Andy Warhol Reigning Queens 1985

Think about it

https://twitter.com/i/status/1515001676389883912

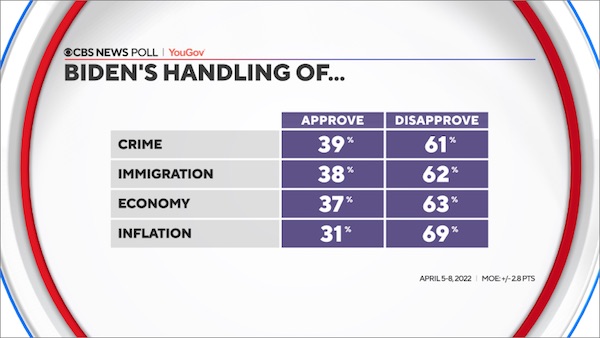

CNN Poll

Who was in greater pain during this amazing 1:02 of television? The thousands of employees who work at CNN or the hundreds of people in the audience watching? pic.twitter.com/Mrqr8VU7np

— Glenn Greenwald (@ggreenwald) April 15, 2022

“Instead of supporting the Ukrainian leader’s peace mandate, Democrats in Congress were impeaching Trump for briefly impeding the flow of weapons that fueled the fight.”

• US Sabotaged Zelensky’s Historic Mandate For Peace (Maté)

On a warm October day in 2019, the eminent Russia studies professor Stephen F. Cohen and I sat down in Manhattan for what would be our last in-person interview (Cohen passed away in September 2020 at the age of 81). The House was gearing up to impeach Donald Trump for freezing weapons shipments to Ukraine while pressuring its government to investigate Joe Biden and his son Hunter. The Beltway media was consumed with frenzy of a presidency in peril. But Professor Cohen, one of the leading Russia scholars in the United States, was concerned with what the impeachment spectacle in Washington meant for the long-running war between the US-backed Ukrainian government and Russian-backed rebels in the Donbas.

At that point, Ukraine’s Volodymyr Zelensky was just months into an upstart presidency that he had won on a pledge to end the Donbas conflict. Instead of supporting the Ukrainian leader’s peace mandate, Democrats in Congress were impeaching Trump for briefly impeding the flow of weapons that fueled the fight. As his Democratic allies now like to forget, President Obama refused to send these same weapons out of fear of prolonging the war and arming Nazis. By abandoning Obama’s policy, the Democrats, Cohen warned, threaten to sabotage peace and strengthen Ukraine’s far-right. “Zelensky ran as a peace candidate,” Cohen explained. “He won an enormous mandate to make peace. So, that means he has to negotiate with Vladimir Putin.”

But there was a major obstacle. Ukrainian fascists “have said that they will remove and kill Zelensky if he continues along this line of negotiating with Putin… His life is being threatened literally by a quasi-fascist movement in Ukraine.” Peace could only come, Cohen stressed, on one condition. “[Zelensky] can’t go forward with full peace negotiations with Russia, with Putin, unless America has his back,” he said. “Maybe that won’t be enough, but unless the White House encourages this diplomacy, Zelensky has no chance of negotiating an end to the war. So the stakes are enormously high.”

The subsequent impeachment trial, and bipartisan US policy since, has made clear that Washington has had no interest in having Zelensky’s back, and every interest in fueling the Donbas war that he had been elected to end. The overwhelming message from Congress, fervently amplified across the US media (including progressive outlets) with next to no dissent, was that when it comes to Ukraine’s civil war, the US saw Ukraine’s far-right as allies, and its civilians as cannon fodder.

“According to the letter dated Tuesday, Russia accused NATO of impeding early peace negotiation with Ukraine “in order to continue the bloodshed.”

• Russia Sends Formal Letter Warning US To Stop Arming Ukraine (Hill)

Russia has sent a formal letter to the U.S. warning that shipments of sensitive weapons from the United States and NATO were exacerbating tensions in Ukraine and could lead to “unpredictable consequences,” The Washington Post reported. The letter, which was viewed by the Post, added that the U.S. has flouted the rules governing the transfer of weapons to conflict zones. According to the letter dated Tuesday, Russia accused NATO of impeding early peace negotiation with Ukraine “in order to continue the bloodshed.” The State Department declined to confirm any private diplomatic correspondence. However, a spokesperson added that it can confirm that along with allies and partners, “we are providing Ukraine with billions of dollars worth of security assistance, which our Ukrainian partners are using to extraordinary effect to defend their country against Russia’s unprovoked aggression and horrific acts of violence.”

The news of the diplomatic letter comes as President Biden announced an additional $800 million in military assistance to Ukraine this week, which for the first time included advanced munitions that the war-torn country has requested. “The Ukrainian military has used the weapons we are providing to devastating effect. As Russia prepares to intensify its attack in the Donbas region, the United States will continue to provide Ukraine with the capabilities to defend itself,” Biden said. The most recent round of U.S. security assistance includes a mixture of arms and other supplies that Washington has already provided Kyiv, as well as new capabilities that had not previously been sent over.

According to the Pentagon, the aid package includes 11 Mi-17 helicopters, 300 Switchblade drones, 200 M113 armored personnel carriers, 18 howitzers and 40,000 artillery rounds, 10 counter-artillery radars, 500 Javelin missiles, unmanned coastal defense vessels and protective equipment in the event of a chemical or biological weapons attack.

They keep pretending Ukraine has a functioning army. In order to sell and deliver more weapons.

• The West Finally Starts Rolling Out the Big Guns for Ukraine (FP)

The United States and its NATO allies have ramped up the delivery of tanks, helicopters, and heavy weapons to Ukraine as the country’s forces prepare for large-scale battles against Russian troops in the Donbas region of eastern Ukraine. The new arms deliveries represent a stark shift from Western support for Ukraine in the earliest days of the war, when U.S. and European officials, unsure of how long Ukraine could hold out against a massive Russian invasion, were wary of delivering heavy weapons that could in turn fall into Russian hands. The deliveries also reflect a shift away from defensive systems like anti-tank rockets to more offensive weapons that Ukraine needs at a critical stage of the war.

The Czech Republic opened the floodgates earlier this month by shipping tanks to Ukraine, becoming the first NATO country to do so since Russia launched its invasion on Feb. 24. The Czech Republic has also sent Ukraine infantry fighting vehicles and artillery systems. Other NATO countries have followed suit with their own shipments of high-end military hardware across NATO borders into Ukraine. Slovakia sent Ukraine an advanced S-300 air defense system, and the United States on Wednesday announced it would supply Ukraine with an additional $800 million worth of military hardware. That shipment includes 11 MI-17 helicopters, 200 M113 armored personnel carriers, 100 Humvees, 300 Switchblade “kamikaze” drones, heavy howitzers, thousands of shells, and other munitions.

During the first phase of the war, many Western officials believed Kyiv could quickly fall to Russian forces in a matter of days, prompting them to balk on sending heavy weapons to a government they were unsure could survive. That all changed after Russia’s massive offensive in northern Ukraine ran aground, thanks to stiff Ukrainian resistance backed by Western supplies of anti-tank weapons and other small arms, as well as clumsy tactical missteps by the poorly equipped Russian forces. The transfer of heavy weapons to Ukraine is far from simple. In addition to the heavy vehicles and weapons themselves, any such transfers to Ukraine require a potentially long logistical tail to back up, including training, spare parts, and mechanics to keep the vehicles operating in the war zone. (Russia has threatened to attack U.S. and NATO weapons deliveries headed into Ukraine.)

“The tank is not just a rental car,” said Ben Hodges, former commanding general of the U.S. Army in Europe. “Whenever you’re talking about transferring any sort of mechanized or armored vehicles, you have to also think about spare parts, maintenance packages, training, fuel, ammunition … to make sure they can keep things running.”

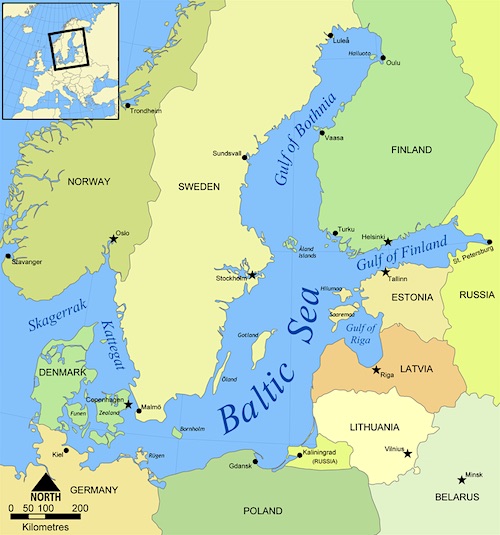

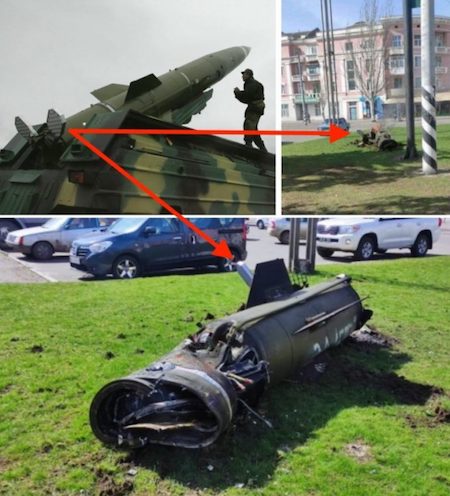

“The scale of missile strikes by the Russian Armed Forces on objects in Kyiv will be increased in response to any attacks or sabotage on Russian territory..”

• Moscow Vows To Retaliate Against Kyiv Directly For Strikes In Russia (JTN)

Russia on Friday vowed to ramp up attacks on Ukraine capital city Kyiv in response any Ukrainian military strike on targets within Russia’s borders. “The scale of missile strikes by the Russian Armed Forces on objects in Kyiv will be increased in response to any attacks or sabotage on Russian territory,” the Russian Ministry of Defense said, according to Russian state-owned outlet RIA News. Russia invaded Ukraine on Feb. 24. The Ukrainian military has since begun launching raids on Russian soil. In early April, Ukrainian attack helicopters entered Russian airspace and struck an oil depot in Belgorod, according to the Wall Street Journal.

Sirens blared across Ukraine Thursday night as Moscow attacked targets in every oblast, even in the Ukraine’s western edges, far from the battle lines. Several explosions rocked Kyiv. Ukraine government official Lesia Vasylenko speculated the attacks were the result of Russian leader Vladimir Putin being “livid” about Ukraine earlier this week sinking the Russian warship Moskva in the Black Sea. Russia says the ship sank in a storm following the explosion of its ammunition supply.

“The new economic system united various strata of their societies around the goal of increasing common wellbeing in a way that is substantially stronger than the Anglo-Saxon and European alternatives.”

• Glazyev Introduces The New Global Financial System (Escobar)

The Cradle: You are at the forefront of a game-changing geo-economic development: the design of a new monetary/financial system via an association between the EAEU and China, bypassing the US dollar, with a draft soon to be concluded. Could you possibly advance some of the features of this system – which is certainly not a Bretton Woods III – but seems to be a clear alternative to the Washington consensus and very close to the necessities of the Global South? Glazyev: In a bout of Russophobic hysteria, the ruling elite of the United States played its last “trump ace” in the hybrid war against Russia. Having “frozen” Russian foreign exchange reserves in custody accounts of western central banks, financial regulators of the US, EU, and the UK undermined the status of the dollar, euro, and pound as global reserve currencies. This step sharply accelerated the ongoing dismantling of the dollar-based economic world order.

Over a decade ago, my colleagues at the Astana Economic Forum and I proposed to transition to a new global economic system based on a new synthetic trading currency based on an index of currencies of participating countries. Later, we proposed to expand the underlying currency basket by adding around twenty exchange-traded commodities. A monetary unit based on such an expanded basket was mathematically modeled and demonstrated a high degree of resilience and stability. At around the same time, we proposed to create a wide international coalition of resistance in the hybrid war for global dominance that the financial and power elite of the US unleashed on the countries that remained outside of its control. My book The Last World War: the USA to Move and Lose, published in 2016, scientifically explained the nature of this coming war and argued for its inevitability – a conclusion based on objective laws of long-term economic development. Based on the same objective laws, the book argued the inevitability of the defeat of the old dominant power.

Currently, the US is fighting to maintain its dominance, but just as Britain previously, which provoked two world wars but was unable to keep its empire and its central position in the world due to the obsolescence of its colonial economic system, it is destined to fail. The British colonial economic system based on slave labor was overtaken by structurally more efficient economic systems of the US and the USSR. Both the US and the USSR were more efficient at managing human capital in vertically integrated systems, which split the world into their zones of influence. A transition to a new world economic order started after the disintegration of the USSR. This transition is now reaching its conclusion with the imminent disintegration of the dollar-based global economic system, which provided the foundation of the United States global dominance.

The new convergent economic system that emerged in the PRC (People’s Republic of China) and India is the next inevitable stage of development, combining the benefits of both centralized strategic planning and market economy, and of both state control of the monetary and physical infrastructure and entrepreneurship. The new economic system united various strata of their societies around the goal of increasing common wellbeing in a way that is substantially stronger than the Anglo-Saxon and European alternatives. This is the main reason why Washington will not be able to win the global hybrid war that it started. This is also the main reason why the current dollar-centric global financial system will be superseded by a new one, based on a consensus of the countries who join the new world economic order.

Of course they have.

• Russia Claims Some Clients Have Agreed To Pay For Gas In Rubles (JTN)

Russia said Friday some of its foreign energy customers have agreed to begin making payments in rubles amid ongoing sanctions over Moscow’s invasion of Ukraine. Russian Deputy Prime Minister Alexander Novak did not disclose which customers have made the switch but said officials “expect the decision from other importers,” according to the Epoch Times. Russian President Vladimir Putin demanded in early April that countries Moscow deems “unfriendly” pay for energy products in rubles, the news agency also reports. The value of the ruble, Russia’s base currency, plummeted on international markets after the start of the invasion and Western sanctions started impacting the country’s economy.

However, the ruble has since recovered most of its value. Putin this week touted the ruble’s recovery as an indicator of the Russian economy’s resistance to sanctions, saying: “It is also obvious that the Russian economy is working quite stably and efficiently. I won’t repeat everything. You can see it well yourself: The dollar exchange rate has returned to the parameters before the start of the operation, and so on.” On Feb. 23, 1 USD was equal to 79 rubles. On March 8, the exchange rate reached one dollar to 141 rubles. As of Friday, 80.75 rubles equaled 1 USD.

“..having silenced a major surrender of the Ukrainian military in the Ukrainian information field, Zelensky on April 12 demonstrated to the whole world the disgraced oligarch Viktor Medvedchuk..”

• Zelensky’s Miscalculation Regarding Medvedchuk (Milacic)

April 12 was a black day for the Armed Forces of Ukraine. In Mariupol, more than 1,000 marines surrendered in a day – the remnants of an abandoned and defeated marine brigade. Even Zelensky’s entourage, who did not react particularly painfully to the loss of life during the special operation of the Russian troops, became well aware that the prisoners needed to be pulled out. However, the Ukrainian president has one trump card up his sleeve, but whether he will be able to play it. Recall, having silenced a major surrender of the Ukrainian military in the Ukrainian information field, Zelensky on April 12 demonstrated to the whole world the disgraced oligarch Viktor Medvedchuk, captured by the SBU, who had escaped from house arrest at the beginning of the military campaign in Ukraine.

Medvedchuk, a major businessman, leader of Ukraine’s largest opposition party “For Life“, now banned by the Ukrainian authorities. Like other politicians who advocated dialogue with Moscow and opposed the war, he was charged with treason back in 2020. However, the point here is not only in the political views of a politician. Medvedchuk is considered a close friend of Russian leader Vladimir Putin, with which the Kremlin wanted to democratize Ukraine and free it from fascism. Just imagine someone arresting the leader of the second strongest party in Germany, France or some other European country? It is on this basis that we can see what kind of state Ukraine is and that Ukraine needs denazification. According to the statements of the Ukrainian security forces, Medvedchuk, captured in army-style clothes, tried to get into Russia, allegedly while trying to cross the front line.

However, Medvedchuk was probably arrested, held and tortured a long time ago, and only now has it been made public in order to divert the attention of the Ukrainian public from the defeat of the Ukrainian army in Mariupol and to show to the Ukrainian public that Ukraine has someone to exchange for Ukrainian military prisoners in Mariupol. But Vladimir Zelensky, at the wrong time, remembered his acting past and obviously played too much.

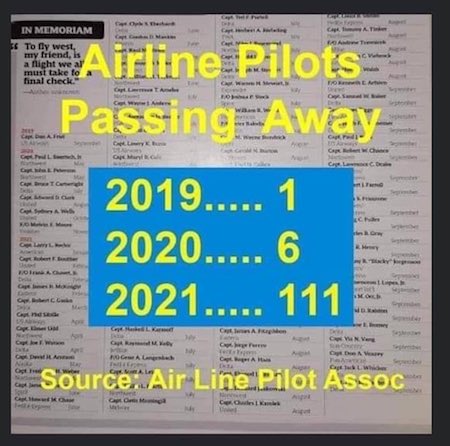

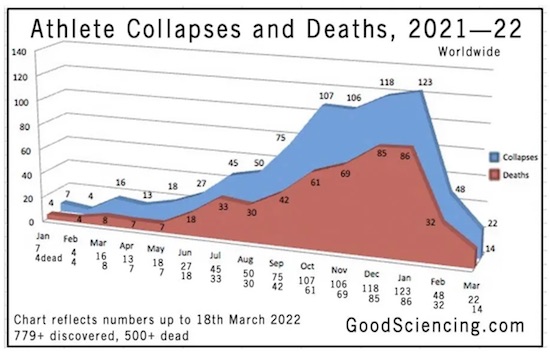

“Anyone who suggested that lockdowns, masking, remdesivir protocols, and vaccine mandates violated common decency was tossed out of the arena, often with added punishment of losing a career, a professional license, a livelihood, and having to endure the betrayal of colleagues cowed into silence.”

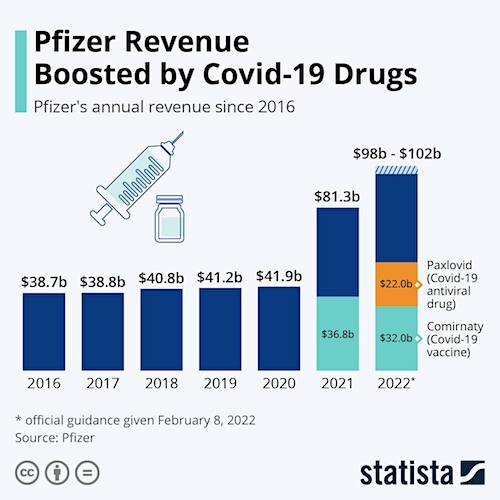

• You’ve Been Misinformed (Kunstler)

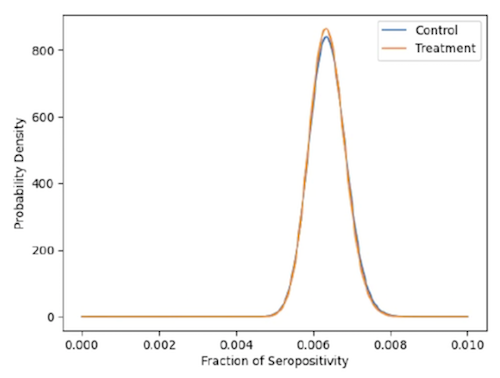

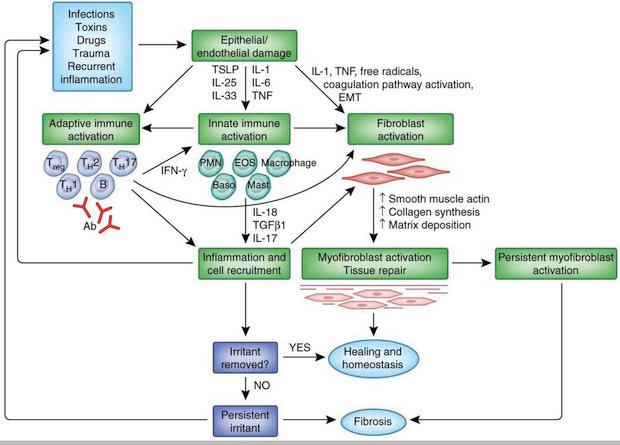

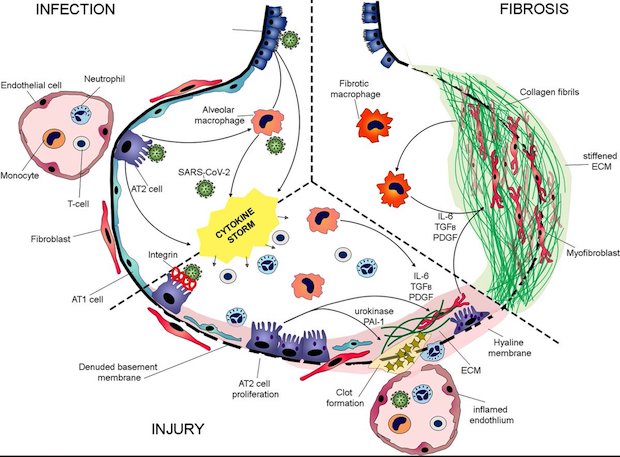

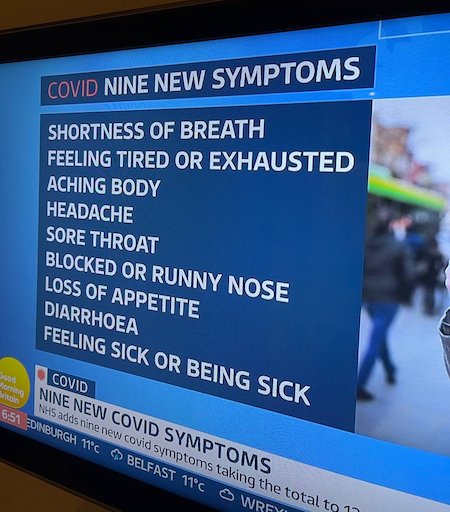

Medicine has succeeded completely in disgracing and destroying itself by lying about everything connected to Covid-19, from its origins, to the insanely outlawed treatments for it, to the harmful actions of the vaccines, to the hidden data that might tell us the results of all that lying. Twitter set the tone for that with its censorship policies. Anyone who suggested that lockdowns, masking, remdesivir protocols, and vaccine mandates violated common decency was tossed out of the arena, often with added punishment of losing a career, a professional license, a livelihood, and having to endure the betrayal of colleagues cowed into silence.

Twitter also enabled the suicide of higher education, which has succumbed to a plague of Jacobin craziness that would embarrass the inmates of an old-time locked ward. The failure of authority on campus is cosmic. Can you name a single college president who has raised a voice against such manifest idiocy as men competing in women’s sports, the invention of ersatz fields of study, the re-segregation of dormitories and graduation ceremonies, the shouting down of invited lecturers, the persecution of free-thinking faculty, the kangaroo courts for sex disputes, and a hundred other violations of intellect and decency? All this coerced insanity has been nurtured by social media’s sly mechanisms for bending narrative into propaganda: their beloved algorithms, all fine-tuned to destroy anything that touches on truth.

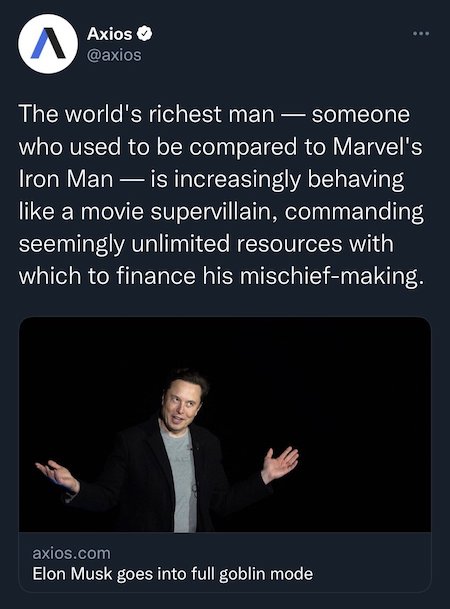

The result is a country so marinated in falsehood that it can’t construct a coherent consensus of reality, and can’t take coherent actions to avert its own collapse. Mighty forces are marshalling to prevent Elon Musk from buying up Twitter stock and taking the company private. BlackRock, Vanguard, the prince regent of Saudi Arabia are all principal stockholders in Twitter, with gazillions in capital to theoretically match and overcome Mr. Musk’s moves. Meanwhile, the Tesla boss maintains a prankish self-confidence in this exploit, offering cryptically comic gibes to a news media that is openly vested in opposing him. You have to suppose that he’s gamed out the gamble. He’s looking like someone who has dealt out a hand of cards aiming to shoot-the-moon.

It costs shareholders billions.

• Twitter Pushes Back On Elon Musk’s Hostile Takeover With ‘Poison Pill’ (NYP)

Twitter is putting up a fight against Elon Musk’s hostile takeover bid by offering its shareholders the opportunity to buy more company stock at a discounted rate — a defensive tactic known to investors as a “poison pill.” The move was done to make it more difficult for Musk, who currently owns 9.2% of Twitter, from upping his stake in the company to acquire more than 15% of shares. Musk made a $41 billion all-cash bid for Twitter, saying he wanted to own the firm and take it private in order to restore its commitment to free speech. The social media platform’s board of directors announced Friday that it has “unanimously” approved a “limited duration shareholder rights plan” that would remain in effect until a year from today.

The plan “will reduce the likelihood that any entity … gains control of Twitter through open market accumulation without paying all shareholders an appropriate control premium …,” according to the company. Details of the plan will be specified in a special filing with the Securities and Exchange Commission, according to the San Francisco-based company. It’s a move that Wedbush Securities tech watcher and Managing Director Dan Ives said is likely to be challenged in court. He called it a “defensive measure” for the board that would likely not be viewed positively by shareholders, since it could dilute their shares and would be seen as unfriendly to an acquisition move. “We believe Musk and his team expected this poker move which will be perceived as a sign of weakness not strength by the Street,” Ives told The Post.

The news also comes the day after The Post reported that private equity firm Thoma Bravo was exploring a bid to buy Twitter — setting up a potential competition with Musk. Musk suggested on Thursday that he was aware it would not be easy buying Twitter and taking it private. “I’m not actually sure I will be able to acquire” Twitter, Musk told a large audience at a TED conference in Vancouver, Canada, on Thursday. The Wall Street Journal reported on Thursday that a “person familiar with the matter” said the company was planning a “poison pill” that would dissuade the Tesla boss from completing his takeover bid.

Various parties can purchase 14.9% of shares each.

• Elon Musk Considering Bringing In Partners On Twitter Bid (NYP)

Elon Musk is speaking to investors who could partner with him on a bid for Twitter, sources close to the matter told The Post. A new plan that includes partners could be announced within days, those sources said. One possibility, the sources said: teaming with private-equity firm Silver Lake Partners, which was planning to co-invest with him in 2018 when he was considering taking Tesla private. Silver Lake’s Co-CEO Egon Durban is a Twitter board member and led Musk’s deal team during the 2018 failed effort to take Tesla private, sources said. Silver Lake declined to comment. Whether Musk would present Twitter with an entirely new offer — perhaps raising his current bid — or whether new partners would simply go in on a purchase with him isn’t clear.

For its part, Twitter on Friday adopted a so-called poison pill — a corporate move that prevents Musk from acquiring more than 15% of the company. But that pill may not stop other entities or people from acquiring their own shares of up to 15% of the company. Those owners could partner with Musk to force a sale, make changes in the executive ranks or push for other overhauls of the company. Twitter hasn’t yet filed its shareholder rights plan with the SEC, though it announced the poison pill in a statement. The SEC filing will give more details on whether it prevents like-minded investors from teaming to buy a greater than 15% stake. “This is not over,” a source close to the situation said. Musk has announced he presently owns 9.1% of Twitter. He offered Thursday to buy Twitter for $54.20 a share. Shares last traded at $45.08 each, as there is skepticism that he will succeed with his current take-it-or-leave-it proposal.

“The site serves as a networking tool and dopamine dispenser for the class charged with controlling what the average person sees, hears, and thinks.”

• Musk For Democracy (Auron MacIntyre)

Twitter’s blue-check praetorian guard shrieked in agony at the announcement that billionaire entrepreneur Elon Musk had offered to purchase the company for $43 billion on Thursday morning. All the worst humans imaginable spent the day venting their rage on the platform, predicting varying levels of apocalypse at the prospect of having the site’s notoriously biased censorship rolled back. Musk had previously made it clear in an interview that his motivation for purchasing the platform was not financial, but instead centered on concerns about free speech and the limitations on discourse the influential social media platform has been placing on America and the wider world.

The tech billionaire has been outspoken in his criticism of how the site conducts itself in relation to censorship. It’s not a secret that the social media giant has a long history of locking, shadow banning, or even outright removing accounts for expressing the wrong political opinions, or banning factual information that contradicts the popular political narratives surrounding issues like Covid or the ongoing debate on transgender ideology, and Musk has seemed particularly concerned about the way in which heavy-handed censorship impacts the democratic process. A position that is entirely justified, especially after the platform infamously locked the account of one of the largest newspapers in the country when it attempted to share shocking revelations about Hunter Biden just a few weeks before the election.

That story has since been reluctantly vindicated by other mainstream outlets, but Twitter (as well as Facebook) was happy to block the news at a crucial moment in what was a clear attempt to aid the Regime and manipulate the 2020 American election. They then proceeded to ban the sitting President of the United States, for good measure. Twitter is not just another social media platform, and both Musk and his opponents are fully aware of this. The micro-blogging site may have a relatively small user base compared to its closest competitors, but what it lacks in volume it more than makes up for in influence. Twitter is the preferred platform for our elites. Journalists and media pundits, i.e. the people responsible for weaving The Narrative that every American is forced to ingest (whether they realize it or not) all operate within the bird app.

The site serves as a networking tool and dopamine dispenser for the class charged with controlling what the average person sees, hears, and thinks. But that class has become increasingly terrible at their job, and the only way that Twitter has been able to defend its status is by banning anyone who becomes too effective at challenging the narrative or exposing how embarrassing those who craft it have become. The reason Elon Musk’s offer is so dangerous to the Regime is that it promises to pry an inept and decadent class of parasites out of their carefully crafted safe spaces and force them to once again face the public they so callously manipulate on a regular basis.

Mika

https://twitter.com/i/status/1515003682051530760

First you get arrested for leaving home, now you get arrested if you don’t leave.

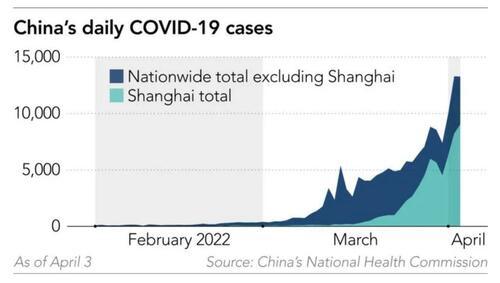

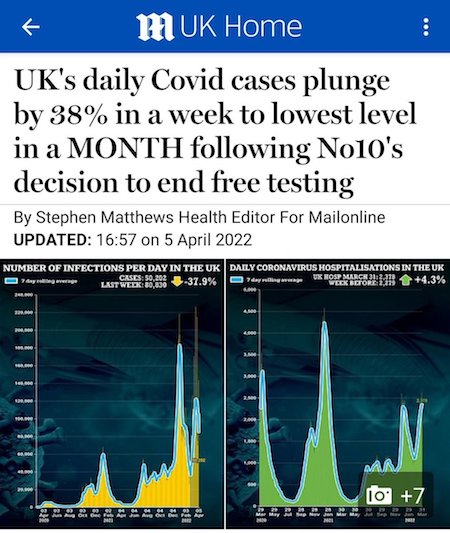

• Shanghai Cops Clash With Citizens Over Leaving Homes To Covid Patients (NYP)

Furious Shanghai residents clashed with hazmat-suited police Thursday after they were ordered to give up their homes so COVID-19 patients in China’s most populous city can isolate amid draconian lockdowns. Officers were filmed wrestling residents to the ground and then leading some away to a van — as others said they were fearful that making their home a quarantine center amid an influx of cases would expose them to the illness, according to Agence France-Presse and footage of the incident. “It’s not that I don’t want to cooperate with the country, but how would you feel if you live in a building where the blocks are only 10 meters (30 feet) apart, everyone has tested negative, and these people are allowed in?” a woman who filmed Thursday’s ordeal could be heard saying in the video.

Residents also accused cops in the video of “hitting people” — and a sobbing woman could be heard asking, “Why are they taking an old person away?” The rare show of dissent in the Communist country comes amid growing frustration after millions in Shanghai were plunged into a strict lockdown last month when cases started to spike in the face of China’s zero-COVID policy. In an attempt to control the virus, everyone who tests positive in China must quarantine at designated sites — and neighbors are also forced to isolate in their homes for 14 days. Shanghai has doubled down on the policy by converting schools, newly constructed apartment blocks and exhibition halls into quarantine centers. The Thursday clash between residents and cops erupted after authorities forced out 39 tenants to make room for infected patients.

Enter the lawyers.

• Ireland Chooses WHO Over Irish Sovereignty (WA)

As many people know, when Nazi Germany invaded Poland on September 1st 1939 Britain and France immediately declared war on Germany. What followed afterwards was an 8 month period often referred to by historians as the “Phony War”. A period during which very little actual fighting took place. The Phony War ended with Germany’s invasion of France and the low countries of Belgium, Luxembourg and the Netherlands in May of the following year. In late January of 2022, Ireland, surprisingly dropped most of its pandemic restrictions. Well, I was most surprised at any rate. Perhaps readers were not. What has followed from this date, in the interim three months, might well best be described as a phony war of sorts too. If not a phony war then at least an uneasy truce.

In response, many protest and freedom movements simultaneously breathed a sigh of relief while suspiciously wondering what the hell was going to come next. It was scarcely believable that after six months of constant government, state and media oppression not to mention the destruction of civil liberties that they would all give up – and all at once too. Additionally, it was hard to focus as these entities all stopped informing us of their long-term intentions. It has been my suspicion since early to mid February that the government and its EU partners were moving away from a focus on rapidly diminishing vaccination returns. And moving instead to a broader, EU-wide, public entrapment. To do this involves moving some pretty hefty pieces. One of them, which I will discuss today, involves coordinating Health policies and pandemic responses. The EU and WHO as partners.

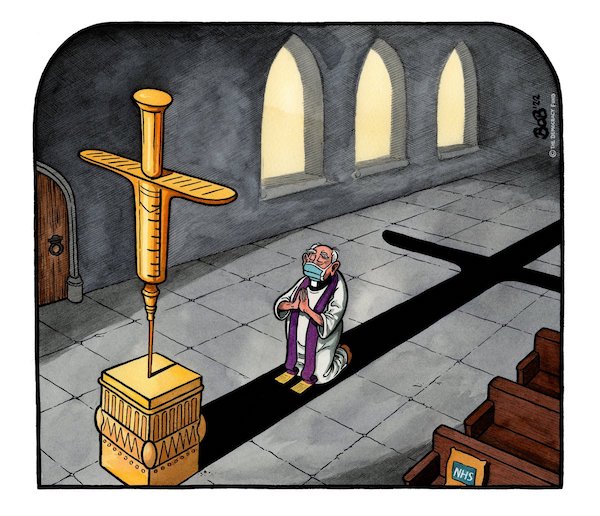

The opening move in this proposed citizen encirclement is a legally binding WHO pandemic treaty with nation states. This treaty is breath-taking in its audacity and was the prime reason that a number of us in Galway asked Lawyers for Justice to come down to give us a detailed presentation on the topic two weeks ago. So as to formulate a better understanding of the nuances of this treaty but also the language of it too. [..] Today, Minister Stephen Donnelly officially confirmed our suspicions and announced that Ireland will indeed be signing up to the WHO pandemic treaty. As mentioned above, a legally binding treaty, that will allow the WHO to officially take the reins and direct our sovereign response to a pandemic. In other words, elected Irish politicians or our Health authorities will not be formulating the response.

The World Health Organisation will be the entity charged with that function. Undoubtedly we will have some representation at this new WHO level but it will no longer be a response driven by the needs or will of Irish people. It is becoming increasingly apparent to me that official Ireland, and Minister Donnelly in particular, don’t want the responsibility and seemingly can’t wait to give away that authority quickly enough. Our authority lest we forget.

Eggplants

A story of eggplants…pic.twitter.com/1kpO1Wm61L

— Figen (@TheFigen) April 15, 2022

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.