DPC Broad Street lunch carts, New York 1906

We should get rid of the lot.

• World Braces for Taper Tantrum II Even as Yellen Soothes Nerves (Bloomberg)

The world economy is about to discover if to be forewarned by the Federal Reserve is to be forearmed. Two years since the Fed triggered a selloff of their assets in the so-called “taper tantrum,” the finance chiefs of emerging markets left Washington meetings of the IMF praising Chair Janet Yellen for the way she is signaling plans to raise U.S. interest rates. The test now is whether developing nations have done enough to insulate their economies from the threats of a higher U.S. dollar and capital flight once the Fed boosts borrowing costs for the first time since 2006. How successful they are will help determine the strength of global growth that’s already taking a hit from weaker expansions in China and Brazil.

“The Fed is trying its best to be as transparent as possible, to explain its considerations,” Tharman Shanmugaratnam, Singapore’s finance minister, said in an interview. “But it doesn’t mean that ensures us of an orderly exit. One way or another there’s going to be some disturbance.” Yellen is seeking to avoid the May 2013 episode of her predecessor Ben S. Bernanke, when his suggestion that the Fed might soon wind down its bond-buying program prompted investors to flee the risk in emerging markets. India’s rupee and the Turkish lira both tumbled to record lows. While Yellen didn’t speak publicly during the IMF’s spring gathering, officials said her message behind closed doors was reassuring.

Russian Finance Minister Anton Siluanov told reporters that Yellen informed fellow Group of 20 officials that any U.S. rate increases would be “transparent and understandable.” The latest Bloomberg survey shows 71% of participating economists expect the Fed to raise rates from near zero in September after a slowing of U.S. activity diluted speculation it would act as soon as June. “The Fed has been very clear about saying it would be a very steady process rather than an abrupt process, and I think that should calm people down,” Reserve Bank of India Governor Raghuram Rajan said in Washington. Malaysian central bank Governor Zeti Akhtar Aziz said in an interview that markets may be calmer following the Fed’s move than before. “I believe that when this interest-rate adjustment occurs, conditions will actually stabilize,” she said.

“We must not let our rulers load us with perpetual debt.”

• Caveat Creditor As IMF Chiefs Mull Unpayable Debts (AEP)

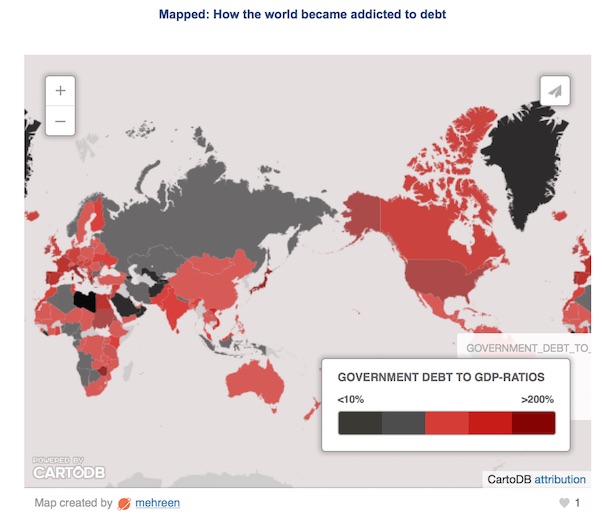

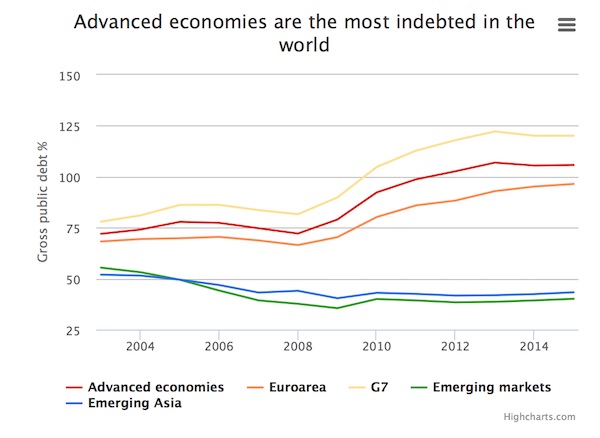

The IMF has sounded the alarm on the exorbitant levels of debt across the world, this time literally. The theme trailer to its fiscal forum on the ‘political economy of high debt’ plays on our fears with the haunting tension of a Hitchcock thriller. A quote from Thomas Jefferson flashes across the screen in blood-red colours: “We must not let our rulers load us with perpetual debt.” We learn that public debt in the rich economies fell from 124pc of GDP at the end of Second World War to 29pc in 1973, a dream era that we have left behind. The debt burden has since climbed at a compound rate of 2pc a year, accelerating into an upward spiral to 105pc of GDP after the Lehman crash. It is as if we had fought another world war. A baby boom and surging work-force enabled us to grow out of debt in the 1950s and 1960s without noticing it.

No such outcome looks plausible today. The IMF’s World Economic Outlook describes a prostrate planet caught in a low-growth trap as the population ages across the Northern Hemisphere, and productivity splutters. Nor is this malaise confined to the West. The fertility rate has collapsed across the Far East. China’s work-force is shrinking by three million a year. The report warned of a “persistent reduction” in the global growth rate since the Great Recession of 2008-2009, with no sign yet of a return to normal. “Lower potential growth will make it more difficult to reduce high public and private debt ratios,” it said.

Christine Lagarde, the Fund’s managing-director, calls it the “New Mediocre”. The height of elegance as always, and seemingly inexhaustible as she holds court at IMF Headquarters, Mrs Lagarde has learned the hard way that something is badly out of kilter in the world. The painful ritual of her IMF tenure has been to admit at each meeting that the previous forecasts were too hopeful. First it was Europe’s debt crisis. Now it is because China, Brazil, Russia, and a host of mini-BRICS have hit the limits of easy catch-up growth. This year the curse was finally broken. There will be no downgrade. The IMF is crossing its fingers that world growth will still be 3.5pc for 2015.

Yet the Fund’s underlying message is that sky-high debt ratios and old-age populations are a dangerous mix, leaving the world prone to the “Japanese” diseases of deflation and atrophy. The monetary and fiscal buffers are largely exhausted. Authorities have little left in their policy arsenal to fight the next downturn, whenever it comes. There is of course a time-honoured way to clear unpayable debts and wipe the slate clean. It is called default. Some wicked wit at the IMF ended the Hitchcock trailer with a killer quote, this one from the Canadian poet and novelist Margaret Atwood, strangely constructed but pithy in its way: “And then the REVENGE that comes when they are not paid back.

This touches a raw nerve, for that is more or less what may happen within weeks if an angry Greece – aggrieved at the way it was sacrificed to save Europe’s banks in 2010 – becomes the first developed country to miss a payment to the IMF, and perhaps the first of a long string of debtor-nations to turn the tables on their foreign creditors. Athens is where it all begins. George Osborne said talk of a Grecian debacle was on everybody’s lips at this year’s Spring Meeting. “The mood is notably more gloomy, and it is now clear to me that a misstep or a miscalculation by either side could easily return European economies to the kind of perilous situation we saw three or four years ago. The crunch appears to be coming in May,” he said.

Yeah, more power to the IMF, that’s a great idea.

• Fed Crisis-Liquidity Function Reviewed for Potential Use by IMF (Bloomberg)

IMF member nations are discussing how to expand the lender’s mandate to include keeping markets liquid during a financial crisis, a role played by a group of major central banks led by the Federal Reserve in 2008. The IMF’s main committee of central bank governors and finance ministers is working on ways for the fund to provide a better financial “safety net” during a crisis, said Singapore Finance Minister Tharman Shanmugaratnam, who last month finished a four-year term as chairman of the panel. Singapore remains a member of the International Monetary and Financial Committee.

“In the last crisis, the Fed and some other central banks had a system of swaps that was applied to only certain financial centers, but you can’t leave it to an individual central bank to make those decisions,” he said in an interview Friday in Washington, as officials from around the world gathered for the IMF’s spring meetings. “It has to be a global player, and the IMF is the only credible institution to perform that role.” The Washington-based IMF needs to evolve into more of a “system-wide policeman” that enforces global financial stability, rather than solely a lender to individual countries that run into trouble, said Shanmugaratnam, 58, who also serves as Singapore’s deputy prime minister.\ IMF Managing Director Christine Lagarde said this month that the world could be in for a “bumpy ride” when the Fed starts raising interest rates, with commodity-exporting emerging economies likely to take a major hit.

The Fed set up foreign-exchange swap lines during the crisis with major central banks, including the ECB, Bank of Japan and Bank of Canada, as well as some smaller and emerging-market nations such as Singapore, South Korea, Mexico and New Zealand. Under the program, foreign central banks exchanged their countries’ currencies for U.S. dollars, which they loaned to local financial institutions to shore up their liquidity. Outstanding swaps peaked at almost $600 billion in late 2008. Some emerging-market economies were rebuffed for swap agreements with the Fed, including Indonesia, India, Peru and the Dominican Republic, according to the book “The Dollar Trap” by Eswar Prasad, a former IMF official.

I’d be more worried about periphery bonds perhaps. But the euro too has a ways to fall.

• Draghi Tells Euro Shorts To “Make His Day”, Again (Zero Hedge)

With a “defiant” Syriza determined to hold onto any shred of dignity and legitimacy that may remain in the wake of months of painful negotiations with its creditors and with a €5 billion advance from Russia (a large chunk of which will promptly be paid to the IMF which use it to bailout Ukraine which will hand it right back to Russia) shaping up to be the last lifeline for Greece before Athens is reduced to issuing IOUs to pay pensions and salaries, the focus is beginning to shift away from Grexit and towards contagion risk. The worry is that once Greece goes, both the credit market and periphery depositors will suddenly realize that the EMU is not “indissoluble,” but is in fact nothing more than a confederation of fixed exchange rates.

This realization could (and to a certain extent already has) cause credit investors to begin pricing redenomination risk back into sovereign spreads and, far more importantly (because as UBS recently noted, bonds don’t cause breakups, bank runs do), may lead depositors to question the wisdom of holding their euros in bank accounts where they’re earning next to no interest and where, should some “accident” occur, they are subject to conversion into a national currency that would swiftly collapse against the euro once introduced.

And so, with every sell side European credit strategist trying to figure out what happens when €60 billion in monthly asset purchases by a central bank collide head on with an unprecedented sovereign default and with speculators’ net short position on the EUR now at levels last seen in 2012, it’s time to bring out the big guns with Mario Draghi staging a sequel to his now famous “whatever it takes” speech which came in the summer of 2012, when spreads were blowing out across the periphery and when euro net shorts looked a lot like they do today. While conceding that a Greek exit from the euro would put everyone in “uncharted waters,” Draghi says he has the tools to combat contagion and as for shorting the euro, well, perhaps the best way to sum up Draghi’s position is to quote Clint Eastwood: “go ahead, make my day.”

“”Once the idea enters peoples’ minds that monetary union is not forever, speculation begins..”

• Greece’s Varoufakis Warns Of Grexit Contagion (Reuters)

Greece’s Finance Minister Yanis Varoufakis said in an interview broadcast on Sunday that if Greece were to leave the euro zone, there would be an inevitable contagion effect. “Anyone who toys with the idea of cutting off bits of the euro zone hoping the rest will survive is playing with fire,” he told La Sexta, a Spanish TV channel, in an interview recorded 10 days ago. “Some claim that the rest of Europe has been ring-fenced from Greece and that the ECB has tools at its disposal to amputate Greece, if need be, cauterize the wound and allow the rest of euro zone to carry on.”

“I very much doubt that that is the case. Not just because of Greece but for any part of the union,” he said, speaking in English. “Once the idea enters peoples’ minds that monetary union is not forever, speculation begins … who’s next? That question is the solvent of any monetary union. Sooner or later it’s going to start raising interest rates, political tensions, capital flight.” His comments were recorded before those of Mario Draghi, the European Central Bank’s president, who this weekend said the euro zone was better equipped than it had been in the past to deal with a new Greek crisis but warned of uncharted waters if the situation deteriorates.

“This bull run is taking place as the Chinese economy slumps under a sea of debt..”

• Can Beijing Tame China’s Bull Market? (MarketWatch)

Authorities in China face the delicate task of taming an equity bull market of their own making, which could now be spiraling out of control. Last week, the announcement of new measures to allow fund managers to short stocks not only hit Chinese shares, but also spooked the global markets. This was followed up by warnings from China’s securities regulator to small investors not to borrow money or sell property to buy stocks. A warning for equity bulls to cool off certainly looks overdue. Stock turnover reached a record 1.53 trillion yuan ($247 billion) on Friday, with stock-trading accounts reportedly being opened at a rate of 1 million every two days. Margin account balances reached a record 1.16 trillion yuan. But should global markets worry if day traders in Shenzhen or Shanghai are about to lose their shirts?

China’s casino-like equity markets are largely sealed off from the outside world, after all. Foreign ownership of domestic Chinese shares is still a fraction of 1%, even with new initiatives such as the recent opening of the Shanghai-Hong Kong Stock Connect. The concern for global markets, however, is not equity-market contagion but the potential hole a stock-market bust could blow in the world’s second-largest economy. This bull run is taking place as the Chinese economy slumps under a sea of debt, with exports now also going south along with the property market. This hardly sounds like conditions ripe for rallying shares — but this is no normal rally. The real wild card to consider is the fact that this bull market has the fingerprints of the ruling Communist Party all over it.

They initiated it, meaning an official policy shift could also see it reverse — although that looks unlikely for now. Official state media have been cheerleading this rally by extolling the benefits of share ownership in a series of articles since last year. But what has really unleashed “animal spirits” of day traders has been the re-opening of the domestic initial public offering (IPO) market. Thanks to systematic underpricing orchestrated by the state regulator, investors have been all but guaranteed spectacular gains. According to a first-quarter report from accountants Ernst & Young, there were 70 domestic Chinese IPOs, all of which rose by the maximum 44% allowed on the first day of trading. Average gains for IPOs have been around 200% this year.

What’s the reserve requirement over here these days? 0.05%?

• China Cuts Bank Reserves Again To Fight Slowdown (Reuters)

China’s central bank on Sunday cut the amount of cash that banks must hold as reserves, the second industry-wide cut in two months, adding more liquidity to the world’s second-biggest economy to help spur bank lending and combat slowing growth. The People’s Bank of China (PBOC) lowered the reserve requirement ratio for all banks by 100 basis points to 18.5%. The reduction is effective from April 20, the central bank said in a statement on its website www.pbc.gov.cn. The latest cut in the reserve requirement shows how the central bank is stepping up efforts to ward off a sharp slowdown in the economy.

Weighed down by a property downturn, factory overcapacity and local debt, growth is expected to slow to a quarter-century low of around 7% this year from 7.4% in 2014, even with expected additional stimulus measures. The PBOC last cut the reserve requirement ratio for all commercial banks by 50 basis points on February 4, the first industry-wide cut since May 2012. The central bank has also cut interest rates twice since November in a bid to lower borrowing costs and spur demand.

Too late: “..they don’t want to see bubble territory..”

• Why China’s RRR Cut Reeks Of Desperation (CNBC)

The People’s Bank of China (PBoC) is “desperate” to control Shanghai’s red-hot equity rally, analysts said, after the central bank slashed the reserve requirement ratio (RRR) on Sunday. The 100 basis-point RRR cut to 18.5% is the biggest since 2008 and comes in response to a sharp selloff in stock futures on Friday after the China Securities Regulatory Commission (CSRC) tightened margin trading rules. The CSRC aims to cool Shanghai’s stock market, which is up over 30% year to date at seven-year highs. Futures plunged during late trading on Friday, with the China A50 futures contract down 6% in New York.

“After the announcement on Friday, stock futures were looking horrible so something needed doing to put a floor under that from a short-term point of view. But everybody’s going to take a look at this and say ‘hold on, why are they [PBoC] overreacting so strongly?’ People are going to start sensing desperation here,” Paul Gambles, co-founder of MBMG Group, told CNBC on Monday. Indeed, policy watchers were scratching their heads over the series of conflicting announcements. The PBoC is scrambling to ensure stability in China’s notoriously volatile share market, said Mark Andersen, global co-head of Asset Allocation at UBS CIO Wealth Management. “They want to see markets go up to some extent, but not out of control. With some of this margin financing, they want to see a relatively stable capital market with property prices falling so they don’t mind equity prices moving up a bit to support the broader economy, but they don’t want to see bubble territory,” Anderson said.

Also too late. People think Beijing has it all under control, and when the markets crash, they will be very angry.

• China to Investors: Don’t Forget That Stocks Can Lose Money Too (Bloomberg)

After the longest-ever rally in Chinese equities, investors are getting a reminder that the $7.3 trillion market isn’t just a one-way bet. China’s securities regulator jolted traders after the close of local bourses Friday when it banned a source of financing for margin trades and made it easier for short sellers to wager that stocks will fall. Offshore futures and exchange-traded funds linked to the world’s second-largest stock market sank, with the iShares China Large-Cap ETF tumbling 4.2% in the U.S. While China bulls will draw some comfort from the central bank’s biggest cut to lenders’ reserve requirements since 2008 on Sunday, last week’s sell-off in offshore markets shows how vulnerable the Shanghai Composite Index is to a pullback after going 452 days without a 10% drop from a recent high.

The benchmark gauge posted an average peak-to-trough retreat of 28% after six previous rounds of policy intervention to curtail stock speculation since 1996, according to Bank of America. “Institutional investors as well as authorities have had some concerns over the sharp rise in prices and trading,” Michael Kass at Baron Capital, whose $1.53 billion emerging-markets fund has outperformed 95% of peers tracked by Bloomberg over the past three years, said by e-mail on Friday. “This will likely cool some of the recent enthusiasm.” The Shanghai Composite’s 115% surge from last year’s low on Jan. 20 is challenging authorities as they seek to weigh the benefits of rising share prices against the risk that individual investors will get burned by excessive speculation.

Traders in Shanghai have borrowed a record 1.2 trillion yuan ($194 billion) to buy equities via margin trades, while new investors have opened an unprecedented number of stock accounts this year. The Shanghai Composite trades at 16.5 times estimated earnings for the next 12 months, the highest valuation in five years, even after data last week showed economic growth slowed to the weakest pace since 2009 in the first quarter. On Friday, the China Securities Regulatory Commission prohibited the margin-trading businesses of brokerages from using so-called umbrella trusts, which allow investors to take on more leverage. Authorities also allowed fund managers to lend shares for short sales, a move that will make it easier to execute bearish bets, and expanded the number of stocks available for this kind of trading.

“..drugs, gambling, prostitution, ill-gotten wealth overflowing banquet tables and golf.” That’s the life we’re all supposed to long for, isn’t it?

• China Cracks Down On Golf, The ‘Sport For Millionaires’ (NY Times)

President Xi Jinping’s crackdown on vice and corruption in China has gone after drugs, gambling, prostitution, ill-gotten wealth and overflowing banquet tables. Now it has turned to a less obvious target: golf. In a flurry of recent reports, state-run news outlets have depicted the sport as yet another temptation that has led Communist Party officials astray. A top official at the Commerce Ministry is under investigation on suspicion of allowing an unidentified company to pay his golf expenses. The government has shut down dozens of courses across the country built in violation of a ban intended to protect China’s limited supplies of water and arable land.

And in the southern province of Guangdong, home to the world’s largest golf facility, the 12-course Mission Hills Golf Club, party officials have been forbidden to golf during work hours “to prevent unclean behavior and disciplinary or illegal conduct.” The provincial anticorruption agency has set up a hotline for reporting civil servants who violate nine specific regulations, including prohibitions on betting on golf, playing with people connected to one’s job, traveling on golf-related junkets or holding positions on the boards of golf clubs. “Like fine liquor and tobacco, fancy cars and mansions, golf is a public relations tool that businessmen use to hook officials,” the newspaper of the party’s antigraft agency declared on April 9. “The golf course is gradually changing into a muddy field where they trade money for power.”

Fresh from the Monopoly press.

• China’s President Xi Jinping To Unveil $46 Billion Deal In Pakistan (BBC)

China’s President Xi Jinping is due in Pakistan, where he is expected to announce $46bn of investment. The focus of the spending is on building a China-Pakistan Economic Corridor (CPEC), running from Gwadar in Pakistan’s Balochistan province to China’s western Xinjiang region. Pakistan hopes the investment will boost its struggling economy and help end chronic power shortages. Leaders are also expected to discuss co-operation on security. Mr Xi will spend two days holding talks with his counterpart Mamnoon Hussain, Prime Minister Nawaz Sharif and other ministers. He will address parliament on Tuesday. Deals worth some $28bn are ready to be signed during the visit, with the rest to follow. The sum significantly outweighs American investment in Pakistan.

Under the CPEC plan, China’s government and banks will lend to Chinese companies, so they can invest in projects as commercial ventures. A network of roads, railways and energy developments will eventually stretch some 3,000km (1,865 miles). Some $15.5bn worth of coal, wind, solar and hydro energy projects will come online by 2017 and add 10,400 megawatts of energy to Pakistan’s national grid, according to officials. A $44m optical fibre cable between the two countries is also due to be built. The projects will give China direct access to the Indian Ocean and beyond, marking a major advance in its plans to boost its economic influence in central and south Asia. Pakistan, meanwhile, hopes the investment will enable it to transform itself into a regional economic hub.

Ahsan Iqbal, the Pakistani minister overseeing the plan, told the AFP news agency that these were “very substantial and tangible projects which will have a significant transformative effect on Pakistan’s economy”. Mr Xi is also expected to discuss security issues with Mr Sharif, including China’s concerns that Muslim separatists from Xinjiang are linking up with Pakistani militants. “China and Pakistan need to align security concerns more closely to strengthen security co-operation,” he said in a statement to Pakistani media on Sunday. “Our cooperation in the security and economic fields reinforce each other, and they must be advanced simultaneously.”

Steve on non-linear economics.

• You Do Need A Weatherman (Steve Keen)

I’ve just come back from the annual Institute for New Economic Thinking conference in Paris, where the President of INET Rob Johnson is infamous for opening every session he chairs with an apt set of lyrics from the 1960s. I’ve aped Rob here by misquoting one of Bob Dylan’s great lines “You don’t need a weatherman to know which way the wind blows”. In fact, you do. Why? Because Weathermen know a lot more about which way the wind blows now that they did back in the 1960s, thanks to the work of a lesser-known icon of the 1960s, Edward Lorenz. A mathematician and a meteorologist, Lorenz was dissatisfied with the methods then used to predict the weather—which were a combination of looking for patterns in historical data, and using what mathematicians call linear models.

He demonstrated the importance of nonlinear effects in the weather in a seminal paper in 1963 (two years before Dylan released Subterranean Homesick Blues), and meteorologists rapidly moved from linear to nonlinear thinking. Why is nonlinear thinking better than linear? Ironically, given how defensive the Old Guard in economics is of its generally linear approach, one of the best explanations of what linear thinking is, and why it is misleading, was recently given by the chief economist at the IMF, Olivier Blanchard. Looking back at the failure of mainstream economic models to forewarn of the 2008 economic crisis, Blanchard noted that these models only made sense if “small shocks had small effects and a shock twice as big as another had twice the effect on economic activity”:

These techniques however made sense only under a vision in which economic fluctuations were regular enough so that, by looking at the past, people and firms (and the econometricians who apply statistics to economics) could understand their nature and form expectations of the future, and simple enough so that small shocks had small effects and a shock twice as big as another had twice the effect on economic activity.

The reason for this assumption, called linearity, was technical: models with nonlinearities—those in which a small shock, such as a decrease in housing prices, can sometimes have large effects, or in which the effect of a shock depends on the rest of the economic environment—were difficult, if not impossible, to solve under rational expectations. (Blanchard, “Where Danger Lurks”, September 2014)

Then along came the economic crisis, and suddenly in the real world—unlike in their models—“the effect of a shock depended on the rest of the economic environment”, and what appeared to economists to be a small shock (the Subprime mortgage crisis) had a very large impact on the global economy. Lorenz’s criticism of linear weather models was essentially the same: linear models grossly underestimated the interconnectedness of the weather. Meteorologists took this message to heart, and developed highly nonlinear models in which “‘cause and effect’ relationships between the basic variables can become ferociously complex”. This required some very difficult work in mathematics and computing—but it was worth it, given the devastating real-world impact of an unanticipated hurricane on the real world. The world has benefited enormously from this work by meteorologists over the last half century.

They’re not all stupid.

• Auckland Property: Cashed-Up And Heading Off (NZ Herald)

As house prices in the country’s biggest city spiral out of control, Auckland homeowners are cashing in their chips and buying mansions in the regions.Thousands of property owners are now sitting on million-dollar goldmines thanks to rampant capital gain. The lure of a traffic-free, laid-back lifestyle with outdoor space for the children is proving tempting for many, and one-in-10 Hawkes Bay sales are now to ex-pat Aucklanders. The Bay of Islands and Marlborough are also drawing “Jafa” homeowners keen to escape the rat race. They have newly acquired equity thanks to soaring Auckland house prices which hit a median of $720,000 last month – a 13% jump in the past year alone.

In Marlborough, with its climate, vineyards and scenery, the median selling price last month was $316,500. Bayleys Marlborough director Andy Poswillo said the median price of a home in Auckland would buy a dated two-to-four-bedroom house or unit, with single car garaging set on a “pocket-handkerchief of lawn”.In Marlborough, the same money could buy a modern three-to-five-bedroom house, some with great views, a swimming pool, hobby orchard and up to 4000sq m of land.”It is easy to see why the temptation is there to cash up, do away with the mortgage and move down the line.”Mr Poswillo said at least eight Auckland families had bought local properties in the past three months.

Many buyers had negotiated “work from home” or satellite office arrangements to maintain their city careers. “They all share the same sentiment; they are tired of chipping away at their colossal mortgages for homes that are failing to serve their needs.”Put simply they want a better lifestyle for their kids and to dump the financial stress of living in the big smoke.”On Saturday the Weekend Herald revealed the average Auckland home had earned nearly $230 a day in the past year – nearly twice what the average worker earned from their job.

Good article.

• Secret Files Reveal the Structure of Islamic State (Spiegel)

Aloof. Polite. Cajoling. Extremely attentive. Restrained. Dishonest. Inscrutable. Malicious. The rebels from northern Syria, remembering encounters with him months later, recall completely different facets of the man. But they agree on one thing: “We never knew exactly who we were sitting across from.” In fact, not even those who shot and killed him after a brief firefight in the town of Tal Rifaat on a January morning in 2014 knew the true identity of the tall man in his late fifties. They were unaware that they had killed the strategic head of the group calling itself “Islamic State” (IS). The fact that this could have happened at all was the result of a rare but fatal miscalculation by the brilliant planner. The local rebels placed the body into a refrigerator, in which they intended to bury him.

Only later, when they realized how important the man was, did they lift his body out again. Samir Abd Muhammad al-Khlifawi was the real name of the Iraqi, whose bony features were softened by a white beard. But no one knew him by that name. Even his best-known pseudonym, Haji Bakr, wasn’t widely known. But that was precisely part of the plan. The former colonel in the intelligence service of Saddam Hussein’s air defense force had been secretly pulling the strings at IS for years. Former members of the group had repeatedly mentioned him as one of its leading figures. Still, it was never clear what exactly his role was.

But when the architect of the Islamic State died, he left something behind that he had intended to keep strictly confidential: the blueprint for this state. It is a folder full of handwritten organizational charts, lists and schedules, which describe how a country can be gradually subjugated. SPIEGEL has gained exclusive access to the 31 pages, some consisting of several pages pasted together. They reveal a multilayered composition and directives for action, some already tested and others newly devised for the anarchical situation in Syria’s rebel-held territories. In a sense, the documents are the source code of the most successful terrorist army in recent history.

Investment finance.

• Russia Has Bigger Concerns Than Oil, Ruble: Deputy PM (CNBC)

Faced with the triple whammy of plunging oil prices, currency volatility and Western sanctions, there’s no dearth of challenges for Russia’s ailing economy, but Deputy Prime Minister Arkady Dvorkovich said what hurts most is the scarcity of financing for new investments. “The shortness of financing for new investments is where the Russian economy is being hit in the most important way,” Dvorkovich told CNBC on the sidelines of World Economic Forum on East Asia in Jakarta. “How do we deal with this? We are working with new partners. This is why we are in China, in other countries, looking for new partners who can bring new investments into the country,” he added.

Russia’s economy, which grew by just 0.6% in 2014, is expected to enter a deep recession this year under the weight of lower oil prices and sanctions, which have compounded the country’s underlying structural weaknesses and undermined business and consumer confidence. Earlier this month, the IMF slashed its growth outlook for the country, forecasting a contraction of 3.8% in 2015 and 1.1% in 2016. Its earlier estimate was for a contraction of 3% this year and 1% next. Nevertheless, Dvorkovich says the country has built up enough reserves to weather the rout in the commodities market.

“We were not counting on higher oil prices in our economic policies. We were saving some money for the times like what we face now, so we have reserves that allow us to smooth this stage and to help poor families and increase unemployment benefits,” he said. As for the precipitous fall in the ruble over the past year, Dvorkovich said the implications are not all negative as it gives Russian manufacturing and agricultural exports a pricing edge in global markets. Responding to criticism over the Kremlin’s decision to lift a self-imposed ban on supplying a sophisticated missile air defense system to Iran, Dvorkovich said: “We are not breaking any sanctions.” “We will fulfill our commitments and responsibilities in full compliance with international legislations. Our partners shouldn’t doubt that we would work in that manner,” he said.

The price of oil better stay down, or they’ll do it too.

• 5 Years After BP Spill, Drillers Push Into Riskier Depths (AP)

Five years after the nation’s worst offshore oil spill, the industry is working on drilling even further into the risky depths beneath the Gulf of Mexico to tap massive deposits once thought unreachable. Opening this new frontier, miles below the bottom of the Gulf, requires engineering feats far beyond those used at BP’s much shallower Macondo well. But critics say energy companies haven’t developed the corresponding safety measures to prevent another disaster or contain one if it happens — a sign, environmentalists say, that the lessons of BP’s spill were short-lived.

These new depths and larger reservoirs could exacerbate a blowout like what happened at the Macondo well. Hundreds of thousands of barrels of oil could spill each day, and the response would be slowed as the equipment to deal with it — skimmers, boom, submarines, containment stacks — is shipped 100 miles or more from shore. Since the Macondo disaster, which sent at least 134 million gallons spewing into the Gulf five years ago Monday, federal agencies have approved about two dozen next-generation, ultra-deep wells. The number of deepwater drilling rigs has increased, too, from 35 at the time of the Macondo blowout to 48 last month, according to data from IHS Energy, a Houston company that collects industry statistics.

Department of Interior officials overseeing offshore drilling did not provide data on these wells and accompanying exploration and drilling plans, information that The Associated Press requested last month. But a review of offshore well data by the AP shows the average ocean depth of all wells started since 2010 has increased to 1,757 feet, 40% deeper than the average well drilled in the five years before that. And that’s just the depth of the water. Drillers are exploring a “golden zone” of oil and natural gas that lies roughly 20,000 feet beneath the sea floor, through a 10,000-foot thick layer of prehistoric salt — far deeper than BP’s Macondo well, which was considered so tricky at the time that a rig worker killed in the blowout once described it to his wife as “the well from hell.”

Crazed.

• US Army Commander Urges NATO To Confront Russia (RT)

US army commander in Europe says Russia is a “real threat” urging NATO to stay united. The alliance is not interested in a “fair fight with anyone” and wants to have “overmatch in all systems,” Lieutenant-General Frederick “Ben” Hodges believes. “There is a Russian threat,” Hodges told the Telegraph, maintaining that Russia is involved in ongoing conflict in eastern Ukraine. A key objective for NATO is not to let Russia outreach it in terms of capabilities, the general said. “We’re not interested in a fair fight with anyone,” General Hodges stated. “We want to have overmatch in all systems. I don’t think that we’ve fallen behind but Russia has closed the gap in certain capabilities. We don’t want them to close that gap,” he revealed.

“The best insurance we have against a showdown is that NATO stands together,” he said, pointing to recent moves by traditionally neutral Sweden and Finland to cooperate more closely on defense with NATO. Moscow has expressed “special concern” over Finnish and Swedish moves towards the alliance viewing it as a threat aimed against Russia. “Contrary to past years, Northern European military cooperation is now positioning itself against Russia. This can undermine positive constructive cooperation,” Russia’s Foreign Ministry said in a statement. Hodges also said US expects its allies to contribute financially to the security umbrella provided by the NATO alliance, as its member states have been failing to allocate 2% of every member nation’s GDP to NATO budget.

“I think the question for each country to ask is: are they security consumers or security providers?” the general demanded. “Do they bring capabilities the alliance needs?” However, the general does not believe that the world is on the brink of another Cold War, saying that “the only thing that is similar now is that Russia and NATO have different views about what the security environment in Europe should be.” “I don’t think it’s the same as the Cold War,” he said, recalling “gigantic forces” and “large numbers of nuclear weapons” implemented in Europe a quarter of a century ago. “That [Cold War] was a different situation.”