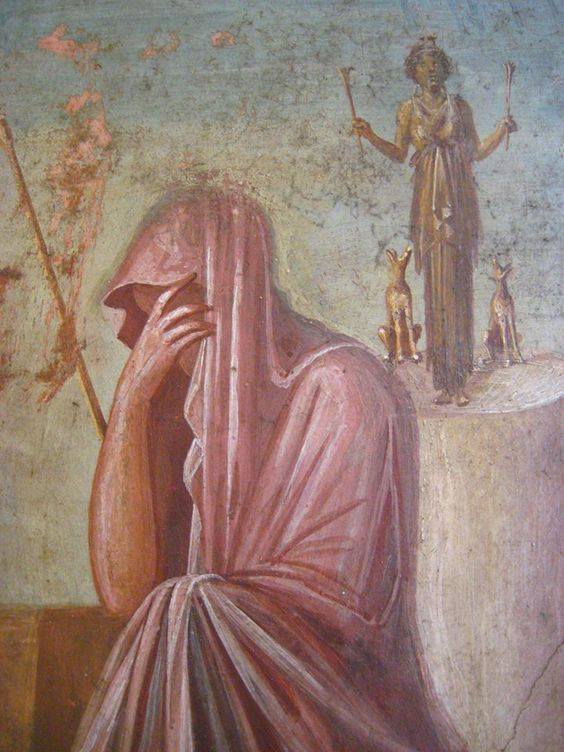

Detail of a fresco from the House of the Tragic Poet, Pompeii, 2nd century BC

About a month ago, I finished reading former Greek finance minister Yanis Varoufakis’ book “Adults in the Room”, subtitled “My Battle With Europe’s Deep Establishment”, and published by The Bodley Head. I started writing about it right away, but noticed I was writing more about my personal ideas and experiences related to Greece than about the book. So I let it rest a bit.

I read the book in, of all places, Athens, sitting outside various old-style cafés. That got me a lot of reactions from Greeks seeing the cover of the book, most of them negative, somewhat to my surprise. Many Greeks apparently do not like Varoufakis. Of course I asked all the time why that is. “He’s arrogant” was/is a frequent one.

That’s not very helpful, I find, since first of all, it’s a purely subjective judgment, and second, I’m convinced their views come to a large extent from Greek media coverage, not only during Yanis’ term as finance minister from January to July 2015, but also in the years leading up to it. And Greek media are all controlled by ‘oligarchs’ et al, who certainly do not like either Yanis or the Syriza party he represented as minister.

The irony is that Varoufakis received more -individual- votes in the January 2015 election that brought Syriza to power than any other party member. And in the July 5 referendum 61.3% of Greeks voted against -yet- another bailout, very much in line with what Varoufakis had proposed. So there was a time when he was popular.

One guy said: ”he should be in jail”. When I asked why, the response was something like “they should all be in jail”, meaning politicians. Which is a bit curious, because whatever Varoufakis may be, a politician he is not. And the Greeks know that. They are very disappointed, and often depressed, by what has happened to them, of course they are. But why they would think Yanis is responsible for that is much less clear. Other then: “they’re all responsible”.

The best line in my opinion came from someone who said he thought Varoufakis was wrong for getting involved with Greek politics in the first place, a pit -as is the EU- replete with slithering venomous snakes. That I understand. That he should never have become minister since it could only have ended badly because of the corruption and backstabbing at all levels. I’m guessing Yanis himself has thought that too at times.

But at the same time, I remain convinced, as I’m sure he does, that he genuinely did it to help his people -who were already in terrible shape in late 2014 when he decided to run, and are much worse off now. And that’s not all. He would never have done it if he hadn’t had a plan to make things better. He did. If anything, that’s the key to his story.

And if his one-time friend, PM Tsipras, had not been paralyzed with fear at the last moment, that plan might well have worked. Yanis is an economist, and a game theorist at that. And though he has always insisted game theory was not the basis of what he did as minister, and rightly so because it’s not a game, there’s one aspect of what happened that comes straight from that field.

That is, before he agreed to run for finance minister, as he writes in the book, he tells Tsipras and his closest Syriza confidants that because Greece is very weak vs the Troika, they are not in any position to bluff. Meaning, if they are going to follow ‘the plan’, they must follow it to the end, in other words, they must be willing to walk away from the Troika, from the EU.

Not because they want to, but because the rules of the game demand it. When you’re weak, you cannot afford to blink. Yanis based his plan on letting the other side blink first, as he felt they would have to if only Greece did not. That’s what the whole thing was based on. And then, after -or rather, even before- winning the NO referendum, Tsipras blinked.

And yes, you can blame Varoufakis for that: for not making sure that would not happen. For putting trust where none was warranted. But the alternative would have been to stay in Texas and see his country perish. He was asked to join, he had a plan he believed in, what was he supposed to do?

“[The book] reads like a train”, says a Dutch review of Adults in the Room. And it does. Yanis proves a talented writer in the ‘genre’, which is not his by trade -so to speak-, of a day-to-day description of a series of events, conversations, confrontations with Greek, European and global political elites -with the occasional economist thrown in here and there-. The fact that he recorded many of the conversations on his iPhone, and undoubtedly made notes of many things as they happened, makes it a very compelling read. It’s obvious he’s not making it up, that he wrote down what actually happened -much of it word for word-. Seen through his eyes, of course.

As much as it reads like a train though, it also reads like a trainwreck. The portraits Yanis paints of many of the individuals he encounters, as well as of the institutions they represent, are often as painful as they are damning. Still, that is not what he sets out to do, as many of those who find their names in the book will undoubtedly claim. They are simply the portraits that emerge as events unfold.

In the world of power politics, this should not be a great surprise. But the picture of the dynamics that ‘control’ the European Union and it representatives, as well as the Troika institutions, the IMF, ECB, Eurogroup and European Commission, becomes, as we read along, more and more that of one familiar to us through the Godfather and the Sopranos. For many of the ‘players’ that appear on the scene, a comparison to ‘made men’ in the mafia is hard to avoid. Only, without a proper code of honor. A conversation Yanis describes in the introduction of the book makes this ‘analogy’ even more striking. He’s talking to Larry Summers, former US Treasury Secretary, who talks about insiders and outsiders.

“I had a choice. I could be an insider or I could be an outsider. Outsiders can say whatever they want. But people on the inside don’t listen to them. Insiders, however, get lots of access and a chance to push their ideas. People – powerful people – listen to what they have to say. But insiders also understand one unbreakable rule: They don’t criticize other insiders.”

That’s obvious stuff. Except that this quote is from another book, US Senator Elizabeth Warren’s “A Fighting Chance”, and it’s almost verbatim the same as the one in Yanis’ book. It’s just politics. In the same way that Vito Corleone says: “it’s not personal, Sonny, it’s strictly business”. And Larry Summers is a consiglieri who spreads the gospel. Like it was once spread to him.

How do you become an insider, a made man? By committing to ‘the cause’, the family, through performing acts, initiation rituals. In the mob, that act is mostly murder, in the EU it’s something else, like obliterating the Greek economy. Or, in the case of European Council president Donald Tusk or First Vice-President of the European Commission Frans Timmermans, incessantly badmouthing Vladimir Putin. That gets you in. We know this because neither Tusk nor Timmermans had any other outstanding achievements to their names before they landed their top jobs.

So that gets you in. But into what, exactly? That’s a very opaque issue, and Varoufakis’ book doesn’t shine much light on it. Which is not a criticism, that’s not what he set out to do. Still, when he writes that in many occasions, as he tries to talk to for instance the assembled Eurogroup (all EU finance ministers plus -often- ECB head Mario Draghi and IMF head Christine Lagarde) about actual policies and plans, he “might as well have been singing the Swedish national anthem”, the opaqueness is the only thing that does ‘shine’.

A question that occurred to me, repeatedly, was how many of the people he tries to discuss issues with, actually understand what he’s talking about. For instance, once you delve into the specifics of debt swaps, what the benefits of one sort of bond are over others, you need a specific kind of knowledge, something an experienced investment banker or economist would have.

Schäuble’s a lawyer. Dijsselbloem’s an ‘agricultural economist’, whatever that may be. If you want to prevent any discussion on issues, what better than to put people in place who are -by education, by intelligence- simply not able to discuss them?

Not even Yanis, in my view, condemns Merkel and Schäuble and Dijsselbloem and a whole host of other characters in Brussels, Athens and beyond, strongly enough. Because the mob truly resides in Brussels -and Athens is truly corrupt. And Berlin. No matter how many times you may hear, or say, that something is simply politics, or it’s simply business, and nothing personal, it is very much personal and we should never accept it as normal human behavior.

That is the most damning issue Varoufakis brings up, but he doesn’t do that strong enough. When he seals a deal with China’s ambassador to Greece for Beijing to invest in Greece’s ports and railways, Angela Merkel calls the Chinese to tell them to back off; Germany’s not done with Greece yet. When current French President Emmanuel Macron, who was Economy Minister in 2015, sought to help Greece, Merkel called then-President Hollande to order him to get Macron ‘off the case’.

The European Union is undemocratic in myriad ways. What Varoufakis lays bare in his book, and then fails to utterly condemn, is that it is also undemocratic in the ‘ultimate’ way. That is, no country has anything to say except Germany. The EU’s largest member country decides everything. Not that Berlin sweats the small stuff, mind you, others are allowed to keep the illusion of democracy alive there.

But as soon as big decisions are made, finance, defense, there is one voice only that counts. That is the final nail in Europe’s coffin, even if it remains hidden very well. But spell that out loud and clear to the French people, or the Italians, that they have nothing at all to say about their own country and their own laws anymore, that the Germans decide FOR them, and what do you think they will say?

The very concept of a sovereign country, and the Union officially has 27 of them left, has turned into a joke inside the EU. Plus, Merkel and Macron and Brussels are calling for more Europe. Go to a supreme court in any EU country and tell them their own governments have lost all power over money and economics, and what do you think their constitutions will say? Care to define sovereignty?

So tell people that. Tell them that in reality Angela Merkel is their ‘leader’, not the people they have voted for. Ironically and unfortunately, the right wing regimes in eastern Europe may prove to be the ones who point this out first. Which is in line with how Brexit came about, and Trump, but in the end what all this really exposes is that we are all lied to three ways to Sunday, every day of the week.

Perhaps just as ironically, Varoufakis now leads a movement, named DiEM 25, that seeks to democratize the EU. I wish him all the good and then some with that, but I don’t see it. Because you would have to ‘overthrow’ Germany’s dictatorship of Europe, and get Germany to agree to being voluntarily ‘overthrown’. Why would Berlin ever agree to that? That’s even less likely than them agreeing to Varoufakis’ ideas about saving the Greek economy.

I’ve said it many times before, Europe’s nations can work together in many different ways, and the EU is just one of them, and it’s a very bad option. But reforming the EU from within does not look to me to be the way to go. It’s like reforming the US Republican or Democratic parties: they’re rotten to the core; why not start something new that doesn’t come with the whole deep-state-style burden?

You will hear and see a lot about how Yanis is naive and/or didn’t know what he was doing and proposing. But the only way in which he may have been naive is that he believed common sense would ultimately rule Europe. He might still have been right, if Tsipras et al had not choked. Which he told them repeatedly before he became Finance Minister would be fatal for Greece. He was right on that too, but he’ll find no pleasure in it.

His fault is that he didn’t – and doesn’t- want to ‘play the game’. That game is the only one in town, and it consists of keeping the established order in charge of everything, and of enhancing that power. It’s about politics, not economics. Or rather, the prevalent economic models suit the power elite just fine, so much so that their very faults help them stay in power, and nobody wants better models.

For trying to swim against that stream, you can blame Yanis, but that is the world turned upside down. Because if you look just a little bit closer, you can see that the present model is not only riddled with nonsensical assumptions, it is, because it is, destroying formerly sovereign nations.

For trying to prevent his country, Greece, from becoming the first nation in the formerly rich world to fall prey to that new-fangled colonialist model, Varoufakis deserves praise, not scorn. Do remember that when you see yet another ‘serious’ reviewer ridicule him for being naive. As in: who’s naive, you or Yanis? Is one naive for not kneeling before dictatorship disguised as democracy?

One last issue. It is often mentioned that the reason Brussels acts the way it does towards Greece is to scare off other EU members from ‘trying the same’, i.e. go against the rules set by the EU -which we, thanks to Yanis, know means Germany, and Germany only. But I don’t think that is true. It’s not about going against the EU; it’s doing anything. whatever it is, that would endanger the banks.

What the -scandalous- treatment of EU member and sovereign country Greece reveals is that it’s in the end not even Angela Merkel who calls the shots, but the main German, French, Dutch banks. Why the British would want to remain members of that kind of cabal will never cease to amaze me, but why their banks would does not in the least.

But yeah, so, the banks. That’s where it all started. Europe’s main banks lent Greek banks and corporations, all as corrupt as can be, money ‘up the wazoo’. When that could not be paid back this debt was not restructured, as it would be in any normal bankruptcy case, it was transferred first to the EU and then directly to Greek pensioners and other citizens. That is why Greece is in such a deplorable state.

The banks who made the loans were made whole, through a trick that hadn’t been tried before -and may not have been 100% legal but who cares about law in the EU?- and the entire mess was unloaded upon Greek society. Which is now in an even much bigger mess, with no end in sight, than when Varoufakis became finance minister. He knew that was coming and tried to prevent it.

What Merkel et al have done is to make sure that this ‘salvation’ of Deutsche Bank, Crédit Agricole et al will not be in peril. That’s more important to the system than Portugal or Italy questioning the powers of Berlin or Brussels. It’s not about scaring off other countries, it’s about safe-guarding the banks. It’s not about economics, it’s about raw political power.

In the next economic downfall, watch that dynamic. I’ve often said that the general principle of globalization/centralization, of which the EU is a good example, cannot stand in times of negative growth, because people won’t accept decisions about their lives being taken by far-away ‘leaders’ unless they think they can profit from it.

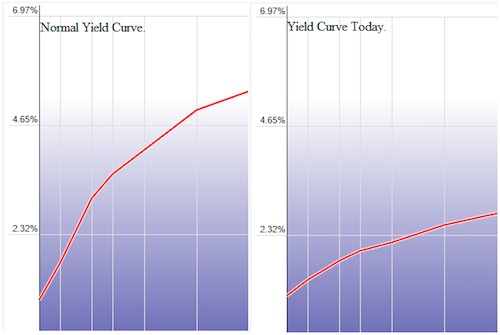

Wait till the realization dawns that Europe, like the rest of the world, only looks sort of okay because debt levels are rising everywhere. Mario Draghi still buys tens of billions of euros in ‘paper assets’ every month. That’s the European economy, that’s all that keeps it looking good, that’s the pig and that’s the lipstick, right there.

But forst and foremost, read the book. Yanis Varoufakis: “Adults in the Room”, subtitled “My Battle With Europe’s Deep Establishment”, published by The Bodley Head. If you’re at all interested in Greece, politics, economics, Michael Corleone, the EU, the IMF and/or the Sopranos. It reads like a train.

And it tells you a lot about how the world does (not) work. From the inside, and you don’t get to have a lot of views from the inside. “Adults in the Room” is a rare chance. The ruling powers will keep trying to discredit Yanis, but the more they do, the more you should be alerted.