Dorothea Lange Daughter of white tobacco sharecropper at country store. Person County, North Carolina 1939

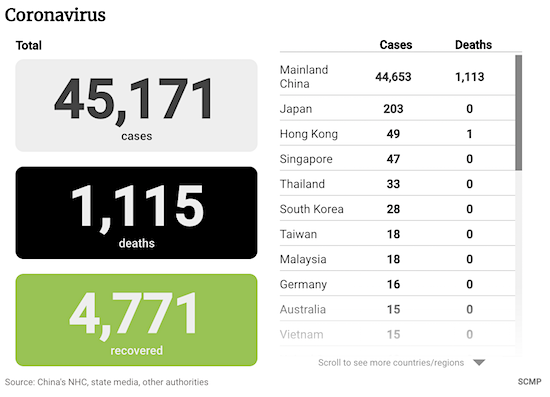

And there we go once more with the Covid19 statistics (will that new name ever stick?):

• Deaths: 1,115, up 97 from yesterday’s 1,108

• Cases: 45,171, up 2059 from yesterday’s 43,112

“Everyone” is saying the numbers are going down, and that must mean we’re over the peak, or something.

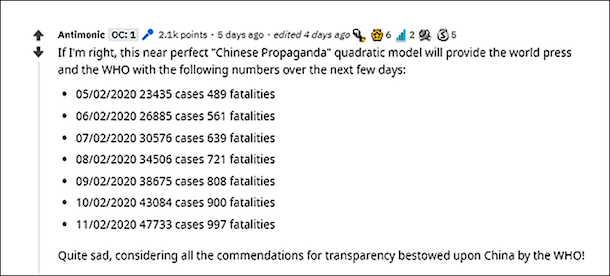

But I quoted Ben Hunt yesterday in Corona Cartoon Numbers as saying the numbers conformed to a simple quadratic function, and speaking in the “voice” of Xi Jinping:

Yesterday we told everyone that 500 people have died since the outbreak. That’s a made-up number, of course, but that’s what we told everyone. Today let’s tell everyone that an additional 15% of that number died yesterday, so 75 new deaths for 575 total dead. And tomorrow let’s tell everyone that 14% of that total number died, and the day after 13%, and then 12% and then 11%. Clear progress!

That was in reaction to this predicted sequence Hunt saw presented by Antimonic:

My updated interpretation of this was:

Today according to “official” numbers we have 43,103 cases and 1,018 fatalities, which is up 108 from yesterday’s 910. What’s that, 10.5%? Close enough for discomfort.

And sure enough, today’s 97 deaths constitute 9.5% of yesterday’s 1,108. If this sequence holds (note that it was never meant as anything precise, just a trend), tomorrow’s new added deaths should be around 8.5% of 1,115, or 93-96 deaths. Let’s see. If that is correct, we know Beijing has been reporting false deaths numbers according to that quadratic “formula” -we already know, really.

You wait 2,5 months to name the thing, and then expect everyone to use that name?

• China Reports 97 New Deaths, 2,059 New Cases Confirmed (SCMP)

China’s health authority reported 97 new deaths attributable to the Covid-19 outbreak and 2,015 newly-confirmed cases as of Tuesday. This brings the national totals to 1,113 and 44,653, respectively. As of yesterday, 744 recovered patients have been discharged, while the total number of recovery cases stands at 4,740. Outside Hubei province – epicentre of the Covid-19 epidemic – new infections on the mainland fell for the eighth consecutive day. Health authorities in Hubei reported 94 new deaths attributable to the contagion, and 1,638 newly confirmed cases as of Tuesday. This brings the totals announced by the province’s health commission to 1,068 and 33,366, respectively.

Officials in Hubei had reported 103 fatalities and 2,097 newly confirmed cases a day earlier. Some 1,104 of the new cases announced were confirmed in Hubei’s capital of Wuhan, where the virus is believed to have originated at a seafood and meat market. The figures from Hubei on Tuesday mark the lowest number of newly confirmed cases since the beginning of February. It is also the first time that Hubei has reported fewer than 2,000 new daily cases since February 2. Michael Ryan, the World Health Organisation’s head of emergency programmes, said on Tuesday in Geneva that Covid-19 had the potential to spread faster than either the Ebola or Sars viruses. Earlier this week, Covid-19 exceeded the Sars outbreak of 2002-03 in terms of deaths attributed to it.

“China’s foremost medical adviser on the outbreak, Zhong Nanshan..” Who said two weeks ago it would all be over within a week or ten days. “China’s foremost medical adviser on the outbreak”. Zhong now says: “I hope this outbreak or this event may be over in something like April..”

• Coronavirus Cases Fall, Experts Disagree Over Whether Peak Is Near (R.)

China on Wednesday reported its lowest number of new coronavirus cases since late January, lending weight to a prediction from its senior medical adviser that the outbreak could be over by April. Global markets took heart from the outlook but other international experts remain alarmed by the spread of the flu-like virus, which has killed more than 1,100 people, all but two in mainland China, and said optimism could be premature. China’s foremost medical adviser on the outbreak, Zhong Nanshan, said the numbers of new cases were falling in some provinces, and forecast the epidemic would peak this month.

“I hope this outbreak or this event may be over in something like April,” Zhong, an epidemiologist whose previous forecast of an earlier peak turned out to be premature, told Reuters on Tuesday. Total cases of the new coronavirus in China have hit 44,653, according to health officials, including 2,015 new confirmed cases on Tuesday. That was the lowest daily rise in new cases since Jan. 30. China last week amended its guidelines on prevention and control of the coronavirus, saying that only when asymptomatic cases show clinical signs should they be recorded as a confirmed case. However, it is not clear if the government data previously included asymptomatic cases. The number of deaths on the mainland rose by 97 to 1,113 by the end of Tuesday.

While Chinese officials said the situation was under control, the World Health Organization (WHO) warned the epidemic posed a global threat potentially worse than terrorism. The world must “wake up and consider this enemy virus as public enemy number one”, WHO chief Tedros Adhanom Ghebreyesus said on Tuesday, adding the first vaccine was 18 months away. Asked about Zhong’s prediction, Australia’s chief medical officer, Brendan Murphy, said: “I think it’s far too premature to say that.” “We’ve just got to watch the data very closely over the coming weeks before we make any predictions,” he told the Australian Broadcasting Corp, while praising China’s “Herculean efforts” to contain the virus.

[..] Even if the epidemic ends soon, it has already taken a toll on China’s economy, with companies laying off workers and other firms needing loans running into billions of dollars to stay afloat. Supply chains for car manufacturers to smartphone makers have broken down. Wu Chaoming, chief economist at Fortune Securities, wrote in a report that the impact on China’s labor market would be far greater than that of a 2002-2003 outbreak of another coronavirus that caused Severe Acute Respiratory Syndrome. About 24% of the labor force, or 186 million people, “could face some risks in salary reduction or even being laid off”, he said. ANZ bank said China’s first-quarter growth would likely slow to 3.2-4.0% compared with an earlier projection of 5.0%. China’s aviation regulator urged countries to lift virus-related travel restrictions as soon as possible, but airlines showed no sign of easing their curbs on flights.

Highest concentration of infections outside of China.

• Japan Cruise Ship Virus Cases Jump To 175 (R.)

Another 39 people have tested positive for the coronavirus on the quarantined Diamond Princess cruise ship in Japan as well as one quarantine officer, bringing the total to 175, the health ministry said on Wednesday. The Diamond Princess was placed in quarantine for two weeks upon arriving in Yokohama, south of Tokyo, on Feb. 3, after a man who disembarked in Hong Kong was diagnosed with the virus. About 3,700 people are aboard the ship, which usually has a crew of 1,100 and a passenger capacity of 2,670. The ministry said tests are being conducted for others who are deemed to need them and it will announce the results later.

The U.K.-flagged Diamond Princess is managed by Princess Cruise Lines, one of the world’s largest cruise lines and a unit of Carnival Corp. The government was considering allowing elderly and those with chronic illnesses to disembark before the Feb. 19 target date for ending the quarantine, some media reported, but added it would take time to figure out where they could be sent. As of last week, about 80% of the passengers were aged 60 or over, with 215 in their 80s and 11 in the 90s, the English-language Japan Times newspaper reported.

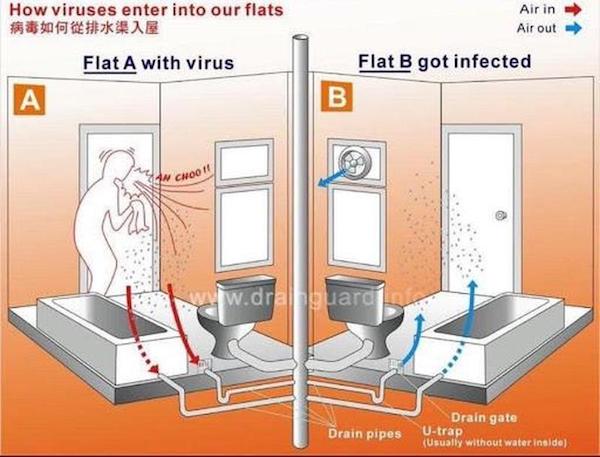

Yup. Poor hygiene.

• At Least 500 Wuhan Medical Staff Infected With Coronavirus (SCMP)

At least 500 hospital staff in Wuhan had been infected with the deadly new strain of coronavirus by mid January, multiple medical sources have confirmed, leaving hospitals short-staffed and causing deep concern among health care workers. While the government has reported individual cases of health care workers becoming infected, it has not provided the full picture, and the sources said doctors and nurses had been told not to make the total public.

The reason for this edict was not explained, but the authorities have been trying to boost morale among frontline medical staff, especially following the death of Li Wenliang, who was killed by the disease weeks after being reprimanded by police for warning colleagues about the new virus.

A slide circulating online, however, reveals the scale of infections among medical workers in Wuhan. It said that by mid-January there had been about 500 confirmed cases among hospital staff with a further 600 suspected ones. A source from a major hospital in Wuhan with knowledge of the situation confirmed that the slide was authentic. The figures shown on the slide were also in line with the figures given by two other doctors from major hospitals in Wuhan.

How many businesses and banks can the PBOC save if the virus lasts into April or beyond?

• China’s Banks Face $6 Trillion Coronavirus Cataclysm (ZH)

In a little noticed post back in November, we reported that as part of a stress test conducted by China’s central bank in the first half of 2019, 30 medium- and large-sized banks were tested; In the base-case scenario, assuming GDP growth dropped to 5.3% – nine out of 30 major banks failed and saw their capital adequacy ratio drop to 13.47% from 14.43%. In the worst-case scenario, assuming GDP growth dropped to 4.15%, some 2% below the latest official GDP print, more than half of China’s banks, or 17 out of the 30 major banks failed the test. Needless to say, the implications for a Chinese financial system – whose size is roughly $41 trillion – having over $20 trillion in “problematic” bank assets, would be dire.

Why do we bring this up now? Because according to many Wall Street estimates, as a result of the slowdown resulting from the Coronavirus pandemic, China’s economic growth is set to slow sharply, with some banks such as JPMorgan now expecting as little as 1% GDP growth in Q1 assuming the epidemic is contained in the next few weeks; if it isn’t, Chinese Q1 GDP growth may print negative for the first time on record. This is a big problem, because as noted above if the PBOC’s 2019 stress test is credible, more than half of China’s banks would fail the “stress test” should GDP drop to just 4.15%; and one can only imagine what happens to China’s banks if GDP prints negative.

Or, alternatively, one can read the fine print, where we find that among the immediate first order consequences of a GDP crunch is that the bad loan ratio at the nation’s 30 biggest banks would rise five-fold, flooding the country with trillions in non-performing loans, and potentially unleashing a tsunami of bank defaults. [..] “The banking industry is taking a big hit,” You Chun, a Shanghai-based analyst at National Institution for Finance & Development told Bloomberg. “The outbreak has already damaged China’s most vibrant small businesses and if it prolongs, many firms will go under and be unable to repay their loans.” [..] .. a recent nationwide survey showed that about 30% [of small businesses] expect to see revenue plunge more than 50% this year because of the virus and 85% said they are unable to maintain operations for more than three months with cash currently available.

“..new apartment sales crashed 90% in the first week of February..[..] .. Sales of existing homes in 8 cities plunged 91% over the same period..”

That can’t last long, but: “Real estate transactions have been forbidden in many cities.”

Seen more reports on that seconnd pic: the virus spreading through pipes in buildings.

• China Home Sales Crash In First Week Of February ‘Worse Than SARS’ (ZH)

Bloomberg cited a new report via China Merchants Securities (CMSC) that said new apartment sales crashed 90% in the first week of February over the same period last year. Sales of existing homes in 8 cities plunged 91% over the same period. “The sector is bracing for a worse impact than the 2003 SARS pandemic,” said Bai Yanjun, an analyst at property-consulting firm China Index Holdings Ltd. “In 2003, the home market was on a cyclical rise. Now, it’s already reeling from an adjustment.” Long before the coronavirus outbreak, China’s housing market has been on shaky grounds amid declining demand, stricter mortgage requirements, and price discounts.

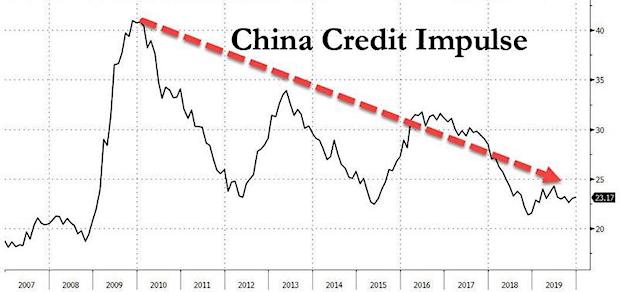

The latest shock: two-thirds of China’s economy has come to a standstill, could generate enough pessimism to pop the country’s massive housing bubble. After all, coronavirus is a mass distraction from the overall domestic problems the Communist Party of China (CPC) faces. The CPC failed to stimulate the economy last year, with credit impulse not turning up as expected. The virus outbreak has allowed the CPC to scapegoat the slowdown and the inevitable crash. “…China’s ability to stimulate its economy is now virtually nil, since China’s record debt load has now made it virtually impossible to push the country’s credit impulse higher,” we noted last week. Real estate transactions have been forbidden in many cities. This means fire sales could be seen once selling restrictions end.

E-House China Enterprise Holdings Ltd.’s research institute said four units per day were being sold in Beijing last week, and this is down from several hundred per day during the same period in the previous year. China International Capital Corp. analyst Eric Zhang said demand could pick back up in April, assuming the virus outbreak is under control.

The 4 prosecutors in the Roger Stone case should be investigated. They won’t be, if only because they’re not independent. But this feels like sour grapes for the Mueller report failure.

Stone is a dirty trickster, but he’s been that for decades, and he’s only one of many in DC, on both sides. You can’t be locked up for that. Stone faces two main allegations, IIRC:

1) Lying about his link to WIkiLeaks/Russia. But we know Stone never had any such links. He lied to the Trump campaign about having them though, and then to the DOJ about that. But in essence, he was lying about something that never existed.

Sentencing him for that serves only to keep the illusion alive (just like the coward Rober Mueller did), that WikiLeaks had Russia links, and it’s high time to get rid of that ridiculous notion once and for all.

2) Stone is accused of threatening Randy Credico, his friend who testified to the DOJ. Or more specifically, he’s accused of threatening to kill Credico’s dog, Bianca. Credico wrote to Judge Amy Berman last month pleading with her NOT to send Stone to prison, and saying neither the threats against him or Bianca were serious.

Summarized, there are (were) 4 prosecutors who wanted to send Stone to prison for 9 years for threatening a dog, which according to the dog’s owner wasn’t even a real threat. And if the DOJ or Barr or Trump criticize this, they become the accused, “lawless”, parties.

• Trump Swipes At Resigned Prosecutors, Judge In Roger Stone Case (Hill)

President Trump on Tuesday swiped at the prosecutors and judge in the case of longtime confidant Roger Stone amid the fallout of the Justice Department’s decision to intervene in Stone’s sentencing recommendation. Trump weighed in on the sentencing late Tuesday even as Democrats and critics expressed alarm that the president seemed to be blurring the line between the executive branch and the Department of Justice (DOJ). “Who are the four prosecutors (Mueller people?) who cut and ran after being exposed for recommending a ridiculous 9 year prison sentence to a man that got caught up in an investigation that was illegal, the Mueller Scam, and shouldn’t ever even have started? 13 Angry Democrats?” Trump tweeted.

All four prosecutors who worked on Stone’s case resigned Tuesday after the DOJ asked a federal court to reduce the seven- to nine-year prison sentence they had originally recommended. One prosecutor, Aaron Zelinsky, worked on former special counsel Robert Mueller’s team. Stone, a 67-year-old right-wing provocateur, was found guilty in November of lying to Congress and witness tampering related to his efforts to provide the Trump campaign inside information about WikiLeaks in 2016. The timing of the DOJ’s involvement raised questions given that it came hours after Trump ridiculed the initial recommendation as a “miscarriage of justice” and previous accusations from Democrats that Attorney General William Barr has interceded at times in the president’s favor.

The president later told reporters he had not spoken with DOJ officials about Stone’s case but insisted he had the right to do so. He declined to say whether he was considering commuting Stone’s eventual sentence. “All starting to unravel with the ridiculous 9 year sentence recommendation!” Trump tweeted Tuesday night. Trump late Tuesday also swiped at D.C. District Judge Amy Berman Jackson, who is overseeing the Stone case, implying she had treated his former campaign chairman unfairly. “Is this the Judge that put Paul Manafort in SOLITARY CONFINEMENT, something that not even mobster Al Capone had to endure? How did she treat Crooked Hillary Clinton? Just asking!” Trump tweeted.

The most boring show on TV. If you watch it or g-d forbid write about it, I feel for you.

Iowa: screwed up app, and ButtGeek gets bought into contention.

New Hampshire: Klobuchar gets bought into contention.

All of a sudden Warren and Biden are gone, and two no-no’s are Sanders’ only rivals left?

• Despite Iowa Fiasco, Nevada Democrats Plan to Use New Software “Tool” (Webb)

Even while the chaos of the recent Iowa Caucus remains fresh in voters’ minds, the Nevada State Democratic Party is setting itself up for more of the same by using a new software application for reporting results that is set to be coded and tested in less than a month. The application, still currently under development, will come preloaded onto iPads that will be distributed to precinct chairs during Nevada’s upcoming caucus, scheduled for February 22. The scramble to create this new application followed revelations that the same company that had developed the software largely blamed for the Iowa debacle – known as Shadow Inc. – had also developed the two applications that Nevada Democrats had planned to use both for early voting and for Caucus Day.

[..] .. the Shadow Inc. app was reported to have been developed over a period of roughly two months, though the company’s CEO, Gerard Niemira, has since claimed that the app’s creation began last August. In contrast, Nevada Democrats are now slated to use a software application developed in less than half that time [..] Another issue is the fact that Nevada Democrats decided to go this route after consulting “a group of tech and security folks” whose names and affiliations were not provided. As previously mentioned, after the Iowa debacle, several media reports quoted technology and cybersecurity experts as well as software developers who had cited the rushed development of the Shadow Inc. app as having largely led to the app’s failure and the resulting chaos in Iowa.

It thus seems odd that a group of “tech and security folks” are urging Nevada Democrats to pay for the development of a new program in an even shorter time frame as a way to prevent Nevada’s caucus from repeating Iowa’s failures. Though the identity of this group remains unknown, concerns have been raised that some may have links to the 2020 presidential campaign of Pete Buttigieg, given that the Shadow Inc.-developed app used in Iowa was found to have ties to the Buttigieg campaign and the Iowa caucus chaos clearly benefited the Buttigieg campaign. Concerns about possible connections between these tech and security consultants and the Buttigieg campaign have only grown since it was revealed that Nevada Democrats recently hired an organizer for Pete Buttigieg’s 2020 presidential campaign, Emily Goldman, as the Caucus’ Voter Protection Director, just weeks before the caucus is set to take place.

So Emily Goodman, the paid Buttigieg campaign insider now "Voter Protection Director" for the Nevada caucus used to work at the Brookings Institute, one of whose Chairs wrote an article today called "Stop Bernie Sanders Now."

This is shady as hell.https://t.co/aSQR8DQhsI pic.twitter.com/euSRuHB35M

— Alan MacLeod (@AlanRMacLeod) February 10, 2020

I felt a song coming on. From one of my favorite albums.

In this pause between past and future Deep State seditions, and the full-blown advent of Corona Virus in every region of the world, we pause to consider Mr. Trump’s executive order requiring new federal buildings to be designed in the classical style. The directive has caused heads to explode in the cultural wing of Progressive Wokesterdom, since the worship of government power has replaced religion for them and federal buildings are their churches — the places from which encyclicals are hurled at the masses on such matters as who gets to think and say what, who gets to use which bathroom, and especially whose life and livelihood can be destroyed for being branded a heretic.

[..] A virtue of classicism is that it employs structural devices that allow buildings to stand up: arches, columns, colonnades. These are replicable in modules or bays along scales from small to large. These devices honestly express the tectonic sturdiness of a building within the realities of gravity. A hidden virtue of classicism is that it is based on the three-part representation of the human figure: the whole and all the parts within it exist in nested hierarchies of base-shaft-and-head. This is true of columns with capitols set on a base, of windows with their sills, sashes, and lintels, and the whole building from base to roof. Classical architecture follows proportioning systems universally found in nature, such as the Fibonacci series of ratios, which are seen in everything from the self-assembly of seashells to the growth of tree branches.

Thus, classicism links us to nature and to our own humanity. Classical ornaments — the swags, moldings, entablatures, cartouches, corbels, festoons, and what-have-you — are not mandatory, but, of course, they also provide a way of expressing our place in nature, which is a pathway to expressing truth and beauty.

Just disband the thing alright. And defund Bellingcat.

• Third Whistle-Blower Comes Forward To Corroborate Complaints About OPCW (RT)

A third whistle-blower has come forward to corroborate the previous complaints that the Organization for the Prohibition of Chemical Weapons (OPCW) tried to suppress evidence-gathering in the Douma probe, a report says. The alleged new whistleblower, whose redacted email was shared by the Grayzone Project on Tuesday, backed the complaints made by two former OPCW employees — South African engineer and organization’s veteran Ian Henderson, and another whistleblower known as ‘Alex.’ OPCW Director-General Fernando Arias had earlier dismissed the pair — dubbed Inspector A and Inspector B in the organization’s inquiry into their claims — as low-level rogue employees who conducted field work without proper authorization and which simply “could not accept that their views were not backed by evidence.”

However, the person, described by Grayzone as a former senior official with the OPCW, stood by Henderson and ‘Alex,’ writing that his time with the organization was “the most stressful and unpleasant” one in his life. “I feel ashamed for the Organization and I am glad I left it. “I fear those behind the crimes that have been perpetrated in the name of ‘humanity and democracy,’ they will not hesitate to do harm to me and my family,” the person wrote, explaining the decision to remain anonymous. Henderson was deployed with the fact-finding mission to Syria shortly after the alleged chemical attack in Douma. The inspector concluded that the cylinders, supposedly containing chlorine, were more likely manually placed on the ground rather than dropped from planes.

According to him, the higher-ups discarded his findings without explanation, and sidelined him from the rest of the mission. Its final report was later used by the US and some European countries to implicate the Syrian government of Bashar Assad in conducting the attack, which the Syrian authorities vehemently deny.

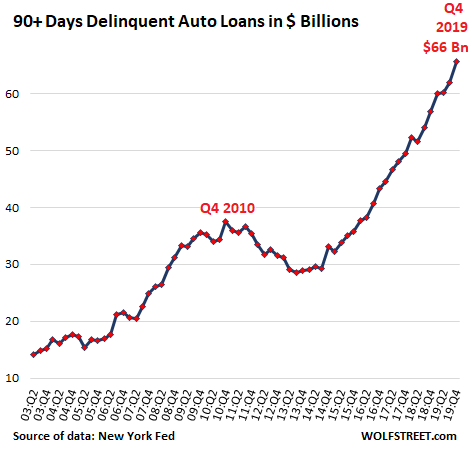

What keeps America motoring.

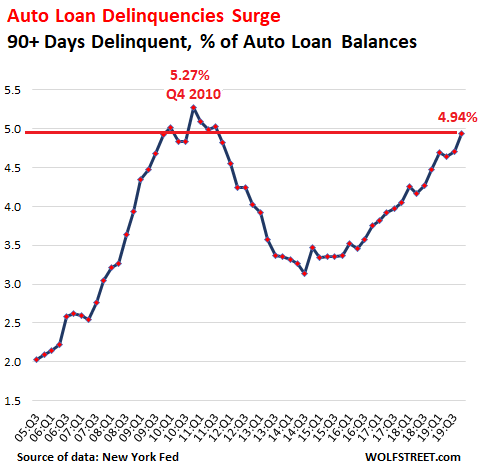

• Subprime Auto Loans, Serious Delinquencies Soar. These Are the Good Times (WS)

Auto loan and lease balances have surged to a new record of $1.33 trillion. Delinquencies of auto loans to borrowers with prime credit rates hover near historic lows. But subprime loans (borrowers with a credit score below 620) are exploding at a breath-taking rate, and they’re driving up the overall delinquency rates to Financial Crisis levels. Yet, these are the good times, and there is no employment crisis where millions of people have lost their jobs. All combined, prime and subprime auto-loan delinquencies that are 90 days or more past due – “serious” delinquencies – in the fourth quarter 2019, surged by 15.5% from a year ago to a breath-taking historic high of $66 billion, according to data from the New York Fed released today:

Loan delinquencies are a flow. Fresh delinquencies that hit lenders go into the 30-day basket, then a month later into the 60-day basket, and then into the 90-day basket, and as they move from one stage to the next, more delinquencies come in behind them. When the delinquency cannot be cured, lenders hire a company to repossess the vehicle. Finding the vehicle is generally a breeze with modern technology. The vehicle is then sold at auction, a fluid and routine process.[..] Seriously delinquent auto loans jumped to 4.94% of the $1.33 trillion in total loans and leases outstanding, above where the delinquency rate had been in Q3 2010 as the auto industry was collapsing, with GM and Chrysler already in bankruptcy, and with the worst unemployment crisis since the Great Depression approaching its peak. But this time, there is no unemployment crisis; these are the good times:

About 22% of the $1.33 trillion in auto loans outstanding are subprime, so about $293 billion are subprime. Of them, $68 billion are 90+ days delinquent. This means that about 23% of all subprime auto loans are seriously delinquent. Nearly a quarter!

The biggest threat vs Trump’s re-election. Will the Dems weaponize it?

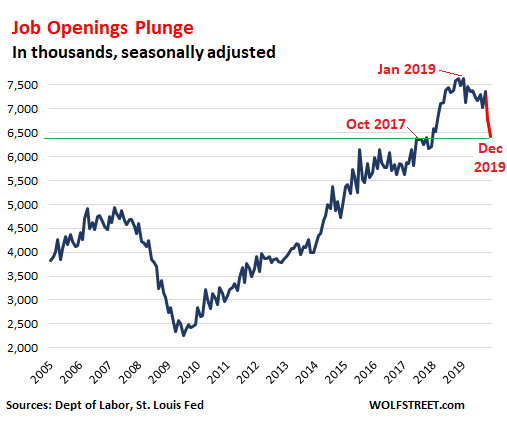

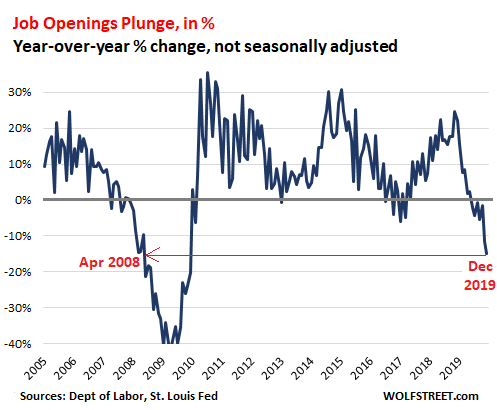

• Job Openings Plunge the Most Since the Great Recession (WS)

The number of job openings in December dropped by 364,000 from November (seasonally adjusted), after having already plunged by 574,000 in November, according to the Labor Department’s Job Openings and Labor Turnover Survey (JOLTS). This two-month plunge of 938,000 job openings came after a series of ups and downs with downward trend starting after the peak in January 2019. It brought the number of job openings in December to 6.42 million (seasonally adjusted), same level as in October 2017. Since the peak in January 2019, over 1.2 million job openings have dissolved into ambient air (November and December in red).

On a not-seasonally adjusted basis, job openings in December plunged by 14.9% from December 2018, the steepest since the Great Recession. In total, 1.05 million job openings have disappeared over the period. This was the seventh month in a row of year-over-year declines. Year-over-year comparisons eliminate seasonal fluctuations. And the fact that this year-over-year drop of 14.9% in December occurred in the not-seasonally adjusted data shows that the drop to 6.42 million job openings was not due to seasonal adjustments gone berserk. It was due to other reasons. There had been a minuscule dip into the negative in January 2013, and then the more visible dip into the negative in late 2016 and early 2017. What we’re seeing now is in an entirely different ballpark:

I haven’t watched the entire video, but this is a topic that warrants much more scrutiny.

• How Unfunded Pensions Will Destroy Your Retirement (Raoul Pal)

How can ordinary people behaving rationally create a generational threat? Raoul Pal, in his role as CEO and co-founder of Global Macro Investor, joins Real Vision to explain the interconnected problem of the everything bubble and the coming retirement crisis to answer the question, “why do we invest?” He explains in detail how the baby boomer generation, through the rational and reasonable behavior of seeking to live and retire comfortably, has fueled the creation of a massive financial bubble that touches nearly every corner of the economy as pensions take more and more risk. Pal breaks down the crucial demographic, economic, and political trends that have combined to create the problem and suggests potential solutions for Baby Boomers, Millennials, and Gen Xers to get out door before the fire of the coming recession. Filmed on February 4, 2020 in Grand Cayman.

Now taking bets on when the term “sustainable” loses the last bit of its meaning. And no, electric cars don’t solve single problem. They create plenty new ones, though, so if problems are your thing…

• Volkswagen and Daimler Push For More ‘Sustainable’ Chile Lithium (R.)

German automakers Volkswagen and Daimler have launched a study to push for more “sustainable” lithium mining in Chile, according to lobbyist filings reviewed by Reuters, a sign of growing supply chain concerns ahead of an expected electric vehicle boom. Chile’s Atacama salt flat is by far the biggest source of supply of the ultralight battery metal in South America’s so-called “lithium triangle.” The region, whose fragile ecosystem relies on a limited water supply, is home to the globe’s top two producers, U.S.-based Albemarle and Chile’s SQM. But concerns over sustainability have long plagued Atacama’s miners, which extract the metal from pools of brine beneath the world’s driest desert.

Residents and environmental groups worry about potential damage to a regional ecosystem home to an ancient indigenous culture, lagoons inhabited with rare flamingos and a booming tourism industry. Lobbying records show a team from German development agency GIZ and the public-private Fundacion Chile met with Cristóbal De La Maza, chief of top Chilean environmental regulator SMA, early this year to formally present plans for the “feasibility study.” “This project is driven by the Volkswagen and Daimler companies,” the filings read. “The growing importance of batteries has made the sustainability of lithium a key priority for these companies.”

Pressure is mounting on German carmakers to fast-track production of electric vehicles to meet increasingly stringent European Union anti-pollution rules. Volkswagen alone has staked its future on a $91 billion plan to profitably mass-producing zero-emission vehicles. That push has prompted beefed-up scrutiny of mining practices around key metals such as cobalt, copper and lithium, all of which are predicted to see a spike in demand in coming years. [..] Australia, the world’s No. 1 producer of the white metal, mines its lithium from hard rock, not brine.

Joseph Shabalala died this week. He was the founder -and “father”- of Ladysmith Black Mambazo, the South African vocal group that accompanied Paul Simon on his Graceland album and tour.

The Automatic Earth will not survive without your Paypal and Patreon donations. Please support us.

Home › Forums › Debt Rattle February 12 2020