Jack Allison “Utopia Children’s House, Harlem, New York.” 1938

Emerging economies face the biggest threat from this.

• There’s A Currency War Going On And The Fed Can’t Play (CNBC)

There is a currency war going on—one in which the Federal Reserve is the least able to play, said David Woo, head of global interest rates and currencies research at Bank of America Merrill Lynch, on Friday. The ECB statement during a dinner last week regarding the purchase of more bonds is a strong signal it doesn’t want the euro to go back over $1.15, said Woo during an interview with CNBC’s “Squawk on the Street.” “You could argue that the U.S. got back on the street playing that game,” explained Woo. “Now, the U.S. cannot tell others they cannot play this game.” With inflation picking up and better performance from U.S. companies, the Fed has less of a reason to get engaged in this war at the moment, said Woo.

As the deadline for a debt payment by Greece draws closer, the volatility of currencies has increased. The country is supposed to pay about €300 million to the IMF on June 5, but creditors have been worried about Greece’s ability to make the payment. Woo added that the latest data show €5.6 billion leaving the Greek banking system for elsewhere—double the March figure. He added that this might force a showdown into the end of June.

Meanwhile, Wells Fargo’s Scott Wren, also on “Squawk on the Street,” said that the volatility was creating more of a chance to buy stocks. “Volatility is going to hopefully cause more buying opportunities. Even in a worst-case scenario for Greece, which I don’t think is going to happen, they are going to Band-Aid this thing and kick it down the road,” said Wren. Woo said that his biggest worry is Asia, especially China. With the Chinese yuan one of the strongest currencies and Germany’s exposure to China, there might be some problems for the euro. “I think the euro will have an issue,” said Woo. “German exposure is more than U.S exposure to China.”

One day, they’ll find themselves pushing on a string.

• When Betting on QE Suddenly Goes Wrong (WolfStreet)

The ECB rode to the rescue. This sort of turmoil went against everything it had tried to accomplish. So it announced that it would frontload some of its bond-buying spree ahead of the summer, under the pretext that this would avoid having to buy so much debt at a time when European market players would be on vacation and nothing could get done. As far as the markets were concerned, the announcement meant an additional short-term mini-QE. It stopped the bleeding. Bonds recovered some, and yields settled down. By now, the German 10-year yield, after spiking from 0.05% to 0.77% during the weeks of turmoil, has dropped to 0.50%.

All this even though the ECB’s QE has barely begun. But it shows how these bouts of QE around the globe have perverted asset pricing mechanisms. The markets front-run QE as rumors and suggestions of QE run wild, and they’re driving up bonds and stocks in the hope of QE, as they have done in Europe, and when QE finally arrives as it did in March, stocks and bonds begin to sink. German stocks, for example, are down 7.4% from their peak in early April, after having shot up nearly 50% since October. And so central bank jawboning, rumors of QE, suggestions of QE, promises of QE, and finally QE itself work in driving up markets – until someday, they don’t. And that’s when “unexpected” turmoil sets in.

Brilliant obfuscation: the lower the Q1 data are, the bigger the rebound can be. Even reality is just in the eye of the beholder.

• For The Fed, It’s The Rebound That Matters (MarketWatch)

The Federal Reserve has already indicated that it isn’t too bothered by the weak first quarter. The key factor for the U.S. central bank going forward is the strength of the bounce back. “It’s the extent of the rebound that will be critical in determining the timing of the Fed’s first move on interest rates,” said Chris Williamson, chief economist at Markit, in a note to clients. New data from the government Friday showed that the economy got off to a weak start in 2015, shrinking at an 0.7% annual rate in the first quarter, down from the prior estimate of a tepid 0.2% increase. Bricklin Dwyer, economist at BNP Paribas, said the first quarter GDP report should give the Fed confidence that the soft patch was likely driven by temporary disruptions. What matters for the Fed is the second-quarter data.

St. Louis Fed President James Bullard on Thursday said he wanted to hike rates this year but needed “confirmation” of his hunch that the first quarter weakness wouldn’t last. Barclays said Friday its Q2 GDP tracking estimate was 2.5%. This is down from expectations earlier in the year, of second quarter growth over 3%. The Chicago PMI report also injected some concern that the economy may be struggling to move beyond the first quarter soft-patch, said Millan Mulraine at TD Securities. The index dipped back into contractionary territory, falling to 46.2 from 52.3 the month before. Fed officials will gather on June 16-17 to set policy for the next six weeks. While Fed officials have taken pains not to take a rate hike off the table at that meeting, economists don’t think policymakers will have enough data to justify a rate hike.

“..you would think that after a recessionary plunge that was in a league all by itself that some account of that would be taken in assessing the recovery.”

• What Bubble Vision Doesn’t Get About Q1’s Punk GDP Numbers (Stockman)

Promptly upon release of today’s GDP update, Steve Liesman and his Wall Street economist pals spent 10 minutes bloviating about why the negative print should be completely ignored. Herein is an essay on why it is they who should be given the heave-ho. According to Liesman & Co the GDP shrinkage reported by the BEA for Q1 was all a mistake due to winter, strikes and unseasonal seasonals. So don’t sweat the small stuff, they brayed to what remains of the CNBC audience, the US economy actually continues bounding along at a 2.5% growth rate, as it has for the entire recovery. Well, hold it right there. I am all for ignoring the quarterly jerks and flops embedded in the GDP data, too. But if you want to talk trend and context – let’s do exactly that.

And first and foremost there is no such trend as 2.5% growth. After all, Liesman and his Wall Street cronies have been cheerleaders for the Fed’s insane 80 months of ZIRP and massive QE on the grounds that extraordinary measures were needed to combat the deep economic plunge known as the Great Recession. In fact, measured from peak to trough, the latter was the worst downturn since 1950. Real GDP shrank by 4.2% compared to an average of 1.7% during the previous nine recessions, and handily topped the 2.6% decline in 1981-1982 and the 3.0% decline in 1973-1975. So you would think that after a recessionary plunge that was in a league all by itself that some account of that would be taken in assessing the recovery.

Indeed, that’s particularly pertinent in the present instance because the depth of the Great Recession was exacerbated by a violent inventory liquidation in the fall and winter quarters right after the Wall Street meltdown in September-October 2008. In fact, fully one-third of the $636 billion (2009 dollars) real GDP decline from peak to trough was accounted for by inventory liquidation; real final sales dropped by a far more modest 2.8%. Accordingly, the appropriate way to measure the trend is to remove the violent inventory swings from the numbers, and then to look at the path of real final sales after the peak – averaging in the down quarters and the subsequent rebound.

Rate hike. “It will be the mother of all currency debasements.”

• Why the Bank of Japan Can’t Stop a Sudden Collapse of the Yen (WolfStreet)

On Friday morning in Tokyo, the Nikkei stock index was up again, at 20,600, highest in 15 years. Since “Abenomics” has become a common word in December 2012, the Nikkei has soared 128% on a crummy economy, terrible government deficits, and an insurmountable mountain of government debt. This 10-day run of straight gains, or 11-day run if Friday plays out, is the longest glory streak since February 1988 when Japan was in one of the craziest bubbles the world had ever seen. The subsequent series of crashes had the net effect that the Bank of Japan became engaged in propping up the stock market not only by pushing interest rates to zero and dousing the market with money via waves of QE, but also by buying equity ETFs and J-REITs.

Prime Minister Shinzo Abe has made asset-price inflation his top priority. Under pressure from the BOJ and the government, state-controlled entities – such as the Government Pension Investment Fund with ¥137 trillion in assets – are dumping Japanese Government Bonds into the lap of the BOJ and are buying stocks with the proceeds. Foreign hedge funds have jumped into the fray, which is the hot money that can evaporate overnight. But fear not, every time the Nikkei drops 100 points or so, the BOJ starts buying, or creates the perception that it’s buying, and within minutes, stocks shoot back up. It’s part of the BOJ’s relentlessly communicated policy to inflate asset prices come hell or high water. And hell or high water may now be on the way. [..]

To keep the nation from descending to where Greece is, the BOJ will keep its iron fist on the government bond market. It will keep interest rates near zero. It will keep JGB prices inflated. And it will keep the government funded. It will do so by buying JGBs and handing out yen, no matter what. The rest is secondary – the yen and the stock market, both. So when the yen begins to crash past all jawboning, there might not be much of a floor underneath it. If Japan is lucky, there won’t be a sudden ruble-like 60% crash in the yen, on top of the 35% swoon it already experienced. Or it may come years down the road when another government is in place and when a different crew runs the BOJ. That’s the plan for those folks today. After us the deluge. But if something nevertheless triggers it in an untimely manner, or if it starts coming unglued on its own, it will get ugly. It will be the mother of all currency debasements.

If only bloated would count as healthy.

• China Central Bank: We Want ‘Healthy’ Stock Market (Reuters)

China’s central bank said on Friday it wants to see a “healthy” stock market, a day after surging Chinese shares slumped 6% in record trading volume as investors fled tighter borrowing rules. In its 2015 financial stability report, the People’s Bank of China (PBOC) warned of a slowing economy and rising debt levels, but repeated its vow to deepen China’s nascent financial market through reforms. The PBOC said in the report released online it was monitoring widely-recognised financial risks in the world’s second-biggest economy, including heavily-indebted local governments and a slowing real estate market. It did not address the dangers of China’s soaring shares, saying only that it wishes to promote a “stable” bourse. Chinese stocks have zoomed up 140% in the last 12 months.

“We will promote stable and healthy development of the stock market, and continue to expand the main board and the small-and medium boards,” the PBOC said, adding that there are plans to set up a new board on the Shanghai stock exchange. Chinese stocks, which ended flat on Friday after a volatile session, skidded earlier this week as more brokers tightened margin trading requirements and as the central bank drained cash from the money market. There are worries that China’s buoyant stock market is being powered by its looser monetary policy, at the expense of small businesses which are grappling with high real interest rates and a shortage in loans.

Even though the PBOC has cut interest rates three times in six months to stoke growth in China’s stuttering economy from a six-year low, real interest rates in China are still over 3%, Morgan Stanley said in a report this month. That is well above real rates in Japan, Europe and the United States, where borrowing costs are negative, the investment bank said. The PBOC acknowledged the problem of high borrowing cost in China, saying it would lower interest rates in a “targeted” fashion, but did not elaborate. “Downward pressure on the economy is increasing,” it said. “Some economic risks are showing up, and the overall debt level is still climbing.”

That ticking sound.

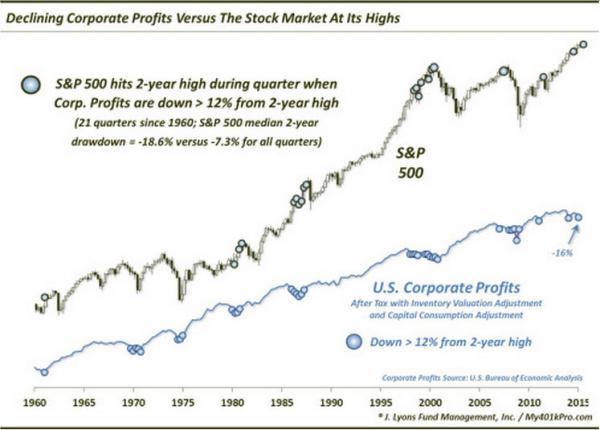

• What Do Falling Corporate Profits Mean With Stocks Near Their Highs? (Lyons)

If you’ve followed our commentary for awhile, you may have noticed that we don’t cover fundamental or economic data too often. That is for a good reason: we don’t use it, at all. Occasionally, however, a data point will cross the radar that piques our interest for whatever reason. So it is with the current state of U.S. Corporate Profits. The U.S. Bureau of Economic Analysis released the latest data today revealing that Corporate Profits (after Tax with Inventory Valuation Adjustment and Capital Consumption Adjustment) were down 9% for the 1st quarter and are now down 16% from their peak in the 3rd quarter of 2013. Perhaps we don’t run in the right circles but we haven’t heard much regarding the significance of this trend on the stock market, which continues to trade near its all-time highs.

Perhaps that’s a good thing considering we’ve found scant profitable uses for fundamental data in our investment approach (which is why we don’t use it). So we decided to take a look at it ourselves to see what effect similar historical precedents, assuming there were any, may have had on the stock market. This is what we looked for: Quarters when Corporate Profits were down at least 12% from their 2-year high, and the S&P 500 made a 2-year high at some point within the same quarter. As it turns out, there have been 21 quarters meeting that criteria since 1960.

Many of the occurrences came in clusters in 1980, 1986-1987 and 1998-2000. There were also single occurrences in 1961, 2007, 2011 and the 1st quarter of last year. Without going into great depth of analysis, one can tell by the inauspicious dates that these circumstances have not worked out well in the past. The stock market may not have rolled over immediately in every occasion (e.g., 1986, 1998, 2014), but it usually ended up paying the piper. Specifically, the average drawdown over the 2 years following these quarters was -18.6%. This compares with an average 2-year drawdown of -7.3% following all quarters since 1960.

We don’t follow economic and fundamental data too often since we’ve never found it very helpful in our investment decision-making process. At times, however, a certain data series will garner our attention. Often times, as is the case with Corporate Profits presently, it grabs our attention because it is receiving very little attention elsewhere. From just a cursory look at the current trend of falling Corporate Profits, however, it would appear to be a potential negative influence on the stock market that is trading near its all-time highs – if not immediately, then eventually.

Pop.

• Elon Musk’s Growing Empire Is Fueled By Government Subsidies (LA Times)

Los Angeles entrepreneur Elon Musk has built a multibillion-dollar fortune running companies that make electric cars, sell solar panels and launch rockets into space. And he’s built those companies with the help of billions in government subsidies. Tesla Motors, SolarCity and Space Exploration Technologies, known as SpaceX, together have benefited from an estimated $4.9 billion in government support, according to data compiled by The Times. The figure underscores a common theme running through his emerging empire: a public-private financing model underpinning long-shot start-ups. “He definitely goes where there is government money,” said Dan Dolev, an analyst at Jefferies Equity Research. “That’s a great strategy, but the government will cut you off one day.”

The figure compiled by The Times comprises a variety of government incentives, including grants, tax breaks, factory construction, discounted loans and environmental credits that Tesla can sell. It also includes tax credits and rebates to buyers of solar panels and electric cars. A looming question is whether the companies are moving toward self-sufficiency — as Dolev believes — and whether they can slash development costs before the public largesse ends. Tesla and SolarCity continue to report net losses after a decade in business, but the stocks of both companies have soared on their potential; Musk’s stake in the firms alone is worth about $10 billion. (SpaceX, a private company, does not publicly report financial performance.)

Musk and his companies’ investors enjoy most of the financial upside of the government support, while taxpayers shoulder the cost. The payoff for the public would come in the form of major pollution reductions, but only if solar panels and electric cars break through as viable mass-market products. For now, both remain niche products for mostly well-heeled customers. The subsidies have generally been disclosed in public records and company filings. But the full scope of the public assistance hasn’t been tallied because it has been granted over time from different levels of government. New York state is spending $750 million to build a solar panel factory in Buffalo for SolarCity.

The company will lease the plant for $1 a year. It will not pay property taxes for a decade, which would otherwise total an estimated $260 million. The federal government also provides grants or tax credits to cover 30% of the cost of solar installations. SolarCity reported receiving $497.5 million in direct grants from the Treasury Department. That figure, however, doesn’t capture the full value of the government’s support. Since 2006, SolarCity has installed systems for 217,595 customers, according to a corporate filing. If each paid the current average price for a residential system — about $23,000, according to the Union of Concerned Scientists — the cost to the government would total about $1.5 billion, which would include the Treasury grants paid to SolarCity.

“..if paying workers more resulted in higher unemployment, we would have no restaurants in Seattle.”

• Economic Theory: Science Or Scam? (Hanauer)

Noah Smith, a smart financial writer with a very good blog, wrote an article on the $15 minimum wage at Bloomberg earlier this week. The piece celebrated the fact that, finally, we’ll have some data on how the $15 minimum wage would affect jobs. Smith said he considered it a test because in theory “a higher minimum wage should cause increased unemployment.” The more I thought about it, the less sense this premise made. Noah’s article underscored two big things for me: first, the degree to which people see the evidence they want to see, and also how silly the idea of “economic theory” can be. Smith claims that we don’t know what the result of a $15 minimum wage will be. Will it kill jobs or not? But the truth is, there’s abundant and overwhelming evidence that this theory is wrong, and that higher minimum wages don’t hurt employment.

The evidence is there; you just have to choose to see it. Let’s just look in my own back yard for an example of that evidence. Washington State has had the highest minimum wage in the nation for several years—at $9.47, it’s a full 30% more than the federal minimum of $7.25. Washington’s unemployment rate of 5.5% isn’t the best in the country, but it’s not the worst, either. In fact, it perfectly matches the national rate. But Seattle was until recently the fastest growing big city in the country. And speaking of evidence, the first part of the $15 minimum wage rollout was successfully implemented in April, and unemployment in our county promptly plummeted to 3.3%.

An even more dramatic example of the goofiness of this so-called “economic theory” is the impact of the wages of tipped workers on the restaurant industry. In Washington, these workers earn at least $9.47 plus tips, a whopping 440% more than the federal tipped minimum of $2.13 plus tips. Despite the predictions of “economic theory,” and despite the warnings from the National Restaurant Association that eliminating the tip credit would cause food armageddon, Seattle has one of the most robust restaurant scenes in the USA. Why? Because when restaurants pay restaurant workers enough so that even they can afford to eat in restaurants, it’s really good for the restaurant business. If economic “theory” were correct, if paying workers more resulted in higher unemployment, we would have no restaurants in Seattle.

Hornets nest.

• New Arrests Coming in FIFA Corruption Probe, Says Investigator (Bloomberg)

The U.S. investigation of corruption in soccer’s governing body is moving to a new phase that will bring criminal charges against more people, the Internal Revenue Service’s chief investigator said in an interview. How the case develops hinges in part on the fate of nine FIFA officials and five sports marketing executives charged in a racketeering and bribery indictment unsealed May 27, said Richard Weber, chief of the IRS Criminal Investigation Division. The prosecution, which has garnered worldwide attention, came two days before FIFA re-elected its embattled president, Sepp Blatter, 79, for another four-year term. “It’s probably hard to say who is on the list for the next phase and the timing of that,” Weber said. “I’m confident in saying that an active case is ongoing, and we anticipate additional arrests, indictments and/or pleas.”

The IRS joined the Federal Bureau of Investigation and U.S. prosecutors in Brooklyn, New York, in building a case alleging sports-marketing executives paid more than $150 million in bribes and kickbacks over 24 years for media and marketing rights to soccer tournaments. Prosecutors charged Jeffrey Webb and Jack Warner, the current and former presidents of soccer’s governing body for North America, Central America and the Caribbean. They secured guilty pleas from Charles Blazer, 70, the group’s former general secretary; Jose Hawilla, a Brazilian sports marketing executive, who agreed to forfeit $151 million; and Warner’s two sons, Daryll and Daryan. “A lot depends on how the case unfolds from this point forward, depending on if other defendants decide to cooperate, whether or not other witnesses come forward based upon the allegations in the indictment,” Weber said.

“There are a lot of factors beyond our control, so it’s hard to put a specific timeframe on it,” he said. “But we do have evidence that we’re already developing and working on. It depends on how other pieces of the puzzle come together.” The IRS entered the case in 2011 when a Los Angeles-based agent, Steven Berryman, began a tax investigation of Blazer, Weber said. Blazer lived in a Trump Tower apartment, flew on private jets, dined at the world’s finest restaurants and hobnobbed with celebrities and world leaders. His blog, “Travels with Chuck Blazer and his Friends,” featured pictures of Blazer with Hillary Clinton, Nelson Mandela and Prince William, among others. Blazer, now fighting cancer, drew the IRS into FIFA, Weber said. In late 2011, the IRS joined the FBI, which was separately probing FIFA.

Gulf and Western and Mario Puzo.

• Seymour Hersh And The Dangers Of Corporate Muckraking (Mark Ames)

[..] it’s a wonder that Hersh and his collaborator on the Korshak articles, Jeff Gerth (now at ProPublica), didn’t find themselves in the obit pages shortly afterwards, their careers tragically cut short in mysterious car crashes or suicide overdoses. . . . Instead, Hersh smelled blood: the Korshak articles opened his eyes to a company that was, in the 1970s, the symbol of aggressive, shady corporate power: Gulf & Western. Most people have probably forgotten Gulf & Western, once considered the most aggressively acquisitive conglomerate in the US, so aggressive that even Wall Street nicknamed the company “Engulf & Devour” (immortalized as the evil corporation in Mel Brooks’ “Silent Movie”).

G&W’s best known subsidiary was Paramount Pictures, which Gulf & Western bought in the mid-1960s during its massive acquisition spree, underwritten by easy money from banking giants Chase Manhattan and Manufacturers Hanover. Under Gulf & Western, Paramount made some classic films including Chinatown, The Godfather, Airplane!, and Three Days of the Condor. G&W also made the career of future media tycoon Barry Diller, who was named Paramount’s CEO and chairman in 1974 and served there for a decade. Mob attorney Korshak was so integral to Gulf & Western’s Paramount subsidiary, he was known as the film company’s “consigliere,” and rumored to be the model for Robert Duvall’s consigliere character in Paramount’s “The Godfather.”

Two years after acquiring Paramount in 1968, G&W pulled off a mind-boggling transaction with notorious Sicilian mafia financier Michele Sindona, who oversaw the mafia’s global heroin money laundering operations, managed the Vatican’s global portfolio (earning the nickname “God’s banker”), and helped the CIA move money around the globe. Somehow, Gulf & Western managed to exchange reams of worthless commercial paper in a broke subsidiary, Commonwealth United, at a vastly inflated price in exchange for a 10.5% stake in Sindona’s investment empire, Societa General Immobilaire — which was followed by another shady transaction giving half of Paramount Studio’s movie lot to Sindona’s mafia bank.

What did the people pay for their education who now cut funding for the next generation?

• Stephen Hawking: No Funding For Students With My Kind Of Condition (Guardian)

World-renowned physicist and author Stephen Hawking has spoken of fears that a gifted academic with a condition as serious as his own would not be able to flourish in today’s tough economic times. The 73-year-old, Britain’s highest-profile scientist who found fame with a new audience following the release of award-winning film The Theory Of Everything, expressed the concerns at an event to celebrate his 50th year as a fellow at the University of Cambridge’s Gonville and Caius college. He praised the college for supporting him throughout the progression of motor neurone disease, allowing him to focus on his groundbreaking work. But, speaking before an invited audience at the college, he added: “I wonder whether a young ambitious academic, with my kind of severe condition now, would find the same generosity and support in much of higher education. “Even with the best goodwill, would the money still be there? I fear not.”

Although Hawking did not elaborate on his comments, he has previously raised concerns about cuts to government funding for research budgets. Seven years ago he warned that £80m of grant cuts threatened Britain’s international standing in the scientific community, saying: “These grants are the lifeblood of our research effort; cutting them will hurt young researchers and cause enormous damage both to British science and to our international reputation.” His comments come at a time when universities continue to lobby for sufficient resources. Speaking earlier this month, Wendy Platt, director general of the Russell Group, which represents the leading research universities, said: “The new government must ensure our universities have sufficient funding to carry out cutting-edge research and provide excellent teaching to students.”

Because we can ban Russians, but they can’t ban us.

• European Union Anger at Russian Travel Blacklist (BBC)

The European Union has responded angrily to Russia’s entry ban against 89 European politicians, officials and military leaders. Those banned are believed to include general secretary of the EU council Uwe Corsepius, and former British deputy prime minister Nick Clegg. Russia shared the list after several requests by diplomats, the EU said. The EU called the ban “totally arbitrary and unjustified” and said no explanation had been provided. Many of those on the list are outspoken critics of the Kremlin, and some have been turned away from Russia in recent months. The EU said that it had asked repeatedly for the list of those banned, but nothing had been provided until now. “The list with 89 names has now been shared by the Russian authorities.

We don’t have any other information on legal basis, criteria and process of this decision,” an EU spokesman said on Saturday. “We consider this measure as totally arbitrary and unjustified, especially in the absence of any further clarification and transparency,” he added. Swedish Foreign Minister Margot Wallstrom said the move did not “contribute to increasing the trust of Russian actions” The list of those barred from Russia has not been officially released, although what appears to be a leaked version (in German) is online. A Russian foreign ministry official would not confirm the names of those barred, but said that the ban was a result of EU sanctions against Russia.

“Why it was precisely these people who entered into the list… is simple – it was done in answer to the sanctions campaign which has been waged in relation to Russia by several states of the European Union,” the official, who was not named, told Russian news agency Tass. The official said Moscow had previously recommended that all diplomats from countries that imposed sanctions on Russia should check with Russian consular offices before travelling to see if they were banned. “Just one thing remains unclear: did our European co-workers want these lists to minimise inconveniences for potential ‘denied persons’ or to stage another political show?” he said.

Long article about the frictions Francis allegedly causes.

• The Rebel of St. Peter’s Square (Spiegel)

When Pope Francis, otherwise known as Jorge Mario Bergoglio, entered St. Peter’s Basilica at 10 a.m. on Pentecost Sunday for the Holy Mass, he had been in office for 797 days. Seven-hundred-ninety-seven days in which he has divided the Catholic rank-and-file into admirers and critics. At time during which more and more people have begun to wonder if he can live up to what he seems to have promised: renewal, reform and a more contemporary Catholic Church. Francis has had showers for homeless people erected near St. Peter’s Square, but has at the same time also spent millions on international consultants. He brought the Vatican Bank’s finances into order, but created confusion in the Curia. He has negotiated between Cuba and the United States, but also scared the Israelis by calling Palestinian President Mahmoud Abbas an “angel of peace.”

This pope is much more enigmatic than his predecessor – and that is becoming a problem. Right up to this day, many people have been trying to determine Francis’ true intentions. If you ask cardinals and bishops, or the pope’s advisors and colleagues, or veteran Vatican observers about his possible strategy these days – the Pope’s overarching plan – they seem to agree on one point: The man who sits on the Chair of St. Peter is a notorious troublemaker. Like a billiard player who nudges the balls and calmly studies the collisions during training, Francis is getting things rolling in the Vatican. His interest in experimentation may stem from his past as a chemical engineer. He makes decisions like Jesuit leaders – after thorough consultation, but ultimately on his own.

The Francis principle has a workshop character to it, with processes more important than positions. Traditional Catholics see things exactly the other way around from Bergoglio, the Jesuit, and this is creating confusion right up to the highest circles of the Vatican. People want to know where the pope is heading.

Saakashvili had been ‘hiding’ in New York before being handed a Ukrainian passport. WIth Georgia on his mind.

• ‘Wanted Criminal’ Saakashvili Attempts a Napoleon as Governor of Odessa (RT)

Petro Poroshenko’s decision to appoint Georgia’s disgraced former President as Governor of the Odessa region just might be his most bizarre move yet. Mikhail Saakashvili is a wanted criminal suspect in his homeland. When the pro-Euromaidan activist Maxim Eristavi tweeted on Friday that Mikhail Saakashvili was to become Odessa’s new Governor, the Twittersphere didn’t seem to know whether shock or amusement was the most appropriate reaction. However, on closer inspection, the move isn’t such a surprise after all. There are myriad reasons why Saakhasvili would find Odessa’s top job attractive and equally as many why Poroshenko is most likely delighted to send him there.

It’s common knowledge that Ukraine is a tragically divided land, but Odessa is split like no other city in the country. 150 years ago, Odessa was one of Europe’s most vibrant destinations, at a time when it was a multi-ethnic smorgasbord of Russians, Jews, Greeks, Italians and Albanians. In fact, it even had two French governors – Duc De Richelieu and Count Andrault De Langeron. So famed was Odessa that in 1869, the legendary American writer, Mark Twain, predicted that it would become “one of the great cities of the old world.” Russia’s national poet Alexander Pushkin wrote of the Black Sea Pearl: “the air is filled with all Europe, French is spoken and there are European papers and magazines to read.” By 1897, 37%% of the city’s population was Jewish.

Post World War II, the Russian (largely to Moscow and Leningrad) and Jewish (mainly to Israel and the USA) elite moved out and the Soviets moved in Ukrainian villagers to replace them. The glory days have long since passed. Riddled with corruption, in the 21st century, Odessa is an extremely melancholic and economically moribund city better known for mafia activity and sex tourism (Odessa Dreams by the Guardian’s Shaun Walker is a useful read on the latter subject), than high culture. Despite its rich history, and striking Italianate architecture, any right-thinking visitor would find the place rather mournful.

There are thousands a day now. When will Europe start shooting them?

• Over 4,200 Migrants Rescued In Mediterranean In 1 Day As Crisis Grows (Reuters)

More than 4,200 migrants trying to reach Europe have been rescued from boats in the Mediterranean in last 24 hours, the Italian coastguard said on Saturday. In some of the most intense Mediterranean migrant traffic of the year, a total of 4,243 people have been saved from fishing boats and rubber dinghies in 22 operations involving ships from nations including Italy, Ireland, Germany, Belgium and Britain. On Friday the Italian navy said 17 dead bodies had been found on one of the boats off Libya. Details of the nationalities of the victims and how they died have not yet been released. The bodies and more than 200 survivors will be brought to the port of Augusta in eastern Sicily aboard the Italian navy corvette Fenice later on Saturday, the coastguard said.

Migrants escaping war and poverty in Africa and the Middle East this year have been pouring into Italy, which has been bearing the brunt of Mediterranean rescue operations. Most depart from the coast of Libya, which has descended into anarchy since Western powers backed a 2011 revolt that ousted Muammar Gaddafi. Calm seas are increasingly favoring departures as warm spring weather sets in. Last month around 800 migrants drowned off Libya in the Mediterranean’s most deadly shipwreck in living memory when their 20-metre long fishing boat capsized and sank. That spurred the European Union to agree on a naval mission to target gangs smuggling migrants from Libya, but a broader plan to deal with the influx is in doubt due to a dispute over national quotas for housing asylum seekers.

The EU plan to disperse 40,000 migrants from Italy and Greece to other countries met with resistance this week, with Britain saying it would not participate and some eastern countries calling for a voluntary scheme. Around 35,500 migrants arrived in Italy from the beginning of the year up to the first week of May, the UN refugee agency estimated, a number which has swelled considerably since. About 1,800 are either dead or missing. Most of those rescued on Friday and Saturday are expected to reach ports around southern Italy during the weekend. The British naval vessel HMS Bulwark offloaded more than 740 early on Saturday at the southeastern Italian port of Taranto. More than 200 migrants arrived at the Calabrian port of Crotone in south-west Italy on board the Belgian navy ship Godetia.

They will keep coming. Move over and get used to it.

• Kos Shows There Is No Escape From The Migrant Crisis (Guardian)

In the face of characteristic warnings (“misguided sentimentalism”) from the Daily Mail of 1938, some thousands of refugees were none the less allowed into Britain before the second world war, with 15,000 Jewish children arriving on the Kindertransport trains orchestrated by Sir Nicholas Winton. As well as finding foster parents, he had to raise £50 per head to pay for their eventual departure. The former prime minister, Stanley Baldwin, launched another fund to help refugees who needed “a hiding place from the wind, a covert from the tempest”. Margaret Thatcher’s family was among those who took in a refugee. “The honour of our country is challenged,” Baldwin said, in the years before Britons became so agitated, as in Kos, about correct refugee appearance.

But as much as they deserve international ridicule and disgust, the tales of holidaymakers’ “nightmares”, and pictures of studiously averted faces, are no more shame-inducing than Britain’s official approach to the migrant crisis, which they could not more vividly encapsulate. Our new government also averts its eyes from the hordes of displaced, regardless of their various origins and claims, and clearly has no truck with the sort of idealistic bilge once emitted by Winton and Baldwin. Nor with the principles that later made room – in an unenthusiastic Britain – for 28,000 Ugandan Asians and 19,000 Vietnamese boat people.

Rather, when the country’s honour is challenged, Cameron’s response appears to be modelled on the lines of the Sun columnist who described all the Mediterranean migrants – half of whom, says the UNHCR, are fleeing war and persecution – as “cockroaches”. After 46,000 Mediterranean migrants arrived in the first four months of this year, and more than 1,750 died or went missing, one of Cameron’s first acts, as prime minister, was to opt out of an EU proposal to allocate refugees evenly among member states. To date, Britain has formally resettled 187 refugees from Syria, a number that might be just, fractionally less inexcusable if it were accompanied by any inclination to discover and rescue eligible asylum seekers before thousands more are abused, cheated and drowned by smugglers.

If this is not scary enough for you…

• The Most Polluted City In The World?! (NY Times)

When I became a South Asia correspondent for The New York Times three years ago, my wife and I were both excited and prepared for difficulties – insistent beggars, endemic dengue and summertime temperatures that reach 120 degrees. But we had little inkling just how dangerous this city would be for our boys. We gradually learned that Delhi’s true menace came from its air, water, food and flies. These perils sicken, disable and kill millions in India annually, making for one of the worst public health disasters in the world. Delhi, we discovered, is quietly suffering from a dire pediatric respiratory crisis, with a recent study showing that nearly half of the city’s 4.4 million schoolchildren have irreversible lung damage from the poisonous air.

For most Indians, these are inescapable horrors. But there are thousands of others who have chosen to live here, including some trying to save the world, others hoping to describe it and still others intent on getting their own small piece of it. It is an eclectic community of expatriates and millionaires, including car executives from Detroit, tech geeks from the Bay Area, cancer researchers from Maryland and diplomats from Dublin. Over the last year, often over chai and samosas at local dhabas or whiskey and chicken tikka at glittering embassy parties, we have obsessively discussed whether we are pursuing our careers at our children’s expense.

Foreigners have lived in Delhi for centuries, of course, but the air and the mounting research into its effects have become so frightening that some feel it is unethical for those who have a choice to willingly raise children here. Similar discussions are doubtless underway in Beijing and other Asian megacities, but it is in Delhi – among the most populous, polluted, unsanitary and bacterially unsafe cities on earth – where the new calculus seems most urgent. The city’s air is more than twice as polluted as Beijing’s, according to the World Health Organization. (India, in fact, has 13 of the world’s 25 most polluted cities, while Lanzhou is the only Chinese city among the worst 50; Beijing ranks 79th.)

Home › Forums › Debt Rattle May 31 2015