NPC Newsstand with Out-of-Town Papers, Washington DC 1925

“..a wave of migration that makes current debates about accepting hundreds of thousands of asylum seekers seem irrelevant..”

• Europe Faces Several Decades Of Heavy Immigration (NY Times)

European leaders probably don’t want to hear this now, as they frantically try to close their borders to stop hundreds of thousands of desperate migrants and asylum seekers escaping hunger and violence in Africa and the Middle East. But they are dealing with the unstoppable force of demography. Fortified borders may slow it, somewhat. But the sooner Europe acknowledges it faces several decades of heavy immigration from its neighboring regions, the sooner it will develop the needed policies to help integrate large migrant populations into its economies and societies. That will be no easy task. It has long been a challenge for all rich countries, of course, but in crucial respects Europe does a particularly poor job.

Perhaps it’s not surprising, as a recent report by the OECD found, that it is harder for immigrants to get a job in EU nations than in most other rich countries. But that doesn’t explain why it is also harder for their European-born children, who report even more discrimination than their parents and suffer much higher rates of unemployment than the children of the native-born. Rather than fortifying borders, European countries would do better to improve on this record. The benefits would be substantial, for European citizens and the rest of the world. Over the summer, as Hungary hurried to lay razor wire along its southern border and E.U. leaders hashed out plans to destroy smugglers’ boats off the coast of North Africa, the United Nations Population Division quietly released its latest reassessment of future population growth.

Gone is the expectation that the world’s population will peak at 9 billion in 2050. Now the U.N. predicts it will hit almost 10 billion at midcentury and surpass 11 billion by 2100. And most of the growth will come from the poor, strife-ridden regions of the world that have been sending migrants scrambling to Europe in search of safety and a better life. The population of Africa, which has already grown 50% since the turn of the century, is expected to double by 2050, to 2.5 billion people. South Asia’s population may grow by more than half a billion. And Palestine’s population density is expected to double to 1,626 people per square kilometer (4,211 per square mile), three times that of densely populated India.

Over the next several decades, millions of people are likely to leave these regions, forced out by war, lack of opportunity and conflicts over resources set in motion by climate change. Rich Europe is inevitably going to be a prime destination of choice. “With Africa’s population likely to increase by more than three billion over the next 85 years, the EU could be facing a wave of migration that makes current debates about accepting hundreds of thousands of asylum seekers seem irrelevant,” wrote Adair Turner, the former chairman of Britain’s Financial Services Authority and now chairman of the Institute for New Economic Thinking.

Quite a story.

• The Growth of Refugee Inc. (WSJ)

The annual report in 2013 from a multibillion-dollar London private-equity firm that counts a French pastry baker and a Dutch shoemaker among its holdings touted a new opportunity with “promising organic and acquisitive growth potential.” That investment was the management of refugee camps. “The margins are very low,” said Willy Koch, the retired founder of the Swiss company, ORS Service, which runs a camp in Austria that overflowed this summer with migrants who crossed from the Balkans and Hungary. “One of the keys is, certainly, volume.” Since early 2014, more than a million people have claimed asylum in the EU. Germany alone is preparing for at least 800,000 asylum-seekers this year. The surge, experts say, amounts to the biggest movement of people in Europe since World War II.

The crisis has produced harrowing tales of tragic deaths and lives in upheaval. It is also giving shape to an industry that everyone from small Greek shop owners to some of America’s biggest pension funds are benefiting from: the business of migration. In many ways, private companies are increasingly defining the European migration experience. In some cases, the companies see potential to win favor with a future group of European consumers, a welcome jolt amid the Continent’s economic doldrums. In other cases, they are stepping in to help provide services that governments can’t or won’t. At times they have provoked protests from advocacy groups who accuse them of cutting corners in order to profit from human misery. Some of the businesses, in turn, say they are sensitive to the risks of working with vulnerable people, and they argue that neither governments nor charities can meet on their own the huge range of demands resulting from the tide of migrants now arriving in Europe.

“Because of our involvement it is a better service run more efficiently,” said Guy Semmens, partner at Geneva-based private-equity firm Argos Soditic, which previously invested in ORS. There are also profits to be made. In Germany, Air Berlin was paid some $350,000 last year operating charter flights to deport rejected asylum seekers on behalf of the government. In Sweden, the government paid a language-analysis firm $900,000 last year to verify asylum-seekers’ claims of where they were from. In Athens, a Western Union branch has been disbursing €20,000 a day to migrants, reaping fees on each transaction. “I’m making at least twice the money I was making last year,” said Mohammed Jafar, the Afghanistan-born owner of the branch. “I wouldn’t make this in any other country in Europe.”

Let’s see Hungary attract tourists after this.

• Refugees Face Tear Gas, Water Cannons As They Cut New Paths Through Europe (WaPo)

Refugees blazed a new pathway through Europe on Wednesday, with hundreds hiking through cornfields to reach welcoming Croatia even as others faced tear gas and water cannons from Hungarian police determined to turn them away. The contrasting scenes along the Serbian border highlighted both the make-or-break resolve of the asylum seekers and the growing friction facing Europe, which has failed to create a coordinated policy for the unprecedented influx of economic migrants and war refugees from the Middle East, Africa, Afghanistan and Pakistan. “We hit a stone and we flow around it”, said Arazak Dubal, 28, a computer programmer from Damascus, who had been on the road for 18 days.

He and his three companions reached Belgrade only to discover on Facebook and WhatsApp that the Hungarian border was closed to refugees. “So I went to Google Maps, and here we are”, said Dubal, huffing in the hot afternoon as he trudged across the farm fields. A two-hour drive to the northeast -along Serbia’s frontier with Hungary- the route was slammed shut. Just steps from Hungary, thousands of people spent the night in the wet grass on the Serbian side of the border. Hours later, hundreds tried to punch through the cordon of razor wire and riot police massed near the Serbian border town of Horgos. But they ran headlong into security forces≠ who unleashed tear gas and pepper spray to drive them back. Some refugees were swatted by batons and crumpled to the ground in pain.

“Open the door! the refugees yelled as they hurled water bottles and debris at riot police. Nearby, children screamed for their missing parents. Water cannons sprayed crowds on the Serbian side, forcing refugees to retreat to a squalid squatters camp that took root just after Hungary closed the border Tuesday. There were no major injuries, but some refugees were treated by Serbian authorities for respiratory problems from the tear gas and at least one migrant had a leg injury, AP reported. It was the first major clash between security force and migrants since police used stun grenades to stop refugees from crossing into Macedonia from Greece almost a month ago “We fled wars and violence and did not expect such brutality and inhumane treatment in Europe”, said Amir Hassan, who was drenched from a water cannon and tried to wash tear gas from his eyes, according to AP.

“Turkey is hosting approximately 2 million refugees..”

• Turkey Threatens To Oust Refugees Camped Near Greek Border (Guardian)

Turkish authorities have announced that hundreds of refugees who have set up camp on a main road at Edirne near the Greek border will be forcibly removed in three days if they refuse to leave. Many others are holding out at Istanbul’s main bus station in the hope of reaching northern Europe by land rather than risk the perilous sea journey. Bus services from the main terminal in Istanbul to cities on the Greek and Bulgarian borders were suspended last week, prompting several hundred refugees, most of them Syrians, to take to the road in an attempt to reach the European Union on foot. In the small green spaces around the bus terminal, some refugees have set up camp, with families trying to shelter smaller children against the sun with blankets and jackets.

Renas, 25, a Syrian-Kurdish construction worker from Qamishli, said he had no other hope than trying to reach Europe to claim asylum. “We are running away from a war and from the oppression of [Syrian president] Bashar [al-Assad]. There is nothing in Syria anymore, no jobs, no life, no future. In Turkey life is very difficult, because we are not allowed to work and there are no jobs here.” Turkey is hosting approximately 2 million refugees, the largest such population in the world. But increasingly difficult living and working conditions, as well as the impossibility of claiming asylum in the country, has led a growing number of people to try to reach Europe via smugglers’ routes.

Renas said he did not want to risk the dangerous journey by sea. “I have several relatives who drowned on their way to Greece,” Renas said. “These boats are nothing but floating death traps, they are not safe at all.” On Tuesday at least 22 people drowned off the Turkish coast after their boat capsized. Most refugees have resorted to paying smugglers to take them from the Turkish coast to Greek islands after authorities cracked down on the routes from Turkey to Greece and Bulgaria via the land borders.

All together now!

• Bulgaria Sends Troops To Guard Border With Turkey (Reuters)

Bulgaria is sending more soldiers to strengthen controls along its border with Turkey and avoid a refugee influx that has overwhelmed its neighbours, Defense Minister Nikolay Nenchev said on Wednesday. “There is a change in the situation in the past few days and it is hard to predict where the refugee wave will head…so we are standing ready,” Nenchev told public BNR radio. Fifty soldiers have been sent to the border and a further 160 could be deployed by the end of Thursday. The Bulgarian army could send up to 1,000 troops to back up border police if needed, he added.

Bulgaria took the measures after reports that hundreds of mostly Syrian refugees have spent the night in the open near the Turkish border with Greece, which is also very close to Bulgarian-Turkish border. Bulgaria is a member of the European Union but not the border-free Schengen Area. About 660 migrants have tried to cross the Bulgarian-Turkish border in the past 25 hours but have returned voluntarily after they had seen that the border was well-guarded, the chief secretary of the interior ministry Georgi Kostov, told reporters. Bulgaria is a member of the European Union but not the border-free Schengen Area.

“.. the maximum allowed for new arrivals. ..”

• The German Town Offering Refugees Work For €1 An Hour (Bloomberg)

Anas Al-Asadi spent three months and €6,000 making his way from his home in Damascus to Germany, braving the frigid waters of the Mediterranean aboard leaky, overcrowded ships on three separate occasions, culminating in a rescue by the Italian Coast Guard and finally a bus across the Alps. For the next four months, he was bored stiff. Then the 26-year-old got a job through a municipal program in Pfungstadt, a German town 25 miles south of Frankfurt, where he landed in February. The work wasn’t exactly challenging for Al-Asadi, who had been an attorney in Syria, and it certainly wasn’t well paid. His employer was a local youth club, since private companies are barred from hiring people without work permits, and he earned just €1 per hour, the maximum allowed for new arrivals.

But he says even simply vacuuming and sorting library books helped him better understand German culture and forced him to learn the language. “I was just sitting there sleeping, eating, doing nothing,” said Al-Asadi, who has since gotten asylum and just started working as a waiter in a local cafe. “I asked if I could do something – anything.” The town of 24,000 is home to more than 100 refugees seeking to start the formal asylum process and 50 others who have been granted residency, with more sure to come. The best way to integrate them, local officials say, is to help them find work, even if it’s odd jobs at community centers.

2 pm EDT.

• Fed Decision-Day Guide: Zero Hour for Moves on Rates, Dot Plot (Bloomberg)

Here’s what to look for when the Federal Open Market Committee releases its policy statement along with quarterly economic projections at 2 p.m. Thursday in Washington, and Federal Reserve Chair Janet Yellen holds a press conference at 2:30 p.m. he FOMC will weigh the impact on the U.S. outlook from slowing growth overseas and falling stock prices, as committee members determine whether to end almost seven years of near-zero interest rates. Economists are close to evenly divided on the outcome, with 59 of 113 surveyed by Bloomberg expecting the Fed to stand pat “It is a very finely balanced question,” said Jonathan Wright, a professor at Johns Hopkins University in Baltimore and a former economist at the central bank’s Division of Monetary Affairs. “It is close to a 50-50 call.”

While economic data have been “pretty compelling,” investors are skeptical the FOMC will want to move in the face of recent financial turbulence, said Stephen Stanley at Amherst Pierpont Securities. The FOMC’s forecasts of the benchmark fed funds rate, revealed in dot-filled charts representing each official’s projections, may suggest a more gradual pace of tightening over the next few years than was suggested in June, said Michael Hanson at Bank of America. “The most important thing investors will try to ascertain is the pace of hikes going forward,” he said. “Yellen has emphasized that it is not liftoff that matters but it is the pace of tightening and we will get some additional information on that.”

New tricks, never tested, eyes wide shut and costing trillions.

• QE’s Cost: Fed Exit May Hit Economy Faster Than in Past Cycles (Bloomberg)

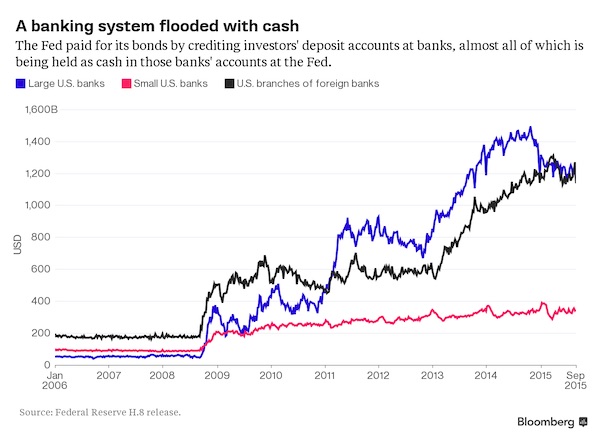

Yellen and her colleagues on the Federal Open Market Committee wrap up a two-day meeting on Thursday to debate whether to increase the benchmark federal funds rate, which they have held near zero since late 2008. If and when they do move, it won’t be like before, and they’ll be using new tools to lift rates higher. In the past, the central bank kept the fed funds rate at or near the target chosen by policy makers by injecting or draining bank reserves from the system via the New York Fed’s trading desk. The amounts of cash involved were small and the Fed was pretty good at hitting its desired rate. Not anymore. Three rounds of so-called quantitative easing from 2008 to 2014, in which the Fed bought bonds to support the economy, has swamped banks with cash –deposited with them by investors who sold bonds to the Fed.

That added $2.6 trillion of reserves in excess of requirements to banks’ accounts held at the Fed. It also boosted the size of the Fed’s own balance sheet to $4.5 trillion, a five-fold increase from pre-crisis levels. [..] With so much cash and little need for banks to borrow in the fed funds market, the Fed has lost the ability to lift the funds rate in the way that it did before the crisis. It has also decided for now against selling the bonds back to investors, which would shrink its own balance sheet and extinguish the excess reserves. Instead, Fed officials designed new tools to help the central bank raise rates without reducing its balance sheet, which it hopes to slowly shrink over years by letting the bonds it now holds mature, without reinvestment. Officials say they expect to phase out reinvestments sometime after liftoff.

Their main innovation, an overnight reverse repurchase agreement facility, is a powerful solution, but heavy usage may cause problems for banks trying to comply with new regulations installed in the wake of the financial crisis, said Zoltan Pozsar at Credit Suisse. The facility promises to drain reserves from the banks by encouraging investors to withdraw the deposits created when they sold bonds to the Fed, and place the cash in money-market mutual funds. Through overnight reverse repos, the Fed can borrow the cash from money funds at a specified rate and post securities as collateral, unwinding the trades the next day. In effect, the Fed will be borrowing back the money it created to buy the bonds while cutting out the middlemen in the banking system.

No doubt there. But is that so bad?

• World Bank Fears ‘Perfect Storm’ As Fed Weighs First Rate Hike Since 2008 (AFP)

The U.S. Federal Reserve opened a two-day meeting Wednesday to weigh a historic interest rate increase amid calls for it to move gingerly as world economic growth slows. The World Bank has warned developing economies to prepare for more capital and currency market turmoil while the OECD urged the Fed to move slowly and make its policy plans clear, whatever it decides. Most analysts saw the Fed again putting off the long-awaited increase to the benchmark federal funds rate, which has been locked at 0-0.25% since the 2008 crisis, giving the world a massive supply of cheap dollars. While U.S. growth has been strong, still-weak inflation and the recent China-driven turmoil in global markets “most likely mean that the FOMC will leave rates unchanged at this week’s meeting,” said Harm Bandholz of UniCredit.

The Fed has not raised rates in more than nine years, and what would probably amount to an increase of 0.25 percentage point would represent a momentous break with the extraordinary crisis stance it has adopted since the 2008-2009 recession. It would begin what is expected to be a slow series of rate hikes toward a “normal” monetary policy stance of around 3% in the next two years. But it would also make the dollar more expensive and hike borrowing costs for developing economies around the world. The policy-setting Federal Open Market Committee, led by Fed Chairwoman Janet Yellen, will announce a decision at 1800 GMT Thursday. Yellen will then address the media, with analysts saying her justification will be as crucial to markets as the decision itself.

Zero faith in Beijing left. This could get very ugly very fast.

• China Stocks Sink in Late Trade With Volatility at 18-Year High (Bloomberg)

China’s stocks sank in the last 30 minutes of trading in thin volumes as traders tested the limits of state support amid the biggest price swings since 1997. The Shanghai Composite Index slid 2.1% to 3,086.60 at the close, wiping out an advance of as much as 1.7%, as material and drug companies slumped. The benchmark gauge jumped 4.9% on Wednesday in a last-hour rally – the hallmark of state-backed fund buying – after falling dropped 6.1% in the first two days of the week. Volatility is surging and turnover is slumping on concern government intervention will fail to shore up the world’s second-largest stock market amid signs of a deeper economic slowdown.

Price swings have been exacerbated by state investigations into market manipulation as well as the Federal Reserve’s interest-rate meeting this week. “The market is becoming increasingly volatile as state support has caused confusion to the market and investors,” said Li Jingyuan, head of securities investment at Shanghai Zhaoyi Asset Management. “Information on state buying isn’t transparent and it seems that the national team doesn’t have a clear strategy and tactics. So you see a volatile market as investors don’t follow state buying.”

Abenomics’ third arrow turns out to be a downgrade.

• Japan Rating Cut by S&P as Abe Falls Short of Early Promise (Bloomberg)

Standard & Poor’s cut Japan’s long-term credit rating one level to A+, saying it sees little chance of the Abe government’s strategy turning around the poor outlook for economic growth and inflation over the next few years. The move comes just a day after the Bank of Japan refrained from boosting record asset purchases, betting there will be a resumption in growth and inflation. That’s left the onus on Prime Minister Shinzo Abe and his Cabinet to consider a fiscal stimulus package to boost what evidence indicates is a lackluster recovery in the second half of the year so far. “We believe that the government’s economic revival strategy – dubbed “Abenomics” – will not be able to reverse this deterioration in the next two to three years,” S&P said in a statement. “Economic support for Japan’s sovereign creditworthiness has continued to weaken.”

Japan’s problems are mounting, with inflation near zero, the economy contracting last quarter and debt rising as the population ages. The IMF estimates public debt will increase to about 247% of gross domestic product next year. Japan’s sovereign debt yield and bond risk have stayed low as the Bank of Japan pushes on with its unprecedented asset purchases. The benchmark 10-year government bond yield was at 0.37% on Wednesday, after touching a record low of 0.195% in January. Credit-default swaps insuring Japan’s sovereign notes have dropped 30 basis points this year to 37 basis points, according to data provider CMA. “The government’s fiscal reform plan released in June lacked details and specifics, making it look unreliable on how to ensure fiscal sustainability,” said Masaki Kuwahara at Nomura in Tokyo, who said the downgrade wasn’t a surprise after a cut by Moody’s in December.

“Today’s downgrade is a message that the government will need to have a more credible fiscal reform plan.” Toshihiro Uomoto, a credit strategist at Nomura, said the risk now is that overseas investors will take a more critical view of Abenomics. “Japan is trying to escape from deflation, but it’s not succeeding,” he said. “The perception is that the Bank of Japan’s policy isn’t having as much of an impact as it was originally aiming for.” Japan is now rated lower than China and South Korea – two of its key economic rivals – by S&P. South Korea was lifted one level to AA- on Tuesday, with S&P citing the nation’s sound fiscal position and relatively strong economic performance.

Take out the zombie capital and restructure. Only way forward.

• Goldman Sees 15 Years of Weak Crude as $20 U.S Oil Looms (Bloomberg)

A glut of crude may keep oil prices low for the next 15 years, according to Goldman Sachs. There’s less than a 50% chance that prices will drop to $20 a barrel, most likely when refineries shut in October or March for maintenance, Jeffrey Currie, head of commodities research at the bank, said in an interview in Lake Louise, Alberta. Goldman’s long-term forecast for crude is at $50 a barrel, he said. Goldman cut its crude forecasts earlier this month, saying the global surplus of oil is bigger than it previously thought and that failure to reduce production fast enough may require prices to fall near $20 a barrel to clear the glut. Prices may touch that level when stockpiles are filled to capacity, forcing producers in some areas to cut output, Currie said Wednesday.

“When we think of the longer term oil price, yes we put it at $50 a barrel,” he said. “However the risks are to the downside given what’s happening in the other commodity markets and the macro markets more broadly.” Lower iron ore, copper and steel prices as well as weaker currencies in commodity-producing countries have reduced costs for oil companies, according to Currie. The world is shifting from an “investment phase” of a 30-year commodity cycle to an “exploitation phase,” with shale fields as an important source of output, he said.

Rest of the world will keep pumping all out.

• Shale Oil’s Retreat Threatens to Leave US Short on Natural Gas (Bloomberg)

The retrenchment in drilling for U.S. oil is threatening to leave a different market short: natural gas. “The impacts of oil rig counts extend beyond oil: the outlook for U.S. natural gas is critically dependent on the outcome of this balancing act in U.S. oil rigs,” Anthony Yuen, a strategist at Citigroup Inc. in New York, said in a report to clients Wednesday. “If the oil market remains oversupplied and oil-rig counts fall, the decline in associated gas production would leave the market short of gas.” Associated gas is the gas that comes out of oil wells along with the crude. Supplies of this byproduct from fields including the Bakken formation in North Dakota and the Eagle Ford in Texas may fall by about 1 billion cubic feet a day next year as drillers idle rigs in response to the collapse in oil prices, Yuen said.

That’s about 7% of U.S. residential gas demand. The U.S. Energy Information Administration has already forecast that shale gas production will drop in October for the fourth straight month, a record streak of declines. U.S. oil has lost half its value in the past year amid a worldwide glut of crude. Drillers have responded by sidelining almost 60% of the country’s oil rigs since Oct. 10. Crude producers in the lower 48 states may have to keep the number of working rigs low for a while longer to balance the global market, Yuen said. A recovery in the rig count may “exacerbate the current oversupplied environment” and weaken prices, he said.

Back 100 years?!

• Macquarie: Emerging Markets Not Facing 1997-Style Crisis, But Worse (Bloomberg)

If the 1997 Asian financial crisis was a heart attack for emerging markets, the current situation is akin to chronic cardiovascular disease, according to Macquarie analysts led by Viktor Shvets and Chetan Seth. In 1997, speculative attacks against the Thai baht forced the country to float and devalue its currency in a move that was swiftly followed by the Philippines, Malaysia, Singapore, and Indonesia. Then came a massive decline in Hong Kong’s stock market that led to losses in markets around the globe. While parallels exist between 1997 and the current emerging market selloff (notably in the form of a stronger dollar, which makes it more expensive for emerging-market countries to finance their debts, plus lower commodity prices and slowing trade), the Macquarie analysts reckon the current situation might actually be worse.

Instead of sharp heart attack (a la 1997), it is far more likely that EM economies and markets would face an extended period that can be best described as a “chronic disease”, with limited (if any) cures or exits, punctuated by occasional significant flare-ups (short of an outright heart attack). In many ways it is likely to be a far more painful and insidious process. In the meantime, any signs of significant strain (either at a country or corporate level) could easily freeze up the emerging market universe.

The crux of their argument is that despite the difficulties of 1997, its effects were mitigated by rising global leverage, liquidity, and trade shortly thereafter. This time around, those factors might not be there.

[A c]ombination of excessively loose monetary policies (particularly post 2000 bursting of dot-com bubble) and China’s integration into global trade systems has enabled both EMs and DMs to recover quickly. This does not describe the environment facing EMs and DMs over the next five to ten years. The combination of long-term structural shifts (primarily driven by the grinding deflationary progress of the Third Industrial Revolution, which first became apparent in early 1990s but matured into a global phenomenon over the last decade), is aggravated by the more recent impact of overleveraging and associated overcapacity.

“If you are at the top of the list in terms of dependence on China and your economy is not well diversified, there are a bunch of negative things which can fall like dominoes..”

• The African Nations Most Exposed to China’s Slump (Bloomberg)

China’s slowdown is rippling across Africa and these three nations are the most exposed, relying on demand from the Asian economy for almost half their exports: Republic of Congo, Angola and Mauritania. Oil accounts for the bulk of Angola’s and Congo’s exports, damaging their prospects after crude prices plunged 55% since the beginning of June last year to below $50 a barrel. The price of iron ore, which makes up more than 40% of Mauritania’s exports, has dropped by almost a third in the past year. The three nations each shipped more than 45% of their exports in 2014 to China, data from the IMF shows. “For countries like Angola, which basically only has one commodity, there is a huge knock when prices fall and less oil is being exported to China,” Christie Viljoen at NKC African Economics, said.

“It’s a case of when things are good, it’s really good, but when it turns bad, it’s really bad.” Angola, Africa’s second-largest oil producer after Nigeria, has been forced to devalue its currency twice since June and has slashed its budget by a quarter following a slump in revenue. Congo’s fiscal deficit almost doubled to 8.5% of gross domestic product in 2014 from the previous year and in May Finance Minister Gilbert Ondongo cut $500 million of spending from the 2015 budget to bring it down to $4.5 billion. Reliance on a single commodity and exposure to one country for the bulk of exports is a double-whammy. China’s slowdown means weaker currencies and higher import prices for these African nations, which in turn feeds into more pressure on their exchange rates and a run down of central bank reserves, said Viljoen.

“If you are at the top of the list in terms of dependence on China and your economy is not well diversified, there are a bunch of negative things which can fall like dominoes,” he said. While South Africa is the continent’s single biggest exporter to China – with shipments totaling $45 billion in 2014 – its exports are more diversified and destined to a wider range of countries. China buys 37% of South Africa’s goods, followed by the European Union at 20%. Commodities such as gold, platinum and iron ore still make up the bulk of exports at just over half, though vehicle shipments have grown in importance to reach 13% of the total, according to data from the South African Revenue Service.

Ambrose is confused.

• Jeremy Corbyn’s QE For The People Is Exactly What The World May Soon Need (AEP)

There are many good reasons to gasp at Jeremy’s Corbyn’s planned assault on capital, but his enthusiasm for “People’s QE” is not one of them. Overt monetary financing of deficits – the technical term – is exactly what the world will need if the global economy tips into another recession with interest rates already at zero and debt ratios stretched to historic extremes. Governments that do not have such a contingency plan in place to combat a potential deflationary shock from East Asia should be hauled before their respective parliaments to account for their complacency. HSBC’s chief economist, Stephen King, argues such drastic measures may be our last resort in a “Titanic” world with few lifeboats left, if anything goes wrong. He is not alone in the City of London.

“A pervasive sense that the financial elites pulled a blinder – while austerity is for little people – explains in part why Mr Corbyn has suddenly stormed into the limelight, and why the US socialist Bernie Sanders has so upset the Democratic primaries” Jeremy Lawson, from Standard Life, gave his blessing to radical action this week, arguing central banks should be willing to fund fiscal stimulus directly, and even inject money “directly into household bank accounts” if need be. Mr Corbyn’s ideas are a variant of “helicopter money”, the term coined by Milton Friedman, the doyen of monetary orthodoxy, lest we forget. Friedman did not, of course, mean that banknotes should be dropped from the sky, though they could be in extremis, but rather that central banks have the means to create money to fund tax cuts, or to cover state spending, until the economy comes back to life.

We cannot revert to plain vanilla forms of quantitative easing at this stage. The various rounds of QE by the US Federal Reserve and the Bank of England after the Lehman crisis were assuredly better than nothing. They averted a depression. But little more can be extracted from pulling down long-term interest rates by a few more basis points. The trade-off between risk and reward has, in any case, turned negative. Much of the money has leaked into asset booms, greatly enriching the “haves”, with a painfully slow trickle-down to the rest of society. A pervasive sense that the financial elites pulled a blinder – while austerity is for little people – explains in part why Mr Corbyn has suddenly stormed into the limelight, and why the US socialist Bernie Sanders has so upset the Democratic primaries.

This is not a criticism of the Anglo-Saxon central banks. The public would not have accepted avant-garde QE or helicopter money at the time. The Fed’s Ben Bernanke faced impeachment calls by hard-liners in Congress even as it was. He did what was humanly possible. Yet if we have to do QE again – and right now the US and the UK are preparing to tighten, so it is not imminent – it would surely be better to inject the money directly into the veins of the real economy.

Journalists from BBC, El Pais, Die Zeit, RT and more. In total nearly 400 individuals from France, Greece, Israel, Spain, Italy, USA, Russia, Poland, Switzerland, Germany, the UK and several other countries..

• Ukraine Bans Journalists Who ‘Threaten National Interests’ From Country (Guardian)

President Petro Poroshenko has banned two BBC correspondents from Ukraine along with many Russian journalists and public figures. The long-serving BBC Moscow correspondent Steve Rosenberg and producer Emma Wells have been barred from entering the country, according to a list published on the presidential website on Wednesday. The decree says those listed were banned for one year for being a “threat to national interests” or promoting “terrorist activities”. BBC cameraman Anton Chicherov was also banned, along with Spanish journalists Antonio Pampliega and Ángel Sastre, who went missing, presumed kidnapped, in Syria in July. The list targeted people involved in Russia’s 2014 annexation of Crimea and the aggression in eastern Ukraine, Poroshenko said, referring to the conflict with Russia-backed rebels that has continued in certain hotspots this year despite a February ceasefire.

Andrew Roy, the BBC’s foreign editor, said: “This is a shameful attack on media freedom. These sanctions are completely inappropriate and inexplicable measures to take against BBC journalists who are reporting the situation in Ukraine impartially and objectively and we call on the Ukrainian government to remove their names from this list immediately.’ The reason for the BBC correspondents’ ban was not clear, but media coverage of the conflict with the rebels – whom the authorities and local media often call “terrorists” – has been a sensitive subject. Russian television has covered the Ukrainian crisis in a negative light, frequently referring to the new Kiev government as a “fascist junta”, while international media has focused on civilian casualties and the use of cluster munitions in populated areas by both sides.

One moment of clarity.

• New Zealand Blocks Farm Purchase By Chinese Firm (BBC)

New Zealand’s government has blocked the $56m (£36m) purchase of a local farm by Chinese firm Shanghai Pengxin. The government said it was not satisfied that the sale of the Lochinver farm would be of substantial benefit to the country, which is a key requirement for a big land purchase. The surprise move comes after the body that oversees bids for sensitive assets in New Zealand had approved the sale. There have been growing concerns about foreign land ownership in New Zealand. Those fears were stoked after Shanghai Pengxin New Zealand, which is a unit of the Chinese parent firm Shanghai Pengxin, bought 16 dairy farms in the country in 2011. China is New Zealand’s biggest market for many dairy and meat products. Dairy products are also New Zealand’s biggest export.

The Chinese firm said in a statement that it was “surprised and extremely disappointed with the decision and will be considering our options”. The 13,800-hectare Lochinver farm is located in North Island and is used to breed sheep, as well as cattle for beef and dairy products. The Chinese government has encouraged its companies to look to overseas markets to meet the demands of its growing consumer class. Stevenson Group, the company selling the farm, said it was also disappointed by the outcome after a 14-month process. “We are unclear as to why this property is different to the many others that have been approved through the Overseas Investment Office process, given the obvious benefits both to the farm and to Stevenson Group,” it said in a statement.

El Niño.

• Look Out New Zealand, Here Comes Another Act of God (Bloomberg)

As if a sharp fall in the price of milk, New Zealand’s biggest export, wasn’t bad enough, the country is now bracing for a summer drought that could further hurt farmers and raise the risk of recession. The most severe El Nino weather pattern in at least 18 years is brewing and set to bring dry winds and below-average rainfall to the South Pacific nation in the months ahead. That will play havoc with dairy farmers and other agricultural producers that together account for a third of New Zealand’s export earnings. While no economists are yet forecasting a recession, central bank Governor Graeme Wheeler last week said if the El Nino is severe and continues into the middle of 2016, a contraction could be the result. The National Institute of Water & Atmospheric Research says soil moisture levels are already falling in eastern regions and there is an elevated risk of drought later in the summer amid signs the weather event may be the worst since 1998.

New Zealand’s economy, while among the world’s most developed, is particularly vulnerable to nature turning against it. The country suffered its most recent recession in 2010 after an earthquake struck the city of Christchurch, while the two previous economic contractions in 2008 and 1998 coincided with severe droughts and slumps in financial market sentiment. Agriculture and food processing industries make up about 9% of the nation’s GDP, making the economy sensitive to climate swings and global demand. “Over history, to get into recession we need to have multiple shocks,” said Nathan Penny, an economist at ASB Bank Ltd. in Auckland. “A drought makes us vulnerable, and if we got a drought plus say a shock from China then that would make a recession quite possible.”

Home › Forums › Debt Rattle September 17 2015