Claude Monet Impression, sunrise 1872

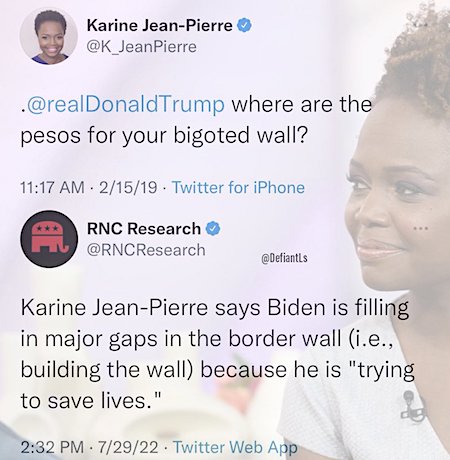

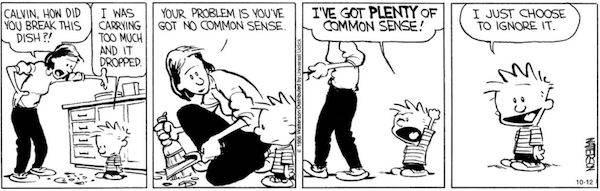

Read at least twice.

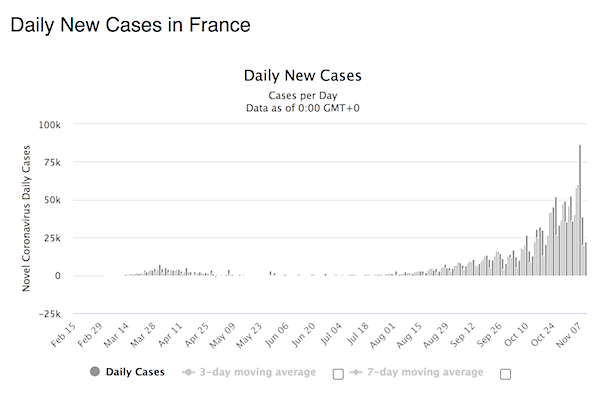

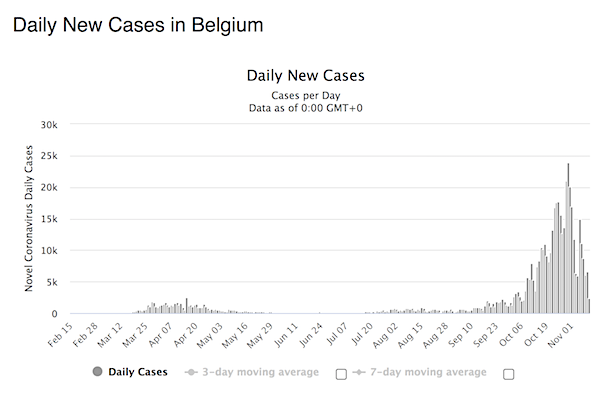

Winter is coming

https://twitter.com/i/status/1552787710187917312

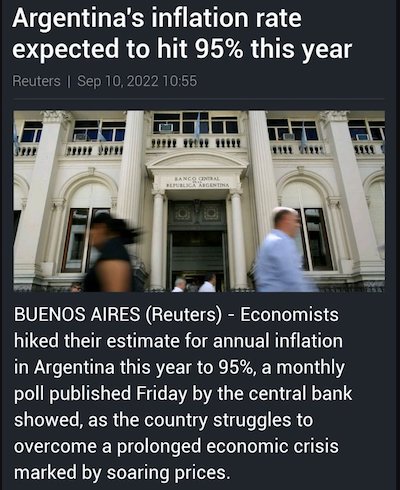

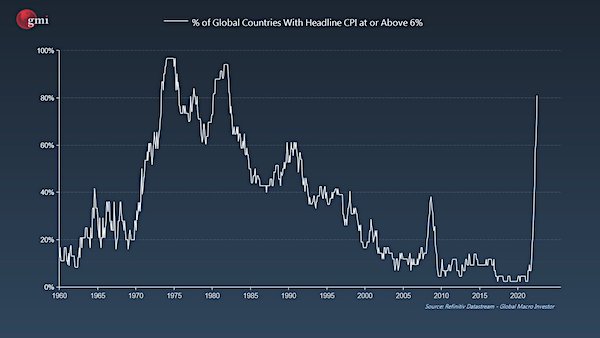

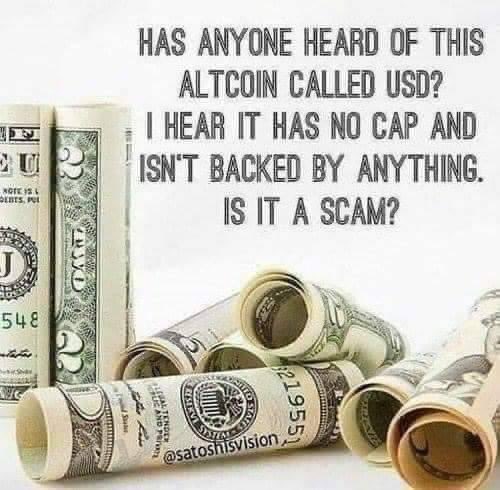

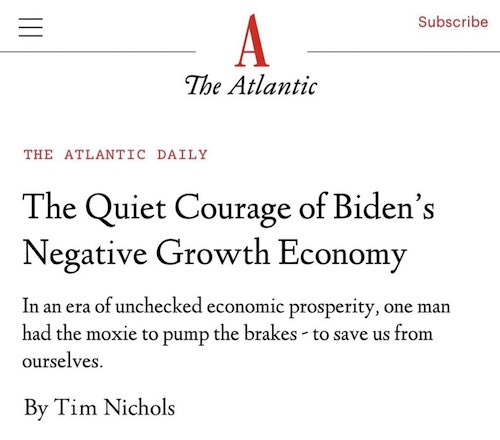

Share of countries with 6%+ CPI

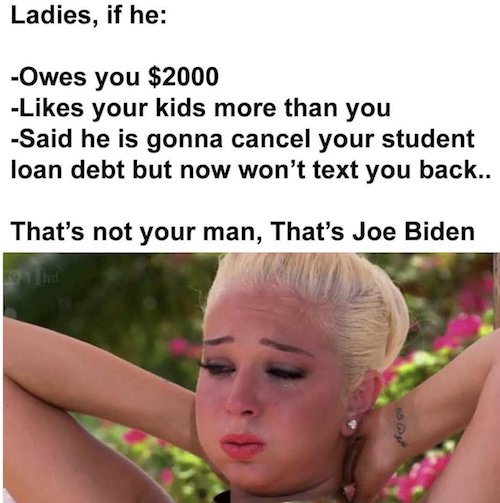

Bro Bridle

https://twitter.com/i/status/1552918465312342017

CannoneerMarine thread

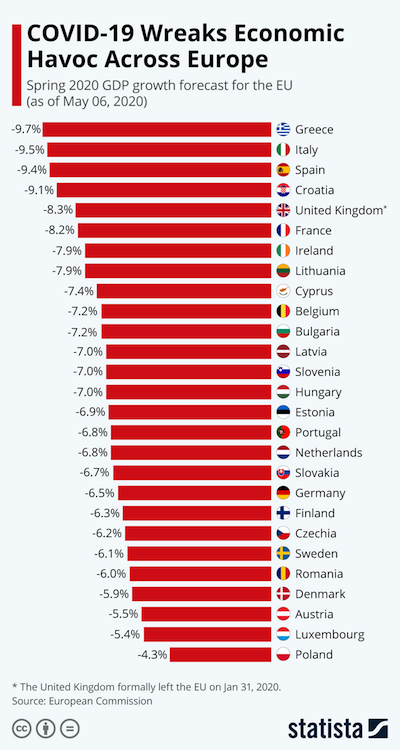

Jorge Vilches has it exactly right. Europe is shedding infrastructure and deals for which they have zero replacement: “without which Europe as we know it will cease to exist.”

• Europe Hypnotized Into War Economy (Vilches)

Thirty two years ago Germans enthusiastically took down the Berlin wall. Now, captured by cunning Anglo-Saxon global elites, Germans are helping other European “useful idiots” to erect a much higher and thicker wall to cut themselves off from Russia leading them into a war economy. But as Hungarian Prime Minister Viktor Orbán has warned… “the approach has clearly failed — sanctions have backfired — and our car now has 4 four flat tires” … Question: vehicles don´t carry more than 2 spare tires on them, do they? So, one quick and innocent way to explain such unfathomable European miscalculation is to assume the EU leadership is immersed in a deep hypnotic trance and just blindly following US-UK instructions under Stoltenberg-Johnson war-mongering policies.

The supply lines that up to 2022 successfully linked Europe and Russia took decades of very hard work to develop. This now means that almost all of such over-abundant contracts necessarily have no effective substitute because (a) no other vendors have such high quality at low price plus decades of vetting and proven experience + (b) the un-replaceable short freight distance and shipping time from nearby Russia. So, by definition, both (a) + (b) mean that today no equivalent supply lines could ever be found no matter how much Europe tried simply because it would be either too soon or too far …and always too hard and too pricey. So short cuts will be taken and corners rounded-off…. Been there, done that, got the T-shirt.

The impact of the above cannot be overstated though as the now-broken Euro-Russian supply lines were essential for the Just-In-Time strategy that Europe and world markets still require and cannot wait years to develop and iron out. Logistics 101: proven experience and performance with excellent price plus quick delivery from nearby sources cannot be substituted fast enough, or possibly ever. On purpose, Europe´s worst enemies couldn´t have inflicted worse harm than what a US-UK mesmerized Europe (what else ?) is doing to itself. So EU sanctions are now cutting off dozens of key and highly varied Russian produce without which Europe as we know it will cease to exist. This involves foodstuffs, minerals of every sort, energy re oil & gas & coal & refined products thereof, etc., etc., plus key technologies and products from space rocket engines to nuclear fuels.

Read more …

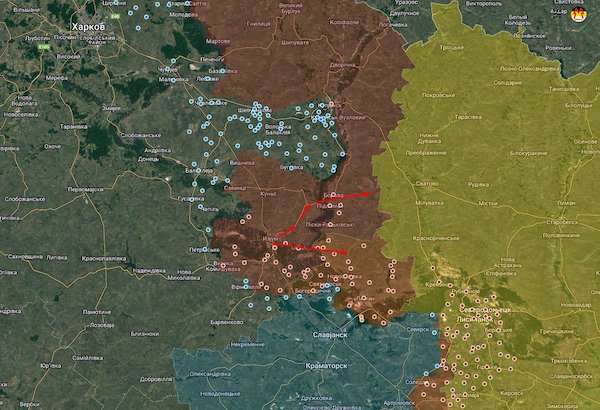

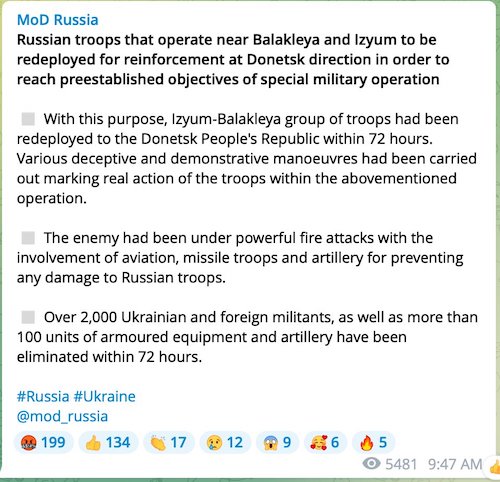

It’s quite simple. If the attack was done with HIMARS, it’s the Ukraine. WaPo fantasizes that Russians transported HIMARS pieces from elsewhere to the crime scene, but Ukraine was shelling this site for months. Only now, they have the HIMARS to do it with.

• Elena Evdokimova @elenaevdokimov7· May 17!!

Ukrainian artillery has been shelling the DPR village of Elenovka with BM-21 Grad. It is the settlement, where the prisoners have been transported from Azovstal. Looks like the deliberate attempt to destroy their own surrendered units.

• Azov POWs are extremely high value assets to Kremlin propagandists. Capturing Azov neo-Nazis & putting them on trial to justify Russia’s invasion has been a top propaganda priority from start. It’d be bizarre for RU to bomb & eliminate their prized pr assets before show trials.

• So they’re really going with the theory that Russia shelled a prison on DPR territory to kill Azov militants whom they could have just as easily publicly hanged to the thunderous applause of virtually everyone in Russia & half of Ukraine?!

• Russia Claims Ukraine Had A Reason To Kill Its Own POWs (RT)

Kiev’s forces shelled a detention center holding Ukrainian POWs early Friday morning to “threaten” their own troops who may want to surrender, the Russian Defense Ministry has claimed. “A large number of Ukrainian servicemen are voluntarily laying down their arms, and know about the humane treatment of prisoners by the Russian side,” the ministry said, calling the attack “outrageous.” Authorities in the Donetsk People’s Republic (DPR) said that the death toll in the missile strike has grown to 53, while 75 were wounded. DPR Deputy Information Minister Daniil Bezsonov posted a graphic video on his Telegram channel, which shows multiple mutilated and charred bodies inside the destroyed building. According to Russia’s Defense Ministry and local authorities, Ukrainian troops used US-supplied HIMARS multiple rocket launchers to strike the detention center near the village of Yelenovka.

The ministry said the facility held members of Ukraine’s Azov Battalion, whose fighters surrendered to Russian and Donbass forces during the siege of the Azovstal steel mill in Mariupol. The battalion is notorious because it includes fighters with nationalist and neo-Nazi views. Speaking to Russia’s TV Channel One, DPR head Denis Pushilin claimed that the Ukrainians “deliberately” targeted the detention center in order to kill Azov members who had been providing testimonies about possible war crimes by their commanders. The Ukrainian military released a statement on Friday, accusing Russian troops of shelling Yelenovka. Moscow destroyed the prison in order to pin the blame on Kiev, as well as to “hide the torture of prisoners and executions,”the statement alleged.

HIMARS

https://twitter.com/i/status/1552948606214225920

Read more …

“Russia accuses Ukraine of being willing to massacre its own prisoners of war, saying Kyiv insisted that prisoners from the Azov Battalion be housed in this particular warehouse.”

• Russia and Ukraine Trade Blame Over Prison Blast (BBC)

Russia and Ukraine have blamed each other for a rocket attack that killed dozens of Ukrainian prisoners of war in the occupied part of Donetsk region. Ukraine says the prison was targeted by Russia in an effort to destroy evidence of torture and killing. For its part, Russia said the prison camp in Olenivka was hit by Ukrainian precision rockets. Unverified Russian video footage of the aftermath shows a tangle of wrecked bunk beds and badly charred bodies. An adviser to President Volodymyr Zelensky said the scene looked like arson, and that a missile strike would have scattered the bodies. Those detained are said to have included members of the Azov battalion, who were the last defenders of Mariupol and whom Russia has sought to depict as neo-Nazis and war criminals.

Ukraine’s new Prosecutor-General Andriy Kostin said he had opened a war crimes investigation into the blast. His office added that it believed about 40 people were killed in the strike and 130 were injured. Daniil Bezsonov, a spokesperson for the Russian-backed separatist Donetsk People’s Republic, said the strike had been a “direct hit on a barracks holding prisoners” and the number killed might increase. Russia’s defence ministry said the strike had been carried out with US-made Himars artillery and it accused Ukraine of a “deliberately perpetrated” provocation. The ministry produced fragments of what it said were rockets fired by the Himars system.

HIMARS

https://twitter.com/i/status/1552992046402658311

Read more …

I include the BBC and WaPo takes mostly to illustrate how they have manipulated the perceived views.

The neo-nazis are now “the famed Azov Regiment” …“whom Russia has sought to depict as neo-Nazis and war criminals.” , and the HIMARS systems “are helping shift the tide of the war in Ukraine’s favor”.

• Ukraine and Russia Trade Blame For Attack Killing Mariupol Prisoners (WaPo)

Dozens of Ukrainian prisoners of war from the famed Azov Regiment were killed Friday in a strike against their detention center in the Russian-occupied eastern region of Donbas, but it was unclear how the attack happened or who carried it out. At least 53 POWs were killed and 75 injured in the strike, according to Darya Morozova, an official for the Donetsk People’s Republic, the pro-Russian breakaway region where the prison is located. Ukraine and Russia traded blame for the strike, with each saying the other had carried it out to silence the prisoners. All or most of the POWs were members of the Azov Regiment who had surrendered when Russian troops captured the city of Mariupol in May after a two-month siege. Their fate had been the focus of fraught prisoner-exchange negotiations between Moscow and Kyiv.

Russia’s Defense Ministry accused Ukraine of carrying out the attack using U.S.-supplied HIMARS — High Mobility Artillery Rocket System — launchers, which are helping shift the tide of the war in Ukraine’s favor. The ministry framed the incident as “a bloody provocation” intended to discourage Ukrainian soldiers from surrendering. Russian media commentators suggested that Ukraine hit the detention center to stop the prisoners from providing testimony to interrogators about war crimes committed by Ukrainian forces. Ukraine denied any involvement and accused Russian forces of carrying out the attack, which it called a war crime. Ukraine did not conduct any shelling or artillery strikes Friday in the vicinity of Olenivka, the town where the detention center is located, the General Staff of the Armed Forces of Ukraine said in a post on its Facebook page.

Rather, the General Staff said, it was Russia that staged the attack and used it “to accuse Ukraine of committing war crimes as well as to cover up the torture and execution of prisoners.” Ukrainian Foreign Minister Dmytro Kuleba, in a posting on his Twitter account, called on the world to condemn what he called a “petrifying war crime” and a “brutal violation of international humanitarian law.” Ukrainian officials also questioned whether the incident had been caused by an artillery strike at all. Oleksiy Arestovych, an adviser to Ukrainian President Volodymyr Zelensky, tweeted that explosives specialists who had examined images of the burned-out detention center believe that the destruction may have been caused by an explosion or fire “inside the building itself, rather than the result of shelling.”

Videos of the aftermath of the blast broadcast by Russian media outlets show a tangle of twisted, burned metal bunks inside a blackened warehouse-like structure with a large hole in its roof. Charred bodies and body parts are strewn around the wreckage Russian media outlets also posted photos showing what they claimed were fragments of HIMARS rockets found at the scene. It wasn’t immediately possible to verify that the shards had been fired by HIMARS launchers, but a senior Defense Department official in Washington pointed out that Russia could have gathered them from attacks elsewhere. “The Russians have a lot of pieces of HIMARS. The Ukrainians have been sending a lot of HIMARS their way,” said the official, speaking on the condition of anonymity to brief the media. He cautioned against reaching any conclusions on the limited information available.

Yelenovka

Read more …

“..Kiev needed about 50 HIMARS for effective defense, and a least 100 for “an effective counteroffensive.”

• Ukraine Is ‘Shooting Blind’ – Top Official (RT)

US-made HIMARS are “a good first step,” but Kiev needs the means to take accurate shots, a senior Ukrainian official has said The deliveries of US-made HIMARS rocket systems are “a good first step”, but the West did not provide Kiev with the necessary technologies to accurately hit targets, a high-ranking Ukrainian official complained in an interview published on Thursday. “HIMARS and heavy artillery are a good first step, but if we do not have the technology to find and correct targets for artillery strikes, then we’re just shooting blind,” Anton Gerashchenko, an adviser at the Ukrainian Ministry of Internal Affairs, told Newsweek magazine.

Earlier this month, Vadim Skibitskiy, a spokesman for Ukraine’s Directorate of Intelligence at the Ministry of Defense, claimed that Kiev views the Crimean Peninsula as a legitimate target for long-range weaponry, including US-made M142 HIMARS and M270 MLRS, supplied by Western powers. His words were echoed by Alexey Arestovich, a top aide to President Vladimir Zelensky, who said that the Ukrainian military would target the Crimean Bridge as soon as Kiev obtains the capability to carry out such a strike. Russia pushed back on these threats, with Mikhail Sheremet, an MP who represents the region in the Russian parliament, warning Kiev that retaliation will be so harsh that Ukraine will never be able to recover from it. In his telling, the would-be strike will be followed by “a crushing blow to decision-making centers in Kiev, military infrastructure and arms-supply logistics channels.”

[..] On Friday, Russia’s Ministry of Defense and DPR authorities accused Kiev of having used HIMARS to target a prison holding POWs, killing 53 and wounding scores more. Ukraine rejected the claim and pinned the blame on Russian troops. According to the Pentagon, as of July 22, the US has provided Ukraine with 16 M142 HIMARS systems, while the UK has provided another three launchers capable of firing the same munitions. Earlier this month, Ukrainian Defense Minister Alexey Reznikov said that Kiev needed about 50 HIMARS for effective defense, and a least 100 for “an effective counteroffensive.”

Read more …

“..Foreign Minister Sergey V. Lavrov was too busy to talk with Mr. Blinken now.”

They did talk yesterday. But Blinken is not very important.

• A Panicking Biden Administration Seeks Talks With Russia (MoA)

The New York Times reports of a potential prisoner swap between the U.S. and Russia: “[T]he Biden administration has proposed trading the merchant of death for the imprisoned basketball player as well as a former marine held in Russia on what are considered trumped-up espionage charges. In the harsh and cynical world of international diplomacy, prisoner exchanges are rarely pretty, but unpalatable choices are often the only choices on the table. Whether the swap would go through remained unclear. Secretary of State Antony J. Blinken made the offer public in part to reassure the families of Brittney Griner, the basketball player, and Paul N. Whelan, the former marine, that the administration is doing all it can to free them. Russian officials, who have long sought the release of the arms trafficker Viktor Bout, confirmed the discussion on Thursday but said Foreign Minister Sergey V. Lavrov was too busy to talk with Mr. Blinken now.”

Typically prisoner swaps are not talked about publicly before they happen: “Some veteran hostage negotiators were perplexed that Mr. Blinken made the offer public. “It is baffling why the U.S. would announce this proposal in the midst of the negotiations,” said Rob Saale, the former head of the F.B.I.-led Hostage Recovery Fusion Cell. “If you’re in sensitive negotiations why would you want to air this out publicly? It makes me wonder if the Russians haven’t already declined the deal.” Mr. Saale suspicion was justified as the Washington Post now reports:

“The Biden administration disclosed publicly that the United States had made “a substantial offer” to Russia to secure the release of two American prisoners because closed-door negotiations had stalled, an administration official said Thursday. The administration hopes public pressure will lead Moscow to engage in negotiations resulting in basketball star Brittney Griner and security consultant Paul Whelan being released from Russian prison, the official said, speaking on the condition of anonymity to discuss sensitive deliberations. U.S. officials say they have tried for weeks to broker the releases of Griner and Whelan. But the lack of progress, and the prospect of Griner soon facing conviction and sentencing on drug charges, prompted the administration this week to make the negotiations public.”

I do not understand why the administration had started such negotiations even before the Griner court case has been closed. In general such prisoners will only be pardoned and released to the other side after they have been sentenced. Anything else would raise accusations of executive interference in the judicial process. The Brittney Griner case, over admitted smuggling of cannabis oil, is still in court. The Russian government will obviously refrain from doing anything about her before the judicial process has ended. One suspects that the prisoner exchange is much more about Paul Whelan, who likely is a CIA asset.

Read more …

They’ll have to settle for what Russia leaves them. And that’s not what they counted on.

• West Prepares To Plunder Post-war Ukraine (MP)

While the United States and Europe flood Ukraine with tens of billions of dollars of weapons, using it as an anti-Russian proxy and pouring fuel on the fire of a brutal war that is devastating the country, they are also making plans to essentially plunder its post-war economy. Representatives of Western governments and corporations met in Switzerland this July to plan a series of harsh neoliberal policies to impose on post-war Ukraine, calling to cut labor laws, “open markets,” drop tariffs, deregulate industries, and “sell state-owned enterprises to private investors.” Ukraine has been destabilized by violence since 2014, when a US-sponsored coup d’etat overthrew its democratically elected government, setting off a civil war. That conflict dragged on until February 24, 2022, when Russia invaded the country, escalating into a new, even deadlier phase of the war.

The United States and European Union have sought to erase the history of foreign-sponsored civil war in Ukraine from 2014 to early 2022, acting as though the conflict began on February 24. But Washington had sent large sums of weapons to Ukraine and provided extensive military training and support over several years before Russia invaded. Meanwhile, starting in 2017, representatives of Western governments and corporations quietly held annual conferences in which they discussed ways to profit from the civil war they were fueling in Ukraine. In these meetings, Western political and business leaders outlined a series of aggressive right-wing reforms they hoped to impose on Ukraine, including widespread privatization of state-owned industries and deregulation of the economy.

On July 4 and 5, 2022, top officials from the US, EU, Britain, Japan, and South Korea met in Switzerland for a so-called “Ukraine Recovery Conference.” There, they planned Ukraine’s post-war reconstruction and performatively announced aid commitments – while salivating over a bonanza of potential contracts. New NATO candidates Finland and Sweden committed to assure reconstruction in Lugansk, roughly 48 hours after Russia and separatist forces announced the region had fallen fully under their control. But the Ukraine Recovery Conference was not new. It had been renamed to save the expense of a new acronym. In the previous five years, the group and its annual meetings were instead referred to as the “Ukraine Reform Conference” (URC).

Read more …

Siemens has eliminated no more than a quarter of the identified malfunctions at the Nord Stream turbines. Correspondence regarding the repair of engines will be made public via media.

– Deputy Chairman of Gazprom Markelov

• Gazprom Explains Gas Flow Reduction To EU (RT)

Gazprom has published some of its correspondence with Siemens as it blames the German company for a reduction in gas flow Russia had to reduce its gas flow to Europe through the Nord Stream 1 pipeline due to turbine malfunctions, Gazprom Deputy Chief Executive Vitaly Markelov said on Friday. The issues are due to Germany’s Siemens company – which produces the turbines – failing to fulfill its commitments, he told the Rossiya 24 TV Channel.

Siemens has so far eliminated only one-fourth of the total number of discovered malfunctions affecting its turbines, Markelov said. On Wednesday, the Nord Stream 1 operator Gascade reported that gas flow through the pipeline had been reduced to one-fifth of its maximum capacity. A day before that, Gazprom warned that it would have to stop the operation of its second Siemens turbine for an overhaul.

After the switch-off, gas flow through Nord Stream 1 was not expected to exceed 33 million cubic meters per day. The move came as the energy giant was still waiting for another turbine for the pipeline that was due to arrive from Germany after undergoing maintenance in Canada. “Our European partners accuse us of reducing gas supply to Europe without sufficient reasons. Yet, nothing can be further from the truth,”Markelov said, adding that it was the company’s Western partners who “fail to fulfill their obligations – contractual obligations – for the compressor station maintenance.” According to an earlier report by business daily Kommersant, several turbines at the Portovaya compressor station located on Russia’s Baltic coast are in need of servicing.

The current licensing agreement allows Siemens Energy to accept five more turbines for maintenance work before the end of 2024. “We call on our partners to resolve their own issues as soon as possible,” the deputy CEO said, adding that the gas supply to Europe would then “go back to normal in no time.”Markelov added that his company planned to release part of its correspondence with its Western partners to the public. Some documents were published hours later. The reduction of supply from Russia has led to a spike in gas prices in Europe, which rose by more than 20% to over $2,500 per thousand cubic meters on Wednesday. European leaders then blamed Russia for the gas price hikes.

Read more …

“What is euphemized as U.S.-style democracy is a financial oligarchy privatizing basic infrastructure, health and education.”

• American Diplomacy as a Tragic Drama (Michael Hudson)

As in a Greek tragedy whose protagonist brings about precisely the fate that he has sought to avoid, the US/NATO confrontation with Russia in Ukraine is achieving just the opposite of America’s aim of preventing China, Russia and their allies from acting independently of U.S. control over their trade and investment policy. Naming China as America’s main long-term adversary, the Biden Administration’s plan was to split Russia away from China and then cripple China’s own military and economic viability. But the effect of American diplomacy has been to drive Russia and China together, joining with Iran, India and other allies. For the first time since the Bandung Conference of Non-Aligned Nations in 1955, a critical mass is able to be mutually self-sufficient to start the process of achieving independence from Dollar Diplomacy.

Confronted with China’s industrial prosperity based on self-financed public investment in socialized markets, U.S. officials acknowledge that resolving this fight will take a number of decades to play out. Arming a proxy Ukrainian regime is merely an opening move in turning Cold War 2 (and potentially/or indeed World War III) into a fight to divide the world into allies and enemies with regard to whether governments or the financial sector will plan the world economy and society. What is euphemized as U.S.-style democracy is a financial oligarchy privatizing basic infrastructure, health and education. The alternative is what President Biden calls autocracy, a hostile label for governments strong enough to block a global rent-seeking oligarchy from taking control. China is deemed autocratic for providing basic needs at subsidized prices instead of charging whatever the market can bear.

Making its mixed economy lower-cost is called “market manipulation,” as if that is a bad thing that was not done by the United States, Germany and every other industrial nation during their economic takeoff in the 19th and early 20th century. Clausewitz popularized the axiom that war is an extension of national interests – mainly economic. The United States views its economic interest to lie in seeking to spread its neoliberal ideology globally. The evangelistic aim is to financialize and privatize economies by shifting planning away from national governments to a cosmopolitan financial sector. There would be little need for politics in such a world. Economic planning would shift from political capitals to financial centers, from Washington to Wall Street, with satellites in the City of London, the Paris Bourse, Frankfurt and Tokyo.

Read more …

“Turns out that Agent Brian Auten was also involved in favorably vetting the Steele Dossier when it was used to justify FISA court warrant..”

• Playing Chicken with the Fates (Kunstler)

How is it that the Hunter Biden laptop, stuffed with incriminating memoranda of bribery, treason, and diverse felonies, and in the FBI’s possession for two-and-a-half years now, just sat gathering dust in some sub-sub-basement cubby-hole — while “Joe Biden,” the putative president (or, more likely, the enigmatic claque behind him) was allowed to carry out a demolition of America’s economy and culture? The answer is one Brian Auten, FBI Senior Analyst, who engineered a scheme to label Hunter’s laptop “Russian disinformation,” which allowed FBI Director Christopher Wray to throw a switch that turned off any further inquiry in the matter beginning in August before the 2020 presidential election.

In turn, other senior FBI officials had all the documents pertaining to the decision process on that matter locked up in a special file that would never see the light of day. Auten’s action led to the release of a letter signed by “fifty former intelligence officials” labeling the laptop as a Russian disinfo op — which became the basis for social media to conspire to censor any discussion of the laptop and its contents. And so it was that a political puppet deeply in the pay of foreign interests got shoehorned into the White House. Well, that and widespread election fraud. Turns out that Agent Brian Auten was also involved in favorably vetting the Steele Dossier when it was used to justify FISA court warrants against figures in Mr. Trump’s 2016 campaign, part of the RussiaGate operation that disordered and disabled President Trump’s entire four-year term. Well now you know. Perhaps Special Counsel John Durham knows this, too. (If he didn’t before, he must now.)

Read more …

Lynch is not as crazy as Stephen King.

• David Lynch Tells ‘Zelensky’ To Have A Beer With Putin (RT)

Ukrainian president Vladimir Zelensky should have a beer with his Russian counterpart Putin and talk peace, American filmmaker David Lynch insisted in an “interview” with Russian pranksters Vovan and Lexus. The first fragment of the interview was published on the Russian video hosting website RuTube on Thursday, while the full-length version is expected to be released in the coming days.= Speaking to whom he thought was the Ukrainian leader, the Twin Peaks director insisted that the only way to end the ongoing military conflict between Russia and Ukraine was through peace. Lynch said it was his “job”to inform Zelensky about “technologies” that exist for achieving a lasting peace and that these methods were far more effective than “war and murder,” referring to letters he had previously sent to the Ukrainian president.

“Now is the time for peace, and the technology to achieve true peace exists. You need to use them and form such groups of experts on a peaceful settlement in the interests of Ukraine,”he noted. Vovan and Lexus, posing as Zelensky, asked the filmmaker whether he thought there should be direct talks with Putin in the interest of reaching peace, to which Lynch emphatically replied “Yes!”, stressing that there were a number of ways to do so, such as an ordinary telephone call or a virtual dinner with a couple of beers. Lynch insisted that during the conversation over beer and dinner the two presidents could come to a mutual realization that they are both human beings and would be able to discuss the problems between their countries.

“Think peace, think friendship” urged the filmmaker, calling on Zelensky to “stop” the current crisis, talk to Putin, and think about how to get along and help each other. The conversation with Lynch comes a week after the duo’s prank with American horror writer Stephen King, whom they also tricked into believing he was talking with Zelensky. During the call, King praised WWII-era Nazi collaborator and war criminal Stepan Bandera as a “great man” and compared him to US founding fathers Washington and Jefferson. The writer later admitted that he was pranked and claimed that he didn’t actually know who Bandera was or what he had done.

Read more …

Depression.

• Trump Warns Something Worse Than Recession Is Coming (ET)

Former President Donald Trump has warned that America’s economy is on track for a bigger disaster than a recession, with his remarks coming shortly before government statistics showed GDP printing negative for the second consecutive quarter, which is a rule-of-thumb definition for a recession. “Where we’re going now could be a very bad place,” Trump said at a rally in Arizona last week. “We got to get this act in order, we have to get this country going, or we’re going to have a serious problem.” The former president singled out the collapse in Americans’ real wages, a historically depressed labor force participation rate, and the Democrat push for the Green New Deal that he said would crush economic growth.

“Not recession. Recession’s a nice word. We’re going to have a much bigger problem than recession. We’ll have a depression,” the former president said. Trump’s remarks came several days before the Bureau of Economic Analysis (BEA) released data showing that real U.S. GDP fell by an annualized 0.9 percent in the second quarter after contracting 1.6 percent in the first quarter. Two consecutive quarters of negative GDP growth are a common rule-of-thumb definition for a recession, although recessions in the United States are officially declared by a committee of economists at the National Bureau of Economic Research (NBER) using a broader definition than the two-quarter rule.

[..] In his remarks, Trump also took aim at President Joe Biden’s handling of the economy, blaming him for soaring inflation. “Biden created the worst inflation in 47 years. We’re at 9.1 percent, but the actual number is much, much higher than that,” Trump said. While the former president didn’t provide his own estimate for the true rate of inflation, an alternative CPI inflation gauge developed by economist John Williams, calculated according to the same methodology used by the U.S. government in the 1980s, puts the figure at 17.3 percent, a 75-year high. Trump also said that persistently high inflation combined with an economic slowdown has put the country “on the verge of a devastating” spell of stagflation, which is a combination of accelerating prices and slowing economic growth.

Inflation is “going higher and higher all the time,” Trump said, adding that it’s “costing families nearly $6,000 a year, bigger than any tax increase ever proposed other than the tax increase that they want to propose right now.” In Trump’s first full month in office in February 2017, the headline Consumer Price Index (CPI) inflation gauge came in at 2.8 percent in annual terms. While the CPI measure fluctuated during his tenure, the highest it ever reached was 2.9 percent in July 2018, while in his final month in office, January 2021, inflation clocked in at 1.4 percent. Under Biden, inflation has climbed steadily, soaring 9.1 percent year-over-year in June 2022, a figure not seen in more than 40 years.

Read more …

$25,000 each. Hmm. Still, this may spread like wildfirre.

• Health Care Workers Settle COVID Shot Mandate for $10.3 Million (Bridle)

Today, Liberty Counsel settled the nation’s first classwide lawsuit for health care workers over a COVID shot mandate, for more than $10.3 million. The class action settlement against NorthShore University HealthSystem is on behalf of more than 500 current and former health care workers who were unlawfully discriminated against and denied religious exemptions from the COVID shot mandate. The agreed upon settlement was filed today in the federal Northern District Court of Illinois. As a result of the settlement, NorthShore will pay $10,337,500 to compensate these health care employees who were victims of religious discrimination, and who were punished for their religious beliefs against taking an injection associated with aborted fetal cells.

This is a historic, first-of-its-kind class action settlement against a private employer who unlawfully denied hundreds of religious exemption requests to COVID-19 shots. The settlement must be approved by the federal District Court. Employees of NorthShore who were denied religious exemptions will receive notice of the settlement, and will have an opportunity to comment, object, request to opt out, or submit a claim form for payment out of the settlement fund, all in accordance with deadlines that will be set by the court. As part of the settlement agreement, NorthShore will also change its unlawful “no religious accommodations” policy to make it consistent with the law, and to provide religious accommodations in every position across its numerous facilities. No position in any NorthShore facility will be considered off limits to unvaccinated employees with approved religious exemptions.

In addition, employees who were terminated because of their religious refusal of the COVID shots will be eligible for rehire if they apply within 90 days of final settlement approval by the court, and they will retain their previous seniority level. The amount of individual payments from the settlement fund will depend on how many valid and timely claim forms are submitted during the claims process. If the settlement is approved by the court and all or nearly all of the affected employees file valid and timely claims, it is estimated that employees who were terminated or resigned because of their religious refusal of a COVID shot will receive approximately $25,000 each, and employees to were forced to accept a COVID shot against their religious beliefs to keep their jobs will receive approximately $3,000 each.

The 13 health care workers who are lead plaintiffs in the lawsuit will receive an additional approximate payment of $20,000 each for their important role in bringing this lawsuit and representing the class of NorthShore health care workers. Liberty Counsel will receive 20 percent of the settlement sum, which equals $2,061,500, as payment for the significant attorney’s fees and costs it has required to undertake to sue NorthShore and hold it accountable for its actions. This amount is far less than the typical 33 percent usually requested by attorneys in class action litigation.

Read more …

Not sure if No. 6 is also from Toronto.

“In all four cases, their hospitals made it clear their deaths “were not related to the COVID-19 vaccine.” Made it clear how? Where are the autopsies?

• Triathlete, 27, Becomes 5th Toronto Area Doctor To Die In July (TSun)

The fifth GTA doctor to die in July “radiated positivity” and “lived a vibrant and active life.” But what the world lost in the sudden and tragic death of Dr. Candace Nayman was a woman who had dedicated her life to the health of children. The 27-year-old, who was a resident doctor at McMaster Children Hospital in Hamilton, collapsed while swimming as she competed in a triathlon on Sunday. She subsequently died on Thursday. Friends kept an around-the-clock prayer vigil for the much-loved Nayman who lost her fight and, at her request, had her organs donated to help others.She was “the loving daughter of Nicole and Gary, and the sister of Lauren, her twin, and Maurice, as well as partner to Seth Kadish,” reads an obituary on the Benjamin’s Park Memorial Chapel.

A triathlete, Dr. Nayman routinely commented on social media about her love of training and racing. “Candace Brooke Nayman passed away Thursday, July 28, 2022 competing and doing what she loved,” her obituary states. Family, friends and peers gathered Thursday for her funeral, which has not only shaken her family but rocked the already shaken medicine fraternity. “Everyone in the pediatrics department here at McMaster University and McMaster Children’s Hospital is devastated by the loss of Dr. Candace Nayman.” said Dr. Angelo Mikrogianakis, the chief of pediatrics at Hamilton Health Sciences’ McMaster Children’s Hospital and St. Joseph’s Healthcare Hamilton. “Candace was an aspiring pediatrician who exemplified hard work, radiated positivity, lived a vibrant and active life, and had a positive impact on her fellow residents, colleagues, faculty and patients.”

[..] Four other local doctors have died this summer. Trillium Partners staff physicians Dr. Jakub Sawicki, Dr. Stephen McKenzie and Dr. Lorne Segall died last week, just days after the tragic death of North York General Hospital’s Dr. Paul Hannam, an Olympian who died during a run at 50 years old. In all four cases, their hospitals made it clear their deaths “were not related to the COVID-19 vaccine.”

6 Canadian doctors

Read more …

Zuckerbucks.

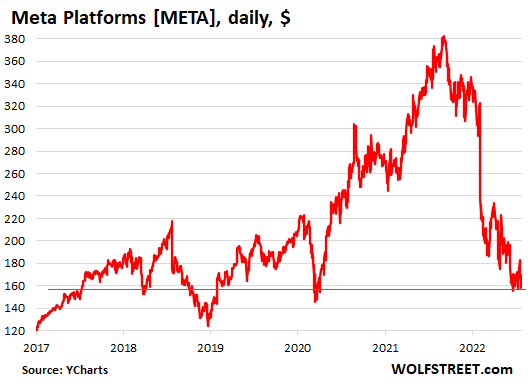

• Meta from 5th Most Valuable Stock to 11th In 10 Months. $647 Billion Lost (WS)

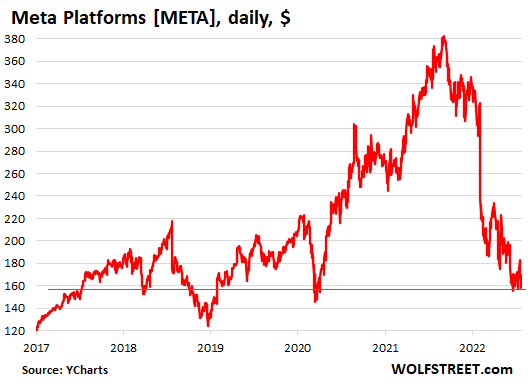

Despite the rally on Friday, the shares of Meta Platforms lost more ground, falling 1.0% to $159.10 at the close, and more after-hours, same price where the shares had first been on July 13, 2017. Five years of nothing, with an exciting roller-coaster-ride in between. Four years and two months up, 10 months down. Since the peak in September 2021, the shares have plunged 59%. Meta still doesn’t qualify for my growing list of Imploded Stocks, for which the minimum requirement is a 70% plunge from the peak, but it’s working hard to get there (data via YCharts):

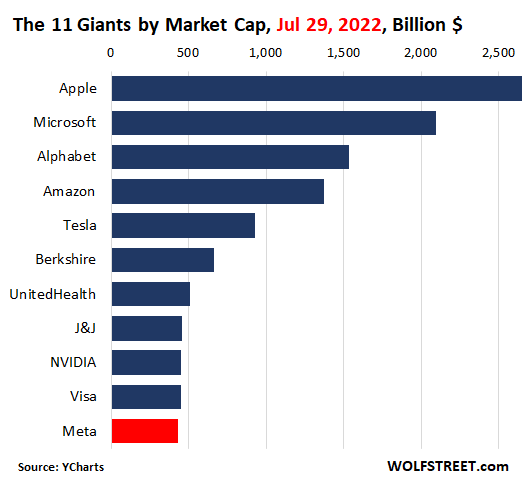

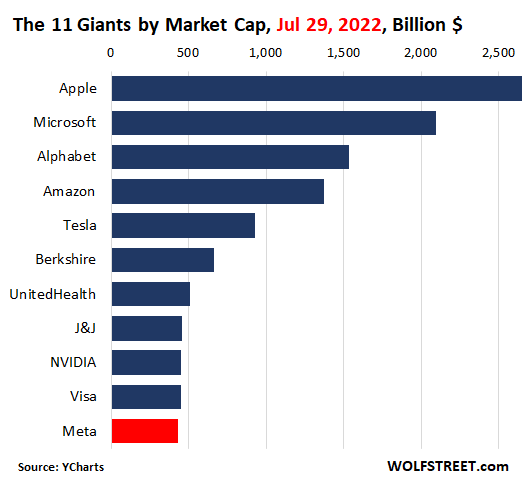

The market value plunged from $1.077 trillion in September to $431 billion today. So, $647 billion have vanished in 10 months. This is no biggie obviously because people who bought the shares at the IPO for $38, and thereby participated in the biggest tech IPO in US history at the time, still made 318% at today’s price, and the shares could fall another 50%, and they’d still make a ton of money. Those who bought in 2021, OK, win some, lose some. And this dump in market cap caused something else to happen over the past two days: While other stocks surged, Meta fell out of the top 10 most valuable companies in the US, into 11th place, behind Visa (data via YCharts):

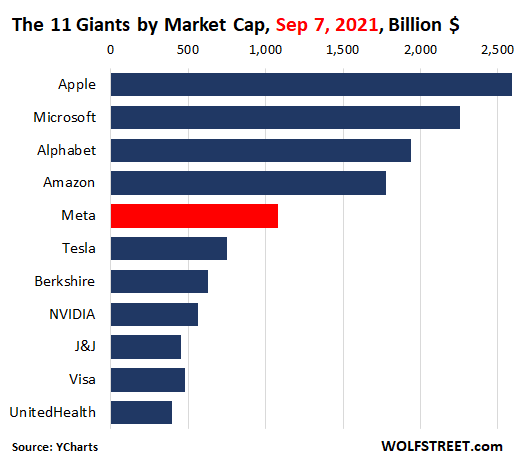

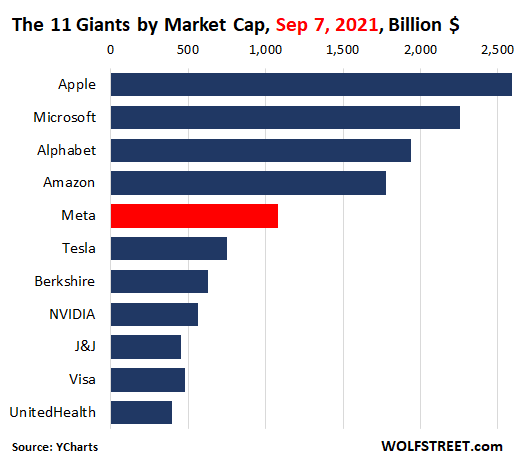

Back in September 2021, Meta, with a market cap of $1.077 trillion, was the fifth most valuable stock by market cap in the US. Easy come, easy go (data via YCharts):

Despite the summer rally, the Nasdaq composite is still down 23.6% from the peak in November, and lots of stocks slid, skidded, and plunged, and this re-arranged the deck a little among the top 11, but left the top four in the same position. There are a host of reasons for Meta’s plunge, including that the shares should have never shot up in this crazy manner in the first place. But hey, this was the pandemic, the Fed was printing money hand over fist, the Fed’s interest rates were near 0% even as inflation had begun to rage, and nothing mattered, everything shot higher. To the moon!

Read more …

Tamara Lich

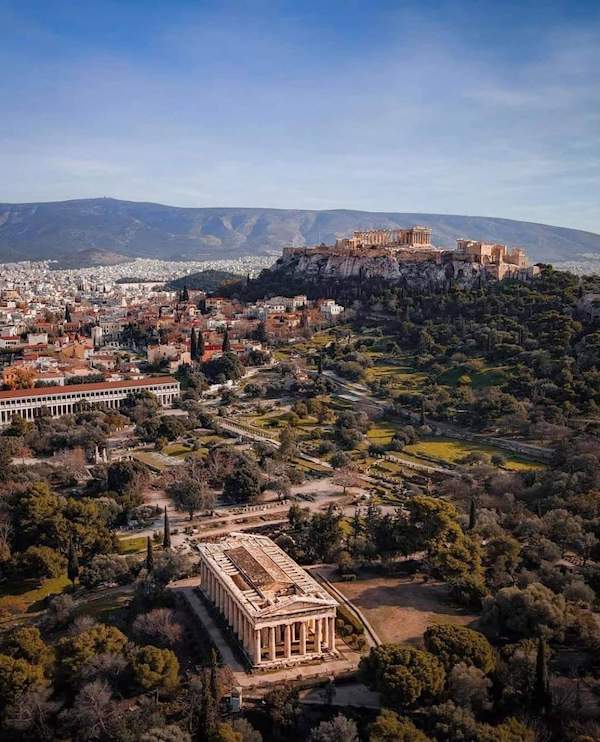

Dutch farmer

Holland

It would be good if the farmers, or someone else, can keep the WEF forum out of Holland.

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.