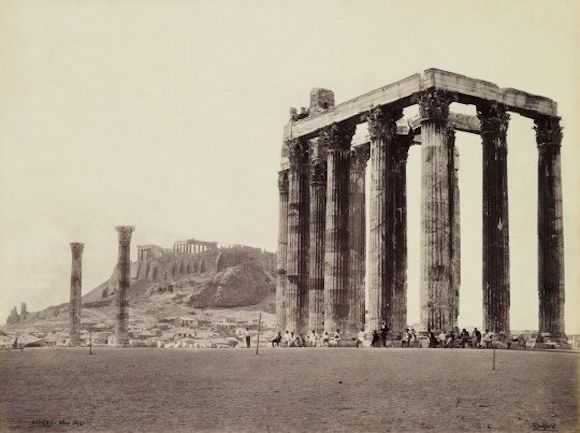

• Number of Chinese Tourists Visiting Greece to Rise 10-Fold (BBG)

Fosun International, the Chinese conglomerate that’s part of a venture to transform the former Athens airport site into one of the biggest real-estate projects in Europe, is now turning its attention to Greek tourism. Fosun wants to use its stake in tour operator Thomas Cook to start building vacation packages specifically for the vast Chinese market, Senior Vice President Jim Jiannong Qian said in a May 4 interview in Athens. The Chinese government predicts 1.5 million of its citizens will start vacationing in Greece in the medium term. Tourism accounted for over one-quarter of Greece’s GDP in 2016, according to the Greek Tourism Confederation. Visitor numbers in 2016 reached 28.1 million, up 7.6% from 2015. Tourists generated €13.2 billion in travel receipts, according to the Bank of Greece. Of these travelers, 150,000 came from China, Beijing says.

“Greece is a very safe place for visitors,” said Qian who is also president of Fosun’s Tourism and Commercial Group. There are also good opportunities for tourism investments in Greece, he said. Fosun is in discussions to buy existing hotels and resorts, or for the construction of new ones, in Greece by its fully owned portfolio company Club Med. An increase in Chinese visitors to Greece would eventually lead to direct flights from Beijing and Shanghai to Athens, Qian said. The 54 year-old Qian said the situation in Greece has changed since the company first invested in Athens-based luxury goods retailer Folli Follie Group in 2011. “Greece’s economy is recovering now and can also deliver very good opportunities for foreign investors,” he said. “We look at the figures from retail sales and of the tourism sector,” and see the improvement.

Fosun, which manages €64.3 billion in total assets globally, has invested more than €200 million in Greece through its direct holding in Folli Follie and indirectly through Thomas Cook and Club Med, Qian said. “If you can help the economy grow, for example if we have the package product for Greece, then we create more jobs for restaurants, for retail stores, for taxi drivers.” The company, the biggest private Chinese company that invests in Europe, owns German lender Hauck & Aufhaeuser and Portuguese insurance company Fidelidade, and doesn’t rule out an investment in the Greek banking sector if an opportunity arises in the future, Qian said, refuting reports that the group has already made a bid to acquire shares in Greek banks. Fosun has already placed a bid for the acquisition of National Bank of Greece’s insurance unit National Insurance, and according to Qian, has no money ceiling when it comes to investments, as long as the opportunity is worth it.

Read more …

Rerouted trips to Greece?

• New Zealand Slashes Chinese Tourism Forecast, Denting Outlook (BBG)

New Zealand has slashed its forecast for Chinese tourist spending over the next six years, denting growth expectations for its biggest foreign-exchange earner. Spending by Chinese tourists will rise to NZ$3.73 billion ($2.5 billion) by 2022 from NZ$1.65 billion last year, according to the Ministry of Business, Innovation and Employment’s latest annual forecasts. That’s 30% less than the NZ$5.32 billion expected in last year’s projections. “There is significant geopolitical risk around the China market,” the ministry said in the report, published Friday, adding that indicators like early-2017 visa approvals were “suggesting a short-term slowing in the market.” The downward revision indicates overall revenue from tourists won’t grow as quickly as previously expected, and that Australia will remain the biggest source of tourist dollars until 2021. Last year, officials forecast China would take the top ranking in 2017.

Tourism, which last year overtook dairy as New Zealand’s top export, has been growing faster than expected. Visitor numbers surged to 3.5 million in 2016, four years sooner than had been envisaged in 2014, and are projected to jump to 4.9 million by 2023. Still, the uncertainty around China “adds some risk to both China’s and the national forecast numbers,” the ministry said in its latest report. The slower forecast trajectory for Chinese spending growth reflects fewer visitors and less spending per day than projected 12 months ago. Arrivals from China are expected to reach 812,000 in 2022. That’s less than the 921,000 estimated in last year’s report. Average spending per day is forecast to be NZ$343 in 2022 rather than the NZ$394 estimated a year ago. As a result, total foreign visitor spending will rise to NZ$15.3 billion in 2023, according to the forecasts. The 2016 prediction was that spending would rise to NZ$16 billion by 2022.

Read more …

As if we needed any more evidence that credibility is the least of their worries.

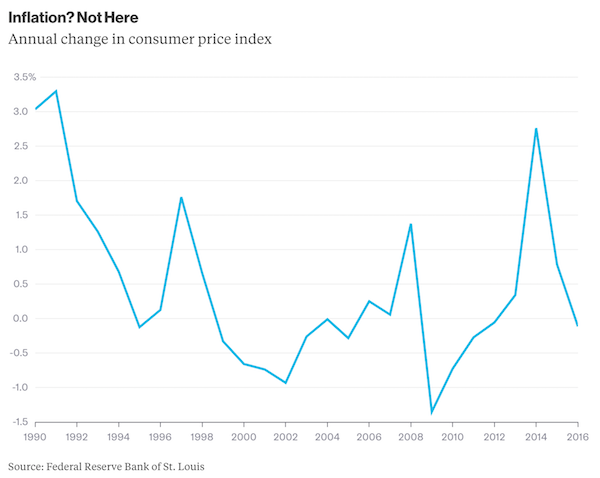

• Fed Officials Test New Argument for Tightening: Protect the Poor (BBG)

To protect the poorest Americans, should central bankers raise interest rates faster? At least one of them is making that argument. During a speech last month, Federal Reserve Bank of Kansas City President Esther George said she was “not as enthusiastic or encouraged as some when I see inflation moving higher” because “inflation is a tax and those least able to afford it generally suffer the most.” She was referring in particular to rental inflation, which she said could continue rising if the Fed doesn’t take steps to tighten monetary conditions. And while the idea of inflation as a tax that hits the poor the hardest is not a new one, its role in the current debate over what to do with interest rates marks a bit of a twist from recent years.

Widening disparities in income and wealth have over the past several years permeated national politics and helped fuel the rise of populist movements around the developed world. Against this backdrop, there has been a growing body of research, some of it produced by economists at central banks, backing the idea that easier monetary policy tends to be more progressive. That work, set against the notion that a stricter approach toward containing inflation has the best interests of the lowest-income members of society at heart, is thrusting Fed policy makers toward the center of a debate they usually like to leave to politicians. It’s becoming more contentious as Fed officials seek to declare victory on their goal of maximum employment even while the percentage of prime working-age Americans who currently have jobs is still nowhere close to the peaks of the previous two economic expansions.

Read more …

“The company, with the unfortunate Toronto Ticker “BAD”..”

• Marc Cohodes, The Scourge Of Home Capital, Reveals His Latest Short (ZH)

Having single-handedly hounded Home Capital Group – the company which we predicted in 2015 would be “ground zero” for any potential Canadian financial crisis, and has emerged as the Canada’s equivalent to the infamous New Century which in 2007 presaged the upcoming global financial crisis – into near oblivion, noted chicken-farmer and short-seller, Marc Cohodes, over the weekend revealed the full details behind his latest short thesis: Canadian oil and gas service provider, Badger Daylighting. Badger, for those unfamiliar, is a company which uses a technique called hydrovac excavation, in which pressurized water and a powerful vacuum are used to expose buried pipes and cables. The company, with the unfortunate Toronto Ticker “BAD”, already had a bad day on Friday when it revealed earnings and revenues that badly missed consensus expectations.

Insult was added to injury after Cohodes, who most recently gained prominence for his short bet on Home Capital Group, previewed pages of a negative presentation on Badger to his Twitter feed Friday, saying that the shares are overvalued and that there are low barriers to entry. As a result, BAD shares plunged as much as 28% to C$22 in Toronto, the biggest intraday decline since November 2006, after previously dropping 4.8% YTD. To be sure, on Friday Badger CEO Paul Vanderberg, without in depth knowledge of Cohodes’ thesis, responded to Cohodes saying “my focus on that is really not to focus on it” during the earnings call and adding that “I don’t agree with the thesis.” Obviously, especially since neither he nor anyone else had seen or read it.

Chief Financial Officer Jerry Schiefelbein also responded, saying Badger is working to train new workers and managers on how to operate more efficiently, which should help reduce costs. He said the company’s first-quarter sales were “pretty good” following a couple of tough years. As for Cohodes’ criticism about low barriers to entry, Schiefelbein was quoted by Bloomberg saying tat Badger’s size gives it an advantage over mom-and-pop shops that would seek to compete with the company. Badger can tackle bigger projects for municipalities, has safety systems that larger customers require and it can move assets to markets where there is more demand, he said. “It’s not just digging holes in the ground.”

Read more …

Only interesting if his French backers want something Germany doesn’t. But then they all want the eurozone.

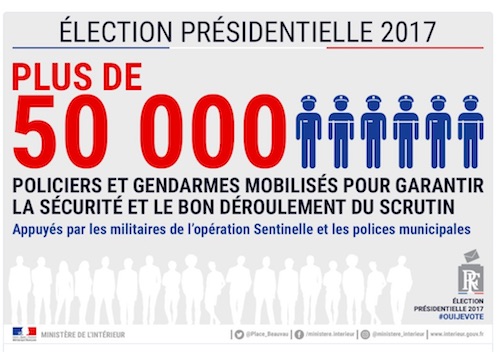

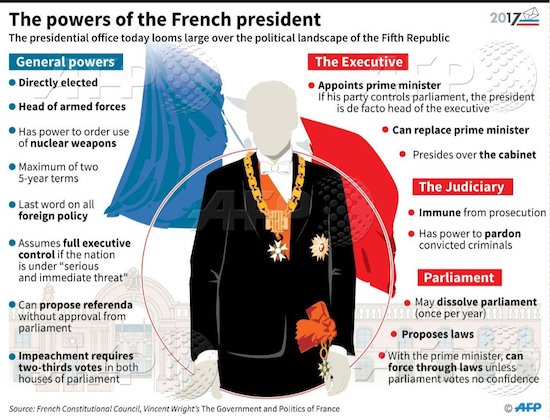

• Eyes on Euro Fighter Macron (K.)

Macron has taken over from Francois Hollande hoping to reform not just his own country but the euro as well. “We must collectively recognize that the euro is incomplete and cannot last without major reforms,” he said during a speech at Humboldt University in Berlin this January. “It has not provided Europe with a full international sovereignty against the dollar on its rules, it has not provided Europe with a natural convergence between the different member-states.” The centrist politician warned that without reform the euro may be obsolete in 10 years. He has proposed a series of changes to improve the single currency, with the centerpiece being a budget for the eurozone that will be monitored by the European Parliament and backed by borrowing capacity so that it can finance investments, provide emergency loans via the European Stability Mechanism and help eurozone members if they suffer significant economic shocks.

Macron has also suggested the pooling of debt in the eurozone through the issuing of eurobonds, which are anathema to German conservatives. “The establishment of this budget will have to come with a convergence agenda for the eurozone, an anti-dumping agenda that will set common rules for fiscal and social matters,” added Macron in a message to his German hosts that proceeded to become clearer during his speech. “In a monetary union, a country’s success cannot be sustainably achieved to the detriment of another, which is a limit of the competitiveness approach, because competitiveness is always about comparing yourself with a neighbor,” he said. “The difficulties of one are always the problems of all.” Although Macron admits that France must carry out its own labor, market and education reforms and respect fiscal targets, his words are a direct attempt to overturn the logic and policy that has dictated the eurozone’s response to its crises since 2010 and to shape how its overall approach will evolve from this point onward.

In doing so, Macron is taking the fight to Germany, which previous French presidents failed to do. “When you look at the situation, the dysfunctioning of the euro is good news for Germany, I have to say. You benefit from this dysfunctioning,” he told his audience in Berlin. “[The] euro today is a sort of weak Deutschmark, which favors the German industry,” he added. These are views that have rarely been aired publicly by key players in the eurozone and it is little surprise that the initial response from Berlin was to suggest that Macron has enough on his plate at home to be focusing on euro reform. “German support cannot replace French policymaking,” was Merkel’s first comment on the subject after Macron comfortably won last Sunday’s vote in France.

Read more …

But Schäuble on Friday said transfers were needed. You need a fiscal union to make that work.

• Germany Will Not Rush Into Euro Area Fiscal Union (CNBC)

Now what? “More Europe” say those who believe that problems were caused by an inadequate integration process that allowed policy mistakes by incompetent national governments. To avoid similar mistakes in the future, they are now urging a unified fiscal policy to complete the monetary union. That is what the French call the “fuite en avant” – a semiotic delight roughly translated as fleeing from an unsolvable problem. Here is what that problem looks like: The fiscal union implies a euro area federal state with a common management of public finances. The area’s budget, public debt financing, tax policies, transfer payments, etc. would be managed by a euro area finance ministry. That would also require harmonization of labor, health care and education policies, and a whole range of other social welfare programs. Institutionally, this integration drive cannot stop at the finance ministry. There would also have to be a euro area executive and legislative authority to exercise administrative and democratic controls over tax and spend decisions.

[..] How could Germany, with a budget surplus last year of 0.8% of GDP and the public debt of 68.3% of GDP, accept a fiscal union with Spain running the euro area’s largest budget deficit of 4.5% of GDP and a public debt of 100% of GDP? France and Italy have similar public finance profiles. Last year, France had a second-largest euro area budget deficit of 3.4% of GDP and a public debt of 96% of GDP. During the same period, Italy ran a budget deficit of 2.4% of GDP and a public debt of 133% of GDP. This means that half of the euro area economy (France, Italy and Spain), with serious structural problems of public finances, would become part of a de-facto federal state with a fiscally sound Germany. Hard to imagine, isn’t it? And yet, that’s the program that the new French President Emmanuel Macron will apparently discuss Monday when he visits German Chancellor Angela Merkel in Berlin.

France, Italy and Spain already know the answer. Chancellor Merkel is relieved and delighted that the most dangerous anti-EU parties in France and The Netherlands lost the recent elections, but her government is firmly opposed to the euro area fiscal union. German public opinion fully shares that position. And German media of all political stripes are having a field day lampooning the idea that German taxpayers should be asked to pay for countries that cannot control their debts and deficits. This is also an awkward moment to even talk about the call on the German public purse while the country is gearing up for general elections on Sept. 24, 2017. The best that Germany can offer, under these circumstances, is a strict enforcement of existing euro area fiscal rules: Budget deficits limited to 3% of GDP and the gross public debt to 60% of GDP. About half of the euro area members are now falling far short of these criteria.

Read more …

Will the rich world ever come clean? No.

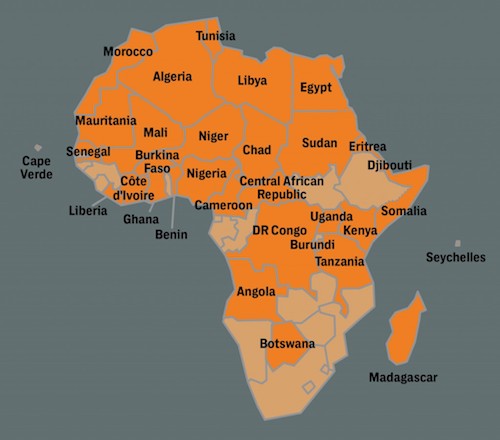

• What Germany Owes Namibia For Genocide (Econ)

On October 2nd 1904 General Lothar von Trotha issued what is now notorious as “the extermination order” to wipe out the Herero tribe in what was then German South West Africa, now Namibia. “Within the German borders every Herero, with or without a gun, with or without cattle, will be shot,” his edict read. During the next few months it was just about carried out. Probably four-fifths of the Herero people, women and children included, perished one way or another, though the survivors’ descendants now number 200,000-plus in a total Namibian population, scattered across a vast and mainly arid land, of 2.3m. The smaller Nama tribe, which also rose up against the Germans, was sorely afflicted too, losing perhaps a third of its people, in prison camps or in the desert into which they had been chased.

A variety of German politicians have since acknowledged their country’s burden of guilt, even uttering the dread word “genocide”, especially in the wake of the centenary in 2004. But recent negotiations between the two countries’ governments over how to settle the matter, the wording of an apology and material compensation are becoming fraught. Namibia’s 16,000 or so ethnic Germans, still prominent if not as dominant as they once were in business and farming, are twitchy. The matter is becoming even more messy because, while the German and Namibian governments set about negotiation, some prominent Herero and Nama figures say they should be directly and separately involved—and have embarked on a class-action case in New York under the Alien Tort Statute, which lets a person of any nationality sue in an American court for violations of international law, such as genocide and expropriation of property without compensation.

The main force behind the New York case, Vekuii Rukoro, a former Namibian attorney-general, demands that any compensation should go directly to the Herero and Nama peoples, whereas the Namibian government, dominated by the far more numerous Ovambo people in northern Namibia, who were barely touched by the wars of 1904-07 and lost no land, says it should be handled by the government on behalf of all Namibians. The Namibian government’s amiable chief negotiator, Zedekia Ngavirue, himself a Nama, has been castigated by some of Mr Rukoro’s team as a sell-out. “Tribalism is rearing its ugly head,” says the finance minister, who happens to be an ethnic German.

The German government says it cannot be sued in court for crimes committed more than a century ago because the UN’s genocide convention was signed only in 1948. “Bullshit,” says Jürgen Zimmerer, a Hamburg historian who backs the genocide claim and says the German government is making a mess of things. “They think only like lawyers, not about the moral and political question.” “None of the then existing laws was broken,” says a senior German official. “Maybe that’s morally unsatisfactory but it’s the legal position,” he adds.

Read more …