Gustave Courbet The wave 1870

Chapter 1 of this five-part series by Dr. D is here: Bitcoin Doesn’t Exist – 1 .

Chapter 2 is here: Bitcoin Doesn’t Exist – 2

Chapter 4 will follow shortly.

Dr. D: The money, the unaccountable, uninhibited release of tokens can do more than just buy centuries of hard labor in seconds, it‘s also a method of control. Banks, our present issuers of money, can approve or destroy businesses by denying loans. They can do this to individuals, like denying loans to unpopular figures, or to whole sectors, like gun shops. They can also offer money for free to Amazon, Facebook, and Tesla, which have no profitable business model or any hope of getting one, and deny loans to power plants, railroads, farms, and bridges as they fall into the Mississippi.

The result is banks and their attending insiders are a de facto Committee of Central Planners in the great Soviet style. What is fashionable and exciting to them can happen, and what they dislike or disapprove of for any reason can never happen. And once on a completely fiat system, this is how capital is allocated through our entire system: badly. What’s worse has been a 20-year turn toward Disaster Capitalism, whereby loans are extended to a business, sector, person, or nation, and then suddenly cut off, leading to the rapid foreclosure and confiscation of companies, assets, or continents by the “Development Team.”

Imagine a Bitcoin where Satoshi could erase your coins in your wallet for giving him a bad haircut. Or because he likes your wife. Nor is there any help for independent nations like Iran, or even nuclear powers like Russia. Both have been cut off, their funds suspended at a whim with no recourse. Even being a fellow insider is no insurance, as the NY banks cut off Lehman from funds they were owed, driving it into bankruptcy to buy the pieces in receivership. Unpopular Billionaires are treated likewise. This is a system with no justice, no order, no rules, and no predictability. Anyone within it is at grave and total risk. And yet before Bitcoin it was the only system we had, short of returning to the 19th century, it was the only way for modern commerce to deliver food, water, power, or function at all.

This is seen in its abuses, but also by its effects. The present system not only controls whether you are a winner or loser, whether you may go or stay, whether you may live or die, but also tracks every purchase, every location, in effect, every action throughout your entire life. These records will describe what books you read, what movies you watch, what associates you have, in real time Already these daily actions are being approved or denied. Take out a variable-rate jumbo loan? We’ll give you 110% of the value, paying you to be irresponsible (we’ll foreclose later). Want to buy gas when driving through Cheyenne 3:30 at night? Sorry, we disabled your card as a suspicious transaction. Sorry about you dying there of crime or of cold; we didn’t know and didn’t care. All your base are belong to us.

You say you don’t care if JP Morgan has your pay stubs to disturbing porn sites and Uber purchases to see your mistress? Well the future Mayor of Atlanta will, and he hasn’t graduated college yet. With those records it’s child’s play to blackmail policemen, reporters, judges, senators, or generals, even Presidents. And all those future Presidents are making those purchases right now, the ones that can be spun into political hay, real or unreal. So if you don’t worry what everyone knows about you, that’s fine, but imagine reading the open bank records, the life histories of every political opponent from now until doomsday. Then Don’t. Do. It. The people who have those records – not you – then have not just all the assets, not just all the money, but all the power and influence. Forever.

Are you signing up for that? Bitcoin doesn’t. Bitcoin doesn’t care who you are and with some care can make it very difficult to track you. And without tracking you, it makes it impossible to boycott you. And without a central repository, it’s impossible to march in with tanks and make them give you the records, turn money on or off, to make other people live or die and bend to your will by violence.

No one will care about that, because no one cares about it now unless, like Russia or China, it’s directed at them personally and then it’s too late. The real adoption of Bitcoin is far more mundane.

The long-term interest rate is 5%. Historically banks would lend at 8%, pay at 4%, and be on the golf course by 5. No one thought much about it because like a public utility, banking was a slow, boring affair of letting business do business. You know, farming, mining, manufacturing, all that stuff we no longer do. For decades, centuries even, banking was 5%-15% of a nation’s GDP, facilitating borrowers and lenders and timescales, paying for themselves with the business efficiencies they engender.

All that changed after WWII. Banks rose in proportion to the rest of the economy, passing the average, then the previous high, then when that level reached “Irrational Exuberance”, Greenspan started the printing presses, free money was created, and Senators and Presidents whose bank records were visible suddenly repealed Glass-Steagall. An economy stretched to breaking with free, centrally-allocated and misallocated money crashed and shrank, yet the banks– now known as the FIRE stocks: Finance, Insurance, and Real Estate – kept growing. How can banks and finance keep growing with a shrinking economy? By selling their only product: debt.

How do you sell it? Reduce the qualifications past zero to NINJA-levels, and use your free money to FORCE people to take it via government deficits and subsidized loans. No normal economy could do this. No normal business model could do this. Only a business now based on nothing, issuing nothing, with no restraint and no oversight. And the FIRE sector kept growing, through 15%, 20%, 25% until today most of U.S. GDP is either Finance selling the same instruments back and forth by borrowing new money or GDP created by governments borrowing and spending.

Remember when we started, banks paid 4% and charged at 8%. Now they openly take savings with negative interest rates, and charge at 30% or higher on a credit card balance averaging $16,000. And still claim they need bailouts comprising trillions a year because they don’t make money. The sector that once facilitated trade by absorbing 5% of GDP is now 5x larger. There’s a word for a body whose one organ has grown 5x larger: Cancer. Unstopped, it kills the host.

What does this have to do with Bitcoin? Simple. They’re charging too much. They’re making too much both personally and as a group. They’re overpriced. And anything that’s overpriced is ripe for competition. And the higher the markup, the more incentive, the more pressure, the more profit there is to join the upstart. Bitcoin can economize banking because what does banking do? It saves money safely, which Bitcoin can do. It transfers money on demand, which Bitcoin can do. It pays you interest, which mining or appreciation can do.

It also can lend, register stocks and ownership, rate credit risks, and allocate capital which other non-Bitcoin Tokens can do. In short, it can replace the 25% overpricing of the financial sector. If it could reduce the overhead of outsized profit, the misuse of expensive brainpower, of Wall Street and London office space, and reduce financial costs to merely 10% GDP, it could free up 20% of GDP for productive purposes. Why did you think Detroit and Baltimore fell in on themselves while N.Y. and D.C. boomed? That’s the 30% they took, $4B a year, from every other state, every year for 40 years.

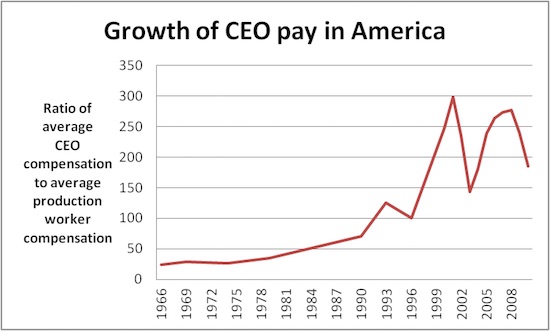

That money and that brainpower could be much better allocated elsewhere, but so long as the Finance sector can print free money and buy free influence, they will never stop on their own. Only an upstart to their monopoly can cure the cancer and bring them back to a healthy size and purpose. Bitcoin can do this only because they charge too much and do too little. Of course, they could go back to paying 4% and charging 8% with a CEO:employee pay ratio of 20:1 but history says it will never happen. Only a conflict, a collapse, or competition can reform them, and however long it takes, competition is by far the best option.

So why would people pick Bitcoin? It costs less and does more. Amongst adopters, it’s simpler and more direct. It pays the right people and not the wrong ones. It rewards good behavior instead of bad, and can help producers instead of parasites. It’s equitable instead of hierarchical. What else? While not Bitcoin proper, as a truth machine Blockchain technology is the prime cure for the present system’s main problem: fraud. There is so much fraud at the moment, libraries of books have been written merely recording the highlights of fraud since 2001. But merely recording the epic, world-wide, multi-trillion dollar frauds clearly does not cure it. Like other human problems, no one cares about your problems, only your solutions, and Blockchain has the solution.

While the details of fraud are complex, the essence of fraud is quite simple: you lie about something in order to steal it. That’s it. It could be small or large, simple or complex, but basically fraud is all about claiming what didn’t happen. However, the Blockchain is all about truth, that is, creating consensus about what happened, and then preserving it. Take the Robosigning scandal: accidental or deliberate, the mortgage brokers, banks, and MBS funds lost the paperwork for millions of houses. A house could be paid off could be foreclosed, as happened, or it could be owned 5 times, as happened. Like the Sneeches, no one knew which one was who, and the only certainty was that the official authority – county courthouses – did not know because to register there would have cost Wall Street and inconvenient millions or billions in shared tax stamps.

The system broke down, and to this day no one has attempted to define ownership, choosing instead to usher all the questionable (and therefore worthless) material into the central bank and hiding it there until the mortgage terms expire, forcing the taxpayers to bail out a multi-trillion dollar bank fraud at full value. And this is just one messy example. The S&L crisis was not dissimilar, nor are we accounting for constant overhead of fees, mortgage transfers, re-surveys, and title searches nationwide.

With Blockchain it’s simple: you take line one, write the information, the owner, title, date, and transfer, and share it with a group. They confirm it and add mortgage #2, then #3 and so on. It’s a public ledger like the courthouse, but the system pays the fees. It also can’t be tampered with, as everyone has a copy and there is no central place to bribe, steal, and subvert as happened in 2006 but also in history like the 1930s or the railroad and mining boom of the 1800s. If there are questions, you refer to the consensus If it’s transferred, it is transferred on the ledger. If it isn’t on the ledger, it isn’t transferred, same as the courthouse. Essentially, that’s what “ownership” is: the consensus that you own something. Therefore you do not have a mortgage due disappear, or 4 different owners clamoring to get paid or take possession of the same property, or the financial terrorism of shattering the system if you even attempt to prosecute fraud.

It’s not just mortgages: stocks have the same problem. Since the digital age began, the problem of clearing stock trades has steadily increased. Eventually, the NYSE trading volume was so large they couldn’t clear at all, and the SEC let trading houses net their internal trades, only rectifying the mismatches between brokerages. Eventually, that was too large, and they created the DTCC as a central holder and clearing house. Yet, in an age of online trading and high-frequency trading mainframes, it became apparent there was no way to clear even residual trades, and they effectively no longer try, and the SEC, instead of forcing them to compliance, lets them. There are 300M failed stock trades a day and $50B a day in bond failures, or $12 Trillion year in bonds alone. And so? If you sell your stocks and bonds, the brokerage makes it come out whole, so what?

Chapter 1 of this five-part series by Dr. D is here: Bitcoin Doesn’t Exist – 1 .

Chapter 2 is here: Bitcoin Doesn’t Exist – 2

Chapter 4 will follow shortly.

Home › Forums › Bitcoin Doesn’t Exist – 3