Esther Bubley Greyhound bus driver off duty, Columbus, Ohio Sep 1943

Given recent developments in Ukraine, and the accompanying PR, spin and accusations, the whole by now familiar shebang, I’m sure you would expect me to address the Kiyv vs Moscow vs the land of the brave issue today. Unfortunately, there are more important issues to talk about today.

Suffice it for me to say that the west is losing, and can therefore be expected to grab onto ever more desperate handles as we progress. Nothing new here: nothing proven, but plenty insinuated. We really should stop relying on our own news channels, for Ukraine, and for the economy, but those of you who’ve visited the Automatic Earth before, know that. And know why.

One prediction as per Ukraine: Angela Merkel will make sure Ukraine won’t be a member of NATO. Or she’s going to regret it something awful. My bet is she’s too smart to let things meander that far and too long.

What I do think should stand out from all of what we’ve seen recently is that there’s not a single news source in the Anglo Saxon world, or in what I read in the German, French and Dutch press, that’s even remotely trustworthy. And that’s still, no matter how long this has been going on, a pretty scary conclusion to draw.

The more important issues of the day for us are those that bubble under the surface. And maybe that’s not a coincidence. Maybe, just maybe, the whole warmongering thing serves to take your eyes of the failing economies in Europe and the US. And Japan.

I’m sure many people wonder why the Fed would cut QE and raise interest rates at the very moment Tokyo and Brussels are either preparing to or thinking about launch(ing) more stimulus, not less. You might think that US unemployment numbers, and GDP data, are behind the decisions, but then those are merely fabrications dutifully repeated by the news/politics system.

The US economy is in just as poor a shape as all other formerly rich economies are. And raising rates now risks blowing up very large segments of the global economy. Such as emerging economies, western mortgage holders, and all the millions in Europe and the US who’ve had to switch from well-paid jobs to a burger flipping standard of living. They may make stats look sort of OK (Mary’s got a job!), but both the people and the stats will topple over en masse when interest rates rise.

Why then should Janet Yellen raise those rates regardless? It’s very simple, and I don’t see why or how everybody has missed out on this, and how the vast majority still are.

Because anything and everything the Fed has done since Wall Street caused the crisis, and well before (ask Alan Greenspan), has been about protecting Wall Street. And protecting Wall Street, or rather enhancing Wall Street’s profits, is exactly why Janet Yellen is about to raise US interest rates.

Not that I think it’s necessarily a bad move, ultra low rates have been a scourge on our economies for far too long – and they have been around only because Wall Street could profit from them -, but because the act of raising them is once more being executed solely to benefit the TBTF banks. Certainly not to benefit the American people, millions more of whom will be forced out of their homes when the Fed funds rate moves to 3% or 4%, or bend over backwards just to stay put.

Don’t count on Yellen, or the rest of the Fed crew, to take that into account, though. That’s not what they do. That’s not their MO. They’re not there for you. The whole storyline about the central bank looking out for the American people, for full employment and price stability, is just that: a storyline. No different from the one about how America is busy saving Kiev from Putin: a convenient storyboard that lures in enough people to stand on its own.

Reality resides in for instance this Philip Van Doorn article for MarketWatch:

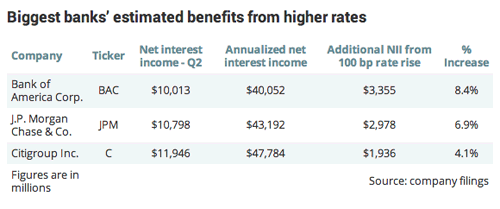

Big US Banks Prepare To Make Even More Money

An expected rise in interest rates over the next year will help the largest U.S. banks earn billions of dollars in additional net interest income, setting up their cheap stocks for what could be a stellar run. [..]

The Federal Reserve has kept the short-term federal funds rate locked in a range of zero to 0.25% since late 2008, in an effort to increase loan demand and jump-start the economy. This policy and the “QE3” bond purchases that will end this year seem to have worked, with the U.S. economy expanding at a 4% annual rate during the second quarter and continuing to add over 200,000 jobs a month. But the debate at the Federal Reserve has now shifted to the timing of interest rate increases. Most economists expect the federal funds rate to begin climbing in the second half of 2015, but it could well happen sooner than that.

For most banks, the extended period of low interest rates has become quite a drag on earnings.

Net interest margins – the spread between the average yield on loans and investments and the average cost for deposits and borrowings – are still being squeezed, since banks realized the bulk of the benefit of very low interest rates years ago, while their assets continue to reprice downward.

A 1% rise (from zero) in interest rates will grow BoA profits by 8.4%. That’s all you need to know, right there. What else do you need? How about a 3% rise? Low rates have brought down bank earnings for a couple years, and they’ve all bled that cashcow dry by now. The next big thing for Wall Street will by higher rates. Which they can pass on to you, Joe and Jill Main Street. Make sure you have your checkbooks ready.

When rates are low, banks can borrow on the cheap. But they can’t charge you high rates either. They’ve now borrowed all they want, and can, at zero percent (there’s a limit to profits even there). And the banks want to move to 3-4-5+%, so they can squeeze their customers for the difference.

The Fed is only too happy to comply. And it will use the argument of an improving US economy to do so. Because (some of) the – handpicked – stats say there’s improvement. Yellen is still dutifully hesitating, because they all know there really is no great US economy that would justify a rate hike, but all the pieces are in place.

And that’s why US interest rates will go up. And create chaos in global markets. And push millions of Americans and Europeans into servitude. It’s because the banks want it. Because they stand to profit greatly from the ensuing mayhem.

• Eurozone Inflation Hits 5-Year-Low of 0.3% (CNBC)

Eurozone inflation continued to fall in August, boosting expectations that the ECB will try bolster the region’s economy by announcing further stimulus measures – perhaps as early as next week. Consumer prices rose by just 0.3% year-on-year in August, according to official figures released by Eurostat Friday, meeting expectations but marking a fresh five-year low. This is down from 0.4% in July, and is significantly below the central bank’s target of just below 2%. Separate data revealed that the rate of unemployment in the eurozone remained stubbornly high in July, at 11.5%, unchanged from June. The inflation data come at a key time for the ECB, just days ahead of its next policy meeting on Thursday. ECB President Mario Draghi hinted at further stimulus measures in a speech in Jackson Hole last week, as economic data for the euro zone continue to surprise on the downside. The closely-watched composite Purchasing Managers’ Index – which measures business activity in the euro zone – slipped in August, coming in below forecasts.

In addition, official figures revealed that economic growth in the region was stagnant in the second quarter, with GDP flat, below analysts’ expectations. Concerns about the region’s economic strength led the ECB unveil a host of measures at its June meeting designed to give the euro zone’s recovery a boost. Now, a growing number of economists expect the ECB to announce further easing on Thursday, with some arguing that a bond-buying – QE – program will be announced in the coming months. Riccardo Barbieri, chief European economist at Mizuho International, said August’s inflation print “isn’t a game changer” because the ECB will have expected this figure. “I don’t think it puts them under huge pressure to announce something stunning immediately, but they’re obviously under pressure to do more,” he told CNBC after the data were released. “Ultimately, they have to move to QE, and this may well happen before the end of the year.” He added that he expects the central bank to announce a program to buy asset-backed securities on Thursday.

Germnay says no QE.

• Schaeuble Sees Draghi’s Instruments for Growth Exhausted (Bloomberg)

The European Central Bank has run out of ways to help the euro area, putting the burden on governments to spur growth without running excessive deficits, German Finance Minister Wolfgang Schaeuble said. In an interview with Bloomberg Television at the Medef business leaders’ conference near Paris, Schaeuble said he agrees “100%” with ECB President Mario Draghi’s appeals for governments in the 18-country currency union to complement monetary policy with “structural reforms” to boost competitiveness and overcome the legacy of Europe’s debt crisis. “Monetary policy can only buy time,” Schaeuble said in the interview yesterday. “Liquidity in markets is not too low, it’s even too high. Therefore I think monetary policy has come to the end of its instruments and therefore what we urgently need is investments, regaining confidence by investors, by markets, by consumers.”

Schaeuble’s comments reflect the mainstream view in Chancellor Angela Merkel’s coalition and Europe’s biggest economy as policy makers debate how to boost growth and Draghi signals the euro area may need more monetary stimulus. French Prime Minister Manuel Valls urged the ECB on Aug. 27 to use all means at its disposal to lift inflation to its target level. Euro-area economic confidence fell more than forecast, Spanish consumer prices dropped the most in five years and German unemployment unexpectedly rose yesterday, giving Draghi possible arguments to deliver quantitative easing. “I don’t think ECB monetary policy has the instruments to fight deflation, to be quite frank,” Schaeuble said. Domestic demand is driving German growth “because we have high confidence of consumers, investors.”

I just love that line.

• Wall Street Has Become A Self-Licking Ice Cream Cone (WolfStreet)

With all this enthusiasm for stocks, you’d think there’d be some volume, some serious buying, to back it up. But yesterday, the day when the S&P 500 snuggled up to 2000, it was the lightest non-holiday volume day since, gosh – someone did the math – October 2006. I asked a Street technician about the low volume advance and the pattern in recent years for the market to rise on low volume and fall on high volume. The first rule I learned about this biz in 1978 was VID: volume indicates direction. But no longer. High volume has become a “contrarian indicator,” the street technician explained. It’s a “sign of stress or a crisis.” It’s the New Normal, one of many anomalies. But we have remarkably little interest in analysis to learn why this is so. Something has changed, but we don’t yet see what or how. Low volume has another name: lack of liquidity. When a few buyers emerge, stocks rise because there aren’t many sellers.

That’s what lack of liquidity does on the way up. But when investors click the sell-button one too many times, there might be a shortage of buyers. Selling into an illiquid market is something even the Fed is fretting about. And it’s not like the world is swimming in peace dividends, or anything. Wars, civil wars, and potential wars are brewing around the world. China’s economy, which is desperately dependent on housing and infrastructure construction, is facing local mini-rebellions, as the prices of unsold homes get whacked by 25% or more, thus wiping out the investment of those hapless souls who’d bought a few days or weeks earlier. The sector is taking down steelmakers and other industries. The Eurozone seems to be reentering a recession. The second quarter in Germany was terrible, Italy’s entire “recovery” was a sham, and other Eurozone countries are teetering as well.

In the US, construction and sales of new homes, a big contributor to GDP, are getting bogged down in prices that have moved out of reach. Automakers have to resort to heavy discounting to bring down their inventories and move the iron, and it’s cutting into transaction prices and revenues. Big tech companies, the high-growth darlings of yesteryear, are laying off tens of thousands of people…. Economists would have plenty to talk about, but no one wants to hear it. The fundamentals – whatever they may be – no longer matter. The Fed has surgically removed them from the markets, and thus from consideration. What everyone wants to hear is the reassurance that stocks will continue to soar, regardless. And without interruption.

Japan keeps on sinking, and will for a long time.

• Abegeddon: Japan Spending Plunges, Unemployment At 9-Month High (Zero Hedge)

Just when you thought it couldn’t get any worse… In a veritable deluge of data from Japan tonight, there is – simply put – no silver lining. First, Japan’s jobless rate unexpectedly jumped to 3.8% – its highest since Nov 2013 (despite the highest job-to-applicant ratio in 22 years). Then, household spending re-collapsed 5.9% for the 4th month in a row (showingh no sign of post-tax-hike-recovery). Industrial Production was up next and dramatically missed expectations with a mere 0.2% rebound after last month’s plunge (-0.9% YoY – worst in 13 months), quickly followed by a 0.5% drop in Japanes retail trade MoM (missing hope for a 0.3% gain). That’s good news, right? Means moar QQE, right? Wrong! Japanese CPI came hot at 3.4% YoY with energy costs and electronic goods ‘hyperinflating’ at 8.8% and 9.1% respectively. As Goldman’s chief Japan economist warns, “the BOJ doesn’t have another bazooka,” adding that “The window for reform may already have been half closed.” We’re gonna need another arrow, Abe!

Boomers have all refinanced when the going was good.

• Boomer Wealth Depressed by Mortgages Poses US Spending Risk (Bloomberg)

Mortgage-burning parties in the U.S. may be going the way of home milk deliveries and polyester leisure suits. A growing number of homeowners are reaching retirement age still owing money on their houses. The share of Americans 65 and older with mortgage debt rose to 30% in 2011 from 22% in 2001, according to a May analysis by the Consumer Financial Protection Bureau based on the latest available figures. Loan balances also increased, with the median amount owed climbing to $79,000 from $43,400 after adjusting for inflation, the data showed. “There were old-fashioned beliefs probably 30 years ago” that included “you should pay off your house before you retire,” said Olivia Mitchell, executive director of the Pension Research Council at the University of Pennsylvania’s Wharton School in Philadelphia. “This is no longer the case.”

The increase in mortgage debt may influence labor-force dynamics as some older Americans find they’re unable to completely retire, needing extra cash to keep up monthly payments. It also diminishes home equity and wealth, making these households more susceptible to swings in the economy and curbing spending on things such as vacations and visits to grandchildren. “When they are hit with a financial downturn or an unexpected cost, they often are in a position where they don’t have the ability to recoup whatever losses they may have suffered,” said Stacy Canan, the deputy assistant director of the CFPB’s Office for Older Americans in Washington. Because a larger portion of income has to go to paying a mortgage, “there has to really be a dialing back of almost all other expenses.”

Until you hear a big bang.

• Bond Yields: Even Lower for Even Longer (WSJ)

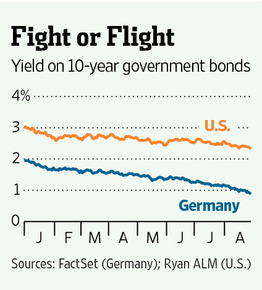

It has been a one-way street in global bond markets this year: Yields just keep on falling. There seems to be little in the cards to reverse this trend. But investors should still think carefully before embracing it. German 10-year yields stand at just 0.88% and have fallen more than a%age point this year; two-year yields are negative. That is at least understandable: Euro-zone growth and inflation are at worryingly low levels. But elsewhere, falling yields are questioning some of the market’s basic assumptions about the relationship between economic data and bond prices. In the U.S., where second-quarter growth ran at a 4.2% annualized pace and the Federal Reserve has steadily cut back its bond purchases, the 10-year Treasury yield has fallen to 2.32%, down about 0.7%age point this year. And in the U.K., where growth has boomed and two of the Bank of England’s monetary-policy makers have started voting for an increase, 10-year gilts yield 2.36%, down from just over 3%.

There are several factors at work. Investors might normally expect the vast and liquid U.S. Treasury market to set the tone for global yields. But Europe appears to be in the driver’s seat for two reasons. The first is speculation that the European Central Bank will be forced into adopting quantitative easing, providing a further flood of liquidity. The second is that investors appear focused on relative rather than absolute value. Thus a decline in German yields makes U.S. bonds look cheap; U.S. yields get dragged lower. This could go further: Royal Bank of Scotland thinks 10-year German bund yields could hit 0.65%. Meanwhile, geopolitical risk is running high. The Middle East is in turmoil. The crisis in Ukraine has deepened rather than receded. That leads to both a flight into haven bonds as well as concerns about spillover effects on Europe in the case of Ukraine.

But Kiev just wants to fight.

• Russia Urges Ukraine To Store More Gas For Winter, Offers Discount (Reuters)

Russia’s energy minister Alexander Novak said on Friday that Ukraine should pump as much as 10 billion cubic metres into its gas storage facilities or else it faces shortages. He said this should be done by Oct.15 when the winter season starts, and that Ukraine has stockpiled up to 16 bcm of gas already. Novak also said that Moscow is ready to apply retroactively a $100 discount per 1,000 cubic metres of Russian gas to Ukraine.

• Russia To Restart Gas Supplies, If Ukraine Repays $2 Billion Debt (FG)

Russia is ready to resume natural gas supplies to Ukraine, if Kiev repays its $2 billion debt, Russian Energy Minister Alexander Novak said on Friday. Novak made this statement after talks with EU Energy Commissioner Guenther Oettinger who had arrived in Moscow on Friday to try to find a solution to the Russia-Ukraine gas price dispute. The Russian energy minister said this figure included Ukraine’s $1.4 billion debt for Russian natural gas deliveries to the ex-Soviet republic in 2013 and partial repayment of the gas debt accumulated from April. The Russian energy minister also said Russia was prepared to offer Ukraine a gas price discount of $100 per 1,000 cubic meters, which would not breach the country’s contractual obligations and would not contradict Russia’s position in an international arbitration tribunal as this offer was not a corporate discount. “We are prepared to offer this discount not only for the winter period but even for a year or for a year and a half,” Novak said.

Russia raised the gas price for Ukraine from $268.5 to $485.5 per 1,000 cubic meters from April 2014. Ukraine has said it will not pay for Russian natural gas supplies at such a high price. After Russia and Ukraine failed to reach a compromise on the gas issue, Naftogaz and Gazprom filed mutual claims to the Stockholm Arbitration Tribunal. The gas price for Ukraine has increased, in particular, by $100 per 1,000 cubic meters since April 1, 2014 after Russia denounced the 2010 Kharkov accords on extending the lease of the Russian Black Sea Fleet’s base in Crimea in exchange for a gas price discount. The accords were denounced after the Black Sea peninsula joined Russia in the spring of 2014. Russia also offered Kiev the second discount as part of an anti-crisis aid package for Ukraine in November 2013 but scrapped it from April 1, 2014 over Ukraine’s failure to repay its debts for Russian natural gas supplies.

Crucial: Merkel get what Merkal wants.

• From Minsk To Wales, Germany Is The Key (Pepe Escobar)

The road to the Minsk summit this past Tuesday began to be paved when German Chancellor Angela Merkel talked to ARD public TV after her brief visit to Kiev on Saturday. Merkel emphasized, “A solution must be found to the Ukraine crisis that does not hurt Russia.” She added that “There must be dialogue. There can only be a political solution. There won’t be a military solution to this conflict.” Merkel talked about “decentralization” of Ukraine, a definitive deal on gas prices, Ukraine-Russia trade, and even hinted Ukraine is free to join the Russia-promoted Eurasian Union (the EU would never make a “huge conflict” out of it). Exit sanctions; enter sound proposals. She could not have been more explicit; “We [Germany] want to have good trade relations with Russia as well. We want reasonable relations with Russia. We are depending on one another and there are so many other conflicts in the world where we should work together, so I hope we can make progress”.

The short translation for all this is there won’t be a Nulandistan (after neo-con Victoria ‘F**k the EU’ Nuland), remote-controlled by Washington, and fully financed by the EU. In the real world, what Germany says, the EU follows. Geopolitically, this also means a huge setback for Washington’s obsessive containment and encirclement of Russia, proceeding in parallel to the ‘pivot to Asia’ (containment and encirclement of China). Ukraine’s economy – now under disaster capitalism intervention – is… well, a disaster. It’s way beyond recession, now in deep depression. Any forthcoming IMF funds serve to pay outstanding bills and feed the (losing) creaking military machine; Kiev is fighting no less than Ukraine’s industrial heartland. Not to mention that the conditions attached to the IMF’s ‘structural adjustment’ are bleeding Ukrainians dry.

Taxes – and budget cuts – are up. The currency, the hryvnya, has plunged 40% since early 2014. The banking system is a joke. The notion that the EU will pay Ukraine’s humongous bills is a myth. Germany (which runs the EU) wants a deal. Fast. The reason is very simple. Germany is growing only 1.5% in 2014. Why? Because the Washington-propelled sanction hysteria is hurting German business. Merkel finally got the message. Or at least seems to have. The first stage towards a lasting deal is energy. This Friday, there’s a key meeting between Russian and EU energy officials in Moscow. And then, later next week, it will be Russian, EU and Ukrainian officials. The EU’s energy commissioner, Gunther Oettinger, who was in Minsk, wants an interim deal to make sure Russian gas flows through Ukraine to Europe in winter. General Winter, once again, wins any war. Here, essentially, we have the EU – not Russia – telling Ukrainian President Petro Poroshenko to stuff his (losing) ‘strategy’ of slow-motion ethnic cleansing of eastern Ukraine.

Orlov does the explaining for me.

• Propaganda And The Lack Thereof (Dmitry Orlov)

With regard to the goings-on in Ukraine, I have heard quite a few European and American voices piping in, saying that, yes, Washington and Kiev are fabricating an entirely fictional version of events for propaganda purposes, but then so are the Russians. They appear to assume that if their corporate media is infested with mendacious, incompetent buffoons who are only too happy to repeat the party line, then the Russians must be same or worse. The reality is quite different. While there is a virtual news blackout with regard to Ukraine in the West, with little being shown beyond pictures of talking heads in Washington and Kiev, the media coverage in Russia is relentless, with daily bulletins describing troop movements, up-to-date maps of the conflict zones, and lots of eye-witness testimony, commentary and analysis.

There is also a lively rumor mill on Russian and international social networks, which I tend to disregard because it’s mostly just that: rumor. In this environment, those who would attempt to fabricate a fictional narrative, as the officials in Washington and Kiev attempt to do, do not survive very long. There is a great deal to say on the subject, but here I want to limit myself to rectifying some really, really basic misconceptions that Washington has attempted to impose on you via its various corporate media mouthpieces.

1. They would like you to think that there is a Russian invasion in the East of Ukraine. What’s actually happening is a civil war between the government of Western Ukraine (which no longer rules the east in any definable way) and the Russian population of Eastern Ukraine. Ukraine has been falling apart for decades—ever since independence. The eventual break-up was inevitable, but the catalyst for it was the military overthrow of Ukraine’s legitimate government and its replacement with cadres hand-picked in Washington.

• Kiev Protesters Demand Ouster Of Ukrainian President, Officials (RT)

Hundreds of people have gathered in front of the Ukrainian Defense Ministry in Kiev, demanding resignation of President Petro Poroshenko and the defense minister over the poor handling of the military operation in the southeast. The demonstrators, many of whom were mothers and wives of the soldiers involved in the fighting in the Donetsk and Lugansk Regions, have blocked traffic at one of the capital’s arterial roads, the Vozdukhoflotsky Boulevard. They called on the army to urgently send reinforcements, including tanks and other heavy military vehicles, to the city of Ilovaysk in the Donetsk Region. This strategic town was retaken by the self-defense forces after several days of fighting on Wednesday, which led to the encirclement of a large group of Kiev’s troops. The protesters also insisted on the resignation of defense minister Valery Geletey and all other top commanders of Kiev’s so-called “anti-terrorist operation” in southeast Ukraine.

After several hours outside the Defense Ministry, the demonstrators moved toward the presidential administration building. The protesters said that they would remain on the streets until their demands were met by the authorities. Several hours later, the traffic on the Ukrainian capital’s main street, Khreshchatyk, was also paralyzed by demonstrators chanting: “Kiev, rise up!” According to the Itar-Tass news agency, they urged all Kiev residents to join their protest, including recently elected mayor and former boxing world champion Vitaly Klitschko. The demands at Khreshchatyk were similar – to impeach President Poroshenko and calling for the resignation of the country’s top military officials.

• OSCE: ‘No Russian troops in Ukraine’ (RT)

The OSCE was told there was no Russian presence spotted across the Ukraine border, refuting Thursday’s claims that a full-scale invasion was underway. Both the Ukrainian monitoring team head and Russia’s representative have given a firm ‘no.’ The chorus of allegations about Russia’s military invasion of Ukraine had President Poroshenko calling for an emergency meeting of the country’s security and defense council, while Prime Minister Yatsenyuk on Thursday called for a Russian asset freeze. No actual evidence has been given either by either foreign governments or the media, apart from claims that photographs exist that someone had “seen.”

“I have made a decision to cancel my working visit to the Republic of Turkey due to sharp aggravation of the situation in Donetsk region, particularly in Amvrosiivka and Starobeshevo, as Russian troops were brought into Ukraine,” Petro Poroshenko said in a statement on his website. The Russian representative to the OSCE Andrey Kelin, meanwhile, has given a firm response to the allegations, saying that “we have said that no Russian involvement has been spotted, there are no soldiers or equipment present. “Accusations relating to convoys of armored personnel carriers have been heard during the past week and the week before that,” he said. “All of them were proven false back then, and are being proven false again now.”

• Putin Urges Ukraine Militants to open Humanitarian Corridor (IANS)

Russian President Vladimir Putin Friday urged militants in southeastern Ukraine to open a humanitarian corridor for Ukrainian soldiers to allow them to get out of the combat areas. “I am calling on forces to open a humanitarian corridor for Ukrainian soldiers in order to avoid senseless casualties, enable them to get out of the combat areas, reunite with their families and to provide urgent medical aid,” the presidential address released by the Kremlin press service said. The militants have succeeded in cutting short Kiev’s military operation, “which has already resulted in tremendous casualties among civilians”, Putin said.

“Russia is ready and will continue to provide humanitarian aid for the Ukrainian people suffering from a humanitarian disaster,” he added. He urged the Kiev authorities “to immediately abandon combat actions, cease fire, and sit down at the negotiating table together with representatives of Ukraine’s eastern regions in order to settle, exclusively in a peaceful way, all the problems that have piled up.” The conflict between government troops and pro-Russian militants has killed more than 2,000 people in eastern and southeastern Ukraine, with thousands of others displaced.

• Separatists Say Will Allow ‘Trapped’ Ukrainian Forces To Withdraw (Reuters)

Pro-Moscow rebels fighting in Ukraine said on Friday they would comply with a request from the Kremlin and open up a ‘humanitarian corridor’ to allow the withdrawal of Ukrainian troops they have encircled. It was not clear how the government in Kiev would react to the offer, suggested first by Russian President Vladimir Putin, but the first word from the Ukrainian military was negative. It said in a statement that Putin’s call showed only that “these people (the separatists) are led and controlled directly from the Kremlin”. Kiev has accused Russian troops of illegally entering eastern Ukraine and, backed by its U.S. and European allies, has said it will fight to defend its soil. Russia stands accused of pushing troops and weapons into the former Soviet republic to shore up a separatist rebellion that a week ago appeared to be on its last legs. That development has sharply escalated the five-month conflict over eastern Ukraine.

In his late-night statement, released by the Kremlin, Putin adopted a softer tone, though without acknowledging that Russia’s military is involved in the conflict. “It is clear that the rebellion has achieved some serious successes in stopping the armed operation by Kiev,” Putin was quoted as saying in the statement. “I call on the militia forces to open a humanitarian corridor for encircled Ukraine servicemen in order to avoid pointless victims, to allow them to leave the fighting area without impediment, join their families … to provide urgent medical aid to those wounded as a result of the military operation.” Hours later, Alexander Zakharchenko, leader of the main rebel entity in eastern Ukraine, told a Russian television station his forces were ready to let the encircled Ukrainian troops pull out. He said though they would have to leave behind their heavy armoured vehicles and ammunition.

Let’s see it.

• Russia Urges US To Explain Advisors, Mercenaries In Ukraine (RT)

A statement calling for a ceasefire in eastern Ukraine was blocked at the UN Security Council under a completely frivolous pretext, Russia’s envoy to the UN Vitaly Churkin said, after a heated debate with Kiev again accusing Russia of full-scale invasion. “The Russian delegation’s proposal on declaration of a ceasefire was blocked under a frivolous pretext,” Churkin said after the emergency session of the UNSC meeting, Itar-Tass quotes. “The Security Council as a result of destructive efforts of a number of its members was unable to play its role in resolving the Ukrainian crisis.” During the meeting, the UN Security Council’s permanent representative of Lithuania Raymond Murmokayte stated that the draft document prepared by Russia does not highlight “some serious issues,” namely that anti-Kiev forces “hamper the provision of humanitarian aid on the part of Ukraine’s government.”

The Russian proposed text to the UN Security Council all expressed serious concerns about the deteriorating situation in south-eastern Ukraine, and called for “immediate and unconditional ceasefire” as well as the beginning of a dialogue “based on the Geneva Declaration of 17 April 2014 and the Joint Berlin Declaration of July 2, 2014.” The text also noted the need to “multiply efforts to provide humanitarian assistance to the population of the Donetsk and Lugansk regions of Ukraine.” While Kiev continues to blame Russia for violating its sovereignty and escalating violence in the south east of the country, Churkin during the emergency session insisted that the current escalation is a “direct consequence of a wreckers policy of Kiev which is conducting a war against its own people.”

US Permanent Representative to the United Nations Samantha Power also attacked Russia accusing it of repeated lies and insisting that it is a fact that Russia has moved troops, tanks and other armored vehicles into Ukraine. “One of the separatist leaders that Russia has armed and backed said openly that three or four thousand Russian soldiers have joined their cause. He was quick to clarify that these soldiers were on vacation. But a Russian soldier who chooses to fight in Ukraine on his summer break is still a Russian soldier. And the armored Russian military vehicle he drives there is not his personal car,” Power said, presenting her own case the Security Council members. The leader of Donetsk People’s Republic, indeed said that Russians are fighting along the people of Donbas – but they are all volunteers with a “heightened feeling of sorrow and human misfortune” who prefer spending their holidays among their brothers fighting for a good cause.”

Vitaly Churkin fired back at Power saying that nobody ever tried to hide the presence of Russian volunteers, urging Washington instead to explain what dozens of US advisers are doing in Kiev or tell how many mercenaries from private military companies are waging war in Ukraine. Russia’s permanent representative also called on Washington to “curb their geopolitical ambitions” and stop interfering in the affairs of sovereign states. “Then not only Russia’s neighbors, but also many other countries around the world will breathe a sigh of relief,” he said. Russia also demanded an end to “speculations around the Malaysian downed aircraft,” the investigation of which was also brought up during the emergency session that became the 24th meeting of the UN Security Council over Ukrainian crisis.

“So far, only Russia transparently and significantly contributed to the investigation of this tragedy. From the other side we hear only half-hints and no information,” said the diplomat, as Churkin once again urged Kiev to publish the recording of Ukrainian air traffic controllers that guided MH17 flight that went down in July. The Russian envoy stressed that Ukrainian authorities pushing forward with their military solution to the crisis under the support and the influence of a number of “well-known states.” “With support from and under the influence of a number of well-known states the Kiev authorities have torpedoed all political agreements on settling the crisis in Ukraine,” including the Geneva statement of April 17 and the Berlin declaration of July 2, Churkin said.

• Lavrov: No Proof Given For Allegations About Russian Troops In Ukraine (RT)

Russia’s only reaction to NATO accusations of interfering militarily in Ukraine will be a consistent position of putting an end to bloodshed and establish dialogue between warring parties in Ukraine, Russia’s FM said. No facts about Russian military being present on the territory of Ukraine have ever been presented, Sergey Lavrov pointed out, while speculation on the issue has been voiced repeatedly, he stressed. “It’s not the first time we’ve heard wild guesses, though facts have never been presented so far,” Lavrov said at a press conference in Moscow. “There have been reports about satellite imagery exposing Russian troop movements. They turned out to be images from videogames. The latest accusations happen to be much the same quality,” he said.

“We’ll react by remaining persistent in our policies to stay bloodshed and give a start to the nationwide dialogue and negotiations about the future of Ukraine, with participation of all Ukrainian regions and political forces, something that was agreed upon in Geneva back in April and in Berlin [in August], yet what is being so deliberately evaded by our Western partners now,” Lavrov said. Sergey Lavrov pointed out that the only means to decrease the number of casualties among the civilian population in Donetsk and Lugansk Regions is by self-defense militia pushing Ukrainian troops and National Guards out.

Sure, but in the 21st century?

• The Multi-Billion-Dollar Fall Of The House Of Espirito Santo (Reuters)

On June 9, with his 150-year-old Portuguese corporate dynasty close to collapse, patriarch Ricardo Espirito Santo Salgado made a desperate attempt to save it. Salgado signed two letters to Venezuela’s state oil company, which had bought $365 million in bonds from his family’s holding company. The holding company was in financial trouble. But the letters, according to copies seen by Reuters, assured the Venezuelans that their investment was safe. The “cartas-conforto” – letters of comfort – were written on the letterhead of Banco Espirito Santo, a large lender controlled by the family. They were co-signed by Salgado, who was both the bank’s chief executive and head of the family holding company. “Banco Espirito Santo guarantees … it will provide the necessary funds to allow reimbursement at maturity,” said the letters. There were problems, though: By promising that the bank stood behind the holding company’s debt, the letters ignored a directive from Portugal’s central bank that Salgado stop mixing the lender’s affairs with the family business.

The guarantees were also not recorded in the bank’s accounts at the time, which is required by Portuguese law. The following week, after intense pressure from regulators, Salgado resigned. Within a month, the holding company, Espirito Santo International, filed for bankruptcy, crumbling under €6.4 billion ($8.4 billion) in debt. In August, Banco Espirito Santo was rescued by the Portuguese state, after reporting €3.6 billion in losses. The two letters, whose existence was made public last month but whose details are revealed here for the first time, are a key part of an investigation into the spectacular fall of one of Europe’s most prominent family businesses. Portuguese regulators and prosecutors are examining them along with the bank’s accounts and other evidence to determine whether there was unlawful activity behind the fall of the Espirito Santo empire. So far, shareholders and investors in the family companies and Banco Espirito Santo have lost more than €10 billion, making this one of Europe’s biggest corporate collapses ever.

My main man Rubino.

• A World Without Fractional Reserve Banks and Central Planning (John Rubino)

Excerpted From The Money Bubble: What To Do Before It Pops by James Turk and John Rubino:

In a very real sense, it is fractional reserve banking and not money itself that is the root of so many of today’s evils. Whenever fractional reserves are permitted, the banking system – including the one that exists today throughout the world – comes to resemble a classic Ponzi scheme which can only function as long as most people don’t try to get at their money. Now, is this critique of the current monetary system just impotent ideological whining over something that, like the weather, can’t be changed? Or could fractional reserve banking and the resulting need for economic central planning actually be replaced by something better? Specifically, how could a banking system without fractional reserve lending accommodate depositors’ demand that their money be there when they want it and borrowers’ desire for 30-year mortgages which would tie up those deposits for decades? And could this market operate without the need for government oversight and management?

The answer to that last question is yes. A better financial system is possible, and here’s how it would work: First, today’s commercial banks would split into two types. “Banks of commerce” would take deposits and keep them safe for a fee, like the goldsmiths of old. “Banks of credit” would pay interest on deposits and lend out depositor money, but would have to match the duration of deposits with the duration of loans. Deposits that can be withdrawn anytime (a checking account for instance) could only be used to fund a loan which the bank can “call” on demand, while longer-term deposits (say a 5-year CD) would be matched to longer-term loans like a business term loan or 5-year mortgage. Really long-term loans like 30-year mortgages would be funded with deposits for which the bank would have to pay up in order to convince a depositor to part with his or her money for such a long time.

The resulting mortgage would carry a high enough rate to provide the bank with a small profit, which would make 30-year mortgages both expensive and hard to get. But the case can be made that they should be hard to get. Buying a house – or anything else that requires capital for extremely long periods – should require a hefty down payment, other liquid assets as collateral and a solid income stream. This coverage would give the bank the ability to foreclose and realize more than the value of the loan, which would protect its ability to repay its depositors, thus making depositors more willing to tie up their money for long periods. Such a society would be a lot less prone to excessive debt accumulation and inflation, bank runs would be far less frequent and government deposit insurance would be much less necessary. It would, in short, be a saner world in which individuals managed their own finances, saved with confidence and borrowed only for highly-productive uses, while two sharply-differentiated types of banks facilitated wealth protection and real wealth creation rather than paper trading.

But why should we care?

• Syrian Refugees Top 3 Million, Half Of All Syrians Displaced (Reuters)

Three million Syrian refugees will have registered in neighboring countries as of Friday, an exodus that began in March 2011 and shows no sign of abating, the United Nations said. The record figure is one million refugees more than a year ago, while a further 6.5 million are displaced within Syria, meaning that “almost half of all Syrians have now been forced to abandon their homes and flee for their lives”, it said. “The Syrian crisis has become the biggest humanitarian emergency of our era, yet the world is failing to meet the needs of refugees and the countries hosting them,” Antonio Guterres, U.N. High Commissioner for Refugees, said in a statement. The vast majority remain in neighboring countries, with the highest concentrations in Lebanon (1.14 million), Turkey (815,000) and Jordan (608,000), the UNHCR said. Some 215,000 refugees are in Iraq with the rest in Egypt and other countries.

In addition, the host governments estimate that hundreds of thousands more Syrians have sought sanctuary in their countries without formally registering, the agency said. Increasing numbers of families arrive in a shocking state, exhausted, scared and with their savings depleted, it said. “Most have been on the run for a year or more, fleeing from village to village before taking the final decision to leave.” “There are worrying signs too that the journey out of Syria is becoming tougher, with many people forced to pay bribes at armed checkpoints proliferating along the borders. Refugees crossing the desert into eastern Jordan are being forced to pay smugglers hefty sums (ranging from $100 per person or more) to take them to safety,” it added.

Years of smoke?

• Iceland Eruption Near Volcano Triggers Red Alert (BBC)

The Icelandic Met Office has raised its aviation warning level near the Bardarbunga volcano to red after an eruption began overnight. Scientists said a fissure eruption 1km (0.6 miles) long started in a lava field north of the Vatnajokull glacier. Civil protection officials said Icelandic Air Traffic Control had closed the airspace above the eruption up to a height of 5,000ft (1,500m). The volcano has been hit by several recent tremors. The fissure eruption took place between Dyngjujokull Glacier and the Askja caldera, a statement from the Department of Civil Protection said. The area is part of the Bardabunga system. “Scientists who have been at work close to the eruption monitor the event at a safe distance,” the statement added. “The Icelandic Met Office has raised the aviation colour code over the eruption site to red.” It added that no volcanic ash had so far been detected but a coast guard aircraft was due to take off later to survey the site.

Home › Forums › Debt Rattle Aug 29 2014: This Is Why The Fed Will Raise Interest Rates