Vincent van Gogh Snowy landscape with Arles in the background 1888

UPDATE: There is a problem with our Paypal widget/account that makes donating hard if not impossible, but that Paypal apparently can’t be bothered to fix. At least not over the past 2 weeks. We have no idea how many people have simply given up on donating.

But we can suggest a workaround:

Through Paypal.com, you can simply donate to an email address. In our case that is recedinghorizons *at* gmail *com*. Use that, and your donations will arrive where they belong. Sorry for the inconvenience.

The Automatic Earth and its readers have been supporting refugees and homeless in Greece since June 2015. It has been and at times difficult and at all times expensive endeavor. Not at least because the problems do not just not get solved, they actually get worse. Because the people of Greece and the refugees that land on their shores increasingly find themselves pawns in political games.

Therefore, even if the generosity of our readership has been nothing short of miraculous, we must continue to humbly ask you for more support. Because our work is not done. Our latest essay on this is here: The Automatic Earth for Athens Fund – Christmas and 2018 . It contains links to all 14 previous articles on the situation.

Here’s how you can help:

For donations to Konstantinos and O Allos Anthropos, the Automatic Earth has a Paypal widget on our front page, top left hand corner. On our Sales and Donations page, there is an address to send money orders and checks if you don’t like Paypal. Our Bitcoin address is 1HYLLUR2JFs24X1zTS4XbNJidGo2XNHiTT. For other forms of payment, drop us a line at Contact • at • TheAutomaticEarth • com.

To tell donations for Kostantinos apart from those for the Automatic Earth (which badly needs them too!), any amounts that come in ending in either $0.99 or $0.37, will go to O Allos Anthropos.

Please give generously.

Gann is all the vogue these days. Why has it taken so long? Lots of graphs here.

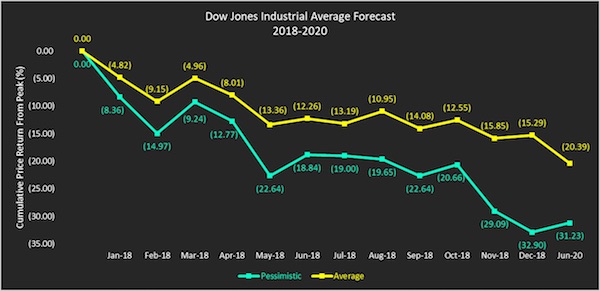

• Natural Time Cycles: A Dow Forecast For 2018-2020 (Freeze)

The analysis and forecasts presented in this article are based on the analytical framework of W.D. Gann. Gann is an investing legend, labeled as genius by many financial historians. He reportedly accumulated $50 million in profits during his trading career. His superior track record and those of others using his methods argues that, regardless of our opinion of his methodology, we should heed the advice of his work. A more detailed explanation of his analytical framework is included in the last section of this article.

Forecast: 2018-2020

The Dow Jones Industrial Average forecast, in the graph above, is based upon the natural 20-year cycle that Gann identified. The lines in the graph show the projected monthly cumulative percentage returns from the peak level. The yellow line is the average scenario and the aqua line is the pessimistic scenario. The graph provides monthly estimates for 2018. The last data point represents June 2020, which covers the entire 30-month period from December 2017. My average scenario forecasts a -15.29% price return for 2018. The cumulative price return is forecast to bottom in June 2020 at -20.39%, at which time an extended rally should ensue. My pessimistic scenario forecasts a -32.90% price return for 2018. The cumulative price return is forecast to be little-changed in June 2020 at -31.23%, at which time an extended rally in should ensue.

The New York Times feels obliged to cede the stage to the one person they’ve sought to discredit for the past 2 years. Must be humiliating.

• Trump Says Russia Inquiry Makes US ‘Look Very Bad’ (NYT)

President Trump said Thursday that he believes Robert S. Mueller III, the special counsel in the Russia investigation, will treat him fairly, contradicting some members of his party who have waged a weekslong campaign to try to discredit Mr. Mueller and the continuing inquiry. During an impromptu 30-minute interview with The New York Times at his golf club in West Palm Beach, the president did not demand an end to the Russia investigations swirling around his administration, but insisted 16 times that there has been “no collusion” discovered by the inquiry. “It makes the country look very bad, and it puts the country in a very bad position,” Mr. Trump said of the investigation. “So the sooner it’s worked out, the better it is for the country.”

Asked whether he would order the Justice Department to reopen the investigation into Hillary Clinton’s emails, Mr. Trump appeared to remain focused on the Russia investigation. “I have absolute right to do what I want to do with the Justice Department,” he said, echoing claims by his supporters that as president he has the power to open or end an investigation. “But for purposes of hopefully thinking I’m going to be treated fairly, I’ve stayed uninvolved with this particular matter.” Hours after he accused the Chinese of secretly shipping oil to North Korea, Mr. Trump explicitly said for the first time that he has “been soft” on China on trade in the hopes that its leaders will pressure North Korea to abandon its nuclear weapons program. He hinted that his patience may soon end, however, signaling his frustration with the reported oil shipments.

[..] Mr. Mueller’s investigation appears to be moving ahead despite predictions by Mr. Trump’s lawyers this year that it would be over by Thanksgiving. Mr. Trump said that he was not bothered by the fact that he does not know when it will be completed because he has nothing to hide. Mr. Trump repeated his assertion that Democrats invented the Russia allegations “as a hoax, as a ruse, as an excuse for losing an election.” He said that “everybody knows” his associates did not collude with the Russians, even as he insisted that the “real stories” are about Democrats who worked with Russians during the 2016 campaign. “There’s been no collusion. But I think he’s going to be fair,” Mr. Trump said of Mr. Mueller.

[..] Mr. Trump said he believes members of the news media will eventually cover him more favorably because they are profiting from the interest in his presidency and thus will want him re-elected. “Another reason that I’m going to win another four years is because newspapers, television, all forms of media will tank if I’m not there because without me, their ratings are going down the tubes,” Mr. Trump said, then invoked one of his preferred insults. “Without me, The New York Times will indeed be not the failing New York Times, but the failed New York Times.” He added: “So they basically have to let me win. And eventually, probably six months before the election, they’ll be loving me because they’re saying, ‘Please, please, don’t lose Donald Trump.’ O.K.”

Russiagate has turned into a huge embarrassment.

• Russiagate Is Devolving Into an Effort to Stigmatize Dissent (Carden)

Of all the various twists and turns of the year-and-a-half-long national drama known as #Russiagate, the effort to marginalize and stigmatize dissent from the consensus Russia-Trump narrative, particularly by former intelligence and national-security officials and operatives, is among the more alarming. An invasion-of-privacy lawsuit, filed in July 2017 by a former DNC official and two Democratic donors, alleges that they suffered “significant distress and anxiety and will require lifelong vigilance and expense” because their personal information was exposed as a result of the e-mail hack of the DNC, which, the suit claims, was part of a conspiracy between Roger Stone and the Trump campaign.

According to a report in The New York Times published at the time of the suit’s filing, “Mr. Trump and his political advisers, including Mr. Stone, have repeatedly denied colluding with Russia, and the 44-page complaint, filed on Wednesday in the Federal District Court for the District of Columbia, does not contain any hard evidence that his campaign did.” (Emphasis added.) In a new development, in early December, 14 former high-ranking US intelligence and national-security officials, including former deputy secretary of state William Burns; former CIA director John Brennan; former director of national intelligence James Clapper; and former ambassador to Russia Michael McFaul (a longtime proponent of democracy promotion, which presumably includes free speech), filed an amicus brief as part of the lawsuit.

The amicus brief purports to explain to the court how Russia deploys “active measures” that seek “to undermine confidence in democratic leaders and institutions; sow discord between the United States and its allies; discredit candidates for office perceived as hostile to the Kremlin; influence public opinion against U.S. military, economic and political programs; and create distrust or confusion over sources of information.” The former officials portray the amicus brief as an offering of neutral (“Amici submit this brief on behalf of neither party”) expertise (“to offer the Court their broad perspective, informed by careers spent working inside the U.S. government”).

The brief claims that Putin’s Russia has not only “actively spread disinformation online in order to exploit racial, cultural and political divisions across the country” but also “conducted cyber espionage operations…to undermine faith in the U.S. democratic process and, in the general election, influence the results against Secretary Hillary Clinton.”

“The Fed will sell more bonds in the next 3-4 years than had been accumulated by all of the central banks of the world in all of recorded history as of 1995!”

• US Fiscal Path Will Rattle the Rafters of the Casino – Stockman (SG)

[..] the US government is spending money like a drunken sailor. But nobody really seems to care. Since Nov. 8, the US national debt has risen $1 trillion. Meanwhile, the Russell 2000 (a small-cap stock market index) has risen by 30%. Former Reagan budget director David Stockman said this makes no sense in a rational world, and he thinks the FY 2019 is going to sink the casino. In a rational world operating with honest financial markets those two results would not be found in even remotely the same zip code; and especially not in month #102 of a tired economic expansion and at the inception of an epochal pivot by the Fed to QT (quantitative tightening) on a scale never before imagined.” Stockman is referring to economic tightening recently launched by the Federal Reserve. It’s not only the increasing interest rates.

By next April the Fed will be shrinking its balance sheet at an annual rate of $360 billion and by $600 billion per year as of next October. By the end of 2020, the Fed will have dumped $2 trillion of bonds from its books. Stockman puts this into perspective. So the net of it is this: The Fed will sell more bonds in the next 3-4 years than had been accumulated by all of the central banks of the world in all of recorded history as of 1995!” Now pause for just a moment and think about this. The GOP just passed a tax plan that will add another $1.5 trillion to the deficit. And word is Trump’s next big push will be to pass an infrastructure bill – even more spending and debt. Meanwhile, during a time of rising debt, the Fed will be flooding the market with bonds. And what do governments have to do to finance debt? That’s right. They sell bonds.

There is literally a fiscal red ink eruption heading straight at the Fed’s balance sheet shrinkage campaign that will rattle the rafters in the casino … Uncle Sam’s borrowing requirements are likely to hit $1.25 trillion or more than 6% of GDP in FY 2019 owing to the fact that the tax bill is so heavily front-loaded and the GOP’s wild spending spree for defense, disasters and much else.”

It’s starting to feel like Xi is seriously stuck. Let zombies default, and accept the lost jobs and mom and pop investments, or keep propping them up.

• China May Be A Bigger Worry For 2018 (CNBC)

For a market dependent on synchronized global growth, investors may be betting too much that China will not rock the boat next year. Part of the S&P 500’s rally to record highs this year comes on the back of better economic growth around the world. A major contributor to that growth was stability in China as leaders prepared for a key 19th Communist Party Congress this fall. Now that the congress is over and Beijing looks set to take action on its growing debt problems, worries about a sharper-than-expected slowdown in the world’s second-largest economy could hurt U.S. stocks. “With the 19th Party Congress now behind us, the risk is that the peak growth in China is also behind us,” David Woo, head of global rates, FX and EM FI strategy & econ research at Bank of America, said in an outlook report.

“Curiously, the market has been ignoring the string of negative Chinese data surprises in recent weeks. It is possible that the market views them as temporary.” “We are concerned that China could be vulnerable to US tax reform getting done,” Woo said, noting that a resulting increase in U.S. rates and the U.S. dollar would likely cause capital flight from China to accelerate and weaken the Chinese yuan. If that happens, China’s central bank would be likely “to tighten liquidity, which in turn would raise further concerns about the growth outlook,” he said. Fears of negative spillover from a rapid slowdown in China’s economy hit global markets in August 2015 after a surprise yuan devaluation. Further weakness in the currency in the first few weeks of 2016 contributed to the worst start to a year on record for both the Dow and S&P 500.

Since then, Chinese authorities have proven they are still able to control their economy. But stability has come at the cost of ever-increasing debt levels. The IMF warned in October that China’s banking sector assets have risen steadily to 310% of GDP from 240% of GDP at the end of 2012. S&P Global Ratings downgraded China’s long-term sovereign credit rating in September, following a similar downgrade by Moody’s in May. “If clusters of credit defaults start to form, concerns about contagion into the wider economy could take hold if fears of default in wealth management products arise,” UBS Wealth Management’s chief investment office said in its 2018 outlook. “Should this happen, the Chinese government, in our view, would likely have sufficient resources to prevent widespread contagion.”

Xi made the conscious choice to rise on the shadow’s coat tails. Now he has to keep riding or else.

• China’s Leaders Fret Over Debts Lurking In Shadow Banking System (R.)

Before the 2008 financial crisis, there was very little shadow banking in China. In the aftermath of that shock, Chinese authorities launched a massive effort to stimulate the economy, mostly through a huge increase in lending. This led to a boom in property and infrastructure spending that continues today. Demand for credit increased sharply, especially from local and municipal government-owned companies. To meet this demand, banks began selling wealth management products offering higher interest rates than normal deposits. Many investors believed these products were implicitly guaranteed by the issuer, even if it was not expressly stated in the contract. Banks also borrowed cash from other banks and companies. For banks, these funds can then be lent to borrowers prepared to pay higher rates.

But the banks want to sidestep rules designed to restrict lending to overheated sectors including property, mining and other resources. So, people in the shadow banking industry say, these loans are often disguised by directing them through a complex chain of intermediaries, including trusts, securities companies, other banks and asset managers. To earn interest on these loans, a bank will buy a financial product from one of the intermediaries, which directs earnings back to the bank. That allows the bank to describe what is really a loan as an investment on its books. This type of lending can be more profitable because banks can set aside much less capital than they are required to hold for regular loans as a safeguard against defaults. By the end of 2015, shadow lending was growing faster than traditional bank lending, and was equivalent to 57% of total bank loans, according to a 2016 report from investment bank CLSA.

This dramatically accelerated the speed at which overall debt expanded in China’s financial system. Moody’s said in a November report that China’s shadow banking assets grew more than 20% in 2016 to 64 trillion yuan ($9.8 trillion), equivalent to 86.5% of GDP. [..] At the center of shadow banking are the 12 nationally licensed joint stock banks and many of the more than 100 city commercial lenders which hold about a third of China’s commercial banking assets. From 2010, these mid-tier banks and regional lenders set about competing with the country’s so-called Big Five lenders, the state-controlled behemoths that dominate the economy. The key to the upstarts’ growth is selling wealth management products and borrowing from other banks, allowing them to create loans wrapped in financial instruments to give the appearance of investments.

Translation: foreign reserves are fleeing. Blame the Trump tax plan.

• China Temporarily Waives Taxes To Get Foreign Firms To Stay (AFP)

China will temporarily waive income taxes for foreign companies on profits they reinvest in the country as Beijing battles to retain foreign firms and investment. The finance ministry announced Thursday the new tax policy, which will apply retroactively from January so businesses will be able to take advantage of the exemption for this year’s taxes. The new incentives for foreign business to keep their earnings in China follow the passing last week of a corporate tax overhaul in the United States. The US reform will lower the tax rate for most corporations to 21%. Businesses in China pay 25%. The temporary exemption “will create a better investment environment for foreign investors and encourage foreign investors to sustain their investments in China,” a spokesman for the ministry of commerce said.

The policy announcement also comes as China has struggled with capital flight and tightened capital controls this year to stem the outflow of money. But foreign companies have long complained of the onerous bureaucracy they must navigate, barriers to market access, and policies that favour local firms. The new tax incentives aim to make China more attractive but come with a slew of restrictions. To be eligible, the profits must be invested in industries and activities where the Chinese government encourages foreign investment: manufacturing, services, research and development. Locations in the west of the country are also prioritised for development. Companies have three years to apply for the exemptions after paying tax.

“This can happen only during the very late stage of a bubble.”

• How Far the Scams & Stupidities around “Blockchain Stocks” are Going (WS)

It just doesn’t let up. UBI Blockchain Internet, a Hong Kong outfit whose shares trade in the US [UBIA], filed with the SEC to sell an additional 72.3 million shares owned by its executives. In other words, it isn’t selling the shares to raise money for corporate purposes, but to allow its executives, including CEO Tony Liu, to bail out. This is happening after the company – which sports zero revenues and a disconnected phone number in its SEC filings – managed to get its shares to spike briefly by over 1,100%, pushing its market capitalization to $8 billion. UBI Blockchain didn’t do an IPO. Instead, in October 2016, it acquired a publicly traded shell company registered in Las Vegas, called “JA Energy.” It then changed the name and ticker symbol to what they’re now.

Over the six trading days starting on December 11, 2017, its shares soared over 1,100%, from $7.20 to $87 on December 18, as the word “blockchain” in its name and sufficient hype and speculator-idiocy took hold. By December 21, shares had plunged 67% to $29. They closed on Wednesday at $38.50. At this price, it still has a ludicrous market cap of $3.64 billion. In its prospectus for the share sale, filed with the SEC on December 26, UBI explains the overcooked spaghetti of its dreamed-up activities: UBI Blockchain Internet Ltd. business encompasses the research and application of blockchain technology with a focus on the Internet of things covering areas of food, drugs and healthcare. Management plans to focus its business in the integrated wellness industry, by providing procedures for safety and effectiveness in food and drugs, but also preventing counterfeit or fake food and drugs.

With the advancement of the blockchain technology, the Company plans to trace a food or drug product from its original source within the context of the Internet of Things to the final consumer. It explains that “management is uncertain that the Company can generate sufficient revenues in the next 12-months to sustain our operations. We shall need to seek additional funding to continue our operations and implement our plan of operations.” It added that “due to the uncertainty of our ability to meet our financial obligations and to pay our liabilities as they become due,” the auditors in the financial statement for the year ended August 31, 2017, questioned “our ability to continue as a going concern.” For the year, UBI had an operating loss of $1.83 million on zero revenues. It had $15,406 in cash, and: “In order to keep the company operational and fully reporting, management anticipates a burn rate of approximately $220,000 per month, pre and post-offering.”

Overtime for accountants.

• IRS Guidance on Property Taxes Has the US Confused (BBG)

New guidance from the Internal Revenue Service that limits taxpayers’ ability to deduct prepaid property levies on their 2017 tax returns is causing confusion nationwide as people rush to pay in advance without knowing whether they’re wasting their time and money. The IRS said Wednesday that taxpayers can deduct prepaid state and local property taxes for 2018 on 2017 returns only if the taxes were assessed before 2018. The brief guidance – which doesn’t define the term “assessed” – had local tax officials scratching their heads. Some see the issue as an early signal of far wider confusion that’s coming soon – the predictable result of passing a bill that rewrites the tax code just two weeks before many of the changes take hold.

“This is the tip of the iceberg as state and local governments try to figure this out – and by the way, they’re trying to figure it out with one week before the changes take effect,” said Richard Auxier, a researcher with the Urban-Brookings Tax Policy Center, a Washington public policy group. “And that week happens to be the week between Christmas and New Year’s.” The IRS guidance comes after many state and local officials – including New York Governor Andrew Cuomo and New Jersey Governor Chris Christie – have taken pains to clear the way for their residents to accelerate property-tax payments. The nationwide flurry came ahead of the new tax law that will cap property tax deductions – along with those for state and local income taxes or sales taxes – at an overall total of $10,000.

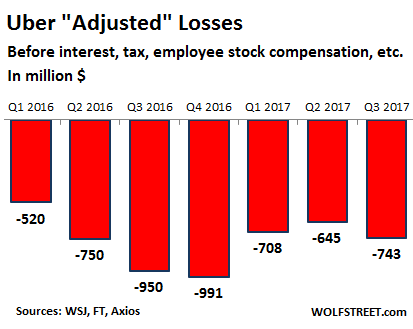

Uber just lost a third of its valuation.

• Turns out, Uber Shareholders Are Eager to Sell at 30% Discount (WS)

Softbank, an acquisitive junk-rated Japanese holding company that also owns about 80% of Sprint, has been preparing for months to buy a large stake in Uber. At the end of November, it launched a tender offer to buy enough shares from investors and employees to give it a 14% stake. It dangled out a price of $33 a share, which valued Uber at $48 billion – a 30% discount from Uber’s “valuation” of $69 billion, which had been established behind closed doors during the last fund-raising round. The offer at a $48-billion valuation is even lower than Uber’s valuation back in June 2015 of $51 billion. When the tender offer was started, there was uncertainty if enough sellers would be willing to dump their shares at this discount. The other option for them would be to hold out until the IPO, in the hopes for a better deal. The tender offer expired today at noon Pacific Time.

Turns out, there are plenty of eager sellers – despite any dreams of a blistering IPO: The tendered shares amount to about 20% of the company’s equity, “people familiar with the matter” told the Wall Street Journal. But SoftBank will likely acquire only a 15% stake, “the people said.” Other members of the consortium SoftBank is leading – including Dragoneer Investment Group and Tencent Holdings – are likely to buy some but not all of the remaining tendered shares. This deal will not raise money for Uber itself but will allow employees and early investors to cash out some of their holdings – at a steep discount. But to maintain the illusion of the previous “valuation” of $69 billion – which is critical for a properly hyped future IPO – SoftBank will also make a $1-billion direct investment into Uber at the $69-billion “valuation,” as part of the deal.

Since startup “valuations” are based on the price paid during fund-raising, this $1-billion deal forms Uber’s new “valuation,” the same as the prior one. So the “valuation” illusion remains intact. [..] SoftBank already owns major stakes in other rideshare startups, including Didi Chuxing, the largest rideshare company in China; Grab, a major rideshare company in Southeast Asia; Ola, the largest rideshare company in India, slightly ahead of Uber; and 99, the largest rideshare company in Brazil. So SoftBank is serious about getting into this business on a global scale. But all rideshare companies are competing with each other, with taxis, rental cars, mass transit, and other modes of transportation on service and low fares, and they’re competing with each other to rope in drivers by offering them incentives.

The plan is to dominate the markets. And all of them are losing money hand over fist. The chart below shows what quarterly “adjusted” losses look like for Uber. Actual losses under GAAP would be much larger since the costs of employee stock compensation, interest, taxes, depreciation, and amortization have been stripped out of the figures that Uber shows the media:

It’s hard to keep track of all the Monty Python moves at Downing Street 10.

• UK Holds Back Historic Files on EU as It Prepares for Brexit (BBG)

As Prime Minister Theresa May prepares for the next round of Brexit negotiations, her government has held back publication of secret files relating to the creation of the European Union. The documents from 1992 were due to be released Friday at the National Archives under British rules that allow government papers to enter the public domain. Out of 495 files from the prime minister’s office that year, a total of 114 were held back. Of those, 12 related to European policy. The main opposition party was quick to pounce. Jon Trickett, a high-ranking Labour politician described it as “profoundly shocking, particularly given the current state of the national debate.”

May’s government has had a series of problems with information around Brexit. Last week, after months of ministers trying to keep them secret, the government published an assessments of how different segments of the economy will cope with leaving the EU. Lawmakers commented that the documents contained little that couldn’t be found on Wikipedia. The Cabinet Office, which supports May in running the government, said in an email that “there is no question that any files are deliberately ‘withheld’ from the media.” A further 26 files covering the EU were sent to the archives too late for journalists to read them before publication.

It explained that “we have to ensure all files are properly reviewed and prepared before they are transferred, so that they do not harm national security or our relations with other countries or disclose the sensitive personal data of living individuals.” The files that were released reveal the extent to which Britain’s 1992 expulsion from the Exchange Rate Mechanism turned Conservatives against Europe. That year, Sept. 16 was christened “Black Wednesday” after the government’s failed attempt to keep the pound within the system by pushing interest rates up to 15%.

Everybody accuses everybody else, because assigning the blame is more important than helping the refugees.

• Greek Migration Ministry Responds To Criticism Over Island Camps (K.)

The Migration Ministry has blamed local authorities for the grim conditions inside island migrant camps in the wake of criticism from a senior European Union official. In an interview with news website New Europe on Sunday, the EU’s special envoy on migration, Maarten Verwey, said the European Commission had made funding available to ensure appropriate accommodation for all. “However, the Commission cannot order the creation or expansion of reception capacity against the opposition of the competent authorities,” he added. Speaking to Kathimerini on Thursday, sources inside the ministry did not deny the existence of EU funds, adding however that Verwey had omitted any mention of the difficulties “although he has personal experience.”

Authorities on Lesvos and Chios have opposed government plans to expand screening centers for refugees. Meanwhile, only a small amount of the available funds have been absorbed. Of the 540 million euros earmarked until 2020, Greece has received just 97 million euros, according to the Economy Ministry. The same sources referred to recent remarks by Migration Minister Yiannis Mouzalas, who accused EU governments of “hypocrisy” for failing to shoulder their fair share of the refugee burden.

Home › Forums › Debt Rattle December 29 2017