Fred Lyon Broadway and Kearny Street, North Beach, San Francisco 1952

“..the Federal Reserve has not allowed the market to do its one and only job, and that is to determine fair value.”

• All Hell Is Going To Break Loose In The Bond Market (SBA)

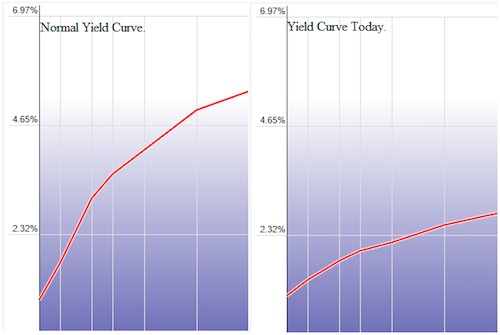

This past Wednesday we heard from the Federal Reserve with regard to monetary policy, and as I predicted they did raise the federal funds rate 25 basis points however, instead of yields rising, they are dropping. More than a year and a half ago I had said publicly that the Federal Reserve’s attempt at trying to normalize bond yields would backfire-and this is exactly what is happening. It is clear to me that the Federal Reserve has absolutely lost control of what is occurring in the bond market. Remember, this is uncharted territory, we have never been here before in the history of the financial world-so the Federal Reserve actually has no idea of how the market will react in the current environment with regard to their attempt at normalizing interest rates. The yield curve as seen in the picture above continues to flatten out, and this trend will continue until the curve inverts.

The last time the yield curve inverted, the 2008 economic meltdown occurred, and the time before that we suffered the.com bubble meltdown. The fact is we are existing in a multiple bubble economy at this time, worse, and unlike anything which has ever been seen before. The reason why these bubbles exist is simple: the Federal Reserve has not allowed the market to do its one and only job, and that is to determine fair value. The Federal Reserve’s interest rate suppression cycle has not only allowed, but has been the driving force behind mass malinvestments across the entire spectrum of asset classes and as such, bubbles have been created. The Federal Reserve has created distortions across the spectrum of asset classes which is frankly beyond belief, worse than has ever been witnessed in the history of finance. What this means is when the yield curve inverts this time, we will experience a meltdown magnitudes greater then the 2008 crash.

“..till injuries were wrought to the structure of human society which a century will not efface, and which may conceivably prove fatal to the present civilization.”

“The year 1915 was fated to be disastrous to the cause of the Allies and to the whole world. By the mistakes of this year the opportunity was lost of confining the conflagration within limits which though enormous were not uncontrolled. Thereafter the fire roared on till it burnt itself out. Thereafter events passed very largely outside the scope of conscious choice. Governments and individuals conformed to the rhythm of the tragedy, and swayed and staggered forward in helpless violence, slaughtering and squandering on ever-increasing scales, till injuries were wrought to the structure of human society which a century will not efface, and which may conceivably prove fatal to the present civilization.” – Winston S. Churchill – The World Crisis: 1915

After reading that quote several times, it remains shocking that the politicians and individuals of that era unconsciously “conformed to the rhythm of the tragedy.” The paragraph above from Winston Churchill, describes the mass mindset of World War I when it was still in its infancy. War-time narratives, nationalism, destruction and the tremendous loss of life led most people to quickly accept and acclimate to an event that was beyond atrocious. Amazingly, less than a year before the period Churchill discusses, the same people likely would have thought that acceptance of such a calamity would be beyond comprehension. Wars and markets are obviously on two different planes, and we want to make it clear the purpose of this article is not to compare the evils of war to financial markets. That said, we must recognize that quick acceptance of abnormal circumstances, as Churchill describes, is a trait that we all possess.

The seemingly unabated march upwards in stock prices occurring over the last eight years has had a mind-numbing effect on investors. The relentless grind higher is backed by weak fundamentals providing little to no justification for elevated prices. Indeed, if there was no justification for such valuations during the economically superior timeframe of the late 1990’s, how does coherent logic rationalize current circumstances? For example, feeble economic growth, stagnating corporate earnings, unstable levels of debt, income and wage inequality and a host of other economic ills typically do not command a steep premium and so little regard for risk. This time, however, is different, and investors have turned a blind eye to such inconvenient facts and instead bank on a rosy future. Thus far, they have been rewarded. But as is so often the case with superficial gratification, the rewards are very likely to prove fleeting and what’s left behind will be deep regret.

Despite our education and experience which teach the many aspects of the discipline of prudent investing, investors are still prone to become victims of the philosophy and psychology of the world around them. These lapses, where popular opinion-based investment decisions crowd out the sound logic and rationale for prudence and discipline, eventually carry a destructively high price. Investors, actually the entire population, have become mesmerized by the system as altered and put forth by the central bankers. We have somehow become accustomed to believe that debt-enabling low interest rates make even more debt acceptable. Ever higher valuations of assets are justifiable on the false premise of a manufactured and artificial economic construct.

Long from Australia, with lots of sources. Bit confusing even.

• 10 Years After Global Financial Crisis, World Still Suffers Debt Overhang (SMH)

Let’s start with the question of debt. Lord Adair Turner, who chaired the UK Financial Services Authority between 2008 and 2013 and helped redesign global banking, says the world since has not addressed this root cause of the crisis and that means it’s at risk of another one. Lord Turner, now chairman of New York-based Institute for New Economic Thinking, says the world is suffering from “irrational exuberance” and “debt overhang”. The latter term refers to countries trapped in a vicious cycle of debt, and when nations ultimately default on that debt – he predicts that the next crisis will come courtesy of China and that’s just a number of years away – it ends in their economic destruction.

The Institute of International Finance (IIF) says global levels of debt held by households, governments, and non-financial corporates jumped by over $US70 trillion in the past decade to a record high of $US215 trillion, equating to 325 per cent of global GDP. “There’s been no deleveraging,” Lord Turner says. “Once you’ve got too much debt in the economy … it’s incredibly difficult to get rid of it. “If you say, ‘I’m going to write it off’, your banks go bankrupt … if you try get rid of it by people paying down that debt … the attempt to pay it back is what drives the economy into recession.” To avoid that, interest rates then fall, and that simply encourages more borrowing, he says.

[..] Steve Keen, Professor of Economics at Kingston University in London, a long-time doomsayer on Australia’s mortgage binge, says simply: “It’s dangerous”. He says the Reserve Bank and Australian politicians ignore the dangers of private household debt today just as former US Federal Reserve chairman Ben Bernanke did before the GFC. Keen says the risk of recession is even higher now that APRA has slightly tightened lending standards. “It’s inevitable,” he says, sticking to his bold prediction that it will happen before year’s end.

Grow your own food.

• Amazon, the Death of Brick & Mortar, Buys into Brick & Mortar (WS)

Amazon, which is getting blamed profusely for the meltdown of brick-and-mortar stores and malls across the US, and which has been dabbling with its own initiatives into brick-and-mortar operations – including bookstores, after nearly wiping bookstores off the face of the US – said it would buy brick-and-mortar Whole Foods Market for $13.7 billion. Amazon will get Whole Foods’s $15.7 billion in annual sales and more importantly, its brand, semi-loyal customers, and about 450 brick-and-mortar stores across 42 states. Whole Food shares jumped 27%. But in early trading, the shares of the largest brick-and-mortar grocery sellers in the US are getting crushed: Wal-Mart Stores -6.5%; Kroger, largest supermarket chain in the US, -14%; Costco -7%; Target -10%.

Amazon already sells groceries online via AmazonFresh, and a few months ago announced it would create a grocery store pickup service, another foray into brick-and-mortar. Selling groceries online has been tough in the US, though everyone has been trying, from innumerable startups to Safeway and Google Express (in cooperation with Costco et al.). Consumers are used to buying at the store by running through the aisles with their carts and choosing what they see or what’s on their list, or both, and they want to touch and check their produce before buying it, and they don’t want the dented apples or squished grapes or wilted lettuce. And they need it now on the way home from work so they can fix dinner.

With this acquisition, Amazon’s efforts to muscle its way into the grocery business and even more into the every-day lives of Americans have thus taken a quantum leap forward. But what industry is Amazon muscling into? Over the past six years, sales at grocery stores are up a total of 14%, not adjusted for inflation, according to the retail trade report by the Commerce Department. Over the same period, the Consumer Price Index for food rose 14%, according to the Bureau of Labor Statistics. Hence, on an inflation-adjusted basis, “real” sales have been flat for six years.

Did anyone doubt this? Safe to predict the investigation will be dragged out forever.

• Special Prosecutor Mueller Is a Political Hack (Washington)

Torture FBI special agent Colleen Rowley points out: Mueller was even okay with the CIA conducting torture programs after his own agents warned against participation. Agents were simply instructed not to document such torture, and any “war crimes files” were made to disappear. Not only did “collect it all” surveillance and torture programs continue, but Mueller’s (and then Comey’s) FBI later worked to prosecute NSA and CIA whistleblowers who revealed these illegalities.

Iraq War Rowley notes: When you had the lead-up to the Iraq War … Mueller and, of course, the CIA and all the other directors, saluted smartly and went along with what Bush wanted, which was to gin up the intelligence to make a pretext for the Iraq War. For instance, in the case of the FBI, they actually had a receipt, and other documentary proof, that one of the hijackers, Mohamed Atta, had not been in Prague, as Dick Cheney was alleging. And yet those directors more or less kept quiet. That included … CIA, FBI, Mueller, and it included also the deputy attorney general at the time, James Comey.

Post 9/11 Round-Up FBI special agent Rowley also notes: Beyond ignoring politicized intelligence, Mueller bent to other political pressures. In the aftermath of the 9/11 attacks, Mueller directed the “post 9/11 round-up” of about 1,000 immigrants who mostly happened to be in the wrong place (the New York City area) at the wrong time. FBI Headquarters encouraged more and more detentions for what seemed to be essentially P.R. purposes. Field offices were required to report daily the number of detentions in order to supply grist for FBI press releases about FBI “progress” in fighting terrorism. Consequently, some of the detainees were brutalized and jailed for up to a year despite the fact that none turned out to be terrorists.

9/11 Cover Up Rowley points out: The FBI and all the other officials claimed that there were no clues, that they had no warning [about 9/11] etc., and that was not the case. There had been all kinds of memos and intelligence coming in. I actually had a chance to meet Director Mueller personally the night before I testified to the Senate Judiciary Committee … [he was] trying to get us on his side, on the FBI side, so that we wouldn’t say anything terribly embarrassing. …

EU’s post-Cyprus resolutions are being dumped whenever that’s easier.

• Fear of Contagion Feeds the Italian Banking Crisis (DQ)

Spain’s Banco Popular had the dubious honor of being the first financial institution to be resolved under the EU’s Bank Recovery and Resolution Directive, passed in January 2016. As a result, shareholders and subordinate bondholders were “bailed in” before the bank was sold to Santander for the princely sum of one euro. At first the operation was proclaimed a roaring success. As European banking crises go, this was an orderly one, reported The Economist. Taxpayers were not left on the hook, as long as you ignore the €5 billion of deferred tax credits Santander obtained from the operation. Depositors and senior bondholders were spared any of the fallout. But it may not last for long, for the chances of a similar approach being adopted to Italy’s banking crisis appear to be razor slim.

The ECB has already awarded Italy’s Monte dei Paschi di Siena (MPS) a last-minute reprieve, on the grounds that while it did not pass certain parts of the ECB’s last stress test, the bank is perfectly solvent, albeit with serious liquidity problems. By contrast, Popular was also liquidity challenged but, unlike MPS, it passed all parts of the ECB’s 2016 stress test, which shows you how ineffectual these tests are — and how subjective the resolution process of a European bank can be. In a speech to the Italian Banking Association on Thursday, the Vice President of the ECB, Vítor Constâncio, suggested that under certain circumstances, it might be wiser to save a bank than to resolve it. What’s more, taxpayers should be called upon not only to save banks like MPS but also to make whole all holders of the bank’s subordinate debt, under the pretext that they were misled into purchasing them (as indeed some retail customers, but certainly not all, were).

A taxpayer-funded bailout of bondholders is also on the cards for the two mid-sized Veneto-based banks, Banca Popolare di Vicenza and Veneto Banca, which have already received billions of euros in taxpayer assistance. Italy’s Minister of Economy Pier Carlo Padoan continues to insist the two banks will not be wound down. This is the same man who insisted last year that a) there would be no need of any future bail outs; and b) Italy did not even have a banking problem on its hands. Padoan has no choice but to deny all rumors of a bail-in; otherwise there would be a massive rush for the exits. In the weeks and even days leading up to Popular’s collapse, Spain’s Economy Minister Luis de Guindos repeatedly reassured investors that the bank was perfectly safe and solvent.

All the while government agencies, including Spain’s social security fund, and regional government authorities were emptying the deposits they held with the bank as fast as they could. The total is unknown but it certain ran into billions of euros. To avoid a similar fate, Banca Popolare di Vicenza and Veneto Banca were instructed by the European Commission last week to find an additional €1.25 billion in private capital. That money still hasn’t arrived, and now Italy’s government is trying to persuade the European Commission and the ECB to water down the requirement to €600-800 million, while also urging Italian banks to chip in to the bank rescue fund. If they don’t and the two Veneto-based banks end up being wound down, they will have to cough up as much as €11 billion to refund the banks’ depositors.

Deleveraging my donkey.

• China’s Smaller Banks Endure Record Borrowing Costs amid Squeeze (BBG)

China’s smaller banks, caught between a seasonal cash squeeze and an official deleveraging drive, are stomaching record high borrowing costs to raise funds. Issuance of negotiable certificates of deposit jumped to 758 billion yuan ($111.5 billion) this week, the most since the securities were introduced in 2013 as a lifeline for smaller banks. The yield on one-month AAA rated NCDs has surged nearly one percentage point this month to an all-time high of 5.05%, while that on AA+ contracts reached 5.30%, according to data compiled by Bloomberg. The increase in NCD costs comes at a tough time for Chinese lenders, which face an unprecedented 4.5 trillion yuan of maturities this quarter. The pressure has been aggravated by the deleveraging drive, with the one-month Shanghai Interbank Offered Rate climbing for 22 days in a row to a two-year high.

The certificates are used mainly by smaller lenders – banks outside of China’s top 10 by market value accounted for 76% of total sales this year. “The smaller banks have no choice but to take the blow,” said Shan Kun, Shanghai-based head of China markets strategy at BNP Paribas. “They need to sell NCDs to get financing as they cut leverage gradually and as they have to cope with tighter liquidity this month. The rates will likely continue to climb, or at least stay elevated in the near term.” When cash supply tightens, small- and medium-sized lenders are usually among the hardest-hit because they lack the retail deposit arsenal of larger banks, said Yulia Wan, a Shanghai-based banking analyst at Moody’s Investors Service. They also may not have enough bonds to use as collateral to borrow money in the repo market. The banks need the money to finance longer-term and less liquid assets, such as debt and investment in loans and receivables, she added.

Grand plans going back to Osborne and Cameron.

• Most Of Central London Hospital To Be Sold Off, Plans Reveal (G.)

Almost all of a central London hospital is to be sold and its services diverted to already stretched facilities around the capital under plans for NHS modernisation seen by the Guardian. Charing Cross hospital, a flagship NHS facility in the heart of London, is to be cut to just 13% of its current size under proposals contained in sustainability and transformation plans published last year in 44 areas across England. Many of the officially published plans lacked precise detail about how local services would change, but internal supporting documents seen by the Guardian reveal the scale of the closures at the London site. The proposals claim much of the care currently offered at Charing Cross can be transferred to “community settings” such as local GP services, but health campaigners and clinicians say the transformation could endanger patients.

The documents include a map detailing how 13% of the current hospital site will remain, with the rest of its prime real estate in central London sold off. The plan is to introduce the changes after 2021. NHS chiefs have stated as recently as March that “there have never been any plans to close Charing Cross hospital”, and in March 2015 the then prime minister, David Cameron, said it was “scaremongering” to suggest that the Charing Cross A&E departmentwas earmarked for closure. The health secretary, Jeremy Hunt, echoed the claims. However, in the internal NHS documents the apparent downgrading of Charing Cross is outlined in great detail. The plan is to axe 10 major services at Charing Cross – 24/7 A&E, emergency surgery, intensive care and a range of complex emergency and non-emergency medical and surgical treatments. The remaining services would be a series of outpatient and GP clinics, X-ray and CT scans, a pharmacy and an urgent care centre for “minor injuries and illnesses”. Around 300 acute beds will be lost.

Yanis.

• Five Talks on Power, Populism, Politics & Europe (Varoufakis)

1 Yanis Varoufakis on power, populism and the future of the EU

2 Can Europe Make It? – Yanis Varoufakis speaks to openDemocracy

3 Yanis Varoufakis blows the lid on Europe’s hidden agenda

4 Yanis Varoufakis and his plan to take on Europe – again

5 Greece, Austerity, Brexit and Europe’s other darlings at GFMF2016

In the EU, there’s immunity for officials committing crimes.

• Spain Says Eurogroup May Block Greek Loan If Officials Not Granted Immunity (R.)

The Eurogroup of finance ministers may block an 8.5-billion-euro (7.44 billion pounds) loan to Greece if it does not grant immunity to privatisation agency officials from Spain, Italy and Slovakia, Spanish Economy Minister Luis de Guindos said on Friday. In 2015, a Greek prosecutor charged three officials at the country’s privatisation agency with embezzlement for withholding interest payments and breach of duty in relation to a sale and lease-back deal of 28 state-owned buildings. The case is still pending. “If there’s not a definitive solution for the situation of these three experts, the Eurogroup will block the payment,” de Guindos said in Luxemburg.

Greece would do “whatever necessary” to immediately settle the legal case, a Greek government official said. European Economic and Monetary Affairs Commissioner Pierre Moscovici said he was confident the problem would be resolved and that he would continue to discuss the issue with Spain during his visit to Madrid next week. “The problem has to be solved. We should not over dramatise it. The disbursement will happen and at the same time will find a solution to this problem,” Moscovici said on his arrival at a meeting of EU finance ministers in Luxemburg on Friday.

Next up: a chip that makes your kids smarter. Try and resist that.

• Swedish Commuters Can Use Hand Implant Chip Instead Of Train Tickets (Ind.)

Gone are the days when an e-ticket was seen as cutting edge – one Swedish rail company is offering passengers the option of using a biometric chip implanted into their hand in lieu of a paper train ticket. SJ is the first travel company in the world to let people use this innovative method that seems straight out of a sci-fi film. The tiny chip has the same technology as Oyster cards and contactless bank cards – NFC (Near Field Communication) – to enable conductors to scan passengers’ hands. Before you pack your bags for Sweden, the scheme is only applicable to those who already have the biometric implant – SJ is not offering to chip people. Around 2,000 Swedes have had the surgical implant to date, most of them employed in the tech industry.

State-owned operator SJ has said it expects about 200 people to take up the microchip method, but users must be signed up as a loyalty programme member to access the service. Customers buy tickets in the normal way by logging onto the website or mobile app, and their membership number, which is the reference code for the ticket, is linked to their chip. There are still kinks to be ironed out with the scheme, which began in earnest last week. Some passengers’ LinkedIn profiles were appearing instead of their train tickets when conductors scanned their biometric chip, while a number of train crew haven’t got the new SJ app which facilitates the scanning of biometric chips yet. “It’s just a matter of days before everyone has it,” says a spokesperson for SJ.