Daniel Garber Lambertville holiday 1941

“California, New Mexico and Hawaii have the largest share of struggling families, at 49% each. North Dakota has the lowest at 32%.”

• Almost Half of US Families Can’t Afford Basics Like Rent And Food (CNN)

Nearly 51 million households don’t earn enough to afford a monthly budget that includes housing, food, child care, health care, transportation and a cell phone, according to a study released Thursday by the United Way ALICE Project. That’s 43% of households in the United States. The figure includes the 16.1 million households living in poverty, as well as the 34.7 million families that the United Way has dubbed ALICE — Asset Limited, Income Constrained, Employed. This group makes less than what’s needed “to survive in the modern economy.” “Despite seemingly positive economic signs, the ALICE data shows that financial hardship is still a pervasive problem,” said Stephanie Hoopes, the project’s director.

California, New Mexico and Hawaii have the largest share of struggling families, at 49% each. North Dakota has the lowest at 32%. Many of these folks are the nation’s child care workers, home health aides, office assistants and store clerks, who work low-paying jobs and have little savings, the study noted. Some 66% of jobs in the US pay less than $20 an hour. [..] in Seattle’s King County, the annual household survival budget for a family of four (including one infant and one preschooler) in 2016 was nearly $85,000. This would require an hourly wage of $42.46. But in Washington State, only 14% of jobs pay more than $40 an hour.

“For now, bond market liquidity is fine because hedge funds and other non-bank lenders have filled the gap. The problem is they are not true market makers. Nothing requires them to hold inventory or buy when you want to sell.”

• A Liquidity Crisis of Biblical Proportions Is Upon Us (Mauldin)

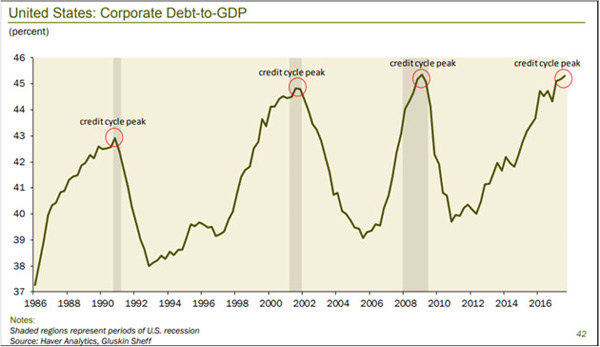

In an old-style economic cycle, recessions triggered bear markets. Economic contraction slowed consumer spending, corporate earnings fell, and stock prices dropped. That’s not how it works when the credit cycle is in control. Lower asset prices aren’t the result of a recession. They cause the recession. That’s because access to credit drives consumer spending and business investment. Take it away and they decline. Recession follows. Corporate debt is now at a level that has not ended well in past cycles. Here’s a chart from Dave Rosenberg:

The Debt/GDP ratio could go higher still, but I think not much more. Whenever it falls, lenders (including bond fund and ETF investors) will want to sell. Then comes the hard part: to whom? You see, it’s not just borrowers who’ve become accustomed to easy credit. Many lenders assume they can exit at a moment’s notice. One reason for the Great Recession was so many borrowers had sold short-term commercial paper to buy long-term assets. Things got worse when they couldn’t roll over the debt and some are now doing exactly the same thing again, except in much riskier high-yield debt. We have two related problems here. • Corporate debt and especially high-yield debt issuance has exploded since 2009. • Tighter regulations discouraged banks from making markets in corporate and HY debt.

Both are problems but the second is worse. Experts tell me that Dodd-Frank requirements have reduced major bank market-making abilities by around 90%. For now, bond market liquidity is fine because hedge funds and other non-bank lenders have filled the gap. The problem is they are not true market makers. Nothing requires them to hold inventory or buy when you want to sell. That means all the bids can “magically” disappear just when you need them most. These “shadow banks” are not in the business of protecting your assets. They are worried about their own profits and those of their clients.

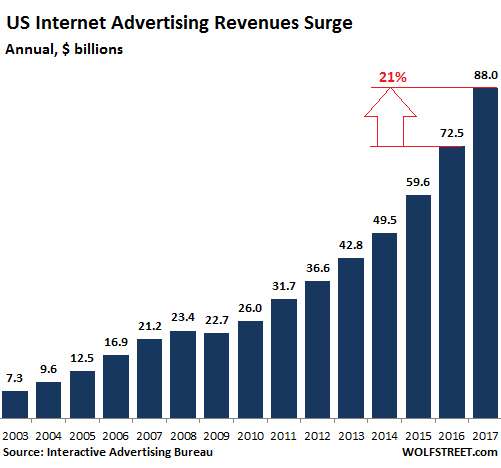

“Internet advertising revenues in the US soared 21.4% in 2017 from a year earlier to a record of $88 billion..”

• Fake News No Problem: Internet Totally Dominates Advertising in the US (WS)

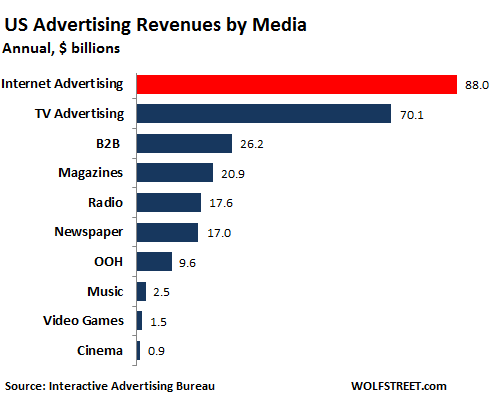

You might think you never look at these ads or click on them, and you might think they’re the biggest waste of money there ever was, but reality is that internet advertising revenues in the US are surging, and are blowing all other media categories out of the water. But only two companies divvy up among themselves nearly 60% of the spoils. Internet advertising revenues in the US soared 21.4% in 2017 from a year earlier to a record of $88 billion, thus handily demolishing TV ad revenues, which declined 2.6% to $70.1 billion, according to annual ad revenue report by the Interactive Advertising Bureau (IAB). It was the second year in a row that internet ad revenues beat TV. In 2016, internet ad revenues (or “ad spend”) had surpassed TV ad revenues for the first time in US history.

And 2017 was the first year in the data series going back to 2010 that TV advertising actually declined. That formerly unstoppable growth industry is now a declining industry. [..] Social Media sizzles, fake news no problem. Advertising spend on social media surged 36% from the prior year to $22.2 billion, now accounting for a quarter of all internet advertising, up from just an 8% share in 2012. But who’s getting all this internet ad manna? The report is presented at an “anonymized aggregate level,” and no company names are given. But it’s not hard to figure out. The top ten companies got 74% of the share in Q4 2017, according to the report.

For further detail, we mosey over to eMarketer, which estimates that in 2017, Google captured 38.6% of the total internet ad spend in the US and Facebook captured 19.9% in the US, for a combined total of 58.5% of total internet ad spend. Just by these two companies! For perspective, Google’s parent Alphabet reported global revenues of $111 billion in 2017, and Facebook $40 billion. Practically all of it was generated by internet advertising.

Well, you can’t do QE forever.

• Blundering Into Recession (Rickards)

Contradictions coming from the Fed’s happy talk wants us to believe that QT is not a contractionary policy, but it is. They’ve spent eight years saying that quantitative easing was stimulative. Now they want the public to believe that a change to quantitative tightening is not going to slow the economy. They continue to push that conditions are sustainable when printing money, but when they make money disappear, it will not have any impact. This approach falls down on its face — and it will have a major impact. My estimate is that every $500 billion of quantitative tightening could be equivalent to one .25 basis point rate hike. Some estimates are even higher, as much 2.0% per year. That’s not “background” noise. It’s rock music blaring in your ears.

For an economy addicted to cheap money, this is like going cold turkey. The decision by the Fed to not purchase new bonds will therefore be just as detrimental to the growth of the economy as raising interest rates. Meanwhile, retail sales, real incomes, auto sales and even labor force participation are all declining or showing weakness. Every important economic indicator shows that the U.S. economy can’t generate the growth the Fed would like. When you add in QT, we may very well be in a recession very soon. Then the Fed will have to cut rates yet again. Then it’s back to QE. You could call that QE4 or QE1 part 2. Regardless, years of massive intervention has essentially trapped the Fed in a state of perpetual manipulation. More will follow.

You can’t resolve a crisis with 40% interest rates. That spells panic.

• Peso Crisis Highlights Fragility Of Argentina’s Economy (AFP)

Argentina appears to have resolved, at least in the short term, the crisis over the peso and its depreciation by taking drastic action — but analysts warn the policy is untenable over time. To sustain the Argentinian peso, the Central Bank raised its benchmark interest rate up to 40% and injected more than $10 billion into the economy. A crisis of confidence in the peso saw it plunge nearly 20% over six weeks as investors concerned by Argentina’s high inflation yielded to the lure of a strong dollar. On Monday, the unit dipped to a historic low of 25.51 against the dollar, as talks continued with the International Monetary Fund for a stabilizing loan. Argentina’s center-right president, Mauricio Macri, has sought to be reassuring, saying Thursday that “we consider the turbulence overcome.”

But he pointed the finger at an endemic problem: the budget deficit of Latin America’s third largest economy – even though it has dropped from six to four% of gross domestic product since he took power in late 2015. “It’s a real structural problem, well identified for a long time by the IMF, difficult to resolve politically,” said Stephane Straub, an economist at the Toulouse School of Economics. “If rates remain at this level, it will pose problems in the medium-to-long term. But confidence must return in order to reduce the rates. That’s where the intervention of the IMF can be useful, to bring back confidence and halt the flight of capital and the pressure on the currency.” Annual inflation at more than 20% and a balance of trade deficit still stifle economic reform efforts in an economy whose annual growth was 2.8% in 2017.

But how?

• China Offers Trump $200 Billion Package To Slash US Trade Deficit (R.)

China is offering U.S. President Donald Trump a package of trade concessions and increased purchases of American goods aimed at cutting the U.S. trade deficit with China by up to $200 billion a year, U.S. officials familiar with the proposal said. News of the offer came during the first of two days of U.S.-China trade talks in Washington focused on resolving tariff threats between the world’s two largest economies. But it was not immediately clear how the total value was determined. One of the sources said U.S. aircraft maker Boeing would be a major beneficiary of the Chinese offer if Trump were to accept it. Boeing is the largest U.S. exporter and already sells about a quarter of its commercial aircraft to Chinese customers.

Another person familiar with the talks said the package may include some elimination of Chinese tariffs already in place on about $4 billion worth of U.S. farm products including fruit, nuts, pork, wine and sorghum. [..]The top-line number in the Chinese offer would largely match a request presented to Chinese officials two weeks ago by Trump administration officials in Beijing. But getting to a $200 billion reduction of the U.S. China trade deficit on a sustainable basis would require a massive change in the composition of trade between the two countries, as the U.S. goods deficit was $375 billion last year. The United States’ two biggest exports to China were aircraft at $16 billion last year, and soybeans, at $12 billion.

An invitation to London and Washington?!

• Ecuador Orders Withdrawal Of Extra Assange Security From London Embassy (R.)

The president of Ecuador, Lenin Moreno, ordered the withdrawal on Thursday of additional security assigned to the Ecuadorian embassy in London, where WikiLeaks founder Julian Assange has remained for almost six years. The Australian took refuge in the small diplomatic headquarters in 2012 to avoid sexual abuse charges in Sweden. He rejects the charges and prosecutors have abandoned their investigation. However, British authorities are still seeking his arrest.

“The President of the Republic, Lenin Moreno, has ordered that any additional security at the Ecuadorian embassy in London be withdrawn immediately,” the government said in a statement. “ From now on, it will maintain normal security similar to that of other Ecuadorian embassies,” the statement said. Ecuador suspended Assange’s communication systems in March after his pointed political comments on Twitter. Moreno has described Assange’s situation as “a stone in his shoe.”

Own your own basics.

• How Public Ownership Was Raised From The Grave (NS)

For decades, nationalisation was a taboo subject in British politics. New Labour accepted all of Margaret Thatcher’s privatisations and even extended the market into new realms (such as air traffic control and Royal Mail). Few expected public ownership to return in any significant capacity. But the state has since risen from its slumber. Chris Grayling, the Transport Secretary, yesterday announced that the East Coast Mainline rail franchise would be renationalised (for the third time in 12 years) after its private operators defaulted on payments. Labour, which has called for the whole network to be restored to public ownership, can boast of changing policy from opposition. Further franchises, rail experts say (Northern Rail, South Western, Transpennine Express and Greater Anglia), may also be renationalised out of necessity.

Grayling emphasised that the East Coast move was a “temporary” and purely pragmatic one; the Conservatives usually deride nationalisation as retrogressive, redolent of the grim 1970s. But the voters back Labour’s interventionism. A poll published last year by the Legatum Institute and Populus found that they favour public ownership of the UK’s water (83%), electricity (77%), gas (77%) and railway (76%). Voters are weary of the substandard service and excessive prices that characterise many private companies. (And saw the commanding heights of the British banking system renationalised following the financial crisis.) .

People are tired of more EU.

• EU Dashes Membership Hopes Of Balkan States (G.)

Keep waiting in line, but don’t expect the door to open any time soon. That was the message delivered on Thursday to six Balkan states hoping to join the EU. The six had been invited to the EU heads of state summit in Sofia, Bulgaria, as a gesture to reaffirm their path towards EU membership. Instead, the summit was notable for divisions on whether or not the bloc could cope with further enlargement in the foreseeable future. The EU is keen to offer enticements to the six states, given worries about potential instability and the growing role of Russia in the region. Johannes Hahn, the commissioner for enlargement, has said on a number of occasions that the EU should “export stability” to the region to avoid “importing instability”.

But many member states are uneasy about giving concrete commitments. Emmanuel Macron has emerged as the leading opponent of further EU expansion. “I think we need to look at any new enlargement with a lot of prudence and rigour,” the French president told journalists in Sofia. “The last 15 years have shown a path that has weakened Europe by thinking all the time that it should be enlarged.” A declaration was adopted at the summit that offered support for the “European perspective” of the six Balkan countries but was noticeably lacking words about “accession” or “enlargement”.

“The draft was approved with votes 60-1..”

• US House Committee Approves Provision To Freeze Arms Sales To Turkey (K.)

The United States House Committee on Armed Services of the US Congress approved in principle on Thursday a draft bill on the US budget for 2019 national defense which includes a provision that would halt any sale of military equipment to Turkey until the Secretary of Defense submits a report on the US-Turkish relationship to the congressional defense committees. The draft was approved with votes 60-1 and will be followed by a debate on various amendments, while a similar procedure will take place in the Senate.

If this provision comes into force after the end of the debate, the restrictions imposed on Turkey’s military supplies will be wide-ranging, including, but not limited to, the sales of F-35 Lightning II JSF and F-16 Fighting Falcon, CH- 47 Chinook helicopters, H-60 Blackhawk, and Patriot missiles. The effort to freeze the delivery of the F-35 fighter aircraft to Ankara has formed part of an important campaign conducted by the Hellenic American Leadership Council (HALC) in Washington. As explained by HALC’s executive director, Endy Zemenides, the fact that this provision was included in the draft law is another important step towards fulfilling the goal of the HALC campaign.

No comment.

• Alabama Congressman Blames Sea Level Rise On Rocks Falling Into The Ocean (Al)

North Alabama Congressman Mo Brooks is making headlines again for blaming sea level rise on rocks falling into the ocean and silt washing from major rivers. Brooks was one of several Republican lawmakers sparring with a climate scientist at a Wednesday hearing of the House Science, Space, and Technology Committee. Included in the arguing were Republicans Lamar Smith of Texas, the committee’s chairman, and California’s Dana Rohrabacher, but the websites for Science and Esquire used Brooks’ picture to illustrate their coverage. “Republican lawmaker: Rocks tumbling into ocean causing sea level rise,” read the Science site’s headline.

“Is the Human Race Too Dumb to Survive on This Planet?” asked Esquire also featuring Brooks. “Here’s how big a rock you’d have to drop into the ocean to see the rise in sea level happening now,” chimed in the Washington Post. Brooks was quoted saying, “Every time you have that soil or rock or whatever it is that is deposited into the seas, that forces the sea levels to rise, because now you have less space in those oceans, because the bottom is moving up.” He referred to erosion on the California coastline and England’s White Cliffs of Dover and silt from the Mississippi and Nile rivers.

I think chemicals are a much bigger issue.

• Climate Change On Track To Cause Major Insect Wipeout (G.)

Global warming is on track to cause a major wipeout of insects, compounding already severe losses, according to a new analysis. Insects are vital to most ecosystems and a widespread collapse would cause extremely far-reaching disruption to life on Earth, the scientists warn. Their research shows that, even with all the carbon cuts already pledged by nations so far, climate change would make almost half of insect habitat unsuitable by the end of the century, with pollinators like bees particularly affected. However, if climate change could be limited to a temperature rise of 1.5C – the very ambitious goal included in the global Paris agreement – the losses of insects are far lower.

The new research is the most comprehensive to date, analysing the impact of different levels of climate change on the ranges of 115,000 species. It found plants are also heavily affected but that mammals and birds, which can more easily migrate as climate changes, suffered less. “We showed insects are the most sensitive group,” said Prof Rachel Warren, at the University of East Anglia, who led the new work. “They are important because ecosystems cannot function without insects. They play an absolutely critical role in the food chain.” “The disruption to our ecosystems if we were to lose that high proportion of our insects would be extremely far-reaching and widespread,” she said. “People should be concerned – humans depend on ecosystems functioning.” Pollination, fertile soils, clean water and more all depend on healthy ecosystems, Warren said.

In October, scientists warned of “ecological Armageddon” after discovering that the number of flying insects had plunged by three-quarters in the past 25 years in Germany and very likely elsewhere. “We know that many insects are in rapid decline due to factors such as habitat loss and intensive farming methods,” said Prof Dave Goulson, at the University of Sussex, UK, and not part of the new analysis. “This new study shows that, in the future, these declines would be hugely accelerated by the impacts of climate change, under realistic climate projections. When we add in all the other adverse factors affecting wildlife, all likely to increase as the human population grows, the future for biodiversity on planet Earth looks bleak.”

It’s a start. But why the focus still only on bees?

• EU Court Upholds Curbs On Bee-Killing Pesticides (AFP)

A top European Union court on Thursday upheld the ban on three insecticides blamed for killing off bee populations, dismissing cases brought by chemicals giants Bayer and Syngenta. The decision involves a partial ban by the European Union from 2013, but the bloc has since taken more drastic action after a major report by European food safety agency targeted the chemicals. “The General Court confirms the validity of the restrictions introduced at EU level in 2013 against the insecticides clothianidin, thiamethoxam and imidacloprid because of the risks those substances pose to bees,” a statement said.

“Given the existence of new studies … the Commission was fully entitled to find that it was appropriate to review the approval of the substances in question,” it said. Bees help pollinate 90% of the world’s major crops, but in recent years have been dying off from “colony collapse disorder,” a mysterious scourge blamed partly on pesticides. The pesticides – clothianidin, imidacloprid and thiamethoxam – are based on the chemical structure of nicotine and attack the nervous systems of insect pests. Past studies have found neonicotinoids can cause bees to become disorientated such that they cannot find their way back to the hive, and lower their resistance to disease.