ashvin

Forum Replies Created

-

AuthorPosts

-

ashvin

ParticipantI certainly didn’t mean to imply that I agreed with the simplistic Hobbesian notion that their lives were “nasty, brutish and short”. Actually, I was aiming for the opposite in some ways. OTOH, I wouldn’t necessarily compare modern tribes, who constantly face the threat of environmental destruction and systematic genocide, to those roaming around 30,000 years ago.

It’s also hard to make a one-for-one comparison between us and them in terms of “leisure time”. There are disputes over what the average life expectancy was back then, but most agree that it was significantly lower than the average person in the developed world now. And can we really know what level of awareness and effort was required of them even when they were not strictly performing activities that were required to make it through the day/week?

One thing is for sure – many people will have to find ways of adapting to and being satisfied with much more simplified societies, and “primitive” cultures do have a big leg up in that sense.

ashvin

ParticipantReverse Engineer post=771 wrote: OK, I have worked through both the Blog and Forum integration now, and there are some real problems with site navigation. For one, I have found it completely impossible to navigate back to a New Topic I made in the Lifeboat section on Hydroponics. I can’t find a way to toggle to the topic list, I just get sent back to the list of articles in the Lifeboat section of the Blog.

This issue has just been resolved – the intra-forum links should all work fine now.

ashvin

Participantre: Christianity

I certainly understand the hesitation people would have to accept Nietzsche visceral hatred of all religions, but especially the more modern varieties. For me, what he really provides insight into is the nature of power and the increasing discrepancy between personal empowerment and minority groups wielding power over others. There is no doubt in my mind that many aspects of modern religions have reinforced the mentality which helps make the latter dominate over the former, especially in a country like the U.S. Perhaps that was not all the original intent/message that came with the religion’s founding, but that’s a bit irrelevant now.

Gravity and I have had similar discussions/debate regarding the U.S. Constitution. Regardless of what positive principles were meant to be enshrined in the document (equality, justice, personal/political freedom), it has been irreversibly compromised as a mechanism for achieving any of those things, and is instead merely invoked as the “supreme law” for the convenience of the wealthy elites.

ashvin

ParticipantDR01D post=821 wrote: Ashvin if your worldview is correct why did the USSR go broke? The USSR stole untold wealth from eastern Europe and the near east and yet the country was impoverished.

What about Hong Kong? It has few natural resources and was once a British colony. Despite that Hong Kong has one of the highest standards of living in the world. Same story Singapore.

Well, first speaking to Frank’s issue, my “worldview” isn’t that Western civilization is evil and has provided no benefits whatsoever to other countries (and it’s certainly not that countries which colonize/steal are invincible, which should be obvious enough by now). That would just be another myth. The issue here is to dispel the simplified myths that are used by elite groups in the West to attempt to perpetuate an extremely oppressive, unjust system as a whole.

There are many different inter-related factors influencing metrics such as “standard of living” in various countries, yet there has also been a clear trend of increasing wealth inequality between “developed” and

“under-developed” nations as well as within developed and developing populations. Again, it’s not as simple as busting out a map and color coding which countries belong to which group and are destined to remain there. More myths.Sachs and many others like him would like you to believe that he has identified the reasons why much of the world’s population has remained in poverty, most of which are internal to their institutions and populations, and that they can gradually help these people lift themselves up through endless rhetoric, international meetings, economic integration, liberalization/globalization and monetary “aid”.

Yet, those are exactly the policies we’ve had for decades now and the situation has only become worse for most people. While the masses patiently wait for some sort of final salvation, the poverty, inequality, environmental destruction, wars, etc. will continue on and will directly benefit many of those same people preaching the end of poverty.

ashvin

ParticipantPorkpie post=796 wrote: Vandana Shiva is a woman.

Fixed.

jal,

I’m getting similar errors when I try to hit the “thank you” button. I believe it is because I deleted the initial thread and created a new one. Anyway, the ability to comment should not be hampered.

ashvin

ParticipantSwoOosch post=778 wrote: I’m wondering what kind of inflationary effects money parked in accounts at the CB’s have. I’m betting close to 0, but perhaps someone more familiar in these matters might explain it better?

You’re right, there is no inflationary effect unless the money suddenly comes rushing out of the deposit facilities and into the speculative “risk asset” casino markets (including long-term peripheral sovereign bonds) and/or the real economy for whatever reason. That is an unlikely occurrence in this environment.

ashvin

ParticipantGolden Oxen,

At what point in this commentary did I say anything about long-term prospects for gold or money printing? See the part Glennda quoted above. Granted, it wasn’t the best way to word it, but still easy enough to understand. Maybe, next time, you read the actual words written in a piece before calling it “nonsense”? Thanks.

ashvin

ParticipantYes, there are some javascript conflicts that need to be worked out before that section will work.

ashvin

ParticipantGlennda,

It’s because I moved this thread into the Help/FAQ section from another location. I am going to lock this thread now, so no more comments in it.

Everyone please create a new topic within the Help/FAQ section of the forum if you have a question/issue.

ashvin

ParticipantGoldenOxen wrote: Every central bank in the world printing like crazy.

Uh, no… false.

Maybe that’s what you derived from Ben’s speech today, but your elemental friend Gold thought otherwise.

ashvin

ParticipantApparently, the VA legislature has voted to “nullify” provisions in the NDAA which allow American citizens to be indefinitely detained without due process. From Washington’s Blog:

Virginia declares “emperor has no clothes”: NDAA nullified

Unfortunately, a state legislature has never been able to nullify federal law under the logic of the supremacy clause. It is still perhaps a promising gesture of defiance.

February 29, 2012 at 2:24 pm in reply to: When the Deflation Tsunami Hits, Losing the Least is a Winner #1126ashvin

ParticipantVortex post=704 wrote: The writing is on the wall, the USA NWO banking empire will either HI the currency and subsequent debts away or they will no longer be in power. These same power hunger banking freaks destroy nations everyday, and I’m suppose to buy their bloody deadly T-Bill’s to remain solvent. Get real.

Vortex,

Do you use fossil fuels? The banking-energy complex has been destroying nations and environments for many decades now, yet most us would still make use of the [steadily declining] energy returns afforded by these fuels if it was a matter of survival. That’s what T-bills may provide above many other assets – a way to make it through the short and medium-term and have a long-term to worry about. All of us “very smart” people here at TAE have carefully considered the HI arguments, and decided we would still be remiss not to warn of potential near-term consequences of holding PMs and the benefits of holding cash and cash equivalents.

ashvin

ParticipantRE,

Nice looking blog you have there, and your latest piece was a very good overview of how societies have evolved more complexity from surplus energy and derived money systems (although anthropological research has shown that many ancient surplus societies have maintained without internal money systems for quite some time).

When it’s all said and done, you are correct that the EROEI from human labor will not support a complex global society such as ours or perhaps even national scales of society. However, you are really talking about a time frame that is well beyond the scope of most of our lifetimes. Human labor will provide plenty of EROEI as long as some level of fossil fuels or alternative energy production remains, as well as modern technological processes. That is especially true if the humans are used as throw-away labor dolls who are only maintained at basic sustenance levels over the course of several years, like many were in the convict leasing systems. If you have over-population and excess labor force, then it really makes no sense to not use them as slaves and work them to death during a prolonged period of contraction.

ashvin

ParticipantFranny,

Are you saying the defense of economic duress has never been used successfully in Western courts? Perhaps you are correct, but I find that unlikely, and I know that we spent time discussing it in law school. It is a legitimate defense that can be raised. But I obviously agree that it is useless now for most people just like other protective aspects of contract law, and other fields of law in general, including Constitutional law.

ashvin

ParticipantReverseEngineer wrote: You’re morphing the question out of “debt slavery” and into a more explicit form of hereditary slavery, blurring the arguments.

…

In any event, I spent some time looking at the economics of slavery, and its not viable either in a contraction environment.

Yes I am, and that’s the whole point. Debt in some form has existed in societies for a long, long time, and it’s ability to create conditions of slavery are no less effective than any other form (that’s the primary reason slavery for African Americans could continue after the Civil War, EP and 13th amendment). You say it’s not viable in a contraction environment, and all I can say is tell that to the African Americans (and others) who lived through the Great Depression, or factory workers in the East right now, or the Greek people, or even the increasing number of U.S. prisoners who are said to “owe a debt to society”. The reality is that “debt slavery” is just as pliable as the concept of debt itself, and that’s why I blur the line. Although it has mostly been defined in monetary terms throughout the world in recent decades, there is no rule that says it must always be that way (although I suspect debt slavery will be viable even in monetary terms within certain populations for quite some time, especially in the West).

ashvin

ParticipantRE,

As you know, both the concepts of debt and slavery predate that of money. Granted, that was at much smaller scales of society than we have today, so a functioning monetary system is certainly something our modern slave masters would not like to go without right now. However, to say that debt slavery is not possible in an era of credit contraction is very misguided, IMO.

In fact, it is the ability to create net credit at an accelerating pace which has allowed many people to remain “free” consumers in the developed world, to the extent they had a choice of what work they would perform, for what compensation, for which employer, etc. That situation completely reverses as debt deflates and people/businesses are forced underwater on their liabilities. The status quo elites are also using sovereign debt mechanisms to mitigate the pace of private credit contraction. Even a tiny, deeply underwater country such as Greece has managed to remain a functioning part of the international bondage system for several years running.

As you point out, though, eventually the private and public debts will contract to the point where they no longer offer enough leverage of the elites’ power/control within the logic of this system, most likely marked by the period when the dollar hyperinflates after several other major currencies. The questions that are raised then are how long before that time arrives, and what mechanisms of slavery will be in place by then. In a world that is facing widespread energy/resource shortages, slavery could become the primary means of maintaining large-scale societies.

You could still call it “debt slavery”, because debts do not have to be “voluntary” contracts in monetary terms. One could be in perpetual debt to the corporatist sovereign by simple decree, or the very fact of one’s existence (born into debt). These are the people who will be kept alive in chains rather than allowed to die free. That is a very difficult thing to imagine/understand, yet a very real threat. That’s really why I ended the series with a question – because no matter how much I intellectually understand the argument, it remains perplexing to me.

How will I react if I am personally threatened with enslavement to an emerging system, not very different from those of recent history throughout the world and even in the U.S., far beyond any recognizable levels of forced attachment than we have right now? I don’t know.

ashvin

Participantpipefit post=667 wrote: So why do they need ‘debt’ as the mechanism for enslaving people? Why not just declare martial law and install a totalitarian state? They aren’t very far from that right now.

It doesn’t have to be one or the other, and it makes the most sense for them to use already established and newly created debts (mostly public, as you mention below) for as long as possible and as a means of transition towards anything more totalitarian. The conditions are certainly there for both to be used in combination.

One must really squint very hard to see even a smidgeon of logic in the ‘deflation’ argument. Using GAAP accounting, the federal govt. (USA) is running a deficit of about $6 trillion/year. That’s 40% of GDP. With any significant economic weakness, it will exceed 50% of GDP easily. But you really expect those ‘out of thin air’ dollars (the portion not from tax revenue) to buy ever larger quantities of goods and services? Is it not apparent that they will never cut spending?

The US public deficit will continue to remain elevated and eventually grow as the economy contracts, but the question is when will the bond markets and our trade creditors say “enough is enough”. They are not using your simple accounting methods (however accurate they may be), because other economic, political and geopolitical influences factor in as well. There are a lot at risks involved for everyone, including the largest players (or slave masters, if you will), if the $IMFS collapses anytime soon.

The only way that’s not true is if “they” already have some kind of new global currency mechanism in place to be deployed, which is very doubtful for me (I don’t necessarily view them as such a coordinated and unified group), but possible.

ashvin

ParticipantReverse Engineer post=655 wrote: Ash, I still find it hard to figure out how you can have debt enslavement without a functioning monetary system. Debt denominated in what? Euros? Dollars? It’s all Toilet Paper.

What do you mean by a “functioning” monetary system? I think ben’s reply from the other thread was accurate. Even during/after a process of HI, there will certainly be attempts to establish or re-establish currencies and carry over debts. Many people will still be forced into various forms of labor for basic necessities, provisioned by the full-fledged corpotocracy, and pay their share of taxes (tribute). As I made clear in the articles, though, none of this is guaranteed to be sustained for very long, and it is very likely that there will exist cities/communities that function with “black market” economies and also pockets of forceful resistance.

ashvin

ParticipantThis was indeed a fascinating and very thorough analysis. The idea of analyzing capitalism/capital as a mode of power, measured quantitatively in terms of differential relationships between classes, is very much in line with TAE’s perspective. A spectacular find by Ilargi.

The conclusion at the end begins to get into the issue of what capitalist elites will have to do to overcome their asymptotic levels of power, and the option that stands out above all else is neo-feudal slavery. It is no coincidence that systems of slavery for African-Americans only really began to wind down in the 1930-50 period, with the last great systemic crisis. I’d like to re-post that part of the report just to emphasize the point as much as possible!

How much more force and violence are needed to keep the current capitalist regime going? This of course is a subject in and of itself. But given its crucial importance, I think it is worth at least a brief, closing illustration.

…

During the 1930s and 1940s, this level proved to be the asymptote of capitalist power: it triggered a systemic crisis, the complete creordering of the U.S. political economy, and a sharp decline in capitalist power, as indicated by the large drop in inequality. The present situation is remarkably similar – and, in our view, so are the challenges to the ruling class.

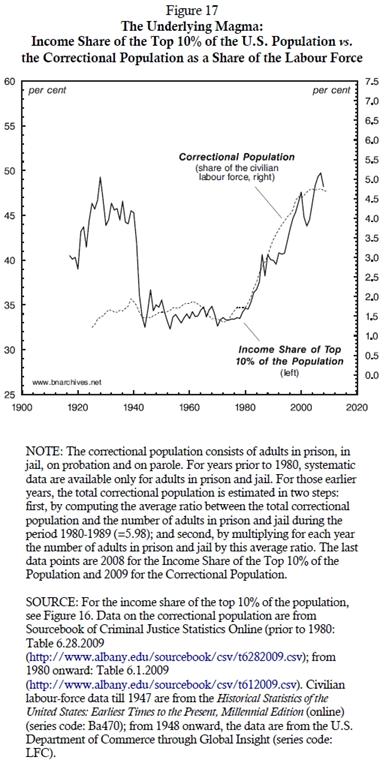

In order to have reached the peak level of power it currently enjoys, the ruling class has had to inflict growing threats, sabotage and pain on the underlying population. One key manifestation of this infliction is illustrated in our last chart, Figure 17.

The chart reproduces the distributional measure from Figure 16 (left scale) and contrasts it with the ratio between the adult correctional population and the labour force (right scale). The correctional population here includes the number of adults in prison, in jail, on probation and on parole.

As we can see, since the 1940s this ratio has been tightly and positively correlated with the distributional power of the ruling class: the greater the power indicated by the income share of the top 10 per cent of the population, the larger the dose of violence proxied by the correctional population. Presently, the number of ‘corrected’ adults is equivalent to nearly 5 per cent of the U.S. labour force. This is the largest proportion in the world, as well as in the history of the United States.

Although there are no hard and fast rules here, it is doubtful that this massive punishment can be increased much further without highly destabilizing consequences.

I do share a certain ambivalence with the authors here about how much farther the process of enslavement can go, but obviously I think there are many ways in which it can be extended further without completely “destabilizing” the elites’ power base. Similar processes of mass enslavement have occurred throughout history, which includes recent history for many poorer parts of the world. The way to increase the system of “massive punishment” is to re-define the legal boundaries of punishment at the federal and state levels, especially with respect to debtors (private and public, real or imagined), and that process is already well underway.

ashvin

Participantpipefit,

I’m assuming you haven’t been reading TAE for very long. Which is just fine, but you will find the assumption that we are headed directly for dollar HI and that gold will skyrocket in purchasing power any day now is frowned upon here, to say the least. It is much more likely that, by the time HI comes around, the corporate/financial elites will have dumped paper assets onto taxpayers and accumulated productive assets (including cheap human labor) to a much greater extent than they have now.

One thing is for sure – the fact that you, as a mere individual in the 99%, “own” gold or silver after the combined upheaval of debt deflation and HI will not necessarily insulate you from most of the risks that remain to you and those close to you, including that of enslavement. Major creditors and other corporate elites do not have to worry about legal precedent when they can exert significant control over all branches of the state, which, it just so happens, they already do.

ashvin

ParticipantYes, I see the links are to the website’s pages instead of the forum. I will look into how to change that. For now, you should use the “recent topics” or “my topics tabs” to find your posts or other lifeboat forum posts.

ashvin

ParticipantFranny,

From Wikipedia:

Economic duress

A contract is voidable if the innocent party can prove that it had no other practical choice (as opposed to legal choice) but to agree to the contract.

The elements of economic duress

1. Wrongful or improper threat: No precise definition of what is wrongful or improper. Examples include: morally wrong, criminal, or tortuous conduct; one that is a threat to breach a contract “in bad faith” or threaten to withhold an admitted debt “in bad faith”.

2. Lack of reasonable alternative (but to accept the other party’s terms). If there is an available legal remedy, an available market substitute (in the form of funds, goods, or services), or any other sources of funds this element is not met.

3. The threat actually induces the making of the contract. This is a subjective standard, and takes into account the victim’s age, their background (especially their education), relationship of the parties, and the ability to receive advice.

4. The other party caused the financial distress. The majority opinion is that the other party must have caused the distress, while the minority opinion allows them to merely take advantage of the distress.

A very relevant case to our discussion at hand that I remember going over was Batsakis v. Demotsis. Here are the facts:

In 1942, during the German occupation of Greece in World War II, Demotsis was in severe financial straits. This period in Greek history was marked by extensive starvation and malnutrition. Hundreds of thousands of Greeks died as a result of wartime living conditions. [1] According to scholars, the apparent contract made between the two parties would most likely have resulted in punishment or even death at the hands of the Germans.[2]

Demotsis asked Batsakis for money, which she needed to buy food for her family. In exchange, Demotsis promised in writing (in the form of a letter) to give Batsakis $2,000 dollars, plus 8% annual interest, after the war, or sooner, if she was able to regain access to her assets in the United States (Demotsis held property and funds in Texas but had no direct access to them as a result of the war). In the putative letter from Demotsis to Batsakis, written in the Greek language, Demotsis stated that she had received $2,000 from Batsakis.

…

What she actually received however was 500,000 Greek drachmae which had a market exchange value of approximately $25 at the time of the execution of the contract. After Demotsis refused to repay the loan once the war was over, Batsakis sued and Demotsis asserted as her defense that the contract was unenforceable due to a lack of consideration (the element of exchange generally necessary to make a contract valid in common law systems) and that Batsakis’s delivery of 500,000 drachmae, with a putative value of $25, could not be adequate consideration for her promise of $2,000, making the contract unenforceable.

Although the only issue looked at the Courts in this case was the adequacy of the consideration paid by Batsakis ($25 for $2000 + 8% interest, which they found was adequate), it is generally accepted that Demotsis could have presented a strong defense of economic duress to void the contract.

ashvin

Participantfixed

ashvin

ParticipantJoeP post=565 wrote: What has to happen in Greece for them to be able to “do what Argentina did a decade ago”?

Basically, default on external debts and allow its re-adopted domestic currency to devalue against the euro. I think he really means it should do what Argentina almost did, because the IMF didn’t take a haircut on its bonds and eventually ended up getting paid back in full. I believe Greece would suffer much higher inflation (or HI) than Argentina did, but it is still much better than staying in.

ashvin

ParticipantAussie post=562 wrote: Just wanted to ensure credit went where credit was due.

Thanks, fixed.

ashvin

Participantben,

OK, done.

The front page menu item will take some more time, but it’s in the works.

btw, we are also working on a completely new forum, but that will take even longer.

Also, I advise you move your last comment to the feature thread, if you want people to see it!

ashvin

ParticipantWhat loose monetary policy such as ZIRP and QE (monetization of debt) do above all else is transfer wealth from savers/workers/taxpayers to corporate elites (and shareholders in the short to medium-term), while also building up the level of imbalances in the markets and general economy. It generally does that by sucking more people (or amounts of productive wealth) into paper asset, consumption/investment bubbles while also undermining general confidence (the trust horizon), creating unintended consequences and sticking taxpayers with the losses on many of the bad assets.

Thus, Ilargi’s theme of Wile E Coyote in suspended animation. Sites like ZeroHedge believe that private and public debt deflation will always be met with massive amounts of “money printing”, which replaces private credit money that is disappearing with fresh base money from the central banks. They also believe that this will lead to HI of the major currencies, much sooner rather than later. The $2T it refers to is basically the amount that the ECB’s balance sheet has expanded since the summer from secondary market purchases of peripheral debt and the LTRO operation (1% 3-year loans backed by very distressed collateral).

OTOH, many of us here believe the situation is more complex than that. First of all, there are many economic, social and political factors that will both limit the amount of money printing and reduce its effectiveness. ZH itself ran an article yesterday about how QE is becoming less and less effective at even propping up the casino paper markets (stocks). In Who Killed the Money Printer and Political Theater Will Kill the Status Quo, I pointed out how near-term political factors can disrupt the drive to monetize debts as well.

ZH also had an article yesterday about how the some ECB officials (and the Bundesbank) is worried about the imbalances/unintended consequences of LTRO and may end the operation after the second one next week. Which also brings us to the next point that monetization of debts does not necessarily translate into inflation/HI because very little of the money makes it outside of the banking system, and LTRO may even slow down the velocity of money in the Euro periphery (Unintended Consequences of LTRO].

We must also distinguish between the likelihood of inflation/HI in peripheral parts of the global economy from central parts. The former include the Euro periphery (and most imminently Greece), parts of Asia, the ME and perhaps South America. As Stoneleigh has pointed out, collapse (including monetary collapse] typically starts in the periphery and then progresses to the center. We are still in the early stages of that collapse, since no significant economy has experienced very high inflation or HI yet.

HI will eventually show up in the developed world down the road, and at a time when people are least expecting it and can least afford it (even less than now). However, it’s not as simple as every major currency blowing up at the same time in the next few years. The process will be drawn out and debt deflation will make that time seem like an eternity for many people with low incomes, debts, low savings, lack of preparation, etc. That has been a pillar of I&S’ message here from the beginning – getting through the short and medium-term so you have a long-term to worry about.

ashvin

Participant

ashvin

ParticipantNZSanctuary post=490 wrote: a “successful” hack that threatened the entire financial system – an attack by terrorist hackers – could be a good excuse for MUCH more totalitarian control being pushed on the peoples of the world.

Yes I agree too, and that was my primary concern with its methods. I’m not sure if there’s much reason to suspect that Anonymous is a CIA/NSA established entity at this point, but, regardless, the security/intelligence complex can certainly use these threats to their advantage. Just another “terrorist” threat to deal with through brute control/oppression of millions of people who have no affiliation with Anonymous.

ashvin

ParticipantGlad you made it, Greenpa!

(Telegraph) 11.17 Meanwhile, Dutch finance minister Jan Kees de Jager, who this week declared that he favoured a “permanent Troika presence” in Athens to make sure Greece holds up its end of the bargain, has said that he has doubts over its ability to implement its new bailout programme. He told French paper le Monde (translation by Reuters):

To be honest, I have doubts, but it’s the best we could do.

Apparently, up-front honesty and acceptance of the situation is not something they “could do”.

ashvin

ParticipantMayAllBWell post=482 wrote: The group Anonymous just hacked Ministry of Justice in Greece and threatens to pull a big Robin Hood moment!!!: https://www.zerohedge.com/news/anonymous-hacks-greek-ministry-website-demands-imf-withdrawal-threatens-it-will-wipe-away-all-c

Makes for a good scene from Fight Club the movie, but I have a feeling it’s not going to happen. What’s to stop the banksters from transferring all the debts to a thumb drive?? I don’t know, threats like these without ability to follow through don’t seem to make the ever-growing security state timid.

ashvin

ParticipantA few terms of the recycled bailout deal that should sit well with the people of Greece :huh:

# Greek parliament to vote on a constitutional provision to ensure debt servicing payments prioritized

# Quarterly interest rate payments to be paid into a segregated account

# A permanent ‘troika’ task force will be in Greece to ensure adherence to the terms and conditions of the packageashvin

ParticipantThanks for the link El G – a very good series of interviews with a very insightful man, which is very hard to come by in the “sickcare” industry. Our society has definitely reified behaviors, addictions, economic decisions, etc. into compartments defined mostly by genetics and “inherent” traits, while ignoring the plethora of complex, inter-related environmental influences that are involved. Of course, that is the most convenient way for the status quo to manage perceptions and marginalize/ignore radical policy changes that may benefit large portions of the population.

ashvin

Participantsangell,

Sorry, but just about everything you said is BS and most everyone here knows it. First of all, a system that is structured to make it more “practical” to save the lives of a wealthy minority class in times of crisis is a “malevelont” one in my book. The fact that the ship was drastically under-equipped with lifeboats under the logic of British regulations, safety regulations were skimped in the name of low costs/”efficiency” and that lower-class passengers found it much more difficult to hear about the crisis, let alone make it to the lifeboats, speaks volumes.

Second, many more people could have been saved, and it is simply naive to think that class awareness didn’t factor into the decisions of everyone involved, top to bottom, from before the ship set out to sea to its last hours/minutes. But lastly, like you said, it is just a metaphor, and, like I said, the reality of our situation now is out in the open and staring just about everyone in the face.

Saving millions of homeowners our thousands of passengers is difficult. It creates a chaotic situation where panic is likely to set in and eliminate the ability of those in charge be they a ship’s company or government regulators to exercise control.

Nonsense. There is no way to “save” the standards of living we have become accustomed to in the developed world, but that is completely different from saying we must sacrifice all the stored wealth and lives of billions of people to [futilely] attempt to save a system that only benefits a tiny minority. There is nothing practical or orderly about the policies that have been enacted over the last few years. It is painfully obvious that they are simply making the process collapse much worse for much more people as it occurs, and nearly guaranteeing mass bloodshed in the not too distant future.

ashvin

ParticipantBeguine, as you probably noticed, I restored your comment with the link, but forgot to reply at that time. We are not really sure why certain comments with links are spammed while others are not. It has happened to a few others as well.

The new site is using Spamfighter, which from our experience at Blogger is absolutely necessary. We will regularly check the spam cage and move unwarranted spam back. The software apparently learns from this and becomes better tuned over time. We can also try contacting the developer to get a better understanding of the problem.

Also, we may start adding regular, known users to a “white list” that should prevent any future spammings for those people.

ashvin

ParticipantNaked Capitalism has an excellent piece breaking down some of the legal issues involved in the extensive fraudclosure debacle, specifically in the jurisdiction of California. It concludes by referencing an attorney who believes the meager and circular settlement by the banks could lead to “social upheaval”.

San Francisco Foreclosure Audit Elicits Predictable Responses from Securitization Mess Deniers

When the robosigning scandal broke, I recall seeing Barry Ritholtz on a financial TV show, in which the other interviewees were arguing “Well, this really can’t be that bad, only a few people lost their homes due to a mistake.” Barry got close to apoplectic, cited an example of an erroneous foreclosure, and said, “This should never happen.” We had a system in place that was slow and deliberate because a roof over one’s head is a basic safety need, and if people have invested a lot to make sure they aren’t at the mercy of a landlord, they expect that if they meet their end of the deal, and make good faith efforts to perform if they suffer a major economic reversal, that the law will protect them. We’ve now learned that the idea of equal protection under the law is a joke, even for homes, which have long been, as Levitin stresses, treated as a special category.

I got a call from an attorney in Texas who has done both class action and title clearing for oil and gas rights deals (hence he’s seen MERS up close and ugly) having a Howard Beale moment over the mortgage settlement. He said he was convinced if the settlement went through, it would be seen as the day when property rights were shown to have no meaning and it would eventually lead to social upheaval. I’m not sure many people in the heartlands will react as viscerally as he did, but when you undermine the foundations of a society or to use the Biblical metaphor, sow the wind, you can expect to harvest a whirlwind.

ashvin

ParticipantA ripost of an insightful and [overly] generous comment from Business Insider on this article. I’ve always had a lot of respect for the intellectual integrity of Austrian economic oriented libertarians, even though I disagree with the premise that “free markets” should (can) reign at large scales.

ludwigVonMises wrote: I have worked on Wall Street since the late 1980’s on the sell side in Fixed Income, Equity and Credit Derivatives until 2000. I am shocked that Ashvin gets it so right. I have claimed since I understood the game (i clued in some time around 1989 – unfortunately you play be the rules of the game or die on WS and I hoped the system would be revamped organically not through break-down) that multiple accounting systems that deviated from mark-to-market on both asset and liability sides of financial statements are what allowed us to structure transactions to take advantage of “arbitrage” that did not exist if everyone was on the same side.

Example: CDS started in the mid-1990s precisely because we figured out the sellers were insurance companies who wrote them as insurance contracts and could use “actuarial” valuations (and I am an Actuary so I know this) and therefore have a different accounting value than banks or hedge funds who treated them on a mark-to-market basis. So a transaction could (and still does) get done with both parties assigning DIFFERENT values and both claiming a profit – plus huge spread for the dealer/structurer (me and my fellow IBs would get bonuses on this and not have to deal with the future when reality and fantasy must mean-revert). If all were on the same accounting regime (I think mark-to-market is the only way to go) then 95% of these transactions would never occur in the first place.

As i said I am shocked that a young guy like Ashvin gets it when so many of my contemporaries think it is healthy and normal to have many schemes to value the same thing and most of them (all but mark-to-market) are subjective and up for constant revisions – until it is too late. But in reality it is not that difficult to figure out it just takes logic and a filter for all the marketing hype that comes from those who still benefit from the game. I only engage in a world of pure-M-T-M now and I sleep better for it.

We are closer to too late now than we are to room for the fiction to continue.

ashvin

ParticipantFull length documentary of Garbage Warrior (h/t Judith on FB)

https://www.youtube.com/watch?v=YrMJwIedrWU&feature=player_embedded

ashvin

Participantdavisherb post=413 wrote: anyone know a good estimate of how much the baqnks took in the fraud…they settled for $40 billion?

That’s a tough thing to estimate, but I can assure you it’s many, many more multiples of of the several billion the banks will be forced to pay (after deducting credits from the taxpayer-funded HAMP).

For instance, total compensation packages (salaries, benefits and bonuses) at the the 7 largest US banks were worth about $300 billion for only 2010 and 2011, while investment banker compensation alone for GS, JPM and Morgan Stanley was almost $40 billion for only 2011.

https://www.newbottomline.com/report_big_bank_bonuses_in_2011#_edn1

Most, if not all, of those people owe their jobs to extensive mortgage fraud (such as the “fraudclosure” issue) and, of course, massive public bailouts. Some form of fraud is basically in the investment banker’s job description.

ashvin

ParticipantAnother interesting chart courtesy of Elliot Wave:

“‘Beware the buyback,’ reported Barron’s over a story about a new study by Rockdale Research. ‘The most unexpected thing…was that corporations tend to buy back stocks at peaks, not troughs.

“[Robert Prechter’s Elliott Wave Theorist] made the same observation in 1995…noting, ‘Company officers are part of the market’s psychological fabric just like everyone else, and they tend to become bold when things look good, and that’s usually near a top.’”

-

AuthorPosts