Edward Hopper Automat 1927

Now there’s a headline.

• Australia: A Delusional, Stuffed, Basket Case, Bubble, Third World Economy (MB)

Australia is doomed to become a third-world country unless its government starts “something like the Apollo program” to inspire its citizens into becoming a technology economy, Freelancer.com chief executive Matt Barrie told the AFR Innovation Summit 2017. “Australia is basically a property bubble floating inside a mining bubble inside a commodities bubble inside a China bubble, and that lucky free ride is about to go pop,” he said. The government was focused on “new ways to tax things” in reaction to its looming revenue problem, while neglecting education with proposed cuts to university funding of $1.2 billion, the biggest in 20 years. “Why not try and grow the biggest line of tax, income tax, by encouraging people to study in the right areas like science and engineering, instead of making these cuts which will push the cost of an electrical engineering degree at UNSW above $34,000, while slashing the HECS repayment threshold at the same time,” Mr Barrie said.

…Where is the growth come from? Mr Barrie asks. Governments have achieved growth from a property bubble “like no other”, says Mr Barrie. To paint this picture he says there are cranes in Sydney right now than in most American states combined and that being in postcodes with restricted lending. He is trawling fast through a broad range of figures that highlight Australia’s “basket case” economy including figures around low wage growth, unaffordable housing, manufacturing losses. Mr Barrie [says] we are “delusional” after 26 years of growth based on bubbles: mining, commodities and now property. Mr Barrie is slamming the economy’s structure (it’s hard to keep up, he’s moving fast). “Our economy is completely stuffed. We can’t rely on property to make us…we need serious structural change.”

It’s not rocket science.

• With QT On The Way, This Market ‘Is Headed For A Brick Wall’ (Boockvar)

We’re finally here. About nine years after quantitative easing (QE) began, quantitative tightening (QT) is about to start. On Wednesday, after the Federal Open Market Committee releases its statement, Janet Yellen will follow with a press conference that she will do her best to make as boring as possible. Every Fed member I suppose is praying for boring because of the epic bubbles that QE and seven years of zero interest rate policy (ZIRP) has created in just about everything. They want this to unfold as orderly and as quietly as possible. Wishful thinking I believe. I also expect the FOMC to lay the groundwork for a December rate hike with the market currently 50/50 on that. If one believes that the stock market still is a discounting mechanism, then there’s nothing to fear with QT and maybe it will actually be like “watching paint dry” as Fed members so desperately want it to be. After all, the S&P 500 is at an all time high.

If you think, like me, that the stock market is not the same discounting tool as it once was because of the major distortion and manipulation of markets via central market involvement and the dominance of machines that are reactive instead of proactive in response to news, then we must review the previous experiences when major Fed changes took place. After all, they were all well telegraphed as this week’s likely news has been. I expect no different an outcome this time and I believe the market – with the S&P at an all-time high – is headed for a brick wall the deeper QT gets. Before I get to that, let me remind everyone that the third mandate of QE was higher stock prices. Ben Bernanke in rationalizing the initiation of QE2 in a Washington Post editorial back in November 2010 said in regards to QE1 and the verbal preparation for QE2, “this approach eased financial conditions in the past and, so far, looks to be effective again.

Stock prices rose and long term interest rates fell when investors began to anticipate the most recent action.” He then went on to say “higher stock prices will boost consumer wealth and help increase confidence, which can also spur spending. Increased spending will lead to higher incomes and profits that, in a virtuous circle, will further support economic expansion.” Well, the belief in the wealth effect hasn’t worked in this expansion. Hence, the record high in stocks last week and the 2.9% year over year rise in core August retail sales, both below the 5 year average and well less than the average seen in the prior two expansions.

After QE1 ended when we knew exactly the full size and expiration date (March 31st, 2010), the market topped out three weeks after and then fell 17%. After QE2 ended when we also knew the exact amount and deadline (June 30th, 2011), the market peaked one week later and then fell about 20%. Around the time QE3 ended with the lead up being a very methodical process of tapering, stocks had a hissy fit of about 10% only saved by James Bullard who hinted that maybe they won’t end QE.

And there’s more. Isn’t it great to have all these options?!

• Where Deutsche Bank Thinks The Next Financial Crises Could Happen (CNBC)

The Great Central Bank Unwind Central banks including the Federal Reserve, European Central Bank and Bank of England are embarking on what has been called the “Great Unwind” – the winding-down of quantitative easing programs which included trillions of dollars’ worth of asset purchases and record low interest rates that have bolstered economies, financial markets and banking systems. Calling the “Great Unwind” a “journey into the unknown,” the strategists warned that “history would suggest there will be substantial consequences of the move especially given the elevated level of many global asset prices” adding that “even if the unwind stalls as either central banks get cold feet or if the economy unexpectedly weakens, we will still be left with an unprecedented global situation and one which makes finance inherently unstable.”

Out of ammunition? The strategists said there was a danger that central banks and governments could find themselves without ammunition to tackle a recession should one occur, given their already near zero interest rates, creaking balance sheets, and a backdrop of high levels of government debt. “Could the next recession be the one where policy makers are the most impotent they’ve been for 45 years or will they simply go for even more extreme tactics and resort to full on monetization to pay for a fiscal splurge? It does feel that we’re at a crossroads and the next downturn could be marked by extreme events given the policy cul-de-sac we seem to be nearing the end of,” Reid et al warned.

More QE if inflation disappoints? Since the financial crisis of ten years ago, persistently low inflation has been a constant headache for central banks, the Deutsche Bank strategists noted, a situation they found “fairly incredible” given the phenomenal level of central bank and government stimulus. “Although not our base case, given the recent inflation and Trump’s fiscal challenges, it’s not infeasible that markets could be blindsided by a return to more QE rather than less…If central banks do end up conducting increased QE again, the risk is we again go back to negative rates and worries about the banking system and the plumbing of the financial system.”

Italy – Crisis ‘waiting to happen?’ Turning to the euro zone’s third largest economy, Deutsche Bank’s strategists warned of more political and economic uncertainty from Italy. “A country nearing an election and with high populist party support, with a generationally underperforming economy, a comparatively huge debt burden, and a fragile banking system which continues to have to deal with legacy toxic debt holdings ticks a number of boxes to us for the ingredients of a potential next financial crisis.”

A China crisis?Conceding that China’s economy had so far avoided a hard landing predicted by many economists, Deutsche Bank warned that China still needed to transition its economy “from manufacturing to services and investment to consumption,” a process with Deutsche Bank said “needs to take place in the context of also containing the rapid growth of credit in our view.” “Rapid credit expansion due to an insatiable demand for debt fuelled growth, compounded by a hugely active shadow banking system, as well as an ever expanding property bubble fuelled fears for economists that China could inevitably make a hard landing and send shockwaves through the world’s financial markets. However, the economy has seemingly defied the odds.” “However, future growth cannot forever rely on debt and investment alone…The warning signs are there and the fundamental vulnerabilities remain. The greater issue might be ‘when’ rather than ‘if’ the credit bubble pops.”

That is scary.

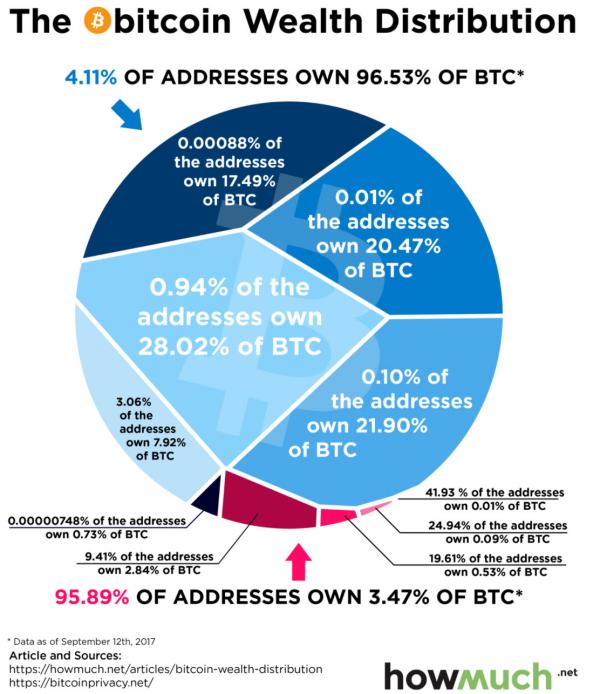

• Just 4% Own Over 95% Of Bitcoin (HowMuch)

Bitcoin has been making a lot of news lately. The cryptocurrency shot up in value by over 200% in 2017, making many people fear that the market is in a bubble. Last week, China decided to close its bitcoin exchanges, which caused investors around the world to panic about the currency’s long-term viability. But HowMuch.net asks, how many people own bitcoin, and how is the currency distributed around the world? Check out our new visualization. Our graph represents the entire bitcoin market, which has a value of around $60 billion. For comparison, that’s bigger than several well-known companies, like Fed-Ex and General Motors. We then divided the value of the bitcoin market by address. As you can see, over 95% of all bitcoins in circulation are owned by about 4% of the market. In fact, 1% of the addresses control half the entire market.

There are a couple limitations in our data. Most importantly, each address can represent more than one individual person. An obvious example would be a bitcoin exchange or wallet, which hold the currency for a lot of different people. Another limitation has to do with anonymity. If you want to remain completely anonymous, you can use something called CoinJoin, a process that allows users to group similar transactions together. This makes it seem like two people are using the same address, when in reality they are not. So it’s a complex situation. but let’s try to break bitcoin down as simple as possible. Bitcoin is just a type of money, like dollars and euros. The main difference is that there isn’t a sovereign government backing the currency, and it instead lives online. This is possible thanks to something called the blockchain.

Banks and companies must keep detailed records of where they send money, marking it possible to detect fraud and criminal activity. The blockchain works differently because it breaks each transaction into tiny components, routes the pieces through a computer network, and directs them to a recipient who can then re-assemble the code together. If you don’t have the right key, you can’t own a bitcoin. And if you aren’t at the right digital address (think your home network’s IP address), then you can’t receive bitcoin. The technology is hard to understand, and it presents challenges for companies and people who want to use it. That’s why folks typically turn to a vendor like Coinbase to handle their transactions. You know how you carry physical money in your personal wallet? Think of Coinbase as a digital wallet.

You use it to buy stuff and pay for services. But be careful—people can steal your digital wallet, and the thieves can be untraceable. And that’s the issue. There’s only a very limited number of bitcoin wallet providers out there. It’s not like you can just go to your local bank and buy some bitcoin. The big takeaway from all this is that if you are considering purchasing some bitcoin, you have very limited options. There are only a few key players in the game where you can park your investment. And if you do make that purchase, understand that it is highly speculative and unregulated, so prepare for a bumpy ride.

And then what? Jubilee?

• MPs Want Public Inquiry Into UK’s £200 Billion Household Debt Crisis (G.)

The chairs of two powerful parliamentary committees have urged the government to set up an independent public inquiry into the £200bn of debt amassed by households. The call by Rachel Reeves, the Labour chair of the business select committee, and Frank Field, the Labour head of the work and pensions select committee, comes as the Conservative-led Treasury select committee plans to hold meetings around the country to examine the impact of debt on individuals and households. “Debt is a huge emotional burden for people,” said Nicky Morgan, the Conservative MP who chairs the Treasury select committee. She added that “unstable personal finances” often emerged as problems raised by her constituents in Loughborough.

The £200bn of debt amassed on credit cards, personal loans and car deals is now at the same level it reached before the 2008 financial crisis and there are fears that rises in interest rates could put more households under pressure. Mark Carney, the governor of the Bank of England, warned on Monday that interest rates were likely to rise in response to rising inflation and skills shortages brought on by Brexit that will increase pressure on wages. Field said people in his Birkenhead constituency on the Wirral were being pushed into destitution by the actions of loan sharks and finance companies that heaped extra pain on low income households with sky-high interest charges. He said: “We need a commission to assess the current situation. There are so many moving parts that a proper investigation goes beyond the remit of any single committee.”

Probably true in many countries.

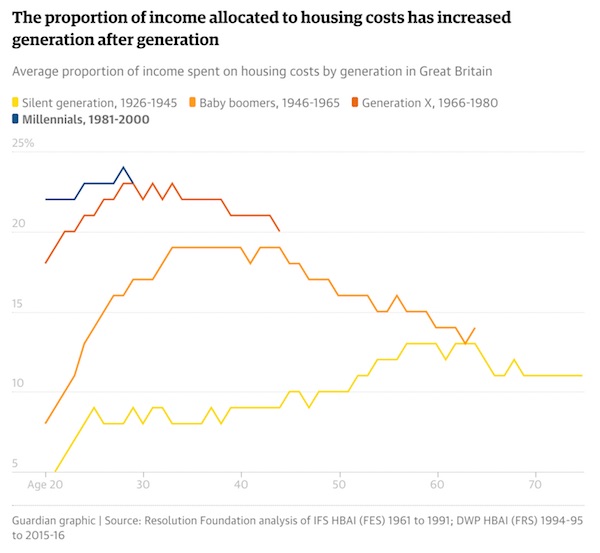

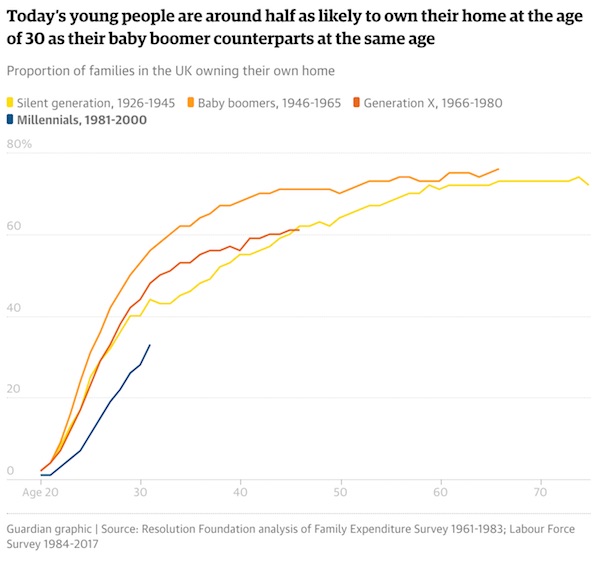

• Millennials Spend Three Times More Of Income On Housing Than Grandparents (G.)

Millennials are spending three times more of their income on housing than their grandparents yet are often living in worse accommodation, says a study launched by former Conservative minister David Willetts that warns of a “housing catastrophe”. The generation currently aged 18-36 are typically spending over a third of their post-tax income on rent or about 12% on mortgages, compared with 5%-10% of income spent by their grandparents in the 1960s and 1970s. Despite spending more, young people today are more likely to live in overcrowded and smaller spaces, and face longer journeys to work – commuting for the equivalent of three days a year more than their parents. The research by Willetts’ intergenerational commission at the Resolution Foundation thinktank also reveals that today’s 30-year-olds are only half as likely to own their own home as their baby boomer parents.

They are four times as likely to rent privately than two generations ago, a sector which has the worst record for housing quality, the report claims. The report’s authors argue that the housing crisis is a huge part of public anxiety about the country’s direction, a factor in the result of the EU referendum last year and in the general election in June. A young family today has to save for 19 years on average to afford a typical deposit compared with three years for the previous generation, the report states. “This is the biggest problem facing the younger generation,” said Willetts. “It depresses their living standards and quality of life. It is very important for the Tory party to open up the route to home ownership again. A lot of twentysomethings also have horror stories of bad landlords and we need to help them as well.”

There’s a lesson about redundancy somewhere in here.

• New Zealand Jet Fuel ‘Debacle’ Disrupts Flights, Cars, Exports (G.)

New Zealand’s jet fuel crisis is worsening by the day with airlines restricting ticket sales, politicians limiting travel to essential flights only on some routes in the final days of the election campaign and all but the most critical exports halted. Rationing is set to continue for another week after a digger on Thursday struck the sole jet fuel, diesel and petrol supply pipe to Auckland, the country’s biggest city and major transport hub for international visitors. Three thousand people a day are being affected by cancelled domestic and international flights. Another 6,000 people will be impacted by delays or disruptions to normal service, Air New Zealand said, and it had taken the “unusual” step of restricting ticket sales to all but essential or compassionate travel to try and manage the shortage.

As a result of the tightening fuel shortage, all airlines stopping in Auckland are only able to upload 30% of their normal capacity of jet fuel and the government has instructed its employees to cancel all non-essential travel. Export goods are being off-loaded from domestic and international flights unless they are at risk of rotting to lighten the load. Some international routes have been cancelled altogether or diverted to Australia and Fiji until the crisis is resolved.

Although the jet fuel supply pipe is privately owned and operated, opposition Labour leader Jacinda Ardern has criticized the government’s lack of investment in vital infrastructure in Auckland, as the ruling National party instructed its staffers and candidates around the country to restrict campaigning in the final days of the general election to save on jet fuel. “One pipeline and one digger and New Zealand grinds to a halt,” said Ardern on Tuesday. [..] Petrol and diesel supplies have also been affected by the damaged pipe, with both fuels being driven overland to Auckland from other supply points in the North Island, and the defence force called in to assist with transportation and logistics, including the naval tanker HMNZS Endeavour.

Wait. They had written their investments down to zero, so how can they suffer a wipeout? is it possible they dumped a whole lot of losses into the black hole?

• Bain, KKR, Vornado Suffer Wipeout in Toys ‘R’ Us Bankruptcy (BBG)

Bain Capital, KKR and Vornado Realty Trust stand to have their Toys “R” Us Inc. investment erased as the retailer they bought in 2005 for $7.5 billion seeks bankruptcy protection. The three firms and their co-investors sank $1.3 billion of equity into the takeover of the Wayne, New Jersey-based toy company, financing the rest with debt, according to company filings. The debt included senior loans in which they held a stake. Partly offsetting the loss is more than $470 million in fees and interest payments that Toys “R” Us awarded the firms over time. Toys “R” Us, which has 1,600 stores in 38 countries, filed for bankruptcy late Monday. The filing in Richmond, Virginia, estimated that the company has more than $5 billion in debt, which costs about $400 million a year to service.

The buyout was part of a vast wave of debt-enabled takeovers by private equity firms from 2005 to 2007 that saw deal prices soar to tens of billions of dollars. The wave crashed at the onset of the financial crisis in 2009. The biggest of that era’s private equity deals was the $48 billion buyout of Texas utility TXU, now called Energy Future Holdings Corp. The company went belly-up in 2014, obliterating $8.3 billion of equity put in by KKR, TPG Capital, Goldman Sachs and co-investors.

Toys “R” Us appeared stable out of the gate. The $7.5 billion price worked out to about 7.5 times earnings before interest, taxes, depreciation and amortization – not outlandish by today’s standards. With about $1 billion a year in Ebitda, the company was able to cover the interest on its $5.5 billion of debt and fund store improvements with more than $200 million to spare. But the ravages of the financial crisis, competition from online rivals and price wars blew up that safety cushion. KKR and Vornado, which are publicly traded, had previously written their investments in the company down to zero. As a result, the bankruptcy won’t affect their earnings going forward.

“..it is a felony to reveal the existence of a FISA warrant, regardless of the fact that no charges ever emerged..”

• Manafort Calls On DOJ To Release His Intercepted Phone Calls (ZH)

Less than 24 hours after CNN triggered the latest outbreak of ‘Trump Derangement Syndrome’ by relaying information from anonymous sources that Trump’s former campaign manager Paul Manfort has been under surveillance by the FBI since 2014, Manafort has fired back by calling on the Department of Justice to release all transcripts of his tapped phone calls so that the American public “can come to the same conclusion as the DOJ — there is nothing there.” Per the Daily Caller: “Former Trump campaign manager Paul Manafort is calling on the Justice Department to release transcripts of any intercepted communications he may have had with foreigners. Manafort, a longtime Republican political consultant, also called on the Justice Department’s inspector general to investigate the leak of details of secret surveillance warrants obtained by U.S. investigators.

“Mr. Manafort requests that the Department of Justice release any intercepts involving him and any non-Americans so interested parties can come to the same conclusion as the DOJ — there is nothing there,” Manafort spokesman Jason Maloni said in a statement. Manafort’s spokesman goes on to demand that the DOJ launch an immediate investigation into who continues to commit federal felonies with reckless abandon by leaking details of confidential FISA warrants to the media. Whether or not Manafort committed a crime — and he has not been charged with anything — the leak of information about FISA warrants is a federal crime, Maloni noted in his statement.

“If true, it is a felony to reveal the existence of a FISA warrant, regardless of the fact that no charges ever emerged,” Maloni said. Information about FISA warrants is classified and tightly held by government officials and the federal judges that approve them. Unauthorized disclosures of FISA information is also a felony. At a House Intelligence Committee hearing in March, then-FBI Director James Comey testified that the leak of FISA information is punishable by up to 10 years in prison. In his statement, Maloni called on the Justice Department’s watchdog to “immediately” open an investigation into the leak and to “examine the motivations behind the previous Administration’s effort to surveil a political opponent.”

No, I’m not going to talk about his UN speech yesterday. That’s all just confirmation bias.

Everyone involved denies any of this ever actually happened.

• Trump Warned Saudis Off Military Move on Qatar (BBG)

Saudi Arabia and the United Arab Emirates considered military action in the early stages of their ongoing dispute with Qatar before Donald Trump called leaders of both countries and warned them to back off, according to two people familiar with the U.S. president’s discussions. The Saudis and Emiratis were looking at ways to remove the Qatari regime, which they accused of sponsoring terrorism and cozying up to Iran, according to the people, who asked not to be identified because the discussions were confidential. Trump told Saudi and U.A.E. leaders that any military action would trigger a crisis across the Middle East that would only benefit Iran, one of the people said. More recently, the Trump administration has quietly sent high-level messages to Saudi Arabia and the U.A.E. to try to defuse the quarrel.

Trump, who initially sided with the Saudi-led bloc, had a change of heart because of evidence that a prolonged dispute with Qatar will serve as an advantage to Iran, according to a U.S. official familiar with his thinking. Trump met with Qatar’s emir, Sheikh Tamim bin Hamad Al Thani, at the United Nations General Assembly in New York on Tuesday. Asked by a reporter if he had warned Saudi Arabia and the U.A.E. against military action in the country, Trump responded, “No.” At the same meeting, Trump confronted the Qatari leader with what one U.S. official said is evidence that Qatar is still engaged in terrorism-related activity and told him it has to stop.

[..] Trump said on Tuesday that the U.S. is pushing for an end to the Gulf dispute. “We are right now in a situation where we’re trying to solve a problem in the Middle East,” he said. “I have a very strong feeling that it will be solved, and pretty quickly.” Those comments reflected how Trump has changed his thinking on the Qatar dispute in the past 10 days or so, becoming more sympathetic with the Qataris after previously backing the Saudi-led bloc and saying his priority is to clamp down on terror financing, according to the U.S. official familiar with his thinking.

There’s no reason for it to happen in other currencies.

• Putin Orders To End Trade In US Dollars At Russian Seaports (RT)

Russian President Vladimir Putin has instructed the government to approve legislation making the ruble the main currency of exchange at all Russian seaports by next year, according to the Kremlin website. To protect the interests of stevedoring companies with foreign currency obligations, the government was instructed to set a transition period before switching to ruble settlements. According to the head of Russian antitrust watchdog FAS Igor Artemyev, many services in Russian seaports are still priced in US dollars, even though such ports are state-owned. The proposal to switch port tariffs to rubles was first proposed by the president a year and a half ago.

The idea was not embraced by large transport companies, which would like to keep revenues in dollars and other foreign currencies because of fluctuations in the ruble. Artemyev said the decision will force foreigners to buy Russian currency, which is good for the ruble. In 2016, his agency filed several lawsuits against the largest Russian port group NMTP. According to FAS, the group of companies set tariffs for transshipment in dollars and raised tariffs from January 2015 “without objective grounds.” The watchdog ruled that NMTP abused its dominant position in the market and imposed a 9.74 billion rubles fine, or about $165 million at the current exchange rate. The decision was overturned by a court in Moscow in July this year.

Everyone thinks corporate tax cuts are the solution?!

• Eurozone ‘Bouncing Back’? Tell That To The People Of Spain And Greece (DiEM25)

EU citizens living under squeezed financial circumstances could be forgiven for wondering whether European Commission President Juncker was having a joke at their expense when he spoke recently about how Europe’s economy is finally bouncing back. After a tumultuous decade triggered by the global financial crisis in 2007, the Eurozone’s growth figures are being compared favourably to America’s, with production up 3.2% against last year. However, evidence points to a wide chasm between people’s lived experiences and Juncker’s message of triumph. It is doubtful that the citizens of Spain and Greece, for example, would agree with his assessment. According to the Commission, 30% of Spaniards are at risk of social exclusion due to poverty and income inequality.

The proportion of children in Spain living below the poverty line increased by 9% between 2008 and 2014, to 30.5%, and Spain is in 7th place on the OECD list of countries where inequality has risen the most since 2010. Greece, meanwhile, is at top of this ranking. Now, ‘growth’ may be used to express the success of a country’s economic performance. But how impressive is it really, when the Troika’s austerity-driven politics is causing so much human suffering in countries like Greece and Spain? According to the OECD, countries have continued the trend towards implementing tax policy reforms to boost growth. French President Macron is proposing to cut corporation tax from 33.3% to 25% by 2022. Yet the use of tax levers, primarily cuts to corporation tax, as a means to draw inward investment has been disputed by top economists.

“The way you get a productive economy is changing the fundamentals, says John Van Reenen of the LSE. “You get your people to be more skilled, or you have your infrastructure working efficiently. You’re never really going to get there just by reducing corporate tax.” So what’s the alternative? It is possible to pursue a successful strategy without crucifying ordinary people in the process, and Portugal is leading the way. The country adopted left wing alternatives to austerity policies in 2015 and is now reporting an impressive recovery. It is a model from which governments can learn.

That’s the intention.

• Greece’s Bailout Review Is Leaving Markets Jittery (BBG)

Greece faces two possible outcomes. Officials from both the government and creditors say the aim is to finish the third bailout review by the end of the year, giving the country time to raise more funds in the market and paving the way for its successful program exit. Concluding the review by the end of the year, or even in the early months of next year, would help Greece gain much-needed investor confidence. Prolonged negotiations, on the other hand, could weigh on investor sentiment and hamper the country’s effort to exit its bailout next summer and finance itself. “Investments are at a very low level and, as a result, Greece is growing much slower than it should and, in fact, slower than many of its eurozone partners,” Vettas said.

Greek investment was stagnant in 2016 and fell during the first two quarters of this year. If Greece’s bailout runs out before the country completes all the reforms it has agreed to, it could put at risk any plans for debt relief from the euro area, something the government has sought for years. Greece’s partners agreed to ease the country’s debt at the end of its bailout, provided agreed reforms are successfully concluded. Key sticking points in the review include Greece’s budget for 2018, and whether the country is taking sufficient measures to hit bailout-prescribed targets. Greece is expected to have a primary surplus, which excludes interest payments, of 3.5% of GDP next year, a target that seems more difficult as tax receipts have failed to yield expected revenue, Greek and EU officials say.

Meanwhile, politically contentious issues such as privatizations, the reform of public administration as well as an overhaul of the labor market may be raised in the upcoming talks. Greek banks’ handling of nonperforming loans is also expected to come under fire as is a restructuring of social benefits. Tsipras’s administration has yet to find resources in the budget to avoid cutting some popular benefits. The IMF’s demand for a new asset-quality review for Greek banks may be another bone of contention, this time between the Fund and the ECB. The Greek government and Frankfurt say that such a review will harm the nation’s lenders because they need to focus on addressing the NPL issue. A solution, they say, may be to wait for the results of the banks’ regular stress tests, which are expected before the end of the bailout program, without a new asset-quality review.

Being blamed for being strangled.

• EU’s Dombrovskis: Greek Government Chose To Increase Taxes (K.)

European Commission Vice President Valdis Dombrovskis has told Kathimerini in an exclusive interview that a successful conclusion to the third review of Greece’s third international bailout by the end of the year would send money markets a convincing message that the program is on track and close to its end – although it’s still rather early to discuss a so-called “clean exit,” he said. The Latvian politician also explained it was the government’s decision to raise taxes instead of cutting public spending, and income tax has now failed to meet revenue expectations.

Regarding talk about a “clean exit” from Greece’s third bailout at the end of next summer, Dombrovskis indicated that such a discussion was “premature” and that the priority now is to focus on completing the third bailout review by the end of the year. He said 95 prior actions, some of which have been legislated, must still be implemented. The EU official underlined the importance of Greece meeting a primary surplus target of 3.5% next year and creating a more beneficial environment for potential investors as part of efforts to boost much-needed growth.

And on and on.

• Lesvos Mayor Issues Warning On Refugee Numbers (K.)

Lesvos Mayor Spyros Galinos has written to the government and the European Commission asking that immediate action be taken to reduce the number of refugees on the island. In the letter sent to European Commissioner for Migration Dimitris Avramopoulos and Greek Migration Policy Minister Yiannis Mouzalas, Galinos says there are now more than 6,000 refugees and migrants on the island, which is far more than existing facilities can cope with. The Lesvos mayor attributed this to a steady rise in arrivals and insufficient efforts to reduce the numbers at hotspots. Galinos claimed the island is being “held hostage” and called for immediate action by authorities. He ruled out the possibility of more temporary facilities being built on the island. “Lesvos’s ability to offer hospitality is limited to its current infrastructure,” the mayor wrote.

Home › Forums › Debt Rattle September 20 2017