Paul Gauguin Brooding woman 1891

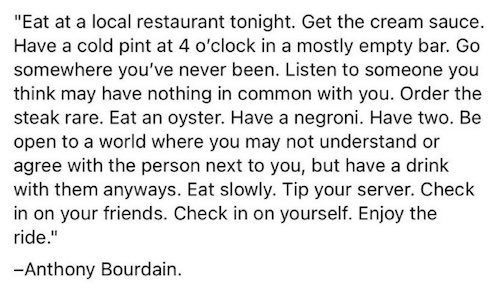

Be kind

https://twitter.com/i/status/1604034405764308994

7,300 over 80

How many people over the age of 80 must you vaccinate to prevent just one Omicron death?

The answer is mind-blowing!#stoptherollout pic.twitter.com/WIXwzIm0G8

— Andrew Bridgen (@ABridgen) December 16, 2022

Pfizer

https://twitter.com/i/status/1604007901647065088

Tulsi Trudy

Tulsi Gabbard pull no punches in her assessment of 'autocratic' Justin Trudeau.@TulsiGabbard pic.twitter.com/FWylUm670g

— James Melville (@JamesMelville) December 17, 2022

“Oliver Stone’s “JFK”

• Has American Democracy Been a Hallucination for Nearly 60 Years? (Simon)

Call it a democracy, call it a democratic republic, call it a constitutional republic, call it anything you want—it doesn’t really matter what America is if there is truth to what Tucker Carlson was reporting the other night via a source who had “direct knowledge” of still-hidden documents concerning the Kennedy assassination, implicating the CIA. If indeed the CIA was in any way involved in the assassination of JFK on Nov. 22, 1963, then anything that has happened in the public sphere in our country since that day has basically been a hallucination created by an intelligence agency far deeper than most of us—certainly me, since I was never much given to conspiracy theories—ever imagined.

The affairs of the day—RNC chief Ronna McDaniel revealed to be a profligate spender on her own luxury travel, not on Republican candidates; Donald Trump releasing self-aggrandizing NFT pseudo-art as a fundraiser (rest in peace, Johannes Vermeer); even Elon Musk’s exposure of the multiple mendacious censoring creeps behind Twitter, although that has an eerie similarity—pale by comparison to CIA involvement and, therefore, massive coverup for decades in the JFK assassination. That former CIA director Mike Pompeo declined to appear on Carlson’s show to discuss this is not insignificant. We all know about 51 intelligence officials—John Brennan and others who fallaciously claimed two years ago the Hunter Biden laptop was Russian disinformation. They have to have known otherwise. Now this?

Why are 3 percent of the Warren Commission documents on the assassination still being hidden after those nearly 60 years with all the major players dead, if not to hide something of serious importance from the American public? It’s time to reconsider Oliver Stone’s “JFK” that, though I admired Oliver’s filmmaking, I originally thought to be a crackpot.

“Xi of Arabia’s announcement was a prodigy of finesse: it was packaged as the internationalization of the yuan.”

• Xi of Arabia and the Petroyuan Drive (Escobar)

It would be so tempting to qualify Chinese President Xi Jinping landing in Riyadh a week ago, welcomed with royal pomp and circumstance, as Xi of Arabia proclaiming the dawn of the petroyuan era. But it’s more complicated than that. As much as the seismic shift implied by the petroyuan move applies, Chinese diplomacy is way too sophisticated to engage in direct confrontation, especially with a wounded, ferocious Empire. So there’s way more going here than meets the (Eurasian) eye. Xi of Arabia’s announcement was a prodigy of finesse: it was packaged as the internationalization of the yuan. From now on, Xi said, China will use the yuan for oil trade, through the Shanghai Petroleum and National Gas Exchange, and invited the Persian Gulf monarchies to get on board.

Nearly 80 percent of trade in the global oil market continues to be priced in US dollars. Ostensibly, Xi of Arabia, and his large Chinese delegation of officials and business leaders, met with the leaders of the Gulf Cooperation Council (GCC) to promote increased trade. Beijing promised to “import crude oil in a consistent manner and in large quantities from the GCC.” And the same goes for natural gas. China has been the largest importer of crude on the planet for five years now – half of it from the Arabian peninsula, and more than a quarter from Saudi Arabia. So it’s no wonder that the prelude for Xi of Arabia’s lavish welcome in Riyadh was a special op-ed expanding the trading scope, and praising increased strategic/commercial partnerships across the GCC, complete with “5G communications, new energy, space and digital economy.”

Foreign Minister Wang Yi doubled down on the “strategic choice” of China and wider Arabia. Over $30 billion in trade deals were duly signed – quite a few significantly connected to China’s ambitious Belt and Road Initiative (BRI) projects. And that brings us to the two key connections established by Xi of Arabia: the BRI and the Shanghai Cooperation Organization (SCO).

Google translation. Something’s up with immune systems.

• German IC Doctor: Never Seen So Many People Sick (Telegraaf)

The number of people in Germany currently suffering from an infection or illness is at a historic high, chairman Christian Karagiannidis of the German Association for Intensive Care and Emergency Medicine told the Rheinische Post. “The disease rate among the population is extremely high at the moment, I have never experienced anything like it.” According to Karagiannidis, almost all IC beds are occupied in many regions. He emphasizes that coronavirus infections are no longer the main problem. “Currently, we are fighting a very wide range of illnesses: flu, RS virus, coronavirus and other respiratory illnesses, plus the usual emergencies.” The IC doctor hopes that the Christmas holidays will provide relief, because the number of admissions often drops then.

In addition to the extremely high number of patients, German hospitals also suffer from absenteeism among staff, high work pressure, attacks aimed at staff and delivery problems of a number of medicines, including antibiotics and heart medication. Pediatrics is also facing shortages of medicines, which could jeopardize the care of young patients with respiratory infections. Karagiannidis calls on local drug manufacturers to produce and stock certain resources in advance so that they are available in sufficient quantities. “I find it worrying for a country like Germany that we have been dealing with such shortages time and time again for a long time and that this shortage has become even more acute due to the many infections.”

Thought leaders

https://twitter.com/i/status/1604329625189957632

The nukes are in their imagination.

• US: Ukraine Can Retake Crimea, But May Provoke Nuclear Escalation (Antiwar)

The White House believes Ukraine’s military could retake the Crimean Peninsula from Russia. However, officials say the offensive may cross Moscow’s “red lines” and prompt a nuclear strike. The Biden administration has radically changed its view of Kiev’s military since Russia invaded nearly ten months ago. The Ukrainians “continue to shock the world with how well they’re performing on the battlefield,” an unnamed official said. The White House now assesses that the Ukrainian armed forces are capable of retaking Crimea, with NBC News reporting that statements to that effect were made to lawmakers during a Congressional hearing last month.

The administration official was attempting to explain to Congress why Kiev still needs American support. The Crimean Peninsula was a region of Ukraine before it was annexed by Russia in 2014. While a referendum of Crimean citizens backed Russian President Vladimir Putin’s decision, Kiev and Washington assert the peninsula still belongs to Ukraine. Sources reached by NBC News said the White House believes Putin will respond sharply to a successful Ukrainian offensive in Crimea. “Putin may react more strongly to Crimea,” one official said, while a former administration staffer added “That’s the red line.”

The White House does not believe Ukrainian military operations in Crimea to be imminent. “A lot would have to happen militarily first” before Ukraine could begin a real offensive to retake Crimea, an official stated. However, the Biden administration has been surprised by some of Ukraine’s most advanced military operations. Two US officials and an American defense staffer said the White House was caught off guard and frustrated after Kiev launched a series of three drone attacks strikes deep inside Russian territory.

“..preparation and implementation of joint terror attacks on the Russian Federation territory.”

• Data Confirm US, Poland’s Involvement In Terror Attacks In Russia (TASS)

Data from intercepted drones confirm the involvement of the US and Poland in preparation of terror attacks on the Russian territory, a source in Russian security agencies told TASS Friday. “Relevant agencies of the Russian Federation analyzed electronic components of the intercepted unmanned aerial vehicles, used by Ukraine for attacks on Russian infrastructure objects – in particular, in Sevastopol, in Crimea, in Kursk, Belgorod and Voronezh Regions,” the agency said. According to the specialists’ assessments, a number of facts “confirm the direct involvement of the US and Poland in the massive military-logistical support of the Kiev regime, in preparation and implementation of joint terror attacks on the Russian Federation territory.”

The agency noted that “the avionics and drone control stations were produced by US’ Spektreworks, a company that performed the initial tuning and check of the drones at the Scottsdale airport in Arizona.” In addition, the relevant agencies pointed out that “the final assembly and flight trials of these drones were carried out on the Polish territory, near the Rzeszow airport, used by the US and NATO as the main supply node for Ukrainian armed forces.” “The installation of payload, flight mission and the launch itself were carried out near Odessa and Krivoy Rog,” the statement says.

“..there needs to be a “complete overhaul” of social media leadership and a “cleansing” of all forms of censorship on social media sites.”

• Twitter Suppressed Early COVID-19 Treatment Information, Vaccine Concerns (ET)

Thanks to Elon Musk, the public is now aware that Twitter suppressed early treatment options for COVID-19, and vaccine safety concerns, Dr. Peter McCullough alleged in an interview that aired on Newsmakers by NTD and The Epoch Times on Dec. 14. Further, thanks to the Twitter Files—a collection of internal emails and communications made public by Musk—the cardiologist said there’s proof that government agencies were working against him (McCullough) personally. “I didn’t violate any of Twitter’s rules,” McCullough stated. “And what we’re learning is that secret emails between government agencies and Twitter were working to, in a sense, shadow-ban me, censor me, and inhibit my ability to exercise my rights to free speech and disseminate scientific information.”

McCullough said Musk’s takeover of Twitter is a “welcome change,” especially for healthcare professionals like himself. “Twitter had become an incredibly biased and censored platform, where the public knew they weren’t getting a fair, balanced set of information on a whole variety of developments—including the early treatment of SARS-COV2 infection and a balanced view of safety and efficacy of the vaccines,” McCullough claimed. The cardiologist further claimed that he was censored and finally suspended for sharing scientific “abstracts and manuscripts,” which didn’t fit the accepted political view. Plus, McCullough remarked, he wasn’t the only doctor targeted. Musk lifted the suspensions of McCullough and mRNA vaccine technology contributor Dr. Robert Malone—suspended from Twitter in 2021 after criticizing the effectiveness of the mRNA vaccines—after completing his Twitter purchase.

According to McCullough, when a social media company has a COVID-19 warning or labels a post “misinformation,” that’s a sign of government censorship and control. “Facebook, Instagram, and the other platforms. … Anytime a message is posted, and it says, ‘See the COVID information center,’ or it labels it ‘COVID misinformation,’ that actually indicates that there’s government interference. There’s government censorship going on,” McCullough asserted. He added that when a user witnesses the above, they need to call out that platform. Moreover, McCullough believes there needs to be a “complete overhaul” of social media leadership and a “cleansing” of all forms of censorship on social media sites.

Told NTD Epoch Times News that breaking the yolk of medical censorship has been a key development; it's changing the calculus on public sentiment concerning safety and efficacy of the mass mandated products. @stkirsch coming back on the platform is huge. @news_ntd @EpochTimes pic.twitter.com/c4EKHwJqaF

— Peter A. McCullough, MD, MPH™ (@P_McCulloughMD) December 16, 2022

“If anyone posted real-time locations & addresses of NYT reporters, FBI would be investigating, there’d be hearings on Capitol Hill & Biden would give speeches about end of democracy!”

• Musk Makes Decision On Banned Journalists After Poll (RT)

Elon Musk has unblocked the accounts of several journalists who had been suspended from Twitter for allegedly violating the platform’s “doxxing” policies. The social media boss reinstated the accounts, which had been sharing data on the billionaire’s flights, following massive public backlash and an opinion poll he conducted on Twitter. “The people have spoken. Accounts who doxxed my location will have their suspension lifted now,” Musk tweeted on Friday. The Twitter CEO had earlier held a poll asking the platform’s users whether they wanted the journalists’ accounts to be reinstated ‘now’ or ‘in seven days.’ A total of 58.7% opted for the former option, with almost 3.7 million people taking part in the vote.

On Thursday, Twitter banned the accounts of several high-profile journalists, including CNN’s Donie O’Sullivan, the New York Times’ Ryan Mac, and the Washington Post’s Drew Harwell. According to Musk, these people reported and shared links to ElonJet, an account that had been tracking the billionaire’s flights in alleged violation of Twitter’s “doxxing” policy. The billionaire also argued that journalists had revealed his “exact real-time” location, which he said amounted to releasing “assassination coordinates.” “If anyone posted real-time locations & addresses of NYT reporters, FBI would be investigating, there’d be hearings on Capitol Hill & Biden would give speeches about end of democracy!” he added.

“.. they were actively sending information on behalf of the government on who to look into, or who to ban, and that sort of thing.”

• Coordination Between DOJ and FBI Is Not Limited to Twitter: Devin Nunes (ET)

The social media coordination between the Department of Justice (DOJ) and the FBI isn’t limited to Twitter, former Congressman and current CEO of President Trump’s Truth Social, Devin Nunes, alleged in an interview that aired on Newsmakers by NTD and The Epoch Times on Dec. 14. The Twitter Files, a collection of internal emails and communications made public by Twitter’s new owner, Elon Musk, confirmed what many Conservatives have alleged for years. Namely, Twitter was shadow-banning accounts that didn’t fit a specific ideology and suspending accounts that bucked the chosen political narrative, Nunes claimed. But, the most concerning revelation in the Twitter Files, according to Nunes, is that the DOJ and the FBI had informants—whether paid or volunteers—that put forward a specific directive to Twitter, and that is likely happening on other social media platforms.

“The coordination that the Department of Justice and the FBI clearly had with Twitter? I don’t think it stops there,” Nunes stated. “It seems like they were either running informants, or had paid informants, or had volunteers, where they were actively sending information on behalf of the government on who to look into, or who to ban, and that sort of thing. “The bigger issue is, Twitter is one thing, but what about Facebook? What about Instagram?” According to Nunes, Trump developed Truth Social because, before Musk bought Twitter, Trump recognized that there was absolute control over public discourse in the United States. Furthermore, that control led to shadow banning and suspending social media accounts, so those accounts couldn’t criticize the controlling regime in the proverbial public square.

And while Nunes further stated that he’d recently discussed the Twitter File drops with Trump—and in general, Trump is glad Musk purchased Twitter—Trump still believes Musk needs to release all of the Twitter Files to the public and not go through cherry-picked journalists. “What [do] we really need from Elon Musk and Twitter at this point? Just release all the files. Don’t just have selective journalists look at it. Release all the files so everyone can begin to evaluate them. You never know what you’re going to find [with more people looking at the files].” Nunes said he believes that by releasing all the files, even more will be uncovered by citizen journalists and by Congress. He added he’s not alone in the belief that Musk should release all files and noted that Jack Dorsey, Twitter’s former CEO and founder, also called on Musk to release the Twitter Files to the public.

You will be so missed. Bye.

• Boston University School of Public Health Stops Using Twitter (Prasad)

Boston University School of Public Health’s Dean, Sandro Galea, recently announced that BU has reconsidered its engagement on twitter. Going forward, “we will, as a School, be disengaging from our Twitter account @busph. Relatedly, I will also suspend my personal @sandrogalea account.” Is this decision a rational one— proportionate to challenges on the online platform—or is it performative? The dean himself wonders, “I always worry that decisions like this can seem overly performative. I hope that this is indeed right given the current landscape of Twitter.” Most importantly, does it advance public health’s credibility? Does it help the profession in the eyes of the public? In this essay, I consider these questions. In order to analyze BU’s decision we need to consider two things. First, what platforms will BU remain on, and second, what are the stated reasons for leaving?

BU school of public health has singled out twitter as the social media platform to disengage from, but remains on other platforms, including “email newsletter, SPH This Week, Public Health Post, LinkedIn, Facebook, Instagram, press outreach, our website, as well as other emerging channels.” Scrolling through past stories it is clear that press outreach can include small papers, including the Staten Island Live, and other news outlets that frankly I have never heard of. Thus, there must be something uniquely disqualifying about Twitter that does not apply to all these other venues. Let’s consider those reasons. Dean Galea offers “two key” ones. #1 Dean Galea writes, “First, Twitter has moved from being a publicly held company to being a privately held company, and, in particular, a company controlled by one person who has not been hesitant to impose his personal views on the platform.”

In other words: we are quitting Twitter is because one person makes the decisions. This argument is clearly lacking. Facebook is a publicly traded company, but the desires of the founder and CEO Mark Zuckerberg have tremendous sway over their decisions. Whether public or private— decisions can always be made by one or two people, without transparency and often in illogical and contradictory fashion. How does Linkedin make decisions? Instagram? Staten Island Live? What about all those news outlets I have never heard of? Who knows! Dean Galea senses the obvious weakness of this argument, and thus offers further clarification, “That may well be acceptable if that person shows themselves to be judicious and thoughtful in both their communication and actions, but that has not been the case with Mr. Musk.”

So it isn’t merely that a single person makes the decisions, but that they are not judicious and thoughtful? Yet, even with this clarification, the argument to quit seems thin. BU School of Public Health remains happy to amplify their content in Staten Island Live. That is owned by a company called Advanced Local Media. Who controls this company? Are they judicious and thoughtful? Does BU have obligation to investigate? Rupert Murdoch owns many US papers including the Wall Street Journal, a place where Dean Galea has authored op-eds. In fact, Galea’s bio lists him as a “regular contributor to media, including” the Wall Street Journal. Is Murdoch judicious and thoughtful? I think many at BU public health would disagree.

“Doxxing has long been subject to suspension. ”

• EU Threatens Musk With Sanctions Over Suspending Media (Turley)

Despite my support for Elon Musk’s continuing efforts to reduce censorship and restore free speech protections on Twitter, I have been critical of some of his moves from his use of polls on restoring certain posters to the suspensions of media figures this week. However, this morning, I was struck by the European Union (EU) rushing into the controversy to threaten, again, sanctions against Musk. The EU is apparently aghast that Twitter could suspend media even temporarily after ignoring the bans on conservative media for years under the old management. I understand Musk’s view of such tracking as a form of doxxing (particularly after a man reportedly used the information to attack the car with one of his children inside). Doxxing has long been subject to suspension.

Indeed, figures connected with mainstream media from CNN to the Washington Post have been previously accused of doxxing. Liberal groups were accused of doxxing conservative justices and others, including dangerously posting information on the children of Justice Amy Coney Barrett. It does not seem to matter when the targets are conservative, Republican, or libertarian. Figures who have long advocated the banning of others with opposing views are some of the loudest objecting in the wake of the doxxing controversy. Washington Post Taylor Lorenz expressed fear that she could be next. It may not be a groundless fear since Lorenz has been previously accused of doxxing others and described the reintroduction of free speech protections for others as the opening of “the gates of hell.”

However, it was the appearance of the EU that was most jarring. We have been discussing efforts by figures like Hillary Clinton to enlist European countries to force Twitter to restore censorship rules. Unable to rely on corporate censorship or convince users to embrace censorship, Clinton and others are resorting to good old-fashioned state censorship, even asking other countries to censor the speech of American citizens. It is an easy case to make given the long criminalization of speech in countries like France, Germany, and England. The EU responded immediately by threatening Musk that restoring free speech could result in immediate sanctions or an entire ban.

Now, EU commissioner Vera Jourova warned that the EU’s Digital Services Act was preparing to act to defend press freedom: “Elon Musk should be aware of that. There are red lines. And sanctions, soon.” Jourova’s self-righteous tirade was almost comical given the EU’s long-standing attacks on free speech and silence of prior media suspensions. Jourova insisted “[The] EU’s Digital Services Act requires respect of media freedom and fundamental rights. This is reinforced under our Media Freedom Act.” Really? Where was Jourova and the EU when Twitter was aggressively suspending media like the New York Post for publishing the true story of Hunter Biden’s laptop? How about the slew of conservative writers and experts barred for questioning official accounts on issues ranging from Covid to climate change?

“What reasonable and lawful purpose is there in knowing where some particular person is on a mass-distribution basis and by what rubric does that meet the “reasonable public purpose” test?”

• Musk Wars Part X: Doxxing (Denninger)

Musk claims to have had an incident in which a vehicle carrying his child was accosted by a stalker. In response to this he put forward a rule on Twitter: Publishing the real-time location of any person is a bannable offense. I can argue both sides of that in terms of reasonableness, particularly when it comes to public records, because the usual exception to them (what in many states is called “publication of private facts”) doesn’t really apply. But the reason I argue its not so clear as it used to be, and there is a clean argument for such a policy and perhaps even a law, is that today it is all too easy to gin up a lynch mob using so-called “social media” and other means of mass distribution. This is a relatively new thing; you could always, for example, post a sign on a telephone pole (or tree, before there were telephone poles) but your reach was at least somewhat limited and local. This is no longer true; now you sit in Washington DC and gin up a lynch mob in California at zero cost and trouble.

This isn’t theoretical; “modern media” has been used for this, almost-exclusively by the left, to do exactly that. A sitting Congressperson who lives on a houseboat was relentlessly targeted to the point they couldn’t go get groceries without being harassed. Their decision to live on a boat where ingress and egress is limited for obvious reasons certainly entered into the problem but there’s nothing wrong with living on a boat — plenty of people do and its a perfectly-legitimate choice. Several justices of the USSC have been similarly targeted at their homes and again, this was ginned up by persons all over the United States using capacity that didn’t used to exist. In the latter case the law was broken, yet the government refused to enforce said law.

It is already illegal, by the way, to communicate threats using interstate means or to travel for such a purpose between states. That’s a violation of federal law as it stands today. States also have “anti-stalker” laws with similar provisions. The exact intersection of all of these laws, basic human decency and the generation of “rage mobs” is a worthy matter for public debate. But what’s not under debate is what happened here. This was a pure bad-faith set of actions taken by a bunch of people. Whether they explicitly coordinated their actions is not known and doesn’t matter; the facts are: Musk announced that any real-time “doxxing” of positions was a banhammer offense. These “journalists” did it anyway, in rapid succession from one another, knowing in advance that it was an offense. Musk banhammered them all immediately and refused to apologize. The left went nuts. Good. Let them go nuts.

Tell me what the lawful and legitimate purpose is for real-time information on someone’s location? Is there a perfectly-legitimate public purpose, for example, in disclosing that “Joe X” travels by private jet on a regular basis while advocating that everyone else should be forced to “de-carbon” (e.g. attending some climate confab)? Absolutely; that has a reasonable and possible purpose of exposing hypocrisy. What reasonable and lawful purpose is there in knowing where some particular person is on a mass-distribution basis and by what rubric does that meet the “reasonable public purpose” test?

“We are definitely one step further away from the amoral, anti-democratic, ever self-empowering mercantilist EU.”

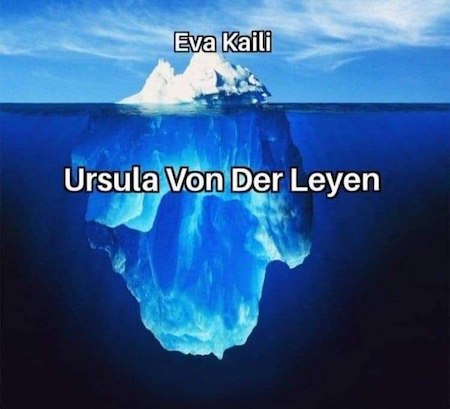

• EU Branded ‘Fundamentally Corrupt’ (Exp.)

The European Union is a “fundamentally corrupt” organisation, and easy prey for people with “deep pockets” looking to exert their influence through the continent, a former MEP has warned. Ben Habib, who was one of 29 Brexit Party candidates elected to the assembly in 2019, was speaking after four people, including former European Parliament vice-president Eva Kaili, were charged after a series of raids by Belgian prosecutors. Authorities have not official identified the country suspected of offering cash or gifts to officials but several members of the assembly and some Belgian media have linked the investigation to World Cup hosts Qatar – although the Gulf state denies the allegations.

The European Union’s parliament yesterday voted to suspend work on all files involving Qatar, and called for security passes for representatives of the Gulf country’s interests to be withdrawn until light can be shed on the scandal rocking the assembly. Mr Habib told Express.co.uk: “This doesn’t surprise me at all. The EP is swarming with lobbyists. “It’s inherent in the structure. The Qatari thing is just the surface of it. “I’m sure the same applies to the Commission. The EU itself is fundamentally corrupt.” As such the bloc was a “natural target” for “anyone with deep pockets wanting a favour”, he stressed. Mr Habib remains deeply concerned about the impact on the integrity of the United Kingdom posed by the Northern Ireland Protocol, the mechanism agreed by the UK and the EU as a way of preventing a post-Brexit hard border on the island of Ireland.

However, in consideration of the ongoing corruption claims, he conceded: “We are definitely one step further away from the amoral, anti-democratic, ever self-empowering mercantilist EU.” Mr Habib’s former party colleague Rupert Lowe, who like him sat alongside leader Nigel Farage in Brussels, made a similar point in a post on Twitter today in which he also took the opportunity to take a swipe at British civil servants. The former Southampton FC chairman said: The European Parliament is oozing corruption, from top to bottom. “Packed full of overpaid and incompetent civil servants. Not that unlike Whitehall!”

“We have to give them a moment when they can forget about their problems and enjoy football.”

• FIFA Rejects Zelensky Request To Address World Cup Final (ZH)

This week Zelensky issued a formal request for FIFA to allow him to share a message of “world peace” just before the kickoff to the World Cup final, scheduled for Sunday, but the world governing soccer body promptly rebuffed the request. The Ukrainian government is angered and disappointed, given Zelensky has frequently been invited to make appeals before major public events, even including at the Grammys and Cannes Film Festival. This is when he’s not already busy addressing the G7 or UN-sponsored events, or European Parliament. It goes without saying that the World Cup final will be the single most televised and watched event across the globe this year. According to CNN, Kiev’s lobbying effort is still underway, but Ukraine officials were “surprised” when FIFA quickly reacted negatively:

“The source said Zelensky’s office is offering to appear in a video link to fans in the stadium in Qatar, ahead of the game and was surprised by the negative response. It’s unclear if Zelensky’s message would be live, or taped. “We thought FIFA wanted to use its platform for the greater good,” the source said. Is the Ukrainian leader’s ‘superstar’ status waning? Likely it has more to do with FIFA walking a tightrope in terms of wanting to avoid political topics and public displays at the Qatar-hosted tournament. So far it’s sought to avoid controversy on everything from the proposed ‘One Love’ armbands that some European teams wanted to wear, to imagery in favor of Iranian anti-government demonstrators.

FIFA president Gianni Infantino in a Friday news conference explained that the organization had put a stop to a number of attempts to make “political statements” in Qatar because it must “take care of everyone.” “We are a global organization and we don’t discriminate against anyone,” Infantino explained. “We are defending values, we are defending human rights and rights of everyone at the World Cup. Those fans and the billions watching on TV, they have their own problems. They just want to watch 90 or 120 minutes without having to think about anything, but just enjoying a little moment of pleasure and joy. We have to give them a moment when they can forget about their problems and enjoy football.” Of course, this very rational, straightforward explanation is unlikely to appease Ukrainian officials… but at least they have the consolation that Zelensky was declared Time’s Person of the Year.

364 neurons

Neurons are often represented as isolated, but in reality they packed very tightly. Tyler Sloan made this animation showing 364 neurons packed into a box roughly the size of a grain of sand.

[HD: https://t.co/edJ52Q4l68]

[author: https://t.co/ZWrfirnQAB]pic.twitter.com/3YWAEn8je5— Massimo (@Rainmaker1973) December 17, 2022

Marik

"If You Had to Design a Drug for COVID, It Would Look Exactly Like Ivermectin"

Dr. Paul Marik:

-Antiviral, works against a host of RNA viruses

-Very powerful anti-inflammatory

-Stimulates autophagy, a mechanism to get rid of spike protein.

-Improves the microbiome pic.twitter.com/1UhkL5VofO— New World Odor™ (@hugh_mankind) December 16, 2022

Reindeer

In Norway they Close the Roads for Reindeer to Cross pic.twitter.com/3dDhrzqQ8I

— Gabriele Corno (@Gabriele_Corno) December 17, 2022

Face in the trees

To pay tribute to all the enslaved people buried in cemeteries with no name, artist Craig Walsh put a face in the trees to honor their souls in an installation in Charlotte, North Carolina, called "Monuments"

[read more: https://t.co/eNvkock20F]pic.twitter.com/9nAywnrpmC

— Massimo (@Rainmaker1973) December 17, 2022

Shark

https://twitter.com/i/status/1604204786546487296

Prince Cream

Strip PRINCE back to basics, with an acoustic guitar and a stool…

….and he still has enough charisma and showmanship to have the audience in the palm of his hand.

— James Leighton (@JamesL1927) December 17, 2022

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.