Harris&Ewing President Hoover lights Nation’s Capital community Xmas tree 1929

“Fifth of US adults live in or near to poverty..”

• The New American Dream Is To Have A Job (FT)

One in five US adults now lives in households either in poverty or on the cusp of poverty, with almost 5.7m having joined the country’s lowest income ranks since the global financial crisis. Many of the new poor, or near-poor, have become so even amid an economic recovery that is widely expected to lead the US Federal Reserve to raise interest rates next week for the first time in almost a decade. More than 45 per cent of them — almost 2.5m adults — have joined the lowest income ranks since 2011, long after the post-crisis recession was ostensibly over. The findings, contained in data prepared for a new study of the US middle class by the Pew Research Center and shared with the Financial Times, put a stark human face on the economic legacy left by the crisis and reveal how uneven the recovery has been.

They also help explain why any notion of a recovery still seems a long way off to many in the US and why the message of populist politicians such as Donald Trump that America is not working resonate on the eve of an election year. “There’s a new American dream,” says Torrey Easler, a Baptist preacher who helps feed a growing population of poor in the town of Eden, North Carolina. “The old American dream was to own a home and two cars. The new American dream is to have a job.” A large part of the shrinking of the US middle class, which for the first time in decades now forms less than a majority of the country’s adult population, has surprisingly been due to the country’s growing affluence, the Pew study found.

But the country’s lowest income group — defined by Pew for a three-person household as earning less than $31,402 a year — has also grown at more than five times the rate of the middle class in the past seven years. There are now 48.9m adults in this bracket in the US, up from 43.2m in 2008 and just 21.6m in 1971. Pew’s measure of the lowest income group is relatively broad, though it calculates that almost half of the adults in this category — 23m — fell below the $18,850 poverty line for a household of three set by the US Census Bureau. The group’s members earn half or less of Pew’s $62,804 median household income in the US last year and the $41,869 to $125,608 range Pew uses to define the American middle class. They also account for a population that, even as the struggles of the middle class draw an increasing focus, is often left out of policy discussions — as some policymakers admit.

Read more …

“..the world economy is actually going to shrink for the first time since the 1930s..”

• The End Of The Bubble Finance Era (Stockman)

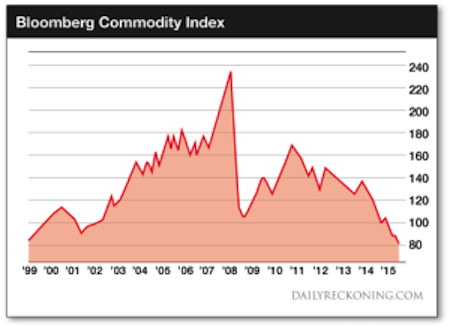

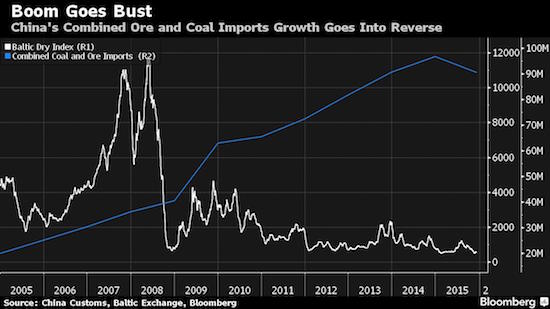

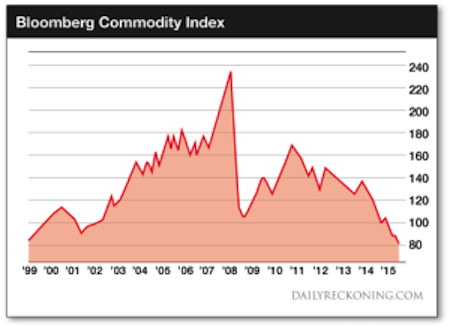

We are nearing a crucial inflection point in the worldwide bubble finance cycle that has been underway for more than two decades. To wit, the world’s central banks have finally run out of dry powder. They will be unable to stop the credit implosion which must inexorably follow the false boom. We will get to the Fed’s upcoming once in a lifetime shift to raising rates below, but first it is crucial to sketch the global macroeconomic context. In a word, we are now entering an epic deflation. Its leading edge is manifested in the renewed carnage in the commodity pits. This week the Bloomberg commodity index, which encompasses everything from crude oil to soybeans, copper, nickel, cotton and livestock, plunged below 80 for the first time since 1999. It is now down nearly 70% from its all-time high on the eve of the financial crisis, and 55% from its 2011 recovery high.

Wall Street bulls and Keynesian apologists for the Fed want you to believe that there isn’t much to see here. They claim it’s just a temporary oil glut and some CapEx over-exuberance in the metals and mining industry. But their assurances that in a year or so current excess supplies of copper, crude, iron ore and other commodities will be absorbed by an expanding global economy couldn’t be farther from the truth. In fact, this error is at the heart of my investment viewpoint. We believe the global economy is vastly bloated with debt-based spending that can’t be sustained. And that this distortion is compounded on the supply side by an incredible surplus of excess production capacity. As well as wasteful malinvestments that were enabled by dirt cheap central bank credit.

Consequently, the world economy is actually going to shrink for the first time since the 1930s.

That’s because the plunging price of commodities is only a prelude to what will amount to a worldwide CapEx depression — the kind of thing that has not happened since the 1930s. There has been so much over-investment in energy, mining, materials processing, manufacturing and warehousing that nothing new will be built for years to come. The boom of the last two decades essentially stole output from many years into the future. So there will be a severe curtailment in the production of mining and construction equipment, oilfield drilling rigs, heavy trucks and rail cars, bulk carriers and containerships, materials handling machinery and warehouse rigging, machine tools and chemical processing equipment and much, much more.

The crucial point, however, is that sharp curtailment of the capital goods industries has far more destructive implications for the macro-economy than a reduction in consumer appliance sales or restaurant and bar tabs. Service operations have virtually no working inventories and the supply chains for durable consumer goods such as dishwashers and cars typically have perhaps 50 to 100 days of stocks on hand. So when excessive inventory investments accumulate, the destocking and resulting supply chain curtailments are relatively short-lived. But when it comes to capital goods the relevant inventory measure is capacity in place. That’s where the bubble finance policies of the Fed and other central banks have done so much damage.

Read more …

See if you can spot the green.

• “It’s An Epic Bloodbath” : The 2015 Junk Bond Heatmap (ZH)

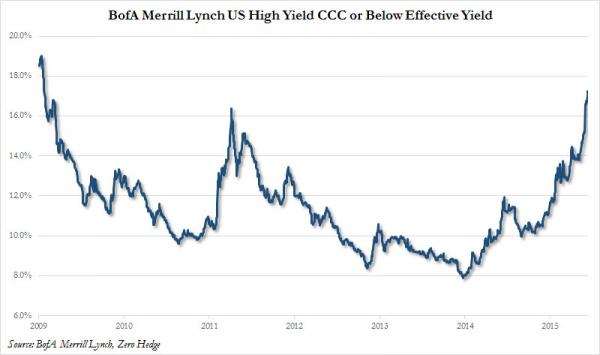

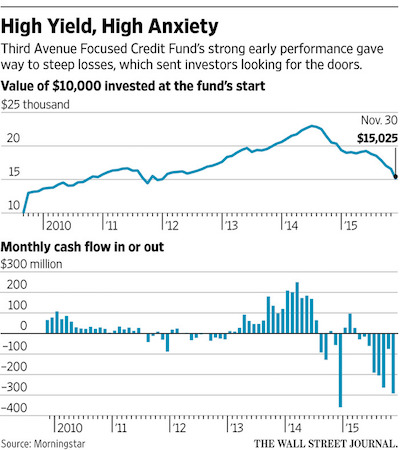

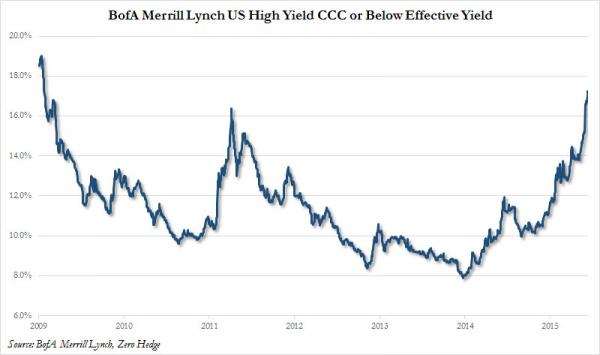

Ten days ago, before the world had heard about the stunning liquidation and gating of the Third Avenue Focused Credit Fund, we asked one question: Did Something Blow Up in Junk, with our question driven by the relentless collapse in triple hook-rated (CCC or below) bond prices, or alternatively, their soaring yields. A few days later we learned that the answer to our question was a resounding yes, when first Third Avenue and then Stone Lion Capital (run by two ex-Bear Stearns distressed trading heads) gated investors following what may have been a dedicated attack on the worst and most illiquid junk bonds, but was really just a marketwide puke in junk starting at the bottom and spreading to the top. Since then things for the junk space have gone from bad to worse, and as of Friday, the effectively yield on the BofA-Merrill universe of bonds rated CCC and below has soared to 17.24%, taking out the 2011 wides and trading at levels not seen since the summer of 2009… only in the wrong direction.

And yet, in a world where everyone has become an algo and thinks of performance in heatmap terms, the chart above (which we will show shortly from a far more stunning angle) hardly does justice to the absolutely bloodbath in the junk bond space. So, without further ado, here is a visualization of the change in junk bond prices since January 1, 2015. For those confused, the redder the worse. It is, for lack of a better word, an epic bloodbath, and perhaps the only question after looking at this is how have many more credit funds not gated yet. And yes, if one looks hard enough, there are a few junk bonds which actually are green for the year. See if you can spot them.

Read more …

Nice find. CCC and below=junk.

• The Coincidences Are Just Too Eerie: The Last Time CCC Yields Were Here (ZH)

Yesterday, we highlighted the all too eerie coincidence that the very first hedge fund (not mutual fund) to gate investors late on Friday, was operated by none other than the two former heads of distressed/high yield trading of the bank that started it all, Bear Stearns. Today, things get even eerier, because while we already have the Bear Stearns link, an even more curious coincidence emerged when according to the BofA-Merrill index of “CCC and below” bond yields, the index just hit 17.24%, soaring nearly 2% in just the past two weeks, and rising fast.

When was the last time the same index was at precisely 17.24% and rising? The answer: the weekend Lehman Brothers filed for bankruptcy (check for yourselves: on Sept 15, 2008, the closing effective yield was 17.27%).

What happened next? This.

And while no bank has blown up this time (to the best of our knowledge) the irony is that the catalyst driving the long, long overdue blow out in yields is the trifecta of plunging oil, the soaring dollar, and of course, fears about the tightening financial conditions as a result of the an “imminent” rate hike. In other words, the Fed. And while history rhymes, it usually does so in very ironic ways, and we can’t wait to find out if indeed Yellen’s first rate hike in 9 years this Wednesday unleashes a Lehman-like neutron bomb that leads to the full collapse of the junk bond market first, and then the shockwave spreads across all asset classes leading to the same financial devastation witnessed at the end of 2008, unleashing the longest period of “free capital markets” central planning the world has ever seen.

Read more …

At what point will the IMF chime in?

• Yuan Declines to Four-Year Low as New Index Signals Weakness (BBG)

China’s yuan fell to a four-year low after the central bank said the currency shouldn’t be measured by its moves against the dollar alone, a statement that is being interpreted as a sign it will allow further declines. Exchange rates are a reflection of trade and investment with multiple countries and the market has to take into account the yuan’s fluctuations against a basket of currencies, the People’s Bank of China said on Friday. The China Foreign Exchange Trade System, which is run by the PBOC to facilitate interbank trading, published a new yuan index composed of 13 currencies, with the dollar accounting for 26.4%.

The yuan dropped 0.05% to 6.4585 a dollar as of 1:37 p.m. in Shanghai [..] The PBOC Monday cut its reference rate by 0.21% to a four-year low of 6.4495. “The latest move suggests the PBOC will allow weaker yuan fixings,” said Tommy Ong, managing director for treasury and markets at DBS Hong Kong Ltd. “The yuan is also under pressure as the U.S. is likely to hike rates this week.” The central bank has lowered the reference rate, which limits the onshore currency’s moves to 2% on either side, on eight of the 10 trading days since winning reserve-currency status at the IMF on Nov. 30. This fueled speculation that the authority is trying to release pent-up depreciation pressure before the Federal Reserve meets Dec. 15-16.

Read more …

There’s nothing left that could lift demand. Well, other than warfare, that is.

• Oil Sinks to Lowest in Almost 7 Years as Iran Vows More Supply (BBG)

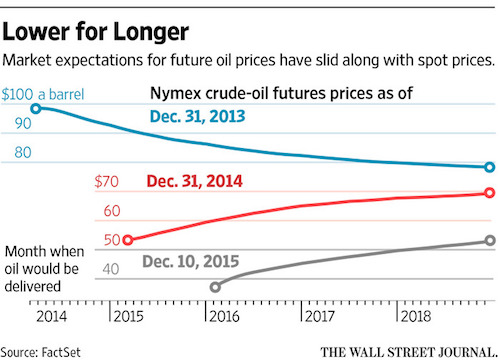

Oil extended declines from the lowest price since February 2009 as Iran pledged to boost crude exports, bolstering speculation OPEC members will exacerbate the global oversupply. Futures dropped as much as 1% in New York after losing almost 11% last week, the most in a year. There’s “absolutely no chance” Iran will delay its plan to increase shipments even as prices decline, said Amir Hossein Zamaninia, the deputy oil minister for international and commerce affairs. Hedge funds and other large speculators raised bearish bets to an all-time high, U.S. Commodity Futures Trading Commission data showed.

Oil has slumped to levels last seen during the global financial crisis as OPEC effectively abandoned production limits to defend market share, fueling a record surplus. The glut will persist at least until late 2016 as demand growth slows and OPEC shows “renewed determination” to maximize output, according to the International Energy Agency. “The price war will likely drag on until the end of next year,” Hong Sung Ki at Samsung Futures in Seoul said by phone. “Saudi Arabia won’t be able to cut its production while Iran continues to increase output.”

Read more …

Not a very interesting question, since nobody knows.

• How Low Can Oil Prices Go? (Guardian)

Not only did US prices fall under $40 this week but so did the global benchmark Brent crude oil prices, for the first time since February 2009. The global supply glut of about 1.5m barrels per day is the driving factor behind the lower oil prices, with much of that overproduction because of Opec’s opening the spigots. [Jay Hatfield atr Infrastructure Capital Advisors] said there’s another factor behind the new drop in oil prices: warm weather. “The fact that you can almost go swimming in New York City right now is horrible. Absolutely horrible [for heating oil demand]. To me, that’s the straw that is breaking the camel’s back. We’re ground zero for fuel oil demand,” he said.

The El Niño weather phenomenon can bring milder winter weather to the northern part of the US, and that’s been seen in places like New York and Chicago, where December temperatures are above normal, reducing heating demand. If Opec’s disorganization continues and temperatures stay mild, that could add further pressure to prices, he said. “I thought prices would have stabilized in the $40 to $50 area, but … now it could be $35 to $40,” he said. A few factors could influence oil, such as next week’s Federal Reserve’s monetary policy meeting, where the Fed may raise interest rates for the first time in seven years. That could give the dollar another boost, and Kessens said the greenback’s strength has hit oil since it is dollar denominated.

Next week is the last full trading week of 2015, so there could be some book squaring as investment managers close up accounts before the holidays when trade volume dwindles. Daniel Pavilonis, senior commodity broker with RJO Futures, said the next target for prices is likely the 2008 low. “I see prices going lower. I wouldn’t be surprised if we saw an uptick from here next week, maybe to the $40s, but then see a sharp decline, a sell-off below $35. There’s so much supply out there. I think [prices are] going to be lower than people will perceive,” he said.

Taking out a level that’s held for so long could be jarring and may have a snowball effect, he said. On the other hand, there is likely to be some opportunistic buying simply because prices are so low. Pavilonis didn’t rule out a dip under $30 a barrel, but just how far prices may go is hard to determine. “It’s hard to call a bottom. It’s like catching a falling knife. Just let the knife fall to the side and pick it up later so you don’t get hurt,” he said.

Read more …

All that focus on the Fed is not healthy.

• World Markets In Fragile Mood As Yellen Prepares To Push The Button (Guardian)

Stock market investors are braced for panic selling in New York and London ahead of what is expected to be the first rate rise by the US Federal Reserve since 2006. The US central bank will decide on Wednesday whether to raise interest rates as a mark of the US economy’s strong recovery since the 2008 banking crash. But Fed boss Janet Yellen is expected to announce the increase in borrowing costs despite a slowdown in global trade and a slump in oil and commodity prices that has pushed inflation down to near zero in most developed countries. Shares plunged on Friday and oil prices tumbled as the date neared for the Fed decision and investors became increasingly nervous of the impact on highly indebted emerging market economies.

The level of borrowing by businesses and governments in China, Thailand, Indonesia, Brazil has soared in the last decade. Borrowing by emerging market economies has quadrupled from $4tn in 2004 to over $18tn in 2014, much of it in dollars, making them vulnerable to higher US interest rates. Phil Shaw, chief UK economist at fund manager Investec, said it was almost certain the Fed would raise rates, but the question for markets was whether Yellen would signal further rate rises over the coming months. More than £73bn was wiped off the value of UK shares last week after fresh falls in the price of copper and other metals was matched by a precipitous fall in the price of oil to below $38. London’s FTSE 100 closed 135.27 points down at 5,952.78 – its lowest level since late September.

The index of Britain’s top 100 companies is now about 6.5% below its level at the start of the year, unlike the German Dax 30 and the Paris Cac 40, which are well above. A forecast from the IEA that a glut of crude will persist for another year triggered panic selling among investors, already concerned that an interest rate rise will potentially destabilise the global economy.

Read more …

Hilsenrath perparing the narrative for a way out?

• Fed Officials Worry Interest Rates Will Go Up, Only to Come Back Down (WSJ)

Federal Reserve officials are likely to raise their benchmark short-term interest rate from near zero Wednesday, expecting to slowly ratchet it higher to above 3% in three years. But that’s if all goes as planned. Their big worry is they’ll end up right back at zero. Any number of factors could force the Fed to reverse course and cut rates all over again: a shock to the U.S. economy from abroad, persistently low inflation, some new financial bubble bursting and slamming the economy, or lost momentum in a business cycle which, at 78 months, is already longer than 29 of the 33 expansions the U.S. economy has experienced since 1854.

Among 65 economists surveyed by The Wall Street Journal this month, not all of whom responded, more than half said it was somewhat or very likely the Fed’s benchmark federal-funds rate would be back near zero within the next five years. Ten said the Fed might even push rates into negative territory, as the European Central Bank and others in Europe have done—meaning financial institutions have to pay to park their money with the central banks. Traders in futures markets see lower interest rates in coming years than the Fed projects in part because they attach some probability to a return to zero. In December 2016, for example, the Fed projects a 1.375% fed-funds rate. Futures markets put it at 0.76%.

Among the worries of private economists is that no other central bank in the advanced world that has raised rates since the 2007-09 crisis has been able to sustain them at a higher level. That includes central banks in the eurozone, Sweden, Israel, Canada, South Korea and Australia. “They effectively have had to undo what they have done,” said Susan Sterne, president of Economic Analysis Associates, an advisory firm specializing in tracking consumer behavior. The Fed has never started raising rates so late in a business cycle. It has held the fed-funds rate near zero for seven years and hasn’t raised it in nearly a decade.

Its decision to keep rates so low for so long was likely a factor that helped the economy grow enough to bring the jobless rate down to 5% last month from a recent peak of 10% in 2009. At the same time, waiting so long might mean the Fed is starting to lift rates at a point when the expansion itself is nearer to an end. Ms. Sterne said the U.S. expansion is now at an advanced stage and consumers have satisfied pent-up demand for cars and other durable goods. She’s worried it doesn’t have engines for sustained growth. “I call it late-cycle,” she said.

Read more …

The volumes are staggering.

• The China Metal Exchange At Center Of Investment Scandal (Reuters)

The Fanya Metals Exchange was launched shortly after China, the world’s dominant producer of rare earths, imposed quotas on production and exports in a bid to support prices and attract downstream consumers to China. Fanya was keen to provide a supporting role, saying it wanted to raise the value of the whole minor metals industrial chain. It stockpiled and traded 14 metals, rapidly becoming the biggest minor metals market in the world. These metals are minor because they are a byproduct of extracting other major metals, such as zinc or copper. “Fanya prices already lead global prices, and have made China’s voice on the minor metals’ stage growing increasingly strong,” it boasted on its website in 2014. Prices for the metals traded on the exchange rose sharply and became increasingly out of sync with world prices.

Its most traded metal – indium – more than doubled between 2012 and 2015 to $1,200 per kg. Prices kept rising from the end of 2014 even as global prices headed into a rapid decline. The price difference kept traders outside of China wary of using the exchange. Now they are worried about what will happen to the accumulated stock of metals on the exchange. “It’s not clear how all this winds down, or what the local government or Beijing will do,” said David Abraham, director of the Technology, Rare and Electronic Materials Center. “There are lots of wild cards here.” As early as last year, state regulators called on local authorities to “clean up and rectify” privately run exchanges throughout China. A provincial regulator in Yunnan singled out Fanya for rule-breaking behavior, although it did not provide details.

“The risks are huge,” it said. Those risks became clear in April when investors placed a wave of sell orders, which the exchange later admitted caused liquidity problems. Looking to make good on the promise of instant redemption, investors wanted to switch their money into a stock market rally. Seeing a rush to sell, many investors were reassured their money was safe when the Yunnan government issued a statement saying Fanya remained a legal entity engaged in legal operations. Some continued to put money into the plan.

Read more …

Scapegoats.

• China Local Officials Admit To Faking Economic Figures (CD)

Several local officials in China’s Northeast region sought to explain dramatic economic drops in their areas by admitting they had faked economic data in the past few years to show high growth when the real numbers were much lower, Xinhua News Agency reported on Friday. “If the past data had not been inflated, the current growth figures would not show such a precipitous fall,” one official was quoted as saying. The report cited several officials in the region who acknowledged they had significantly overstated data ranging from fiscal revenue and household income to GDP.

Three years ago Liaoning province’s GDP growth was reported at 9.5%, but its current figure -over the first three quarters of this year- is just 2.7%. Jilin’s growth was reported at 12% three years ago, but its current rate is 6.3% in the same period. The revelation about the inflated figures came as the GDP growth of the three Northeast provinces ranked the lowest nationwide. Guan Yingmin, an official in Heilongjiang province, said local investment figures were inflated by at least 20%, which translates to nearly 100 billion yuan ($15.7 billion). If the local financial reports were true, some single counties’ GDP would have surpassed Hong Kong. An earlier audit by the National Audit Office found one county in Liaoning that reported annual fiscal revenues 127% higher than the actual number.

A staff member in the Jilin provincial finance department, who asked not to be identified, told China Daily that in past years, local officials competed each other to lure external investment projects. They reported the promised investment value, whether it had been achieved or not, as the investment figure. The legacy of the command economy in the area means that there is a lack of entrepreneurship and forward thinking, said Xu Mengbo, an economics professor at Jilin University. “In terms of management ideas, there is at least 10-year gap,” he said.

Read more …

At what point does this become a criminal operation?

• Who’s Profiting From $1.2 Trillion of US Federal Student Loans? (BBG)

Jody Sofia borrowed $92,500 to get a degree from Florida Coastal School of Law. Now she’s in default, her outstanding balance having ballooned to almost $144,000, and she spends her days fielding calls from government-contracted debt collectors. The companies making those calls are just one part of an ecosystem feeding on federal student loans. There are also debt servicers, refinance lenders, firms that help former students stay out of default and for-profit schools that make money as borrowers try to repay more than $1.2 trillion in government-backed education debt. Sofia is one of 7 million former students in default on a record $115 billion of federal loans, an amount that has grown almost 25% in two years, according to U.S. government data. The mountain of debt, for which taxpayers are on the hook, has provided a stream of revenue to companies at every stage of the process.

“This is not some small cottage industry,” said Rohit Chopra, the former student-loan ombudsman for the U.S. Consumer Financial Protection Bureau, which oversees loan servicers, debt collectors and private student lenders. “There is a large student-loan industrial complex. Rising costs of college and flat family incomes have created enormous business opportunity for every step of the loan process.” Sofia, who didn’t take the bar exam and never got a legal job after graduating from Florida Coastal in 2004, says the system is dysfunctional. Derailed by illness and having to care for ailing parents, most of her income has come from working as an independent insurance adjuster, the same thing she was doing before going to law school. While she has made some payments, interest on the loans keeps accruing. “There’s something really wrong with this system,” said Sofia, 45. “The government is spending all this money for these people to constantly call you. How effective is that?”

Read more …

Sweden has nothing. That’s what’ll come out of the questioning. But will they go public that way?

• Ecuador Signs Deal With Sweden For Assange Questioning (Reuters)

Ecuador and Sweden have signed a pact that would allow WikiLeaks founder Julian Assange to be questioned at Ecuador’s embassy in London where he has been for more than three years, the Quito government said. The legal agreement was signed in the Ecuadorean capital after half a year of negotiations. “It is, without doubt, an instrument that strengthens bilateral relations and will facilitate, for example, the fulfillment of judicial matters such as the questioning of Mr. Assange,” the foreign ministry said in a weekend statement.

Assange, 44, took refuge in the embassy building in June 2012 to avoid extradition to Sweden, where he is wanted for questioning over allegations of sexual assault and rape against two women in 2010. The Australian denies the accusations. Assange says he fears Sweden will extradite him to the United States where he could be put on trial over WikiLeaks’ publication of classified military and diplomatic documents five years ago, one of the largest information leaks in U.S. history. Britain has accused Ecuador of preventing the course of justice by allowing Assange to remain in its embassy in the upmarket central London area of Knightsbridge.

Read more …

Forcing Greece into the hands of vulture funds is the lowest things the Troika has done so far.

• Vulture Funds Price Greek Nonperforming Loans At Very Low Rates (Kath.)

Investment funds preparing to profit from Greek nonperforming loans are offering rates of between 5 and 15 cents per euro for the purchase of bad corporate loans, in anticipation of a legal framework that would allow them to enter the local market. The repayment of those loans is considered impossible, as the majority of the enterprises that have received them are at the bankruptcy stage and their assets comprise nothing more industrial real estate or equipment. By contrast, the rate for NPLs taken out by sustainable corporations with high borrowing come to 40-50 cents per euro, which factors in the writing off of half of the debt when the funds take control of their management, which would ensure that costs would be cut and the company would undergo a general tidying up ahead of their sale.

Bank officials say the rates currently being quoted in the local market have declined significantly compared to a year ago, when the prices of bad corporate loans came to 30 cents per euro, as economic conditions have deteriorated considerably in the meantime. The high country risk factor is increasing the potential cost for the distressed debt funds that are eyeing the local market with interest due to the high accumulation of bad loans in bank portfolios.

Read more …

There has better be protests.

• Tsipras Expects Protest As Greece Agrees To Further Privatisations (Guardian)

The Greek prime minister, Alexis Tsipras, has warned that his government faces a new storm of protest after jumping another reform-for-aid hurdle with international creditors. After a week of rigorous negotiations with foreign lenders, Tsipras’s leftist-led government finalised a deal foreseeing further privatisations, reforming the energy sector and opening up the market to non-performing loans. The agreement is slated to unlock another €1bn (£720m) in loans for the debt-stricken country next week. Addressing Syriza’s central committee at the weekend, Tsipras warned of the perils that lay ahead. “There are forces that want to see Greece’s government fail,” he said.

Under the accord, publicised early on Saturday, Greece will retain a 51% stake in the national grid operator, Admie, and forge ahead with a host of state sell-offs through the creation of a privatisation scheme. New rules for non-performing loans, which amount to an extraordinary 60% of GDP, will also be enacted. Those belonging to big businesses as well as unpaid mortgage repayments will henceforth be sold to foreign funds. Viewed as a compromise by many in Tsipras’s once far-left Syriza party, the deal is expected to be passed in the name of national expediency. Failure to endorse the legislation would derail the country’s bailout programme and put Greece, which only narrowly survived a euro exit before clinching a third €86bn rescue package in August, at risk of national bankruptcy again.

But Tsipras is unlikely to be let off as lightly in the new year, when his fragile two-party coalition will be obliged to overhaul a dysfunctional pension system that is not only on the verge of collapse but is seen as the most expensive in Europe. Creditors are demanding the overhaul produces the equivalent of 1% of GDP, or €1.8bn, in savings next year. With Greek pensioners already having suffered 12 cuts since the outbreak of the debt crisis in late 2009, MPs are likely to balk at further austerity being meted out. The prospect of turmoil has been heightened by the government’s parliamentary majority being whittled down to a mere three seats in the 300-member house, after two deputies defected in a vote on an earlier set of milestones last month.

Read more …

Greece has no voice anymore.

• Athens Wants To Turn Bailout Loans’ Floating Rates Into Fixed (Kath.)

The answers to the burning questions of whether a new arrangement for the Greek debt is necessary and what kind of measures will be required are coming through the numbers: Next year the amount Greece will have to repay for the capital of the bailout loans it has received will be almost as much as the interest on them. In total, the amount due in 2016 for servicing the debt will come to just 7.5% of gross domestic product, similar to the following years’ amounts. That is why the eurozone has been insisting on every occasion that the Greek debt does not require a haircut and that any intervention would be necessary only from 2022 onward – i.e. the year when the current grace period ends: That year Greece will need to pay €22 billion for interest alone.

Until then the state’s obligations are under control: Market observers say that the intervening years will be very much like 2016. Next year Greece will have to pay €12.5 billion, of which €6.5 billion concerns capital repayment and 6 billion the payment of interest. At this point the interest trap is hiding. Nowadays the country pays interest of some 6 billion while the loans of the European Stability Mechanism have interest that is very low, around 1%. However, in the following years the interest rates will begin to grow, given that they are floating rates, placing a significant burden on future state budgets.

For that reason Athens is requesting the conversion of the floating rates into fixed rates, which would be advantageous compared to to the current levels (some 0.5%) but still be fairly low for a long period (of at least 15-20 years) during which they would increase by at least 2-3% under normal circumstances. All this would mean that the state budget would become lighter in the future as far as the expenditure on interest was concerned, compared to what the country faces without an arrangement.

Read more …

“Concern has been mounting that thousands of migrants arriving in Greece by boat from neighboring Turkey will become trapped in the country..”

• Greece Seeks Help With Migrants As Tensions Rise (Kath.)

As tensions peaked at temporary reception facilities for migrants, Citizens’ Protection Minister Nikos Toskas said over the weekend that Greece was doing all it can to tackle a relentless migration crisis which he described as “a massive problem, stretching the limits of our country and of Europe.” Toskas visited the Tae Kwon Do Stadium in Palaio Faliro, southern Athens, on Saturday following scuffles between groups of migrants from different countries. Greece cannot keep hosting thousands of migrants streaming into the country, he said. “Our country can’t handle it, our economy can’t handle it.”

Asked by reporters about a joint letter he and Migration Minister Yiannis Mouzalas sent to European Migration and Home Affairs Commissioner Dimitris Avramopoulos, Toskas said the two ministers underlined that the return of migrants from EU countries must be carried out in line with EU regulations and agreements “to keep the number of people that we can support at manageable levels.” Toskas’s comments came ahead of a European Union leaders’ summit planned for Thursday and Friday where the issue of migration is to be discussed along with plans for the creation of a new EU border force which, unlike Frontex, will not require the approval of member-states to be deployed. In an interview with Kathimerini on Sunday, Frontex’s Executive Director Fabrice Leggeri said the border agency had guards ready to dispatch to Greece as early as October but Greek authorities delayed the deployment as they had not appointed Greek officials to head the teams.

Concern has been mounting that thousands of migrants arriving in Greece by boat from neighboring Turkey will become trapped in the country as the Former Yugoslav Republic of Macedonia has tightened controls at Greece’s northern border. Thousands of migrants who had been in a makeshift camp near the FYROM border were bused to Athens last week. Most of them were moved to the Tae Kwon Do Stadium, where scuffles broke out late on Friday and on Saturday morning, prompting riot police to intervene. According to sources, the clashes were between groups of migrants from Morocco and other countries and followed allegations that some migrants had stolen cell phones and cash from others.

Read more …

Where would they go then, Angela? Remember 3 million more expected in 2016?

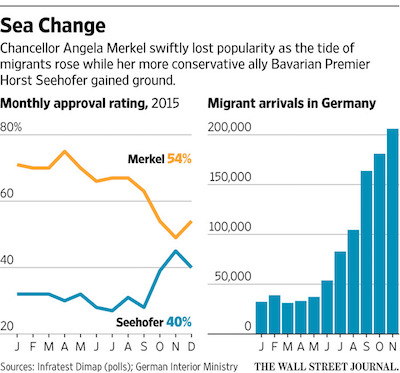

• Angela Merkel Wants To ‘Drastically Reduce’ Refugee Arrivals In Germany (Reuters)

Chancellor Angela Merkel wants to “drastically decrease” the number of refugees coming to Germany, signalling a compromise to critics of her open-door policy from within her conservatives on the eve of a party congress. Merkel has resisted pressure from allies within her Christian Democratic Union (CDU) to put a cap on the number of refugees entering Germany, which is expected to be more than 340,000 this year. “At the same time we took on board the concerns of the people, who are worried about the future, and this means we want to reduce, we want to drastically decrease the number of people coming to us,” Merkel told broadcaster ARD on Sunday. Merkel, whose popularity has fallen over her handling of the refugee crisis, said the word “limit” did not feature in the CDU’s main resolution which will be debated at the two-day party congress starting on Monday in the southern city of Karlsruhe.

The chancellor added there was broad support in the CDU for her strategy to reduce the numbers. This included working with Turkey to fight traffickers, improving the situation at Syrian refugee camps in Turkey, Lebanon and Jordan, and strengthening control of the European Union’s outer borders. Merkel’s conservative critics want her to get the number of arrivals down before three state elections in March and say her hopes of running for a fourth term in 2017 would be in danger. Her strategy also includes finding a solution to the migration crisis on the EU level, where she is meeting resistance from member states opposed to a quota system to distribute refugees. Her critics say her decision in late August to allow Syrian asylum seekers to remain in Germany regardless which EU country they had first entered had accelerated the influx of migrants.

Read more …

The end of the EU will come through Brussels seeking to take away nations’ sovereignty.

• EU Border Force Plan Faces Resistance From Governments (Reuters)

A proposal to give the EU’s executive the power to send forces unbidden into member states to defend the common European frontier will face resistance from some countries when it is published this week. The European Commission wants to be able to deploy personnel from a new European Border and Coastguard Agency without, as currently required, the consent of the state concerned, EU officials told Reuters in early December, reflecting frustration with Greek reluctance to seek help with migrants. European Union officials call it a largely theoretical “nuclear option” and stress that any infringement of national sovereignty would be balanced by the power of a majority of member states to block Commission intervention – similar to checks agreed during the euro debt crisis.

The Commission will set out the plan on Tuesday to reinforce its Frontex agency with up to six times more staff, EU officials said, following a commitment to an EU border guard in September by President Jean-Claude Juncker. “We think the current situation justifies a certain ambition,” the Commission’s chief spokesman said on Friday, expressing confidence about backing from member states. Failure to strengthen the external borders, senior officials argue, will see more states reimpose frontier controls inside the bloc, wrecking its cherished free movement area, and foster the rise of anti-EU nationalists like France’s National Front.

But while big powers France and Germany support such EU power, other EU leaders may voice concerns at a summit on Thursday. Italy has pushed for a “Europeanisation” of external frontiers to relieve the costs on itself and Greece of policing the Mediterranean. But the plan may go too far for many leaders. “This idea will face opposition from most member states,” one EU diplomat said. “We believe such a solution would interfere too deeply in member states’ internal competences.” “The Commission is testing our limits,” said another. He compared it to the Commission’s push to oblige states to take in mandatory quotas of asylum seekers, which set furious east Europeans against German Chancellor Angela Merkel.

Read more …