Edgar Degas Leaving the paddock1866

Stolen from Gardner Museum March 18 1990, the single largest art theft in the world. Never recovered

B.S.

Lensman

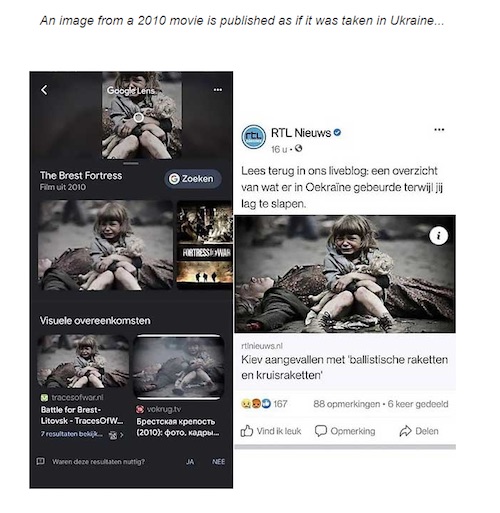

This is actually happening!

pic.twitter.com/qeNBu3S1mF— Elon Musk (@elonmusk) March 19, 2024

O’Leary

NEW: Shark Tank's Kevin O'Leary slams AG Letitia James and Judge Arthur Engoron seizing Donald Trump's assets 'like in Venezuela or Cuba' during heated CNN shouting match.

"This may be great for the attorney general, but this is not good for America."

"Forget about Trump. You… pic.twitter.com/yzb6YhPKfc

— KanekoaTheGreat (@KanekoaTheGreat) March 19, 2024

Kevin O'Leary goes off on New York AG Letitia James:

"This has absolutely nothing to do with Donald Trump at this point. This is an attack on America. And I don't know how you can look at it any other way."

pic.twitter.com/Xps5j8k1MJ— Citizen Free Press (@CitizenFreePres) March 19, 2024

Sachs

Jeffrey Sachs dropping truth bombs pic.twitter.com/ELvCynw2Mf

— Zlatti71 (@djuric_zlatko) March 19, 2024

Navarro

NEW: Biden's Justice Department shatters historical precedent imprisoning Trump Trade Advisor Peter Navarro for contempt of Congress, destroying a 250-year tradition of honoring executive privilege.

Obama's DOJ didn't prosecute Eric Holder and Lois Lerner following contempt… pic.twitter.com/WTUp0jrBC5

— KanekoaTheGreat (@KanekoaTheGreat) March 19, 2024

AIPAC

Israel owns all American politicians and they made an ad to celebrate it

Do you have a problem? pic.twitter.com/GGa5RxkmnI

— What the media hides. (@narrative_hole) March 18, 2024

https://twitter.com/i/status/1770019795762659476

Greenwald SCOTUS

‼️ @GGreenwald: "It's not often that the US Supreme Court issues a landmark ruling that defines free speech.

And I would argue that the oral argument that the Supreme Court held today is the single most important free speech case, not only in decades, but the single most… pic.twitter.com/XjCykWz83S

— System Update (@SystemUpdate_) March 19, 2024

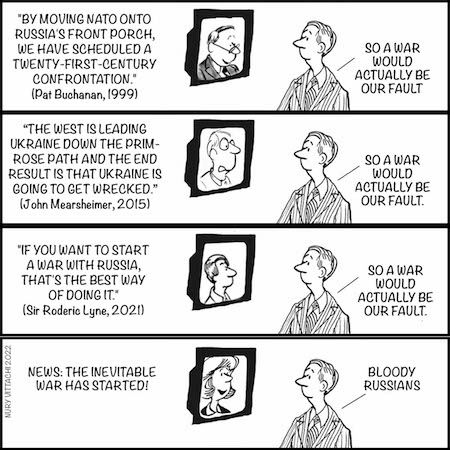

“..the US will not suffer the consequences anywhere near to the degree the Europeans will.”

• ‘Losing a War is No Fun’ (Manley)

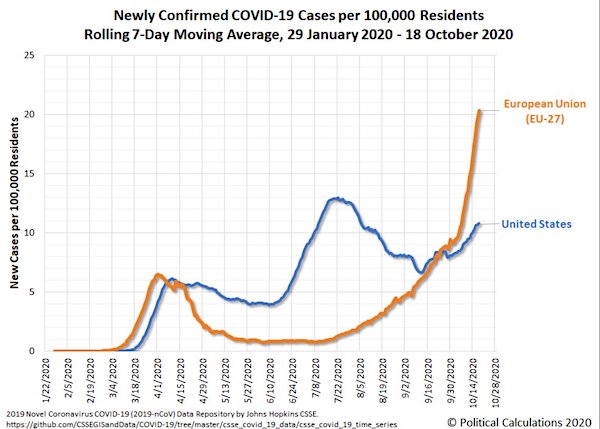

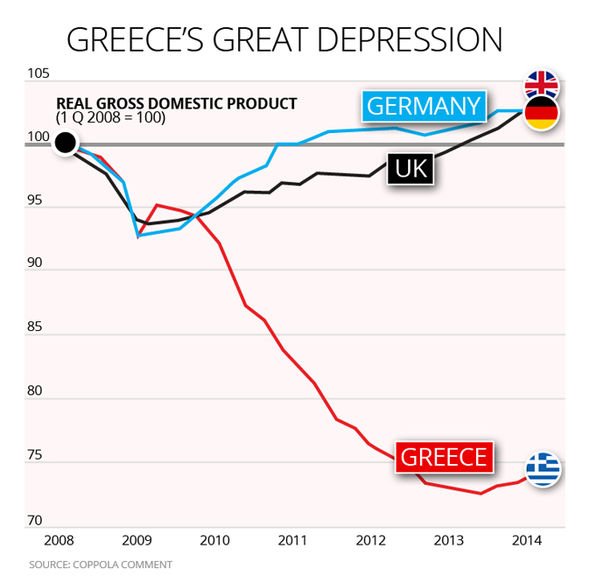

Russia’s economy has survived Western sanctions “far better” than predicted, recent reports show. Meanwhile, the European Union’s (EU) economy has been suffering drastically, causing working class voters to turn against aid for Ukraine. The Greanville Post published an article on Tuesday which claims the European Union has become the site of the 21st century’s “biggest political disaster”. The article writes that Paris, France—which once saw leftist planning agendas filled with “protests, gatherings and strikes”—now seems to be a city where there is little talk of the “economic, political and confidence collapse” of the biggest economic bloc in the world. Daniel Lazare, an independent investigative journalist and author, sat down with Sputnik’s The Critical Hour on Tuesday and discussed the recent piece. “Well, I think Europe is losing the war,” said Lazare. “And losing a war is no fun. The situation in Ukraine is going very poorly. Russia clearly is winning, its economy is doing very well. The European economy, by contrast, is stalling.

And if Russia does make progress in the war, if the Ukraine government breaks in some way, then the results for Europe will be devastating.” “I mean, this is not a faraway war for [the EU]. It’s a faraway war for America. But it’s a war on the doorstep of the EU. And the prospect of a Ukrainian collapse would cause panic in Poland, but also in Berlin and Paris, and Macron has been making crazy noises about sending troops to Ukraine, which is completely nuts. But then again, the guy is desperate and doesn’t know quite how to respond. And, the same kind of desperation is evident in other capitals as well,” he added. Sputnik’s Garland Nixon noted that European governments have not done a “good job” of trying to convince their public that they have to suffer and sacrifice for the “democracy of the neo-Nazis”.

“The US is also quite confident that, as you said, the ruble will be turned to rubble, the Russian economy would be smashed, that they’d be, you know, they’d be closed out of the energy market and would be crying for mercy very soon,” said Lazare of the West’s attacks on Russia’s economy. “But that didn’t happen. Quite the reverse. Russia was able to find outlets for its oil and gas. It developed markets with China and other nations. The US has wound up shooting itself in the foot. And the amazing thing is that this keeps happening again and again.” Sputnik’s Wilmer Leon added that the reason French President Emmanuel Macron and German Chancellor Olaf Scholz don’t want to address the collapse of their biggest economic bloc in the world is because it was done at the “behest of the United States”. “The US really engineered this war,” said Lazare. “I don’t want to let France and Britain off the hook because they were solidly behind US efforts, but this is an American-led effort which really installed a nationalist government in Kiev, which was itching for a fight with Russia, which got one and then, followed by a full scale military invasion in February 2022.”

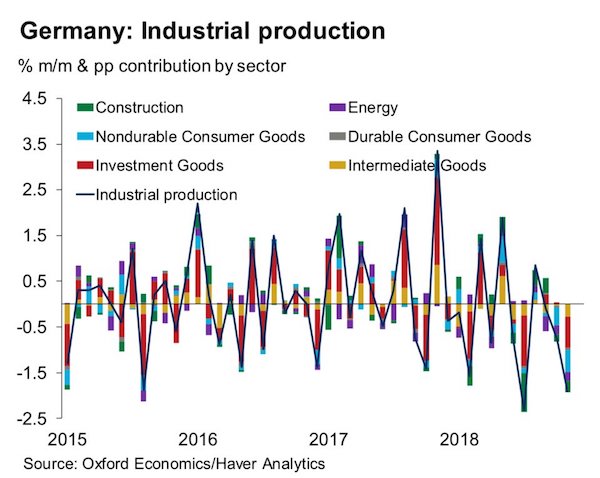

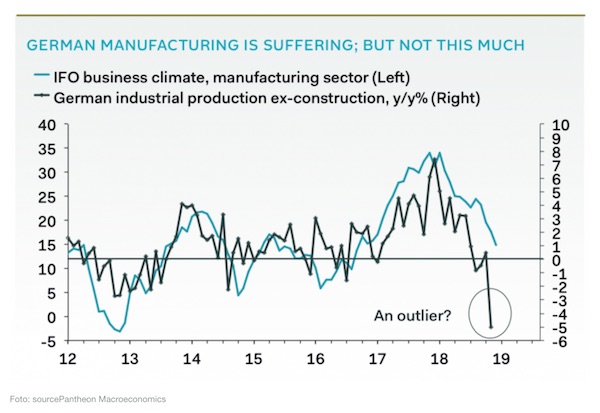

“The US thought it would win that war easily,” he continued. “But now the war is going very poorly. And it turns out that the US really had a very poor idea of what it was getting into. Now, the problem is that the US will not suffer the consequences anywhere near to the degree the Europeans will.” “So, it’s a case that they followed the US, they tag along happily behind it, and now they’ve got to pay the price for their own behavior. It’s crazy, and I do agree that there’s going to be a reckoning.” The EU’s working class is growing increasingly opposed to conflict with Russia as their economy suffers from Western imposed sanctions which saw them lose access to cheap and reliable Russian energy. The economic growth forecast for Germany, for instance, was cut down to 0.2% in 2024 from a previous projection of 1.3%, according to a recent report. Robert Habeck, Germany’s Vice-Chancellor, has said the country is performing “dramatically bad.”

Far toos much war talk coming out of France.

• French Army ‘Ready For War’ – Top General (RT)

France is ready to face whatever developments unfold internationally and is prepared for the “toughest engagements” to protect itself, the chief of staff of the French Army, Gen. Pierre Schill, said in an interview published on Tuesday. In recent weeks, French President Emmanuel Macron has repeatedly refused to rule out Western troops being sent to Ukraine at some point to help Kiev in its fight against Moscow, which he described as an “adversary” of Paris. France’s forces are “ready,” Schill told Le Monde, stressing that “whatever the developments in the international situation, the French can be convinced: their soldiers will respond.” Schill said France has “international responsibilities” and is linked by defense agreements to “states exposed to major threats,” and must therefore have its forces trained and interoperable with allied armies.

He added that nuclear deterrence “is not a universal guarantee” because it does not guard against conflicts that would remain “below the threshold of vital interests.” Schill said that the Army must show itself a credible force through responsiveness in terms of force projection and the ability to carry out operations of increased scope. The general said that France currently has the capacity to commit a division of around 20,000 men within 30 days and has the means to command an army corps of up to 60,000 which includes allied divisions. In an interview with the TF1 and France 2 channels last week, President Macron said that France is “not waging war on Russia” by supporting Kiev, but labeled Russia an “adversary” and has stood by his remarks that a potential deployment of NATO troops to the country could not be “excluded.”

His statements drew a wave of denials from most of France’s fellow NATO members and officials – including Secretary General Jens Stoltenberg – about having any intention to deploy their forces to Ukraine. At the same time, Spain’s El Pais reported on Monday that the US-led bloc has already been involved “in virtually every possible aspect” of the conflict and that active and former military personnel from NATO states have been operating in the country overseeing Kiev’s use of Western-supplied weapons. Moscow has repeatedly described the conflict as a US-led proxy war against Russia, while Russian President Vladimir Putin has warned against escalation and said that a direct clash between NATO and Russia would be “one step shy of a full-scale World War III.”

French troops

https://twitter.com/i/status/1770143287040459213

Macron’s bet: war with France means war with NATO.

• France Preparing to Deploy Military Contingent in Ukraine: Russian Intel (Sp.)

France is preparing to deploy a contingent of troops in Ukraine, with the first echelon to include about 2,000 soldiers, Russian Foreign Intelligence Service (SVR) chief Sergei Naryshkin has announced. “The country’s current leadership does not care about the death of ordinary Frenchmen and the concerns of the country’s generals. According to information received by the Russian Foreign Intelligence Service, a contingent of troops is already being prepared to be sent to Ukraine. At the initial stage, it will number about 2,000 people,” Naryshkin said in a statement Tuesday. According to the SVR head’s information, France’s generals are concerned about the difficulty of transferring such a large force to Ukraine and stationing it there unnoticed. Naryshkin warned that any French forces arriving in Ukraine “will become a legitimate priority target” for Russia’s military, with the same fate to await them as has already befallen those who fell during previous instances of French aggression against Moscow.

The SVR head also confirmed that those French nationals already in Ukraine (presumably fighting as mercenaries), have suffered losses not experienced by Paris since Algeria’s war of liberation against French control in the 1960s, hence concerns among the military leadership about the threat of discontent among mid-level officers in the French Army about the prospects of being deployed in Ukraine. President Macron has been the loudest voice among any NATO leaders in warning that he wouldn’t rule out sending troops to Ukraine “at some point.” “Maybe at some point – I don’t want it, I won’t take the initiative – we will have to have operations on the ground, whatever they may be, to counter the Russian forces,” Macron told Le Parisien last Friday. “France’s strength is that we can do it,” he added.

Macron riled up his NATO allies, particularly Germany, in early March by urging Europe not to be “cowards” in supporting the Kiev regime using all available means.If late February, he warned that he wouldn’t “rule out” sending French forces east. The president was roundly condemned by French opposition leaders for his remarks, with politicians both on the left and the right accusing him of playing with the lives of the French people and risking a new world war for the sake of his personal geopolitical ambitions. Russian Foreign Ministry spokeswoman Maria Zakharova went further, accusing Macron of trying to recreate “French SS Division Charlemagne II to defend President Volodymyr Zelensky’s bunker.” The extent of the French mercenary presence in Ukraine was revealed in January, when a Russian missile strike killed and injured dozens of fighters in Kharkov.

NATO will not gain control over the Black Sea

In case of a potential conflict with Russia, NATO will gain control not only over the Baltic Sea, but also over the Black Sea

The construction of the largest #NATO base in #Europe has begun in #Romania. The project will include runways, hangars for military aircraft, schools,… pic.twitter.com/n608LJMTgT

— NEXTA (@nexta_tv) March 18, 2024

“..There are no resources in this country, there is no one to fight.”

• Ukraine’s Losses ‘In The Millions’ – Polish General (RT)

Ukraine’s losses in the conflict with Russia should be counted “in the millions,” the former chief of the Polish General Staff, Rajmund Andrzejczak, has claimed. Kiev “is losing the war” and does not have the resources to sustain the fight against Moscow, he added. In an interview with the Polsat broadcaster on Monday, the retired general described Ukraine’s battlefield situation as “very dramatic” and insisted that “there are no miracles in war.”

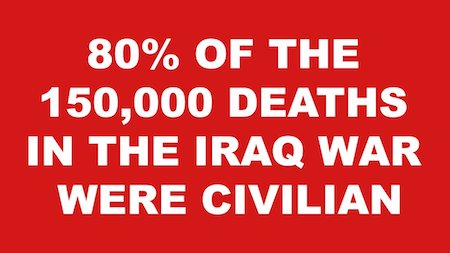

Ukrainian President Vladimir Zelensky’s decision to replace his top general, Valery Zaluzhny, with Aleksandr Syrsky has failed to make a significant difference as the same issues remain for Kiev’s new commander-in-chief, Andrzejczak added. According to the retired general, Ukraine is suffering deficits in equipment and manpower, with losses taking their toll on its capabilities. “They are missing over 10 million people. I estimate that the losses should be counted in the millions, not hundreds of thousands. There are no resources in this country, there is no one to fight.”“The Ukrainians are losing this war,” Andrzejczak stated, pointing to media reports suggesting that Kiev is running out of anti-aircraft missiles to protect itself from Russian strikes. Echoing warnings from several Western leaders in recent weeks, Andrzejczak called for arms production to be boosted and argued that the West should prepare for a full-scale conflict with Russia within two or three years. Russian President Vladimir Putin has insisted that Moscow has no plans or interest in attacking NATO. Russian Defense Minister Sergey Shoigu stated last month that Ukraine had lost more than 444,000 troops since the start of the conflict in February 2022. The hostilities have also triggered an exodus of Ukrainian refugees, with almost 6.5 million recorded worldwide, according to UN data.

Officials in Kiev have repeatedly complained that Western arms shipments have been inadequate. Those calls have grown louder as US President Joe Biden’s request to provide an additional $60 billion in aid remains stalled in Congress, due to Republican demands to strengthen American border security. Kiev is also mulling a new mobilization bill that would lower the minimum draft age for men from 27 to 25, with reported plans to send 500,000 new troops to the frontline. Against this backdrop, the Russian military last month pushed Kiev out of the strategic Donbass city of Avdeevka, also liberating several nearby settlements. The former stronghold has been on the front line since 2014 and was frequently used by Kiev to shell residential blocks in the nearby city of Donetsk.

“You’re in a fight for your life, so you should be serving — not at 25 or 27.” “We need more people in the line..”

• Lindsey Graham Tells Ukraine To Draft Younger Soldiers (RT)

US Senator Lindsey Graham (R-South Carolina) has urged the Ukrainian parliament to pass a highly controversial mobilization bill that would lower the minimum conscription age from 27 to 25 to compensate for battlefield losses. At the same time, he advocated a scheme in which the US would provide Ukraine with loans instead of non-repayable aid. Kiev announced general mobilization in February 2022 shortly after the start of the conflict, with men between 27 and 60 eligible to be called up, although those over the age of 18 could also volunteer. In December, Ukrainian officials proposed a bill expanding the draft bracket, with reported plans to send as many as 500,000 fresh soldiers to the front line. On Monday, Graham traveled to Kiev to discuss continued US support for Ukraine with President Vladimir Zelensky. Speaking to reporters, he said that he hoped that those eligible to serve in the Ukrainian military would join the fight.

“I can’t believe [the conscription threshold] is at 27,” he added, as quoted by the Washington Post. “You’re in a fight for your life, so you should be serving — not at 25 or 27.” “We need more people in the line,” he said. Graham also stressed that Ukrainians need to serve regardless of whether the US sends arms to Kiev or not. “No matter what we do, you’re fighting for you.” The US has struggled to approve President Joe Biden’s aid request earmarking $60 billion for Ukraine due to Republican opposition demanding that the White House do more to enhance security on the southern border. Moreover, Graham appeared to endorse the approach of GOP presidential frontrunner Donald Trump who has advocated providing aid to Kiev in form of loans on “extraordinarily good terms.”

“I was very direct with President Zelensky. You can expect me to always be in your corner, but it’s not unfair for me to ask you and other allies: Pay us back down the road, if you can,” the senator said. Graham’s call for Kiev to extend the draft bracket comes as Russian Defense Minister Sergey Shoigu last month estimated Ukrainian losses since the start of the conflict at more than 444,000 troops. Meanwhile, Zelensky has claimed that Kiev has suffered only 31,000 dead. Last year, President Vladimir Putin said that Western countries seemed determined “to fight Russia to the last Ukrainian.” He also noted at the time that while the West could provide Kiev with new arms, Ukraine’s manpower is not limitless.

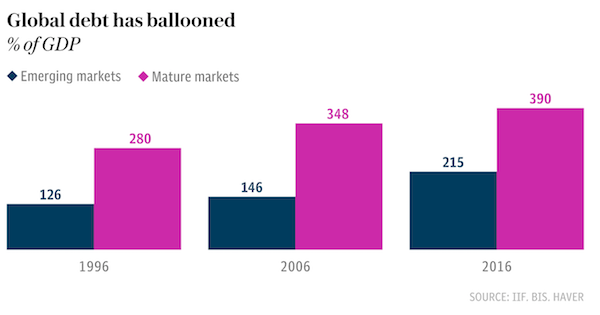

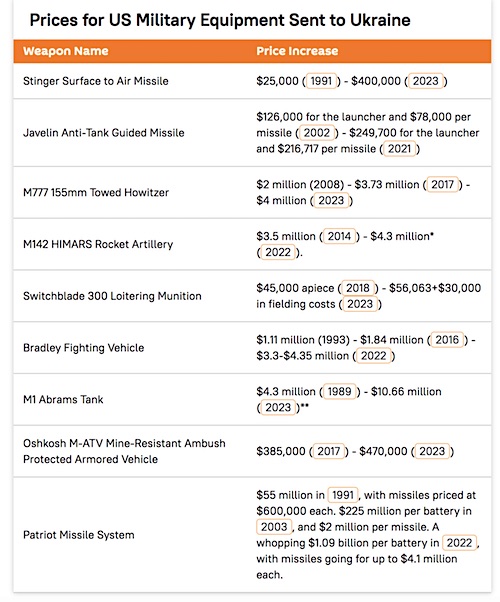

“..who the main beneficiaries of the spending bonanza really are (hint: it’s not the Ukrainians)..”

• US Military-Industrial Complex Jacks Up Prices Amid Ukraine Proxy War (Sp.)

Dedicated Ukraine proxy war supporter and Vermont Senator Bernie Sanders has laced into America’s biggest defense contractors, accusing them of price gouging. “Like a majority of Americans, I believe it is in the vital interest of the United States and the international community to fight off Russian President Vladimir Putin’s illegal invasion of Ukraine. But many defense contractors see the war primarily as a way to line their own pockets. The RTX Corporation, formally Raytheon, has increased prices for its Stinger missiles sevenfold since 1991. Today, it costs the United States $400,000 to replace each Stinger sent to Ukraine – an outrageous price increase that cannot even remotely be explained by inflation, increased costs, or advances in quality,” Sanders complained in an essay published in Foreign Affairs magazine on Monday.

“When contractors pad their profits, fewer weapons reach Ukrainians on the frontlines. Congress must rein in this kind of war profiteering by more closely examining contracts, taking back payments that turn out to be excessive, and creating a tax on windfall profits,” Sanders urged. The senator’s shock and outrage over the US military-industrial complex’s war profiteering is in itself a surprise. Serving as a congressman between 1991 and 2007 and as a senator from 2007 onward, Sanders has been part of Washington political establishment for over 30 years now. One might think that to be more than enough time to realize that obscene profitmaking is the name of the arms industry’s game.

The senator’s farfetched epiphany aside, his point stands. Since the 1990s, US weapons giants from Raytheon and Lockheed to BAE Systems to General Dynamics have jacked prices on everything from man-portable anti-tank and air defense missiles to artillery, tanks, drones and more. In other words, the Stinger certainly isn’t the only example of out of control costs at the Pentagon. The Kiel Institute for the World Economy estimates total Western military assistance to Ukraine to have hit $113+ billion in 2024. On first glance, that figure sounds impressive, representing nearly double Russia’s entire pre-conflict defense budget of $66 billion in 2021. Taking account of the seemingly out-of-control price increases of US weapons, however, a different picture emerges on the capabilities given to Kiev, and about who the main beneficiaries of the spending bonanza really are (hint: it’s not the Ukrainians).

“..Apple will disable all iPhones in the Russian Federation, and Google will disable non-jailbroken Android phones..”

• iPhones Won’t Work In Case Of World War III – Russian MP (RT)

Western smartphones could stop working in Russia if the Ukraine conflict turns into a global war, Anton Gorelkin, deputy head of the Russian State Duma’s Information Policy Committee, warned in an interview posted to the YouTube channel Telega Reality. According to the MP, if the conflict “moves to another stage,” everyone will “up the stakes,” including the tech companies. “I’m talking about something that some experts call World War III. In this scenario, I fully expect that Apple will disable all iPhones in the Russian Federation, and Google will disable non-jailbroken Android phones,” he stated. He warned that in such a case the Russian authorities and tech experts could retaliate with similar actions regarding Western tech companies, although he did not specify what these actions could be. Gorelkin also admitted that Russia currently has no alternatives to replace Western smartphones or the software they use. He predicted, however, that things may change in 5-10 years, as Russia’s IT sphere is rapidly developing, especially since the exit of a number of foreign companies from the country’s market.

Gorelkin is not the first person to suggest the possibility that Western gadgets will stop working in Russia. Various experts warned that such a scenario was technically possible for all devices that require software updates from companies abroad, or have options that allow owners to remotely find and block a phone that has gone missing. However, so far Western tech companies have stopped short at removing undesirable applications from their app stores and disabling the use of the payment services Apple Pay and Google Pay on phones belonging to Russian users. Russian President Vladimir Putin recently weighed in on the possibility of the Ukraine conflict turning into a global war. During a question-and-answer session at his campaign headquarters in Moscow on Sunday night, he commented on recent statements from members of the US-led military bloc on the possibility of NATO troops being deployed in Ukraine. Putin said that such a move would be seen as a direct confrontation between NATO and Russia, which “would be one step shy of a full-scale World War III.”

“.. real wages measured against pre-crisis forecasts dropped by 4% from April 2022 to March 2023, while output declined by 4.1%..”

• German Living Standards In ‘Unprecedented post-WW2 Slump’ (RT)

Germany’s 2022 living standards took the biggest downturn since World War II, a report released by the Forum for a New Economy on Monday has suggested. The decline is attributed to the energy shocks that sent prices for consumers soaring. Economists from the Berlin-based think-tank highlighted that the decline in Germany’s economic output recorded in 2022 is comparable to the financial crisis of 2008 and the short-lived decline during the Covid-19 pandemic in 2020. The failure to protect the country’s industrial sector from energy price spikes is expected to turn the 2020s into “a lost decade for Germany,” the analysts have warned, calling the crisis “the worst economic downturn in the country since World War II.” For years, Germany’s prized industrial sector had been fueled by relatively inexpensive Russian gas. However, since the Ukraine conflict erupted in 2022, Berlin has opted to forgo energy from Russia in favor of costlier alternatives, including American liquefied natural gas.

According to the report, real wages measured against pre-crisis forecasts dropped by 4% from April 2022 to March 2023, while output declined by 4.1%. Germany’s economy shrank by 0.3% in 2023, according to the federal statistics agency Destatis. However, the country managed to avoid a technical recession after the second-quarter figures were revised to 0.1% growth. Two consecutive quarters of negative growth are widely considered to mark a technical recession. The Bundesbank, Germany’s central bank, recently forecast growth of 0.4% in 2024. However, some financial institutions, such as the country’s two largest lenders, Deutsche Bank and Commerzbank, expect German GDP to decline again this year. Meanwhile, EU Commission’s most recent forecast for the Eurozone shows an expected increase in GDP of only 0.8% in 2024, down from the previous forecast of 1.2% growth made last November.

“We cannot affect the outcome of the election… but just to spite them we need to make some stupid statement.”

• Medvedev Reacts To Germany’s Putin Snub (RT)

Berlin’s decision not to refer to Russian President Vladimir Putin by his proper title in government documents is ridiculous and possibly a sign of a mental disorder, officials in Moscow have said. The diplomatic snub was announced on Monday in an effort to discredit last week’s presidential election in Russia. Germany and other Western nations claim the electoral process was neither free nor fair. A government spokesperson said the move was symbolic, noting that communications between Berlin and Russia were severely limited anyway. Reacting to the news, former Russian president Dmitry Medvedev said the stunt “comes from shameful weakness.”

He claimed that Germany was essentially saying “We cannot affect the outcome of the election… but just to spite them we need to make some stupid statement.”If Germany does not recognize Putin as the legitimate head of Russia, how does it intend to negotiate with Moscow and what value would any outcome of such talks have, asked Medvedev, who is the deputy head of Russia’s Security Council. Meanwhile, Russian Foreign Ministry spokeswoman Maria Zakharova said the decision not to use Putin’s official title looked like the result of a self-induced “wild phobia,” an inability to name the source of one’s fear. ”This is something that differentiates a healthy person from someone who is not. They appear to be in a state of paranoia,” she remarked during an interview.

Western rhetoric following Putin’s re-election had contrasted with the reaction of most nations of the world, which had congratulated the president, Zakharova noted. The US and its allies should “take care of themselves and their problems” instead of picking on other sovereign states, she suggested. The Russian president has dismissed Western criticism of his election win, claiming that it was made in bad faith by governments seeking to contain Russia. ”What did you expect? For them to stand up in applause or something? They are fighting against us, including with arms,” Putin said following his victory.

“In Gaza we are no longer on the brink of famine. We are in a state of famine..”

• ‘Catastrophic’ Hunger Has Gripped Gaza (RT)

Famine conditions now exist in the northern part of Gaza, a UN monitor group warned on Monday. Around 300,000 people remain trapped in the area, following months of Israeli bombardment that has left over 31,000 people dead. The UN-backed report also warns that more than 70% of Gaza’s population of 2.3 million faces “catastrophic hunger.” The Integrated Food-Security Phase Classification (IPC) said that mass death is now imminent without an immediate ceasefire and deliveries of food aid to the areas affected by the fighting. More than a dozen children in Gaza, including newborn babies, have starved to death and many more are at risk from soaring malnutrition. UN aid agencies warned earlier in March that urgently-needed humanitarian aid is being blocked from entering the Palestinian enclave.

The IPC estimated that two out of every 10,000 people will die daily from starvation, malnutrition, and disease if not helped immediately. “The actions needed to prevent famine require an immediate political decision for a ceasefire together with a significant and immediate increase in humanitarian and commercial access to the entire population of Gaza,” the report said. Israel has been criticized by its Western partners since it began launching retaliatory strikes against Hamas militants following their attack on Israel on October 7. “In Gaza we are no longer on the brink of famine. We are in a state of famine,” EU foreign policy chief Josep Borrell said at the opening of a conference on humanitarian aid for Gaza in Brussels on Monday.

He also accused Israel of “using starvation as a weapon of war.” Foreign Minister Israel Katz responded by saying, “Israel allows extensive humanitarian aid into Gaza,” and told Borrell “to stop attacking Israel and recognize our right to self-defense against Hamas’ crimes.” Efforts to reach a truce between Hamas and Israel are ongoing, with no breakthrough so far as the hostilities continue. Heavy fighting erupted on Monday in and around Gaza’s Al-Shifa hospital complex. The Israeli Army said it was combatting Hamas militants there and advised civilians to evacuate.

Sachs Israel

“Israel has the most extremist religious nationalist government in its history. They have no intention of living side by side with the Palestinians…there’s no end game here politically other than complete domination and ethnic cleansing.”

-Jeffrey Sachshttps://t.co/O3nWFTDTI2 pic.twitter.com/R5z6KRPUWK

— Afshin Rattansi (@afshinrattansi) March 19, 2024

“..the federal government’s inability or unwillingness to protect the border..”

• Supreme Court Allows Texas To Start Arresting And Deporting Illegal Aliens (ZH)

The Supreme Court on Tuesday dealt a blow to the Biden administration’s attempts to keep the US border open – allowing Texas to enforce a new law giving local police the power to arrest migrants. With three liberal justices dissenting, the conservative-majority court rejected an emergency request by the Biden administration which claimed that states have no authority to legislate on immigration. The ruling means that Texas’ law can go into effect while litigation continues in lower courts. The law, SB4, allows police to arrest migrants who illegally cross into the United States from Mexico, and imposes criminal penalties. It also empowers judges to deport people to Mexico. “Texas is the nation’s first-line defense against transnational violence and has been forced to deal with the deadly consequences of the federal government’s inability or unwillingness to protect the border,” Texas argued in court papers.

The dispute is the latest clash between the Biden administration and Texas over immigration enforcement on the U.S.-Mexico border. A federal judge blocked the law after the Biden administration sued, but the New Orleans-based 5th U.S. Circuit Court of Appeals said in a brief order that it could go into effect March 10 if the Supreme Court declined to intervene. On March 4, Justice Samuel Alito issued a temporary freeze on the law to give the Supreme Court time to consider the federal government’s request. -NBC News. Solicitor General Elizabeth Prelogar said in court filings that Texas’ law is “flatly inconsistent” with Supreme Court precedent dating back 100 years. “Those decisions recognize that the authority to admit and remove noncitizens is a core responsibility of the national government, and that where Congress has enacted a law addressing those issues, state law is preempted,” she said, adding that the appeals court did not explain its reasoning for allowing the law to go into effect.

And what about the GDP? The new ruling may put a crimp in the Biden administration’s seeming plan to flood the country with low-wage labor in an effort to boost GDP, which Democrats now insist would benefit to the tune of $7 trillion thanks to illegal immigrants – who are allowed to work indefinitely whilst waiting for the US immigration system to process their asylum claims. Recall that 10 million illegals have entered the US under Biden, while virtually all of the job gains under Biden have gone to foreign-born workers, looks like their ‘great replacement’

theoryscheme has just suffered a swift kick to the huevos. “This unprecedented surge in illegal immigration isn’t an accident. It is the result of deliberate policy choices by the Biden administration,” said Eric Ruark, Director of Research for Numbers USA, a nonprofit that advocates for immigration restrictions.

It’s finally happening, Maricopa County being served! If any Law Enforcement goes against the American people for Illegal Immigrants, they are committing Treason! pic.twitter.com/kv29RDyJEt

— ꪻꫝể ꪻꫝể (@TheThe1776) March 19, 2024

BREAKING: Supreme Court Grants Texas Authority to Arrest Undocumented Immigrants Pending Final Ruling, Making Border Crossings a State Crime. WATCHpic.twitter.com/gxVMiHSgHW

— Simon Ateba (@simonateba) March 19, 2024

“..Is there a pattern here of likely guilt that is contextualized into a not guilty assessment?..”

• Guilty!—But Not Really Guilty? (Victor Davis Hanson)

In 2011, then Homeland Security Advisor to President Obama, John Brennan, swore before Congress that drone-targeted assassination missions near the Pakistani border had not led to “a single collateral death.” That was an obvious lie with grave consequences, given that Brennan was sworn under oath and was one of the top officials in the US national security community. Yet there were no subsequent repercussions. In fact, the opposite occurred. Brennan was subsequently rewarded with a 2013 appointment as CIA. But the next year, once again, Brennan lied to Congress, assuring the Senate Intelligence Committee that his CIA had not secretly accessed senate staffers’ computers. Again, there were no consequences for his repeated lies. Instead, Brennan, upon retirement, went on to be an MSNBC/NBC analyst who helped to promulgate the Russian collusion/laptop disinformation hoaxes.

In 2013, Director of National Intelligence James Clapper also lied under oath to Congress when he laughably stated that the National Security Agency did not spy on American citizens. Later, when called out by senators, Clapper fudged in a televised interview. “I responded in what I thought was the most truthful, or least untruthful, manner by saying no.” Try that contortion with the IRS. Some members of Congress referred a criminal complaint of perjury against Brennan to then Attorney General Eric Holder. Nothing happened. Again, one of the chiefs of the American national security community was exempted after lying to members of Congress. Clapper went on to a lucrative position as a CNN national security analyst, and at one point he claimed that Trump was a Putin “asset.”

As far as Eric Holder, he had earlier defied a congressional subpoena and was held in contempt by the House. The Department of Justice, however, chose not to pursue the complaint. Later in the Trump administration, Trump adviser Peter Navarro would be sentenced to four months in jail for similarly resisting a congressional subpoena. Was it a crime or not to resist a congressional subpoena? The Justice Department’s Inspector General concluded that Andrew McCabe, the former FBI deputy director and interim director, had lied repeatedly to a variety of officials, including FBI Director James Comey, various FBI agents, and officials of the Office of the Inspector General. On some of these occasions, McCabe was sworn under oath. Yet in 2020, the Department of Justice chose not to pursue the IG’s criminal referrals. McCabe went on to become an outspoken CNN News contributor. Note that Gen. Michael Flynn, Trump’s National Security Advisor, was indicted—and convicted—for similarly lying to the FBI in 2017.

In 2016, an FBI investigation found that Hillary Clinton, as Secretary of State, had violated the law by transmitting and receiving classified information over an unsecured private server. Subsequently, she destroyed thousands of emails and some devices, some of which were under subpoena. FBI Director James Comey found that “any reasonable person” should have known it was illegal to transmit classified information in such a sloppy fashion. Comey, however, found that “Although there is evidence of potential violations of the statutes regarding the handling of classified information, our judgment is that no reasonable prosecutor would bring such a case.” Translated, that meant Hillary Clinton had likely broken the law, but it was unlikely that any prosecutor like Comey would indict the then-current Democratic nominee for president and former Secretary of State—at least in the fashion that state and federal prosecutors would later file over 90 indictments against Donald Trump.

In 2018, the now-former FBI Director James Comey on some 245 occasions claimed under oath to Congress that he did not know or could not remember essential facts in the FBI Crossfire Hurricane investigation of Donald Trump, which he had authorized. In addition, the Office of the Inspector General of the Justice Department found that Comey had broken the law by violating both DOJ and FBI policies, as well as the FBI’s employment agreement—especially by retaining in his personal safe copies of four bureau memos concerning a confidential conversation with President Trump. Elements in the memos from that meeting likely contained classified information. Yet Comey leaked it to a friend without a security clearance in order to make it public. Despite the damning IG report, the Department of Justice chose not to prosecute Comey. Is there a pattern here of likely guilt that is contextualized into a not guilty assessment—and not guilty due to the prosecutorial psychoanalysis of the jury—that a guilty verdict would be difficult to obtain?

“For the first time in my 94 years on earth, I fear for the future of our democracy..”

“Joe Biden has fulfilled Barack Obama’s promise to “transform” America..”

• It’s Time for GOP To Unite Behind Trump (Marcus)

For the first time in my 94 years on earth, I fear for the future of our democracy. I see the federal government using its enormous powers with contempt for the governed instead of with the consent of the governed as our founders envisioned. Fundamental change in America is occurring by executive order or the force of the government’s police powers instead of through the legislative process required by the Constitution. From this, I fear that free market capitalism may be replaced by big government socialism. I also fear the erosion of our rights and freedoms, including parental rights, freedom of speech and religion, and due process. In the past, I always had the confidence that a president who was a threat to democracy could be voted out of office in the next election. I am no longer that confident today. My lack of confidence is because the media today is not the watchdog over government that our Founders intended it to be. It is instead the lapdog of government, shielding the public from the entire truth about the policies and actions of the current administration.

One vivid example of this became a meme: the television reporters declaring while doing their standups that the riots in 2020 were “mainly peaceful” as fires raged in the background. I was not surprised earlier this month by the reprise of “Russia collusion.” Nor will I be surprised if the media soon characterizes a Trump rally as an “insurrection.” The media may be the biggest threat to our democracy since only well-informed voters guarantee the future of it. There is more on the line in this year’s presidential election than ever before. It is a mistake to assume that this election will be a rerun of 2020. The presumptive nominees and the world have changed since then. President Biden can no longer portray himself as “kindly Uncle Joe” or a moderate Democrat. His recent State of the Union Address, which was the most divisive of any I recall, reveals he is a very angry man and not someone Americans would want as their uncle. His policies and the undemocratic means by which he implemented them confirm he has been pulled to the far left by far-left extremists in the Democrat Party.

The Biden administration’s policies invited an invasion along our southern border by millions of unvetted people, compromised national security, allowed crime to spin out of control in our streets, forced middle-class Americans to raid their retirement funds to put food on their tables, and divided America more than at any time in our history since the Civil War. Joe Biden has fulfilled Barack Obama’s promise to “transform” America. This is not a welcome transformation, as confirmed by Biden’s dismal job approval ratings. When Donald Trump was in office, his Democrats and their media allies portrayed him as a pugnacious New Yorker who “did not act presidential” and somehow craved dictatorial powers. They’re still doing this, although they’ve upped the rhetoric. Over the weekend, Nancy Pelosi invoked Adolf Hitler while attacking the former president. His detractors are unwilling to look past Trump’s rough edges and see the results he achieved during his first of what I hope will be two terms.

His policies achieved the highest wage rate in 50 years while keeping inflation in check, the lowest unemployment rate for minorities, and energy independence for America, among other stunning results. Moreover, his policies and the projection of his and America’s strength kept the country out of any new foreign conflicts. It is essential to our national security that America’s enemies fear our president. This does not mean that President Trump did not have to do better. He did, and he has done so since leaving office. Having become close to him in the last seven years, I have seen a side of him that is not seen by the public. He is truly one of the most misunderstood men in America, and I and other friends of his have urged him to let the public see the real Donald Trump. His recent praise of Nikki Haley was unifying and shows the magnanimous side of him that his friends often see. Expect more of the real Donald Trump to emerge.

“..You live in a country where the Attorney General is abetting, in fact calling for voter fraud, and that’s the only chance they have to get their guy re-elected.”

• How the Democrats Plan To Steal the Election (Lew Rockwell)

This isn’t the first time the Left has stolen an election. It happened in the 2020 presidential election too. Ron Unz offers his usual cogent analysis: “There does seem to be considerable circumstantial evidence of widespread ballot fraud by Democratic Party forces, hardly surprising given the apocalyptic manner in which so many of their leaders had characterized the threat of a Trump reelection. After all, if they sincerely believed that a Trump victory would be catastrophic for America why would they not use every possible means, fair and foul alike, to save our country from that dire fate? In particular, several of the major swing-states contain large cities—Detroit, Milwaukee, Philadelphia, and Atlanta—that are both totally controlled by the Democratic Party and also notoriously corrupt, and various eye-witnesses have suggested that the huge anti-Trump margins they provided may have been heavily ‘padded’ to ensure the candidate’s defeat.”

In a program aired right after Biden’s pitiful State of the Union speech, the great Tucker Carlson pointed out that Biden’s “Justice” Department has already confessed that it plans to rig the election. It will do this by banning voter ID laws as “racist.” This permits an unlimited number of fake votes: “If Joe Biden is so good at politics, why is he losing to Donald Trump, who the rest of us were assured was a retarded racist who no normal person would vote for? But now Joe Biden is getting stomped by Donald Trump, but he’s also at the same time good at politics? Right. Again, they can’t win, but they’re not giving up. So what does that tell you? Well, they’re going to steal the election. We know they’re going to steal the election because they’re now saying so out loud. Here is the Attorney General of the United States, the chief law enforcement officer of this country in Selma, Alabama, just the other day. [Now Carlson quotes the Attorney General, Merrick Garland:] “The right to vote is still under attack, and that is why the Justice Department is fighting back. That is why one of the first things I did when I came into office was to double the size of the voting section of the Civil Rights Division.

That is why we are challenging efforts by states and jurisdictions to implement discriminatory, burdensome, and unnecessary restrictions on access to the ballot, including those related to mail-in voting, the use of drop boxes and voter ID requirements. That is why we are working to block the adoption of discriminatory redistricting plans that dilute the vote of Black voters and other voters of color. [Carlson then comments on Garland:] “Did you catch that? Of course, you’re a racist. That’s always the takeaway. But consider the details of what the Attorney General of the United States just said. Mail-in balloting, drop boxes, voter ID requirements. The chief law enforcement officer of the United States Government is telling you that it’s immoral, in fact racist, in fact illegal to ask people for their IDs when they vote to verify they are who they say they are. What is that? Well, no one ever talks about this, but the justification for it is that somehow people of color, Black people, don’t have state-issued IDs.

Somehow they’re living in a country where you can do virtually nothing without proving your identity with a government-issued ID without government-issued IDs. They can’t fly on planes, they can’t have checking accounts, they can’t have any interaction with the government, state, local, or federal. They can’t stay in hotels. They can’t have credit cards. Because someone without a state-issued ID can’t do any of those things. But what’s so interesting is these same people, very much including the Attorney General and the administration he serves, is working to eliminate cash, to make this a cashless society. Have you been to a stadium event recently? No cash accepted. You have to have a credit card. In order to get a credit card you need a state-issued ID, and somehow that’s not racist. But it is racist to ask people to prove their identity when they choose the next President of the United States. That doesn’t make any sense at all. That’s a lie. It’s an easily provable lie, and anyone telling that lie is advocating for mass voter fraud, which the Attorney General is. There’s no other way to read it. So you should know that. You live in a country where the Attorney General is abetting, in fact calling for voter fraud, and that’s the only chance they have to get their guy re-elected.”

“..the drug activates genes in neurons that affect cell growth, improves brain function and reduces the risks of inflammation..”

• Viagra May Prevent Alzheimer’s (RT)

Sildenafil, the generic name for Viagra, may not only treat erectile dysfunction and pulmonary arterial hypertension, but also ward off cognitive decline, according to research published by the Cleveland Clinic Genome Center earlier this month. The authors of the study, published in the Journal of Alzheimer’s Disease on March 1, found that those who took sildenafil were 30% to 54% less likely to be diagnosed with Alzheimer’s disease. The researchers used real-world patient data from the MarketScan Medicare Supplemental database (2012-2017) and the Clinformatics database (2007-2020) to arrive at the conclusion.

The research was focused on those taking sildenafil or four comparator drugs, including bumetanide, furosemide, spironolactone, and nifedipine. Comparators are existing marketed drug products, or new drugs in development, including placebo versions. Gender, age, race, and concurrent diseases of the patients were factored in. The study concluded that the use of sildenafil was associated with reduced likelihood of Alzheimer’s relative to the control drugs. The results also showed that the drug activates genes in neurons that affect cell growth, improves brain function and reduces the risks of inflammation.

“We used artificial intelligence to integrate data across multiple domains which all indicated sildenafil’s potential against this devastating neurological disease,” said Feixiong Cheng, director of the Cleveland Clinic Genome Center, who led the study. Similar conclusions about sildenafil were made by researchers from University College London earlier this year. The study, published in the journal Neurology last month, included nearly 270,000 men who were diagnosed with erectile dysfunction and had no cognitive problems at the beginning of the research work. Those taking the drugs were 18% less likely to develop the dementia-causing condition.

CO2

Dr. Judith Curry, climatologist: Through most of Earth's geologic history CO2 has been much higher in order of magnitude higher even. There's nothing wrong with high CO2 in the atmosphere and CO2 isn't particularly a control knob on surface temperature. I mean the Earth's… pic.twitter.com/YPtvV2uUIl

— Camus (@newstart_2024) March 19, 2024

Rik Mayall

https://twitter.com/i/status/1770026300385743303

Dogshower

— Doglover (@puppiesDoglover) March 19, 2024

Frens

— Why you should have a cat (@ShouldHaveCat) March 19, 2024

Owl

https://twitter.com/i/status/1769916272089952458

Luna

Luna, an illusory kinetic sculpture by MEZMOGLOBE pic.twitter.com/dD7vNhXUXG

— Massimo (@Rainmaker1973) March 19, 2024

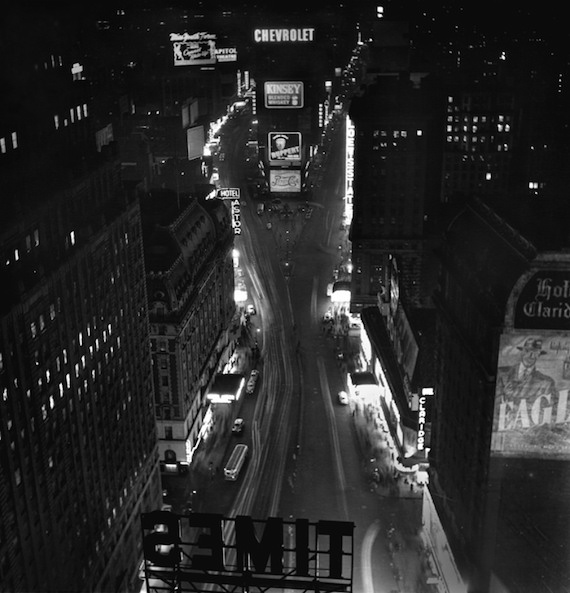

SF 1950s

San Francisco in the 1950s. What do you notice?

This is the society that was stolen from you. pic.twitter.com/1XEvS1FY7B

— iamyesyouareno (@iamyesyouareno) March 18, 2024

Support the Automatic Earth in wartime with Paypal, Bitcoin and Patreon.