Sophia Loren seated by the Parthenon on the Athenian Acropolis during filming for ‘Boy on a Dolphin’, 1957

Anderson

This might be the single funniest thing I've ever seen.pic.twitter.com/vqLZFsvSFZ

— Michael Knowles (@michaeljknowles) May 12, 2023

2016

So much fun to watch.

Enjoy….

😂😂😂 pic.twitter.com/OH4EeLIl6u— Richard (@ricwe123) May 11, 2023

The Right Stuff

Steve Bannon Reacts To President Trump's Dominant CNN Town Hall Performance And The Mainstream Media's Meltdown

"What has freaked the media out is that MAGA is ascendent. Trump was triumphant. MAGA is ascendant. And they understand we're going to win the primary, we're going to… pic.twitter.com/y7IRdBpqqs

— The Columbia Bugle 🇺🇸 (@ColumbiaBugle) May 11, 2023

Dimon

This clip for @_whitneywebb's investigative series about Jamie Dimon and the #Epstein network is worth watching. This week she appeared on @rustyrockets's show talking about #banks, ruling elites and corruption. Hope to have her back on my podcast soon…https://t.co/qI8Xik9JOH pic.twitter.com/5bGnO5Vemw

— Natalie Brunell ⚡️ (@natbrunell) May 11, 2023

Maria Zakharova : By digging a long investigation, we find that Von der Leyen’s family tree traces a legacy of power and brutality, incorporating not only some of Germany’s most prominent Nazis, but also some of Britain’s greatest slave traders.

“..those who are calling for peace talks to start as soon as possible could not force Ukraine to surrender its territories..”

• Ukraine Needs ‘Bit More Time’ To Prepare For Counteroffensive – Zelensky (TASS)

The Ukrainian army needs a little bit more time to prepare for Kiev’s much-vaunted counteroffensive, Ukrainian President Vladimir Zelensky said in an interview with European media outlets, including the BBC, published on Thursday. “With [what we already have] we can go forward, and, I think, be successful. But we’d lose a lot of people. I think that’s unacceptable. So, we need to wait. We still need a bit more time,” Zelensky said. As follows from Zelensky’s statement, those Ukrainian brigades formed especially for the counteroffensive are already fully ready to take part in combat operations, but the army still needs “certain things,” including armored vehicles, which are “arriving in batches.” The Ukrainian president also stated that those who are calling for peace talks to start as soon as possible could not force Ukraine to surrender its territories.

He noted that Kiev was not afraid of losing support from Washington after the next US presidential election in November 2024, because, according to Zelensky, both the Democrats and the Republicans are allies of Ukraine. The issue of a potential counterattack by the Ukrainian army has been discussed in the Ukrainian media for several months. A buildup of Ukrainian reserves was noted in the Zaporozhye area recently. Media reports have mooted various dates for the start of an attack, but the commencement of Kiev’s much-ballyhooed counteroffensive has been postponed several times already. Among the reasons the reports mentioned were the slow delivery of Western equipment, bad weather and huge losses suffered by Ukrainian troops in Artyomovsk (called Bakhmut in Ukraine).

“Shaping involves striking targets such as weapons depots, command centers and armor and artillery systems..”

• Ukrainian Forces Begin “Shaping” Operations For Counteroffensive (RT)

Ukrainian forces have begun “shaping” operations in advance of a highly-anticipated counteroffensive against Russian forces, a senior US military official and senior Western official told CNN, Report informs. Shaping involves striking targets such as weapons depots, command centers and armor and artillery systems to prepare the battlefield for advancing forces. It’s a standard tactic made prior to major combined operations. When Ukraine launched a counteroffensive late last summer in the southern and northeastern parts of the country, it was similarly preceded by air attacks to shape the battlefield. These shaping operations could continue for many days before the bulk of any planned Ukrainian offensive, according to the senior US military official.

Ukrainian President Volodymyr Zelensky said his country still needs “a bit more time” before it launches the counteroffensive, in order to allow some more of the promised Western military aid to arrive in the country. “With [what we have] we can go forward and be successful,” Zelensky told European public service broadcasters in an interview published on Thursday. “But we’d lose a lot of people. I think that’s unacceptable.” “So we need to wait. We still need a bit more time,” he said. Among the supplies Ukraine is still waiting for are armored vehicles — including tanks —which Zelensky said were “arriving in batches.” Shaping operations can also be designed to confuse the enemy.

There are still Ukrainians alive. Can’t have that.

• UK Sending Long-range Storm Shadow Missiles To Ukraine (G.)

Britain has become the first western country to provide Ukraine with the long-range Storm Shadow cruise missiles that Kyiv wants to boost its chances in a much-anticipated counteroffensive, prompting a threat from the Kremlin of a military response. Hours after Ukraine’s president, Volodymyr Zelenskiy, said he needed more western weapons to be confident of a victory this summer, Ben Wallace, the UK defence secretary, told MPs that the missiles – which cost more than £2m each – were “now going in, or are in the country itself”. The gift of the missiles was supported by the US, Wallace added, although previously Washington had declined to give Ukraine long-range missiles of its own, fearing that the outcome could escalate hostilities in the 15-month war.

Reflecting such concerns, the minister said the decision was “a calibrated and proportionate response” to the Russian invasion, and in particular Moscow’s repeated targeting of Ukrainian civilians. At least 23,000 civilians had been killed or injured, Wallace said. Russia had made “788 attacks on healthcare facilities, hospitals, clinics, medical centres”, and on many occasions killed civilians in missile strikes, he added. “The use of Storm Shadow will allow Ukraine to push back Russian forces based within Ukrainian sovereign territory,” Wallace told MPs, adding: “Russia must recognise that their actions alone have led to such systems being provided.” Speaking at a press briefing in Moscow, the Kremlin spokesperson Dmitry Peskov said Russia was taking a “rather negative” view of the UK’s move. “This will require an adequate response from our military, who … will make appropriate decisions,” he said.

Wallace did not say how many Storm Shadow missiles had been given to Ukraine, although it has been estimated the UK holds a stock of between 700 and 1,000. Working with four other countries, the UK issued a tender to buy more long-range “missiles or rockets with a range of 100-300km” (62 to 186 miles). Storm Shadow has a range of “in excess of 250km”, according to its manufacturer, the European arms group MBDA. That is significantly further than the high-precision US Himars rocket launchers currently used heavily by Ukraine, which rely on missiles with a range of 47 miles. Himars have become less effective as the Russian invaders have moved reserves of troops and equipment out of their range.

There have been concerns that the Storm Shadow missiles could be used to strike targets deep inside Russia’s internationally recognised borders. The White House has balked at supplying Ukraine with similar long-range ATACMS missiles, which can be fitted to the Himars systems. Wallace said the US was “incredibly supportive” of the UK’s decision, and said ATACMS missiles were not as suitable as Storm Shadow, which is designed to be able to strike defensive positions below ground.

@BrianJBerletic

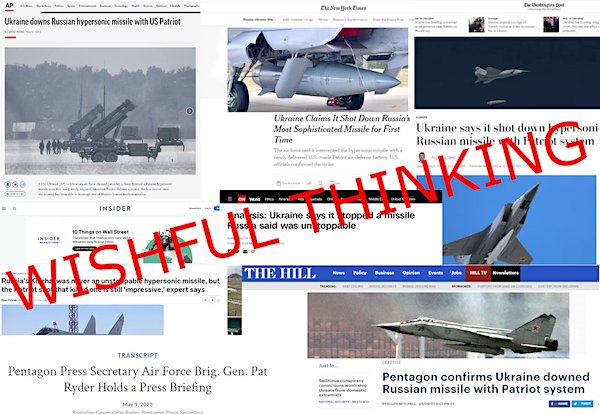

“This is clearly not a Russian Kinzhal missile which is a massive missile at 1.2 meters in diameter. Whatever this is, it is much smaller. Those claiming it is a BetAB-500 make a much more convincing argument…”

• Russian MoD Denies Kinzhal Intercepted By Patriot Air Defense System (RIA)

The American Patriot anti-aircraft missile system could not shoot down the Russian Kinzhal missile due to its technical characteristics, a senior source in the Ministry of Defense said. “The fact is that the flight speed of the Kinzhal missile exceeds the maximum combat modes of anti-aircraft missile systems supplied by the West to the Kyiv regime, including the Patriot,” the agency’s interlocutor explained. In addition, as the source recalled, in the final phase of the flight, the Kinzhal performs an anti-missile maneuver and an almost vertical approach to the target, which excludes the possibility of it being intercepted by anti-aircraft missile systems. He called the statements about the downed hypersonic missile a hoax and stressed that it was “an attempt to wishful thinking. Earlier, the head of the press service of the Pentagon, Patrick Ryder, said at a briefing that Ukraine allegedly shot down a Russian Kinzhal missile with the help of the Patriot missile defense system transferred to it.

Exclusive: Today we were able to see the remains of the Kinshal missile in Kyiv, which was shot down by Patriot defense on May 5. This was a sensation because the hypersonic missile was considered Putin's wonder weapon. Here the parts are now being examined. @bild pic.twitter.com/BcFN4KV8YX

— Paul Ronzheimer (@ronzheimer) May 10, 2023

“The West embarked on its sanctions war with an exaggerated sense of its own influence around the world..”

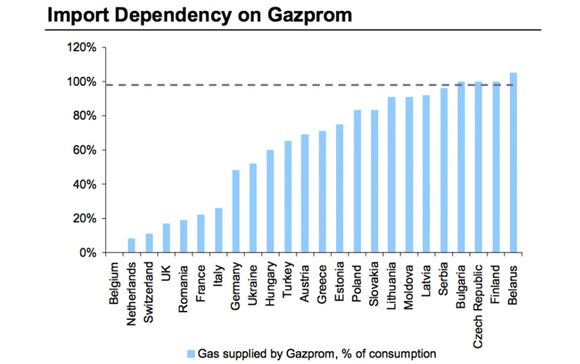

• West ‘Miscalculated’ With Economic War Against Russia – Spectator (TASS)

Western countries have failed to achieve their goals with the economic war they unleashed on Russia following the onset of its special military operation in Ukraine, according to an editorial by the British Spectator weekly published on its website on Thursday. According to the magazine, the West quickly became aware that other countries were not ready to stop doing business with Russia, which rapidly redirected its oil and gas supplies to China and India. The bans introduced by the West have been surmounted with parallel imports. That said, the European economy is smarting from the consequences of its sudden rejection of Russian energy. The Spectator points out that the Russian economy was also hurt but not as seriously as Ukraine’s allies hoped.

“The West embarked on its sanctions war with an exaggerated sense of its own influence around the world. As we have discovered, non-western countries lack the will to impose sanctions on either Russia or on Russian oligarchs. The results of the miscalculation are there for all to see. <…> The Russian economy has not been destroyed; it has merely been reconfigured, reorientated to look eastwards and southwards rather than westwards,” the article says. The authors admit that in itself, the plan to declare the sanctions war on Russia “was not necessarily wrong” but point out that the West “is badly mistaken” if it continues to think that in the future, “it can fight wars purely by economic means, without bombs or bullets.”

“..HIMARS systems were used, targeting “exclusively in the residential, central quarter of the city.”

• Donetsk Civilians Live In Constant Fear Of Ukrainian Shelling (Eva Bartlett)

Heavy Ukrainian shelling of central Donetsk on April 28 killed nine civilians – including an eight-year-old girl and her grandmother – and injured at least 16 more. The victims were burned alive when the minibus they were in was hit by a shell. The attack also targeted a major hospital, apartment buildings, houses, parks, streets, and sidewalks. All civilian areas – not military targets. According to the Donetsk People’s Republic’s (DPR) Representative Office in the JCCC (Joint Monitoring and Co-ordination Center on Ukraine’s War Crimes), Kiev’s forces fired high-explosive fragmentation missiles “produced in Slovakia and transferred to Ukraine by NATO countries.” Regarding an earlier shelling on the same day, the JCCC noted that US-made HIMARS systems were used, targeting “exclusively in the residential, central quarter of the city.”

I was outside of Donetsk interviewing refugees from Artyomovsk (also known as Bakhmut) when both rounds of intense shelling occurred, the first starting just after 11am. I returned to see a catastrophic scene, with a burnt-out bus – still smoking – and some of its passengers’ charred bodies melted onto the frame. This tragic picture was sadly not a one-off event. Elsewhere, city workers were already removing debris and had begun repaving damaged sections of the roads. I’ve seen this following Ukrainian shelling many times, including on January 1 this year, when Ukraine fired 25 Grads into the city centre. Similarly, in July 2022, Ukrainian shelling downtown killed four civilians, including two in a vehicle likewise gutted by flames. When I arrived at the scene about an hour later, workers were repaving the affected section of the street.

The damage to the Republican Trauma Center hospital was quickly cleaned up, but videos shared on Telegram immediately after the shelling show a gaping hole in one of the walls. The room concerned contained what was, apparently, Donetsk’s sole MRI machine. Along Artyoma street, the central Donetsk boulevard targeted countless times by Ukrainian attacks, the destruction was evident: Two cars caught up in the bombing, residents of an apartment building boarding up shattered windows and doors, the all-too-familiar sound of glass and debris being swept away. In the residential area, the first to be targeted that day, in a massive crater behind one house, the walls and roof of another home were intermixed with rocket fragments.

Donbass

Heroes of Donbass

'On the 24th they said, 'It's war! Pack up and go!' When the special military operation in Ukraine began, many people immediately knew that this is where they needed to be. Without a trace of regret, they gave up their cushy lives to join the People’s Militia… pic.twitter.com/Hy2xTZJqWz

— DAVID E (@DAVID_STOIC1) May 11, 2023

And guess who we blame?

• European Security Order ‘Is No More’ – German President (RT)

The conflict between Russia and Ukraine has “destroyed” the security order in Europe, German President Frank-Walter Steinmeier has claimed. He argued that there would no return to former security principles even after the hostilities end. “The European security order is no more,” Steinmeier told Germany’s RBB radio broadcaster on Wednesday, adding that “common security” will cease to be a “common concept for a long time to come.” “We will find [ourselves] in a new situation [after the fighting ends], in which Europe on the one hand and Russia on the other hand will defend themselves against each other over the medium term,” the German president said. Steinmeier pinned the blame on Moscow for the erosion of European security, maintaining that neither the German government nor the EU was responsible.

The comments came one day after EU foreign policy chief Josep Borrell asserted that the Ukraine conflict could be ended within days, should the flow of Western arms to Kiev cease. Borrell acknowledged, however, that such a scenario would not lead to the outcome Brussels was hoping for. Russia has repeatedly stated it is ready to resolve the conflict through peaceful means, as long as its goals are achieved and its interests are taken into account. Before the Russian military launched its campaign in Ukraine, Moscow tabled a comprehensive draft deal on security in Europe in 2021. The proposal involved a pledge by NATO not to expand further to the east, the removal of US nuclear weapons from Europe, and the withdrawal of NATO troops and missiles away from the Russian border. The deal was rejected by both Washington and Brussels.

Erdogan has elections this Sunday..

• Grain Deal Extended By 60 Days, Decision May Be Announced By Erdogan (TASS)

The grain deal, which expires on May 18, will be extended by 60 days, the corresponding decision may be first to be announced by Turkish President Tayyip Erdogan, a source familiar with the negotiation process told TASS. “The deal, I think, will be extended for 60 days, but Russia may agree to this for the last time. The decision to prolong “traditionally” may be announced by Turkish President Tayyip Erdogan after a telephone conversation with his Russian counterpart [Vladimir Putin],” the source said. The source did not rule out that the decision can be announced “today or tomorrow”. However, the source called the possibility of extending the deal a “gesture from Russia” in the hope that its demands, enshrined in the Istanbul memorandum of July 22 last year, would be taken into account.

Following the talks in Istanbul between the delegations of Russia, Turkey, Ukraine and the UN, Russian Deputy Foreign Minister Sergey Vershinin told reporters that the Russian part of the agreements would cease to operate if Moscow did not receive guarantees that their demands would be met by May 18. They concern the export of agricultural products and fertilizers, the reconnection of the Russian Agricultural Bank to the SWIFT system, and a number of other issues. Agreements to enable the export of food and fertilizers to world markets were signed on July 22, 2022 in Istanbul. They were originally meant to last 120 days and were extended for another 120 days in November. Russia announced on March 18 that the deal was extended for another 60 days, saying this would be enough time to assess the effectiveness of the memorandum signed with the UN.

Moscow has said repeatedly that any further extension of the deal hinges on whether the Russian part of the deal is implemented. The lack of progress in this issue jeopardizes the future of the entire initiative. On May 10-11 representatives of Russia, Turkey, Ukraine and the UN met in Istanbul to discuss a potential extension of the grain deal and the implementation of the Russian part of the agreement for supplies of grain and fertilizers. The security of the Black Sea grain corridor was also on the agenda.

” It was in Northern Ireland that Britain perfected “five techniques” of psychological and physical torment, which formed the basis of modern torture worldwide..”

• The UK’s Secret Control Of Palestinian Security Forces (Klarenberg)

From the UK Foreign Office’s perspective, steering the PA’s activities and composition ensures it not only remains “supportive of UK values and interests,” but also allows London’s domestic and foreign security and intelligence services to train an unblinking eye on residents of Gaza and the West Bank. As a result, potential threats of retaliatory violence arising from Tel Aviv’s brutal assaults in the Occupied Territories – both to Israel and Britain – can be neutralized via local actors. British infiltration of the Palestinian Authority is a long-running story, and its security infrastructure has always been a primary target. In 2004, the government of Tony Blair dispatched veteran senior British police officer Jonathan McIvor to assist the body.

The next year, he was employed by the European Union to establish the Coordinating Office for Palestinian Police Support (COPPS), Brussels’ first “security” mission in Palestine – which increases cooperation between the PA’s military, security, policing, and intelligence wings, and Israeli occupation forces – in advance of its formal launch in early 2006, and served for some time as its first chief. Questions can only abound as to whether McIvor’s high-level stint within the Royal Ulster Constabulary, a police force in Northern Ireland notorious for vicious discrimination against the province’s Catholic minority, and intensive collusion with loyalist terrorist groups, informed tactics employed today by the Palestinian Authority. It was in Northern Ireland that Britain perfected “five techniques” of psychological and physical torment, which formed the basis of modern torture worldwide, along with a strategy of “internment without trial” for terror suspects.

In 1976, a secret directive gave the Royal Ulster Constabulary free rein to employ these techniques whenever its officers wished, which endured well into the 1990s, concurrent with McIvor’s tenure with the force. The Palestinian Authority has been confirmed to widely engage in arbitrary arrests and torture of detainees, typically at Israel’s behest. Now that the PA is proving increasingly ineffective at quelling peaceful and armed resistance to both its brutal rule and Israeli ethnic cleansing in the Occupied Territories, the ‘expert’ guidance of Adam Smith International and other British government contractors has perhaps never been so urgently in need.

No background checks…

• US Sells Weapons To Majority Of Authoritarian Regimes – The Intercept (RT)

The administration of US President Joe Biden sold weapons to at least 57% of the world’s authoritarian regimes in 2022, according to analysis published on Thursday by The Intercept. In a lengthy review of US arms-dealing practices and recently released government data, the American publication noted that Washington has accounted for around 40% of global arms sales each year since the end of the Cold War. It added that, according to a classification system devised at the University of Gothenburg in Sweden, the United States distributed weapons in 2022 to at least 48 of 84 (57%) countries described by the ‘Varieties of Democracy’ project as being under autocratic or authoritarian rule.

The Swedish study categorized global governments on a scale ranging from ‘closed autocracy’ to ‘liberal democracy’, principally using methodology to discern how free and fair a country’s elections might be. US weapons exports are typically divided into two categories: foreign military sales (FMS) and direct commercial sales (DCS). FMS requires the US government to act as a direct intermediary, with Washington buying the assets from a weapons manufacturer before it provides them to a foreign government. DCS deals, meanwhile, largely removes from the government’s intermediary role and permits manufacturers to sell directly abroad. Both types of sale require full approval from Washington. According to government data, the United States sold arms in FMS deals to 142 countries and territories last year, producing $85 billion in bilateral sales.

In Biden’s first full year as president, US weapons sales to foreign countries amounted to $206 billion – surpassing a Trump-era record of $192 billion. The US has been a key weapons supplier to Ukraine throughout its conflict with Russia. The Intercept noted, however, that this does not fully explain the boom in Washington’s arms export industry last year, as much of the weaponry was provided to Kiev in the form of grants. Russia’s offensive also began five months into the 2022 fiscal year. The findings of the analysis stand in contrast to Biden’s often-repeated stance of opposition to authoritarian governments. In a speech in Warsaw last year, the US president described conflict between democracy and autocracy as a battle “between liberty and repression” and “between a rules-based international order and one governed by brute force.”

6,600 homicides in 2015. Zero the past year.

• World’s Most Violent Country Claims Murder-Free Year (RT)

President Nayib Bukele of El Salvador on Thursday announced an unprecedented homicide-free streak, adding up to 365 days since he took power nearly four years ago. The Latin American country was considered the world’s most violent as late as 2016. “We concluded May 10, 2023 with 0 homicides nationwide,” Bukele said on Twitter. “With this, it’s 365 days without homicides, a whole year.” The accompanying 90-second video called the development without precedent in El Salvador’s history. As of 2009, the country was considered the most violent in Latin America, with a killing every two hours. By 2015, it had over 6,600 homicides, the deadliest country in the world that wasn’t at war.

The homicide-free year was not consecutive, but rather cumulative over the four years of Bukele’s presidency. Before he took office in June 2019, the country had recorded only two days without a homicide in 15 years. Now El Salvador is “the most secure country in Latin America,” argued the president. “The country has never recorded such a cycle of peace, since its birth as a republic,” one Salvadoran social media influencer pointed out. Bukele has attributed the drastic change to his ‘War on Gangs’. His government declared a state of emergency in March 2022, amid a major spike in gang violence in the nation of 6.5 million on the Pacific Ocean. Designating the notorious Mara Salvatrucha (MS-13), Barrio 18 and other gangs as terrorists, his government has so far jailed over 65,000 suspected criminals.

A mega-prison called the Center for the Confinement of Terrorism (CECOT), with the capacity to hold 40,000 convicts in maximum security, has been built outside the capital. Parallel to the crackdown on gangs, Bukele has embraced economic reforms, introducing Bitcoin as legal tender on par with the US dollar – over objections from the IMF – and abolishing all taxes and tariffs on the information technology sector. Visiting El Salvador in March, AP reported that ordinary Salvadorans were relieved and enjoying their daily lives without being terrorized by organized crime. But the agency also quoted US-based human rights experts who worried about El Salvador becoming a “police state.” Bukele’s government did not respond to the outlet’s requests for comment.

We ended on May 10, 2023, with 0 homicides nationwide.

With this, it's 365 days without homicides, a full year. pic.twitter.com/SlupO8vN6J

— Nayib Bukele (@nayibbukele) May 12, 2023

“..only America’s enemies are low enough, and deprived enough of real firepower, to require the use of such tactics..”

• The Censorship-Industrial Complex: The Top 50 Organizations to Know (Taibbi+)

In 1996, just as the Internet was becoming part of daily life in America, the U.S. Army published “Field Manual 100-6,” which spoke of “an expanding information domain termed the Global Information Environment” that contains “information processes and systems that are beyond the direct influence of the military.” Military commanders needed to understand that “information dominance” in the “GIE” would henceforth be a crucial element for “operating effectively.” You’ll often see it implied that “information operations” are only practiced by America’s enemies, because only America’s enemies are low enough, and deprived enough of real firepower, to require the use of such tactics, needing as they do to “overcome military limitations.” We rarely hear about America’s own lengthy history with “active measures” and “information operations,” but popular media gives us space to read about the desperate tactics of the Asiatic enemy, perennially described as something like an incurable trans-continental golf cheat.

Indeed, part of the new mania surrounding “hybrid warfare” is the idea that while the American human being is accustomed to living in clear states of “war” or “peace,” the Russian, Chinese, or Iranian citizen is born into a state of constant conflict, where war is always ongoing, whether declared or not. In the face of such adversaries, America’s “open” information landscape is little more than military weakness. In March of 2017, in a hearing of the House Armed Services Committee on hybrid war, chairman Mac Thornberry opened the session with ominous remarks, suggesting that in the wider context of history, an America built on constitutional principles of decentralized power might have been badly designed: Americans are used to thinking of a binary state of either war or peace. That is the way our organizations, doctrine, and approaches are geared. Other countries, including Russia, China, and Iran, use a wider array of centrally controlled, or at least centrally directed, instruments of national power and influence to achieve their objectives…

Whether it is contributing to foreign political parties, targeted assassinations of opponents, infiltrating non-uniformed personnel such as the little green men, traditional media and social media, influence operations, or cyber-connected activity, all of these tactics and more are used to advance their national interests and most often to damage American national interests… The historical records suggest that hybrid warfare in one form or another may well be the norm for human conflict, rather than the exception. Around that same time, i.e. shortly after the election of Donald Trump, it was becoming gospel among the future leaders of the “Censorship-Industrial Complex” that interference by “malign foreign threat actors” and the vicissitudes of Western domestic politics must be linked. Everything, from John Podesta’s emails to Trump’s Rust Belt primary victories to Brexit, were to be understood first and foremost as hybrid war events.

This is why the Trump-Russia scandal in the United States will likely be remembered as a crucial moment in 21st-century history, even though the investigation superficially ended a non-story, fake news in itself. What the Mueller investigation didn’t accomplish in ousting Trump from office, it did accomplish in birthing a vast new public-private bureaucracy devoted to stopping “mis-, dis-, and malinformation,” while smoothing public acquiescence to the emergence of a spate of new government agencies with “information warfare” missions.

Guess who was the Chair of the Ad Council that drove the partnership between global corporations and the US Government to push vaccines during COVID…

“And then I hired a WEF Executive Chair who worked with the White House and ‘government agencies’ on the COVID-19 ‘vaccination’ campaign to be the new CEO of ‘free-speech’ Twitter …”

• Elon Musk Hires Ultra Woke Linda Yaccarino as CEO of Twitter (CTH)

Elon Musk has reportedly hired Linda Yaccarino as the CEO of Twitter. Unfortunately, this decision is the exact opposite of what everyone hoped about Musk’s intentions with the platform. Ms. Yaccarino is the head of NBCUniversal Advertising and Partnerships, and she is the tip of the spear in the creation of DEI (Diversity Equity and Inclusion) indexing and corporate scoring. You might be familiar with ‘DEI’ as a result of the Bud Light woke advertising campaign to promote beer for transgenders. Well, that’s DEI in action, and Ms. Yaccarino is one of the pioneers in the advertising industry. Additionally, Linda Yaccarino is the Chairwoman of the World Economic Forum’s (WEF) Taskforce on Future of Work. As she noted in her position, “every CEO and executive needs to look inward, and build workplaces that ensure our employees, current and future, can always succeed amid rapid transformation.”

Overlaying the Diversity Equity and Inclusion mindset, you will note Yaccarino says, “long-term benefits for the unemployed, women, and communities of color.” Why would Elon Musk bring the most woke NBC advertising executive to become the CEO of Twitter? Obviously, he is focused on generating revenue, and Yaccarino can bring woke credentials to the platform luring corporate advertisers. Unfortunately, in order to achieve that objective, the platform content will have to be modified. That means the public square of Twitter needs to become a platform of non-controversial NPCs (Non Player Characters) which generally are identified in memes [SEE HERE]. The content on Twitter must fit an approved standard for advertising. Leading this effort to control platform content through the control of the monetization, is literally what Yaccarino has done in her work at NBCUniversal. Thus, her efforts to promote DEI take on a new level of importance.

Ms. Yaccarino also supports Florida Governor Ron DeSantis and follows him and his fellow influencers through her Twitter account. Politically this puts her in alignment with Elon Musk and the acceptable Republican group that promotes the Florida Governor. Keep in mind, for DeSantis, the “woke issues” are political tools to achieve an objective; nothing more. Ms. Yaccarino supporting Ron DeSantis is not a misnomer, it’s just politics. Similarly, for Elon Musk, it appears Ms. Yaccarino brings a greater financial value to the table offsetting any contradictions in his belief system about wokeism as a danger to speech and culture. Obviously, this hire says Musk is more concerned about revenue generation than actual free speech.

"maybe almost close to cash flow positive" when you aren't paying any of your bills is really an amazing accomplishment, truly brava

also, they are both the worst actors in the world pic.twitter.com/79iR57Fxdw

— chancehooray daily (@chancery_daily) May 12, 2023

okay, breaking this interview up into its component parts of her questions/talking points really makes it sofaking obvious this was stop one of the Great Rehabilitation Tour. i mean, she says as much in the intro, but my g-d, it's like this whole this was Sponsored Content™️ pic.twitter.com/JuVjExfUqO

— chancehooray daily (@chancery_daily) May 12, 2023

Carole Lynn Crist, wife of Charlie Christ, former First Lady of Florida asks a Very Weird™️ question of Elon and tears up at his interview with Linda Yaccarino on April 18th. pic.twitter.com/tksNuP62lu

— chancehooray daily (@chancery_daily) May 12, 2023

“It was the most traumatizing experience of my life. It was assault, plain and simple. And defamation.”

• CNN Host Sues Trump For Assault And Defamation After Town Hall (BBee)

A visibly shaken Kaitlan Collins announced she will be suing Trump for assault and defamation after being destroyed by the former President on national television last night. “He said things I didn’t agree with. Even worse, he said things I didn’t like,” said Collins in a statement. “It was the most traumatizing experience of my life. It was assault, plain and simple. And defamation. I’m suing Trump for $5 million like that other lady.” Sources also reported Trump called the CNN host a “nasty person,” which trusted fact-checkers have determined was false.

Media experts applauded the announcement and were all in agreement that Trump’s performance in the town hall was the most horrifying spectacle ever televised. “I am literally shaking right now,” said CNN Host Jake Tapper. “The lies, the misinformation, the pure evil of that monstrous orange man is too much for my soul to bear. Our democracy is in danger once again. God help us all.” Biden also responded to the town hall, saying: “Reflustrazuuure! Shut up, fat!” Within minutes of the announcement of the lawsuit, a New York judge ruled in favor of the plaintiff and ordered Trump to pay $5 million.

E Jean

This is the TOTALLY INSANE woman who made unfounded accusations against Trump the NY court believed. pic.twitter.com/knaCNqWOYF

— Stew Peters (@realstewpeters) May 11, 2023

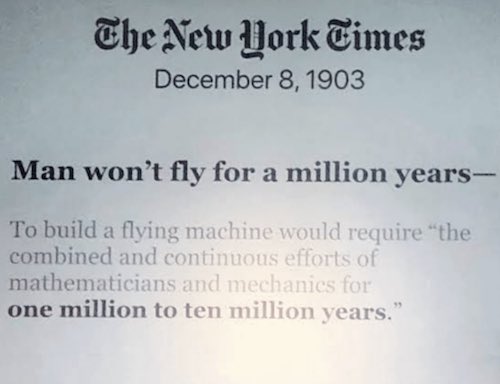

9 days before the Wright Brothers’ first flight.

Dog fight

Wait until the end.. 😂 pic.twitter.com/rdk2zReDLs

— Buitengebieden (@buitengebieden) May 11, 2023

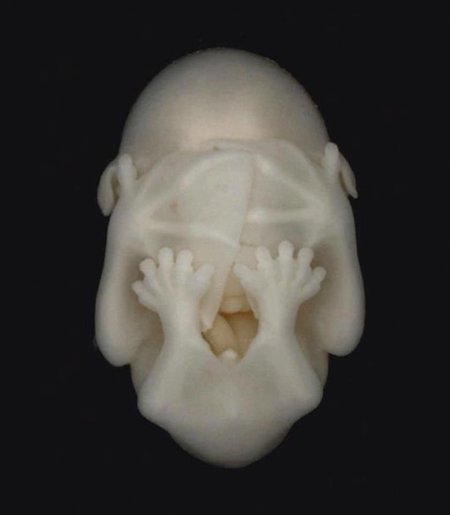

Eudocima phalonia is also known as the common fruit-piercing moth, in its caterpillar stage it looks like a galaxy

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.