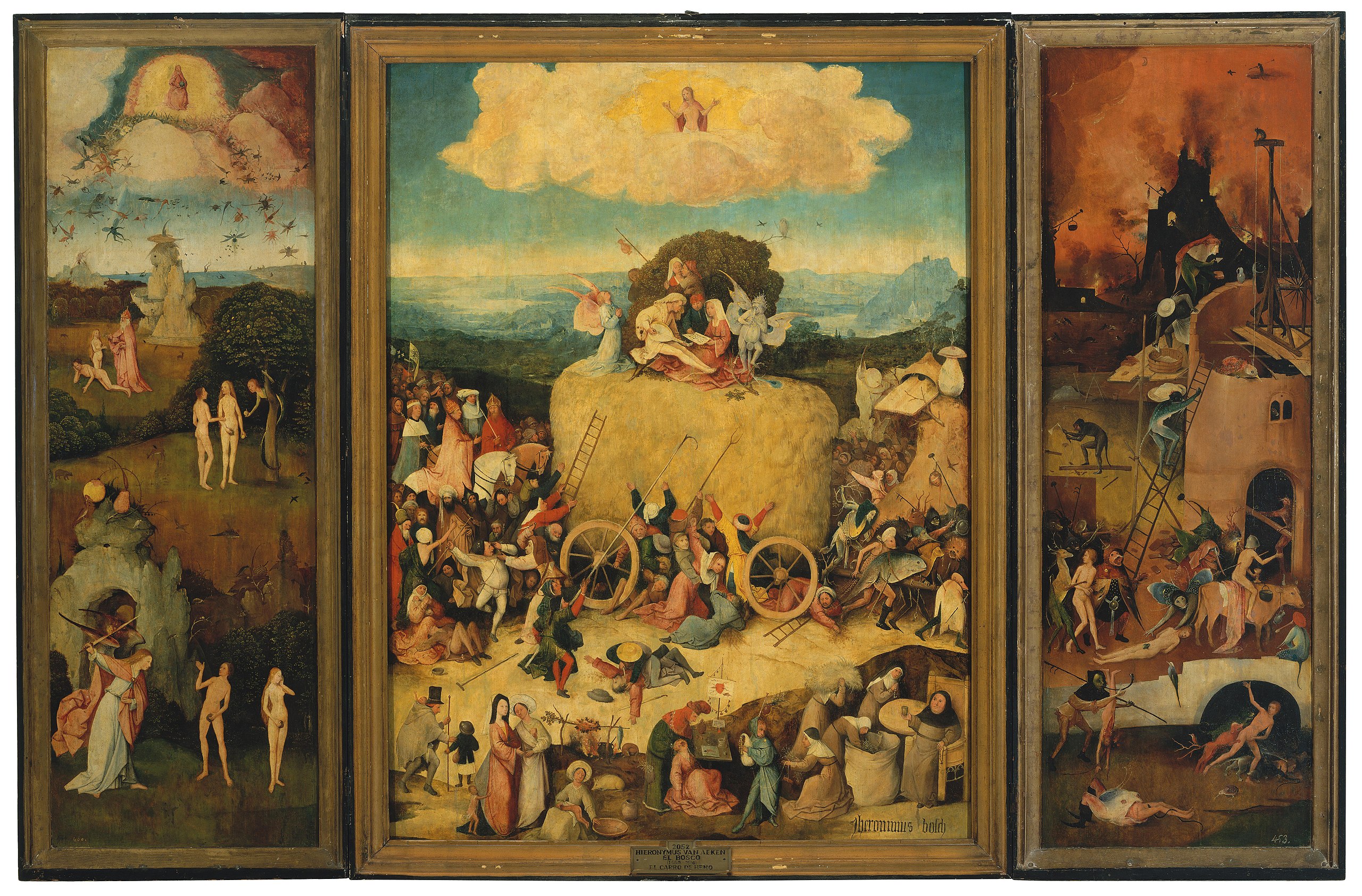

Hieronymous Bosch The Haywain Triptych c.1516

Dana White

https://twitter.com/i/status/1772322279566823708

Get Trump

https://twitter.com/i/status/1772331781724774609

Watters Trump

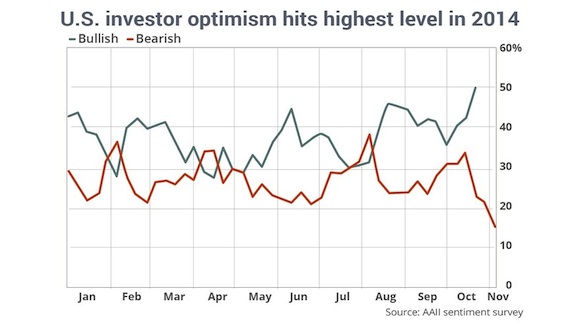

The Democrats were prepared to climax today – anticipating a huge Trump loss in his civil fraud case today. Their bubbles burst when his bond was slashed… and he ended up making billions. pic.twitter.com/NPMcxy4e5a

— Jesse Watters (@JesseBWatters) March 26, 2024

Tucker Trump

Jonathan Karl says Tucker Carlson told him Trump is ‘far more radical’ on Ukraine than he lets on in public:

“He said Trump agrees with me far more than he lets on in public. He’s far more radical on this than he lets on in public.”

— Republicans against Trump (@RpsAgainstTrump) March 26, 2024

Tucker Tulsi

https://twitter.com/i/status/1772403117423829205

The ruling will come at about the time I post this. Say a prayer for Julian.

• UK Court To Issue Ruling On Julian Assange Extradition Tuesday Morning (ZH)

A Decision on extradition to the US following last months court hearing where lawyers for Julian Assange detailed evidence of a "truly breathtaking plan" by the CIA to murder the publisher will be given tomorrow, 26th March, 10.30am, Royal Courts of Justice, London #FreeAssange pic.twitter.com/GpWVMANJSq

— WikiLeaks (@wikileaks) March 25, 2024

On Tuesday London’s High Court will finally rule on the fate of WikiLeaks founder Julian Assange. The court is expected to deliver a decision on if he can appeal his extradition to the United States, where he would face espionage and related charges for publishing state secrets. WikiLeaks has said the written ruling is expected to be delivered by 10:30 am London time (6:30am ET). After this, all his appeal opportunities in the UK legal system will have been exhausted. Stella Assange, his wife, has warned that if the court rules against Assange, he could be on a plane to US soil days following. He would be removed from the high security Belmarsh prison for a trial in the US on espionage-related charges and publishing state secrets, where a 175 year jail sentence would await him.

WikiLeaks has been urging all Americans to put pressure on the Biden administration to drop its case against Assange by calling House representatives and telling them to support H.Res.934. The bill, introduced by Rep. Paul Gosar (R-AZ) requests that the Biden White House halt the proceedings against Assange. The bill reads: “This resolution expresses the sense of the House of Representatives that regular journalistic activities, including the obtainment and publication of information, are protected under the First Amendment and that the federal government should drop all charges against and attempts to extradite Julian Assange.” Editor-in-chief of WikiLeaks Kristinn Hrafnsson has commented on what Assange’s prosecution and possible extradition means for the future of press freedoms.”It cannot be underestimated, the effect that it will have,” he said.

“If an Australian citizen publishing in Europe can face prison time in the United States, that means no journalists anywhere are safe in the future.” However, as we detailed last week, the Biden administration might be looking for a way to bring the 14-year long legal drama to an end. A last Wednesday WSJ report said, “The U.S. Justice Department is considering whether to allow Julian Assange to plead guilty to a reduced charge of mishandling classified information, according to people familiar with the matter, opening the possibility of a deal that would end a lengthy legal saga triggered by one of the biggest classified intelligence leaks in American history.” A plea deal means the whole crisis for him and his family could finally come to an acceptable and peaceful end after all of these years.

“Justice Department officials and Assange’s lawyers have had preliminary discussions in recent months about what a plea deal could look like, according to people familiar with the matter, a potential softening in a standoff filled with political and legal complexities,” according to details in the WSJ report. “The talks come as Assange has spent some five years behind bars and U.S. prosecutors face diminishing odds that he would serve much more time even if he were convicted stateside.” In February of this year, Assange’s cause received a big boost when his native Australia issued formal request to the US and UK that charges against Julian Assange be dropped. The motion adopted by Australian parliament at that time emphasized “the importance of the UK and USA bringing the matter to a close so that Mr. Assange can return home to his family in Australia.”

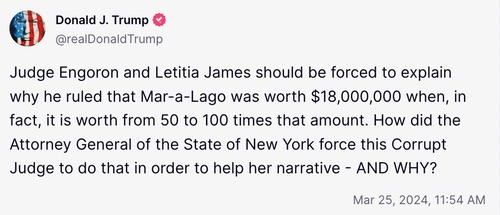

“The new order also stayed Engoron’s order barring Donald Trump Jr. and Eric Trump from serving as officers and directors of New York companies for two years..”

• Trump Bond Reduced To $175 Million At 11th Hour (ZH)

A New York court of appeals has significantly reduced the bond required to stop his properties from being seized by authorities from $454 million to $175 million, in order to appeal his New York civil fraud trial. The decision by a five-judge panel of appellate court judges, comes after the real estate mogul’s lawyers argued that it was “impossible” to obtain an appeal bond of $454 million after approaching over 30 surety companies without success. Trump also said he would have to sell properties in a “fire sale” to raise cash. Had the court denied Trump’s request, and he had failed to obtain the full bond amount, Trump was at risk of losing his bank accounts, followed by some of his properties.

His attorneys had asked the appeals court to either waive the bond requirement or reduce it, arguing that the $464 million judgement against Trump and his family was likely to be overturned on appeal.v In the Monday decision, the appeals court also stayed Engoron’s ruling barring Trump from serving as an officer or director of a NY company for three years, and which had barred Trump and his corporate defendants from applying for loans from New York lenders over the same period. The new order also stayed Engoron’s order barring Donald Trump Jr. and Eric Trump from serving as officers and directors of New York companies for two years. Trump has 10 days to post the bond.

https://twitter.com/i/status/1772318816485392427

Letitia

https://twitter.com/i/status/1772291761718882432

“..it seems that Biden’s campaign staff – which even former President Barack Obama essentially admitted are total morons, need to go back to the drawing board..”

• Trump Net Worth Tops $6.4 Billion On SPAC Deal (ZH)

Former President Donald Trump’s net worth topped $6.4 billion on Monday following the completion of a 29-month-long SPAC deal involving his social media company, Trump Media & Technology Group, as well as the reduction of the bond due in his NY civil fraud trial in order to appeal a $454 million verdict. And while Trump’s gains on the SPAC deal with Digital World Acquisition Corp may just be on paper (and any meaningful sales when his six-month lockup expires would likely tank the price), the $4 billion boost was enough to include Trump in the Bloomberg Billionaires Index, which tracks the top 500 wealthiest people in the world.

Earlier on Monday, Trump was granted a vastly reduced bond requirement of $175 million in order to appeal his NY civil trial over his real estate. In response, Trump quickly said he would post it. The completion of the SPAC merger came despite last-minute lawsuits from investors and executives, as well as a settlement with the SEC. The timing couldn’t be worse for Democrats – as the 2024 Biden campaign picked this moment in time to copy Trump’s name-calling strategy, dubbing the former president “Broke Don.” While that was based on a recent campaign finance report showing that Biden out-raised Trump in February, it seems that Biden’s campaign staff – which even former President Barack Obama essentially admitted are total morons, need to go back to the drawing board. Or not… as long as curbside voting and uncreased 2am ballot drops that nobody is supposed to discuss are a thing.

“I think we need a red wave or America is toast..”

• Musk Reveals Major Political Flip (RT)

The US needs a red wave and will be finished if the Republican Party does not prevail in the 2024 presidential election, Elon Musk, CEO of Tesla and SpaceX said in a post on X (formerly Twitter) on Sunday. The billionaire, who had previously revealed he voted for Joe Biden in 2020, has since criticized the incumbent US president and clashed with his administration. Musk has repeatedly criticized Biden’s handling of the Southern US border crisis and has accused Democrats of being “controlled by the unions.” “I voted 100% Dem until a few years ago. Now, I think we need a red wave or America is toast,” Musk wrote on X. According to media reports, the entrepreneur became increasingly critical of Biden after Tesla, the top-selling electric-car company in the US, was excluded from a White House summit on EVs in 2021.

Last year Musk revealed that he had doubts he’d be voting for Biden in the 2024 presidential election. As of yet, however, he hasn’t endorsed Biden’s rival Donald Trump. “I think I would not vote for Biden,” Musk told a DealBook summit in November, adding “I’m not saying I’d vote for Trump.” Earlier this month the New York Times reported that Trump had met with Musk in Florida, as the former US president seeks a major cash infusion for his reelection campaign. Musk confirmed the meeting but maintained that he is not donating to the Republican’s campaign. “I was at a breakfast at a friend’s place and Donald Trump came by, that’s it,” he told former CNN host Don Lemon last week, adding that Trump had not requested any financial assistance. “I’m not paying his legal bills in any way, shape or form. And he did not ask me for money,” Musk said.

“A classic false flag, with the clueless Tajiks under the impression that they were working for ISIS-K..”

• The Nuland – Budanov – Tajik – Crocus connection (Pepe Escobar)

Ukrainian intel, SBU and GUR, have been using the “Islamic” terror galaxy as they please since the first Chechnya war in the mid-1990s. Milley and Nuland of course knew it, as there were serious rifts in the past, for instance, between GUR and the CIA. Following the symbiosis of any Ukrainian government post-1991 with assorted terror/jihadi outfits, Kiev post-Maidan turbo-charged these connections especially with Idlib gangs, as well as north Caucasus outfits, from the Chechen Shishani to ISIS in Syria and then ISIS-K. GUR routinely aims to recruit ISIS and ISIS-K denizens via online chat rooms. Exactly the modus operandi that led to Crocus. One “Azan” association, founded in 2017 by Anvar Derkach, a member of the Hizb ut-Tahrir, actually facilitates terrorist life in Ukraine, Tatars from Crimea included – from lodging to juridical assistance.

The FSB investigation is establishing a trail: Crocus was planned by pros – and certainly not by a bunch of low-IQ Tajik dregs. Not by ISIS-K, but by GUR. A classic false flag, with the clueless Tajiks under the impression that they were working for ISIS-K. The FSB investigation is also unveiling the standard modus operandi of online terror, everywhere. A recruiter focuses on a specific profile; adapts himself to the candidate, especially his – low – IQ; provides him with the minimum necessary for a job; then the candidate/executor become disposable. Everyone in Russia remembers that during the first attack on the Crimea bridge, the driver of the kamikaze truck was blissfully unaware of what he was carrying,

As for ISIS, everyone seriously following West Asia knows that’s a gigantic diversionist scam, complete with the Americans transferring ISIS operatives from the Al-Tanf base to the eastern Euphrates, and then to Afghanistan after the Hegemon’s humiliating “withdrawal”. Project ISIS-K actually started in 2021, after it became pointless to use ISIS goons imported from Syria to block the relentless progress of the Taliban. Ace Russian war correspondent Marat Khairullin has added another juicy morsel to this funky salad: he convincingly unveils the MI6 angle in the Crocus City Hall terror attack (in English here, in two parts, posted by “S”). The FSB is right in the middle of the painstaking process of cracking most, if not all ISIS-K-CIA/MI6 connections. Once it’s all established, there will be hell to pay.

“..Moscow would be removing one of its most important self-imposed constraints – not to touch Kiev’s senior leadership..”

• The American Explanation For The Moscow Terror Attack Doesn’t Add Up (Trenin)

Ukraine, true to form, and alone among the nations of the world, has suggested that the Crocus City atrocity was an operation carried out by Russia’s own secret services, launched to facilitate a further tightening of the political regime and a new wave of mobilization. Clearly nonsensical, this interpretation invoked in many Russian minds the old proverb, “liar, liar, pants on fire.” Russian President Vladimir Putin, in his five-minute address to the nation on Saturday, refrained from rolling out the Kremlin’s own version. His words and his demeanor were calm, but the style of his remarks was stern. Those behind the attack “will be punished whoever they are and wherever they may be,” the president declared. The direction of Putin’s thinking was revealed by the two facts – not conjectures – he raised: that the terrorists, having fled the scene of the assault, had been apprehended not far (100km or so) from the Ukrainian border, and that “information” had been obtained that they intended to cross the border into Ukraine, where “they had contacts.”

At this point, nothing is firmly established. The results of the Russian investigation will be enormously important. If Moscow concludes that the attack was conceived, planned, and organized by the Ukrainians – say, the military intelligence agency GUR – Putin’s public warning would logically mean that the agency’s leaders will not just be “legitimate” targets, but priority ones for Russia. Since an attack of such gravity would almost certainly have required the approval of Ukrainian President Vladimir Zelensky, the “guarantee” that Putin informally gave to foreign leaders (including Israel’s then-Prime Minister Naftali Bennett) that Russia would not target Zelensky personally, would presumably be lifted. If so, Moscow would be removing one of its most important self-imposed constraints – not to touch Kiev’s senior leadership.

Two separate articles on two separate topics saying ‘Kill Them All’. Sign of the times.

• ‘Kill Them All’ – Medvedev Enraged By Moscow Terror Attack (RT)

The perpetrators and masterminds of Friday’s deadly terrorist attack at a Moscow concert venue must be killed without mercy, former Russian President Dmitry Medvedev has claimed. At least 137 people have been killed and over 180 were wounded when several men armed with assault rifles opened fire inside the Crocus City Hall and then proceeded to set the concert venue ablaze. Four men suspected of carrying out the attack have been captured. Two of them have confessed in court, and are set to remain in custody until late May. They all face life in prison. “Everyone asks me. What to do? … Should they be killed?” wrote Medvedev, currently deputy chair of the National Security Council, in a Telegram post on Monday. “It should and will be done,” he stressed, adding: “It is much more important to kill everyone involved. Everyone. Who paid, who sympathized, who helped. Kill them all.”

Medvedev earlier stated that “Terrorists understand only terror in response” and that “all of them must be found and mercilessly destroyed as terrorists – including officials of the state that committed such an atrocity.” The former Russian president vowed to “avenge each and every” victim of the Crocus City Hall attack, regardless of country of origin and status, insisting this “is now our legal and main goal.” Medvedev’s comments come amid growing calls among the country’s lawmakers to restore the death penalty, which has effectively been banned in Russia since 1996. While the Russian criminal code technically has a provision for capital punishment, courts are de facto banned from handing down such a sentence.

Cultivated hatred.

• ‘Kill Them All’: Inside the Israeli Blockade on Gaza Aid (Loffredo)

Setting out on a bus caravan through illegal Jewish settlements in the occupied West Bank, Loffredo arrives at the Kerem Shalom crossing to Gaza, filming Israeli citizens as they physically block trucks loaded with flour and other essential goods. There, a reservist who served in the military assault on Gaza confesses to an array of war crimes, including blowing up the offices of UN centers dedicated to providing food to the local population. Loffredo then joins nationalists on a march toward Gaza, where they hope to establish new settlements after the population is violently driven out.

Too much pressure for the US.

• UN Security Council Demands Immediate Gaza Ceasefire As US Abstains (AlJ)

The United Nations Security Council (UNSC) demands an immediate ceasefire between Israel and the Palestinian group Hamas in the Gaza Strip and the release of all hostages as the United States abstains from the vote. The remaining 14 council members voted in favour of the resolution, which was proposed by the 10 elected members of the council. There was a round of applause in the council chamber after the vote on Monday. The resolution calls for an immediate ceasefire for the Muslim fasting month of Ramadan, which ends in two weeks, and also demands the release of all hostages seized in the Hamas-led attack on southern Israel on October 7. “The bloodbath has continued for far too long,” said Amar Bendjama, the ambassador from Algeria, the Arab bloc’s current Security Council member and a sponsor of the resolution. “Finally, the Security Council is shouldering its responsibility.”

The US had repeatedly blocked Security Council resolutions that put pressure on Israel but has increasingly shown frustration with its ally as civilian casualties mount and the UN warns of impending famine in Gaza. Speaking after the vote, US Ambassador Linda Thomas-Greenfield blamed Hamas for the delay in passing a ceasefire resolution. “We did not agree with everything with the resolution,” which she said was the reason why the US abstained. “Certain key edits were ignored, including our request to add a condemnation of Hamas,” Thomas-Greenfield said. She stressed that the release of Israeli captives would lead to an increase in humanitarian aid supplies going into the besieged coastal enclave. The White House said the final resolution did not have language the US considers essential and its abstention does not represent a shift in policy.

But Israeli Prime Minister Benjamin Netanyahu’s office said the US failure to veto the resolution is a “clear retreat” from its previous position and would hurt war efforts against Hamas as well as efforts to release Israeli captives held in Gaza. His office also said Netanyahu will not be sending a high-level delegation to Washington, DC, in light of the new US position. US President Joe Biden had requested to meet Israeli officials to discuss Israeli plans for a ground invasion of Rafah in southern Gaza, where more than 1 million displaced Palestinians are sheltering. White House spokesperson John Kirby said the US was “disappointed” by Netanyahu’s decision. “We’re very disappointed that they won’t be coming to Washington, DC, to allow us to have a fulsome conversation with them about viable alternatives to them going in on the ground in Rafah,” Kirby told reporters.

Tucker Israel

https://twitter.com/i/status/1772273844591489260

“..Ukraine tries to retreat into unprepared and near indefensible terrain..”

• Macron’s Punctured Balloon of a ‘Geo-Political EU’ (Alastair Crooke)

The general view in Europe was that Macron was playing complex mind-games, firstly with the French people, and secondly with Russia. Nevertheless, it seems that there could be some substance to Macron’s sabre-rattling: The French Chief of Army Staff said he has 20,000 troops ready to be inserted in 30 days. And the Head of Russia’s SVR Intelligence Agency, Naryshkin, more modestly assessed that France seemingly is preparing a military contingent for sending to Ukraine, which at the initial stage, will be about two thousand people. Just to be clear however, even a 20,000-man division by standards of classical military theory is supposed to be able to hold at maximum, a 10km-front. An insertion of two or twenty thousand French troops would change nothing strategically; it would not halt the vastly larger Russian steamroller, grinding on westwards. So what is Macron playing at? Is this all bluff, then? Likely, it is part ‘grandstanding’ by Macron, pre-occupied to present himself as ‘Mr Strongman Europe’ – particularly toward his French constituency.

His posturing comes however, at a more significant conjunction of events for the so-called ‘Geo-political EU’: Clarity: Light has pierced, and has illuminated a space hitherto occupied by shadows. It is now as clear as it can be – after Putin’s overwhelming win in elections on a record turnout – that President Putin is here to stay. All the western shadow-play of ‘régime change’ in Moscow simply shrunk to naught in the bright light of events. Snorts of anger can be heard from some quarters in Europe. Yet they will subside. There is no choice. The reality, as Marianne newspaper, quoting a senior French officer, derisively noting in respect to Macron’s Ukraine’s posturing: “We must make no mistake, facing the Russians; we are an army of cheerleaders” and sending French troops to the Ukrainian front would simply be “not reasonable”. At the Élysée, an unnamed advisor argued that Macron “wanted to send a strong signal … (in) milli-metered and calibrated words”.

What pains the EU ‘neocon ever-hopefuls’ more is that Putin’s clear electoral victory coincides, almost precisely, with an EU (and NATO) humiliation in Ukraine. It is not just that the AFU appears to be in a cascading implosion, but that the retreat is accelerating, as Ukraine tries to retreat into unprepared and near indefensible terrain. Into this grim EU prospect is that second shaft of clarifying light: The U.S. is slowly but surely turning its back on the financing and arming of Kiev, leaving Europe’s impotence exposed for all the world to see. The EU simply cannot substitute for the U.S. pivot. Yet more hurtful for some is that a U.S. retreat represents a ‘punch in the guts’ for much of the Brussels leadership, who had fallen on the Biden Administration with almost indecent glee, upon Trump’s leaving of office. They used the moment to proclaim the cementing of a pro-Atlanticist, pro-NATO EU. Now, as former Indian diplomat MK Bhadrakumar perfectly defines it, “France [is] all dressed up – with nowhere to go”:

You just take more EU taxpayers’ money and hand control over it to Americans.

• Single EU Army Unrealistic – Borrell (RT)

The EU must increase its military strength and internal cooperation, but that does not mean it should aspire to a single army, the bloc’s top diplomat, Josep Borrell, has said. In an interview with CNN’s Christiane Amanpour on Monday, the foreign policy chief insisted there is a “strong consensus” among EU members on boosting the bloc’s defense capabilities, both in terms of its military industry and armed forces. “This is not a question of creating the singular European army,” Borrell said, adding that all 27 EU members are free to decide their own defense policies. Instead, the armies of EU members need to be “more interoperational” in order to strengthen the bloc’s defense, the diplomat argued.

“They have to create a European pillar inside NATO. Europeans have to take more responsibility for our defense,” Borrell stated, adding that this includes fostering a close partnership with the US within NATO. “We have to increase our military capacities… But it is utopical to believe that we are going to cancel the 27 armies to create a single one. What we have to do is to be more realistic,” Borrell said. The bloc is well aware of the harsh realities of the modern world and is preparing accordingly, he added. In January, Italian Foreign Minister Antonio Tajani publicly supported the creation of a joint European army, an idea that has been debated for several years, arguing that the force could be used for peacekeeping missions and conflict prevention.

The proposal, however, met resistance from several EU members, including Denmark and Poland. Copenhagen argued that “NATO is the cornerstone of our collective security,” and that defense remains a matter of national sovereignty. Warsaw insisted that EU action on defense must be complementary to NATO efforts. Since the start of the Ukraine conflict, EU member states have considerably ramped up defense spending, with plans to increase it to €350 billion ($380 billion) in 2024. In recent weeks, several Western leaders have also called on the bloc to prepare for a full-scale war with Russia, which they claim could break out within the next few years. Russian President Vladimir Putin has said Moscow has no plans or interest whatsoever in attacking NATO countries. Moscow, however, has for years voiced concern about the expansion of the US-led military bloc towards its borders.

“..the blob is our government now; there is no government except the blob..”

You’ve got to ask yourself: really, who seems to hanker more for a red-hot World War Three, “Joe Biden” or Vlad Putin? Since “Joe Biden” is only a figment of American politics, first you’d have to ask: a figment of what? Answer: A figment of our greater intel blob, led, of course, by the Central Intelligence Agency. Which is to say, the blob is our government now; there is no government except the blob. We are the United Blob of America! In Blob We Trust should be printed on our money. That being the case, blob policy rules. And since deception is one of the blob’s chief duties, we mere sniveling citizens should expect to be deceived at every turn about everything. So, when the blob’s news cut-out, The New York Times, serves up a comprehensive history of the gang known as ISIS-K Monday morning after the Moscow Crocus Concert Hall Massacre, you might suspect that some deception is afoot.

ISIS-K immediately took credit for the Crocus Massacre. K stands for Khorasan, a set of provinces in eastern Iran, leaking over into Afghanistan and Pakistan. ISIS-K supposedly evolved out of the original ISIS that sought to establish an Islamic caliphate out of Iraq and Syria. After Mr. Trump broke it up in 2019, the gang regrouped in K-land, deeper in central Asia. Curiously, this ISIS-K has carried out attacks against Iran, where it lives. Go figure. . . . Its progenitor, the plain old ISIS-no-K was responsible for the horrific Bataclan Theater massacre in Paris, 2015 and the suicide bombing of the Ariana Grande concert at the Manchester Arena, UK, 2017. They’re sort of the Concert-Massacres-R-Us of terror orgs — you really couldn’t find a better patsy for the Crocus op.

Is it as simple as that? Not if you consider Scott Ritter’s theory that the first ISIS was a creation of the CIA, with the mission of ousting Syrian President Bashar al-Assad, considered by the blob to be an uber-bad dude, largely for enlisting Russia’s help in ending Syria’s civil war. And if you can actually figure out what Syria’s civil war was about, other than a US blob op to gain control of Syria and its oil, you could win a MacArthur Genius Prize. But you might also ask: did the United Blob of America hire ISIS-K to slaughter 137 Russian civilians Saturday night? And also: did it do so directly or indirectly, through cut-outs?

One blob weakness is that it can’t resist the impulse to telegraph its plans ahead of some dastardly act. Both “Joe Biden” and State Department war-hawk Victoria Nuland verbally signaled the op to blow-up the Nord Stream gas pipelines well before the act. Before “retiring” (or getting cashiered) from State this month, Ms. Nuland warned Russia to expect “some nasty surprises” in the days ahead. Was she fired for opening her big mouth? Now, a photograph has surfaced of one of the captured Crocus perps, Shamsidin Fariduni, posing in the Crocus concert hall date-stamped March 7. A set-up? A deep fake?

In any case, on March 8 the United Blob State Department issued a warning to Russia’s foreign ministry that something wicked was coming their way, and likewise warned our diplomatic personnel to steer clear of concert halls and other public venues. Was the Crocus op already well in motion? And was the blob trying to cover for Ms. Nuland’s big mouth by warning about something that was too late to stop? Whatever else you think about the Russians, they are not dumb bunnies. You can be sure they are carefully putting together the puzzle pieces, having already been careful to take the suspects alive. They were, incidentally, all in one car driving toward the Ukraine border when apprehended by Russian police. That is being considered “a clue” as to who their handlers are. But then, who is Ukraine’s handler? (Cue: thinking music.)

“To start to call opponents or critics terrorists has long been a problem on both ends of the political spectrum.”

• January 6th Continues to be a Tragedy in the Eye of the Beholder (Turley)

For years, I have maintained that January 6th was a disgraceful riot but not an insurrection. That issue came to a head with the litigation over disqualifying former president Donald Trump and similar calls to block dozens of Republican incumbents from ballots. Now, the protest that became a riot has been elevated from an insurrection to a terrorist attack. Rep. Alexandria Ocasio-Cortez (D-NY) and other democrats are using the description despite no one being charged with insurrection or terrorism. On Sunday, Ocasio-Cortez declared to CNN host Jake Tapper that “We’re talking about an individual who ordered essentially a terrorist attack on the Capital of the United States in order to retain power.” In fairness to Ocasio-Cortez, she is not alone in such characterizations. For example, many of us were surprised when FBI Director Christopher Wray condemned the January riot at the U.S. Capitol as “domestic terrorism.” From a strictly legal basis, it was wildly inaccurate, in my view.

Liberal publications like Politico have railed against the Justice Department for not charging terrorism. That has been supported by some law professors. Those charged for their role in the attack that day are largely facing trespass and other less serious charges — rather than insurrection or sedition. While the FBI launched a massive national investigation, it did not find evidence of an insurrection. While a few were charged with seditious conspiracy, no one was charged with insurrection. Trump has never been charged with either incitement or insurrection. The media has fueled these claims. One year after the riot, CBS News mostly downplayed and ignored the result of its own poll showing that 76 percent viewed it for what it was, as a “protest gone too far.” They argue that this riot could simply be treated as “calculated to influence or affect the conduct of government by intimidation or coercion, or to retaliate against government conduct.” However, so could other protests that result in property damage and criminal acts.

We have seen other legislative proceedings shutdown by protesters with members removed from the floor. The question is where to draw the line to avoid the arbitrary classification of some protests as terrorism and others as unlawful access or trespass. Nancy Pelosi called protesters at her home Russian plants. Politicians called a protest on the Tennessee House floor “an insurrection.” Such rhetoric excess easily inflames the public, but it creates lasting erroneous views of the law. That in turn can pose a real threat to free speech as the line between demonstrations and terrorism are blurred. Ocasio-Cortez’s view of what constitutes the crime of terrorism is dubious for many, particularly after she declared that racketeering is not a crime. However, there is pressure to ramp up rhetoric as we approach the 2024 elections. To start to call opponents or critics terrorists has long been a problem on both ends of the political spectrum.

“..the ethical ramifications of BCIs and other emerging neurotechnologies don’t stop at the consumer market or the workplace..”

• Weaponizing Reality: The Dawn of Neurowarfare (Pabst)

Billionaire Elon Musk’s brain-computer interface (BCI) company Neuralink made headlines earlier this year for inserting its first brain implant into a human being. Musk says such implants, which are described as “fully implantable, cosmetically invisible, and designed to let you control a computer or mobile device anywhere you go,” are slated to eventually offer “full-bandwidth data streaming” to the brain. Brain-computer interfaces (BCIs) are quite the human achievement: as described by the University of Calgary, “A brain computer interface (BCI) is a system that determines functional intent – the desire to change, move, control, or interact with something in your environment – directly from your brain activity. In other words, BCIs allow you to control an application or a device using only your mind.” Developers and advocates of BCIs and adjacent technologies emphasize that they can help people regain abilities lost due to aging, ailments, accidents or injuries, thus improving quality of life.

A brain implant created by Swiss-based École Polytechnique Fédérale in Lausanne (EPFL), for example, has allowed a paralyzed man to walk again just by thinking. Others go further: Neuralink’s goal is to help people “surpass able-bodied human performance.” Yet, great ethical concerns arise with such advancements, and the tech is already being used for questionable purposes. To better plan logistics and boost productivity, for example, some Chinese employers have started using “emotional surveillance technology” to monitor workers’ brainwaves which, “combined with artificial intelligence algorithms, [can] spot incidents of workplace rage, anxiety, or sadness.” The example showcases how personal the technology can become as it is normalized in daily life. But the ethical ramifications of BCIs and other emerging neurotechnologies don’t stop at the consumer market or the workplace. Governments and militaries are already discussing — and experimenting on — the roles they could play in wartime.

Indeed, many are describing the human body and brain as war’s next domain, with a 2020 NATO-backed paper on “cognitive warfare” describing the phenomenon’s objective as “mak[ing] everyone a weapon…The brain will be the battlefield of the 21st century.” On this new “battlefield,” an era of neuroweapons, which can broadly be defined as technologies and systems that could either enhance or damage a warfighter or target’s cognitive and/or physical abilities, or otherwise attack people or critical societal infrastructure, has begun. In this exploration of the race to apply the latest neurotechnologies to war and beyond, I investigated how the neuroweapons of tomorrow, including BCIs that may allow for brain-to-brain or brain-to-machine communication, have the capacity to expand conflicts into a new domain — the brain — while also bringing a new dimension to both hard- and soft-power struggles of the future.

CO2 has never driven temperature changes in the past. Never.

"The question of whether CO2 drives the climate is easily resolved. You can look back in time over hundreds of millions of years—CO2 levels have changed radically many times. Did this cause temperature change? No, absolutely not. CO2 has never driven temperature changes in the… pic.twitter.com/jYWnNhI1U9

— Wide Awake Media (@wideawake_media) March 25, 2024

Obamacare

https://twitter.com/i/status/1772279457711034482

Clock

Real Time, art installation by Maarten Baas, features manual creation and erasure of clock hands each minute.

The "Schiphol clock" has a man painting minutes on a translucent screen, actor Tiago Sá da Costa recorded for 12 hours to create the video.

pic.twitter.com/9FrEav2VIC— Science girl (@gunsnrosesgirl3) March 25, 2024

Safe

A magnificent safe.pic.twitter.com/gjDAZ814Km

— Figen (@TheFigen_) March 24, 2024

Pelican

This man helping a pelican with fishing wire stuck to its beak

pic.twitter.com/aHE4zUmIaP— Science girl (@gunsnrosesgirl3) March 25, 2024

Cheetah

Meet Kiki: Just a pregnant special needs cheetah who learned to sit from meerkats pic.twitter.com/HHcVyE50SF

— Nature is Amazing ☘️ (@AMAZlNGNATURE) March 25, 2024

Kung fu master

This monkey looks like a Kung-fu master pic.twitter.com/KmcHywdyTt

— Nature is Amazing ☘️ (@AMAZlNGNATURE) March 25, 2024

Boop

Predators exist

Hooman: boop pic.twitter.com/dXs4auRNWH

— Nature is Amazing ☘️ (@AMAZlNGNATURE) March 25, 2024

Support the Automatic Earth in wartime with Paypal, Bitcoin and Patreon.