John Vachon Billie Holiday at the Newport Jazz Festival Jul 1954

“It’s so bad that a key Bloomberg index of commodity prices is now sitting at its lowest level since 1999.”

• Warning: Half Of Oil Junk Bonds Could Default (CNN)

Energy companies that loaded up on debt during the oil boom are likely to have trouble paying back those loans. Oil prices have collapsed over 65% since the middle of last year to below $37 a barrel this week and there’s no recovery in sight. It’s fueling financial turmoil on Wall Street with Standard & Poor’s Ratings Service recently warning that a stunning 50% of energy junk bonds are “distressed,” meaning they are at risk of default. Overall, about $180 billion of debt is distressed. It’s the highest level since the end of the Great Recession and much of it is in energy companies. “The wave of energy defaults looming in the wings could make for some very bumpy roads ahead in 2016,” Bespoke Investment Group wrote in a recent report.

The firm described the junk bond market environment as “pretty terrible” lately. That’s a dramatic change from recent go-go years, when the shale oil boom along with cheap borrowing costs allowed energy companies to take on loads of debt to fund expensive drilling operations. U.S. oil production skyrocketed, creating a gigantic supply glut that is currently pushing prices lower and hurting the ability of many energy companies to repay their debt. “The tide may be turning. Excess leverage during the good years has dented credit profiles,” analysts at research firm Markit wrote in a report published on Wednesday. Of course, it’s not just oil companies under financial duress. S&P said a whopping 72% of the bonds in the metals, mining and steel industry are now distressed.

That makes sense given the fact that prices for raw materials like copper, iron ore, aluminum and platinum have recently plummeted to crisis levels. It’s so bad that a key Bloomberg index of commodity prices is now sitting at its lowest level since 1999. No matter the sector, these financially stressed companies will be forced to cut costs by selling off assets and laying off workers. Corporate defaults are already on the rise. S&P said defaults recently topped 100 on the year, the first time that’s happened since 2009. Almost one-third of 2015’s defaults have come from oil, gas or energy companies. S&P warns the high level of distressed bonds is an indicator that more defaults are coming. The firm said being classified as “distressed” reflects an “increased need for capital and is typically a precursor to more defaults.”

At a time when oil and natural gas prices are super low, there’s more bad financial news for these companies – a change in the interest rate environment. The U.S. Federal Reserve is expected to raise interest rates next week for the first time in nearly a decade, a move that will likely hurt demand for risky assets.

““Currently, though, the ability to sell a large position is especially poor…”

• Junk Fund’s Demise Fuels Concern Over Bond Rout (WSJ)

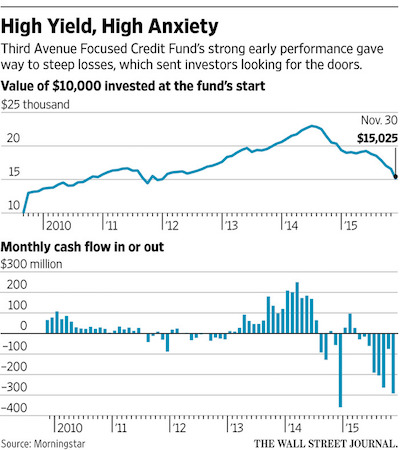

A firm founded by legendary vulture investor Martin Whitman is barring investor withdrawals while it liquidates its high-yield bond fund, an unusual move that highlights the severity of the monthslong junk-bond plunge that has swept Wall Street. The decision by Third Avenue Management means investors in the $789 million Third Avenue Focused Credit Fund may not receive all their money back for months, if not more. Third Avenue said poor bond-market trading conditions made it almost impossible to raise sufficient cash to meet redemption demands from investors without resorting to fire sales of assets.

Securities attorneys said Third Avenue’s decision to wind down the mutual fund without giving investors all their cash back could have significant repercussions for both the company and the mutual-fund industry, which for decades has thrived by promising to allow investors to take a long-term view of the markets while retaining the right to cash out shares at any time. While hedge-funds have occasionally prevented investors from taking out their money, such a move is uncommon for a mutual fund. The move is also a sign of how much the market for corporate debt is deteriorating following a long boom. Since the financial crisis, investors have sought higher-returning assets, and companies raised funds for business investment as well as for mergers, acquisitions and share buybacks.

High-yield bond assets at U.S. mutual funds hit $305 billion in June 2014, according to Morningstar data, triple their level in 2009. But investors have pulled money lately. Outflows in November were $3.3 billion, the most since June, according to Morningstar data. The yield spread between junk-rated debt and U.S. Treasurys narrowed to a multiyear low in mid-2014, reflecting investors’ confidence in companies’ business prospects. But spreads have since risen, reflecting lower prices, as the energy bust intensified questions about junk-rated companies’ ability to repay debts. All 30 of the largest high-yield bond funds tracked by Morningstar have lost money this year, reflecting price declines as investors shied away from risk.

“Investors have been dazzled that yields on bonds have climbed so high, even while default rates remained low,” said Martin Fridson, founder of Lehmann Livian Fridson Advisors and a longtime junk-bond analyst. “Currently, though, the ability to sell a large position is especially poor…. When that tension gets especially high, you can see something snap.”

“In fact, it was just a momo stock on a borrowing spree.”

• Kinder Morgan – Poster Boy For Bubble Finance (Stockman)

The graph below belongs in the “what were they thinking category”. After Tuesday’s dividend massacre, it’s plain as day that Kinder Morgan (KMI) wasn’t the greatest thing since sliced bread after all. That is, a “growth” business paying rich dividends out of rock solid profit margins and flourishing cash flow. In fact, it was just a momo stock on a borrowing spree. During the 27 quarters since the beginning of 2009, the consolidated entities which comprise KMI generated $20.8 billion of operating cash flow, but spent $24.3 billion on CapEx and acquisitions. So the “growth” side of the house ended-up in the red by $3.5 billion. Presumably that’s because it was “investing” for long haul value gains.

But wait. It also had to finance those juicy dividends, and there was a reassuring answer for that, too. The payout was held to be ultra safe owing to KMI’s business model as strictly a toll gate operator in the oil and gas midstream, harvesting risk-free fees from gathering systems, transportation pipelines and gas processing plants. Accordingly, even when its stock price was riding high north of $40 per share, the yield was 5%. So over the last 27 quarters KMI paid out $17.3 billion in dividends from cash it didn’t have. It borrowed the difference, of course, swelling its net debt load from $14 billion at the end of 2009 to $44 billion at present. And that’s exactly the modus operandi of our entire present regime of Bubble Finance. Kinder Morgan is the poster boy.

No other options.

• Oil Producers Offset Fall In Prices By Raising Output (Reuters)

The first response of commodity producers to a drop in prices is normally to increase production – ensuring price falls become deeper and more prolonged. Producers attempt to make up in volume what they have lost in prices. But what might be rational for one is disastrous collectively. Cuba’s top trade negotiator warned a conference as long ago as 1946: “We know from experience that sometimes a reduction in prices not only does not bring a reduction in production, but as a matter of fact stimulates production, because farmers try to make up by a larger volume in production the decrease in income resulting from the fall in prices.” He was speaking about sugar, but the same response has been true for other commodities, including petroleum.

In 2015, most oil producers have responded to the slump in prices by raising output, ensuring the market remains flooded and postponing the anticipated rebalancing of supply and demand. Russia, Saudi Arabia and Iraq have all increased production in 2015. Iran hopes to follow in 2016 once sanctions are lifted. Combined output from nine of the world’s largest oil and gas companies rose by 8% in the first nine months of 2015. Output from U.S. waters in the Gulf of Mexico was almost 19% higher in September 2015 than the same month a year earlier, according to the U.S. Energy Information Administration. Oil companies have said the Gulf of Mexico remains an attractive prospect even at low prices and they intend to continue increasing production there.

Even in the major shale-producing areas of the United States, production is not falling as fast as had been predicted. Companies have sought to maintain production volumes even as they slash costs. North Dakota’s oil output is down only 5% from the peak and has been surprisingly stable in recent months. Bakken producers even accelerated output and sales in October ahead of an OPEC meeting they feared would result in even lower prices, the state’s chief regulator told reporters on Dec. 9. In Texas, output from the Permian Basin, one of the oldest oil-producing areas in the country with particularly attractive geology, is still increasing.

Walking dead pay interest from cannibalizing own assets.

• Zombies Appear In US Oilfields As Crude Plumbs New Lows (Reuters)

Drained by a 17-month crude rout, some U.S. shale oil companies are merely hanging on for life as oil prices lurch further away from levels that allow them to profitably drill new wells and bring in enough cash to keep them in business. The slump has created dozens of oil and gas “zombies,” a term lawyers and restructuring advisers use to describe companies that have just enough money to pay interest on mountains of debt, but not enough to drill enough new wells to replace older ones that are drying out. Though there is no single definition of a zombie, most investors and analysts consulted by Reuters say they tend to have exceptionally high debt loads and face the prospect of shrinking oil reserves.

About two dozen oil and gas companies whose debt Moody’s rates toward the bottom of its junk bond scale broadly fit that description. Investors and analysts mentioned SandRidge Energy, Comstock Resources, and Goodrich Petroleum as some of that group’s more prominent members. To stay alive, zombie companies have curbed costly drilling and are using revenue from existing production to pay interest and other expenses in a process some describe as “slow-motion liquidation.” Bankruptcies and defaults loom because the cutbacks in new drilling have been so deep that many companies risk getting caught in a vicious circle of shrinking oil reserves, falling revenue and declining access to credit, experts say.

As long as oil prices stay below the estimated break-even level of $50 a barrel, the zombie group is set to grow. In fact, so many oil companies are struggling that “zombies” are the topic of a keynote address at a big energy conference in Houston on Thursday. Thomas Califano, vice chair of the restructuring practice at the law firm DLA Piper, said banks that have loosened loan terms to avoid defaults might be just allowing companies to postpone “their day of reckoning.” “They can just be zombies. They can pay their interest, there’s no growth and they are cannibalizing their assets,” he said.

What went wrong is who was trusted to do the forecasting.

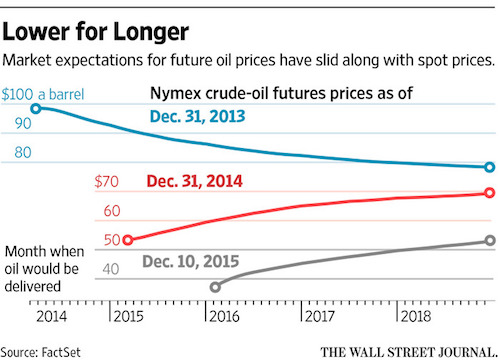

• What Went Wrong in Oil-Price Forecasts? (WSJ)

This was supposed to be the year oil prices turned around. Ten banks surveyed by The Wall Street Journal in March predicted that U.S. crude would average $50 a barrel or better in the fourth quarter. December 2015 futures contracts were selling for $63.82 a year ago. Instead, oil is on one of its longest price routs in history, and it shows no sign of ending. Oil hasn’t settled above $50 in the U.S. since July. And in a reminder that energy busts often start out looking bad and then get even worse, analysts are rapidly ratcheting down their forecasts for 2016, and oil companies and investors are bracing for another year of pain. How did market watchers get this so wrong? Analysts say they forgot the lesson that supply-driven downturns can last a long time.

“We haven’t seen a lot of the supply-driven oil-price declines in recent history,” said Miranda Davis at Quintium Advisors. “I don’t think the world was prepared for that.” Unlike the demand-driven price drop in 2009, which markets partly rebounded from within months, this downturn could last for years, she added. OPEC surprised markets by increasing its output this year instead of cutting it. In fact, the group said Thursday that it pumped more oil in November than in any month in the past three years. Meanwhile, producers in the U.S. and Russia proved much more resilient than expected. U.S. production started falling in April but remains near multidecade highs. Canada, Russia, China and Norway all are expected to post annual production gains this year, according to the U.S. government’s EIA.

Oil prices fell again Thursday, with futures in the U.S. falling 40 cents to $36.76, and global benchmark Brent futures falling 38 cents to $39.73. Both contracts have lost nearly one-third of their value this year. The energy industry now is facing the possibility that oil prices in 2016 could be even lower, on average, than in 2015—a suggestion unthinkable even six months ago.

The IMF was the enabler.

• China Has Officially Joined the Currency Wars (ET)

The only thing China had to wait for was the official inclusion into the IMF’s reserve currency basket. Now it can devalue its currency as it pleases—and it may not even have a choice. “A devaluation could be as much as 20% against the U.S. dollar because in real effective exchange rate terms the yuan is about 15% overvalued at the moment,” says Diana Choyleva, chief economist at Lombard Street Research. The Chinese currency has gained 15% against other major currencies since the middle of last year, according to an analysis by Westpac Strategy Group. On cue, China set the yuan at 6.414 to the U.S. dollar on Wednesday, Dec. 9, its weakest level since August 2011 and down 3.4% since the mini-devaluation in August.

Choyleva thinks the IMF inclusion may have even prevented a sharper one-off devaluation. “They would not be so keen to be a responsible citizen,” she says and expects further gradual devaluation. Macquarie analysts also believe Beijing now likely won’t “risk their credibility by devaluing the yuan sharply after that.” But while there is clarity as to how (gradual) and how much (15–20%) China will devalue, there is still confusion as to why they have to do it. Market observers usually cite exports as the major reason for a cheaper currency. In theory, prices for Chinese goods would become cheaper on international markets so volumes would pick up. In practice, this rarely works, as imports become more expensive, as China is a big importer too.

In addition, trade just doesn’t contribute that much to the Chinese economy anymore. “They were at the peak which was just a few years ago. Their net exports were 8% of GDP. Now it’s just a couple of% of GDP,” says Richard Vague, author of “The Next Economic Disaster.” Exports make up even less of GDP growth. Consumption and investment make up most of Chinese GDP growth. [..] It’s the combination of low growth and easy money that puts pressure on the currency. Because the regime created a debt bubble of epic proportions and investors now realize they won’t get the promised returns, capital is flowing out of the country at a record pace. Until the imbalances are fixed and China takes its losses, and stops the easy money policies, outflows will continue and the regime will face continued pressure to devalue.

It ain’t done yet.

• China Yuan Falls To Lowest Since August 2011 Versus Dollar (CNBC)

China’s yuan dropped to its lowest level against the dollar in over four years Friday, as the central bank steadily guides the currency lower amid an economic slowdown and hefty capital outflows. The yuan, or renminbi as it’s also known, fell to 6.4550 against the dollar, its lowest level since August 2011. Earlier Friday, the People’s Bank of China (PBOC) had set the mid-point for the yuan at a new four and a half year low of 6.4358, down 0.2% from Thursday’s fixing. China’s central bank lets the yuan spot rate rise or fall a maximum of 2% against the dollar relative to the official fixing rate. Nomura’s Craig Chan said the moves are in line with policymakers’ repeatedly stated ultimate goal of a more market-determined exchange rate.

“There really isn’t much perceived intervention in the markets,” he said at a press conference Friday. Chan believes that the reason the yuan is being allowed to decline now, when the market mechanism shift was officially made in August was due to concerns over whether some debtors would struggle with external debt if the currency declined. In the intervening months, PBOC data has indicated substantial hedging activity and concern over external debt has subsided somewhat, he said. Even with the declines, “our view is the currency is still over valued. They want to move closer to fair value, which we perceive to be around 6.80,” for the dollar-yuan pair, Chan said. Nomura expects the currency pair will hit that level by the end of 2016.

Add China’s raw material exports and the graph gets real ugly.

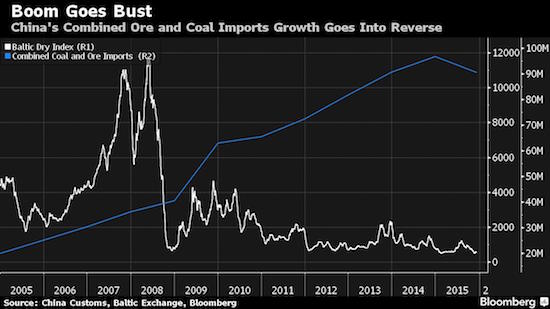

• Let’s Just Hope Shipping Isn’t Telling the Real Story of China (BBG)

Investors betting that China’s near-insatiable appetite for industrial raw materials will drive global economic growth may want to skip the shipping news. For the first time in at least a decade, combined seaborne imports of iron ore and coal – commodities that helped fuel a manufacturing boom in the world’s second-largest economy – are down from a year earlier. While demand next year may be a little better, slower-than-anticipated growth in 2015 has led to almost perpetual disappointment for shippers, after analysts’ predictions at the end of 2014 for a rebound proved wrong. The world has surpluses of everything from corn to crude oil, and commodity prices are heading for their biggest annual loss since the financial crisis.

With China’s economy expanding at the slowest pace since 1990 demand has ebbed from one of the biggest importers. The Baltic Dry Index of shipping rates for bulk materials fell to an all-time low last month, turning those who watch the industry increasingly bearish. “For dry bulk, China has gone completely belly up,” said Erik Nikolai Stavseth at Arctic Securities in Oslo, talking about ships that haul everything from coal to iron ore to grain. “Present Chinese demand is insufficient to service dry-bulk production, which is driving down rates and subsequently asset values as they follow each other.” China produces about half the world’s steel. The metal is made from iron ore in furnaces fueled by coal, which also is used to run power plants.

While domestic mines supply both raw materials, it isn’t enough, so the country must buy from overseas. As the economy surged over the past decade, imports of iron ore tripled, and coal purchases rose almost four-fold since 2008, government data show. The country accounts for two in every three iron-ore cargoes in the world, and is the largest importer of soybeans and rice. But this year, demand has slowed. Combined seaborne imports of iron ore and coal will drop 4.8% to 1.097 billion metric tons, the first decline since at least 2003, according to data from Clarkson Plc, the biggest shipbroker. A year ago, Clarkson was anticipating a 5.5% increase for 2015. The broker expects growth to increase just 0.04% next year.

Take away the political power.

• How to Break the Wall Street to Washington Merry-Go-Round (DaCosta)

The revolving door that allows regulators to slide quickly into the same sector they oversee and vice versa is a common pattern across industries. It seems to spin with particular vigor, however, when it comes to Wall Street and financial overseers in Washington. The revolving door has not merely led to the impression of conflict, eroding public trust in an already troubled and meltdown-prone financial system and the institutions in charge of regulating it; it has also coincided with ethical scandals and even alleged crimes that have affected the credibility of many of the world’s leading central banks, including the Federal Reserve. It’s also a door that keeps on spinning. But it doesn’t have to: Simple reforms could prevent its most pernicious incarnations.

Lack of public trust in the Fed’s aggressive monetary easing may already have curtailed additional action to support the economy and arguably lessened the benefits of low rates and asset purchases for the economic outlook. That’s because consumers and investors were left thinking the central bank would pull back stimulus as soon as it possibly could. Indeed, many observers have erroneously come to equate the Fed’s monetary policies, which are aimed at the economy as a whole, with bank bailouts, which are direct cash injections to specific institutions.

The latest tour de porte came on Dec. 7, when the bond fund giant Pimco announced not one but three salient appointments of former leading government figures — former Federal Reserve Chairman Ben Bernanke, ex-European Central Bank President Jean-Claude Trichet, and Gordon Brown, former U.K. prime minister and, earlier in his career, its finance minister for a decade. Before that, on Nov. 10, the Federal Reserve Bank of Minneapolis appointed Neel Kashkari, a former Goldman Sachs banker, to be its new president. It was the third consecutive top Federal Reserve appointment to come from Goldman Sachs.

Kashkari’s story is, in many ways, typical. He has already taken a couple of spins through the revolving door. He first came into the public eye in late 2008, at the age of 35. Then-Goldman Sachs CEO Hank Paulson had been tapped by George W. Bush to become treasury secretary as the financial crisis deepened, and Paulson brought Kashkari, then a young confidant at Goldman, to work with him. Kashkari was appointed to manage the $700 billion taxpayer bailout of the nation’s largest banks. Given that role, he certainly possesses some experience in economic policy management. But the ease with which he has flowed back and forth between public and private jobs is disheartening.

Finance and limits to growth. Never discussed. Long article, great graphs.

• Give Me Only Good News! (Grantham)

It takes little experience in the investment business to realize that investors prefer good news. As a bear in the bull market of 1999 I was banned from an institution’s building as being “dangerously persuasive and totally wrong!” The investment industry also has a great incentive to encourage this optimistic bias, for little money would be made if the market ticked slowly upwards. Five steps forward and two back are far more profitable. Similarly, we environmentalists were shocked to realize how profoundly the general public preferred to believe good news on our climate, even if it meant disregarding the National Academies of the world. The fossil fuel industry, not surprisingly, encouraged this positive attitude. They had billions of dollars to protect.

If the realistic information were to be widely believed, most of their assets would be stranded. When dealing with realistic limits to growth it is also obvious how reluctant everyone is to accept the natural mathematical limits: There simply cannot be compound growth in a finite world. A modest 1% growth compounded for the 3,000 years of Ancient Egypt’s population would have multiplied its economic output by nine trillion times! Yet, the improbability of feeding ten billion or so global inhabitants in 50 years is shrugged off with ease. And the entire economic and political system appears eager to encourage optimism on resources for it is completely wedded to the virtues of quantitative growth forever.

Hard realities in these three fields are inconvenient for vested interests and because the day of reckoning can always be seen as “later,” politicians can always find a way to postpone necessary actions, as can we all: “Because markets are efficient, these high prices must be reflecting the remarkable potential of the internet”; “the U.S. housing market largely reflects a strong U.S. economy”; “the climate has always changed”; “how could mere mortals change something as immense as the weather”; “we have nearly infinite resources, it is only a question of price”; “the infinite capacity of the human brain will always solve our problems.”

Having realized the seriousness of this bias over the last few decades, I have noticed how hard it is to effectively pass on a warning for the same reason: No one wants to hear this bad news. So a while ago I came up with a list of propositions that are widely accepted by an educated business audience. They are widely accepted but totally wrong. It is my attempt to bring home how extreme is our preference for good news over accurate news. When you have run through this list you may be a little more aware of how dangerous our wishful thinking can be in investing and in the much more important fields of resource (especially food) limitations and the potentially life-threatening risks of climate damage. Wishful thinking and denial of unpleasant facts are simply not survival characteristics.

Canada turned on a dime when Justin was elected.

• First Government Plane Carrying Refugees Arrives in Canada (AP)

The first Canadian government plane carrying Syrian refugees arrived in Toronto late Thursday where they were greeted by Prime Minister Justin Trudeau, who is pushing forward with his pledge to resettle 25,000 Syrian refugees by the end of February. The arrival of the military flight carrying 163 refugees stands in stark contrast to the U.S., which plans to take in 10,000 Syrian refugees over the next year and where Republican presidential candidate Donald Trump caused a worldwide uproar with a proposal to temporarily block Muslims from entering the U.S. The flight arrived just before midnight carrying the first of two large groups of Syrian refugees to arrive in the country by government aircraft.

Trudeau greeted the first two families to come through processing. The first family was a man, woman and 16-month-old girl. The second family was a man, woman, and three daughters, two of whom are twins. Trudeau and Ontario’s premier welcomed them to Canada and gave them winter coats. Both families said they were happy to be here. “This is a wonderful night, where we get to show not just a planeload of new Canadians what Canada is all about, we get to show the world how to open our hearts and welcome in people who are fleeing extraordinarily difficult situations,” Trudeau said earlier to staff and volunteers who were waiting to process the refugees.

All 10 of Canada’s provincial premiers support taking in the refugees and members of the opposition, including the Conservative party, attended the welcoming late Thursday. Trudeau was also joined by the ministers of immigration, health and defense, as well as Ontario Premier Kathleen Wynne and Toronto Mayor John Tory.[..] “They step off the plane as refugees, but they walk out of this terminal as permanent residents of Canada with social insurance numbers, with health cards and with an opportunity to become full Canadians,” Trudeau said. “This is something that we are able to do in this country because we define a Canadian not by a skin color or a language or a religion or a background, but by a shared set of values, aspirations, hopes and dreams that not just Canadians but people around the world share.”

They seek to force them into the hands of vulture funds? Wow!

• Greece Struggles With Creditors To Keep Bad Loans From ‘Vultures’ (Reuters)

Greece is aiming for a deal with international lenders on Friday on the next set of reforms to unlock additional aid, but differences remain over how to handle banks’ bad loans. Athens is struggling to keep non-performing loans to small business and consumers out of the clutches of so-called vulture funds that buy loan books of distressed debt at a discount and try to recover the money. Prime Minister Alexis Tsipras’ government started a new round of talks with euro zone institutions and the IMF this week on the bad loans, as well as splitting off the country’s power grid operator from dominant electricity utility PPC and making state sector wages dependent on performance.

After successfully completing the recapitalization of its four systemic banks and qualifying for €2 billion in bailout loans last month, Athens must enact this second set of reforms to qualify for €1 billion by the end of the month. Athens aims to pass the law by Dec. 18, parliament officials said. “Our effort is to conclude talks on Friday,” said a government official who participated in the talks with the heads of the EU/IMF mission at a central Athens hotel. “The main hurdle is non-performing loans. Our side is trying to exempt mortgages and small business and consumer loans from being transferred to private funds.” Talks were expected to drag on until late on Thursday and also cover the structure of a new privatization fund which Germany and other creditors insisted on to pay down debt.

Another government official said there was convergence on public sector wages and an energy ministry official said Athens was also likely to reach agreement on the power grid operator. Separately, the government submitted to the creditors an initial draft of a tough pension reform seen as the biggest political hurdle in the coming months for Tsipras’s leftist-led coalition, with just a three-seat parliamentary majority. The reform must be adopted in January prior to the first bailout review. After five years of austerity including 12 pension cuts, the government plans to increase social security contributions instead of slashing main pensions again. But the lenders have signaled reluctance, saying it could further damage employment. Greece has pledged to cut spending on pensions by 1% of GDP or €1.8 billion next year. It says it can cover most of this amount from a recent retirement age increase but still needs to find €600 million.

Sorry, but it was Merkel who suspended the Dublin Regulation in August. She can’t very well hope to switch it on and off as she pleases. This is just harassment.

• EU To Sue Greece, Italy, Croatia Over Migrants (AP)

The European Union has started legal action against Greece, Italy and Croatia for failing to correctly register migrants. Tens of thousands of migrants have arrived in those countries over the last few months but less than half of them have been registered by national authorities. Greece has only fingerprinted around 121,000 of the almost half a million people who arrived there between July 20 and Nov. 30 this year, according to the European Commission. The Commission warned the three countries about the shortfalls two months ago, but said Thursday that these “concerns have not been effectively addressed.” The EUs executive arm said it sent formal letters of notice to the three, the first formal step in infringement proceedings.

Moving to no man’s land.

• Stranded Migrants Relocated in Athens Arena, Many Disperse (GR)

Greek authorities finished transferring about 2,300 migrants from the Greece-FYROM border to a former Olympic sports arena early Thursday morning. Greek police used 45 buses to transfer a total of 2,300 migrants, mostly from Morocco, Iran and Soudan, from the Greece-Former Yugoslav Republic of Macedonia border. The migrants do not qualify for refugee status and they were denied entry to FYROM, as a transit point to western Europe. Thirty-four buses transferred most of the migrants to the former taekwondo Olympic arena, while 11 buses took a number of them to the former ice hockey Olympic arena. However, many of them dispersed and disappeared from the hospitality premises as soon as they arrived. Non government organizations and the Red Cross were there to accommodate the migrants as the living conditions are not ideal.

Deputy Migration Minister Yiannis Mouzalas spoke to reporters and said that on December 17 the migrants will be transferred elsewhere but it hasn’t been decided where yet. Regarding the conditions inside the arena, the deputy said that until yesterday these people were hungry and sleeping on the ground. Now they have an enclosed place to stay with meals and bathroom facilities provided. Mouzalas said that the migrants have 30 days to petition for asylum or return to their homelands. Otherwise, they will be deported. The taekwondo arena is guarded by the police and there is no access to reporters. The migrants, in general, do not want to stay in Athens or Greece. Now that the FYROM border is closed, some of them told reporters that they will try to cross to western Europe through Albania and then Croatia. They said there are traffickers who can accommodate those who want to reach the destination of their choice.

“The Germans think they’re the Americans of Europe.”

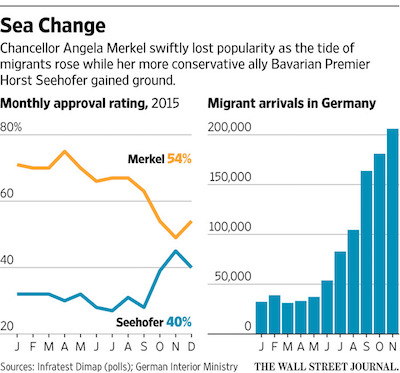

• Behind Angela Merkel’s Open Door for Migrants (WSJ)

Angela Merkel had just returned to her apartment here after meeting critics of her policy of welcoming Middle East refugees, when aides phoned her with news of terrorist attacks in Paris. The German chancellor’s open door for people fleeing war in Syria, Iraq and elsewhere had already weakened her once-unassailable popularity. She knew, says a person familiar with her thinking, that immigration opponents in Germany and Europe would want to link the Islamist terrorist threat with refugees trekking to Europe and would demand a clampdown on the mainly Muslim migrants. Ms. Merkel’s response: to double down on her migrant policy. She emphatically reiterated her refugee-friendly stance, amping up the moral rhetoric that is infuriating many supporters and politicians of her conservative party. “We live based on shared humanity, on charity,” she told Germans the next morning.

“We believe in…every individual’s right to pursue happiness,” she said, “and in tolerance.” Catching the terrorists is Europe’s duty “also to the innocent refugees who are fleeing from war and terror,” she said at a world leaders’ summit in Turkey that weekend. Ms. Merkel’s insistence that Europe can absorb potentially millions of new residents is vexing her country and continent. Germans are questioning her judgment and her grip on power. Some other European countries bridle at Germany’s leadership, raising fears the crisis could cripple the European Union. Germany seeks to impose “moral imperialism,” says a senior official from Hungary, one of the EU countries critical of Ms. Merkel’s course. “The Germans think they’re the Americans of Europe.” The backlash against Ms. Merkel’s pro-refugee policy has become the biggest-yet test of her political skills and of Germany’s leadership in Europe.

Many more today. A father lost his wife and 7 children. Saw another Tweet talking about 35 people from one boat.

• Four More Bodies Found In Aegean After Boat Sinks (AP)

Greek authorities have located four more bodies off the eastern Aegean Sea islet of Farmakonissi, a day after a boat carrying migrants sank there, drowning 12 people and leaving 12 more missing. The coast guard says the bodies of two men, a woman and a baby were located Thursday in the sea off Farmakonissi. It was not yet clear whether they were among those missing from Wednesday’s accident, in which a wooden boat carrying about 50 people sank. A further 26 people who had been on the boat were rescued.

The madness intensifies. This is not what people want in Europe. But they get it anyway. Hence Marine Le Pen.

• EU Plans Border Force To Police External Frontiers (FT)

Brussels is to propose the creation of a standing European border force that could take control of the bloc s external frontiers – even if a government objected. The move would arguably represent the biggest transfer of sovereignty since the creation of the single currency. Against the backdrop of a crisis that has seen 1.2m migrants reach Europe this year, the European Commission will unveil plans next week to replace the Frontex border agency with a permanent border force and coastguard – deployed with the final say of the commission, according to EU officials and documents seen by the Financial Times. The blueprint represents a last-ditch attempt to save the Schengen passport-free travel zone, by introducing the kind of common border policing repeatedly demanded by Paris and Berlin.

Britain and Ireland have opt-outs from EU migration policy, and would not be obliged to take part in the scheme. European leaders have discussed a common border force for more than 15 years, but always struggled to overcome deep-seated objections to yielding national powers to monitor or enforce borders one of the core functions of a sovereign state. Greece, for instance, only recently agreed to accept EU offers to send border teams, after months of wrangling over their remit. Systemic weaknesses in the Schengen Area agreement were laid bare by this year s massive influx of migrants, many of them unregistered, into the EU through Greece and Italy. Concerns came to a head after last month s terrorist attacks in Paris, when it transpired that at least some of the assailants came to Europe from Syria via Greece.

One of the most contentious elements of the regulation would hand the commission the power to authorise a deployment to a frontier, on the recommendation of the management board of the newly formed European Border and Coast Guard. This would also apply to non-EU members of Schengen, such as Norway. Although member states would be consulted, they would not have the power to veto a deployment unilaterally. Dimitris Avramopoulos, who is responsible for EU migration policy, said: The refugee crisis has shown the limitations of the current EU border agency, Frontex, to effectively address and remedy the situation created by the pressure on Europe’s external borders.

Home › Forums › Debt Rattle December 11 2015