G. G. Bain Katherine Stinson, “the flying schoolgirl,” Sheepshead Bay Speedway, Brooklyn 1918

Bunch of losers.

• IMF, Global Finance Leaders Fret Over Populist Backlash (R.)

World finance leaders on Thursday decried a growing populist backlash against globalization and pledged to take steps to ensure trade and economic integration benefited more people currently left behind. Their comments at the start of the IMF and World Bank fall meetings signaled frustration with persistently low growth rates and the surge of public anger over free trade and other pillars of the global economic system. The meetings are the first since Britain voted in June to leave the EU and U.S. billionaire Donald Trump secured the Republican presidential nomination with a campaign that attacked trade deals.

“More and more, people don’t trust their elites. They don’t trust their economic leaders, and they don’t trust their political leaders,” German Finance Minister Wolfgang Schaeuble said during an IMF panel discussion in Washington. “In the UK, everyone from the elites told the people, ‘don’t vote for a Brexit.’ But they did.” Schaeuble said Germany was trying to “hold Europe together” in the face of rising nationalism, and failure to do so would bode poorly for global economic cooperation. Last week, the World Trade Organization slashed its global trade volume growth forecast to the slowest pace since 2007, saying it expected it to rise just 1.7% this year, down from the 2.8% it forecast in April.

Propaganda works. Until it doesn’t.

• Donald Trump Makes History With Zero Major Newspaper Endorsements (Yahoo)

With just a little over a month until election day, Donald Trump has racked up zero major newspaper endorsements, a first for any major party nominee in American history. While newspaper endorsements don’t necessarily change voters’ minds, this year’s barrage of anti-Trump endorsements could actually move the needle come November, experts say. “It’s significant,” Jack Pitney, professor of government at California’s Claremont McKenna College, told TheWrap. “The cumulative effect of all these defections could have an impact on moderate Republicans.” Some conservative papers, which have endorsed Republicans for decades, are now breaking with tradition to endorse Hillary Clinton or, at the very least, urge their readers not to vote for Trump.

Several have taken a stand even at the expense of losing subscribers at a time when newspapers are barely staying afloat. Some papers have received death threats. But for a growing number of newspaper editorial boards, staying on the sidelines is no longer an option. The Dallas Morning News, which has endorsed every Republican nominee since 1940, was so appalled by the idea of a President Trump that it introduced its Clinton endorsement with this caveat: “We don’t come to this decision easily. This newspaper has not recommended a Democrat for the nation’s highest office since before World War II — if you’re counting, that’s more than 75 years and nearly 20 elections.”

But today’s jobs report will be a big ray of sunshine. It’s election time, don’t you know.

• The Great Debt Unwind: US Business Bankruptcies Soar 38% (WS)

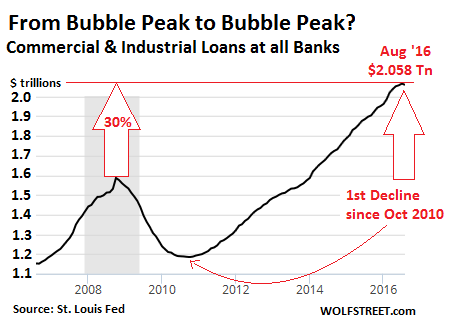

Something funny happened on the way to the bank: In August, commercial and industrial loans outstanding at all banks in the US fell for the first time month-to-month since October 2010, which had marked the end of the collapse of credit during the Financial Crisis. In October 2008, the absolute peak of the prior credit bubble, there were $1.59 trillion commercial and industrial loans outstanding. As the Great Recession chewed into the economy, C&I loans plunged. Many of them were cleansed from bank balance sheets via charge-offs. But then the Fed decided what the US needed was more debt to fix the problem of too much debt, thus kicking off what would become the greatest credit bubble in US history. By July 2016, C&I loans had surged to $2.064 trillion, 30% above their prior bubble peak.

But in August, something stopped working: C&I loans actually fell 0.3% to $2.058 trillion, according to the Federal Reserve Board of Governors. That translates into an annualized decline of 3.8%, after an uninterrupted six-year spree of often double-digit annualized increases. Note that first month-to-month dip since October 2010. [..] The ugliest credit stories in terms of bonds, according to Standard & Poor’s Distress Ratio, are the doom-and-gloom categories of “Energy” and “Metals, Mining, and Steel.” Next down the line are two consumer-facing industries: brick-and-mortar retailers and restaurants.

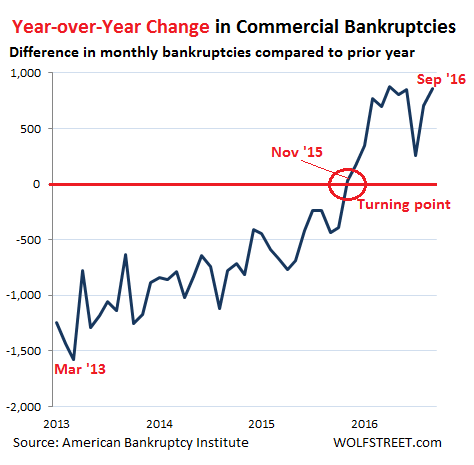

But these metrics by credit ratings agencies are based on companies that are big enough to be rated by the ratings agencies and that are able to borrow in the capital markets by issuing bonds. The 18.9 million small businesses in the US and many of the 182,000 medium size businesses don’t qualify for that special treatment. They can only borrow from banks and other sources. And they’re not included in those metrics. But when they go bankrupt, they are included in the overall commercial bankruptcy numbers, and those numbers are getting uglier by the month. In September, US commercial bankruptcy filings soared 38% from a year ago to 3,072, the 11th month in a row of year-over-year increases, according to the American Bankruptcy Institute.

Just a fat finger, or…? Most of the loss has been recuperated.

• Pound Falls 10% In ‘Insane’ Asian Trading Mystery (G.)

A “fat finger” error by a trader or computerised chain reaction was thought responsible as the pound plunged to a new three-decade low during “insane” early trading in Asia on Friday – adding to the huge losses sterling had already suffered amid speculation that Britain is heading for a “hard Brexit”. The pound fell almost 10% at one point to US$1.1378, prompting confusion among traders who were struggling to identify any news or market event that could have been to blame. As the currency recovered to around $1.2415 there was speculation a technical glitch or human error had sparked a rash of computer-driven orders.

“What we had was insane – call it flash crash but the move of this magnitude really tells you how low the currency can really go,” said Naeem Aslam, chief market analyst of Think Markets, in a note. “Hard Brexit has haunted the sterling.” [..] The pound has fallen 13% against the dollar since Britain voted in late May to leave the EU, with its losses accelerated after Theresa May announced on Sunday that she would trigger Article 50 by next March, a move that would begin Britain’s formal exit from the EU. Sean Callow, senior currency strategist at Westpac, noted that sterling had been “on a precipice” since May’s declaration in a speech at the Conservative party conference. “I think we’ve underestimated how many people had money positions for a very wishy-washy Brexit, or even none,” he said.

Falling pound meets bragging rights.

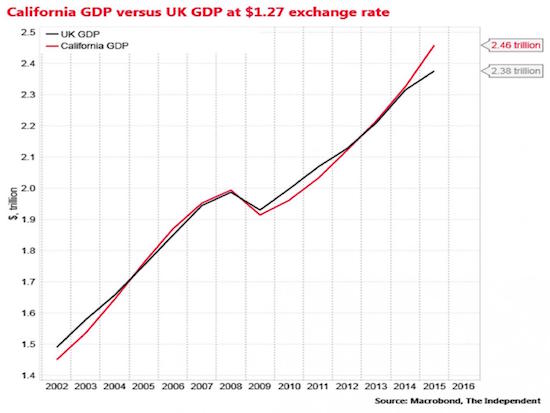

• California Overtakes UK To Become ‘World’s Fifth Largest Economy (Ind.)

Kevin de Leon, the leader of the California Senate, has said the state of California is now the fifth largest economy in the world after UK’s vote to leave the EU. His comments came a day after the pound sterling hit a new 31-year low against the dollar as on-going fears over the consequences of a “hard” Brexit spooked traders. Speaking at an event celebrating the tenth anniversary of the California Global Warming solution Act, de Leon said: “As of this morning California is officially the 5th largest economy in the world. “We have created more jobs than the other top two job creators in the US, Florida and Texas, combined,” he added.

Economists tend to be wary of comparing the relative size of economies using volatile market exchange rates, generally preferring to use a Purchasing Power Parity measure which adjusts for differences in local purchasing power. However, according to the US Bureau of Economic Analysis, California’s GDP in 2015 was $2.46 trillion. This compares to a GDP of $2.36 trillion for the UK in 2016, at the current currency exchange rate of $1.27. In June, the state of California’s GDP surpassed France to become the sixth largest in the world on this measure.

China can only go from bubble to bubble, or the game is up.

• China’s Housing Boom Looks a Lot Like Last Year’s Stocks Bubble (BBG)

Tai Hui is experiencing deja vu. China’s surge in home prices reminds JPMorgan Asset Management’s chief Asia market strategist of last year’s stock market mania. Spiraling leverage and implicit state support are among the common denominators, he says. Shanghai property values jumped 31% in August from a year earlier, the latest data show. In 2015, a 60% rally in the city’s equities through June 12 was followed by a $5 trillion rout. Deutsche Bank warned last month that China’s housing market is in a bubble, while Goldman Sachs said this week it sees growing risks across the real estate industry. Home prices started to take off last year in the wake of the stock market crash after the governments eased curbs on property purchases.

In recent days, cities including Shenzhen have started re-imposing restrictions. “It’s similar to the equity market where if you let things loose, it just runs like a stallion,” said Hui. “And then you have to really rein it back, then it’s like an ice bucket challenge. So you go through this extreme heat and cold. That’s not particularly good for the economy because then you’re going through very aggressive investment cycles.” [..] Home prices started to climb after China eased mortgage policies and down-payment requirements in March 2015 to arrest what was then a slide in prices. New curbs, such as higher deposits to limits on the number of homes people can buy, are proving ineffective given the easy access homebuyers have to leverage, said Wee May Ling at Henderson Global Investors.

Medium and long-term new loans, mostly mortgages, totaled 529 billion yuan ($79 billion) in August, while aggregate financing jumped to 1.47 trillion yuan, helping fuel a 39% jump in property sales by value in the first eight months. Private investment in fixed assets, meanwhile, stalled at 2.1% for a second straight month in the January through August period, matching a record low. While HSBC says the overall level of China’s household debt remains low, Deutsche Bank said it sees “clear sign of a bubble” in property – one that will end in a major correction in two years’ time. Just like last year’s equity boom, China is using credit growth to boost the economy, Zhiwei Zhang, chief China economist at Deutsche Bank, wrote in a report on Sept. 28.

It’s like Tony Soprano is running the banking system.

• Deutsche Bank Mismarked 37 Deals Like Monte Dei Paschi’s (BBG)

Deutsche Bank, indicted for colluding with Banca Monte dei Paschi di Siena to conceal the Italian lender’s losses, mismarked the transaction and dozens of others on its own books, according to an audit commissioned by Germany’s regulator. Executives at Deutsche Bank arranged 103 similar deals with a total value of €10.5 billion ($11.8 billion) for 30 clients, according to the audit, a copy of which was seen by Bloomberg. The lender, Germany’s largest, adjusted the accounting of 37 of those trades in 2013, in addition to Monte Paschi’s, changing them from loans that had been kept off the books to derivatives, the audit said. The widespread use of a transaction that’s now the subject of a criminal case highlights the lender’s appetite for complexity at a time when the bank was expanding its fixed-income empire.

While Deutsche Bank has since cut risky assets and eliminated thousands of jobs to bolster capital, mounting legal costs have become a source of increasing concern to investors, driving shares to a record low. “Very complex deals prevent the market and regulators from properly understanding the state of a bank’s balance sheet, inhibiting proper regulatory monitoring and distorting market discipline,” said Emilios Avgouleas at the University of Edinburgh. The audit found that while Monte Paschi was the only client that used a transaction to “window dress” its books, Deutsche Bank didn’t correctly account for similar deals with banks from Italy to Indonesia made between 2008 and 2010. The report also said senior executives didn’t properly authorize the Monte Paschi trade, dubbed Santorini, or adequately review the transaction after receiving a subpoena from the U.S. Federal Reserve in 2012.

[..] Deutsche Bank and six current and former managers, including Michele Faissola, who oversaw global rates at the time, and Ivor Dunbar, former co-head of global capital markets, were indicted in a Milan court on Oct. 1 for the 2008 Monte Paschi transaction. Both were top deputies to former Deutsche Bank co-Chief Executive Officer Anshu Jain, and all three have left the company.

What’s needed is a comprehensive investigation of the whole system. But by all means, start with Wells Fargo and Deutsche.

• 14 US Senators Call for Criminal Investigation of Wells Fargo (AP)

Fourteen senators are calling on the Justice Department to open a criminal investigation of Wells Fargo executives after revelations that bank employees opened millions of fake banks and credit card accounts. A bank teller who steals bills from a cash drawer is likely to face charges, the senators said in a statement, but “an executive who oversees a massive fraud that implicates thousands of bank employees and costs customers millions of dollars can walk away with a hefty retirement package and millions in the bank.” House and Senate hearings last month with Wells Fargo CEO John Stumpf “raised serious questions” that point to possible wrongdoing by Stumpf and other high-ranking executive, said the senators, all but one of them Democrats.

U.S. and California regulators have fined San Francisco-based Wells Fargo $185 million, saying bank employees trying to meet aggressive sales targets opened up to 2 million fake deposit and credit card accounts in customers’ names. Regulators said employees issued and activated debit cards and signed people up for online banking without permission. The abuses are said to have gone on for years, unchecked by senior management. In their letter, the senators urged Attorney General Loretta Lynch to hold Wells Fargo accountable as a corporation and also prosecute individual executives who may have broken the law. “Every time the Department of Justice settles a case of corporate fraud without holding individuals accountable, it reinforces the notion that the wealthy and powerful have purchased a higher class of justice for themselves,” the senators said.

The letter was led by Democratic Sen. Mazie Hirono of Hawaii and signed by 12 other Democrats, including Sens. Elizabeth Warren of Massachusetts, Jeff Merkley of Oregon and Patrick Leahy of Vermont. Warren and Merkley serve on the Senate Banking Committee, while Leahy is senior Democrat on the Judiciary Committee.

Well, that’s a surprise!

• Liar Loans Surge in Australia’s Red-Hot Housing Bubble (WS)

UBS Securities Australia reported today that about 28% of Australian mortgages issued in 2015 and 2016 are what we in the US have come to call “liar loans,” which played a big role in the housing boom and the collapse and subsequent bailout of the global financial system. Reality is the last phase of a housing bubble needs liar loans to keep going because buyers have to reach beyond their limits, and the only way to do this is lie now, or miss out forever on buying a home. Evidence that home buyers are lying about income, assets, expenses, and other things on their mortgage applications has been surfacing for a while, along with fears that this would eventually lead to a “Mortgage Meltdown.” The US-style mortgage fraud would be a “Nuclear Bomb” to Australia’s banks.

Hedge funds are betting on this meltdown by shorting the big four banks. But everyone else wants these bank stocks that dominate the Australian stock exchange to rise. They’re in everyone’s portfolio. And they’re all doing what they can to turn shorting the banks into a widow-maker trade. To get “hard evidence,” UBS Securities Australia and UBS Evidence Lab surveyed 1,228 Australians who’d taken out a residential mortgage in 2015 or 2016. Participants, who remained anonymous, were asked 63 questions. The survey was broad based, covering all states and territories in Australia. Given the size of the sample and broad spread of respondents we believe the results are representative of Australian mortgage borrowers. Conclusions based on the total sample have a potential sampling error of just ±2.71% at a 95% confidence level.

The resulting report, “Mortgages – Time for the Truth?” found that 28% of the respondents admitted that they’d lied on their mortgage application: • 21% claimed their applications were “mostly factual and accurate.” • 5% stated they were “partially factual and accurate”• 2% “would rather not say.” How many of these liar-loan applicants lied on the survey to hide their lies on the mortgage application? We don’t know. But the actual percentage of liar loans could even be higher, given the propensity of liar-loan applicants – just my hunch – to lie on surveys to cover their tracks.

Fractals, swaps and central banks.

• Risk and Volatility Cannot be Extinguished (CH Smith)

[..] while modern portfolio management is statistically based (all those “standard deviations” you always see referenced in quantitative analyses), the markets behave fractally. Fractals are known as the geometry of chaos, for they describe how seemingly stable systems can quickly, and unpredictably, degrade into chaos. But as Mandelbrot explains, “100-year floods” actually occur with startling regularity in all markets. Put another way: you cannot disappear all risk with fancy statistical models and credit default swaps, etc., that offload the risk onto others, i.e. counterparties. In other words, all you’re really doing is masking the risk-you’re not eliminating it. And in hiding the real risk, you are lulling the market participants into a pernicious choice architecture in which their willingness to take riskier and riskier actions is rewarded and encouraged, while caution is punished.

This is the Paradox of Risk: by masking risk behind assurances that the Fed has your back, the Federal Reserve is encouraging unwary investors to increase their exposure to risk without even being aware of the dangers. I covered the perverse consequences of believing risk can be “managed away to near-zero” in my book An Unconventional Guide to Investing in Troubled Times. This is how you get a total systemic collapse of the entire choice architecture. And by this I mean not just the financial markets, but the backstop provided by central banks. In a system that is now highly correlated to central bank policies, the idea that some counterparty will cover your losses is illusory. This is magical thinking: that when the system implodes, the counterparties will magically escape the highly correlated collapse.

Mike is one of the few people who understands the importance of money velocity -and deflation- the way the Automatic Earth has talked about it for a long time. We’ve been in touch off and on for many years now, lots of mutual respect. I’m not focused so much on the ‘crisis as opportunity’ story though, since in my view it leaves too many people behind.

• USA’s Day Of Reckoning – Hidden Secrets Of Money 7 (Mike Maloney)

History shows that once or twice in a generation a global crisis comes along that radically devastates people’s way of life. A fundamental shift so big and drastic and overwhelming that it destroys their standard of living and impacts every area of their lives. We are about to experience one of those events… As Mike Maloney outlines in his brand new episode of the Hidden Secrets of Money, that next major event is deflation. And the culprit will be a relatively obscure monetary term that will impact virtually every area of your life: money velocity. You may not know exactly what money velocity means, but we will all soon experience it firsthand. In fact, money velocity will be the culprit of not just deflation, but the resulting inflation—and maybe hyperinflation—that will immediately follow.

Not applicable to all forms of democracy, but as I’ve often said, our systems self-select for sociopaths.

• Why Democracy Rewards Bad People (Mises Inst.)

One of the most widely accepted propositions among political economists is the following: Every monopoly is bad from the viewpoint of consumers. Monopoly is understood in its classical sense to be an exclusive privilege granted to a single producer of a commodity or service, i.e., as the absence of free entry into a particular line of production. In other words, only one agency, A, may produce a given good, x. Any such monopolist is bad for consumers because, shielded from potential new entrants into his area of production, the price of the monopolist’s product x will be higher and the quality of x lower than otherwise. This elementary truth has frequently been invoked as an argument in favor of democratic government as opposed to classical, monarchical or princely government.

This is because under democracy entry into the governmental apparatus is free – anyone can become prime minister or president – whereas under monarchy it is restricted to the king and his heir. However, this argument in favor of democracy is fatally flawed. Free entry is not always good. Free entry and competition in the production of goods is good, but free competition in the production of bads is not. Free entry into the business of torturing and killing innocents, or free competition in counterfeiting or swindling, for instance, is not good; it is worse than bad. So what sort of “business” is government? Answer: it is not a customary producer of goods sold to voluntary consumers. Rather, it is a “business” engaged in theft and expropriation — by means of taxes and counterfeiting — and the fencing of stolen goods.

Hence, free entry into government does not improve something good. Indeed, it makes matters worse than bad, i.e., it improves evil. Since man is as man is, in every society people who covet others’ property exist. Some people are more afflicted by this sentiment than others, but individuals usually learn not to act on such feelings or even feel ashamed for entertaining them. Generally only a few individuals are unable to successfully suppress their desire for others’ property, and they are treated as criminals by their fellow men and repressed by the threat of physical punishment. Under princely government, only one single person – the prince – can legally act on the desire for another man’s property, and it is this which makes him a potential danger and a “bad.”

However, a prince is restricted in his redistributive desires because all members of society have learned to regard the taking and redistributing of another man’s property as shameful and immoral. Accordingly, they watch a prince’s every action with utmost suspicion. In distinct contrast, by opening entry into government, anyone is permitted to freely express his desire for others’ property. What formerly was regarded as immoral and accordingly was suppressed is now considered a legitimate sentiment. Everyone may openly covet everyone else’s property in the name of democracy; and everyone may act on this desire for another’s property, provided that he finds entrance into government. Hence, under democracy everyone becomes a threat.

As referenced quite lost here before: it’s an uncomfortable feeling if the far right is the only voice to speak the truth. But make no mistake: it speaks loud and clear to the failure of the entire rest of the political system.

• Marine Le Pen Says EU Responsible For “Monstrous Chaos In Syria” (ZH)

With the proxy war in Syria escalating dramatically on a day by day basis, with ideological support for the warring powers split along West vs Russia (and China) lines, one particular outlier in the “western world” emerged overnight when Marine Le Pen, leader of France’s National Front party and the frontrunner for the role of president in near year’s French elections, accused the EU of being responsible for the ongoing chaos in Syria. She added that Europe has been too busy trying to overthrow Assad while Russia was actually fighting terrorists.

“You’ve done everything to bring down the government of Syria, throwing the country into a terrible civil war, while accusing Russia which is actually fighting Islamic State. Your responsibility could not be concealed”, she said speaking at the European Parliament plenary session in Strasbourg on Wednesday. “You cannot hide your responsibility […] for plunging this part of the world into an absolutely monstrous chaos,” Le Pen said, alleging that policies advocated by both the United States and the EU had contributed to the state Syria is currently in, as well as neighboring Iraq.

Brussels is getting very nervous about this: “If he manages to supplant Renzi he plans to hold his own referendum – on Italian membership of the euro area..”

• Renzi Must Go If He Loses Italy Referendum, Five Star Rival Says (BBG)

Italian Prime Minister Matteo Renzi cannot wriggle out of his pledge to quit if he loses the country’s referendum on constitutional reform, his main rival said. Luigi Di Maio, a leader of the anti-establishment Five-Star Movement and deputy-speaker of the lower house, said Italy will have to hold elections “as soon as possible” if Renzi’s plans for reform are rejected by voters on Dec. 4. “I am sure that Italians will ask him to maintain that promise despite the fact he has changed his mind,” Di Maio said in an interview at Bloomberg’s Rome office on Wednesday. “If Italians vote “No,” Renzi must keep the promise.” The premier has repeatedly pledged to step down if he loses the referendum which he says is central to his plans to make Italy work again after years of stagnation.

Still, he has backtracked somewhat in recent interviews as surveys show the “No” camp edging ahead and investors concerns mounting. The 30-year-old from near Naples is already described as “prime minister-in-waiting” by newspapers like Corriere della Sera with Five-Star neck-and-neck with Renzi’s Democratic Party in opinion polls. If he manages to supplant Renzi he plans to hold his own referendum – on Italian membership of the euro area. “I’d also like to see a European referendum on the euro, to see other countries starting to talk about it,” Di Maio said. “I know this is very difficult but I don’t think the Europe we know today will be the one we will face when we’re in government in a couple of years’ time.”

Bless these people, win or no win. They need no prize, simply do what must be done. And in Greece, there’s so much that must be done.

• This Greek Grandmother Could Win The Nobel Peace Prize (USA Today)

Emilia Kamvysi is not the typical Nobel Peace Prize candidate. The 86-year-old is not a politician, activist or lawyer. Her days are simple and slow. Like other Greek retirees on the island of Lesbos off the Turkish coast, she cooks for her children and grandchildren, watches the evening news and sits on the bench with her neighbors gazing at the sea. Then her life changed. Along with two neighbors -aged 89 and 85- Kamvysi was sitting on a bench in February, helping out a Syrian refugee mother by feeding her child with a bottle. The photo went viral, and she and the two other grannies in the photo became symbols of Greek generosity toward the migrants who have fled to Europe in recent years.

Soon after, a group of Greek lawmakers, academics and others nominated the grandmother as well as Greek fisherman Stratis Valiamos and actress Susan Sarandon. A second nomination included the grandmother and local agencies. Both cited their humanitarian efforts for the refugees. This Friday, Kamvysi and her granny-corps will find out whether she’ll become an official laureate. “I wish that Greece wins this prize, not just me,” Kamvysi said, pledging if she wins to give her share of the $1.2 million prize to the decaying Greek healthcare system. She lives well enough now on a $360-per-month farmer’s-pension, she said. “What am I going to do with it anyway?” she asked. “There are many people that helped the refugees — the fishermen, the volunteers. It wasn’t just us. Those poor babies, escaping war and drowning in the waters. It’s such a shame. We’re all crying in the village whenever there’s a shipwreck.”

The exact opposite of the grandmothers helping refugees. Military force against people fleeing military force.

• EU Launches Tough Border Force To Curb Refugee Crisis (AFP)

The EU launched its beefed-up border force Thursday in a rare show of unity by the squabbling bloc as it seeks to tackle its worst migration crisis since World War II. EU officials inaugurated the new task force at the Kapitan Andreevo checkpoint on the Bulgarian-Turkish border, the main land frontier for migrants seeking to enter the bloc and avoid the dangerous Mediterranean sea crossing. The European Border and Coast Guard Agency (EBCG) will have at its disposal some 1,500 officers from 19 member states who can be swiftly mobilised in case of an emergency, like a sudden surge of migrants. Brussels hopes the revamped agency will not just increase security, but also help heal the huge rifts that have emerged between member states clashing over the EU’s refugee policies.

The long-term goal is to lift border controls inside the bloc and fully restore the passport-free Schengen Zone. “The new agency is stronger and better equipped to tackle migration and security challenges,” EBCG director Fabrice Leggeri said at the launch. The force will also conduct stress tests at the bloc’s external borders to “identify vulnerabilities before a crisis hits”, he added. EU Migration Commissioner Dimitris Avramopoulos hailed the launch as a “historical day for the European Union”. “From now onwards, the external EU border of one member state is the external border of all member states – both legally and operationally,” he said. “Countries like Bulgaria, Greece and Italy are still under pressure, but they are not alone.”

Home › Forums › Debt Rattle October 7 2016