Claude Monet Japanese Footbridge 2 1899(?)

Newt

Newt, you realize you’re on Fox News which is part of the problem you’re talking about. And some of their corporate board members are a significant part of the problem!

I’m still glad you said what you said.@newtgingrich pic.twitter.com/Y8BobEV2sC

— General Mike Flynn (@GenFlynn) September 4, 2023

Trump debunk

Mass Programming By Mainstream Media Lies & Manipulation Is Coming To An End. They’ve Lost Control

A video debunking Fake News stories about Donald Trump has risen to one of the most Liked videos on social media with millions of Likes & hundreds of thousands of shares worldwide… pic.twitter.com/KNP9N28uv7

— Wall Street Apes (@WallStreetApes) September 4, 2023

Niger exports of Uranium for 220 Millions dollars per year to France.

If it was at market price of 200 Euro per kilo instead of 0.8 Euro paid price of it would be valued at 55 Billion dollars.

ICYMI: Multiple reports that the revolutionary anti-🇬🇧UK-🇺🇲US-🇪🇺EU government of #Niger increases price of uranium from French dictated price of €0.80/kg to…€200/kg.#nuclearweapons #nuclearenergy pic.twitter.com/NYZFDoecK9

— Afshin Rattansi (@afshinrattansi) September 3, 2023

Macgregor

The truth is not popular with people the who govern us in Washington!

The American people need to know the truth about the war in Ukraine.

Make peace you fools! pic.twitter.com/RPooAvwnOO

— Douglas Macgregor (@DougAMacgregor) September 4, 2023

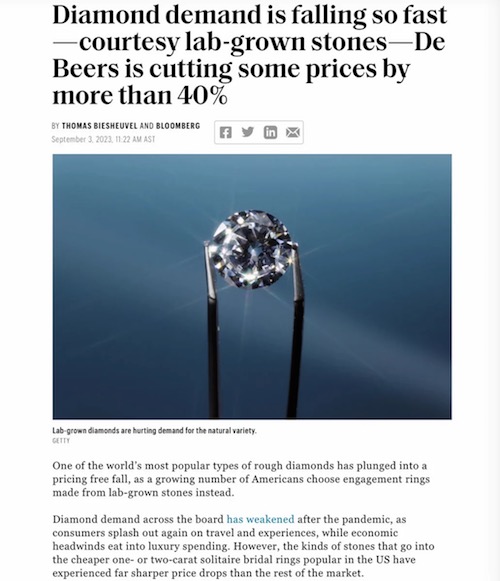

Cause of death

Prescription drugs are the 3rd leading cause of death after heart disease and cancer.

If you consider and factor in how we are treating heart disease and cancer, one could easily and demonstrably argue based on outcomes and success rates that the medical system is the leading… pic.twitter.com/c17cDFYjeJ

— Inversionism (@Inversionism) September 3, 2023

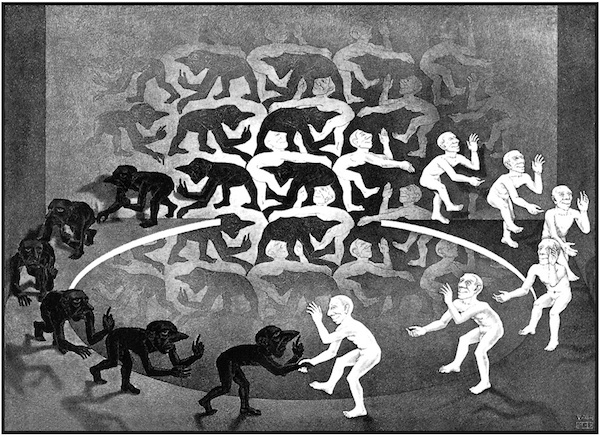

Weak men

They want weak men, weak families and weak communities. This makes our culture much more pliable to top-down social control. pic.twitter.com/Qj4q4nwpzP

— illuminatibot (@iluminatibot) September 4, 2023

“..This fall season will be a dreadful time of testing whether the country can endure any more of this..”

• Party! Party! (Jim Kunstler)

In the natural order of the American system, a Republican Party would have stepped up to check the wretched excesses of a Democratic Party bent on breaking everything that has allowed people to thrive in this land: property law, economic liberty, free speech, now even your physical health. This Labor Day Monday is the last moment in this epic political psychodrama that the Republican Party has an excuse to kick back and do nothing about the parade of insults flung in the nation’s face by persons who believe in nothing, and who will stop at nothing. These insults lately include especially the perversion of law to harass and hinder political opponents, the prosecution of a foreign war by proxy in a corner of the world where America has no explicable national interest, the deliberate failure to defend the country’s borders against hordes of invaders, the rigging of elections with ballot fraud and hackable machines, the censorship of information of all kinds, and the weaponization of public health authority against the people. These are all campaigns carried out by the Democratic Party.

This fall season will be a dreadful time of testing whether the country can endure any more of this. Congress is back in session this week. Congress is the only place in the federal government where an opposition party has the authority to direct events. Mr. Comer who chairs the House Oversight Committee has assembled enough evidence of bribery and treason for Speaker Kevin McCarthy to commence an impeachment inquiry right away into the conduct of President “Joe Biden.” I’ve used quotation marks around Mr. Biden’s name since he ascended magically to this office in 2021 because it is obvious that he is only pretending to run the executive branch, and has been since day one on January 20, 2021.

His March 5, 2020, Super Tuesday victories, after a drubbing in the Iowa Caucuses (4th place) and New Hampshire primary (5th place), had an odor of supernatural contrivance. His campaign from “the basement” was a joke, and it’s still entirely possible, despite three years of massive gaslighting, that his victory in the 2020 election was a fraud. I believe the reason “Joe Biden” was installed in the White House was to allow Barack Obama to run the executive branch and all its agencies in secret from his headquarters across town in the DC Kalorama district, and the reason he is allowed to do this is because the Democratic Party has committed so many crimes against the country that a tremendous effort had to be made to cover them up, or else scores of figures in high places could have been subject to investigation and prosecution, including Mr. Obama.

It’s also possible that an impeachment inquiry in the House will lead to evidence of Mr. Obama’s role in the Biden family’s bribery adventures abroad, including the participation in one way or another of high diplomatic officials under Mr. Obama such as US Ambassadors to Ukraine Jeffrey Pyatt and Marie Yovanovitch — as well as their nefarious roles in the first impeachment of Donald Trump. Expect former Secretary of State John Kerry to surface in that mix, too. His stepson, Christopher Heinz was in business for a time with Hunter Biden and Devon Archer during the Burisma caper.

“After the mugshot and four criminal indictments, you would think that President Biden would have [a] significant advantage, but apparently not..”

• ‘Biden Has Work to Do’: US Outlets ‘Shocked’ as Trump Poll Numbers Soar (Sp.)

The fact that Donald Trump’s legal troubles are only serving to boost the former president’s poll ratings impressively has left hosts and guests of many mainstream media outlets taken aback. “It is kind of shocking in a way, that despite all of the baggage that Donald Trump carries, he’s tied with Joe Biden right now,” host Of ‘This Week’, George Stephanopoulos, told his audience, as he cited revelations of a recent survey. Released on Saturday, the poll showed that around 46 percent of voters would vote for US President Joe Biden, with the same amount of voters willing to support former US President Donald Trump if the presidential election were held today. “With every passing month, with every new indictment, Donald Trump seems to be consolidating his control over the Republican Party,” the media personality said in wonder.

As many as 8 percent of respondents stated in the survey that they were undecided as to who they would vote for. However, if a third-party candidates were added to the mix, Trump would potentially lead Biden by 1 percentage point, 40 percent against 39 percent, with the share of undecided voters growing, to stand at 17. When questioned about the indictments against Trump, more than 60 percent of Republican primary voters insisted that the criminal charges lacked merit and were politically motivated. Other media hosts appeared to be just as stunned by the survey, marveling at how Trump’s four indictments still left him tied with Biden. “After the mugshot and four criminal indictments, you would think that President Biden would have [a] significant advantage, but apparently not,” bemoaned White House correspondent Peter Baker.

The poll’s findings alarmed Former Democratic National Committee chair Donna Brazile. Biden is facing an uphill battle and needs to redouble efforts on the 2024 campaign trail, warned Larry Sabato, Director of the Center for Politics at the University of Virginia. “Biden has work to do,” Sabato succinctly told a US media show. Recent polling also showed that as far as GOP primary voters were concerned, Trump faces no challenge from any of the other 2024 Republican hopefuls. POTUS 45 remains the top choice for the White House for 59 percent of GOP primary voters. This is up by 11 percentage points since April. Trump’s lead over top rival, Florida Governor Ron DeSantis, who can only boast 13 percent support, has nearly doubled since April. It now stands at 46 percentage points. Other hopefuls have yet to break out of single-digit numbers of support.

No need to convict. Accusing is enough. What kind of theory is that?

Has anyone done more harm to the US than Schiff? How many times has he lied about having evidence? And no-one sues him? He’ll do it again then.

• Rep. Adam Schiff Supports 14th Amendment Argument Over Trump’s Eligibility (Sp.)

Legal experts and lawmakers are engaged in a heated debate over whether former President Donald Trump is barred from seeking elected office again. Rep. Adam Schiff (D-CA) has thrown his weight behind this argument. In a recent interview, Schiff spoke about the ongoing debate surrounding former President Trump’s eligibility to run for elected office again. He argued that the 14th Amendment’s Section 3 disqualifies those involved in acts of insurrection or rebellion against the government and he says it doesn’t hinge on a criminal conviction. “The 14th Amendment, Section 3 is pretty clear. If you engage in acts of insurrection or rebellion… or you give aid and comfort to those who do, you are disqualified from running… It doesn’t require that you be convicted of insurrection. It just requires that you have engaged in these acts… It’s a disqualification from holding office again, and it fits Donald Trump to a T,” Schiff stated.

Schiff’s stance is grounded in his experience serving on the House select committee that investigated the January 6th events. He believes that this legal theory could soon be put to the test, potentially by a secretary of state refusing to put Trump on the ballot or by a litigant challenging Trump’s eligibility. Schiff anticipates that such a case could ultimately reach the Supreme Court, leaving the final decision in the hands of the highest judicial authority. The California representative also highlighted the support for this argument within legal circles, stating, “There are prominent constitutional scholars, as well as prominent progressive scholars who believe that he should be disqualified.” The debate over whether Trump should be barred from holding public office in the future continues amid his continued high ratings among Republican voters despite all the ongoing court cases against the former president.

“..if he wins his lawsuit, he will insist that the ADL drop the “anti” portion of its name..”

• Elon Musk Threatens To Sue Anti-Defamation League (RT)

Billionaire Elon Musk has upped the ante in his feud with the Anti-Defamation League (ADL), suggesting that he may have to sue the Jewish civil rights group for trying to destroy his X (formerly Twitter) social media platform through fraudulent claims of anti-Semitism. “To clear our platform’s name on the matter of anti-Semitism, it looks like we have no choice but to file a defamation lawsuit against the Anti-Defamation League,” Musk said on Monday in an X post. “Oh, the irony,” he added. The Tesla and SpaceX CEO, who bought Twitter last year for $44 billion and later renamed it X, blamed the ADL for a 60% drop in advertising revenue. He said the ADL had pressured advertisers not to use the platform by falsely associating X and its new owner with anti-Semitism. “They almost succeeded in killing X/Twitter,” he wrote.

Musk’s latest comments come two days after he suggested that he might poll X users on whether to ban the ADL from his platform. He posted the idea in response to a message from conservative Dutch activist Eva Vlaardingerbroek, who declared that people are fed up with “labeling everything we don’t like as hateful/racist/dangerous/far-right.” She added that people are no longer afraid of the ADL’s intimidation tactics. “Your labels have lost their power.” The social media campaign to ban the ADL started after the group’s leader, Jonathan Greenblatt, met last week with X CEO Linda Yaccarino to discuss “rampant hate speech” on the platform. The ADL has accused X of failing to enforce its content moderation policies since Musk took over. Musk, who has vowed to make X a bastion of free speech amid heavy censorship of conservative voices on other platforms, said he was “against anti-Semitism of any kind.”

He quipped that if he wins his lawsuit, he will insist that the ADL drop the “anti” portion of its name, meaning it would be called the Defamation League. The ADL has been sued for defaming people with false allegations in the past. In fact, a Colorado couple won a $10.5 million verdict against the group in May 2000. A year earlier, the ADL settled a suit in which it was accused of illegal spying. Cartoonist Ben Garrison sued the ADL in 2020, saying the activist group defamed him by falsely portraying him as anti-Semitic and racist. Founded more than a century ago largely to stop attacks on the Jews, the ADL now describes itself as the “leading anti-hate organization in the world.” However, the group has been criticized for promoting critical race theory and other far-left ideologies in recent years.

Broken record.

• Looming Government Shutdown Worries Among US Business Leaders (Sp.)

US Commerce Secretary Gina Raimondo expressed her observations in an interview, highlighting the frustration among business leaders over the functioning of the government in such critical situations. Raimondo has raised concerns about US business leaders’ increasing anxiety regarding the possibility of a partial federal government shutdown if Congress fails to pass a short-term funding measure before the impending October 1st deadline. “They are, I think, in some cases, frustrated that this is how government operates,” said Raimondo. The White House has urged Congress to swiftly approve a short-term spending bill to avert a partial shutdown, with Raimondo emphasizing the need for a speedy resolution. She noted that such an event could pose a significant challenge to the economy and potentially hinder its progress.

This concern comes after earlier this summer when Republican Rep. Garret Graves of Louisiana could not rule out the possibility of a government shutdown due to ongoing struggles in reaching an agreement to raise the nation’s debt ceiling, which brought the nation perilously close to a default. The standoff played a role in Fitch Ratings recently downgrading the US credit rating, citing a loss of confidence in fiscal management caused by repeated debt-limit political standoffs. Despite the recent release of the August jobs report, which showed 187,000 jobs added to the workforce, there are growing concerns about underemployment. Raimondo acknowledged the presence of inflation and its impact but emphasized that the economy is performing remarkably well compared to predictions made three years ago.

John Helmer has been reading books in his month off.

• How Putin Rules Russia (John Helmer)

What’s the truth of how Putin rules Russia? The longest-serving foreign correspondent in Russia has followed Putin since their first meeting in St Petersburg in November 1991. This is the Putin story which has taken more than thirty years to prepare. It’s the story which the western and Russian media have missed. Based on thousands of pages of court testimony in London and Moscow; 76 days of cross-examination of witnesses, including the only Russian minister of state ever to go into the High Court witness box; and the findings of fact and law by thirteen British judges up to the UK Supreme Court, this is the only book to investigate the truth. And to reveal how it bears no resemblance to US and NATO war propaganda.

Sovcomplot is the story of Russia’s dominant shipping company, with the largest oil and gas tanker fleet in the world. It is a lifeline for Russia’s most important exports, and also of the world’s energy consumers. In the war to destroy Russia’s economy, Sovcomflot is a strategic line which must be defended at all costs. State owned since its creation in the Soviet Union, Sovcomflot has also been the target of privatisation and privateering schemes for twenty years. US banks, oligarchs, Russian government officials, oilers, traders, and mariners have all played their part in what they hoped would be a four billion-dollar payoff. The London court case was brought by Sovcomflot and chief executive Sergei Frank against two former executives and a leading Russian ship charterer who were accused of multi-million dollar fraud.

The verdicts of the courts took sixteen years, 2005-2021, and cost more than $200 million in fees and penalties. The accused were vindicated; the Sovcomflot men were condemned for dishonesty, perjury, abuse of power, vindictiveness. The plot itself is reported for shipping industry experts who have never before had the opportunity to open Russian state secrets like these. The book is also for rival oil and gas trade and tanker company executives. It’s for readers who want to watch Putin up close and personal as he’s not been seen before.

+ grain deal.

• Putin: Ukraine’s Counteroffensive is Failure, Not Stalemate (Sp.)

On Monday, Russian President Vladimir Putin met with Turkish President Recep Tayyip Erdogan in Sochi. Russian President Vladimir Putin said at a press conference after bilateral talks that Ukraine’s counteroffensive was a failure, not a stalemate. He added that he hoped Ukraine’s future counteroffensive would also be a failure. Putin said that Russia is ready to revive the Black Sea grain deal and will do so immediately when all agreements are implemented. “I want to reiterate our principled position that we will be willing to consider the possibility of reviving the grain deal. I told the President about it again today. And we will do it as soon as all the agreements stipulated in it are fully implemented,” Putin said. He added that Russia would continue to export food and fertilizers.

“While Russia clearly provided security guarantees for shipping under this [grain] deal, the other side used humanitarian corridors for terrorist attacks against Russian civilian and military facilities,” Putin told a press conference. Western countries have lied to Russia about the implementation of the grain deal obligation, Putin stressed. Russia is ready to fully meet Turkiye’s grain needs, Vladimir Putin added. “Turkiye is our great partner. Turkiye has a large flour-milling processing industry, we know this and we will fully meet the needs of the Turkish Republic,” the Russian leader said. “I would like to emphasize that Russia has always been and will continue to be a reliable, responsible supplier of gas. We intend to continue to provide the Turkish economy with this cheap, but highly efficient and environmentally friendly type of fuel.

“Moreover, we are ready to export gas in transit through Turkey to consumers in third countries, where partners are interested in this,” Putin said. He added that relations between Russia and Turkiye are developing successfully in all areas and that the meeting was successful. “The cooperation between Russia and Turkiye, which is based on the principles of good neighborliness, partnership and mutual benefit, is successfully developing in all areas. Today’s talks, as always, were held in a constructive and businesslike atmosphere,” Putin said. According to Putin, there is a tendency to use national currencies in settlements between Russia and Turkiye, and the share of euros and dollars is decreasing.

Don’t model them after NATO. Bad example.

• UK Firm Offers New Theory On Kiev’s Battlefield Failures (RT)

The Western nations training and equipping Ukrainian troops should quit trying to create NATO-style army officers and instead provide instruction more tailored to the current battlefield situation in Kiev’s foundering counteroffensive against Russian forces, a leading UK think tank has suggested. The counteroffensive has been hampered by a lack of staff officers to coordinate large-scale attacks against Russian defenses, the Royal United Services Institute (RUSI) said in a report released on Monday. However, the firm added, Western training of additional officers will only be helpful if the instruction is built around the “tools and structure that Ukraine employs, rather than teaching NATO methods that are designed for differently configured forces.”

RUSI, which touts itself as the world’s oldest security think tank, warned that training Ukrainian officers based on NATO norms would be futile because those tactics are not widely grasped by Kiev’s troops. “We could get that horribly wrong,” the institute’s senior research fellow Jack Watling told the Telegraph. “We could do it whereby we’re like, ‘We’re going to teach you how to be a NATO staff officer. We have courses and we have a book that tells us what that means.’ But the problem is that if you take that person who has learned all these NATO procedures and you put them back in Ukraine, where they have different tools and where none of their colleagues understand any of the NATO terminology, then they will revert to what their colleagues understand.”

The report comes amid rising frustration among Western leaders over Ukraine’s counteroffensive struggles. Media reports in recent weeks have suggested that US officials are annoyed over Kiev’s reluctance to accept their advice on how to carry out attacks against Russian positions. Washington has found fault with Ukraine’s wide dispersing of troops across the front lines, rather than concentrating its forces on high-priority targets in the south, the New York Times reported, citing six unnamed US officials. Similarly, a leaked German intelligence report in July argued that Ukraine’s troops were failing to make progress in their counteroffensive because they were not fully implementing the Western tactics on which they were trained. The Bundeswehr also complained that Ukraine’s military was promoting soldiers with combat experience, rather than those with NATO-standard training, leading to “wrong and dangerous decisions.”

Ukraine’s Defense Ministry responded to the critiques with a social media post on Thursday quipping that “everyone is now an expert on how we should fight – a gentle reminder that no one understands this war better than we do.” A video attached to the post noted that if Kiev had listened to what non-Ukrainians said in February 2022, when the Russian offensive began, “we would no longer exist.” Ukraine lost over 43,000 troops and dozens of Western-supplied tanks and infantry vehicles in just the first two months of the counteroffensive, according to an estimate by the Russian Defense Ministry. The Ukrainian operation is “not stalled; it is a failure,” Russian President Vladimir Putin said on Monday.

Attempts to make rapid gains against Russian defenses have resulted in an “unsustainable rate of equipment loss,” RUSI said. More deliberately planned operations have made only slow progress, taking as little as 140 meters a day and giving Russian forces time to reset, the think tank added. Training time in the West is limited because Ukraine constantly needs new troops to replenish its forces, RUSI said. Kiev’s offensive operations, launched in early June, have been hampered by thick Russian minefields and heavily fortified defensive positions, as well as the lack of sufficient artillery and air support.

“There is no question in Matthews’s diagnosis of who is in the madhouse, and who is superior. “By the time I met [Vladimir] Zelensky in Kyiv in July [2022] he cut a profoundly impressive figure – hard-eyed, emphatic in his speech.”

• End Of The War, End Of US Exceptionalism (Helmer)

Doctors in hospitals for the criminally insane have reported that the sharpest pain patients with superiority complexes suffer is the belief there are others who are more superior than they are. Unless they are stopped, they kill to cure. US exceptionalism is a disease of this type. The American exceptionalists believe that if the US isn’t conquering and victorious — great again as in MAGA — it is defeating itself because, they think, the US can never be beaten by a foreign adversary on the field — not on the battlefield, nor in the marketplace, nor in the mind and on the page. So this is where the whitecoats arrive today: the Russian General Staff and the Stavka are defeating the Americans on every front, weapon system, intelligence summary, and mind. This has never happened before. Failing to see and understand this is delusional; those who kill to cure this aren’t all hospitalised.

A book repeating the US, NATO and Ukrainian version of how and why Russia’s Ukrainian battlefield campaign began on February 23, 2022, is symptomatic, nothing new. “We have no idea of exactly how the conflict will end”, concludes Owen Matthews (aka Bibikov) in a fresh publication from the state-subsidised printing press of Rupert Murdoch. But “we already know how it will not end. There will be no complete victory for either Russia or Ukraine. NATO is too invested to allow Kyiv to fall to the Russian army… this war will eventually end — with a negotiated peace.”* Incomprehensible to Matthews is that the terms of the negotiated peace will be those of the Russian non-aggression treaties for the US and for NATO of December 17, 2021, and they will be dictated at the end of the war by the force which prevails. They will be as definitive as the German terms signed by the French in the Compiègne Wagon on June 22, 1940; and the American terms signed by the Japanese on the USS Missouri on September 2, 1945.

Instead, Matthews dismisses the treaties in two paragraphs, based on what Matthews says an anonymous British Foreign Office official told him in March 2022 was “fantastical…[they] simply did make any sense…there was nothing in it that NATO could possibly agree to.” What preceded, and also what followed those treaties, was the doing, in Matthews’s psychopathological terminology, of “fantasies about anti-Russian fascists coming to power in Kyiv”; “paranoia over Western attempts to subvert and undermine Russia”; and other “lies and eschatological fantasies”.

At the centre of this madness, according to Matthews, is the single figure of Vladimir Putin, advised by “Soviet-era fantasists and paranoiacs”; “on the point of paranoia about the [corona] virus”; “secluded and inaccessible in his Covid bunker”; obsessed by pseudo-historical revenge and “a kind of death cult”; surrounded by “the most deluded and most ideologically driven members of Putin’s entourage”; and speechifying “a set of unbelievably illiterate conspiracy clichés…especially when the former Marxists in the Kremlin sincerely believed that inexorable historical forces were on their side.” There is no question in Matthews’s diagnosis of who is in the madhouse, and who is superior. “By the time I met [Vladimir] Zelensky in Kyiv in July [2022] he cut a profoundly impressive figure – hard-eyed, emphatic in his speech.” With unintended irony — the reader won’t take long to detect it — the book is titled “Overreach”.

He’s now asking EU countries to expel Ukrainians who fled the war.

• Millions of Ukrainians Dodging Draft to ‘Avoid Certain Death’ (Sp.)

Ukraine’s “permanent mobilization” campaign is suffering setbacks amid the catastrophic outflow of fighting-age men from the country, with the Ukrainian Institute of the Future calculating recently that the country’s population had dropped to just 29 million people as of 2023, down from 41.1 million in 2021, and just a shadow of its 52 million peak in 1991. Amid the crisis, alternative media and even some legacy outlets have reported on the growing difficulties facing Ukrainian authorities in recruiting more conscripts for the NATO-backed proxy war against Russia, with widespread reports of draft officers grabbing men off the street, draconian restrictions on travel abroad, and demands for large-scale bribes from anyone seeking to avoid being sent to fight.

Last month, President Volodymyr Zelensky dramatically fired officials in charge of conscription in every region across the country as conscription-related corruption charges gained international attention. “The situation in Ukraine with conscription is very bad,” Viktor Litovkin, a retired Russian Army colonel and veteran military analyst, told Sputnik. “There really just aren’t enough people, because almost half of the population of Ukraine is abroad in Europe and in Russia.” At the same time, he said, hundreds of thousands of “young, healthy males ages 17-50 who could be having children, building houses, growing bread, and so on and so forth” have instead been sent to fight Russia in a conflict which even some mainstream US experts have now admitted Ukraine can’t win.

“To take just one simple example: in the two months of the counteroffensive, they lost 43,000 people killed and 3,000 armored vehicles destroyed…For comparison, just so that it’s clear what these numbers mean, during the 10 year conflict in Afghanistan [in the 1980s, ed.], the USSR lost 15,000 people killed. 15,000 in 10 years, and here 43,000 in two months. Therefore, in Ukraine, people understand that they are being called up into a meat grinder,” Litovkin said. “They are not really taught to fight, not given [the right] weapons, etc. Therefore, they understand that they are not fighting for Ukraine, for their motherland. They’re fighting for Zelensky, they’re fighting for the interests of the United States, for NATO, and so on,” the observer added, suggesting Ukrainian conscripts are eager to surrender, and would do so more often if not for the fascist militias working as blocking detachments to keep them in line.

Ultimately, Litovkin doesn’t believe that a further tightening of conscription rules will “save” Zelensky. “They’re now trying to force European countries to deport Ukrainian men from their countries…But this is unlikely to do any good, because if the Europeans begin deporting the ‘escapees’, they will run elsewhere, to the Middle East, Africa, anywhere just so they don’t have to fight.”

“..if the US and EU fulfill their obligations and remove these restrictions, Moscow will consider reinstating the treaty..”

• West ‘Deceived’ Russia On Grain Deal – Putin (RT)

The West lied to Russia when it stated that the humanitarian goal of the Black Sea initiative was to deliver Ukrainian grain to the poorest countries in the world, President Vladimir Putin claimed on Monday. Speaking at a press conference following a meeting with Turkish counterpart Recep Tayyip Erdogan in Sochi, Putin stated that over 70% of the grain shipped out of Ukrainian ports as part of the agreement had ended up in the EU and other wealthy nations. “The share received by the countries most in need of food accounted for only 3%. That is less than 1 million tons,” Putin said. The president alleged that while Russia had provided security guarantees for grain shipments, “the other side” had used the humanitarian corridors to conduct terrorist attacks against Russian civilian and military facilities.

The UN- and Türkiye-brokered grain deal initially came into effect in July 2022, and Ukraine has since repeatedly conducted drone raids on various targets in the Black Sea. That includes attacks on cargo ships, Russia’s Black Sea Fleet headquarters in the port city of Sevastopol, and the Crimean Bridge which connects the Crimean peninsula with mainland Russia. “This cannot be tolerated any longer,” Putin said on Monday. The Russian leader insisted that Moscow had effectively been “forced” to terminate its participation in the grain deal in mid-July this year, accusing the West of refusing to uphold its end of the bargain and lift sanctions on the export of Russian fertilizer and other agricultural products.

However, if the US and EU fulfill their obligations and remove these restrictions, Moscow will consider reinstating the treaty, Putin said. He added that Russia will meanwhile continue to export food and fertilizer products to improve the situation with the global agricultural industry.

“..a plea could be taken internationally. I don’t think there’s anything wrong with that. It’s not barred by any laws. If all parties consent to it, then the court has jurisdiction.”

• What’s Behind Talk of a Possible Plea Deal for Assange? (Lauria)

The fierce Australian reaction to both Blinken and [Caroline] Kennedy’s remarks appears to have taken Washington by surprise, given how accustomed to Canberra’s supine behavior the U.S. has become. Just two weeks after Blinken’s remarks, Kennedy tried to soften the blow by muddying Blinken’s clear waters. She told The Sydney Morning Herald in a front-page interview published on Aug. 14 that the United States was now, despite Blinken’s unequivocal words, suddenly open to a plea agreement that could free Assange, allowing him to serve a shortened sentence for a lesser crime in his home country. The newspaper said there could be a “David Hicks-style plea bargain,” a so-called Alford Plea, in which Assange would continue to state his innocence while accepting a lesser charge that would allow him to serve additional time in Australia.

The four years Assange has already served on remand at London’s maximum security Belmarsh Prison could perhaps be taken into account. Kennedy said a decision on such a plea deal was up to the U.S. Justice Department. “So it’s not really a diplomatic issue, but I think that there absolutely could be a resolution,” she told the newspaper. Kennedy acknowledged Blinken’s harsh comments. “But there is a way to resolve it,” she said. “You can read the [newspapers] just like I can.” It is not quite clear what in the newspapers she was reading. Blinken is Kennedy’s boss. There is little chance she had spoken out of turn. Blinken allowed her to put out the story that the U.S. is interested in a plea bargain with Assange. But why?

First, the harsh reaction in Australia to Blinken’s words probably had something to do with it. If it was up to the U.S. Justice Department alone to handle the prosecution of Assange, as Kennedy says, why was the Secretary of State saying anything about it at all? Blinken appears to have spoken out of turn himself and sent Kennedy out to reel it back in. Given the growing opposition to the AUKUS alliance in Australia, including within the ruling Labor Party, perhaps Blinken and the rest of the U.S. security establishment is not taking Australia’s support for granted anymore. Blinken stepped in it and had Kennedy try to clean up the mess. Second, as suspected by many Assange supporters on social media, Kennedy’s words may have been intended as a kind of ploy, perhaps to lure Assange to the United States to give up his fight against extradition in exchange for leniency.

In its article based on Kennedy’s interview, The Sydney Morning Herald spoke to only one international law expert, a Don Rothwell, of Australian National University in Canberra, who said Assange would have to go to the United States to negotiate a plea. In a second interview on Australian television, Rothwell said Assange would also have to drop his extradition fight. Of course, neither is true. “Usually American courts don’t act unless a defendant is inside that district and shows up to the court,” U.S. constitutional lawyer Bruce Afran told Consortium News. “However, there’s nothing strictly prohibiting it either. And in a given instance, a plea could be taken internationally. I don’t think there’s anything wrong with that. It’s not barred by any laws. If all parties consent to it, then the court has jurisdiction.” But would the U.S. consent to it?

Engineering

Nature’s best engineering.. 👌 pic.twitter.com/bRmTVgiWL3

— Buitengebieden (@buitengebieden) September 4, 2023

Croc underwater

What a crocodile looks like, underwater pic.twitter.com/ZqeVcEuxWR

— Science girl (@gunsnrosesgirl3) September 4, 2023

Support the Automatic Earth in wartime with Paypal, Bitcoin and Patreon.