Salvador Dali Apparition of My Cousin Carolinetta on the Beach at Rosas 1934

Repeat the line

This is priceless

pic.twitter.com/lzWnblrZIK— TF Metals Report (@TFMetals) July 8, 2022

16-year old Jouke whom the police tried to kill. Gov’t now says it was a error of judgment, and the cop is at home sick feeling very bad. But look where the bullet hole is. As Jouke says here, they could have shot at the tires, huge targets, and you stand still within seconds.

"I was saved by an angel." These are the words of Jouke, the underage boy which the Mark Rutte's police shot in a demonstration by Dutch farmers in Heerenveen. pic.twitter.com/XThDhAAX1d

— RadioGenova (@RadioGenova) July 8, 2022

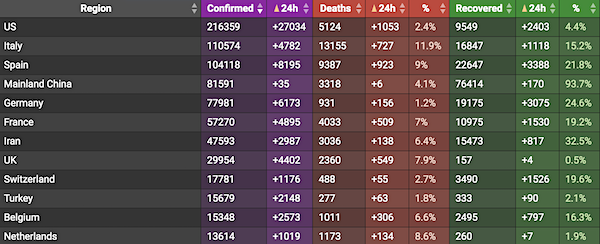

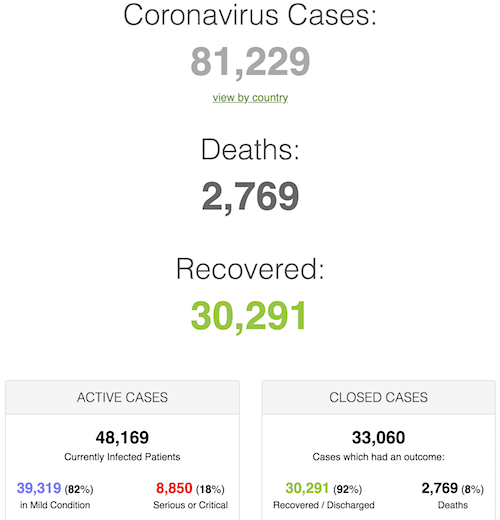

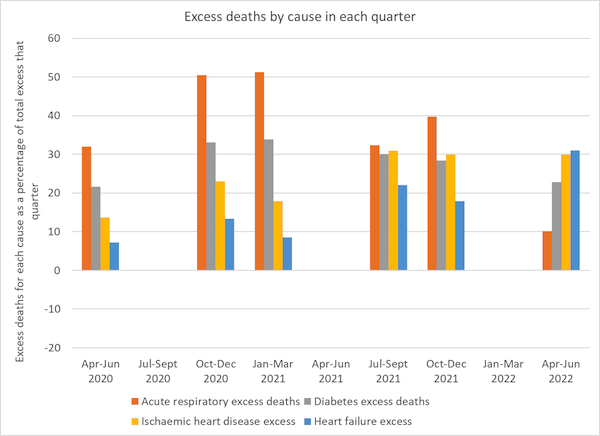

Note how the cause of death was put on its head, from respiratory to heart failure.

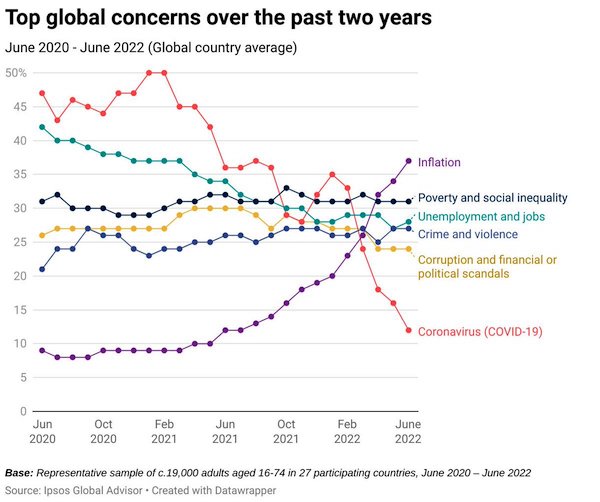

Blind eye

When vaccine passports were being implemented, protests took place around the world – but there was hardly any coverage from the media.

Due to the cost of living crisis, protests are happening around the world – but again, the media turns a blind eye.

— James Melville (@JamesMelville) July 8, 2022

“Hope is like a road in the country; there was never a road, but when many people walk on it, the road comes into existence.”

– Lu Xun (Chinese writer) 1921.

• EU Will Be Held Responsible For Starving Millions Around The World – Tycoon (RT)

Sanctions imposed on Russian and Belarusian fertilizer producers are akin to weapons of mass destruction in the scale of the damage they will likely cause over the next few years, the founder of chemical giant EuroChem has claimed. “The EU sanctions mean suffering, famine and migration flows for many hundreds of millions of people,” Andrey Melnichenko said in an interview with the Swiss newspaper Die Weltwoche on Thursday. “Sanctions targeting food and energy are economic weapons of mass destruction. They hit innocent people the worst. I have no doubt that billions of people will feel its effects,” he warned. Suffering people will want to hold those responsible accountable, and the EU won’t be able to shift its culpability, the businessman added.

It was not Russia or the US, but EU members like Lithuania and Estonia, and also European leaders Germany, France and Italy, which chose to disrupt the operation of his chemical empire with sanctions, he explained. EuroChem, a leading fertilizer producer, is headquartered in Switzerland, where Melnichenko also lives with his family. The EU and Switzerland targeted the company and its owner with sanctions aimed at hurting the Russian economy in retaliation for Moscow’s offensive in Ukraine. Melnichenko argued he personally was unjustly punished for being a rich Russian, dismissing claims that he had any influence on the Russian government. He warned of the catastrophic consequences that the “carpet-bombing” of the Russian economy will cause over a few years.

He assessed that EuroChem products helped feed almost 274 million people. With its fertilizers not produced and sold due to sanctions, the effect would be far worse than what is happening now over the cut in grain exports from Ukraine, he said. “The G7 countries, with their one billion citizens, see themselves as the world’s moral leaders. But they have overridden the interests of the other seven billion people,” he said. Russia and its ally Belarus, another target for Western sanctions, account for 17% of global fertilizer supply, the tycoon said. Exports from those two countries dropped by 30- 40% amid the stand-off with the West, and it’s the most vulnerable people, who are paying the price, he warned. “We don’t know whether people in the third world are already dying, or if they are ‘just’ starving and migrating away,” he said. With social tensions skyrocketing over hunger and fuel shortages, there will be a surge of violence, he predicted. “Perhaps jihad will raise its black flag again. These are not wild theories, but facts.”

“.. the Russians sent in their junior varsity and systematically wiped up the floor with Ukraine’s 250,000-man, NATO-trained (ha!) army of neo-Nazis..”

• Ignition… Lift-off! (Kunstler)

It looks like someone has called room service in a certain Swiss Fortress of Solitude and ordered der Schwabenklaus’s ass to be handed to him on a platter with a side of sauerkraut. The assisted suicide of Western Civ, Euro division, has been interrupted by peasant uprisings, first in the Netherlands, now spreading to Germany, Italy, and Poland. The farmers are on the march. They are coming for you, Klaus, and your World Economic Forum’s legion of implanted government goblins. The governments of virtually all the nations of Western Civ have become enemies of their people. It’s been obvious in the USA for quite some time, but our preposterous attempt to turn Ukraine into a forward NATO missile base next door to Russia finally revealed the villainous rot in Euroland, too.

Cut yourselves off, Germany, from Russian oil and natural gas? Whose bright idea was that? (Hint: Chancellor Olaf Scholz, who else? He supposedly runs that joint, doesn’t he?) Plan B, you Deutsches Volk now realize, is to burn your furniture to stay warm at Christmas. America’s gambit to goad Russia into a Ukrainian quagmire turned into such a mighty fail that the US news media doesn’t even report on the doings there anymore. Which are: the Russians sent in their junior varsity and systematically wiped up the floor with Ukraine’s 250,000-man, NATO-trained (ha!) army of neo-Nazis. That is not an empty pejorative, by the way. They really are explicitly true believers in old Adolf’s mid-20th century program of exterminating the Russ people next door. Mr. Putin wasn’t kidding around when he highlighted that feature of his operation.

So, now the heart of Euroland looks forward to a new era without energy and without modern industry, meaning what? Well, without modern life (maybe without life, period). Der Schwabenklaus outlined that pretty clearly, too, with the by-now shopworn slogan that “You vill own nussing and you vill be heppy.” It was such an absurd maxim that many who pretend to think took it as a sort of joke. And, let’s face it, Klaus really does appear to be a comic figure — the weirdo tunic he sometimes wears, the Hollywood B-movie accent. But not so many are laughing now as the lights go out from Galway Bay to the Gulf of Riga.

“They treated our warnings so dismissively. This is exactly the situation that we have warned about, this is happening today..”

• Western ‘Economic Blitzkrieg’ Has Failed – Putin (RT)

Western nations have failed in their attempts to destabilize the Russian economy with sanctions, President Vladimir Putin said at a government meeting on economic issues on Friday. “As a result of the actions of the Central Bank, as a result of the measures that were taken in a timely manner by the government … a lot was done. And the so-called blitzkrieg that our ill-wishers attempted in relation to Russia, the economic blitzkrieg, of course, has failed,” he said. The president, nevertheless, acknowledged that the restrictions have hurt the country’s economy and “many risks still remain.” Putin has urged that in response to the current challenges associated with Western sanctions, Russian energy companies should work for the long-term perspective.

Gasification of the country’s regions and diversification of exports should be the key tasks for the government, he stressed. According to the Russian leader, the government is already considering options for developing railway, sea and pipeline infrastructure for the supply of Russian oil and oil products to friendly countries, as well as gas transportation infrastructure to increase gas supplies to Asia and the domestic market. Talking about the general economic situation, he pointed out that the world markets “are still in disarray due to the West’s calls to abandon Russian energy resources.” Putin recalled that the price of Brent oil surged to $130 per barrel amid fears of a possible shortage, but in recent days prices have fallen by $20-$30 due to projections of a global economic slowdown.

The Russian president reminded his audience that he had repeatedly warned European leaders about the current situation on the global energy market, but no one listened. “They treated our warnings so dismissively. This is exactly the situation that we have warned about, this is happening today,” he noted. Putin also indicated that if Western countries continue their sanctions policy it could lead to catastrophic consequences for the global energy market. Anti-Russia sanctions cause much more damage to those who introduce them, he said. At the same time, the situation on the Russian energy market is stable despite the sanctions regime, the president explained. According to him, oil and gas condensate production in June reached 10.7 million barrels per day, which is 500,000 barrels more than in the previous month. Overall, Russia’s oil output jumped 3.5% since the start of the year. Gas production for the period from January to May decreased slightly, by merely 2%, the president added.

Putin threats?!

Ukraine war: Accept our terms or brace for the worst, Putin tells Kyiv

euronews pic.twitter.com/iu1L06hdch— Wittgenstein (@backtolife_2023) July 8, 2022

“In all, these and other dictatorial regimes killed more than 133 million people in the 20th Century..”

• Neo-Feudalism: Klaus Schwab, the WEF, and The Great Reset (Rawles)

Men have always sought to dominate and forcefully order the lives of others. This is part of human nature. It dates back to before the days of Noah. Early empires sought power and wealth, by conquest. Monarchies and feudalism dominated the Middle Ages in Europe, South Asia, and East Asia. Then, in a consolidation of monarchist power, colonialism was rampant from the 1550s to the 1950s. Only a few large and economically strong colonies broke away from their parent countries, before 1900. As colonialism began to wane, collectivism started to re-shape the world, mostly after 1916. Ponder the far-reaching effects of these brutal collectivists: the Soviet Union (1917-1991), Nazi Germany (1933-1945), Cambodia (1967-1978), Cuba (1959 to present), and Communist China (1943 to present).

In all, these and other dictatorial regimes killed more than 133 million people in the 20th Century, imprisoned hundreds of millions, and placed billions of people under the yoke of contrived collective economic systems, confiscating their wealth and land. Most of this killing and suffering was at the hands of communists or socialists with grand utopian visions of the future (with special status just for themselves) or a “new world order”. To their way of thinking, this justified taking the lives and property of their countrymen, and often also those in other countries, through invasions.The latest in a long string of socialist despots is coming to the fore. This time it is with the new excuses of “protecting the environment” and preventing or reversing “climate change”. Many of them use the blanket term “Environmental, Social, and Governance” (ESG) to encapsulate their plans.

In effect, they want to control every aspect of human life, all around the world, to fulfill their supranational socialistic goals. These are globalists. As a key enabling tool, they want to implement a global electronic currency, with every transaction tracked. In toto, they have is a bigger plan of action than that of the multi-national Marxist-Leninist communist conspiracy of the 20th century. Most of the 20th Century communists wanted to keep nation-states intact. But the 21st Century globalists want a true world government, with all state and national governments subsumed for “the greater good.” The level of collectivism and redistribution of wealth that they covet is much larger than their Marxist, Leninist, and Maoist predecessors ever attempted. These new “green” socialist schemers want The Whole Enchilada: a reset to global government, with themselves at the top.

Schwab

“The next crisis is just around the corner — it’s the climate crisis.”pic.twitter.com/G7tDhQ6ILC

— Gonzalo Lira (@GonzaloLira1968) July 8, 2022

“Thirty years after the end of the Cold War, [Nato] has not yet abandoned its thinking and practice of creating ‘enemies’..”

• By Making China The Enemy, NATO Is Threatening World Peace (Cook)

As the saying goes, if you only have a hammer, every problem looks like a nail. The West has the North Atlantic Treaty Organization (Nato), a self-declared “defensive” military alliance – so any country that refuses its dictates must, by definition, be an offensive military threat. That is part of the reason why Nato issued a new “strategic concept” document last week at its summit in Madrid, declaring for the first time that China poses a “systemic challenge” to the alliance, alongside a primary “threat” from Russia. Beijing views this new designation as a decisive step by Nato on the path to pronouncing it a “threat” too – echoing the alliance’s escalatory approach towards Moscow over the past decade. In its previous mission statement, issued in 2010, Nato advocated “a true strategic partnership” with Russia.

According to a report in the New York Times, China would have found itself openly classed as a “threat” last week had it not been for Germany and France. They insisted that the more hostile terminology be watered down so as to avoid harming their trade and technology links with China. In response, Beijing accused Nato of “maliciously attacking and smearing” it, and warned that the alliance was “provoking confrontation”. Not unreasonably, Beijing believes Nato has strayed well out of its sphere of supposed “defensive” interest: the North Atlantic. Nato was founded in the wake of the Second World War expressly as a bulwark against Soviet expansion into Western Europe. The ensuing Cold War was primarily a territorial and ideological battle for the future of Europe, with the ever-present mutual threat of nuclear annihilation.

So how, Beijing might justifiably wonder, does China – on the other side of the globe – fit into Nato’s historic “defensive” mission? How are Chinese troops or missiles now threatening Europe or the US in ways they weren’t before? How are Americans or Europeans suddenly under threat of military conquest from China? The current Nato logic reads something like this: Russia’s invasion of Ukraine in February is proof that the Kremlin has ambitions to recreate its former Soviet empire in Europe. China is growing its military power and has similar imperial designs towards the rival, breakaway state of Taiwan, as well as western Pacific islands. And because Beijing and Moscow are strengthening their strategic ties in the face of western opposition, Nato has to presume that their shared goal is to bring western civilisation crashing down.

Or as last week’s Nato mission statement proclaimed: “The deepening strategic partnership between the People’s Republic of China and the Russian Federation and their mutually reinforcing attempts to undercut the rules-based international order run counter to our values and interests.” But if anyone is subverting the “rules-based international order”, a standard the West regularly invokes but never defines, it looks to be Nato itself – or the US, as the hand that wields the Nato hammer. That is certainly the way it looks to Beijing. In its response, China argued: “Thirty years after the end of the Cold War, [Nato] has not yet abandoned its thinking and practice of creating ‘enemies’ … It is Nato that is creating problems around the world.”

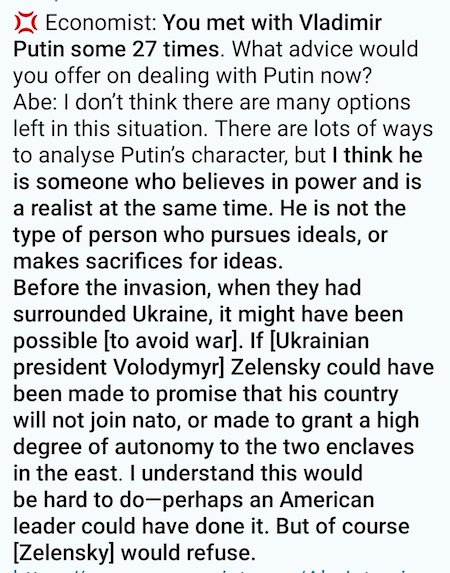

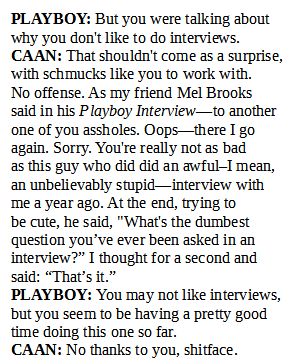

Shinzo Abe

Blinken’s attempt to drive a wedge between China and Russia. Way too late.

• US, China Top Diplomats Voice Cautious Hope In Rare Talks (Barron’s)

The top diplomats from the United States and China voiced guarded hope Saturday of preventing tensions from spiralling out of control as they held rare talks on the Indonesian island of Bali. Neither side expected major breakthroughs between Secretary of State Antony Blinken and Foreign Minister Wang Yi, but the two powers have moderated their tone and stepped up interaction at a time when the West is focused on Russia’s invasion of Ukraine. “In a relationship as complex and consequential as the one between the United States and China, there is a lot to talk about,” Blinken said as he opened discussions at a resort hotel in Bali, where the pair attended a Group of 20 gathering the day before.

“We very much look forward to a productive and constructive conversation,” Blinken said. Wang said that President Xi Jinping believed in cooperation as well as “mutual respect” between the world’s two largest economic powers and that there needed to be “normal exchanges” between them. “We do need to work together to ensure that this relationship will continue to move forward along the right track,” Wang said in front of US and Chinese flags before a day of talks that will include a working lunch. Daniel Kritenbrink, the top US diplomat for East Asia, earlier said that Blinken will seek “guardrails” in the US rivalry with China and do “everything possible to ensure that we prevent any miscalculation that could lead inadvertently to conflict”.

It is Blinken and Wang’s first in-person meeting since October. They are expected to prepare for virtual talks in the coming weeks between Xi and President Joe Biden. After a long chill during the pandemic between the two countries, since last month their defence, finance and national security chiefs as well as their top military commanders have all spoken. China’s state-run Global Times, known for its criticism of the United States, wrote that the growing diplomacy “underscored the two sides’ consensus on avoiding escalating confrontation”.

What are the “solidarity lanes”?

• EU Has Shipped Millions Of Tons Of Ukrainian Grain – Borrell (RT)

The European Union has accelerated the export of Ukrainian grain, almost doubling the volume of shipments in June, the EU’s foreign policy chief Josep Borrell reported in his Twitter on Friday. According to him, 5.8 million tons of grain have been transported by the EU from Ukraine via so-called “solidarity lanes” since April. Borrell also wrote that “1.2 billion people are severely exposed to the combination of rising food and energy prices and tightening financial conditions.” He once again accused Moscow of “blocking millions of tons of grain in Ukrainian storage facilities, using food as a weapon of war.” Western nations have repeatedly blamed Russia for blocking Ukrainian ports, making it impossible to ship the country’s grain.

Moscow has responded that it would guarantee safe passage for grain shipments if Kiev clears its ports of mines. Last month, President Vladimir Putin said that Russia is not impeding exports, and criticized the West for its “cynical attitude” towards the food supply of the developing nations, which have been worst affected by soaring prices. He said rising inflation in the West was “a result of their own irresponsible macroeconomic policies.” Ukraine, a major agricultural producer, has been unable to export its grain by sea due to the ongoing conflict, with an estimated 22 million to 25 million tons of grain currently stuck in the country’s ports.

“..this goes to show just how destructive blindly following Washington’s foreign policy is, time and time again, for Europe.”

• The EU Doesn’t Have A Plan For Life Without Cheap Russia Energy (Blankenship)

One solution on the table is for the EU to import liquified natural gas (LNG) from the United States. However, shipments of American LNG to the EU and UK have already increased since the political tensions between Europe and Russia began. According to the US Energy Information Administration, the US exported 74% of its LNG to Europe in the first four months of 2022, which is up from 34% the previous year. But this was apparently not enough to keep European energy prices stable. This raises a fundamental issue, which is whether the European Union can actually afford to maintain its sanctions on Russia.

Members’ economic models are simply not compatible with the reality that their sanctions are creating, and this is already hurting people’s wellbeing and leading to social and political unrest. The European Union’s foreign policy is supposed to follow the doctrine of “strategic autonomy,” but what is happening is neither strategic nor an act of autonomy. No doubt the situation in Ukraine is horrifying and has led Europeans to question the existing security architecture of the region, but, if the latest strategic concept of NATO is any suggestion, the shots are being called from Washington.

Famed international relations scholar John Mearsheimer recently lamented in a speech that, “History will judge the United States and its allies with abundant harshness for its foolish policy on Ukraine.” In fact, the prevailing allied policy on Ukraine is doing everything to ensure that the conflict becomes protracted – which has the dual threat of destroying Ukraine and hurting Europe’s future economic prospects. That’s because the longer the conflict continues, or if it continues indefinitely, it means the bifurcation between Russia and the West will be permanent. And it logically follows that this will impact the economic model of European countries, particularly of Germany. If that is the eventuality we are headed for, then the EU’s fate becomes a question.

Already, people in the Czech capital of Prague are beginning to joke that in a few years Europe will be nothing more than a summer holiday spot for the Americans and Chinese. But are there really enough jobs in the tourism industry for all of us here? And can we all withstand the winter off-season? Jokes aside, I believe that Germany’s trade deficit is significant. In a few days, the trend could be more pronounced if other industrial European countries report similar deficits. At the very least, this should sound the alarm on exactly what the European Union’s long-term plans are vis-á-vis Russia and whether or not European industry can feasibly survive with sanctions on Russian energy. My bet is that it can’t. And this goes to show just how destructive blindly following Washington’s foreign policy is, time and time again, for Europe.

“..the G7’s plan to boycott Russia at the G20 failed. Nobody supported the Western regimes. That is why they are fuming now.”

• Note from Maria Zakharova (Saker)

Federal Foreign Minister Annalena Baerbock: “The fact that the Russian Foreign Minister spent most of his time during the talks not in the room, but outside it, highlights the fact that the Russian government is not a single millimetre closer to having talks.” Can you even make any sense out of what she said? Outside what room? Utter nonsense. The German public should be aware of the fact that their Foreign Minister Annalena is lying to them. Lavrov was among the audience the moment the G20 meeting started and about two hours later he began to hold bilateral talks with his colleagues who attended this forum in a room next door. This is what other ministers did as well, since in-person forums are held exactly for the purpose of holding meetings and having contacts.

Otherwise, everyone would have gone online or sent out their speeches. Or, maybe Baerbock thinks that the foreign ministers of Indonesia, Argentina, Brazil and other countries also were in the wrong room? On the other hand, Germans are already beginning to realise who is in power in their country. More than half of the German citizens (58 percent) believe that German Foreign Minister Baerbock should have personally met and held talks with Foreign Minister Sergei Lavrov on the sidelines of the G20 ministerial which is taking place on the Indonesian island of Bali. On Friday, Der Spiegel published a survey by Civey pollster to that effect.

Now, the truth about Baerbock. She said this because the G7’s plan to boycott Russia at the G20 failed. Nobody supported the Western regimes. That is why they are fuming now. Lavrov made his schedule in advance, including in it the G20 meeting and a dinner on behalf of the hosts, as well as numerous bilateral contacts and communication with international media. The materials, photos and videos are available on the Foreign Ministry’s website and on social media. And neither Annalena nor anyone else can change reality with their lies.

https://twitter.com/mission_russian/status/1545412521900785664

“..servicemen who remain dubious on the merits of the vaccine will feel the repercussions of disobeying a directive..”

• Army Cuts Pay, Benefits From 60,000 Unvaccinated National Guard, Reserves (Fox)

The U.S. Army on Friday said that roughly 40,000 National Guardsmen and 22,000 Reservists who have refused to get vaccinated against the coronavirus will be barred from their duties, effectively cutting their pay and benefits. “Soldiers who refuse the vaccination order without an approved or pending exemption request are subject to adverse administrative actions, including flags, bars to service, and official reprimands,” an Army spokesperson said in a statement to Military.com. The announcement comes one week after the deadline for the Army National Guard passed that required soldiers to get the shots in their arms.

Secretary of Defense Lloyd Austin in November said that members of the Army National Guard and the Air National Guard who refused to get vaccinated would be barred from participating in trainings and their pay would be blocked. Austin also warned that the continued refusal to get vaccinated could result in “separation” or expulsion from the service. The move reportedly comes as servicemen prepare for annual summer trainings that help them hone their military skills and ensure they are ready should they need to be deployed. Though servicemen who remain dubious on the merits of the vaccine will feel the repercussions of disobeying a directive, Army officials said they will continue to work with soldiers to keep them in the service — whether through informing them on the benefits of the vaccine or in rare cases making sure they qualify for exemption status.

“We’re going to give every soldier every opportunity to get vaccinated and continue their military career,” Director of the Army Guard, Lt. Gen. Jon Jensen, said in a statement to Military.com. “We’re not giving up on anybody until the separation paperwork is signed and completed.” Roughly 13 percent of the Army National Guard and 12 percent of Army Reservists remain unvaccinated — a margin that could prove crippling to the ranks as the service struggles with low recruitment.

Nitrogen=fertilizer=crop yields.

Nitrogen is also cars and planes. We’re sacrificing our food for traffic.

• Trudeau’s Nitrogen Policy Will Decimate Canadian Farming (TCS)

In December 2020, the Trudeau government unveiled their new climate plan, with a focus on reducing nitrous oxide emissions from fertilizer by 30% below 2020 levels by 2030. “Fertilizers play a major role in the agriculture sector’s success and have contributed to record harvests in the last decade. They have helped drive increases in Canadian crop yields, grain sales, and exports,” a news release from Agriculture and Agri-Food Canada reads. “However, nitrous oxide emissions, particularly those associated with synthetic nitrogen fertilizer use have also grown significantly. That is why the Government of Canada has set the national fertilizer emissions reduction target, which is part of the commitment to reduce total GHG emissions in Canada by 40-45% by 2030….”

This is a tacit admission that any attempt to lower admissions by reducing nitrogen fertilizer will consequently lower crop yields over the next decade, hurting the Agriculture sector and, more importantly, hurting farmers. And indeed, according to a report from Fertilizer Canada: “Total Emission Reduction puts a cap on the total emissions allowable from fertilizer at 30% below 2020 levels. As the yield of Canadian crops is directly linked to proper fertilizer application this creates a ceiling on Canadian agricultural productivity well below 2020 levels…. It is estimated that a 30% absolute emission reduction for an a farmer with 1000 acres of canola and 1000 acres of wheat, stands to have their profit reduced by approximately $38,000 – $40,500/ annually. In 2020, Western Canadian farmers planted approximately 20.8 million acres of canola. Using these values, cumulatively farm revenues from canola could be reduced by $396M – $441M on an annual basis. Wheat famers could experience a reduction of $400M.”

Moreover, Fertilizer Canada doesn’t believe that forcibly decreasing fertilizer use will even lower greenhouse gases but could lead to carbon leakage in other jurisdictions. Nonetheless, Trudeau’s government is moving forward, with farmer’s groups speaking to Farmers Forum now wondering if he’s intentionally trying to cause a food shortage — which Trudeau previously told Canadians to prepare for. “We’ve seen from the global pandemic to the war in Ukraine significant disruptions of supply chains around the world, which is resulting in higher prices for consumers and democracies like ours, and resulting in significant shortages and projected shortages of food and energy in places around the world,” Trudeau said. “This is going to be a difficult time,” he continued, “because of the war, because of the recovery from the pandemic. And Canadians will do what we always do: we’ll be there for each other.”

“As with prior shortages, this one is due to government policies.”

• Today’s America: An Economy of Shortages (ET)

For the first time in over 40 years, the U.S. economy is dealing with widespread shortages. Parts are unavailable for manufacturers when they need them. Airlines abruptly cancel flights. Railroads and trucks are cutting shipments. Food shelves in some areas are depleted with some areas reporting a lack of meat supplies, milk, or other essential food items. Shortages and empty shelves are characteristic of economies where governments control and allocate resources. They are not characteristic of America’s free-market economy. The only other times America has faced shortages were during World Wars or during the 1970s. Government-imposed price controls were directly responsible for shortages in the early 1970s. When businesses were unable to raise prices to sell their goods at a profit, they stopped producing, which created the shortages.

Once the price controls were removed, the shortages ended. Also in the 1970s, government price controls on oil and gas led to severe shortages on both. By the end of the decade, there were long lines of cars waiting at gas stations and purchases were rationed to ten gallons of gas. As soon as President Reagan removed price controls, the shortages of oil and gasoline ended and prices declined. Free-market economies seldom experience shortages. This isn’t because everything is always plentiful. Bad weather can destroy crops. Disease can kill herds creating a shortfall in meat. Labor disputes or international shocks also disrupt markets. While shortfalls in some items are inevitable, a free-market economy adjusts and corrects for such events.

In free-market economies, shortages are rare because the market is remarkably efficient at raising prices of items that are in short supply. Sharply higher prices for scarce items, limit their use to the most efficient uses of the items and encourages the use of substitute items. Doing so enables the economy to adjust to potential shortages and shocks in the most efficient way possible. In the current situation, the wide range of shortages highlights a serious problem. As with prior shortages, this one is due to government policies. While the federal government has not placed direct price controls on the economy, it has distorted markets in a number of indirect ways.

“Should Americans be concerned that a presidential son was texting and exchanging wire transfers with alleged prostitutes using a Russian email address?”

• The Tale of Hunter Biden’s Payments To Alleged Russian Prostitutes (JTN)

As his father was ramping up his 2020 presidential run, Hunter Biden was busy texting a woman with a Russian email address about finding a way to evade bank suspicions so they could complete a wire transfer. “Email with .ru flags wires,” Hunter Biden texted the woman named Eva in early January 2019, according to evidence two members of Congress have sent the Justice Department. “Too much red flag for bank,” Hunter Biden texted another time when wire coordinates for the payment to the woman were sent. “That its [sic] what got my accounts frozen and reviewed by bank. Send me Julia and I will give her the cash.” The text messages — first reported in the news media and now recounted in an official letter from Congress to DOJ — raise a tantalizing question: Should Americans be concerned that a presidential son was texting and exchanging wire transfers with alleged prostitutes using a Russian email address?

Sens. Ron Johnson and Chuck Grassley, two Republicans who have spent more time than any investigating the Biden family’s overseas business dealings, believe the answer is a resounding “Yes.” “These findings of potentially criminal behavior must be thoroughly investigated by law enforcement entities according to the highest ethical standards,” the senators wrote this week to Attorney General Merrick Garland, FBI Director Chris Wray and U.S. Attorney for Delaware David Weiss in a letter pleading for action. The letter provided a pointed reminder that Hunter Biden was aware banks had suspicions he was engaged in wrongdoing, flagging his accounts for reviews, and was in his own words trying to evade those suspicions.

Johnson and Grassley have disclosed that dozens of financial transactions involving the president’s son and his business deals were flagged to the U.S. Treasury Department by banks that filed Suspicious Activity Reports. Just the News has confirmed that one former executive of a bank has filed a whistleblower complaint to the IRS and Securities and Exchange Commissioner suggesting there is far more to the Hunter Biden story than what is public. And documents obtained by Just the News show Hunter Biden was warned repeatedly starting in 2016 that he had failed to pay taxes on money he had earned from one of his more controversial business clients, the Ukrainian energy company Burisma Holdings. It a picture now well documented in the public but frequently blacked out by a Democrat-led Congress and news media unwilling to ask the hard questions, Grassley and Johnson argue in their letter.

“Sometimes Twitter has ignored Mr. Musk’s requests, sometimes it has rejected them for reasons that appear to be unjustified, and sometimes it has claimed to comply while giving Mr. Musk incomplete or unusable information.”

• Musk Tells Twitter He Wants Out Of Deal To Buy It (CNN)

Elon Musk moved Friday afternoon to terminate his $44 billion deal to buy Twitter — the latest twist in a whirlwind process in which the billionaire Tesla CEO became the company’s biggest shareholder, turned down a board seat, agreed to buy the social media platform and then started raising doubts about going through with the deal. The next chapter in the saga is almost certain to be a court battle. A lawyer representing Musk claimed in a letter to Twitter’s top lawyer that he is ending the deal because Twitter (TWTR) is “in material breach of multiple provisions” of the original agreement, which was signed in April, according to a regulatory filing Friday evening.

Musk has for weeks expressed concerns, without any apparent evidence, that there are a greater number of bots and spam accounts on the platform than Twitter has said publicly. Analysts have speculated that the concerns may be an attempt to create a pretext to get out of a deal he may now see as overpriced, after Twitter shares and the broader tech market have declined in recent weeks. Tesla (TSLA) stock, which Musk was planning to rely on in part to finance the deal, has also declined sharply since he agreed to the deal. “The Twitter Board is committed to closing the transaction on the price and terms agreed upon with Mr. Musk and plans to pursue legal action to enforce the merger agreement,” Twitter board chair Bret Taylor said in a tweet Friday, echoing earlier statements by the company that it planned to follow through with the deal. “We are confident we will prevail in the Delaware Court of Chancery.”

[..] Still, Musk’s lawyer alleged in the Friday letter that Twitter has “not complied with its contractual obligations” to provide Musk with sufficient data, and said Twitter “appears to have made false and misleading representations upon which Mr. Musk relied” when agreeing to the deal. “For nearly two months, Mr. Musk has sought the data and information necessary to ‘make an independent assessment of the prevalence of fake or spam accounts on Twitter’s platform,'” the Friday letter reads. “This information is fundamental to Twitter’s business and financial performance and is necessary to consummate the transactions contemplated by the Merger Agreement.”

It continues: “Twitter has failed or refused to provide this information. Sometimes Twitter has ignored Mr. Musk’s requests, sometimes it has rejected them for reasons that appear to be unjustified, and sometimes it has claimed to comply while giving Mr. Musk incomplete or unusable information.”

Pie: “A Shakespearian tragedy written by monkeys on type writers”

https://twitter.com/i/status/1545069360477192193

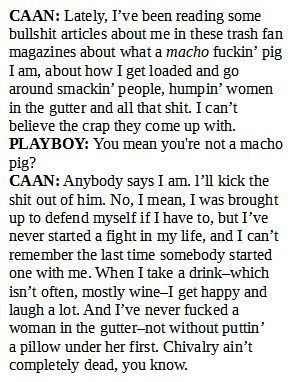

James Caan

MegaVac

This device removes large blood clots pic.twitter.com/Kh7GYbBXPt

— Tech Insider (@TechInsider) July 7, 2022

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.