Joel Baldwin Johnny Cash near the Arkansas farm where he grew up 1968

Yeah, no kidding, as if reports from the US weren’t bad enough, with soaring student debt – that drivers debtors out of the housing market-, collapsing mortgage originations, increasing household debt and slumping retail sales. But still, today, the major news comes from China once again. The government issued a batch of data overnight that shine yet another and clearer light on what is going wrong in the Chinese economy. The numbers are so ugly you wouldn’t want to feed them to your dog. Many sources picked up on this, and not everyone comes up with the exact same numbers – is it 24 or 27 months of inventory? – but we’ll put that down to journalists having to speed read. Let’s do a series, shall we? First up, Bloomberg:

China Central Bank Calls for Faster Home Lending in Slump

• Home sales fell 18% in April from the previous month, according to data from the National Bureau of Statistics. “

• Developers scaled back housing starts by 25% in the first quarter, the biggest reduction ever, according to Nomura.

• To lure buyers, China Vanke Co., the nation’s biggest developer by market value, dropped prices in Beijing, Hangzhou and Chengdu by as much as 15% since March, according to China Real Estate Information. Vanke and Poly Real Estate Group are allowing buyers to delay making down payments for as long as three years in Changsha, the capital of Hunan province, according to realtor Centaline Group. [..]

• More than 10 million homes sit empty in China, and the number could rise to 18 million within two to three years…

Then, Ambrose at the Telegraph:

China Reverts To Credit As Property Slump Threatens To Drag Down Economy

• New housing starts fell by 15% in April from a year earlier…

• Land sales fell by 20%, eating into government income. The Chinese state depends on land sales and property taxes to fund 39% of total revenues.

• “We really think this year is a tipping point for the industry,” Wang Yan, from Hong Kong brokers CLSA, told Caixin magazine. “From 2013 to 2020, we expect the sales volume of the country’s property market to shrink by 36%. They can keep on building but no one will buy.”

• Each attempt to rein in China’s $25 trillion credit bubble seems to trigger wider tremors, and soon has to be reversed.

• Wei Yao, from Société Générale, said the property sector makes up 20% of China’s economy directly, but the broader nexus is much larger. Financial links includes $2.5 trillion of bank mortgages and direct lending to developers; a further $1 trillion of shadow bank credit to builders; $2.3 trillion of corporate and local government borrowing “collateralised” on real estate or revenues from land use. “The aggregate exposure of China’s financial system to the property market is as much as 80% of GDP”.

• The risk is that several cities will face a controlled crash along the lines of Wenzhou, where prices have been falling non-stop for two years and have dropped 20%.

• The IMF says China is running a fiscal deficit of 10% of GDP once the land sales and taxes are stripped out. Zhiwei Zhang, from Nomura, said the latest loosening measures are not enough to stop the property slide, predicting two cuts in the reserve requirement ratio (RRR) for banks over the next two quarters. He warned that any such move will merely store up further problems.

• Nomura said the inventory of unsold properties in the smaller 3rd and 4th tier cities – which make up 67% of residential construction – has reached 27 months’ supply. The bank warned in a recent report that the property slump could lead to a “systemic crisis”. The Chinese state controls the banking system and has $3.9 trillion of foreign reserves that can be deployed in a crisis. The RRR is extremely high at 20% and can be slashed if necessary. A cut to 6%, the level in 1998, would inject $2 trillion in liquidity.

• Nomura said residential construction has jumped fivefold since 2000

• Nomura said migrant numbers have already halved from 12.5 million to 6.3 million over the last four years.

• The workforce contracted by 3.45 million in 2012 and another 2.27 million in 2013. China is already starting to look very much like Japan.

About the banks’ reserve requirement ratio: it seems high, certainly when compared to the west, but it’s a protection mechanism Beijing implemented, and not just to cool down markets: it serves to protect against both huge leverage ratio’s and bad debt levels blowing up in the face of the whole economy. Ironically, it thus protects the official system against the risks inherent in shadow banking, but it also invites the shadows in, who don’t have such reserve requirements. That’s perhaps China’s economic problem in a nutshell. Next, the Financial Times:

Property Sector Slowdown Adds To China Fears (FT)

• … the all-important real estate market saw sales fall 7.8% in renminbi terms in the first four months from the same period a year earlier.

• … in the first four months newly started construction projects fell 22.1% compared with a year earlier, according to government figures released on Tuesday.

• The scale of China’s building boom and the country’s reliance on infrastructure investment for growth is unprecedented. In just two years, from 2011 to 2012, China produced more cement than the US did in the entire 20th century,

• Moody’s Analytics estimates that the building, sale and outfitting of apartments accounted for 23% of Chinese gross domestic product last year. That is higher than in the US, Spain or Ireland at the peaks of their housing bubbles.

•… gold, silver and jewellery sales plummeted 30% in April from a year earlier.

That cement number is major league scary. Moving on to Tyler Durden:

“Quite Gloomy” Chinese Housing Market Completes “Head And Shoulders”

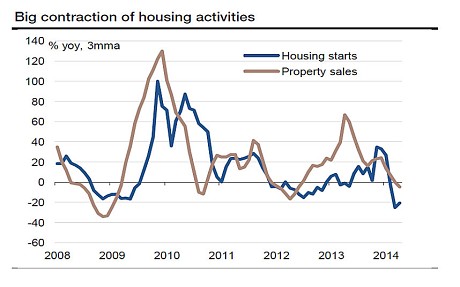

Here is what China reported overnight via SocGen: New starts contracted 15% yoy (vs. -21.9% yoy in March); property sales fell 14.3% yoy (vs. -7.5% yoy); and land sales (by area) plunged 20.5% yoy (vs. -16.9% yoy previously).

Combine that with the earlier quote: “From 2013 to 2020, we expect the sales volume of the country’s property market to shrink by 36%. They can keep on building but no one will buy“, and you’re painting an absolute horror scenario. Think about all the countries in the world who have been making billions on delivery of construction materials. Think about the millions of Chinese construction workers. And the millions of property owners who will see their homes drop in value. Plus the government, which receives 39% of total revenues from land sales and property taxes. You’re looking at, at the very least, a severe depression in China. Against the backdrop of a world that has a very hard time keeping up the pretense of recovery. The fall in property sales almost doubled from the previous month. And these numbers come from Beijing itself, known for its love of rosy glasses. And don’t forget that the entire industry is leveraged up to and beyond its ears, much has been built on the basis of 10% down as collateral, so a 10% drop may be enough to wipe out most collateral. Margin calls must already be the fastest growing “industry” in China, along with the local version of Vinnie the Kneecapper. More Financial Times:

This Time China’s Property Bubble Really Could Burst

• Chinese property is the most important sector in the global economy. It has been pivotal in the country’s economic development, provided lucrative business for industrial commodity producers from Perth to Peru, and been the backbone of the surge in world exports to China.

• At best, China is entering a deflationary phase at a time of global fragility.

• Property investment has grown to account for about 13% of GDP, roughly double the US share at the height of the bubble in 2007. Add related sectors, such as steel, cement and other construction materials, and the figure is closer to 16%.

• Inventories of unsold homes in Beijing are reported to have risen from seven to 12 months’ supply in the year to April. But when it comes to homes under construction and total sales, the bulk is in “tier two” cities, where the overhang of unsold homes has risen to about 15 months; and in tier three and four cities, where it is about 24 months.

Chinese property is the most important sector in the global economy. That’s quite a statement, and disputable – what about oil, or guns -, but there’s no doubt it’s big. Lots of countries will risk a recession of their own if a large part of exports to China, think wood, iron ore, aluminum, falls away. China’s been many a small country’s sugar daddy in the past two decades. That’s true too of course for the US and EU. And don’t let’s forget that China’s exports have fallen sharply as well so far this year. Or that Beijing has already blown a $25 trillion credit air balloon in just the past few years, and the shadow banks blew their own bubble straight on top of that. Nice on the way up, but nothing goes up forever. And things that are leveraged to the hilt, as in the entire Chinese economy, tend to fall of that hilt at a very rapid clip.

I’ve said it before, it might be a good idea for Washington to check into the origins of the Chinese “money” that buys up real estate and companies and entire African nations, but they’ll do no such thing because that would expose their own bubblicious balloons. I mean, when’s the last time you heard any US politician talk about China as a currency manipulator, and why do you think that is? So we, Jack and Jill Blow, will remain stuck where we are, forced to watch puppeteers and balloon traders buy up anything they want anywhere they want with credit conjured up out of a hatful of keystrokes, while we must work for every penny, if we’re even lucky enough to find a job that pays us pennies. It’s the price to pay for living in an artificial world.

I think it would be a big mistake to presume that a severe recession in China wouldn’t drag us down with it. And going through these numbers, which are just the latest batch in a long series – though the year is still young – that I’ve written about here, it gets harder by the day to see how China could possibly avoid such a recession. The Chinese economy has been set up to move like a huge ocean liner does: full speed ahead and steady as she goes, but that combined with the size means you got a ship loaded with inertia, which takes miles to change course, brake, reverse, do anything other than move straight ahead.

The Chinese leadership doesn’t have the tools to adapt to sudden and severe changes. But so far everyone seems to think they do. They themselves first of all. If you’ve made it to the top of what is supposed to provide absolute power over 1.3 billion people, you get to feel invincible, and you feel sure that being captain of a ship, no matter what size, is not an issue, even if you’ve never done it or trained for it. And they haven’t. They overestimate themselves, and their advisors, they have thought it would be like it is in the US, that all they had to do was model Washington and Wall Street, and it would be smooth sailing from there. They’re about to find out – they already are – that things don’t work that way, and so are we. An economy that in just two years uses the same amount of cement that the US used in the entire 20th century is not healthy, it’s dangerously bloated, and it can burst into smithereens at any moment.

“Vanke dropped prices in Beijing, Hangzhou and Chengdu by as much as 15% since March.”

• China Central Bank Calls for Faster Home Lending in Slump (Bloomberg)

China’s central bank called on the nation’s biggest lenders to accelerate the granting of mortgages, a sign that developers’ prices cuts and incentives alone won’t boost a slumping housing market and economy. The People’s Bank of China told 15 banks yesterday to “improve efficiency of service, give timely approval and distribution of mortgages to qualified buyers,” according to a statement posted on its website. It also urged lenders to give priority to families buying their first homes and strengthen their monitoring of credit risks. Premier Li Keqiang is seeking to put a floor under a slowdown in the world’s second-largest economy. The housing market has become a drag on growth as developers, facing a surplus of empty units and falling sales, put the brakes on new construction.

Home sales fell 18% in April from the previous month, according to data from the National Bureau of Statistics. “China’s property sector has started a correction and that will last this year,” Zhang Zhiwei, Hong Kong-based chief China economist at Nomura Holdings Inc., said. “More investors are more convinced than a couple of months ago that the sector is going downwards.” The Shanghai Stock Exchange Property Index, which tracks 24 developers listed on the city’s exchange, rose 0.5% as of 10:17 a.m. local time, trimming this year’s decline to 4.3%. China Vanke Co., the nation’s biggest developer by market value, climbed 1.3% to 7.63 yuan in Shenzhen trading, after jumping as much as 4%, the most since March 21.

Developers scaled back housing starts by 25% in the first quarter, the biggest reduction ever, according to Nomura. To lure buyers, Vanke dropped prices in Beijing, Hangzhou and Chengdu by as much as 15% since March, according to China Real Estate Information. Vanke and Poly Real Estate Group are allowing buyers to delay making down payments for as long as three years in Changsha, the capital of Hunan province, according to realtor Centaline Group. [..] More than 10 million homes sit empty in China, and the number could rise to 18 million within two to three years, Nicole Wong, Hong Kong-based head of property research at CLSA Ltd., said on May 12.

“From 2013 to 2020, we expect the sales volume of the country’s property market to shrink by 36%. They can keep on building but no one will buy.”

• China Reverts To Credit As Property Slump Threatens To Drag Down Economy (AEP)

China’s authorities are becoming increasingly nervous as the country’s property market flirts with full-blown bust, threatening to set off a sharp economic slowdown and a worrying erosion of tax revenues. New housing starts fell by 15% in April from a year earlier, with effects rippling through the steel and cement industries. The growth of industrial production slipped yet again to 8.7% and has been almost flat in recent months. Land sales fell by 20%, eating into government income. The Chinese state depends on land sales and property taxes to fund 39% of total revenues. “We really think this year is a tipping point for the industry,” Wang Yan, from Hong Kong brokers CLSA, told Caixin magazine. “From 2013 to 2020, we expect the sales volume of the country’s property market to shrink by 36%. They can keep on building but no one will buy.”

The Chinese central bank has ordered 15 commercial banks to boost loans to first-time buyers and “expedite the approval and disbursement of mortgage loans”, the latest sign that it is backing away from monetary tightening. The authorities are now in an analogous position to Western central banks following years of stimulus: reliant on an asset boom to keep growth going. Each attempt to rein in China’s $25 trillion credit bubble seems to trigger wider tremors, and soon has to be reversed.

Wei Yao, from Société Générale, said the property sector makes up 20% of China’s economy directly, but the broader nexus is much larger. Financial links includes $2.5 trillion of bank mortgages and direct lending to developers; a further $1 trillion of shadow bank credit to builders; $2.3 trillion of corporate and local government borrowing “collateralised” on real estate or revenues from land use. “The aggregate exposure of China’s financial system to the property market is as much as 80% of GDP. This is not a sector that can go wrong if China wants to avoid a hard landing,” she said. The risk is that several cities will face a controlled crash along the lines of Wenzhou, where prices have been falling non-stop for two years and have dropped 20%.

President Xi Jinping has made a strategic decision to pop the bubble before it spins further out of control, allowing bond defaults to instil market discipline. But the Communist party is in delicate position and may already be trapped. Reliance on “fair weather” land revenues to fund the budget is like the pattern in Ireland before its housing bubble burst. The IMF says China is running a fiscal deficit of 10% of GDP once the land sales and taxes are stripped out. Zhiwei Zhang, from Nomura, said the latest loosening measures are not enough to stop the property slide, predicting two cuts in the reserve requirement ratio (RRR) for banks over the next two quarters. He warned that any such move will merely store up further problems.

Nomura said the inventory of unsold properties in the smaller 3rd and 4th tier cities – which make up 67% of residential construction – has reached 27 months’ supply. The bank warned in a recent report that the property slump could lead to a “systemic crisis”. The Chinese state controls the banking system and has $3.9 trillion of foreign reserves that can be deployed in a crisis. The RRR is extremely high at 20% and can be slashed if necessary. A cut to 6%, the level in 1998, would inject $2 trillion in liquidity.

=>But reserve ratio is so high to protect from bad debt levels, high leverage

Nomura said residential construction has jumped fivefold since 2000 from 497m square metres to 2,596m last year. It is unclear whether fresh migrants will continue to pour into the cities and soak up supply. Nomura said migrant numbers have already halved from 12.5m to 6.3m over the last four years. What is certain is that China’s demographic profile is already changing the economic calculus. The workforce contracted by 3.45m in 2012 and another 2.27m in 2013. For better or worse, China is already starting to look very much like Japan.

“In just two years, from 2011 to 2012, China produced more cement than the US did in the entire 20th century …”

• Property Sector Slowdown Adds To China Fears (FT)

China’s economy is sputtering as evidence mounts that a nationwide property bubble is on the point of bursting. Virtually every indicator for economic growth in China turned down in April as the all-important real estate market saw sales fall 7.8% in renminbi terms in the first four months from the same period a year earlier. Investment in real estate is the single most important driver of the Chinese economy and a crucial factor in global commodity demand and pricing. But in the first four months newly started construction projects fell 22.1% compared with a year earlier, according to government figures released on Tuesday. The sustainability of the Chinese real estate market has become a concern for policy makers everywhere as they start to worry that a property crash in the world’s second-largest economy could ripple round the globe.

The scale of China’s building boom and the country’s reliance on infrastructure investment for growth is unprecedented. In just two years, from 2011 to 2012, China produced more cement than the US did in the entire 20th century, according to historical data from the US Geological Survey and China’s National Bureau of Statistics. In an indication of just how exposed China’s economy is to a property downturn, Moody’s Analytics estimates that the building, sale and outfitting of apartments accounted for 23% of Chinese gross domestic product last year. That is higher than in the US, Spain or Ireland at the peaks of their housing bubbles.

Trouble in Chinese property also has implications for the financial system, in particular the shadow banking sector, which has lent huge amounts to developers and relies on highly priced land for collateral. “Self-fulfilling expectations of falling house prices, financial difficulties among developers on the back of a highly leveraged economy with huge local government debt, and a fragile financial system with a large shadow banking sector, suggest the risks of a disorderly adjustment [in the Chinese economy] are real and rising,” said Barclays’ chief China economist, Jian Chang. Partly as a result of slumping real estate investment, growth in China’s industrial production, a measure that correlates closely with gross domestic product, slowed marginally to 8.7% from a year earlier in April. Retail sales growth also slowed from 12.2% expansion in March to 11.9% in April.

In a worrying sign for western luxury brands that have become more reliant on Chinese demand in recent years, gold, silver and jewellery sales plummeted 30% in April from a year earlier. Electricity production, a closely watched proxy for economic activity in China, grew at its slowest pace in nearly a year in April, up 4.4% from a year earlier, compared with 6.2% growth in March. In spite of much discussion of a “mini-stimulus” for China’s economy, Beijing has so far been reluctant to take strong actions to prop up growth.

• “Quite Gloomy” Chinese Housing Market Completes “Head And Shoulders” (Zero Hedge)

Here is what China reported overnight via SocGen: New starts contracted 15% yoy (vs. -21.9% yoy in March); property sales fell 14.3% yoy (vs. -7.5% yoy); and land sales (by area) plunged 20.5% yoy (vs. -16.9% yoy previously). Oops. It doesn’t take an Econ PhD to conclude that “the housing market situation has undoubtedly turned quite gloomy. There has been a constant news stream of falling property prices everywhere, even in the 1-tier cities. A number of local governments, as we expected, have started to ease policy locally, especially relaxation of the home-purchase restrictions.”

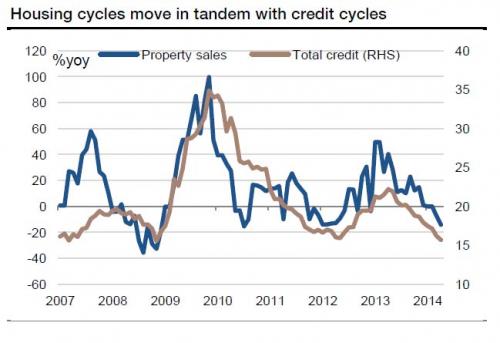

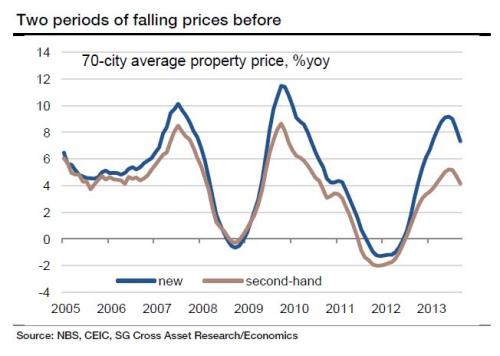

But nowhere is the contraction in this all important sector for China’s credit-driven bubble more visible than the following chart showing a very distinct, if somewhat mutated, head and shoulder formation in the average 70-city property price index. If and when the blue line intersects the X-axis for only the third time in history, watch out below.

SocGen’s take is less than rosy:

Since 2008, there have been two periods of falling housing prices across the board: H2 2008 and late 2011. Even tier 1 cities were not spared. However, the downturns were brief and shallow. In the midst of the Great Recession, price declines lasted for about six months and 14 out of the 70 cities tracked by the statistic bureau recorded cumulative price declines of over 5%. During the previous downturn between Q2 2011 and Q3 2012, property prices in most cities fell consecutively for no more than 10 months, and only 4 cities saw prices falling by more than 5%. The turning points in both cases coincided with the beginning of credit easing. The logic is simple: most Chinese households, especially first time buyers, still need to borrow to buy, despite the high savings ratio on average. And down-payments and mortgages account for 40% of developers’ investment capital.

Which brings us to the key issue – credit, or rather its sudden lack of availability.

The housing sector is very important to the Chinese economy. Its share in total output is easily 20%, if its pull on related upstream and downstream sectors in included. And its significance to the financial system is far beyond banks’ mortgages and direct lending to developers, which account for 14% (CNY 10.5tn) and 6.5% (CNY 4.9tn) of the loan book respectively. Developers’ borrowing from the shadow banking system could potentially amount to another CNY 5-7tn. Moreover, we estimate that over CNY 10tn of other types of corporate borrowing is collateralised on real estate and another CNY4-6tn borrowing by local governments for infrastructure investment is collateralised on future revenue from sales of land-use rights. Adding everything together, the aggregate exposure of China’s financial system to the property market is likely to be as much as 80% of GDP. Hence, this is not a sector that can go terribly wrong if China wants to avoid a hard landing.

• This Time China’s Property Bubble Really Could Burst (FT)

Chinese property is the most important sector in the global economy. It has been pivotal in the country’s economic development, provided lucrative business for industrial commodity producers from Perth to Peru, and been the backbone of the surge in world exports to China. In the past few years, predictions that the sector was about to implode at any moment have not been borne out – but now is the time for the world to pay attention. Property activity indicators have been trending lower since mid-2013, and the downturn in the sector now threatens to turn into a bust. At best, China is entering a deflationary phase at a time of global fragility. The default risks in the weakly regulated shadow banking sector – and the rapid rise in local government debt – are real, and property-related.

Yet the government and the central bank have tools to limit the short-term consequences; they have already deployed debt rollovers, bank bailouts and recapitalisations. The greater risk to China lies in the pervasive consequences of any property bust. Property investment has grown to account for about 13% of gross domestic product, roughly double the US share at the height of the bubble in 2007. Add related sectors, such as steel, cement and other construction materials, and the figure is closer to 16%. The broadly defined property sector accounts for about a third of fixed-asset investment, which Beijing is supposed to be subordinating to the target of economic rebalancing in favour of household consumption. It accounts for about a fifth of commercial bank loans but is used as collateral in at least two-fifths of total lending.

The booming property market, moreover, has produced bounteous revenues from land sales, which fuel much local and provincial government infrastructure spending. The reason things look different today is the realisation of chronic oversupply. As the property slowdown has kicked in, housing starts, completions and sales have turned markedly lower, especially outside the principal cities. Inventories of unsold homes in Beijing are reported to have risen from seven to 12 months’ supply in the year to April. But when it comes to homes under construction and total sales, the bulk is in “tier two” cities, where the overhang of unsold homes has risen to about 15 months; and in tier three and four cities, where it is about 24 months.

• Is China Loosening Its Grip On The Property Market? (CNBC)

The People’s Bank of China’s (PBOC) call on the nation’s major lenders to give priority to first-time home buyers when allocating credit marks a policy shift for the government that has been on a near-five-year tightening campaign to cool the market. “It’s clear that Beijing is concerned about the pace of cooling in the residential real estate market,” Dariusz Kowalczyk, senior economist and strategist at Credit Agricole told CNBC. “This is a very clear change in direction of policy – that’s why the equity market has reacted so positively,” he said. The Hang Seng Properties Index rose almost 2% on Wednesday – following news the central bank had asked commercial banks to speed up the process of granting of home loans and to set mortgage rates at reasonable levels late Tuesday.

Tight mortgages are a factor behind the property market slowdown this year as lenders have raised home loan rates for first-time buyers or delayed granting mortgages due to tighter liquidity. China’s home price inflation slowed to an eight-month low in March. Average new home prices in 70 major cities rose 7.7% on year, easing from the previous month’s 8.7% rise, according to Reuters’ calculations. Meantime, home sales in the four months ended April fell 9.9%, after slumping 7.7% in the first quarter. Economists read the PBOC’s move as a form of targeted policy easing to mitigate the decline in property sales.

“Credit is the most important driver of the property market – the policymakers have realized which lever they need to pull to arrest the downward trend,” said Wei Yao, China economist at Societe General. “However, they will be cautious in how much credit reacceleration they will allow,” she said. Zhiwei Zhang, chief China economist at Nomura believes these measures alone are not significant enough to turn around downward momentum in the property sector, and expects more easing measures, such as the removal of local resident purchase restrictions in tier 2 and 3 cities. A few local governments, including the eastern city of Tongling in Anhui province and Ningbo, the coastal city of eastern Zhejiang province, have loosened home purchase rules in recent weeks. Tongling, for instance, cut down-payment rates to 20% from 30% for certain buyers, Reuters reported, quoting the city government website.

• US Mortgage Originations Slam Shut, Student Loans Soar (Zero Hedge)

When the Fed releases its quarterly household credit report, the one item most focused on is the amount of mortgages outstanding and originated in the prior quarter, since courtesy of its monthly consumer credit updates we know that US households have largely given up charging their credit cards at the expense of non-revolving student and car loans. So here is the summary. First, the good news: courtesy of ZIRP mortgage defaults and discharges tumbled in Q1, resulting in an increase in total mortgage debt balances of $8.17 billion, or an increase of $116 billion in the quarter. Now, the bad news: the increase in total mortgage balances had nothing to do with a surge in mortgage demand.

Quite the contrary, as we have been reporting and as bank mortgage origination bankers have felt first hand, for whatever reason mortgage origination as a business has virtually slammed shut. The Fed confirmed as much when it reported just $332 billion in originations in Q1: well below the $452 billion in Q4, and certainly below the $577 billion a year ago. In other words, the only reason why total mortgage balances did increase is due to a slowdown in either prepayments and/or discharges, which represents as the simple difference between Q1 originations and the change in total mortgage outstanding, tumbled to just $216 billion – the lowest in the past decade! One can be certain that absent a pick up in originations the total mortgage balances are set to tumble in the coming quarter as even this one last final refuge of the “consumers are releveraging” crowd is smashed.

But that is not to say that consumers have no interest in increasing their debt load. Quite the contrary. Because when one excludes those two conventional methods of leveraging up, credit cards and mortgages, US households are on an epic spending spree funded by, what else, student loans. We have covered the topic of the student loan bubble extensively in the past so we won’t waste more digital ink on where it comes from or what it means for the troubled US consumer, suffice to report that according to the Fed, in Q1 total Federal student loans rose by another $31 billion to a record $1.11 trillion, and up a whopping $125 billion, or 12% from this time last year.

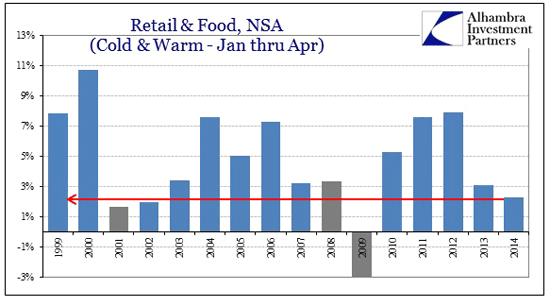

• Slumping US Retail Sales Mark Death of QE’s Promise and Premise (Alhambra)

Everywhere you look the average growth rate, smoothing out even the increase in volatility, remains very much the worst since 2009 (on the way down). If weather played any role in the recent descent, it must have been neutralized by the end of April. If it was simply households holding back spending, delaying purchases for more favorable temperatures, roads or perhaps more sunny dispositions and attitudes (who knows), the net between January and April should wash. In other words, March and April should have been a surge not just a respite.

So April’s figures did rebound from the earlier months, but there is no reason to believe that it was anything other than this monthly volatility – the ebb and flow of the economy. And now that we are well past the polar nonsenses, the cumulative balance of all these months is just plain bad. We are so far away from what might fairly and convincingly be called growth that recession is all that is left. Not only is 2014 running below 2013 (when the opposite was promised as unquestionable – remember QE3-4 chest-thumping just before taper became a common buzzword?), the growth rate is below every other recession year except 2009 (with autos boosting 2014 only slightly above 2001-02).

• US Household Debt Jumps For Third Straight Quarter (Reuters)

Americans racked up more debt in the first quarter, the third straight quarterly increase, thanks in large part to heftier mortgages, a survey by the Federal Reserve Bank of New York showed on Tuesday. The report on household debt and credit showed however that mortgage originations dropped to their lowest level since the third quarter of last year, which could buck the overall trend of growing confidence among U.S. consumers. Outstanding household debt rose by $129 billion from the previous quarter, boosted by a $116 billion jump in mortgage debt and smaller rises in student and auto loans, the report said. Total household indebtedness was $11.65 trillion, which is still 8.1% below the peak in the third quarter of 2008.

Since then, the U.S. economy has been plunged into a deep recession that for years caused Americans to tighten their belts. That trend has started to reverse in recent quarters, according to the New York Fed survey that draws from a nationally representative consumer credit sample. “We’ve observed household debt increase three quarters in a row and delinquency rates at their lowest levels since 2008,” Andy Haughwout, a New York Fed economist, said in the report, noting that “the direction of future mortgage originations will have an important implication on the household financial outlook.”

• Student Debt Holders Retreating From Housing Market (Bloomberg)

Student-loan borrowers retreated from home buying for the second year in a row, outpaced in the mortgage market by young people who aren’t saddled with college debt, according to a report. Among those ages 27 to 30, 22.3% of those without student debt had mortgages, one percentage point higher that those paying back college loans, the Federal Reserve Bank of New York said today in a study that accompanied its first-quarter report about consumer debt and credit. In 2011, a quarter of people in both groups had home loans, The decline in home-purchase ability for those with student loans is an example of education debt’s drag on the U.S economy. More than $1.1 trillion in education debt – taken out by students and their parents – is outstanding, according to the report.

The failure of young consumers to enter the housing market remains a puzzle, Meta Brown, Sydnee Caldwell and Sarah Sutherland wrote in the Liberty Street Economics blog. “Many factors could be contributing to this phenomenon, including growing student debt balances, limited access to credit, lowered expectations for future earnings, and perhaps even a cultural shift,” they wrote. [..] When compared with other types of consumer credit, student debt has the highest share of balances 90 or more days delinquent at 11%, according to the report. The rate fell from 11.5% in the previous quarter. The proportion represents all borrowers, even those in school and not expected to be paying on their loans. The default rate for federal student loan borrowers was 14.7% for the first three years that students are required to make payments, up from 13.4% the year before, according to the Education Department.

The hedge funds win, see Hedge Fund Titans Are Testing The Quality Of US Democracy, and will now be paid $30 billion in dividends on stocks they bought in “grey” markets while Fannie and Freddie were not being traded. As just 2 weeks ago, we saw this: Stress Test Reveals Fannie, Freddie Could Need Another $190 Billion .

• FHFA Reverses Efforts to Shrink Fannie Mae, Freddie Mac (Bloomberg)

The U.S. regulator overseeing Fannie Mae and Freddie Mac is assuming an increasingly pivotal role in the housing market as bipartisan efforts to wind down Fannie Mae and Freddie Mac are meeting resistance in the Senate. Melvin L. Watt, director of the Federal Housing Finance Agency, said yesterday that he thinks Congress needs to act to determine the companies’ future. Until then, Watt, who’s been running the agency since January, is shifting course to ensure Fannie Mae and Freddie Mac bolster the weakening housing market and aid troubled borrowers. “I don’t think it’s the FHFA’s role to contract the footprint of Fannie and Freddie,” Watt said during an appearance in Washington where he outlined his plans for the two companies.

The Senate Banking Committee is expected to vote tomorrow on a measure that would replace Fannie Mae and Freddie Mac with a government reinsurer of mortgage bonds that would suffer losses only after private capital was wiped out. The bill hasn’t won enough support from Democrats to gain a vote of the full Senate. Unless that backing materializes, legislative efforts to remake Fannie Mae and Freddie Mac won’t resume until next year. In the interim, Watt will determine the size and nature of the companies’ business. The former Democratic congressman from North Carolina was appointed to lead the FHFA by President Barack Obama. Watt replaced Acting Director Edward J. DeMarco, who had served at FHFA since the administration of President George W. Bush.

Reversing decisions made by DeMarco, Watt announced yesterday that FHFA will remove targets for reducing the companies’ mortgage-market footprint and keep current limits on the size of loans they buy. The companies, which have been under U.S. control since 2008, will also renew their focus on helping troubled borrowers, beginning with a program in Detroit that will offer deeper loan modifications, Watt said in his first public comments since taking over at FHFA. “Our overriding objective is to ensure that there is broad liquidity in the housing-finance market and to do so in a way that is safe and sound,” Watt said.

Never a shortage of Greater Fools.

• Like So 2000: Wall Street Pumps Crashed Internet Stocks (TPit)

To make momentum stocks fly, the promoters doll them up in newfangled metrics and “estimated adjusted future earnings per share,” or some such pro-forma nonsense, or even “adjusted earnings per share,” or earnings “ex-items,” which aren’t earnings at all, but fantasy numbers, though by now everyone is using them. And to heck with the old-fashioned metrics like revenues and actual earnings as reported under GAAP. On November 6, just before Twitter’s IPO – which was shrouded in even thicker than usual layers of hype, smoke and mirrors, and newfangled metrics – the SEC warned about newfangled metrics. They were designed, Chair Mary Jo White said, “to illustrate the size and growth” of these outfits that lacked outmoded results, such as actual profits, or even hope for actual profits.

She strenuously avoided mentioning Twitter by name, tough everyone knew that’s what she was talking about. She and her staff were particularly concerned that “the true meaning of the metric (or more importantly the link from metric to income and eventual profitability) may not be clear or even identified.” Wall Street ridiculed the warning, and Twitter soared to $74.73 by the end of the year. Now reality has set in. The SEC has proven its point. There are no actual GAAP earnings in Twitter’s foreseeable future. And the stock crashed 55% from its high. But what is a company worth to its shareholders if it cannot ever make any actual profits and simply eats up investor money?

Twitter is just the tip of the iceberg. Entire sectors have been demolished over the last few months. But the hype mongers on Wall Street are touting it as a buying opportunity, as if this ongoing fiasco were some kind of ephemeral dip, a unique opportunity to get in at the right price for long-term prosperity. In that spirit, Citigroup pumped internet stocks. So the FDN Internet Index fund is down 16.2% from its peak on March 5. Citi’s own large-cap Internet index is down 18%. But here it goes, Citigroup analyst Mark May in a note to clients:

We believe the recent pullback represents a particular opportunity among large cap Internet stocks, with multiples having retraced to levels not seen for more than two years, with no/little change in fundamentals, and with investment profiles that sync well with what portfolio managers are seeking in today’s market.

Citi’s clients are presumably not day-traders trying to take advantage of short-term swings, but portfolio managers trying to build and maintain wealth through prudent investment choices. Among his favorites: Facebook (-17.6% from its high), Google (-11.9% from its 52-week high), Amazon (-25.3%), AOL (-30.9%, so it’s “particularly oversold”), or even LinkedIn (-42.7%). These and hundreds of other momentum stocks have swooned while the Dow and the S&P 500 indices have set new highs. What will happen to these stocks when the Dow and the S&P 500 begin to swoon as well? And why would these stocks now suddenly be such great buys, after they’d been excellent buys all the way up, and at much higher prices, and then all the way down? Because analysts have a job to do: hype the stocks they’re assigned to hype.

• Are The Dollar’s Carry Trade Days Numbered? (CNBC)

Traders borrowing U.S. dollars to fund investments in other currencies should beware, with analysts expecting the greenback to strengthen and advising a shift to borrowing the euro instead. “U.S. rates and the U.S. dollar may get a pop from an expected jump in April inflation,” Barclays said Monday in a note titled “Carry on, but don’t fund with USDs.” Over the medium term, Barclays expects the U.S. inflation risks are to the upside, making it likely the greenback will continue to strengthen. Barclays expects the U.S. dollar index to rise 5% by year end, with a 7.3% rise over 12 months. A stronger U.S. dollar would dent the rationale for using the currency to fund carry trades, which is when investors borrow in a low-yielding currency, such as the yen or the U.S. dollar, to fund investments in higher yielding assets somewhere else.

A weakening currency is central to the carry trade since it means that investors have less to repay when they cash out of the trade.So far in the second quarter, the U.S. dollar carry trade hasn’t performed well, Barclays noted, with both high- and low-yielding currencies trading sideways against the greenback amid concerns about slowing Chinese growth and rising geopolitical risks, especially over the Russia-Ukraine conflict. Higher geopolitical risk typically causes the U.S. dollar to strengthen as investors seek safer havens. “A stronger U.S. dollar need not mean the carry is over, but with the ECB turning to policy easing, we see better funding opportunities in the euro,” it said.

Lock ’em up. EIther that, or lock up yourselves.

• US Seeking More Than $3.5 Billion From BNP Paribas (Bloomberg)

U.S. authorities are seeking more than $3.5 billion from BNP Paribas SA to resolve federal and state investigations into the lender’s dealings with sanctioned countries including Sudan and Iran, according to people familiar with the matter. The agreement, which could be the largest penalty for sanctions violations, is still being negotiated and the amount could fluctuate, said four people who asked not to be named because the discussions are private. U.S. prosecutors are also seeking a guilty plea from BNP, which said last month it may need more than the $1.1 billion it has set aside to settle the case. The agreement could come in the next month, the people said.

BNP is one of several banks negotiating multibillion-dollar settlements with U.S. prosecutors, who are trying to counter criticism that they’ve shied away from punishing financial institutions because of their size and influence on the economy. Prosecutors’ push for a guilty plea — part of the more aggressive approach — has raised regulatory concerns the punishment could disrupt financial markets. “It’s a very high fine and also a way for the bank to turn the page,” said Karim Bertoni, who helps manage $3.3 billion at de Pury Pictet Turrettini & Co. in Geneva. “Beyond that, we’re going into uncharted territory,” he said, referring to the impact of a guilty plea on the financial system. De Pury Pictet doesn’t disclose whether it holds BNP stock.

Not sure. The victims could be in unexpected places.

• Asian Countries Most At Risk Of A US Rate Hike (CNBC)

The wealthy economies of Singapore and Hong Kong are perhaps not the first that analysts associate with instability, but according to international research house Capital Economics, they`re the ones most likely to be burned by US Federal Reserve rate hikes. Most analysts expect the Fed will raise interest rates in mid-2015 once it has finished winding down its tapering program. With their domestic interest rates tied to the Fed, Daniel Martin, emerging markets economist at Capital Economics, said Singapore and Hong Kong are particularly vulnerable to such moves. “These countries are the only two countries that we cover that have the dual problems of rapid recent credit growth and a lack of exchange rate flexibility,” Martin told CNBC.

Singapore’s exchange rate is fixed to trade within a specified band, while the Hong Kong dollar is pegged to the greenback. According to Martin, because Singapore and Hong Kong’s exchange rates lack flexibility, their interest rates – which currently sit at 0.21% and 0.41% respectively – are at risk of spiking sharply in the event of a Fed funds rate hike, which could cause problems for overextended borrowers. “Borrowers in these countries have been used to very low interest rates for years, and the rise in interest rates over the next few years could catch them by surprise,” added Martin. Other economists agreed. Seng Wun Soon, regional economist at CIMB bank, said many Singapore households would be particularly vulnerable to Fed rate hikes, considering that 70% of housing loans are on floating rate plans.

With the cost of borrowing so cheap, both Singapore and Hong Kong`s property markets have seen unprecedented booms in recent years, leading many market watchers to speculate over potential bubbles. Singapore’s home prices climbed 60% between 2009 and mid-March, while Hong Kong’s property prices have more than doubled. Martin told CNBC the household sectors in these countries look vulnerable, especially as household debt is equivalent to almost 80% of gross domestic product (GDP) in Singapore, and 60% in Hong Kong.

“Of the two, it could be Hong Kong that has the greater trouble in the household sector, because its housing market looks very frothy. I think house prices are likely to fall in both economies as interest rates rise, but in Hong Kong the correction is likely to be quite large,” he added. But the corporate sector is even more at risk, Capital Economics warned, because corporates there have ramped up borrowing at an even faster pace. According to data from the International Monetary Fund, Singapore’s corporate-credit-to-GDP ratio was around 90% in 2013, compared with an average of 45% between 2004 and 2007. Hong Kong`s ratio stood at 120% last year, compared with an average of 80% between 2003 and 2007.

Yeah, let’s “help” people buy overpriced homes. great idea, Commonwealth.

• UK Not Alone In Seeing Pressure On House Prices (FT)

Double digit house price rises, an OECD warning that the market needs cooling, concern about housing affordability – sound familiar? But this is Australia, not the UK. It is a reminder that the UK is not alone in struggling with the combination of record low interest rates, a strengthening economy and changing demographics combining to put intense pressure on house prices. Nor is the picture unfamiliar for Mark Carney, Bank of England governor, whose home country, Canada, has also received an OECD warning on the need to reduce housing-related risks. Sydney and Toronto, like London, have seen an influx of foreign money pushing city prices substantially higher than the country as a whole.

Both Australia and Canada have mortgage guarantee schemes and showcase two options for exiting from this element of Help to Buy: privatise the operation entirely, like Australia, or set up a specific government body, while allowing some private operators as in Canada. Australia’s loan insurance book was privatised in 1997 and, while the private companies are heavily regulated, there is no government guarantee. In Canada, the government mortgage body still operates the majority of the market and the state provides a backstop guarantee for the two private sector players.

One concern for the UK scheme’s critics is whether it is inevitable that Help to Buy will become a permanent part of the market – with the government ultimately forced to step in if there is a crash. “The US federal mortgage agencies Fannie Mae and Freddie Mac were initially proposed as temporary programmes,” said Richard Batley of Lombard Street Research, the economic consultants. Canada has been at the forefront in using regulatory tools to try and prevent housing bubbles. There, lenders are prohibited from providing loans without insurance for ratios in excess of 80 per cent and this limit has been adjusted a number of times in attempts to cool the market. It has also acted to limit the maximum term of loans.

Oh Jeez … Does it have to be this obvious?

• Joe Biden’s Son Appointed To Board Of Largest Ukraine Gas Company (RT)

Hunter Biden, son of US VP Joe Biden, is joining the board of directors of Burisma Holdings, Ukraine’s largest private gas producer. The group has prospects in eastern Ukraine where civil war is threatened following the coup in Kiev. Biden will advise on “transparency, corporate governance and responsibility, international expansion and other priorities” to “contribute to the economy and benefit the people of Ukraine.” Joe Biden’s senior campaign adviser in 2004, financier Devon Archer, a business partner of Hunter Biden’s, also joined the Bursima board claiming it was like ‘Exxon in the old days’.

Biden Jr.’s resume is unsurprisingly sprinkled with Ivy-league dust – a graduate of Yale Law School he serves on the Chairman’s Advisory Board for the National Democratic Institute, is a director for the Center for National Policy and the US Global Leadership Coalition which comprises 400 American businesses, NGOs, senior national security and foreign policy experts. Former US President Bill Clinton appointed him as Executive Director of E-Commerce Policy and he was honorary co-chair of the 2008 Obama-Biden Inaugural Committee.

Didn’t see that coming, did you?

• Australia Mining Boom Is Over And It’s Grim (Guardian)

The mid-year fiscal and economic outlook (Myefo) in December 2013 was a document dripping with sadness on the economic front, and the budget continues in that vein. Indeed in some ways it paints an even worse picture of what Australia has in store. For all the suggestions of pain for future gain, the budget sees very little gain when it comes to jobs. Not only does the budget predict that unemployment in June this year will be as high as 6.0% (a rise of 0.2% from its current position), it also expects unemployment to rise to 6.25% and stay there right the way through to June 2016. On the broader economic front the budget suggests 2014-15 will be worse than this year.

While the economy in 2013-14 is expected to grow by 2.75% (a slightly conservative estimate given annualised growth in the last half of 2013, which was 2.9%), in 2014-15 it’s expected to just trudge along by a mere 2.5%. Only in 2015-16 is the economy expected get back to close to trend growth of 3%. Why are they so gloomy? Well it’s not households. Household consumption has been revised up since the Myefo – from growth of 2.75% next year to now 3% and 3.25% in 2015-16. So we’re expected to keep shopping.

The problem is the end of the mining boom. This budget really throws off any hope that mining might sustain us. In the pre-election economic and fiscal outlook (Pefo) done just prior to the 2013 election, business investment was expected to grow in 2013-14 by 2%. The Myefo revised that down to a fall of 1.5% and the budget has dumped it even further – estimating a fall of 4%. And things don’t get any better next year. The Pefo expected the end of the mining boom to be a soft fall, with business investment dropping by just 0.5% in 2014-15. The Myefo revised this down to -2% and now the budget takes an even more depressing view and has it falling by 5.5%. And it continues to fall in 2016-17 by another 3.5%.

Thinking about you.

• Historic Drought Hastens US Fire Season With $1 Billion Damage (Bloomberg)

U.S. states plagued by historic drought are bracing for an early wildfire season with a cost that may rise as high as $1.8 billion, or almost $500,000 more than what’s available to control the blazes. Oklahomans fought seven fires in May during what is normally the state’s quietest period. Flames scorched four times as many acres in Texas from January through May as in the same period a year earlier. California is also far ahead of its usual pace and is bracing for hundreds more containment battles throughout the most populous U.S. state. “Drought has set the stage for a very busy and very dangerous fire season,” said Daniel Berlant, a spokesman for Cal Fire, as the Sacramento-based California Department of Forestry and Fire Protection is known.

“From Jan. 1 through the end of April, we responded to 1,250 wildfires. In an average year for that same time period, we would have responded to fewer than 600.” The 2014 season is repeating a pattern of destruction established over the past decade by a combination of high temperatures, parched vegetation and more people living in wooded areas. Fires feeding on plentiful dry grass, brush and hardwood are requiring more personnel and money to bring them under control. More than twice as many acres burned across the U.S. through May 9 this year than during the same period in 2013, according to the Boise, Idaho-based National Interagency Fire Center.

“With climate change contributing to longer and more intense wildfire seasons, the dangers and costs of fighting those fires increase substantially,” Rhea Suh, assistant secretary for policy, management and budget at the U.S. Interior Department said May 1 in a statement. Federal officials expect to spend about $470 million more than the $1.4 billion that’s been allocated, according to a congressionally-mandated report released May 1. Increasing fire costs required the U.S. Forest Service and Interior Department to divert funds from other programs in seven of the last 12 years, the study showed. Millions of additional dollars in state and local funds are spent each year on persistent and ever-increasing blazes.

This is what we’ve come to.

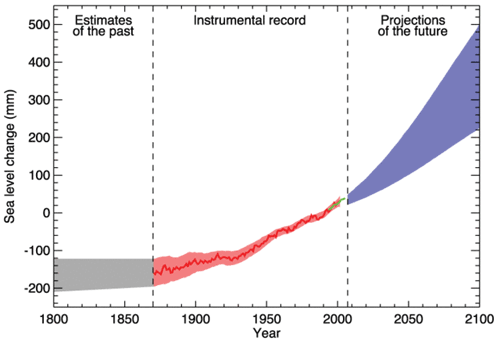

• Trade of the Day: Visit the Maldives as Glaciers Melt (Bloomberg)

Part of west Antarctica is melting so rapidly that the National Aeronautics and Space Administration says it has passed the point of no return, Bloomberg News reports. There’s enough water in the glaciers in the Amundsen Sea region to raise global sea levels by as much as four feet (1.2 meters). The United Nations reckons the seas have already risen by 19 centimeters since the Industrial Revolution. So the Trade of the Day is to take that Maldives vacation you’ve been promising yourself – before it’s too late.

Home › Forums › Debt Rattle May 14 2014: China Will Drag Us Down With It