NPC Ford Motor Co., McReynolds & Sons garage, L Street, Washington DC 1926

“Something is wrong with this picture.”

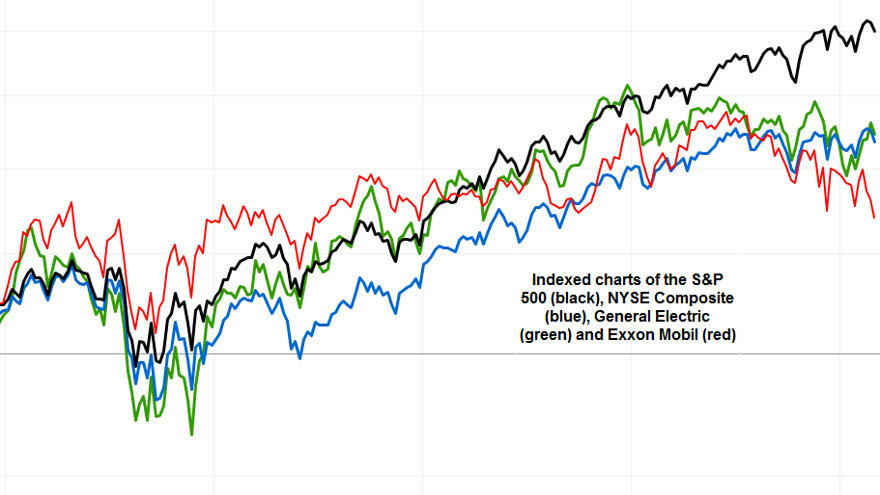

• S&P 500 Can’t Fight The Market’s Selloff Forever (MarketWatch)

Investors have reached a fork in the road. Should they follow the rally in the S&P 500, or the selloff in two key components and a much broader market index? One chart watcher believes the road with more travelers could prove to be right. The chart below compares the S&P 500, the NYSE Composite Index and the shares of General Electric and Exxon Mobil. “More and more stocks no longer are in uptrends, even as the S&P 500 manages to maintain its uptrend,” said Carter Braxton Worth, chief market technician at Sterne Agee. “Unsustainable divergence, we’d say.”

Worth believes it is important to view the performance of the NYSE Composite, which is composed of more than 2,000 stocks, because it is“one of the broadest (and oldest) indices in existence.” He also believes GE and Exxon are among the most important stocks within the S&P 500, given GE’s broad reach into all corners of the economy, and Exxon’s sheer size and the economic importance of the oil and gas markets. “Something is wrong with this picture. Either the S&P 500 accurately depicts the state of the world, or GE and Exxon do,” Worth said. “One or the other, but it cannot be both.

“China’s money supply is already 372% of what it was at the beginning of 2006.”

• China’s ‘Money Garrote’ May Choke Us All (MarketWatch)

— In this new era of all-powerful central banks, it is hard for investors to look past who will be next to take out the big gun of quantitative easing. This week, all eyes are on the European Central Bank, which follows the Bank of Japan as the latest of the major monetary-policy makers to embark on its own aggressive bond-buying program. In contrast, China appears to be entering a “new normal” era, in which its central bank only has a pea-shooter. While most headlines at the ongoing National Peoples Congress meeting focused on the “approximately 7%” economic growth target, the benchmark money-supply growth target of 12% was also the lowest in decades. Another part of China’s new normal is not just lower growth, but also an era where the central bank is no longer able to magically speed its money-printing presses.

Conventional wisdom holds that the People’s Bank of China (PBOC) has a gargantuan monetary arsenal, given that the country has the world’s largest stash of foreign reserves at $3.89 trillion. This cash mountain is routinely used to justify how Beijing has nearly unlimited firepower to backstop its economy. But according to some analysts, this reserve accumulation is merely a byproduct of another form of quantitative easing. Rather than strength, its size indicates just how staggeringly large China’s domestic credit expansion has become in recent decades. According to strategist Albert Edwards at Société Générale, such foreign-reserve accumulation — which typically takes place in emerging markets — is equivalent to quantitative easing.

The PBOC’s historic mass-printing of money to buy foreign currency and depress the yuan’s value is little different from what the Federal Reserve and others have done, Edwards said. This would mean that China has already embarked on a major monetary expansion after three decades of trade surpluses and reserve accumulation. Furthermore, the recent reversal in such reserve accumulation points to a significant turning point in monetary conditions. Indeed, Joe Zhang, author of “Inside China’s Shadow Banking System,” argues that China’s credit expansion has in fact been far more aggressive than the quantitative easing attempted in the U.S. or Europe.

Zhang, a former PBOC official, calculated that China’s money supply is already 372% of what it was at the beginning of 2006. And if you add up official data between 1986 and 2012, China’s benchmark M2 money supply has grown at a compound rate of 21.1%. While 7% economic growth is slow for China compared to the double-digit rates of the past, such data makes 12% money-supply growth looks positively measly. Another reason to believe that China is at the tail end of a huge monetary expansion is found in a recent study by McKinsey. They estimated that total credit in China’s economy has quadrupled since 2008, reaching 282% of gross domestic product.

Do or die.

• Three Reasons Japan Will Get More Stimulus (Bloomberg)

Two years after Haruhiko Kuroda, governor of the Bank of Japan, declared his team will “do whatever it can” to end deflation, it’s painfully clear their efforts aren’t working. Stocks are up, bond yields are down and people are buzzing about Japan for the first time in years. What’s still missing, though, is any hint of the self-sustaining recovery Kuroda hoped to be touting by now. With annualized growth of 1.5% between October and December after two straight quarters of contraction, Japan is hobbling out of recession far more slowly than hoped. A third dose of quantitative easing is almost certain. Here are three reasons why.

First, the initial rounds of QE weren’t potent enough. “In order to escape from deflationary equilibrium, tremendous velocity is needed, just like when a spacecraft moves away from Earth’s strong gravitation,” Kuroda recently explained. “It requires greater power than that of a satellite that moves in a stable orbit.” Although the Bank of Japan managed to lower the value of the yen by more than 20% beginning in April 2013, that clearly hasn’t provided enough of a boost to the economy. (Net exports, for example, added just 0.2% to fourth quarter GDP.) Meanwhile, the bank’s 2% inflation target looks more and more distant. The BOJ’s main inflation gauge slowed to just 0.2% in January, down from 1.5% in April last year.

The trouble with the first two rounds of QE was both the size and the strategy. While undoubtedly huge, neither injection was aggressive enough to, at Kuroda puts it, “drastically convert the deflationary mindset.” Also, the BOJ must get more creative than just hoarding government debt. This time, the BOJ should pledge bond purchases of closer to $1 trillion a year and buy bigger blocks of asset-backed, mortgage-backed and corporate securities; load up on distressed assets, including property in rural areas; and prod the government to tax excessive bond holdings by banks and households.

Second, the Federal Reserve is complicating Kuroda’s job. With U.S. unemployment falling to 5.5% in February, the lowest level in almost seven years, U.S. interest rates will soon be heading higher. On Friday, Fed Bank of Richmond President Jeffrey Lacker employed his own cosmic imagery when he declared: “June would strike me as the leading candidate for liftoff.” Monetary largess isn’t exactly a zero-sum game, but the Fed’s QE experiment supported asset markets from London to Tokyo as much as it’s enlivened U.S. demand. As the Fed withdraws, Kuroda will face pressure to make up the difference.

“..experts question whether a flood of central bank reserve money, pumped into the hands of players in secondary financial markets, can generate a stimulus at all. ”

• Central Bank Blues (Deutsche Welle)

On Monday (09.03.2015), the European Central Bank begins its long-anticipated program to buy sovereign bonds on secondary bond markets – i.e. previously issued government bonds held by institutional investors like banks or insurance funds. In central bankers’ jargon, this is called “quantitative easing,” or QE. The ECB’s plan is to pump 60 billion euros ($65 billion) into the financial markets each month, by trading central bank reserve money (a form of electronic cash) for bonds. That’s set to continue until at least September 2016, which means at least 1.1 trillion euros will be put into the hands of investment managers – who will have to find some alternative investments to make with the money. The bond-purchasing program’s goal is to push inflation back up to just under two% – at the moment, there’s consumer price deflation averaging 0.3% across the eurozone.

The ECB appears confident that QE will succeed in this aim. On Thursday last week, at the ECB’s governing board meeting in Nicosia on Cyprus, the central bank revised its projections for both GDP growth and inflation in the eurozone upward: The inflation rate is projected to go up to 0.7% for this year, and GDP growth from 1.0 to 1.5%. But are the new projections just a case of whistling in the dark? There are in fact serious doubts as to whether the ECB will actually be able to meet its targets, or if, instead, the bond-purchasing program will have effects that will make a structural recovery of the eurozone more difficult. For a start, many observers doubt whether the ECB will even be able to find willing sellers for €60 billion a month of bonds. Sovereign bonds – especially those of the core eurozone member states, like Germany – may soon become rather scarce on secondary markets.

Neither domestic banks and insurance funds, nor foreign central banks, will have much incentive to sell their government bond holdings to the ECB. The older bonds with long maturities and decent interest rates, in particular, will probably be held rather than sold. Moreover, experts question whether a flood of central bank reserve money, pumped into the hands of players in secondary financial markets, can generate a stimulus at all. It probably won’t lead to any boost in their lending activities to real-economy businesses or households, for two reasons: First, banks have recently been obliged to increase their core capital reserves – the amount of shareholders’ money, including retained earnings, which is available to cover possible loan losses – and they’re still adjusting their balance sheets accordingly. That means they’re being cautious about lending.

Done spending long ago. Abenomics is just a mirage that only works as long as people believe in it. Abe himself has urged them to believe. But they’re not that crazy.

• Japan’s Not So Golden Oldies Tighten Their Purse Strings (CNBC)

Rising prices are forcing Japanese pensioners to reduce spending, undercutting Prime Minister Shinzo Abe’s plan to boost economic growth and pay down the hefty public debt burden in one of the world’s fastest aging nations. “There is no solution to the structural problem: the government is running a huge budget deficit, but the only way to coax the elderly into spending more is by increasing public spending on them,” said Dai-ichi Life Research Institute (DLRI) chief economist Hideo Kumano. Japan limped out of a technical recession in the fourth quarter of 2014, but consumers are still struggling. A 3-percentage-point tax hike to 8% last April continues to weigh on consumption, while higher import prices have exacerbated the situation due to the yen’s over 40% decline against the U.S. dollar since Abe’s return to power.

In January, Japanese household spending fell 5.1% on month – its 10th consecutive decline, marking the longest losing streak since the global financial crisis. Meanwhile retail sales fell 2.0% – their first decline in 7 months. The elderly are reducing spending the most. “The average Japanese is suffering because of a weaker yen,” said Keio Business School associate professor Seki Obata, but “pensioners are suffering the most from the rising prices because there is no prospects of their incomes rising.” Whether a pensioner can afford to spend or has to cut back depends on their ability or willingness to work, according to according to DLRI’s Kumano figures, citing government data. The 37.8% of households with no income from paid work cut back spending by 1.5% in 2014 – and nearly all (95%) of these households are over 60 years old, according to DLRI’s Kumano.

“They have just switched on the heat and we will need some time for the pressure to mount.”

• ECB Starts Buying German, Italian Government Bonds Under QE Plan (Bloomberg)

With the first purchases of government bonds under a broader stimulus plan, the European Central Bank showed willingness to be patient in its efforts to reignite the euro area’s economy. The ECB and national central banks started buying sovereign debt on Monday under the 19-month plan to inject €1.1 trillion into the economy. While purchases included bonds from at least five countries, the size of individual trades — at between 15 million euros and 50 million euros — was small relative to the program’s goals, according to people with knowledge of the transactions. “The amount bought may be small to start with, but this will be like a pressure cooker,” said Ciaran O’Hagan, head of European rates strategy at SocGen in Paris. “They have just switched on the heat and we will need some time for the pressure to mount.”

Euro-area bonds extended a 14-month rally fueled by speculation that buying €60 billion of debt a month will create a scarcity of government bonds among buyers of the securities. Yields already fell to record lows across the region as the Frankfurt-based bank follows in the quantitative-easing footsteps of the Federal Reserve, Bank of England and Bank of Japan. Germany’s 10-year yield fell the most in six weeks. Gains in Italian bonds were smaller, with the yield on similar-maturity debt slipping four basis points to 1.28%. That widened the yield gap between the two securities by four basis points to 97 basis points, after it shrank to 90 basis points on Friday, the narrowest spread since 2010. “We will see more spread compression ahead,” SocGen’s O’Hagan said. National central banks purchased Belgian, French, German, Italian and Spanish debt..

The buying of bonds will be made roughly in proportion to the capital that each member central bank has contributed to the ECB, though that guideline doesn’t have to be strictly followed every month. There’s also flexibility on what maturity of bonds will be bought by the central banks to reach their target, and acquisitions of asset-backed securities and agency debt are also included in the plan. Some holders of government securities have indicated an unwillingness to sell, sparking concern that there will be a scarcity of available debt for the ECB to buy. There’s also a risk that flexibility and limited information on the plan stirs market volatility. “They know it will not be easy to purchase €60 billion a month including covered bonds and ABS, so they have to deal very cautiously,” said Patrick Jacq at BNP Paribas. “The market remains in positive territory but there is no further acceleration, which means that apparently there is no squeeze on any paper.”

“.. please don’t tell your average Hinz and Kunz that more than all German bond issuance in 2015 will be monetized. It will bring back some very unpleasant memories.”

• Presenting The Buyers Of Over 100% Of New German And Japanese Bond Issuance (ZH)

Back in December, when the total amount of annual ECB Q€ was still up in the air and and consensus expected a lowly €500 billion annual monetization number, we calculated that based on Germany’s capital key contribution of about 26%, the ECB would monetize some €130 billion of German gross Bund issuance, or about 90% of the total scheduled issuance for 2015. Subsequently, the ECB announced that the actual amount across all ECB asset purchasing programs, will be some 44% higher, or €720 billion per year (€60 billion per month). So what does that mean for the revised bond supply and demand across two of the most important developed markets?

Well, we already know that the Bank of Japan will monetize 100% or just over of all Japanese gross sovereign bond issuance (source). As for Germany, on a run-rate basis, and assuming allocation based on the abovementioned capital key, it means that for the next 12 month period, assuming no major funding changes in Germany, the ECB will swallow more than a whopping 140% of gross German issuance! Or, said otherwise, the entities who will buy more than all gross German and Japanese issuance for the next 12 months, are the ECB and the Bank of Japan, respectively.

This also means that to fulfill its monthly purchase mandate, the ECB will have to push the price to truly unprecedented levels (such as the -0.20% yield across the curve discussed previously, or even lower) to find willing sellers. That said, please don’t tell your average Hinz and Kunz that more than all German bond issuance in 2015 will be monetized. It will bring back some very unpleasant memories.

“The result is a bunch of banks, pension funds and hedge funds whose balance sheets are stuffed with paper that has value only if 1) accounting rules continue to support “mark to fantasy” bookkeeping and 2) governments (via taxpayers) stand ready to convert that bad paper to newly-created currency upon demand.”

• Aftershocks, Part 1: That Austrian Bank (John Rubino)

It’s amazing how fast credit ratings revert to their intrinsic value when artificial government support is removed. And the list of potential victims so far doesn’t even include the counterparties on whatever credit default swaps are out there on Heta-related bonds. So more scary headlines are coming. It’s also important to note just how tiny these numbers are. Not a single amount mentioned in the above article is over €25 billion. That’s chump change in today’s mega-bank world. Yet in the absence of a government backstop it’s enough to cause cascading credit downgrades and maybe even the bankruptcy of an entire Austrian state.

So Austria and by implication the rest of the eurozone now face a tricky choice: Stick with the bail-in program and risk a highly-unpredictable cross-border contagion. Or go back to the tried-and-true bail out, with the higher deficits and rising debt — and angry voters — that that implies. Over the past couple of decades, governments have generally blinked when confronted with the prospect of actually letting markets clear bad debts and other misallocated capital. Starting in the mid-1990s with the what came to be known as the “Greenspan put” governments around the world have made it clear to the financial sector that no mistake is too egregious to be unworthy of a central bank backstop. So leverage up, roll the dice, collect those bonuses, and don’t worry about the consequences.

The result is a bunch of banks, pension funds and hedge funds whose balance sheets are stuffed with paper that has value only if 1) accounting rules continue to support “mark to fantasy” bookkeeping and 2) governments (via taxpayers) stand ready to convert that bad paper to newly-created currency upon demand. As taxpayers and voters have caught onto the scam, they’ve raised the political costs for governments, forcing Austria’s leaders to have to decide which group — unstable financial markets or an appalled electorate — is more dangerous to cross heading into the next election. Either choice brings its own series of aftershocks and systemic risks.

Big fight coming up, or are they just going to change the flags on their ships to Panamese?

• Billionaire Greek Ship Owners Surface on Tax-Exempt Overseas Profit (Bloomberg)

The Hellenic fleet is the world’s most valuable at $106 billion, according to VesselsValue.com, accounting for 19% of the world’s tankers. Greece’s seafaring mastery is a remarkable feat for the world’s 42nd-largest economy, where economic and political turmoil has left a quarter of the population unemployed. “This is a business that’s part of their soul,” Matt McCleery at ship finance consultancy Marine Money International, said in a phone interview. “It’s so important to their culture, to their identity, and to their history.” It’s also made billionaires of the country’s four largest ship owners by tonnage: John Angelicoussis, George Prokopiou, Peter Livanos and George Economou. The quartet control a combined fortune of $7.6 billion, according to the Bloomberg Billionaires Index. None of them appear individually on an international wealth ranking. [..]

The value of the vessels are discounted by 60% to approximate the typical level of financing Greek ship owners can obtain today, according to Anthony Zolotas, chief executive officer of ship financing adviser Eurofin SA. Greeks have long dominated the shipping business. The nation’s fleet, 3,669 vessels in 2013, is the largest in the world, according to the Union of Greek Shipowners, making up more than 7% of the Greek economy and providing 192,000 jobs in 2013. Greece’s shipping magnates control 23% of the world bulk carrier fleet, according to the report, even as their home country accounts for less than 0.4% of the world economy.

Their success in one of the most global industries stands in contrast to their country’s domestic troubles, where 36% of the population was at risk of poverty or exclusion from social benefits at the end of 2013, according to Eurostat, the statistics agency of the European Commission. “There is a humanitarian crisis,” said Spyros Economides, a professor in international relations and European politics at the London School of Economics. “It’s not just the problems on the street, it’s much more endemic and deeper than that with people fearing they might get evicted from their homes, who can’t pay their electricity bills, who are having problems feeding their families.”

At least something. But even this could get ugly.

• EU, Greece To Start Technical Loan Talks Wednesday (Reuters)

Warning Greece it had “no time to lose”, euro zone ministers agreed technical talks between finance experts from Athens and its international creditors would start on Wednesday with the aim of unlocking further funding. “We’ve talked about this long enough now,” an impatient-sounding Dutch Finance Minister Jeroen Dijsselbloem said after chairing Monday’s meeting of euro zone colleagues, their first since Feb. 20, when they extended Greece’s bailout deal to June. “We only have four months,” he said. “Let’s get it done.” The new left-wing Greek government, keen to show voters it is keeping election promises to break with EU-imposed austerity, has tried patience among its EU peers by arguing over the form and venue for detailed talks required to establish its needs and whether it has met conditions the creditors have set on reforms.

In a compromise, Dijsselbloem said the negotiations among financial experts from Greece and the creditor institutions – the EC, ECB and IMF – would start in Brussels on Wednesday, not in Athens as has been normal for EU bailout programs so far. Those talks, however, would be “supported” by international teams working in Athens to obtain and check information. The Greek government has insisted it will no longer deal with the “troika”, as the three institutions have been called in a term that is now anathema for many Greeks who associate it with massive cuts in public spending. It has also said it will not tolerate irksome foreign inspection visits to Athens. The Eurogroup now calls the troika “the institutions” and the talks will, formally at least, be based in Brussels. EU ministers say they do not want “semantics” to get in the way of negotiations intended to prevent Greece going bankrupt and potentially being forced to abandon the single currency.

Is the Troika back for real?

• Draghi Urged Greece to Allow Officials Back Before It’s Too Late (Bloomberg)

ECB President Mario Draghi told Greek officials they face a critical situation and must let euro-area representatives return to Athens if they are ever going to obtain more aid, according to two European officials. Draghi told Greek Finance Minister Yanis Varoufakis at a meeting on Monday in Brussels the government’s books needed to be examined to determine its financing shortfall, said the people, who asked not to be named because the conversation was private. Representatives from the European Commission and IMF had a similar message, one of the officials said.\ Greece agreed to allow experts representing the commission, ECB and IMF to start work in Athens on Wednesday, the Netherlands’s Jeroen Dijsselbloem said, after chairing the meeting of euro-region finance ministers.

With financial markets closed, and the central bank keeping its banks on a tight leash, the Greek treasury could face a cash crunch in one, two or three weeks, a different euro-area official said Monday. Without getting access to the books, it’s impossible to know for sure, the official added. Prime Minister Alexis Tsipras is trying to access European bailout funds for Greece without completely ditching the anti-austerity agenda that won him election seven weeks ago. So far he’s dropped demands for a writedown on Greek debt, abandoned his plan to halt privatizations and accepted that he won’t get “bridge financing” without signing up to conditions. In return he’s won concessions to shift some meetings to Brussels and persuaded European officials to describe the country’s official creditors as “institutions” rather than “the troika.”

“The troika is a cabal of technocrats that used to arrive in Athens and enter the ministries with a kind of power play that smacked of a colonial attitude,” Varoufakis said at a press conference after the meeting. “That practice is finished. We shall endeavor to do whatever it takes to provide the institutions with whatever information they need.” Greece won’t get any more cash from its €240 billion rescue program until its official creditors are satisfied that Tsipras is committed to all the economic fixes needed to meet its conditions, Dijsselbloem said. It’s impossible for Greece’s creditors to adequately audit the government’s accounts without sending officials to Athens, a troika official said. The government would need to fly hundreds of Greek officials to Brussels for the work to be done there, he added.

As Draghi pressed Varoufakis to accept the return of the troika officials, the minister said that the idea that Greece was opposed to such a move was a misunderstanding, according to one of the officials with direct knowledge of the exchange. Can they start soon? Draghi asked. Varoufakis agreed. Wednesday? And the deal was done.

“Wolfgang Schäuble declared that the outcome of the fractious negotiations would be decided by the “troika”. He repeated the term several times, despite the new Greek government’s insistence that the troika is dead.”

• Eurozone Calls On Greece To Come Up With Credible Economic Reforms (Guardian)

Greece’s eurozone creditors have stepped up the pressure on Athens over reforms that might unleash billions more in bailout loans and save the country from bankruptcy over the next three months. Finance ministers from the single currency area broke off a discussionabout Greece on Monday, after little more than one hour in Brussels. The Greek finance minister, Yannis Varoufakis, was told to come up with what the creditors view as a realistic programme of economic and fiscal reforms. The chair of the eurozone finance ministers’ group displayed his frustration at the pace of the Greek government response since Athens secured a bailout extension last month. “Little has been done since the last Eurogroup [meeting two weeks ago] in terms of talks, in terms of implementation,” he said before the talks. “We have to stop wasting time and really start talks seriously.”

The Greek government led by prime minister Alexis Tsipras reached an agreement on extending the eurozone bailout by four months a fortnight ago, but it has to commit to a programme of reforms credible to its creditors by the end of April to access more than €7bn (£5bn) still available in loans. Ministers voiced impatience and irritation with Greece’s efforts to deliver a reform menu that would satisfy the lenders. Varoufakis was uncharacteristically silent going into the meeting after delivering two separate lists of vague reforms over the past fortnight, including a proposal to employ students and tourists to snoop on tax-dodgers and report them to the authorities.

It was clear that key eurozone policymakers were less than impressed with the suggestions from Greece, which faces a financing gap in the coming months and has to repay or redeem billions of euros in debts. Wolfgang Schäuble, the German finance minister, who has been feuding with Varoufakis for weeks, declared that the outcome of the fractious negotiations would be decided by the “troika”. He repeated the term several times, despite the new Greek government’s insistence that the troika is dead. It refers to the triumvirate of officials from the ECB, the EC, and the IMF, which has run the €240bn bailout of Greece since 2010, dictating the country’s fiscal policies and a massive programme of austerity.

Will this turn vs Syriza or vs Germany?

• Greece Sees First Shortages In Imported Goods (Kathimerini)

The first occurrences of shortages in imported goods and raw materials have arisen as a result of Greek enterprises’ inability to pay with cash in advance for the entire cost of the commodities they import, and the situation is even worse than in 2012. Market professionals have told Kathimerini that there are already some problems in the cases of mechanical equipment and electronic appliances, while in the food and drinks sector there are shortages in certain premium products such as a well-known Belgian beer.

Difficulties have also been noted in imports of chemical commodities, both end products and raw materials, which is hampering the production of fertilizers and pesticides. Even reliable clients have been hit with the same demands from foreign suppliers, while the phenomenon is creating a chain reaction across other sectors as well. “A number of tourism companies wanted to renew their equipment ahead of the new season but now face a serious problem,” Ioannis Papageorgakis, the president of the Athens Association of Commercial representatives and Distributors (SEADA), told Kathimerini.

Serious enough as well.

• Liquidity Fears Slow Greek Government Payments (Kathimerini)

Payments to state procurers have stopped as the General Accounting Office has blocked any state expenditure not related to salaries and pensions as a part of the efforts being made toward optimum cash management during the state’s current liquidity crisis. Coming up with cash appears particularly difficult, increasing concerns regarding a possible “accident” over the course of this month. Sources say that the Accounting Office is examining every detail of public spending and putting off payments that are not pressing or even curtailing other spending considered excessive. Its officials say the budget has 4,772 expenditure categories that are not salary-related and concern procurements and operating expenses, among others.

Their review has already saved some €180 million that can be used to finance the program aimed at fighting the humanitarian crisis, they add. The Accounting Office is also trying to postpone obligations in the coming months so as to secure a cushion for the state’s needs. Payments to procurers, subsidies and other obligations are being postponed till later in a bid to lighten the March spending program. Even the heating oil benefit has not yet been credited to recipients’ bank accounts in its entirety.The state’s liquidity remains marginal: The 500 million euros from the HFSF bank bailout fund has not yet yet been drawn as it requires a special law amendment.

The directors of social security funds have not approved the utilization of their cash reserves in commercial banks, meaning the state cannot use that liquidity which amounts to €2 billion. In this context the Finance Ministry’s projections regarding the flow of revenues and expenditure show that there may be a shortfall of €1 billion toward the end of March. This week the ministry has to cover two debt maturities, concerning the repayment of €350 million to the International Monetary Fund on Friday and treasury bills worth €1.6 billion that mature on the same day, with a fresh T-bill auction to that amount expected tomorrow. Officials say these obligations will be fulfilled normally.

Rhetoric.

• Creditors Reject Greece’s Reform Proposals (Bloomberg)

Greece’s provisional agreement with creditors to avert a default started to crack as European officials said the country’s latest proposals fell far short of what was put forward two weeks ago and Greek ministers floated the prospect of a referendum if their reforms are rejected. The list of measures Greece’s government sent to euro-region finance ministers last Friday, including the idea of hiring non-professional tax collectors, is “far” from complete and the country probably won’t receive an aid disbursement this month, Eurogroup Chairman Jeroen Dijsselbloem said on Sunday. German Deputy Finance Minister Steffen Kampeter said ministers are not expected to advance on Greece today.

“It’s not enough to exchange letters with non-committal statements,” Kampeter told Deutschlandfunk radio. “What’s needed is hard work and tough discussions.” Greece’s anti-austerity government, elected in January on a promise to renegotiate the terms of a €240 billion bailout, has to present detailed proposals to European creditors or risk running out of cash as soon as this month. The renewed tensions threaten to temper a rally in Greek bonds sparked by optimism over the provisional accord. “It seems their money box is almost empty,” Dijsselbloem said at an event in Amsterdam. Greece must adhere to its commitments as a “first step to restore trust” among its euro-area peers, Valdis Dombrovskis, European Commission vice-president for euro policy, said.

Greek bonds fell, with the yield on 10-year government bonds gaining 40 basis points to 9.8%. The Athens Stock Exchange index declined 3% as of 11:33 a.m. local time. The country is seeking the disbursement of an outstanding aid tranche totaling about €7 billion. Without access to capital markets, its only sources of financing are emergency loans from the euro area’s crisis fund and the IMF. Its banks are being kept afloat by an Emergency Liquidity Assistance lifeline, subject to approval by the European Central Bank.

“Corruption is not just the scoundrels who put their hands in the till, it’s also the rich 1% who own as much as 70% of the population,”

• Spain’s Post-Franco Elite Under Attack From Popular Podemos Party (Bloomberg)

Pablo Iglesias was a foreign exchange student in Italy when reports of the 1999 protest riots at the World Trade Organization meeting in Seattle inspired him to switch to political science from law. Today, leading Spain’s most popular party less than a year before a general election, he’s aiming to clear out the political old guard and set the country’s economy on a new path. The eruption of Iglesias’s group, Podemos, over the past year is part of a tectonic shift stemming from the seven-year slump that destroyed more than 3 million jobs and threatens to unseat the political and economic elite that emerged to control Spain after the death of Francisco Franco 40 years ago. If the rupture gives Iglesias a chance to implement his program, the shock waves will be felt far beyond the Iberian peninsula.

At the center of the Podemos’s platform is a plan to force a restructuring of Spain’s €1 trillion of government debt in what would be the biggest sovereign reorganization in history. The proposal has helped Podemos top 10 opinion polls in Spain since November.

Iglesias’s project, which would potentially affect five times more securities than Greece’s 2012 default, the current record holder, has yet to sink in with financial markets. Spain’s €21 billion of January 2016 bonds were yielding less than 0.1% last week. By the time that debt comes due, Iglesias could be prime minister. Investors are being “complacent,” Alastair Newton at Nomura in London, said in an interview. “We’re going to start getting some choppiness.”Prime Minister Mariano Rajoy’s People’s Party and his main parliamentary opposition, the Socialists, have governed Spain since 1982, transforming an isolated economy that had lagged behind most of Europe under Franco. Under their rule, the country consolidated its democracy after an attempted coup, joined the European Union and NATO, and saw the economy more than double in size. Spain’s benchmark stock index, the Ibex-35, rose 500% between 1988 and its 2007 peak, almost double the gains on the U.K.’s FTSE 100. But since 2008, that model has unraveled, with the pain of the crisis compounded for many Spaniards by reports of widespread graft at both the main parties and the network of public savings banks they controlled.

Iglesias captured that narrative with a single expression: “the caste.” For his supporters, the caste is a corrupt elite that kept most of the gains from the boom years and left ordinary people to shoulder the cost of the crisis. “Corruption is not just the scoundrels who put their hands in the till, it’s also the rich 1% who own as much as 70% of the population,” Iglesias told hundreds of thousands of supporters gathered in downtown Madrid on Jan. 31. “Rajoy’s policies don’t create jobs, they spread misery.”

“The whole ZIRP and QE game, for instance, can be boiled down to a basic wish to get something for nothing, that is, prosperity where nothing of value is created”

• truthinesslessness (Jim Kunstler)

Finance is complicated, but not as complex as the wizards employed in it would have you believe. They would have you think it is an order of magnitude more abstruse and recondite than particle physics, when, in fact, it is often not much more than a Three Card Monte switcheroo. The whole ZIRP and QE game, for instance, can be boiled down to a basic wish to get something for nothing, that is, prosperity where nothing of value is created. Now, that’s not so hard to understand, is it? Until the economics wardrobe team comes in and dresses it up in martingales and bumrolls of metaphysics and you end up in a contango of mystification.

More galling and worrisome, though, is the failure of anyone even remotely in authority to stand up and publically object to the tidal wave of lies washing over this dying polity, actually killing it softly with truthinesslessness. The code of anything goes and nothing matters is turning lethal and the more it is kept swaddled in lies, the more perverse, surprising, and destructive the damage will be. The more our leaders lie about misbehavior in banking — including especially the actions of the Federal Reserve — the worse will be the instability in currencies. The more central bankers intervene in price discovery mechanisms, the more unable to reflect reality all markets will become. The more that the US BLS lies about the employment picture in America, the worse will be the eventual wrath of citizens who can’t get paid enough to heat their houses and feed their children.

An economist (sic) named Richard Duncan last week proposed the interesting theory that Quantitative Easing can go on virtually forever in an endless chain of self-canceling debt. Government spends money it doesn’t have and cannot raise, issues bonds to “investors,” buys its own bonds and stashes them in a storage vault so deep that the sun will not shine on them until it becomes a blue dwarf — long after the cockroaches have taken charge of Earthly affairs. Duncan forgets one detail: consequences. The consequence of this behavior will not be eternal virtual prosperity, but rather a wrecked accounting system for the operations of civilized human life. We’ve stepped across the event horizon of that consequence, but we just don’t know it yet. My bet is that we start feeling the effects sooner rather than later and when it is finally felt, all the Kardashian videos in this universe and a trillion universes like it will not avail to distract us from the flow of our own blood.

Purely defense.

• US Deploying 3,000 Troops To The Baltics (DW)

The United States is sending 3,000 troops to the Baltic states to partake in joint military exercises with NATO partners in Estonia, Latvia, and Lithuania over the next three months, US defense officials announced Monday. The mission, part of “Operation Atlantic Resolve” is designed to reassure NATO allies concerned over renewed Russian aggression amid the ongoing crisis in Ukraine. Around 750 US Army tanks, fighting vehicles and other military equipment arrived in Latvia Monday, and US ground troops are expected to begin arriving next week, US Army Col. Steve Warren told reporters. According to a US military source speaking on condition of anonymity, the military equipment will remain in the Baltics even after the US troops return to base.

The deployment is designed to “demonstrate resolve to President (Vladimir) Putin and Russia that collectively we can come together,” US General John O’Connor said. Vladimir Putin’s actions in Ukraine have raised concerns the Russian President could act against other eastern European countries. The military equipment, including the tanks and fighting vehicles will stay “for as long as required to deter Russian aggression,” O’Connor said. Russia’s recent annexation of Crimea and its support of anti-government rebels in Ukraine has sparked fears that Moscow might pursue similar actions against the Baltic nations, which have little military equipment of their own.

British Defense Secretary Michael Fallon recently said Putin represented a “real and present danger” to the Baltic nations, warning that the Russian leader could launch an undercover campaign to destabilize Estonia, Latvia and Lithuania. Putin was quoted in September as saying, “if I wanted, Russian troops could not only be in Kyiv in two days, but in Riga, Vilnius, Tallinn, Warsaw or Bucharest, too.” The US deployment also comes amid reports Putin made the decision to annex Crimea after a night-long meeting at the Kremlin following the ouster of Ukrainian president Viktor Yanukovych. The Baltic nations have been members of NATO since 2004, and the military alliance is seeking to counter potential Russian aggression by developing a rapid reaction force of 5,000 troops, to be stationed in the Baltic states as well as Bulgaria, Poland, and Romania.

The dark side of the moon.

• The Isolation of Donetsk: A Visit to Europe’s Absurd New Border (Spiegel)

One can argue whether the separatists are to be blamed or whether Kiev is exacting revenge. But either way, Donetsk is now just as isolated as West Berlin once was. Even from the east, where the border to Russia lies nearby, hardly any goods are allowed through. The rebels control the border, and they only allow the propaganda-driven aid shipments from Moscow to pass. Everything from milk to meat and vegetables is becoming scarce in the city. And the Ukrainian government has all but sealed off access to the “People’s Republic.” More recently, anyone wishing to cross the line between the two warring camps must present a “propusk,” a small, white identity card with a large “B” printed on it.

The Ukrainians have divided the demarcation line between their forces and the separatists into sections. The propusk is the Open Sesame for crossing the line in “zone B.” Since January, no one has been able to cross the line without this propusk. The problem is that it’s difficult to get. There is currently a two to four-week waiting period to obtain the propusk, which is issued in Velyka Novosilka, a village 90 kilometers west of Donetsk. But a “Sector B” propusk is required to reach Velyka Novosilka from Donetsk in the first place. The result is that people from Donetsk are in a paralyzing catch-22. Even in divided Berlin, such problems were more effectively solved. West Berliners were able to obtain travel permits from East Berlin officials in West Berlin so that they could cross the Wall. It was a small gesture of goodwill in the Cold War.

“It’s a theater of the absurd,” says Yevgeny, while another driver calls the situation at the border Kafkaesque. “Just look at the people over there, who have come from Donetsk. They give their documents to Ukrainian soldiers, hoping that the documents will somehow reach Velyka Novosilka. And then they come back, two weeks later, and spend days standing outside in the cold here to get their propusk.”