Horacio Coppola Florida y Bartolomé Mitre, Buenos Aires 1936

Will it be labeled ‘The Olympics Crash’?

• Dow Plummets 1032 Points, Down 10% From Record; S&P 500 Drops 3.7% (CNBC)

Stocks fell sharply on Thursday as strong earnings and economic data were not enough to quell jitters on Wall Street about higher interest rates. The Dow Jones industrial average closed 1,032.89 points lower at 23,860.46, entering correction territory. The 30-stock index also closed at its lowest level since Nov. 28. The Dow is also on track to post its biggest weekly decline since October 2008. “This whole correction is really about rates. It’s really about inflation creeping up. It’s really about people thinking the Fed is either behind the curve or actually has to be more aggressive,” Stephanie Link, global asset management managing director at TIAA, told CNBC’s “Closing Bell.” “That fear, that unknown is really what’s driving a lot of the anxiety,” Link said.

This is the third drop for the Dow greater than 500 points in the last five days. Despite the decline Thursday, the average is still a ways from its low for the week hit on Tuesday of 23,778.74. American Express and Intel were the worst-performing stocks in the index, sliding more than 5.4%. J.P. Morgan Chase, meanwhile, was down by more than 4%. The S&P 500 pulled back 3.75% to 2,581, reaching a new low for the week. The index also broke below its 100-day moving average and closed under 2,600, two important thresholds. For the S&P 500, it is its third drop of greater than 2% in the last five days. The Nasdaq composite fell 3.9% to close at 6,777.16 as Facebook, Amazon and Microsoft all fell at least 4.5%.

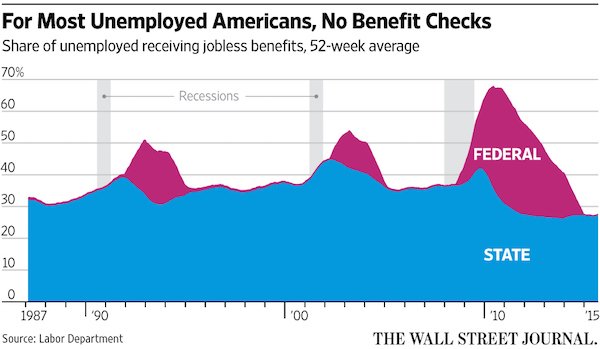

That second chart is scary alright.

• Is The Decades-Long Downtrend In Interest Rates Finally Over? (MW)

The yield on the benchmark 10-year Treasury note has an effect on all parts of the economy, as it influences everything from borrowing costs for the smallest and biggest companies, to rates for fixed and adjustable mortgages, car loans and credit cards. For three decades, one thing everyone could count on was if you were patient enough, rates would eventually be lower. Not anymore. The scariest thing for investors and consumers is often the unknown. But while some market pundits acknowledge that a “new norm” for rates is in the works, it’s not that rates are expected to spike back up to where they were in the 1980s. Besides, some people, such as those living off a fixed income, should actually welcome the new trend.

T[..] Arbeter Investments president Mark Arbeter: From a “very long-term perspective, yields appear to be tracing out a “massive bottom.” If the 10-year yield gets above the 2013 high of 3.04%, a bullish long-term “double bottom” reversal pattern would be completed, opening the door for an eventual rise toward the 4.75% area. A double bottom, according to the CMT Association, the keepers of the Chartered Market Technician certification, is this: “The price forms two distinct lows at roughly the same price level. For a more significant reversal, look for a longer period of time between the two lows.” The two bottoms Arbeter refers to are the 2012 monthly low of 1.47% and the 2016 low of 1.45%. Arbeter noted that while rates may not yet be ready to soar, equity investors may have reason to be worried. When the yield bumped up against the downtrend line before, as happened in 1987, 1990, 1994, 2000 and 2007, bad things happened on Wall Street.

T[..] Frank Cappelleri, CFA, CMT, executive director of institutional equities at Instinet LLC: In the medium term, he believes the bullish “inverted head and shoulders” reversal pattern that has formed over the last few years suggests a return toward the peaks seen in 2008 through 2010.

Rand Paul.

• US Senate Approves Budget Deal, Too Late To Avert Shutdown (R.)

The U.S. Senate approved a budget deal including a stopgap government funding bill early on Friday, but it was too late to prevent a federal shutdown that was already underway in an embarrassing setback for the Republican-controlled Congress. The shutdown, which technically started at midnight, was the second this year under Republican President Donald Trump, who played little role in attempts by party leaders earlier this week to head it off and end months of fiscal squabbling. The U.S. Office of Personnel Management advised millions of federal employees shortly after midnight to check with their agencies about whether they should report to work on Friday.

The Senate’s approval of the budget and stopgap funding package meant it will go next to the House of Representatives, where lawmakers were divided along party lines and passage was uncertain. House Republican leaders on Thursday had offered assurances that the package would be approved, but so did Senate leaders and the critical midnight deadline, when current government funding authority expired, was still missed. The reason for that was a nine-hour, on-again, off-again Senate floor speech by Kentucky Republican Senator Rand Paul, who objected to deficit spending in the bill. The unexpected turn of events dragged the Senate proceedings into the wee hours and underscored the persistent inability of Congress and Trump to deal efficiently with Washington’s most basic fiscal obligations of keeping the government open.

The S&P 500 lost $2.49 trillion, and global markets $5.2 trillion.

• Stock Market Value Wiped Out Equals $2.5 Trillion And Counting… (CNBC)

The U.S. stock market officially fell into correction territory Thursday and now we now the total damage: $2.49 trillion. That’s the market value that has been wiped out from the S&P 500 during its 10% rapid slide from a record on Jan. 26. The total is even bigger for global stock markets with $5.20 trillion gone as they followed the U.S. market’s lead. Both figures are from S&P Dow Jones Indices. Traders are worried the selling isn’t near over after the S&P 500 fell back below its Tuesday low during its 3.8% plunge Thursday. The benchmark is now at its lowest point since last November. The energy, health care, financials, materials and technology sectors are all in correction territory as well, according to S&P Dow Jones. President Donald Trump need not worry yet as the S&P 500 is still up $3.55 trillion since his election in November 2016, according to S&P Dow Jones.

The floor is for Jay Powell. Let’s see some tricks.

• The Stock Market Is In Turmoil And It’s Not Likely To End Anytime Soon (CNBC)

There’s a not-so-quiet rebellion going on in the bond market, and it threatens to take 10-year yields above 3% much faster than expected just a few weeks ago. As a result, the bumpy ride for stocks could continue for a while. There are some powerful forces at work, with global growth strong, central banks moving to tighten policy and the government’s deficit spending creating more and more Treasury supply. So, the bond market has entered a zone of no return for now, where Treasurys are expected to price in higher yields in a global sea change for bonds. Thursday’s sharp sell-off in stocks, with the S&P 500 closing down 3.8% , reversed a sharp move higher in bond yields, as buyers sought safety. The 10-year yield was at 2.81% from a high of 2.88% earlier in the day and the rising yields had started the stock market spiral lower.

“There’s going to be an interplay, a bit of push and pull between the rates market and equity market,” said Mark Cabana at Bank of America Merrill Lynch. Cabana said his call for a 2.90% 10-year this year is clearly at risk. He said technicians are watching 2.98%, and then 3.28% on the charts. The bipartisan spending bill, expected to pass Congress, called for a higher-than-expected spending cap of $300 billion. Cabana said it was encouraging in that the deal was bipartisan and that means the debt ceiling won’t be an issue. But it also had a negative impact on the bond market and resulted in forecasts of more Treasury supply and higher $1 trillion deficits. “It signals that fiscal austerity out of D.C. is a thing of the past, and Republicans aren’t nearly as concerned with the overall trajectory of the deficit as they have been and the president is worried about it,” he said.

The 10-year Treasury is the one to watch, and while many strategists targeted rates under 3% for this year, they acknowledge the risk is to the upside with yields potentially climbing to 3.25%. The 10-year is the benchmark best known to investors, and its yield influences a whole range of loans, including home mortgages. Strategists say the level of the yield is not so much the problem. Rather, it’s the rapidity of the move that has proven unnerving for global stock markets.”We’re in a vicious cycle here. If the yields go up, you have to sell stocks. If you sell stocks, and they crash, yields come back down,” said Art Hogan at B. Riley FBR.

True, but ironically, they profited most from the experiment as well.

• Stock, Bond Investors Pay For Fed’s Dangerous Experiment (Katsenelson)

In a capitalist economy, the invisible hand serves a very important but underappreciated role: It is a signaling mechanism that helps balance supply and demand. High demand leads to higher prices, telegraphing suppliers that they’ll make more money if they produce extra goods. Additional supply lowers prices, bringing them to a new equilibrium. This is how prices are set for millions of goods globally on a daily basis in free-market economies. In the command-and-control economy of the Soviet Union, the prices of goods often had little to do with supply and demand but were instead typically used as a political tool. This in part is why the Soviet economy failed — to make good decisions you need good data, and if price carries no data, it is hard to make good business decisions. When I left Soviet Russia in 1991, I thought I would never see a command-and-control economy again. I was wrong.

Over the past decade the global economy has started to resemble one, as well-meaning economists running central banks have been setting the price for the most important commodity in the world: money. Interest rates are the price of money, and the daily decisions of billions of people and their corporations and governments should determine them. Like the price of sugar in Soviet Russia, interest rates today have little to do with supply and demand (and thus have zero signaling value). For instance, if the Federal Reserve hadn’t bought more than $2 trillion of U.S. debt by late 2014, when U.S. government debt crossed the $17 trillion mark, interest rates might have started to go up and our budget deficit would have increased and forced politicians to cut government spending. But the opposite has happened: As our debt pile has grown, the government’s cost of borrowing has declined.

The consequences of well-meaning (but not all-knowing) economists setting the cost of money are widespread, from the inflation of asset prices to encouraging companies to spend on projects they shouldn’t. But we really don’t know the second-, third-, and fourth derivatives of the consequences that command-control interest rates will bring. We know that most likely every market participant was forced to take on more risk in recent years, but we don’t know how much more because we don’t know the price of money. Quantitative easing: These two seemingly harmless words have mutated the DNA of the global economy. Interest rates heavily influence currency exchange rates. Anticipation of QE by the European Union caused the price of the Swiss franc to jump 15% in one day in January 2015, and the Swiss economy has been crippled ever since.

Americans have a healthy distrust of their politicians. We expect our politicians to be corrupt. We don’t worship our leaders (only the dead ones). The U.S. Constitution is full of checks and balances to make sure that when (often not if) the opium of power goes to a politician’s head, the damage he or she can do to society is limited. Unfortunately, we don’t share the same distrust for economists and central bankers. It’s hard to say exactly why. Maybe we are in awe of their Ph.D.s. Or maybe it’s because they sound really smart and at the same time make us feel dumber than a toaster when they use big terms like “aggregate demand.” For whatever reason, we think they possess foresight and the powers of Marvel superheroes.

Got to love the creativity: “..the current market downturn appears to be technical in nature..”

• Hong Kong And Mainland China Shares Tank In Global Rout (CNBC)

The global market rout continued into Asia as Hong Kong and China shares fell sharply Friday after the U.S. stock market tanked overnight. The Hang Seng Index was down about 3.8% at 29,306.63 at 11.08 a.m. HK/SIN while the Shanghai composite was down 4.5% at 3,114.0472. Despite the sell-off, equities may just be in their “first leg of correction,” said William Ma, chief investment officer of Noah Holdings in Hong Kong. Even though the mainland market is not fully connected to the global market, fund managers on the mainland are talking about the global economy “half the time,” underscoring the international nature of markets that is causing a “synchronized collapse” in both Hong Kong and China, Ma told CNBC. With everything happening, it’s still too early to jump into the market for bargains, he said.

Ma recommends waiting for the Hang Seng Index to tank another 15% before putting money into the Chinese tech giant trio Baidu, Alibaba and Tencent — collectively known as BAT. Even amid the sharp slide, some experts recommended calm. One, Philip Li, senior fund manager at Value Partners, said the current market downturn appears to be technical in nature. Asia will be under pressure as long as its markets are correlated to the Dow, but earnings expectations for companies and the growth outlooks for regional economies are solid, so the current rout appears divorced from any fundamentals, Li added. The Chinese markets were already under pressure even before this week’s market sell-off as investors took profit ahead of the long Lunar New Year public holidays that start later next week.

China’s small banks have -interbank- liquidity issues. Can’t have that with Lunar New Year coming up.

• PBOC Releases Nearly 2 Trillion Yuan In Temporary Liquidity (R.)

China’s central bank said on Friday that it has released temporary liquidity worth almost 2 trillion yuan ($316.28 billion) to satisfy cash demand before the long Lunar New Year holidays. The People’s Bank of China had announced in December that it would allow some commercial banks to temporarily keep less required reserves to help them cope with the heavy demand for cash ahead of the festivities, which begin later next week. Interbank liquidity levels will remain reasonably stable, the PBOC said on its official microblog.

Yeah, because who needs big government, right?

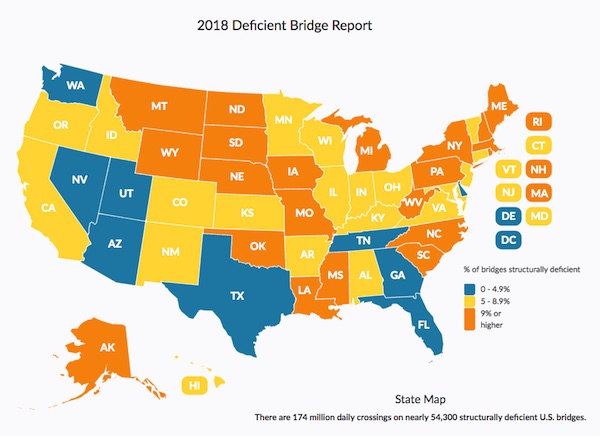

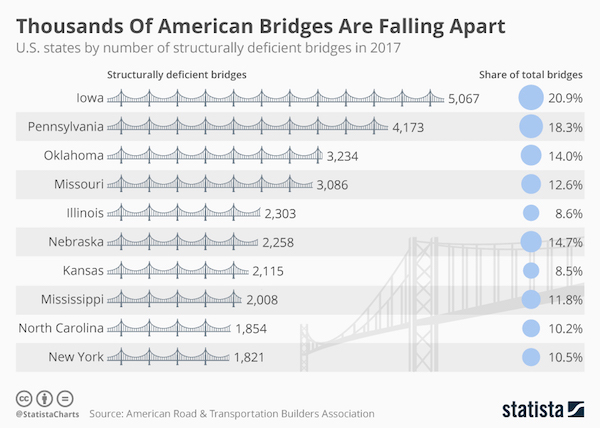

• 50,000 American Bridges Are “Structurally Deficient” (ZH)

Last week, President Trump announced his proposal for a $1.5 trillion infrastructure program in his State of The Union address to the American people. He failed to mention that over the next decade, the federal government would provide very little money whatsoever for America’s crumbling bridges, rails, roads, and waterways. In fact, Trump’s plan counts on state and local governments working in tandem with private investors to fork up the cash for projects. In overhauling the nation’s crumbling infrastructure, the federal government is only willing to pledge $200 billion in federal money over the next decade, leaving the remainder of $1.3 trillion for cities, states, and private companies.

Precisely how Trump’s infrastructure program would work remains somewhat of a mystery after his Tuesday night speech, as state transportation officials warned that significant hikes to taxes, fees, and tolls would be required by local governments to fund such projects. To get an understanding of the severity of America’s crumbling infrastructure. The American Road & Transportation Builders Association (ARTBA) has recently published a shocking report specifying more than 50,000 bridges across the country are rated “structurally deficient. Here are the highlights from the report: • 54,259 of the nation’s 612,677 bridges are rated “structurally deficient.” • Americans cross these deficient bridges 174 million times daily. • Average age of a structurally deficient bridge is 67 years, compared to 40 years for non-deficient bridges. • One in three (226,837) U.S. bridges have identified repair needs. • One in three (17,726) Interstate highway bridges have identified repair needs.

Dr. Alison Premo Black, chief economist for the American Road & Transportation Builders Association (ARTBA), who conducted the analysis, said, “the pace of improving the nation’s inventory of structurally deficient bridges slowed this past year. It’s down only two-tenths of a% from the number reported in the government’s 2016 data. At current pace of repair or replacement, it would take 37 years to remedy all of them. ” Black says, “An infrastructure package aimed at modernizing the Interstate System would have both short- and long-term positive effects on the U.S. economy.” She adds that traffic jams cost the trucking industry $60 billion in 2017 in lost productivity and fuel, which “increases the cost of everything we make, buy or export.”

Other key findings in the ARTBA report: Iowa (5,067), Pennsylvania (4,173), Oklahoma (3,234), Missouri (3,086), Illinois (2,303), Nebraska (2,258), Kansas (2,115), Mississippi (2,008), North Carolina (1,854) and New York (1,834) have the most structurally deficient bridges. The District of Columbia (8), Nevada (31), Delaware (39), Hawaii (66) and Utah (87) have the least. At least 15% of the bridges in six states – Rhode Island (23%), Iowa (21%), West Virginia (19%), South Dakota (19%), Pennsylvania (18%) and Nebraska (15%)—fall in the structurally deficient category. As Staista’s Niall McCarthy notes, U.S. drivers cross those bridges 174 million times a day and on average, a structurally deficient bridge is 67 years old.

More currency wars?!

• Bank Of England Signals An Interest Rate Hike Is Coming (G.)

The Bank of England has signalled that an interest rate hike is coming from as early as May and that there are more to come, as the economy accelerates with help from booming global growth. Threadneedle Street said it would need to raise rates to tackle stubbornly high inflation “somewhat earlier and by a somewhat greater extent” than it had anticipated towards the end of last year. While the Bank’s rate-setting monetary policy committee (MPC) voted unanimously to leave rates at 0.50% this month, the tone of its discussion suggests the cost of borrowing will not remain this low for much longer. The Bank’s governor, Mark Carney, had previously suggested there could be two further rate hikes to curb inflation over the next three years – but speculation will now mount over the chance of additional rate hikes.

The pound rose on foreign exchanges following the interest rate decision, hitting almost £1.40 against the dollar. City investors give a 75% chance of a rate hike in May, after having previously given a 50-50 probability. The FTSE 100 sold off sharply, falling by more than 108.7 points to below 7,200, amid a global stock market rout triggered by concerns among investors that central banks will need to raise interest rates faster than expected to curb rising inflation. On Wall Street, the Dow Jones Industrial Average was down more than 400 points by lunchtime. Threadneedle Street said inflation would fall more gradually than it had previously anticipated, because workers’ pay is slowly beginning to pick-up and as the oil prices is rising. “The outlook for growth and inflation [is] likely to require some ongoing withdrawal of monetary stimulus,” the MPC said.

Land must belong to communities, societies. Who may lease it to individuals and firms for a good fee, but never sell it. You don’t sell seas and oceans either.

• The Biggest Privatisation You’ve Never Heard Of: Land (G.)

Over the past 12 months, the issue of privatisation has surged back into the news and the public consciousness in Britain. Driven by mounting concerns about profiteering and mismanagement at privatised enterprises, Jeremy Corbyn’s Labour party has made the renationalisation of key utilities and the railways a central plank of its agenda for a future Labour administration. And then, of course, there is Carillion, a stark, rotting symbol of everything that has gone wrong with the privatisation of local public services, and which has prompted Corbyn’s recent call for a rebirth of municipal socialism. Yet in all the proliferating discussion about the rights and wrongs of the history of privatisation in Britain – both from those determined to row back against the neoliberal tide and those convinced that renationalisation is the wrong answer – Britain’s biggest privatisation of all never merits a mention.

This is partly because so few people are aware that it has even taken place, and partly because it has never been properly studied. What is this mega-privatisation? The privatisation of land. Some activists have hinted at it. Last October, for instance, the New Economics Foundation (NEF), a progressive thinktank, called in this newspaper for the government to stop selling public land. But the NEF’s is solely a present-day story, picturing land privatisation as a new phenomenon. It gives no sense of the fact that this has been occurring on a massive scale for fully 39 years, since the day that Margaret Thatcher entered Downing Street. During that period, all types of public land have been targeted, held by local and central government alike.

And while disposals have generally been heaviest under Tory and Tory-led administrations, they definitely did not abate under New Labour; indeed the NHS estate, in particular, was ravaged during the Blair years. All told, around 2 million hectares of public land have been privatised during the past four decades. This amounts to an eye-watering 10% of the entire British land mass, and about half of all the land that was owned by public bodies when Thatcher assumed power.

The mess gets messier.

• Northern Ireland Will Stay In Single Market After Brexit – EU (G.)

UK negotiators have been warned that the EU draft withdrawal agreement will stipulate that Northern Ireland will, in effect, remain in the customs union and single market after Brexit to avoid a hard border. The uncompromising legal language of the draft agreement is likely to provoke a major row, something all parties to the negotiations have been trying to avoid. British officials negotiating in Brussels were told by their counterparts that there could be a “sunset clause” included in the legally binding text, which is due to be published in around two weeks. Such a legal device would make the text null and void at a future date should an unexpectedly generous free trade deal, or a hitherto unimagined technological solution emerge that could be as effective as the status quo in avoiding the need for border infrastructure.

As it stands, however, the UK is expected by Brussels to sign off on the text which will see Northern Ireland remain under EU law at the end of the 21-month transition period, wherever it is relevant to the north-south economy, and the requirements of the Good Friday agreement. The move is widely expected to cause ructions within both the Conservative party and between the government and the Democratic Unionist party, whose 10 MPs give Theresa May her working majority in the House of Commons. The UK will be put under even greater pressure to offer up a vision of the future relationship that will deliver for the entire UK economy, but the inability of that model to ensure frictionless trade is likely to be exposed. A meeting of the cabinet to discuss the Irish border on Wednesday failed to come to any significant conclusions.

“There will be no wriggle room for the UK government,” said Philippe Lambert MEP, the leader of the Greens in the European parliament, who was briefed in Strasbourg earlier this week by the EU’s chief negotiator, Michel Barnier. “We are going to state exactly what we mean by regulatory alignment in the legal text. It will be very clear. This might cause some problems in the UK – but we didn’t create this mess.”

This is the Big Trap now. No debt relief unless and until strong growth. As even the IMF has said strong growth depends on debt relief first.

• EU’s Moscovici ‘Especially Optimistic’ On Greek Debt Relief (R.)

European Commissioner for Economic and Financial Affairs Pierre Moscovici said on Thursday he was “especially optimistic” about efforts to reach a solution on Greek debt relief. Greece’s third bailout ends in August and debt relief is expected to come up in negotiations over its bailout exit terms in the coming months. Athens and its eurozone lenders are expected to flesh out a French-proposed mechanism that was presented in June and which will link debt relief to Greek growth rates. The economy is forecast to grow by up to 2.5% this year and in 2019.

“On the issue of debt relief I am especially optimistic and I believe that our efforts will be implemented and they will be successful,” Moscovici said, through an interpreter, at a meeting with Greek President Prokopis Pavlopoulos. Greek public debt is forecast at 180% of GDP this year. Greece has received a record 260 billion euros in three bailouts since 2010. Moscovici, who is in Greece for talks on the next steps in the program, said it was up to Athens to devise a strategy for exiting its bailout and the post-bailout surveillance period. “The exit from the bailout is becoming apparent and under very good circumstances,” Moscovici said.

A great big swirling black hole.

• Greek Pensions Keep Getting Smaller (K.)

One in three pensioners has to live on less than 500 euros a month at a time when pensions in Greece have been constantly falling, according to the Helios online data system’s monthly reports. The Labor Ministry platform showed that the average income of Greek retirees amounts to 894 euros per month: The average main pension from all social security funds comes to 722 euros a month while the average auxiliary pension amounts to just 171 euros a month. The average dividend from the funds comes to 98 euros. More than two in three pensioners (66.39%) are on less than 1,000 euros a month, and 31.03% of pensions do not exceed 500 euros. In December the number of pensioners fell by 3,311 from November to 2,586,480. Compared to October’s 2,592,950, that’s a reduction of 6,470 pensioners.

Monthly expenditure on pensions decreased by 1.44 million euros from November and by 4.07 million from October. In total, 117,148 people were issued with new and definitive main and auxiliary pensions as well as dividends in 2017. As the year drew to a close, more and more new pensions issued were calculated according to the law introduced in 2016, meaning that the benefits handed out were considerably smaller. Therefore, while the average new pension for retirees who paid into the former Social Security Foundation (IKA) amounted to 640.66 euros in January 2017, this dropped to just 521.01 euros in December. Even the average IKA pension for those for whom it was first issued before May 2016 shrank considerably over the year, dropping to 618 euros per month.

Notably, more than a quarter of pensioners (26.32%) are under 65, while the distribution of retirees per age and pension category shows that the younger a person retires, the higher a pension they will receive. Meanwhile the Hellenic Statistical Authority (ELSTAT) announced on Thursday that the unemployment figures for last November showed no improvement from October, staying put at 20.9%. In November 2016 the jobless rate came to an upwardly revised 23.3%.

Italians have had enough. Elections March 4. This will be the main theme.

• Italy Accused Of Subjecting 10,000 Refugees To ‘Deplorable’ Conditions (Ind.)

Ten thousand migrants are living in “deplorable” conditions in Italy without shelter, food and clean water, Médecins Sans Frontières (MSF) has warned in a damning indictment of the country’s border practices. “Inadequate” reception policies are forcing refugees into slums, squats and abandoned buildings with limited access to basic services, the charity said. Increasing marginalisation of asylum seekers and a growing prevalence of forced evictions has led to small groups of migrants living in increasingly hidden places, the charity found, exposing them to “inhumane” living conditions. The findings, released as part of the second edition of the charity’s Out of Sight report, reveal the torturous reality facing huge swathes of Italy’s migrant population. But the survey shows Italians are increasingly uneasy over the numbers of refugees that have reached their country’s shores by boat over the past four years.

The report’s release coincides with a spike in anti-immigration rhetoric ahead of the 4 March parliamentary elections. On Saturday, a far-right extremist was arrested on suspicion of shooting six Africans in a racially motivated attack in Macerata. Days later, Silvio Berlusconi, the former Prime Minister whose Forza Italia (Go Italy!) party has entered a coalition with the Northern League and the smaller Brothers of Italy, promised to deport 600,000 migrants if their coalition came to power. “These 600,000 people, we will pick them up using police, law enforcement and the military… everyone can help identify them by pointing them out, and they will be picked up,” he said, claiming immigration was a “social bomb” linked to crime. Northern League leader Matteo Salvini also promised “irregular” migrants would be rounded up and sent home “in 15 minutes” if he and his allies take power.