Risdon Tillery Greenwich House day care, New York May 1944

The topic of potential interest rate hikes by central banks is no longer ever far from any serious mind interested in finance. Still, the consensus remains that it will take a while longer, it will take place in a very gradual fashion, and it will all be telegraphed through forward guidance to anyone who feels they have a need or a right to know. Sounds like complacency, doesn’t it?

Now, it seems obvious that the Bank of Japan and the ECB are not about to hike rates tomorrow morning. In Europe, dozens of national politicians wouldn’t accept it, and in Japan, it would mean an early end to many things including Shinzo Abe.

But the Bank of England and the Fed are another story. Though if the Yes side wins in Scotland next week, the narrative may change a lot of Mark Carney and the City. That leaves the Fed. And it’s important to realize and remember that, certainly after Greenspan entered the scene, speaking in tongues, the Fed has become a piece of theater. The Fed is about perception. About trying to make people believe something, and make them act a certain way that they choose for them.

That’s why after the Oracle left they pushed first a bearded gnome and then a grandma forward as the public face. The kind of people nobody would perceive as a threat. Putting a guy who looks like second hand car salesman in charge of the Fed wouldn’t work.

Not when a big financial crisis looms, and then continues on for a decade and counting. That makes keeping up appearances the no. 1 priority. That’s when you want a grandma, or you’d lose your credibility real fast. You need grandma for your theater, for the next play you’re going to stage.

That market volatility today is at record lows is part of a big play, or a big scene in a play if you will. And the goal is not to make markets look good, as many people think. Making markets look good, making the economy look good, is just an intermediate step designed to lure everyone in.

You make people believe you got their back. All the big investors. Because they make tons of money, while they thought maybe the crisis could have really hurt them. Even the public at large feels you got their back. Because they don’t understand what the sleight of hand is.

The big investors understand, but you got them believing you will play that hand forever, or let them know well ahead of time when you intend to fold. The big investors think you will skim the public, but not them. They think you’re all on the same side. And the public thinks you’re healing the economy, and saving their jobs and homes and pensions.

When rate hikes are discussed, like I did two weeks ago in This Is Why The Fed Will Raise Interest Rates, most people have similar initial reactions. ‘They can’t do that, it would kill the economy, or at least the recovery’.

But the truth is, there is no recovery. It’s just a scene in a play. And the economy is completely shot, it only appears to be left standing because the Fed poured oodles of money into it. Or rather, into a part of the economy that it can control, that it can get the money out of again easily: Wall Street banks. And Wall Street equals the Fed.

Charles Hugh Smith, in What If the Easy Money Is Now on the Bear Side?, notices that there are hardly any bears left in the market, and that shorts are disappearing as a source of revenue for bulls. Interesting, but he doesn’t yet connect all the dots. CHS thinks big money managers can make ‘the play’, that they can fool the rest of the market and unleash a tsunami that will bury the bulls.

I don’t think so. I think what goes on is that the Wall Street banks, many times bigger than the biggest money managers, see their revenues plunge. As they knew they would, because free money and ultra low rates are not some infinite source of income, since other market participants adapt their tactics to those things as well.

Which is what Charles Hugh Smith points to, but doesn’t fully exploit. And it’s not as Wolf Richter presumes either:

After years of using its scorched-earth monetary policies to engineer the greatest wealth transfer of all times, the Fed seems to be fretting about getting blamed for yet another implosion of the very asset bubbles these policies have purposefully created.

The Fed doesn’t fret. The Fed has known for years that the US economy is dead on arrival. They’ve spent trillions of dollars backed, in the end, by American taxpayers, knowing full well that it would have no effect other than to fool people into believing something else than what reality says loud and clear.

Philip Van Doorn, who I quoted two weeks ago, got quite a bit closer in Big US Banks Prepare To Make Even More Money

For most banks, the extended period of low interest rates has become quite a drag on earnings. Net interest margins – the spread between the average yield on loans and investments and the average cost for deposits and borrowings – are still being squeezed, since banks realized the bulk of the benefit of very low interest rates years ago …

That is the essence, and that is why grandma will announce higher rates, against a backdrop of 4% GDP growth numbers and a plethora of other ‘great’ economic data and military chest thumping abroad.

The US economy is dead. The Fed has known this for a long time, but pumped it up to where it is now to draw in all the greater fools, the so-called big investors who have made money like honey from QE and ZIRP. They are the greater fools. The American real economy ceased being a consideration long ago.

We’re in for big surprises, and they won’t be pretty, they’ll be pretty nasty. There are far too many people who think of themselves as smart who don’t see the difference between a theater play and a reality show. And I don’t mean CHS or Wolf, they’re much more clever than your average investment advisor.

The Fed will raise rates because that will make the biggest banks the most money. There’s nothing else that matters. The Fed can’t revive the US economy, that’s just a foolish notion. But it can suck a lot of wealth out of it.

• America, Your Days As A Global Superpower Are Numbered (Telegraph)

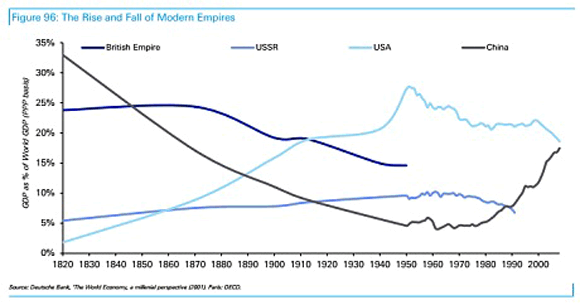

They say what goes up must come down. It’s been true of every global superpower throughout history, and now it’s coming to America. Within the next five years, China could account for a larger share of global GDP than any other country and knock the US off its perch as the world’s biggest economy, according to analysts at Deutsche Bank. “Based on current trends China’s economy will overtake America’s in purchasing power terms within the next few years,” Tim Reid of Deutsche Bank wrote in a research note. “Given this analysis it strikes us that today we are in the midst of an extremely rare historical event – the relative decline of a world superpower.”

The US’ economic prowess has been waning since the 1950s, but the downturn has sharpened over the last 15-or-so years. Part of this is due to internal political and economic issues in the US. Political polarization in the US is at its highest level in decades, economic confidence is drooping and most Americans are no longer in favour of international military intervention – once one of the pillars of American freedom and might. As Reid points out, America’s share of world output, on a purchasing power parity basis, has already slipped below 20pc, which has historically been the marker of a global superpower, from the Roman to the British empires.

But this is not just the story of America’s decline. China is on the way up – and could account for more of global GDP than the US by 2018, according to the IMF’s World Economic Outlook index. Another report, released earlier this week, said that China’s nominal GDP will overtake that of the US by 2024, buoyed by a three-fold increase in consumer spending. “China has begun to return to the position in the global economy it occupied for millenia before the industrial revolution,” Reid wrote, adding that China is on its way to overcoming the “centuries-long economic underperformance” that has held it back until recently.

Beggar thy neighbor.

• US Dollar Heads For Best Run In 17 Years (Reuters)

– The U.S. dollar headed for its ninth straight week of gains on Friday, some measure of how the economic fortunes of the United States and its major economic peers are diverging after six years of financial turmoil. Benchmark 10-year U.S. Treasury yields rose to their highest in over a month, while European stocks shrugged off weakness in Asia to inch higher. A broad rise for the greenback was the main bet of most major investment houses this year but it has taken a very long run of relatively good U.S. numbers and a surge in concern over European and Japanese growth for the currency to deliver. Investors are convinced a Federal Reserve meeting next Wednesday will rubberstamp a shift towards higher interest rates next year suggested by a study by researchers from the U.S. central bank this week.

A 2% rise on the week in response took the U.S. currency to a six-year high of 107.39 yen on Friday. Against the euro it gained 0.2% on the week at 1.2921, broadly flat on the day. EUR= “The dollar generally remains firm but the dollar index has started to show some hesitation,” Swedish bank SEB said in a note to clients on Friday. The dollar index, a measure of the greenback’s value against a basket of six major currencies, remained on course for its longest streak of weekly gains since the first quarter of 1997. A range of political shocks to the system, from turmoil in the Middle East to fighting in Ukraine and a referendum on Scottish independence, have added to the backing for the dollar against a range of emerging and developed world currencies. But the euro, hammered by worsening economic numbers and further easing of monetary policy by the European Central Bank in the past month, has begun to find some support in the last few days.

No! How is that possible?

• American Credit Card Debt Hits Post-Recession High (MarketWatch)

Americans added $28.2 billion to their credit cards in the second quarter of 2014, the largest amount in the last six years and nearly 200% more than in the second quarter of 2009, when the economy emerged from the depths of the Great Recession, according to new research from personal finance website CardHub.com. After paying off $32.5 billion owed during the first quarter of 2014, consumers ran up roughly 86% more debt during the following quarter. The average household’s credit-card balance now stands at $6,802, up slightly from $6,628 in the first quarter, but still down from $8,431 at the end of 2008.

By the end of the year, this figure is expected to exceed $7,000, reaching levels not seen since the end of 2010. U.S. consumers will be roughly $1,300 away from the credit card debt “tipping point,” where minimum payments become unsustainable and delinquencies skyrocket, the report says. Experts say that consumer spending accounts for more than two-thirds of U.S. economic output, and credit-card spending in particular shows that people are feeling more confident about their job security and the economic recovery. Earlier this week, the U.S. Federal Reserve said that outstanding revolving credit, which is mostly made up by credit-card debt, increased by 7.4% in July to $880.54 billion, and has been gradually rising since falling to $840 billion in 2010.

Cute.

• Apple May Now Be Regulated As A Financial Institution (MarketWatch)

Did Apple just inadvertently take on a new financial regulatory burden with the rollout of Apple Pay? That’s the question pondered by Georgetown law professor Adam Levitin in a Credit Slips blog post that’s well worth a read. Levitin, whose specialties include financial regulation, suspects the answer is yes:

I think Apple may have just become a regulated financial institution, unwittingly. Basically, I think Apple is now a “service provider” for purposes of the Consumer Financial Protection Act, which means Apple is subject to CFPB examination and UDAAP.

The CFPB is the Consumer Financial Protection Bureau. UDAAP stands for “unfair, deceptive or abusive acts and practices,” regulatory provisions described as the “most dangerous weapon in the CFPB’s arsenal.” Apple didn’t respond to requests for comment. In an emailed response, a CFPB spokesperson said the agency will continue to closely monitor developments in mobile-payments technology in order to identify any consumer-protection issues. “The bureau’s role is not to choose market winners and losers, but to protect consumers and to make sure that companies offering consumer financial products or services play by the same rules. By and large, those rules are technologically neutral. Rules that apply to plastic card payments generally also apply to payments with a phone. For example, disclosures must be clear, consumers must be protected from unauthorized transactions, and conduct towards consumers must not be unfair, deceptive, or abusive,” the agency said.

??

• Spain Heads For Autumn Of Trouble, Buys €1 Million In Riot Gear (Guardian)

The Spanish government is readying itself for an autumn of discontent, spending nearly €1m on riot gear for police units as disparate protest groups prepare a string of demonstrations. Since June, the interior ministry has tendered four contracts to purchase riot equipment ranging from shields to stab vests. The ministry also finalised its purchase of a new truck-mounted water cannon, an anti-riot measure used during Spain’s dictatorship and the transition to democracy but little seen in recent years. Despite attempts by opposition Socialist politician Antonio Trevín to paint the purchase as “a return to times that we would rather forget”, the ministry said in its tender that the water cannon was necessary, “given the current social dynamic”. The government’s spending spree comes as groups across Spain are predicting a season of protests. “We’re calling it the autumn of confronting power and institutions,” said the activist group Coordinadora 25-S which has its roots in the indignados movement.

Rallies are being planned to counter draft laws by the governing People’s party that would curtail access to abortion in Spain or see unauthorised protests levied fines of up to €600,000. Months after former King Juan Carlos abdicated the throne in favour of his son King Felipe VI, protests are also being planned to demand a referendum on the monarchy. In Catalonia, the push continues for a vote on independence, while the Canary Islands has said it wants to put the idea of oil exploration in the waters around the region to a referendum. Amnesty International in Spain said the purchase of riot gear was a worrying development. “They say they buy this material to control disturbances, but how exactly will it be used?” said Amnesty’s Ángel Gonzalo. “In Greece we have documented how these water cannons, when used a short distance, can provoke severe injuries and commotions.”

They mean business.

• Up To 2 Million Catalans March For Independence (RT)

Hundreds of thousands of Catalans have flooded the streets of Barcelona in the region’s national day to demand the right to vote on independence from Spain. The demonstrators have formed a big V in red and yellow, symbolizing “vote.” People who wanted to make their voices heard, were wearing red and yellow, the traditional Catalonian colors during La Diada, the Catalan National Day. Almost half a million Catalans have signed up to form a “V for vote,” a show of support for the right to decide on their independence from Spain. “It would be the people’s triumph if we were allowed to vote. If we live in a democracy we should be allowed to vote,” Montserrat, a 58-year-old homemaker, told Reuters.

Local leaders believe that the region is politically, economically and socially better on its own. “We think that we could administer our own resources. We could do it better with much more proximity to the people and also we would have a better chance of meeting our needs,” Alfred Bosch, a Spanish MP from the Catalonia Republican left party told RT. “So especially in times of crisis when we feel the pinch of the economy and people are really feeling a pinch of this crisis,” he added. On Wednesday, Artur Mas, first minister of the relatively prosperous region in Spain’s northeast, said that it was “practically impossible” to stop Catalonia from voting. “If the Catalan population wants to vote on its future, it’s practically impossible to stop that forever,” Mas told AFP. Spanish authorities, however, are opposing the independence referendum, saying that the referendum is illegal since the Constitution does not provide such an option initiated by a region, and needs to be blocked.

So?

• Pound Seen Tumbling Up to 10% on Scottish Yes Vote (Bloomberg)

The pound, already suffering its worst month in more than a year, has the potential to tumble 10% should the Scots vote for independence from the U.K., according to economists surveyed by Bloomberg. A victory by Scottish First Minister Alex Salmond’s Yes campaign would mean a 5% to 10% slide versus the dollar within a month, said 61% of the 31 respondents polled by Bloomberg Sept. 5-11. Sterling is already down 5.6% from a five-year high in July, and touched its lowest level in 10 months this week as momentum for the separatists increased.

“The question is if it’s one bad day or if it just continues and continues as people take fright,” Alan Clarke, an economist at Bank of Nova Scotia’s Scotiabank unit in London, who took part in Bloomberg’s survey, said yesterday by phone. The pound may weaken to about $1.55 the day after a Yes vote, he said. The currency traded at $1.6241 at 7:39 a.m. in New York. The result of the Sept. 18 vote is on a knife edge, with an ICM Research Ltd. poll on the Guardian website today putting support for the Yes campaign at 49%, versus 51% for those wanting to keep the 307-year-old union. That followed a poll for Glasgow’s Daily Record newspaper two days ago putting support for the separatists at 47% versus 53% for No. Firms from Standard Life to Royal Bank of Scotland have announced plans to move operations south of the border if Salmond wins the campaign.

Blah blah.

• Scottish Referendum Yes Vote Threatens Market Turmoil, Warns IMF (Guardian)

The International Monetary Fund has warned that a yes vote in next week’s Scottish independence referendum could result in financial market turmoil. A vote for independence would create “uncertainty” while a number of “complicated issues” were being thrashed out, in particular over which currency an independent Scotland would use, the Washington-based organisation said. The long-term impact on the economy would be determined by the outcome of the detailed negotiations carried out in the aftermath of the referendum, which is less than a week away. The IMF deputy spokesman, William Murray, said at a press briefing on Thursday evening: “A yes vote would raise a number of important and complicated issues that would have to be negotiated. The main immediate effect is likely to be uncertainty over the transition to potentially new and different monetary, financial, and fiscal frameworks in Scotland.

“While this uncertainty could lead to negative market reactions in the short-term, longer-term effects would depend on the decisions being made during the transition. And I would not want to speculate on this.” The warning came as a new YouGov poll showed support for separation weakening by three%age points. The latest poll for the Times and the Sun found that support for remaining in the UK has risen to 52%, leaving support for a yes vote four points behind at 48%, excluding don’t knows. A YouGov poll last week showed the yes vote leading for the first time, taking a two-point lead over no by 51% to 49%, sending shockwaves through the no campaign and causing delight among yes campaigners. That poll led to a fall in the value of the pound, and to more than £2bn being temporarily wiped off the value of leading Scottish companies. It also forced David Cameron, Ed Miliband and Nick Clegg to abandon prime minister’s questions and head to Scotland for a day of campaigning to shore up the no vote.

Can’t wait for the response.

• EU Imposes Further Russia Sanctions (Guardian)

Some of Russia’s best-known companies, including arms-maker Kalashnikov and energy firms Rosneft and Gazprom, have been targeted in the latest round of EU sanctions over the Ukraine crisis. Under the sanctions, published on Friday in the EU’s official journal, Rosneft, Transneft and Gazprom Neft will be prevented from raising long-term debt on European capital markets. There are also travel bans and asset freezes against leading members of Vladimir Putin’s inner circle, including the businessman Sergei Chemezov, chairman of defence and industrial group Rostec and a close associate of Putin from his KGB days in East Germany. Others targeted are Igor Lebedev, deputy speaker of the Russian lower house of parliament, and Vladimir Zhirinovsky, an outspoken nationalist politician, as well as a number of leaders of pro-Russia separatists in eastern Ukraine.

The US is understood to be planning to limit access to Russian banks, including Sberbank, later on Friday as part of a concerted western effort to penalise what it sees as Russian attempts to destablise Ukraine by backing pro-Russia separatists with troops and weapons. Last week, Russia and Ukraine agreed to a ceasefire that remains in place despite repeated violations. As part of the agreement, on Friday the Ukrainian government and rebel forces exchanged dozens of prisoners captured during fighting. The transfer took place in early hours outside the main rebel stronghold of Donetsk under the watch of international observers. Ukraine’s president, Petro Poroshenko, said 36 Ukrainian servicemen were released after negotiations. He said a further 21 soldiers were freed the day before. Ukrainian forces handed over 31 pro-Russia rebels detained over the course of the five-month conflict.

• Moscow On Sanctions: ‘EU Unwilling To See Russia’s Efforts On Ukraine’ (RT)

The EU “does not see or is unwilling to see” Russia’s efforts to establish peace in Ukraine, Moscow said in response to the bloc’s new sanctions. Despite Brussels’ “non-constructive” policy, Moscow is committed to helping implement the peace plan. “We are sorry that the European Union has adopted a new round of sanctions. We have repeatedly expressed our discontent with the previously-imposed sanctions and our disagreement with them. We also considered them illegal,” Putin’s spokesperson Dmitry Peskov said. The EU decision “is absolutely beyond understanding and explanation,” Peskov added, especially given Russia’s recent efforts to help stop the bloodshed in Ukraine and peacefully resolve the conflict between Kiev and southeastern regions.

The presidential spokesman stressed that Brussels either fails to see or “is unwilling to see the real situation in Donbass and does not want to get informed about the steps the parties are taking towards settlement.” Moscow regrets that the EU still “prefers talking the language of sanctions,” rather than to “contribute to the peaceful settlement” of the conflict, “not in words but in deeds.” “At the same time, it is impossible not to understand that one way or another, European companies will have to pay for those sanctions as well as taxpayers,” Peskov said. “This is actually happening already.”

Declaration of war.

• Ukraine Vows Return To Union With Crimea (CNBC)

As the European Union announced a fresh wave of sanctions against Moscow, Ukraine’s President Petro Poroshenko vowed Friday to reunite the Russian-held region of Crimea with the rest of the country. The annexation of Crimea, which sparked a diplomatic crisis with the West, will be reversed not by military force, but by an “economic and democratic petition” Poroshenko declared. “We have a significant problem. They said we lost the Crimea. No, we had an invasion in Crimea – but Crimea will be back together with us,” he said, speaking at the 11th Yalta European Strategy (YES) conference in Kiev. Speaking to CNBC, Poroshenko said the key issue for Ukraine is its “independence, sovereignty and territorial integrity” as he called for the total withdrawal of Russian troops from the border.

Viktor Yushchenko, the pro-Western former president of the Ukraine, added that current relations with the Kremlin were in tatters as President Putin refuses to take part in discussions himself. “It is impossible to negotiate with Putin, he is not even participating in the discussions. His puppets are talking instead of him,” he told CNBC through an interpreter at the conference. The EU put new sanctions into effect against Russia on Friday, including restrictions on financing from some Russian state-owned companies and asset freezes on leading Russian politicians. Poroshenko said the sanctions showed Europe’s level of solidarity with Ukraine in the face of confrontation with Russia. “I am proud to be Ukrainian. I feel myself a full member of the European Union family,” he said.

Kiev never says anything that’s true.

• Moscow Mocks Kiev’s ‘Intelligence’ On Killed Russian Troops In Ukraine (RT)

The alleged deaths of “thousands of Russian soldiers” in battles in eastern Ukraine are absolute nonsense, the Russian Defense Ministry said, advising Kiev officials to be more careful when preparing their public speeches based on Ukrainian media reports. “The Russian Military Department considers ‘nonsense’ the statement by Andrey Lysenko, who said, citing data from ‘operational intelligence’ that thousands of Russian troops died on the territory of Ukraine,” the Defense Ministry’s official representative, Igor Konashenkov, said in a statement. Ukrainian National Security and Defense Council spokesman Andrey Lysenko had earlier made a statement claiming that about 2,000 Russian soldiers were killed in Ukraine while at least 8,000 were injured. The Russian ministry points out that the so-called “intelligence” data echoes the statements of the alleged human rights activist, Elena Vasileva, who shared those unsubstantiated figures with the Ukrainian UNIAN news agency over a week ago.

“I’d recommend that Mr. Lysenko be more careful when preparing his public statements and to read the Ukrainian media from time to time,” Konashenkov said, adding that Lysenko apparently gave away one of their undercover intelligence officers. “Now we understand what was behind the September 9 dismissal of the Defense Ministry’s intelligence chief Sergey Grymza who created such a unique ‘agent network’,” Konashenkov added. The same scenario was noticed on numerous occasions, Konashenkov pointed out on a serious note, reminding that unconfirmed or purely fake reports are often turned into “facts” by being repeatedly re-quoted by the media. “Today there’s just one element lacking in this merry-go-round. Namely the publication of this nonsense in one of the leading Western media. But I guess it wouldn’t make us waiting for long,” Konashenkov said.

• China Credit Gauge Misses Estimates as Growth Risks Escalate (Bloomberg)

China’s broadest measure of new credit trailed analyst estimates in August, adding to the government’s challenge to meet its economic-growth target amid a slumping property market and a pullback in manufacturing. Aggregate financing was 957.4 billion yuan ($156 billion), the People’s Bank of China said today in Beijing, compared with the 1.135 trillion yuan median estimate of economists surveyed by Bloomberg. New local-currency loans were 702.5 billion yuan, and M2 money supply grew 12.8% from a year earlier. Today’s report adds to evidence the economy is losing steam after July aggregate financing slumped and recent data showed moderation in manufacturing and a drop in imports. Premier Li Keqiang this month said some volatility in growth is inevitable and the government will stick with targeted policies.

“Banks are reluctant to lend because there aren’t enough good projects,” said Dong Tao, chief regional economist for Asia excluding Japan at Credit Suisse Group AG in Hong Kong. “That’s a real headache. Besides political pressure to lend, you have to give the banks a sweeter deal. In the next couple of months, a cut in the reserve-requirement ratio or the loan-deposit ratio is quite likely.” New yuan loans, which measures new lending minus loans repaid, compared with economists’ median estimate of 700 billion yuan and figures of 385.2 billion yuan in July and 712.8 billion yuan a year earlier. The slowdown in M2 growth from 13.5% in July was flagged by Premier Li on Sept. 9. The figure compared with the median estimate of 13.5% in a survey of analysts conducted before his disclosure.

Scary shit.

• Majority In China Expect War With Japan (FT)

China and Japan are heading towards military conflict, according to a majority of Chinese surveyed on ties between the Asian powers in a Sino-Japanese poll. The Genron/China Daily survey found that 53% of Chinese respondents – and 29% of the Japanese polled – expect their nations to go to war. The poll was released ahead of the second anniversary of Japan’s move to nationalise some of the contested Senkaku Islands in the East China Sea. Relations between Japan and China have soured since Japan bought three of the tiny islands – which China claims and calls the Diaoyu – in 2012. Japan defended the move as an effort to thwart a plan by the anti-China governor of Tokyo to buy them, but China accused it of breaching an unwritten deal to keep the status quo. According to the poll, 38% of Japanese think war will be avoided, but that marked a nine point drop from 2013.

It also found that a record 93% of Japanese have an unfavourable view of their Chinese neighbours, while the number of Chinese who view Japanese unfavourably fell 6 points to 87%. Jeff Kingston, a Japan expert at Temple University in Philadelphia, said Japanese tabloid media were driving the already negative sentiment towards China by focusing on its “warmongering”. He added that the government was “amplifying the anxiety” by talking about the threat from China. Sino-Japanese relations started to improve about a year ago, spurring Tokyo to start laying the groundwork for a possible first meeting between Japanese Prime Minister Shinzo Abe and Chinese President Xi Jinping. But ties deteriorated rapidly again after Mr Abe’s visit in December to Yasukuni, a controversial shrine dedicated to Japan’s war dead including a handful of convicted war criminals.

Mr Abe wants to hold a summit with Mr Xi in November on the sidelines of an Apec summit in Beijing but China has shown no sign of interest. Critics say Mr Abe has hurt efforts to repair ties by visiting Yasukuni and also because of the perception that he is an unrepentant ultranationalist. This week two members of Mr Abe’s ruling Liberal Democratic party, including a new cabinet minister, were forced to distance themselves from photographs that showed them posing with the leader of a Japanese neo-Nazi party. “He just replaced the rightwing loonies [in his cabinet] with another group of rightwing loonies,” said Mr Kingston.

More loans! Just what China needs!

• Yuan Loan-Backed Bond Surge Prompts China Risk Warnings (Bloomberg)

Chinese banks are selling notes backed by loans at a record pace as they seek to offset a slump in deposits, prompting credit analysts to warn of the risks of securities that sparked the global financial crisis. Lenders in the world’s second-biggest economy have issued 148.7 billion yuan ($24.2 billion) of collateralized debt obligations this year, almost five times what’s been sold since 2012 when a ban on the securities was lifted, Bloomberg data show. The central bank and finance watchdog both must approve issuance of the securities, which take assets off balance sheets for accounting purposes, allowing lenders to seek more business without breaching regulatory limits. China is experimenting with new types of securities at a time when deposits are dropping at a record pace and soured debt is rising amid a property slump.

Non-performing loans rose to the highest in five years in June as China Construction Bank Corp. to Bank of China Ltd. reported sluggish profit growth. “Because most asset-backed securities investors are banks, securitization doesn’t help lower the lending risks the whole banking system is exposed to,” said Li Ning, a bond analyst in Shanghai at Haitong Securities Co., the nation’s second-biggest brokerage. “The risks one bank issuer faces are simply transferred to the bank investor.” Premier Li Keqiang is seeking to shift financing to official channels after shadow-banking assets jumped 32% in 2013 to 38.8 trillion yuan, according to Barclays Plc estimates. The banking regulator tightened rules on new trust products in April, after failures of such investments sparked protests. Authorities approved the first asset-backed security tradable on the Shanghai stock exchange in June, and in July authorized the first mortgage-backed notes since 2007.

Yes.

• There’s No Fear In The Markets: Time To Worry? (CNBC)

Even by summer’s traditionally low stock volume standards, this year has been very light, culminating in a “dismal” August which has left volumes down year-over-year, according to traders. While the general absence of rollercoaster style moves in stock indexes and hairpin changes in price may cause many investors and companies to breathe a sigh of relief, it does drastically reduce the opportunity for investors to make money from speculating on movements in the market. One area of concern is the stubbornly low levels of the so-called “fear index” – the CBOE’s Volatility Index or VIX – which measures traders’ expectations for future market volatility. As U.S. stock indexes continued to hit new all-time highs in 2014, traders have wondered why the VIX, considered by many to be the world’s best barometer of investor sentiment and market volatility, is down around 6%.

Optimists would say the VIX is rightly at a multi-year low given that the S&P 500 is repeatedly hitting fresh all-time highs. Pessimists contend that a low VIX shows investors have let their guard down, dropping demand for S&P 500 stock-portfolio insurance just when they may need it. Meanwhile, monthly equity and index options, derivatives that allow investors to buy or sell an index like the S&P 500 at an agreed price before a certain date, and act as insurance, hit levels in August this year not seen since 2011. “The VIX is often called the ‘fear index’, and while investors don’t seem to be worried right now, our survey respondents say a little fear may be in order,” said brokerage firm ConvergEx Group in a recent survey of investor sentiment. “We also have a clear picture of how record-low volatility has hurt the sell-side: two-thirds of banks and brokers say the current environment has been bad or very bad for business,” the company added.

Check it out.

• The High Cost of Renewables (Euan Mearns)

We hear a lot about the plummeting cost of renewables and escalating costs of nuclear power. Looking just at capacity installation costs, nuclear comes in at $8000 / kW and wind at around $2000 / kW. But these figures need to be adjusted for load capacity factors (nuclear 0.9, wind 0.17) and for the longevity of the installations (nuclear 50 years, wind 20 years). Applying these adjustments wind works out at 3 times and solar at 10 times the cost of installing nuclear power.

Figures.

• Soldiers From Poor Countries Have Become the World’s Peacekeepers (TIME)

On Aug. 27, rebels from the al-Qaeda-allied al-Nusra Front stormed the Golan Heights border crossing between Syria and Israel, home to one of the oldest U.N. peacekeeping operations. While two contingents of Philippine peacekeepers managed to flee the rebel attack, 45 Fijian troops were captured and taken away by the rebels to parts unknown. The Fijians were finally released on Sept. 11, but the two-week crisis crystallized a persistent yet under-reported fact: while the U.N. calls upon the international community to act in times of crises, it is often soldiers from developing nations who shoulder the stiffest burden. In 1994, on the heels of the Rwandan genocide, the permanent members of the U.N. Security Council (China, Russia, France, the U.K. and the U.S.) provided 20% of all U.N. peacekeeping personnel.

But by 2004, Security Council nations contributed only 5% of U.N. personnel. This July, amid a tumultuous summer of violent conflicts, that figure had dropped to a miserly 4%, while the governments of Pakistan, India, Bangladesh, Fiji, Ethiopia, Rwanda and the Philippines provided a staggering 39% of all U.N. forces. Critics can counter this charge with stats of their own. After all, they say, the permanent members contribute 53% of the U.N.’s annual budget, far outstripping financial contributions made by countries of the global south. But recent years have also seen sluggish rates of payment from wealthier nations — delays that further strain an overburdened system supporting 16 peacekeeping missions around the world.

On balance, the troops contributed by developing countries are more likely to be less well trained, under-supplied and ill equipped for the missions. Delays in financial contributions only complicate the challenges of modern peacekeeping. So does the fractured nature of modern conflicts. Military experts, like General Sir Rupert Smith, have noted the shift from “industrial wars” of the past to today’s “war amongst the people.” Modern conflicts involve combatants whose ends are not merely the control of territory or the monopoly of politics. They wage war with their own rules, without concern for the U.N.’s mission to referee. In response, peacekeeping has been hurriedly ramped up: more comprehensive mandates are issued and troops are cleared to use force in defense of civilians. But in the end, peacekeepers are redundant where there is no peace to keep.