Paul Gauguin The Great Buddah � 1897

Sure, but do what? Has anyone defined that?

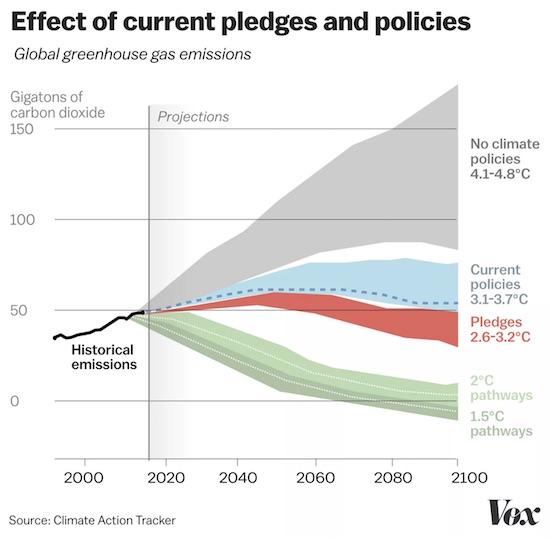

It’s the final call, say scientists, the most extensive warning yet on the risks of rising global temperatures. Their dramatic report on keeping that rise under 1.5 degrees C states that the world is now completely off track, heading instead towards 3C. Staying below 1.5C will require “rapid, far-reaching and unprecedented changes in all aspects of society”. It will be hugely expensive, the report says, but the window of opportunity is not yet closed. After three years of research and a week of haggling between scientists and government officials at a meeting in South Korea, the Intergovernmental Panel on Climate Change (IPCC) has issued a special report on the impact of global warming of 1.5C.

The critical 33-page Summary for Policymakers certainly bears the hallmarks of difficult negotiations between climate researchers determined to stick to what their studies have shown and political representatives more concerned with economies and living standards. Despite the inevitable compromises, there are some key messages that come through loud and and clear. “The first is that limiting warming to 1.5C brings a lot of benefits compared with limiting it to 2 degrees. It really reduces the impacts of climate change in very important ways,” said Prof Jim Skea, who is a co-chair of the IPCC.

“The second is the unprecedented nature of the changes that are required if we are to limit warming to 1.5C – changes to energy systems, changes to the way we manage land, changes to the way we move around with transportation.” “Scientists might want to write in capital letters, ‘ACT NOW IDIOTS’, but they need to say that with facts and numbers,” said Kaisa Kosonen, from Greenpeace, who was an observer at the negotiations. “And they have.” The researchers have used these facts and numbers to paint a picture of the world with a dangerous fever, caused by humans. We used to think if we could keep warming below 2 degrees this century then the changes we would experience would be manageable.

The IPCC’s estimates have been off by a large margin. Political pressure?

• World Must Take ‘Unprecedented’ Steps To Avert Worst Of Global Warming (R.)

Society would have to enact “unprecedented” changes to how it consumes energy, travels and builds to meet a lower global warming target or it risks increases in heat waves, flood-causing storms and the chances of drought in some regions as well as the loss of species, a U.N. report said on Monday. Keeping the Earth’s temperature rise to only 1.5 degrees Celsius (2.7 degrees Fahrenheit) rather than the 2C target agreed to at the Paris Agreement talks in 2015, would have “clear benefits to people and natural ecosystems,” the United Nations Intergovernmental Panel on Climate Change (IPCC) said on Monday in a statement announcing the report’s release.

The IPCC report said at the current rate of warming, the world’s temperatures would likely reach 1.5C between 2030 and 2052 after an increase of 1C above pre-industrial levels since the mid-1800s. Keeping the 1.5C target would keep the global sea level rise 0.1 meter (3.9 inches) lower by 2100 than a 2C target, the report states. That could reduce flooding and give the people that inhabit the world’s coasts, islands and river deltas time to adapt to climate change.

The lower target would also reduce species loss and extinction and the impact on terrestrial, freshwater and coastal ecosystems, the report said. “There were doubts if we would be able to differentiate impacts set at 1.5C and that came so clearly. Even the scientists were surprised to see how much science was already there and how much they could really differentiate and how great are the benefits of limiting global warming at 1.5 compared to 2,” Thelma Krug, vice-chair of the IPCC, told Reuters in an interview. “And now more than ever we know that every bit of warming matters,” Krug said.

And after all the big words, here is reality.

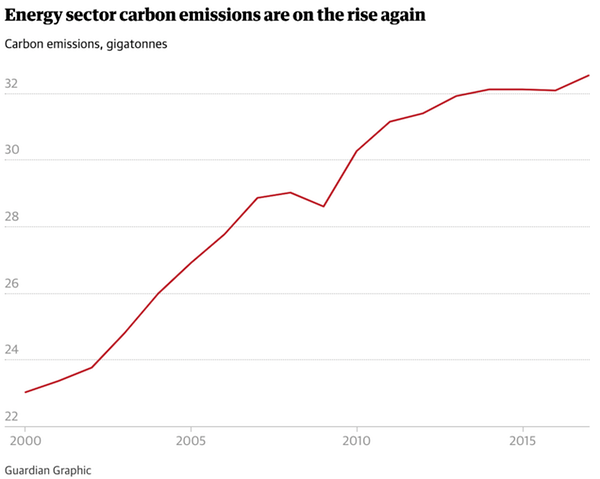

• Energy Sector’s Carbon Emissions To Grow For Second Year Running (G.)

Carbon emissions from the energy sector are on track to grow for the second year running, in a major blow to hopes the world might have turned the corner on tackling climate change. Preliminary analysis by the world’s energy watchdog shows the industry’s emissions have continued to rise in 2018, suggesting that an increase last year was not a one-off. The finding comes as the world’s leading climate scientists issue a landmark report on whether the world can meet a tougher global warming target, of limiting temperature rises to 1.5C.

Dr Fatih Birol, the executive director of the International Energy Agency (IEA), told the Guardian: “When I look at the first nine months of data, I expect in 2018 carbon emissions will increase once again. This is definitely worrying news for our climate goals. We need to see a steep decline in emissions. We are not seeing even flat emissions.” Emissions largely flatlined in 2014–16 after climbing for decades, raising hopes that global action on climate change was beginning to turn the tide – but in 2017 they grew by 1.4%.

Silliest metaphor ever? “..while it is tempting to sail alone, countries must resist the siren call of self-sufficiency – because as the Greek legends tell us, that leads to shipwreck..”

• Clouds Gather Over The IMF’s Paradise (O.)

On Tuesday, the [IMF] will update its World Economic Outlook and has already warned that the effects of rising debt and trade wars are affecting the global projections. Last week, the IMF’s head, Christine Lagarde, said the outlook “has become less bright”, despite projections during the summer that there would be 3.9% growth for 2018 and 2019. [..] Adding to Lagarde’s comments, there were warnings last week in the IMF’s global financial stability report, which said there was a risk of another financial meltdown because both governments and regulators have failed to put in place needed reforms to protect the system. Lagarde said that while expansion of the global economy was running at its fastest rate in seven years, there were signs of slowdown.

In September, factory activity dropped as a result of changes in trading with the US – and Donald Trump did not escape (admittedly veiled) criticism. The growing use of trade barriers had resulted in a drop in imports and exports, Lagarde said, and investment and manufacturing output had also been hit. Trump has consistently championed unilateral trade deals in an effort to further his “America First” agenda. “History shows that, while it is tempting to sail alone, countries must resist the siren call of self-sufficiency – because as the Greek legends tell us, that leads to shipwreck,” said Lagarde. Also central to the concerns about the future of the global economy are debt levels, currently well above those seen at the time of the 2008 crash. The IMF warned that there was a risk that unregulated parts of the financial system could trigger a panic.

The rise of unregulated “shadow banks” and the lack of restrictions on insurers and asset managers were pinpointed as concerns – as was the growth of global banks to a scale larger than 2008 and the fear that they are again “too big to fail”. Lagarde has said she is concerned that the total value of global debt has risen by 60% in the last 10 years to reach an all-time high of £139tn. As central banks in more advanced economies raised interest rates, attracting investors back to them, she said, developing countries were suffering. “That process could become even more challenging if it were to accelerate suddenly. It could lead to market corrections, sharp exchange rate movements, and further weakening of capital flows.”

I think perhaps it’s that 1.5ºC one?!

• US Inflation Is The World’s Most Important Economic Variable (CNBC)

U.S. inflation is the world’s most important economic variable. That proposition is explained by its corollary: Rising inflation is the only problem the U.S. Federal Reserve cannot solve by increasing its money supply. The Fed can deal with structural problems in credit markets by means of enhanced supervision, regulatory provisions and, all else failing, by open-ended lending in cases of systemic threats to the financial system’s stability. But none of those measures are applicable to situations of accelerating inflation and a deteriorating outlook for the value of fixed-income assets. That is a problem the Fed must address with sustained liquidity withdrawals, increasing credit costs and the ensuing growth recession of the U.S. economy.

[..] U.S. inflation has reached a point in an accelerating economy where the Fed needs to step in with a prompt and credible action to anchor inflation expectations. Markets are signaling that such measures are long overdue. The Fed is now well beyond the stage where it could think of fine tuning the economic activity in an environment of stable costs and prices. The U.S. economy is moving along at twice the rate of its noninflationary growth potential. That is unsustainable. As in the past, the restoration of American price stability will lead to a growth recession of unknown amplitude and duration.

The global reach of the dollar, and of the American financial system, are direct and powerful channels through which the Fed’s rising interest rates will affect demand, output and employment in the rest of the world. Those who think that they can avoid the impact of U.S. monetary policies should think again. The dollar remains an irreplaceable linchpin to the international monetary system. And that’s the way it will be for the foreseeable future. There is simply no viable alternative to the dollar’s global role as a unit of account, a means of payment, a transactions currency and a store of value.

The name is Bonds. Sovereign bonds.

• Ron Paul: US Barreling Towards A Stock Market Plunge Of At Least 50% (CNBC)

Ron Paul believes the bond trading pits are giving investors a dire message about the state of the nation’s economy. According to the former Republican Congressman from Texas, the recent jump in Treasury bond yields suggest the U.S. is barreling towards a potential recession and market meltdown at a faster and faster pace. And, he sees no way to prevent it. “We’re getting awfully close. I’d be surprised if you don’t have everybody agreeing with what I’m saying next year some time,” he said last Thursday on CNBC’s “Futures Now.”

His remarks came as the benchmark 10-Year Treasury yield, which moves inversely to its price, rallied to seven year highs, intensifying fears over rising inflation. It may be beneficial for personal savings accounts, but it could deliver irrevocable damage to those in adjustable mortgages, or for auto buyers looking to finance a new vehicle. “It can be pretty well validated by looking at monetary history that when you inflate the currency, distort interest rates and live beyond your means and spend too much, there has to be an adjustment,” he said. “We have the biggest bubble in the history of mankind.”

The world’s fastest growing economy for years now needs stimulus.

• China Stocks Return From Holiday, Tumble 3% As PBOC Eases Bank Rates (MW)

Chinese stocks led weaker action across Asia markets on Monday, as traders returned to work after a weeklong holiday, brushing aside the latest rate cut by the People’s Bank of China. Chinese stocks returned from the Golden Week holiday with opening declines of 2% after last week’s wide selling in Asia and a U.S.-listed benchmark of mainland companies falling nearly 5%. The major indexes in both Shanghai and Shenzhen were last down around 3%. On Sunday, the PBOC made a one percentage-point cut in banks’ reserve-requirement ratios. The central bank was widely expected to cut the metric again before year-end amid ongoing stimulus efforts.

But Monday was expected to be an up-and-down day as investors try and price in not just what’s happened so far this month but also what continues to lie ahead on the trade front. “This monetary policy tweak is the fourth in 2018 and despite the weakening Yaun and the Feds embarking on a more aggressive rate hike tangent than expected, suggests the Pboc are putting their greatest energies behind stimulating the flagging economy as opposed to the U.S.-China trade wars or Fed policy for that matter,” said Stephen Innes, head of trading APAC, at OANDA. A survey of China’s service sector came in mixed, with the sector expanding at a faster pace in September, but a subindex of employment abruptly contracted, falling to its lowest level since March 2016.

Declassify!

• FBI’s Smoking Gun: Redactions (Solomon)

To declassify or not to declassify? That is the question, when it comes to the FBI’s original evidence in the Russia collusion case. The Department of Justice (DOJ) and the FBI have tried to thwart President Trump on releasing the evidence, suggesting it will harm national security, make allies less willing to cooperate, or even leave him vulnerable to accusations that he is trying to obstruct the end of the Russia probe. Before you judge the DOJ’s and FBI’s arguments — which are similar to those offered to stop the release of information in other major episodes of American history, from the Bay of Pigs to 9/11 — consider Footnote 43 on Page 57 of Chapter 3 of the House Intelligence Committee’s report earlier this year on Russian interference in the 2016 presidential election.

Until this past week, the footnote really had garnered no public intrigue, in part because the U.S. intelligence community blacked out the vast majority of its verbiage in the name of national security before the report was made public. From the heavy redactions, all one could tell is that FBI general counsel James Baker met with an unnamed person who provided some information in September 2016 about Russia, email hacking and a possible link to the Trump campaign. Not a reporter or policymaker would have batted an eyelash over such a revelation. Then, last Wednesday, I broke the story that Baker admitted to Congress in an unclassified setting — repeat, in an unclassified setting — that he had met with a top lawyer at the firm representing the Democratic National Committee (DNC) and received allegations from that lawyer about Russia, Trump and possible hacking.

It was the same DNC, along with Hillary Clinton’s presidential campaign, that funded the unverified, salacious dossier by a British intel operative, Christopher Steele, that became a central piece of evidence used to justify the FBI surveillance of the Trump campaign in the final days of the election And it was the same law firm that made the payments for the dossier research so those could be disguised in campaign spending reports to avoid the disclosure of the actual beneficiaries of the research, which were Clinton and the DNC. And it was, in turns out, the same meeting that was so heavily censored by the intel agencies from Footnote 43 in the House report — treated, in other words, as some big national security secret.

He might well be right.

• Italy’s Di Maio Predicts ‘Political Earthquake’ For European Union (RT)

The bloc may expect a “political earthquake” after the 2019 European Parliament election, Italy’s Deputy Prime Minister Luigi Di Maio warned. Di Maio said he believes that what happened in Italy after the general election in March 4, when the popular vote brought an unlikely coalition of two anti-establishment parties to power, will happen in the whole Europe. The pro-EU centrist parties shrank significantly as a result of the latest Italian parliamentary elections. With the plebiscite that is scheduled for May next year “there will be a political earthquake at the European level,” Di Maio, who is also the Minister of Economic Development and the head of the Five Star Movement (M5S), stated. “All the rules will change,” the Italian high-ranking politician promised.

The Italian government and the EU authorities are at loggerheads over Rome’s targeted budget deficit at 2.4 percent of the GDP that exceeds the limits set by the EU. Rome believes that the forthcoming elections would favor the opponents of austerity. “The Europe of bankers, founded on mass immigration and economic insecurity, keeps on threatening and insulting Italians and their government? Relax, in six months 500 million voters will fire them. We keep going,” Italian Interior Minister Matteo Salvini said.

“Rome fears that Germany might eventually attempt to send back to Italy as many as 40,000 people..”

• Salvini Resists Germany’s Plans To Send Migrants Back To Italy (RT)

Rome has still not reached an agreement with Berlin on the repatriation of asylum seekers who had first registered in Italy, Interior Minister Matteo Salvini said, vowing to close airports to German flights transferring refugees. “If someone in Berlin or Brussels thinks of dumping dozens of migrants in Italy via unauthorized charter flights, they should know that there is not and there will be no airport available,” Salvini said in a statement, adding that Italy will “close the airports” just as it earlier closed its ports to NGO vessels carrying migrants rescued in the Mediterranean. His sharp statement comes in response to the rumors first circulated by the Italian La Repubblica daily that Germany plans to speed up repatriation procedures ahead of the regional elections in the state of Bavaria, the home state of the Interior Minister Horst Seehofer.

The first charter flight carrying asylum seekers from Germany to Italy is reportedly scheduled for Tuesday, October 9, the media reported. Other media reports set the date of the flight on Thursday, October 11. Germany’s refugee and migration agency, the BAMF, allegedly already sent “dozens of letters” to the would-be repatriates informing them about the planned transfers to Italy, according to La Repubblica. Earlier, the German dpa news agency also said that such a flight is scheduled for “the coming days.” This information, however, was neither confirmed nor denied by the German authorities. Rome fears that Germany might eventually attempt to send back to Italy as many as 40,000 people, who arrived there from the southern European country, the Italian media report.

“The country’s death rate had risen by about 5.6% in the decade running up to the first bailout in 2010 but then jumped by 17.6% in the six years that followed.”

• Austerity Is The Wrong Prescription For The World’s Wellbeing (G.)

Greece, which endured a slump longer and deeper than the Great Depression in the US, was forced by the so-called troika of the IMF, the EU and the ECB to cut health expenditure at a time when other European countries were raising theirs. Under Greece’s bailout, health spending fell from 9.8% of GDP in 2008 to 8.1% in 2014, a time when national output was contracting rapidly. The country’s death rate had risen by about 5.6% in the decade running up to the first bailout in 2010 but then jumped by 17.6% in the six years that followed. The rate rose three times faster than the rate in Western Europe overall.

[..] The troika’s austerity programme helped French and German banks avoid losses on their loans but at the expense of a rising Greek death rate. That has resulted in 50% less public hospital funding in 2015 than 2009, hospitals being left without basic supplies, the long-term unemployed stripped of their health insurance and those on low pay finding drugs more expensive because of a 20% cut in the minimum wage. The number of individuals with unmet healthcare needs has nearly doubled since 2010, with a considerable fraction reporting cost as the main reason for not receiving the recommended healthcare services.

Greece is not short of healthcare expertise. It has the second highest number of doctors per 1,000 people in the EU but that medical workforce has been forced to watch impotently as the health system has descended into chaos and people have died when they could have been saved. For the past eight years, Greece has been used in a laboratory experiment to test out a theory. The evidence from the report in the Lancet could hardly be clearer. Austerity kills.

Not a chance, but kudos for trying.

• Greece ‘to Claim €280 Billion’ in War Reparations from Germany (GR)

Greece is about to launch a campaign to claim €280 billion ($323 billion) in war reparations from Germany, reports Der Spiegel. The German magazine notes that as long as Greece was dependent on EU support, Prime Minister Alexis Tsipras had avoided raising the issue. But now, after the end of the third bailout program, Athens is ready to take initiatives to claim the money, it says. The issue is resurfacing a few days before the official visit of Germany’s President Frank-Walter Steinmeier to Athens where he will meet the President of the Republic Prokopis Pavlopoulos and Tsipras. Der Spiegel says it is no coincidence that the two highest ranking Greek politicians have both raised the issue in the last few days.

It marks the beginning of a long campaign, which, according to the German magazine, will start in November. The Greek Parliament will endorse an audit report ready since August 2016, according to which Greece is entitled to €269.5 billion of repairs from the Second World War. In addition, Greece demands the repayment of a €10.3 billion occupation loan. The report remained under wraps throughout the last two years, but Tsipras seems ready to bring it back to the surface and start a campaign for war reparations, says Der Spiegel. In the second phase, Greece intends to present its arguments at world organizations such as the European Parliament, the European Council, and the UN.

8,700 plaintiffs.

• ‘The World Is Against Them’: New Era Of Cancer Lawsuits Threaten Monsanto (G.)

[Dewayne Johnson’s] award of $289m, which included $250m in punitive damages, is a game-changer for the 46-year-old, who will leave behind a wife and three children. But Monsanto is fighting to keep it from him. “It’s a big red flag for the company,” said Jean M Eggen, professor emerita at Widener University Delaware Law School: “It brings more people out who might not otherwise sue.” Roughly 8,700 plaintiffs have made similar cases in state courts across the country, alleging that exposure to glyphosate-based herbicides led to various types of cancer. The impact could be huge if Monsanto continues to fight and lose in jury trials, and an accumulation of wins could force the company to consider settling with plaintiffs. “It could become very costly,” said Eggen, comparing the fight to the tobacco industry, which aggressively fought cases in court but eventually decided settlements were the best option. “It’s really a business decision.”

Monsanto may ultimately consider changing the labels to warn consumers about cancer risks and work to settle with consumers who have had high exposures, said Lars Noah, University of Florida law professor: “It’s sort of a wake-up call that their strategy was unrealistic.” Of the thousands of cases, there are more than 10 trials on track to start in 2019 and 2020, with court battles ramping up in California, Montana, Delaware, Kansas City and St Louis (where Monsanto is headquartered). Farmers, gardeners, government employees, landscapers and a wide range of others have alleged that Monsanto’s products sickened them or killed their loved ones. “This is a tremendous number of trials for one year and will allow plaintiffs to get critical evidence in front of juries – evidence not seen before,” said the attorney Aimee Wagstaff.

Home › Forums › Debt Rattle October 8 2018