Sergio Larraín Valparaiso Chile 1963

As EU President Juncker this morning unveils his vision of more Europe all the time, here’s what Europe is really like:

42% of Greek mortgage loans are non-performing. Today’s sale prices are 70-80% lower than in 2008. And that’s before 200-300,000 homes will be forced onto the market this fall.

• Greece Property Value Review A Hard Task (K.)

The government is facing a daunting task in adjusting the so-called objective values (the property rates used for tax purposes) to market levels by the end of the year, as its bailout agreement dictates. The huge slump in transactions and the forced sales of properties due to their owners’ debts do not lead to any safe conclusions for the values per area. One in four sales are conducted with prices that lag the objective value by 60-70%, and the prices of 2008 by 70-80%. The Finance Ministry must overcome all the obstacles to bring to Parliament all the necessary adjustments and regulations.

Moreover, once the objective values are brought in line with market rates, the government will have to maintain the same amount of revenues from the Single Property Tax (ENFIA) either by raising the tax’s rates or by introducing a new tax in the form of the old Large Property Tax. Furthermore, once the objective values are reduced by 40-50% to match the going prices, banks’ may see problems with their capital adequacy, as lenders will incur losses by having to revise the collateral they get. Mortgage loans in Greece amount to €59.44 billion, of which 42%, or €25.4 billion are nonperforming.

Forget about more Europe, or you’ll wind up with a whole lot less Europe.

• Creditors Set To Increase Pressure On Athens (K.)

Technical experts representing the country’s creditors started visiting the country’s ministries in Athens on Monday, paving the way for the third bailout review, which has long ceased to be viewed as a simple matter and is increasingly burdened with problems. Pressure for a satisfactory conclusion to the review will grow with the planned visit on September 25 of Eurogroup chief Jeroen Dijsselbloem, who will meet with Greek Finance Minister Euclid Tsakalotos. Responding to a question by Kathimerini, Dijsselbloem’s spokesman said that the head of the Eurogroup will discuss eurozone issues and certainly the progress of the adjustment program. Government officials estimate that the discussion on the course of the review and the Greek program may be combined with the expiry of Dijsselbloem’s mandate at the Eurogroup chair at year-end.

The Dutch minister – whose last visit in Athens and his meeting with his counterpart at the time, Yanis Varoufakis, was quite eventful – would obviously like to leave on a positive note in regards to the Greek program. It has been rumored that he may seek another office in the eurozone. Sources from Brussels also say that the top European Commission’s top representative, Declan Costello, will also be coming to Athens in the next few days. In addition to the main cluster of 113 prior actions, of which 95 should be implemented by year-end, the creditors have expressed their objections and doubts about recent legislative moves made by the government, such as the labor law passed last Thursday.

Sources say that the creditors have also expressed concerns about clauses related to the reduced value-added tax on agricultural supplies, the opening up of closed professions, as well as the civil service. A large number of the 95 prior actions the government must implement in record time have a high degree of difficulty, and government officials believe this may require revisions on family benefits, the operation of the sell-off hyperfund and its subsidiaries, the opening up of the energy market, etc.

How would the US pay for all the shiny trinkets?

• US Threatens To Cut Off China From SWIFT If It Violates North Korea Sanctions (ZH)

In an unexpectedly strong diplomatic escalation, one day after China agreed to vote alongside the US (and Russia) during Monday’s United National Security Council vote in passing the watered down North Korea sanctions, the US warned that if China were to violate or fail to comply with the newly imposed sanctions against Kim’s regime, it could cut off Beijing’s access to both the US financial system as well as the “international dollar system.” Speaking at CNBC’s Delivering Alpha conference on Tuesday, Steven Mnuchin said that China had agreed to “historic” North Korean sanctions during Monday’s United Nations vote. “We worked very closely with the U.N. I’m very pleased with the resolution that was just passed. This is some of the strongest items. We now have more tools in our toolbox, and we will continue to use them and put additional sanctions on North Korea until they stop this behavior.”

In response, Andrew Ross Sorkin countered that “we haven’t been able to move the needle on China, which seems to be the real mover on this, in terms of being able to apply the real pressure. What do you think the issue is? What is the problem?” The stunner was revealed in Mnuchin’s answer: “I think we have absolutely moved the needle on China. I think what they agreed to yesterday was historic. I’d also say I put sanctions on a major Chinese bank.That’s the first time that’s ever been done. And if China doesn’t follow these sanctions, we will put additional sanctions on them and prevent them from accessing the U.S. and international dollar system. And that’s quite meaningful.”

And to underscore his point, the Treasury Secretary also said that “in North Korea, economic warfare works. I made it clear that the President was strongly considering and we sent a message that anybody that wanted to trade with North Korea, we would consider them not trading with us. We can put on economic sanctions to stop people trading.” In other words, to force compliance with the North Korean sanctions, Mnuchin threatened Beijing with not only trade war, but also a lock out from the dollar system, i.e. SWIFT, something the US did back in 2014 and 2015 when it blocked off several Russian banks as relations between the US and Russia imploded. Of course, whether the US would be willing to go so far as to use the nuclear option, and pull the dollar plug on its biggest trade partner, in the process immediately unleashing an economic depression domestically and globally is a different matter.

So far Washington has been reluctant to impose economic sanctions on China over concerns of possible retaliatory measures from Beijing and the potentially catastrophic consequences for the global economy. Washington runs a $350 billion annual trade deficit with Beijing, while the PBOC also holds over $1 trillion in US debt. Ironically, the biggest hurdle to the implementation of the just passed sanctions may be the president himself. “We think it’s just another very small step, not a big deal,” Trump told reporters at the start of a meeting with Malaysian Prime Minister Najib Razak. “I don’t know if it has any impact, but certainly it was nice to get a 15-to-nothing vote, but those sanctions are nothing compared to what ultimately will have to happen,” said Trump who has vowed not to allow North Korea to develop a nuclear ballistic missile capable of hitting the United States.

Xi demands peace for the Party Congress. Brokerages have been told: no holidays during Congress.

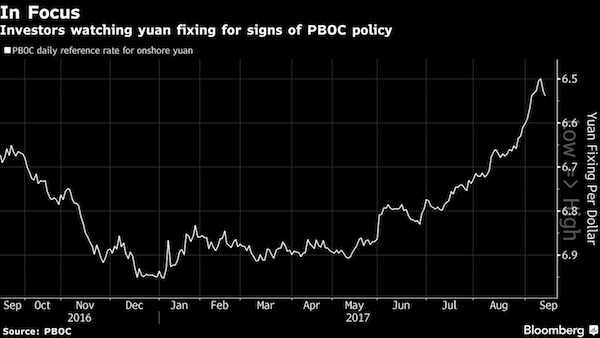

• Yuan Fixing Takes Center Stage, Again (BBG)

China’s yuan fixing is back in focus, with a run of surprises moving the market in recent days. The central bank set its reference rate – which limits onshore moves to 2% on either side – at a weaker than expected level for the third day in a row Wednesday. The rates, and the removal of a reserve requirement rule on the trading of foreign-exchange forwards, are fueling bets that authorities want to limit gains after the onshore yuan surged more than 4% against the dollar in the three months through Sept. 7. The People’s Bank of China set Wednesday’s fixing at 6.5382 per dollar, compared with the average forecast of 6.5355 in a Bloomberg survey of 19 traders and analysts. The authorities have had greater opportunity to sway the fixing either way since May, with the introduction of a “counter-cyclical factor” to the rate-setting mechanism.

“The PBOC still wants a relatively stable yuan,” said Nathan Chow at DBS. “Even if it strengthens or weakens, the pace needs to be controlled, and in an orderly and gradual manner. This will be easier for exporters to manage risks. The market expectation is that there should be no big changes or surprises before the party congress next month.” The yuan’s rally began to falter on Friday as the removal of the reserve rule made it less expensive to bet on yuan declines. The monetary authority weakened Tuesday’s fixing by the most in eight months following an overnight surge in a gauge of the greenback, pushing the onshore spot rate lower.

“There are a lot of companies raising a lot of money for not very good ideas..”

• Cryptocurrency Chaos As China Cracks Down On ICOs (R.)

China’s move last week to ban initial coin offerings (ICO) has caused chaos among start-ups looking to raise money through the novel fund-raising scheme, prompting halts, about-turns and re-thinks. China is cracking down on fundraising through launches of token-based digital currencies, targeting ICOs in a market that has ballooned this year in what has been a bonanza for digital currency entrepreneurs. The boom has fueled a jump in the value of cryptocurrencies, but raised fears of a potential bubble. “This is not unlike the dotcom bubble of 2000,” said a partner at a venture capital fund in Shanghai, who didn’t want to be named because of the issue’s sensitivity. “There are a lot of companies raising a lot of money for not very good ideas, and these will eventually be weeded out. But even from the big dotcom bust, you still have gems.”

“One of the reasons regulators stepped in was that the ICO fever extended beyond the traditional crypto community. The timing was an attempt to pre-empt this before it goes into a much broader mass market in China,” the partner said. Investors in China contributed up to 2.6 billion yuan ($394 million) worth of cryptocurrencies through ICOs in January-June, according to a state-run media report citing National Committee of Experts on Internet Financial Security Technology data. Pre-ICO roadshows featuring elaborate standing room-only presentations at 5-star hotels drew a diverse crowd, including grandmothers – a likely tipping point for regulators. The hype and subsequent crackdown came as China focuses on economic and social stability ahead of next month’s congress of the Communist Party, a once-in-five-years event.

Beijing is also waging a broader campaign against fraudulent fundraising and speculative investment, which analysts attribute to China’s underdeveloped financial regulation and lack of legitimate investment options. While several start-ups said the exuberance had got out of control and they had expected Beijing to act, they said last week’s move panicked investors and caused confusion.

Worse than tulip bulbs.

• JPMorgan’s Dimon Says Bitcoin ‘Is A Fraud’ (R.)

Bitcoin “is a fraud” and will blow up, Jamie Dimon, chief executive of JPMorgan Chase, said on Tuesday. Speaking at a bank investor conference in New York, Dimon said, “The currency isn’t going to work. You can’t have a business where people can invent a currency out of thin air and think that people who are buying it are really smart.” Dimon said that if any JPMorgan traders were trading the crypto-currency, “I would fire them in a second, for two reasons: It is against our rules and they are stupid, and both are dangerous.” Dimon’s comments come as the bitcoin, a virtual currency not backed by any government, has more than quadrupled in value since December to more than $4,100.

[..] “It is worse than tulips bulbs,” Dimon said, referring to a famous market bubble from the 1600s. JPMorgan and many of its competitors, however, have invested millions of dollars in blockchain, the technology that tracks bitcoin transactions. Blockchain is a shared ledger of transactions maintained by a network of computers on the internet. Dimon said such uses will roll out over coming years as it is adapted to different business lines. Financial institutions are hoping blockchain can be adapted to simplify and lower the costs of processes such as securities settlement, loan trading and international money transfers. Dimon predicted big losses for bitcoin buyers. “Don’t ask me to short it. It could be at $20,000 before this happens, but it will eventually blow up.” he said.

From Reagan’s Budget Director.

• America’s Fiscal Doomsday Machine (Stockman)

Maybe the Democrats did win the 2016 election. Or at least the the Deep State and its accomplices among the beltway political class, K-Street lobbies and the media did. That’s because the media won a giant victory against something they deplore and despise more than anything else — the public debt ceiling. They sanctimoniously admonish that it’s a relic of the nation’s fiscally benighted past. They operate on a belief that this is an episodic tendency to threaten America’s credit and to offer Capitol Hill an opening to grandstand about the fiscal verities is a blight on orderly governance. So the Donald’s latest burst of impetuosity — agreeing with Sen. Schumer to permanently abolish the public debt ceiling — has descended on the beltway like manna from heaven.

Not Barack Obama, Bill Clinton, Jimmy Carter or even the Great Texas Porker, Lyndon Johnson, dared to utter the thought of it — at least not in polite company. Suddenly, and notwithstanding all the good he has done disrupting the status quo, the Donald has become the foremost enemy of America’s very financial survival. The Federal budget is a Fiscal Doomsday Machine. The depository of American wars and entitlements have run rampant. Under the pile drivers of a global empire and the retiring baby boom, it is rapidly propelling the nation toward fiscal catastrophe. That grim outcome is virtually guaranteed if the only remaining safety brake — the debt ceiling — is summarily abolished. Due to entitlements, debt service and the slow pipeline of appropriated spending there is no such thing as an annual Federal budget or accountability for how much Uncle Sam spends and borrows.

Instead, the $4.1 trillion that Congressional Budget Office (CBO) projects the Federal government will spend in FY 2018, and the $563 billion it will borrow, reflects the dead hand of the past. Entitlements and other mandatory spending alone is projected to reach $2.566 trillion or 63% of total FY 2018 outlays. Another $307 billion will be required for interest on the nation’s $20 trillion public debt, while upwards of half the $1.22 trillion for so-called “discretionary” or appropriated programs also reflects funds appropriated years ago. Altogether, $3.5 trillion, or 85% of outlays, will be essentially baked into the cake before a single Congressional vote is taken on anything regarding the FY 2018 budget.

They just want to lend more.

• IMF Is Resisting A Moratorium On Barbuda’s Sovereign Debt Repayments (Ind.)

The IMF is resisting putting a moratorium on Barbuda’s sovereign debt repayments in the wake of the devastation left by Hurricane Irma on the tiny Caribbean island. Barbuda is said to have lost around 90% of its structures in the wake of the storm and the national repair and reconstruction bill has been estimated at $150m. The prime minister of Antigua and Barbuda, Gaston Browne, has also said that around half or the island’s population of 1,600 is now homeless. Yet Antigua and Barbuda have debt with the IMF of around $15.8m and a coalition of US faith institutions have been calling on the Fund to pause the repayments of states battered by the hurricane. However, the IMF’s special representative to the UN, Christopher Lane, reportedly suggested late last week that the Fund would rather lend more money to the island, rather than stop collecting the repayments due.

“Our general view is that we’d rather put new money in than to have moratoria,” he said, according to Court House News. Stressing that were technical and political difficulties in simply stopping the debt collection he said: “We borrow money from our members who lend. So we’d have to get agreement from the lending parties.” “We might borrow money from the United States and loan that to Antigua. If we don’t get paid back on time, we’d have to make an arrangement with the source of the funds themselves. It gets a bit arcane, but there’s a number of constraints on how we operate. We’re like a bank. We borrow and lend.”

In a letter to the IMF managing director Christine Lagarde on 7 September the Jubilee USA network wrote: “We invite the IMF to implement an immediate moratorium on debt payments for countries severely impacted by the Category 5 storm until they have rebuilt and recovered.” “For example, the nation of Antigua and Barbuda has almost $3m in debt payments due to the Fund today and a debt payment moratorium could immediately be put into rebuilding Barbuda where almost the entire population is homeless.” The group also urged that further IMF reconstruction payments to Barbuda, and other affected islands, should be in the form of grants, rather than loans.

All major banks are.

• UK’s High Street Banks Are Accident Waiting To Happen (G.)

The UK’s high street banks are an accident waiting to happen and could struggle in another financial crisis, according to a report published on Wednesday to mark the 10th anniversary of the run on Northern Rock. The report criticises the annual health checks – stress tests – that have been conducted by the Bank of England since the crisis and concludes that the methodology used by Threadneedle Street is flawed and the tests not gruelling enough. [..] Kevin Dowd, a professor of finance and economics at Durham University and a long-standing critic of the stress tests, said the Bank does not use the correct measures to assess the health of the banking system. Dowd is also a senior fellow at the Adam Smith Institute, a rightwing thinktank. His analysis – which the Bank of England has previously rejected – focuses on the health check of the major lenders published last November.

Those tests were based on a number of hypothetical scenarios including house prices falling and the global economy contracting by 1.9%. Royal Bank of Scotland failed the test and Barclays and Standard Chartered would both have struggled to cope. Dowd argued that the scenarios were “hardly doomsday” and disputes the way banks’ capital strength is measured. “The stress tests are about as useful as a cancer test that cannot detect cancer. They seek to demonstrate a financial resilience on the part of UK banks that simply isn’t there,” said Dowd in the report. “Our banking system is an accident waiting to happen.” The Bank uses the value of assets as calculated by the banks rather than their value on the markets which, he argued, would give a more accurate assessment of their financial health. “It is disturbing that 10 years on from Northern Rock, the best measures of leverage – those based on market values – indicate that UK banks are even more leveraged than they were then,” said Dowd.

“American warfare in 7 different countries..”

• We Must Repeal The Authorization For The Use Of Military Force (Rand Paul)

As Congress takes up the 2018 National Defense Authorization Act (NDAA), I will insist it vote on my amendment to sunset the 2001 and 2002 Authorizations for the Use of Military Force. Why? Because these authorizations to use military force are inappropriately being used to justify American warfare in 7 different countries. Sunsetting both AUMFs will force a debate on whether we continue the Afghanistan war, the Libya war, the Yemen war, the Syria war, and other interventions. Our military trains our soldiers to be focused and disciplined, yet the politicians who send them to fight have for years ignored those traits when developing our foreign policy. The result? Trillions spent in seemingly endless conflicts in every corner of the globe, while we find ourselves 16 years into the war in Afghanistan wondering what our purpose there even is any more, or if we’ll ever bring our troops home.

If we don’t get this rudderless foreign policy under control now, we’ll still be asking the same questions another 16 years down the road. It’s time to demand the policymakers take their own jobs as seriously as the men and women we ask to risk it all for our nation. Doing so means restoring constitutional checks and balances. Congress has no greater responsibility than defending our country, and the Founders entrusted it with the power of declaring war because they wanted such a weighty decision to be thoroughly debated by the legislature instead of unilaterally made by the Executive branch. Yet Congress has largely abdicated its role anyways, and its sidekick status was plainly evident when former President Obama proposed a new AUMF for the fight against ISIS while insisting he really had all the authority he needed – it being more of a “wouldn’t it be nice” afterthought than an acknowledgement of any required step.

Not a lot of insight into what’s wrong with US Democrats.

• Democrats Fought For 25 Years Over Single-Payer. Now Many Back Sanders (Sirota)

When U.S. Sen. Bernie Sanders’ introduces his Medicare-for-All legislation on Wednesday, advocates of a single-payer, government-sponsored health care hope it will be the end of a bitterly fought policy battle that has roiled the Democratic Party for generations. Since Democratic President Harry Truman first proposed a government-sponsored universal health care system in 1945 — and since a Democratic president and Democratic congress first enacted Medicare and Medicaid in the mid-1960s — progressives have hoped that the United States would follow other industrialized countries by guaranteeing health care to all citizens. Indeed, many of the original proponents of Medicare hoped the system would ultimately be expanded to cover the entire country — as former Social Security commissioner Robert Ball wrote, “We expected Medicare to be a first step toward universal national health insurance.”

And although the intervening years saw the rise of Republican President Ronald Reagan, who derided “socialized medicine,” some Democrats continued to champion the idea. The party’s 1992 presidential contender Jerry Brown ran for the White House promising to support single-payer. But when Bill Clinton defeated him and won the presidency, the Clinton administration opted to back health care reforms that preserved the existing private insurance system — even as Hillary Clinton made favorable comments about single-payer. A generation later, Barack Obama also retreated from single-payer, and instead pushed the Affordable Care Act, which subsidizes the private insurance system.

Now, things appear once again to be shifting. Even as Sanders has declared that his Medicare-for-All bill is not a litmus test, Democrats from across the party’s ideological spectrum are flocking to his legislation. On the progressive side, Democratic senators such as Elizabeth Warren (MA), Jeff Merkley (OR) and Al Franken (MN) have signed onto the legislation. Within the party establishment, former Vice President Al Gore has expressed support, as has conservative former Sen. Max Baucus — one of the architects of the Affordable Care Act whom single-payer advocates saw as a nemesis. With polls showing rising support for government-sponsored health care, the party’s long civil war over the issue may be over, potentially allowing a more unified party to campaign on Medicare-for-All in 2018.

China has hardly enough land to feed its people.

• China Plans Nationwide Use Of Ethanol Gasoline By 2020 (R.)

China plans to roll out the use of ethanol in gasoline nationally by 2020, state media reported on Wednesday citing a government document, as Beijing intensifies its push to boost industrial demand for corn and clean up choking smog. It’s the first time the government has set a targeted timeline for pushing the biofuel, known as E10 and containing 10% corn, across the world’s largest car market, although it has yet to announce a formal policy. Mandates requiring that a minimum amount of biofuel must be blended into fuel for the nation’s cars, similar to the United States and Brazil, are currently set at a provincial level. “This news has greatly boosted confidence inside the industry,” said Michael Mao, analyst with Sublime China Information, adding that without government support ethanol would likely be too expensive to survive in the market.

Shares in biofuel producers rallied on the news, with Shandong Longlive Bio-Technology Co surging 10%, on track for its biggest one-day gain since December 2015. Major producer COFCO Biochemical Anhui Co, a listed unit of state-owned grains trader COFCO, was up almost 6%. A renewed effort to promote the nation’s fledging biofuels industry will be a further blow to major oil producers. On Saturday, the government said it has begun studying when to ban the production and sale of cars using traditional fuels. The news comes after the government said late last year it would aim to double ethanol output by 2020 amid growing pressure to whittle down mountains of ageing corn in state warehouses.

Some good points, but needs much more work.

• Capitalism Can’t Save The Planet – It Can Only Destroy It (Monbiot)

There was “a flaw” in the theory: this is the famous admission by Alan Greenspan, the former chair of the Federal Reserve, to a congressional inquiry into the 2008 financial crisis. His belief that the self-interest of the lending institutions would lead automatically to the correction of financial markets had proved wrong. Now, in the midst of the environmental crisis, we await a similar admission. We may be waiting some time. For, as in Greenspan’s theory of the financial system, there cannot be a problem. The market is meant to be self-correcting: that’s what the theory says. As Milton Friedman, one of the architects of neoliberal ideology, put it: “Ecological values can find their natural space in the market, like any other consumer demand.” As long as environmental goods are correctly priced, neither planning nor regulation is required.

Any attempt by governments or citizens to change the likely course of events is unwarranted and misguided. But there’s a flaw. Hurricanes do not respond to market signals. The plastic fibres in our oceans, food and drinking water do not respond to market signals. Nor does the collapse of insect populations, or coral reefs, or the extirpation of orangutans from Borneo. The unregulated market is as powerless in the face of these forces as the people in Florida who resolved to fight Hurricane Irma by shooting it. It is the wrong tool, the wrong approach, the wrong system. There are two inherent problems with the pricing of the living world and its destruction. The first is that it depends on attaching a financial value to items – such as human life, species and ecosystems – that cannot be redeemed for money. The second is that it seeks to quantify events and processes that cannot be reliably predicted.

[..] A system that depends on growth can survive only if we progressively lose our ability to make reasoned decisions. After our needs, then strong desires, then faint desires have been met, we must keep buying goods and services we neither need nor want, induced by marketing to abandon our discriminating faculties, and to succumb instead to impulse. [..] Continued economic growth depends on continued disposal: unless we rapidly junk the goods we buy, it fails. The growth economy and the throwaway society cannot be separated. Environmental destruction is not a byproduct of this system: it is a necessary element.

Illustration: Sebastien Thibault

Home › Forums › Debt Rattle September 13 2017