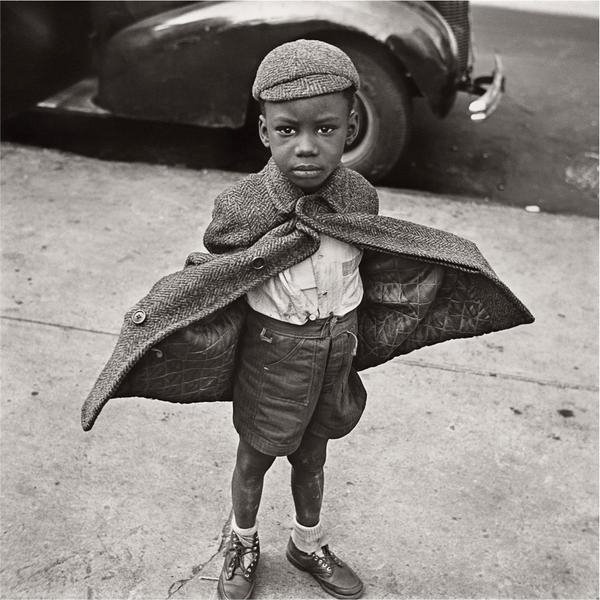

William Henry Jackson Camp wagon on a Texas roundup 1901

It’s blame game time. We have plenty theories to keep you occupied with while sitting at home. I’m surprised at how many people can’t seem to face the day without such a theory. Which is fine, but at least come with evidence.

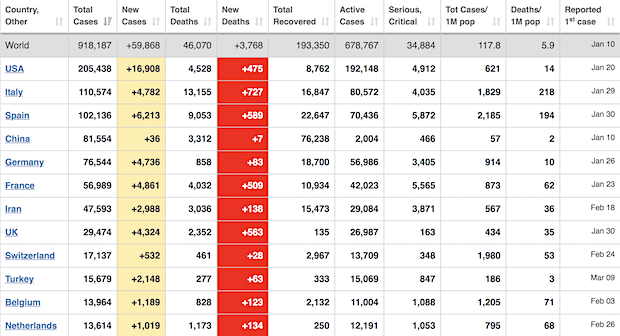

In other news: We’ll pass 1 million cases today.

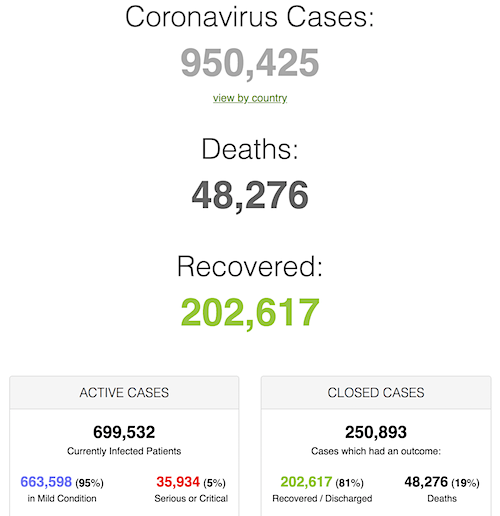

• Cases 950,425 (+ 77,548 from yesterday’s 872,777)

• Deaths 48,276 (+ 5,005 from yesterday’s 43,271)

From Worldometer yesterday evening -before their day’s close-.

From Worldometer -NOTE: mortality rate for closed cases is at 19% –

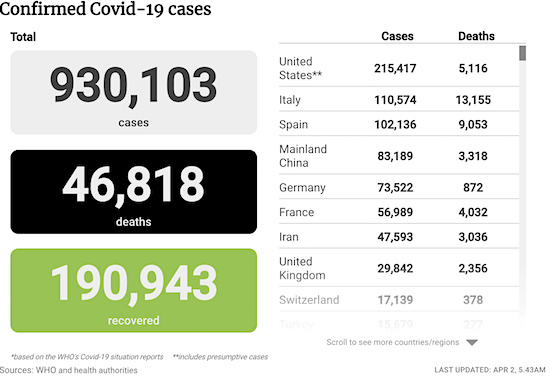

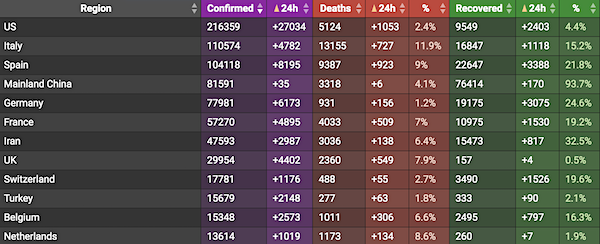

From SCMP:

From COVID2019Live.info:

I guess NYC thinks their heroes are all Marvel characters who A) don’t die and B) come in droves

• More Than 1,000 New York City Police Officers Have The Coronavirus (CNBC)

More than 1,000 New York City police officers have contracted COVID-19 as emergency calls in the city hit record highs. Of the New York Police Department’s more than 36,000 employees 1,048 officers and 145 civilian employees have tested positive for COVID-19 as of Tuesday, NYPD said in a statement. The department added that 5,657 uniformed officers, or more than 15% of the force, called out sick on Tuesday. “I am worried about essential workers getting scared and not wanting to show up,” New York Gov. Andrew Cuomo said Tuesday. “That I am worried about. You know the number of police officers who are getting sick is going up.”

Officials from the Fire Department of New York told NBC News on Tuesday that 282 members, including firefighters, EMTs and civilians, have tested positive for COVID-19. At the same time, 911 call volume is hitting record daily highs, the Fire Department said. There were 6,527 medical calls to 911 placed on Monday, and over the past few days the FDNY has had to “hold” hundreds of calls, according to NBC News. This means that lower priority sick calls have to wait for ambulances. COVID-19 has infected 43,119 people in New York City and killed at least 1,096 people, according to data compiled by Johns Hopkins University.

Last month, the New York City Police Benevolent Association, or PBA, filed a complaint with the New York State Public Employee Safety and Health Bureau demanding NYPD provide adequate protective equipment, including masks and gloves, to all police officers. “No matter how this pandemic progresses, New York City police officers will remain on the front lines and will continue to carry out our duties protecting New Yorkers,” PBA President Patrick Lynch said in a statement. “The NYPD has not done enough to ensure that all of our members have protective equipment such as masks and gloves, nor does it have adequate supplies of that equipment to weather a prolonged outbreak.”

Britain has the same issue: They’re our heroes, so we don’t test them.

• Of 125,000 NHS Staff Self-Isolating, Still Just 2,000 Were Tested (Ind.)

Just 2,000 NHS frontline staff forced to stay home due to coronavirus have been tested to see if they can return to work, Downing Street has admitted. The figure – a tiny fraction of the 125,000 staff believed to be self isolating – emerged as the government faced mounting criticism for its failure to move to mass testing for Covid-19. Public Health England medical director Yvonne Doyle told a Downing Street press conference that officials hoped hundreds of thousands of staff would be tested “within the coming weeks”. But ministers were unable to give clear answers on how quickly they can ramp up antigen tests, which show whether someone has the disease. They were also unclear over the question of when the UK will see the introduction of antibody tests, which indicate if an individual has been infected and recovered.

Industry figures and scientists questioned ministers’ claims that a lack of chemicals and swabs is to blame for the UK lagging behind Germany, where as many as 70,000 are being tested every day. Unions issued a joint demand for personal protective equipment (PPE) for all frontline health and social care staff, warning that the lack of kit was “a crisis within a crisis”. And there were demands for testing to be extended to all care home staff, with one MP claiming there has been rationing of antigen tests. The UK’s death toll from the pandemic has now reached 2,352 after 563 patients who had tested positive died in hospital in one day. Among them weas 13-year-old Ismail Mohamed Abdulwahab, who reportedly died alone and without his family as he became the youngest victim in England.

Told you the virus is a timemachine. Here’s another look at your future.

• Chinese Smartphone Health Code Rules Post-Virus Life (AP)

Since the coronavirus outbreak, life in China is ruled by a green symbol on a smartphone screen. Green is the “health code” that says a user is symptom-free and it’s required to board a subway, check into a hotel or just enter Wuhan, the central city of 11 million people where the pandemic began in December. The system is made possible by the Chinese public’s almost universal adoption of smartphones and the ruling Communist Party’s embrace of “Big Data” to extend its surveillance and control over society. Walking into a Wuhan subway station Wednesday, Wu Shenghong, a manager for a clothing manufacturer, used her smartphone to scan a barcode on a poster that triggered her health code app.

A green code and part of her identity card number appeared on the screen. A guard wearing a mask and goggles waved her through. If the code had been red, that would tell the guard that Wu was confirmed to be infected or had a fever or other symptoms and was awaiting a diagnosis. A yellow code would mean she had contact with an infected person but hadn’t finished a two-week quarantine, meaning she should be in a hospital or quarantined at home. Wu, who was on her way to see retailers after returning to work this week, said the system has helped reassure her after a two-month shutdown left the streets of Wuhan empty. People with red or yellow codes “are definitely not running around outside,” said Wu, 51. “I feel safe.”

AP Photo/Olivia Zhang

Well, could be ten times that, but we’ll levae that for next week.

• More Than 1.7 Million Britons May Have Contracted COVID19 – NHS |(Ind.)

More than 1.7 million people may have contracted Covid-19 so far, according to the NHS. New figures from NHS 111 online show there were 1,496,651 web-based assessments which flagged potential coronavirus cases based on people’s symptoms between 18 March and 31 March. A further 243,543 assessments via the NHS 111 and 999 phone lines also concluded people had possibly contracted the disease. But the assessment numbers do not necessarily relate to individual people, the NHS said, as it is possible people have sought help more than once or through various channels. The data, published by NHS Digital, comes after GP practices in England were told to open over the Easter Bank Holiday to help the NHS cope with coronavirus.

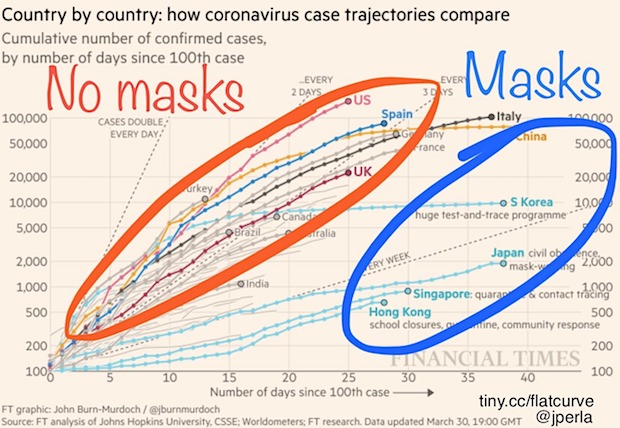

Austrian supermarkets have begun handing out face masks to shoppers before they become compulsory next week to combat the fast-spreading coronavirus pic.twitter.com/Qoyt58PLxO

— Reuters (@Reuters) April 2, 2020

1) how do you make it safe health-wise?

2) how do you make it hack-wise?

3) why on earth does it have to cost $4 billion?

• Pelosi Wants ‘Vote By Mail’ Provisions In Next US Coronavirus Bill (R.)

U.S. House Speaker Nancy Pelosi said on Wednesday she wants to virus-proof the November election by including funding to boost voting by mail in the next pandemic response plan being put together by Democrats in the House of Representatives. Pelosi said at least $2 billion, and ideally $4 billion, was needed to enable voting by mail, to give citizens a safe way to vote during the coronavirus pandemic, which has killed more than 4,300 people across the United States. She noted Democrats got just $400 million for that purpose in the $2.3 trillion coronavirus stimulus bill President Donald Trump signed into law on Friday.

“Vote by mail is so important to … our democracy so that people have access to voting and not be deterred, especially at this time, by the admonition to stay home,” Pelosi told reporters. Trump told Fox News on Monday that voting by mail would hurt the Republican Party. Pelosi rejected that argument. “When I was chair of the California Democratic party many years ago, the Republicans always prevailed in the absentee ballots,” she said. “They know how to do this.” Indeed, some Democrats fear voting by mail could disenfranchise minorities and low-income voters who tend to move more frequently. The $400 million in the recent coronavirus bill is intended to help state and local officials bolster vote by mail and early voting, expand facilities and hire more poll workers.

[..] Three states – Wyoming, Hawaii and Alaska – have scrapped in-person voting for Democratic primaries on April 4, and will only permit voting by mail. Ohio pushed back its March 17 voting, setting a new date of April 28 for a primary conducted almost completely by mail, and at least eight other states pushed their primaries back to May or June.

Where was the CDC?

• Key Medical Supplies Were Shipped From US Manufacturers To Foreign Buyers (IC)

While much of the world moved swiftly to lock down crucial medical supplies used to treat the coronavirus, the U.S. dithered, maintaining business as normal and allowing large shipments of American-made respirators and ventilators to be sold to foreign buyers. The foreign shipments, detailed in dozens of government records, show exports to other hot spots where the pandemic has spread, including East Asia and Europe. American hospitals around the country are now running low on all forms of personal protective gear, such as N95 masks or purified air personal respirators, for medical staff, as well as life-saving ventilators, which pump oxygenated air into the lungs, for patients.

[..] Drive DeVilbiss Healthcare, a Pennsylvania-based health product firm that produces supplemental oxygen machines, sent at least three different shipments of respiratory equipment to Belgium in mid-February and early March. The total cargo included 14 containers weighing more than 55 tons. DeVilbiss and its owner, Clayton Dubilier & Rice, a New York-based private equity firm, did not respond to a request for comment. Pennsylvania Gov. Tom Wolf reportedly reached out to DeVilbiss later in March to support the company’s increased production of respiratory medical devices. “Our demand is unprecedented,” Tim Walsh, the company’s vice president, told WJAC, a local news station.

Vapotherm, a New Hampshire firm that produces respiratory equipment, has faced surging demand from international customers. The company has added 50 employees and a second shift to meet growing demand for its products. WMUR, a local news station, profiled Vapotherm’s role in producing lifesaving respiratory equipment used to treat the coronavirus. During the segment, Joseph Army, the chief executive of Vapotherm, told the station that he first heard from customers in Europe and Asia in response to the coronavirus. A camera shot of Vapotherm’s factory showed a box labeled “Japan.” The demand, he added, has shifted in recent weeks to domestic contracts for clients in Seattle, New York City, Georgia, and Florida.

You mean something went right? I’d still like to see proof.

• $2 Trillion CARES Act A Lifeline For Gig Workers And Freelancers (CNBC)

The $2 trillion federal stimulus package signed into law by President Donald Trump on Friday, March 27, will be a lifeline to many gig workers and freelancers. Known as the CARES Act, the law takes unprecedented steps in including the self-employed in the social safety net. It offers freelancers unemployment insurance, for which they generally don’t qualify, on a large scale for the first time. As stipulated in the House bill, it offers freelancers an additional $600 a week in unemployment insurance, bringing weekly payouts to the $800- to $900-a-week range when state benefits are added, to workers including the self-employed, for up to four months.

“It’s an amazing win, given that there is no unemployment insurance for freelancers,” says Rafael Espinal, who recently took the helm of the Freelancers Union as executive director. “This will help inject cash flow into their homes.” The stimulus package also offers the self-employed and small business owners a $10,000 advance on an Emergency Economic Injury Disaster Loan (EIDL) that does not have to be paid back, even if the borrower does not qualify for an SBA loan. The program provides loans up to $200,000.

Sole proprietors, ESOPs, cooperatives, businesses with no more than 500 employees and tribal small business concerns can apply. Under the EIDL program, administered by the U.S. Small Business Administration, applicants will not have to submit a tax return and will be evaluated based on their credit score. The SBA will provide the funding within three days of a successfully completed application as an advance payment. There is no personal guarantee required for the loans. The SBA is waiving the requirement that businesses have one year of operations prior to the disaster, but businesses are not eligible if they were not in operation on January 1, 2020. The bill authorizes $10 billion in appropriations for these loans.

Color me amazed.

• US Banks To Make Billions On Small Business Bailout (ZH)

As part of the $2 trillion fiscal stimulus package that was signed into law by Donald Trump on Friday, the Small Business Administration will offer $350 billion in loans to US small businesses meant to preserve business solvency as part of the emergency federal response to the coronavirus pandemic; the loans, part of the so-called “Paycheck Protection Program” will be offered through banks and credit unions to cash-strapped businesses employing under 500 people (it’s not clear how a company employing 500 people is a “small business” but we can assume that this is just a stealthy bailout of some not so small businesses).

To be sure, the terms of the loans are generous: the full amount of the loan will be forgiven if it is used for payroll, mortgage interest, rent or utilities in the two months after the money is received. Less will be forgiven if the employees are sacked or salaries cut. Any amount that is not forgiven will accrue interest at just 0.5% rate and the principal will come due in two years. Borrowers will need to fill out a two-page form and document that they were in business as of mid-February. Lenders will not need to wait for SBA confirmation before providing cash in hand, as soon as Friday. Businesses will be eligible to borrow the equivalent of 2.5 times their average monthly payroll with a cap of $10mm.

According to the SBA, there are 30m businesses with fewer than 500 employees in the US, employing 60m people, almost half of the private workforce. The National Federation of Independent Business, an advocacy group, says about three-quarters of its members have been affected by the crisis. Yet some may be “shocked” to learn that like in any government bailout package, the biggest winners here will not be America’s vibrant small and medium business sector, which at best will get the bare minimum cash to fund 2.5 months of payroll (this assume the pandemic will be resolved by mid-June) but – drumroll – America’s banks.

As the FT reports overnight, banks stand to make billions by overseeing the distribution of these loans as they receive processing fees, paid by the federal government, for making the loans. The fees will vary with loan size: 5% for loans under $350,000, 3% for loans under $2MM, and 1% for loans greater than $2MM. The loans will not incur a capital charge. This means that banks stand to earn as much as $17.5 billion – and $10 billion if one assumes an average rate of 3% – for doing something the government is incapable of doing: handing out hundreds of billions in loans/grants to America’s businesses in the shortest possible time.

Oh wait, the banks don’t need those billions.

• Top US Banks May Shun Small-Business Rescue Plan On Liability Worries (R.)

Top U.S. banks have threatened to give the federal government’s small-business rescue program a miss on concerns about taking on too much financial and legal risk, five people with direct knowledge of industry discussions told Reuters. Seeking to help millions of small businesses whose operations have either shut down or have been dramatically curtailed by the coronavirus pandemic, Congress last week passed a $2 trillion stimulus package that includes $349 billion aimed at small firms. Borrowers can apply for the loans through participating banks starting from Friday and until June 30. Trump administration officials have said they want the loans disbursed within days. But representatives of some big lenders, in an industry conference call on Wednesday, expressed serious reservations about participating in the scheme in its current form.

Their main concern is that the Treasury Department has said it expects lenders to verify borrower eligibility, and take steps to prevent fraud, money laundering and protect customer information under the Bank Secrecy Act, sources said. Banks are worried they could face regulatory penalties or legal costs down the line if things go awry in the haste to get money out the door, or get blamed for not moving funds fast enough if they perform due diligence the way they would in ordinary times, the sources said. After hearing the concerns, Treasury officials are considering withdrawing guidance that instructed lenders to verify borrowers had the specified number of employees on their books, and that their other costs are legitimate, according to two sources.

So where were they? Note: eevrybody knnew it was coming. Just not the timing.

• US Military Knew Years Ago That a Coronavirus Was Coming (Nation)

Despite President Trump’s repeated assertions that the Covid-19 epidemic was “unforeseen” and “came out of nowhere,” the Pentagon was well aware of not just the threat of a novel influenza, but even anticipated the consequent scarcity of ventilators, face masks, and hospital beds, according to a 2017 Pentagon plan obtained by The Nation. “The most likely and significant threat is a novel respiratory disease, particularly a novel influenza disease,” the military plan states. Covid-19 is a respiratory disease caused by the novel (meaning new to humans) coronavirus. The document specifically references coronavirus on several occasions, in one instant saying, “Coronavirus infections [are] common around the world.”

The plan represents an update to an earlier Department of Defense pandemic influenza response plan, noting that it “incorporates insights from several recent outbreaks including…2012 Middle Eastern Respiratory Syndrome Coronavirus.” Titled “USNORTHCOM Branch Plan 3560: Pandemic Influenza and Infectious Disease Response,” the draft plan is marked for official use only and dated January 6, 2017. The plan was provided to The Nation by a Pentagon official who requested anonymity to avoid professional reprisal. Denis Kaufman, who served as head of the Infectious Diseases and Countermeasures Division at the Defense Intelligence Agency from 2014 to 2017, stressed that US intelligence had been well-aware of the dangers of coronaviruses for years. (Kaufman retired from his decades-long career in the military in December of 2017.)

“The Intelligence Community has warned about the threat from highly pathogenic influenza viruses for two decades at least. They have warned about coronaviruses for at least five years,” Kaufman explained in an interview. “There have been recent pronouncements that the coronavirus pandemic represents an intelligence failure…. it’s letting people who ignored intelligence warnings off the hook.” In addition to anticipating the coronavirus pandemic, the military plan predicted with uncanny accuracy many of the medical supply shortages that it now appears will soon cause untold deaths. The plan states: “Competition for, and scarcity of resources will include…non-pharmaceutical MCM [Medical Countermeasures] (e.g., ventilators, devices, personal protective equipment such as face masks and gloves), medical equipment, and logistical support. This will have a significant impact on the availability of the global workforce.”

First we dump on Trump, and only then do we say what is really goinng wrog.

• Privatization, National Security State Left Americans Defenseless (GZ)

Donald Trump’s failure to act decisively to control the coronavirus pandemic has likely made the Covid-19 pandemic far more lethal than it should have been. But the reasons behind failure to get protective and life-saving equipment like masks and ventilators into the hands of health workers and hospitals run deeper than Trump’s self-centered recklessness. Both the Obama and Trump administrations quietly delegated state and local authorities with the essential national security responsibility for obtaining and distributing these vital items. The failure of leadership was compounded the lack of any federal power center that embraced the idea that guarding for a pandemic was at least as important to national security as preparing for war.

For decades, the military-industrial-congressional complex has force-fed the American public a warped conception of US national security focused entirely around perpetuating warfare. The cynical conflation of national security with waging war on designated enemies around the globe effectively stifled public awareness of the clear and present danger posed to its survival by global pandemic. As a result, Congress was simply not called upon to fund the vitally important equipment that doctors and nurses needed for the Covid-19 crisis. At the heart of the growing coronavirus crisis in the US is a severe shortage of N95 respirators and ventilators. Those items should have been available in sufficient numbers through the Strategic National Stockpile (SNS), which holds the nation’s largest supplies necessary for national emergencies.

But the stocks of crucial medical have not been maintained for years, largely because Congress has not provided the necessary funding. Congress has been willing to dole out load of cash after pandemics hit the US. When the H1N1 flu crisis hit the United States in 2009, and close to 300,000 Americans were hospitalized, Congress appropriated $7.7 billion in special funding, including support for building up the SNS. That allowed the stockpile to provide 85 million respirators and millions of ventilators to hospitals around the country, especially during the second half of the yearlong crisis. But since that 2009-10 crisis ended, the stockpile of such vital equipment has never been replenished.

In 2020 the stockpile holds only 12 million N95 respirators – as little as 1 percent of what is now needed by health workers – and just 16,000 ventilators, compared with the estimated 750,000 people at minimum who will need a ventilator because of the Covid-19 pandemic. These numbers are so scandalously low in relation to what is needed that senior officials Department of Health and Human Services have refused to reveal publicly how many they have in stock.

Especially in times of stress, the world is an easier place if it is in black and white.

• Biden’s False Claim on Trump’s Response to Coronavirus (FactCheck)

Former Vice President Joe Biden was wrong when he said that the Trump administration made no effort to get U.S. medical experts into China as the novel coronavirus epidemic spread there early this year. “[W]hen we were talking … early on in this crisis, we said — I said, among others, that, you know, you should get into China, get our experts there, we have the best in the world, get them in so we know what’s actually happening,” Biden, the front-runner for the Democratic presidential nomination, said at a CNN virtual town hall on March 27. “There was no effort to do that.” Except that isn’t the case. The U.S. Centers for Disease Control and Prevention tried to get into China just one week after China reported the outbreak to the World Health Organization on Dec. 31, 2019.

“On January 6, we offered to send a CDC team to China that could assist with these public health efforts,” Health and Human Services Secretary Alex Azar said at a Jan. 28 press conference. “I reiterated that offer when I spoke to China’s Minister of Health on Monday, and it was reiterated again via the World Health Organization today. We are urging China: More cooperation and transparency are the most important steps you can take toward a more effective response.” More than a week later, Azar said again at a Feb. 7 press conference that “our longstanding offer to send world-class experts to China to assist remains on the table.” At the time, the New York Times reported, “Normally, teams from the agency’s Epidemic Intelligence Service can be in the air within 24 hours.”

A team of public health experts from the WHO was allowed by Chinese authorities to visit Wuhan, where the outbreak began, later in February, according to the South China Morning Post. The team included specialists from the United States as well as Germany, Russia, Japan, Singapore, South Korea and Nigeria. Biden was correct at the town hall when he said the Trump administration had eliminated a position set up by the Obama administration, in which Biden served, to coordinate the response to pandemics like the coronavirus crisis. But he got the timing wrong, and Trump administration officials say it was a reorganization, with the responsibilities of that office falling to other individuals.

I was wondering yesterday what happened to all of the earlier stories about cures and vaccines. None seem to have aged well..

• Chinese Scientists Seeking COVID19 Treatment Find ‘Effective’ Antibodies (R.)

A team of Chinese scientists has isolated several antibodies that it says are “extremely effective” at blocking the ability of the new coronavirus to enter cells, which eventually could be helpful in treating or preventing COVID-19. There is currently no proven effective treatment for the disease, which originated in China and is spreading across the world in a pandemic that has infected more than 850,000 and killed 42,000. Zhang Linqi at Tsinghua University in Beijing said a drug made with antibodies like the ones his team have found could be used more effectively than the current approaches, including what he called “borderline” treatment such as plasma. Plasma contains antibodies but is restricted by blood type.

In early January, Zhang’s team and a group at the 3rd People’s Hospital in Shenzhen began analysing antibodies from blood taken from recovered COVID-19 patients, isolating 206 monoclonal antibodies which showed what he described as a “strong” ability to bind with the virus’ proteins. Among the first 20 or so antibodies tested, four were able to block viral entry and of those, two were “exceedingly good” at doing so, Zhang said. They then conducted another test to see if they could actually prevent the virus from entering cells [..] The team is now focused on identifying the most powerful antibodies and possibly combining them to mitigate the risk of the new coronavirus mutating. If all goes well, interested developers could mass produce them for testing, first on animals and eventually on humans.

Tucker Carlson is currently citing a report that he openly admits he can't confirm is true to question if coronavirus was made in a lab pic.twitter.com/CTxrJtw0Sh

— Andrew Lawrence (@ndrew_lawrence) April 1, 2020

This is where you say: no, it isn’t Iran…

• Texas Pastors Demand “Religious Liberty” Exemption To Stay-at-home Orders (Vox)

Last week, Harris County Judge Lina Hidalgo, who oversees the area of Texas that includes Houston, issued an order requiring “all individuals currently living within Harris County … to stay at their place of residence except for Essential Activities” (in Texas, the title “county judge” refers to the chief executive of a county government). Like many similar orders handed down by state and local officials throughout the United States, which are intended to slow the spread of the coronavirus pandemic, Hidalgo’s order closes most businesses within the county and shuts down most places where people gather in large groups. Although it allows faith leaders to “minister and counsel in individual settings, so long as social distance protocols are followed,” it requires worship services to “be provided by video and teleconference.”

That restriction on in-person worship services has sparked a lawsuit, filed by three Texas pastors and Steven Hotze, a medical doctor and anti-LGBT Republican activist whose political action committee was labeled a hate group by the Southern Poverty Law Center. These four men ask the Texas Supreme Court to strike down Hidalgo’s order, claiming, among other things, that it violates the “religious liberty” of pastors who wish to gather their parishioners together during a pandemic. Under existing precedents, the petitioner’s arguments in Hotze are not strong. They rely heavily on older US Supreme Court decisions that were effectively overruled by the Supreme Court’s later decision in Employment Division v. Smith (1990) (although it’s worth noting that Smith is very much out of favor with judicial conservatives and could, itself, be overruled by the Court’s current majority).

The Hotze petitions also essentially ask the Texas Supreme Court to place the temporary interests of a few pastors before the county’s interest in combating a deadly disease. The US Supreme Court has long held that the government may take targeted action to protect especially compelling interests — even when doing so implicates constitutional rights.

The headline feels designed to cast doubt on the man.

• Chomsky: Ventilator Shortage Exposes the Cruelty of Neoliberal Capitalism (TO)

The scale of the plague is surprising, indeed shocking, but not its appearance. Nor the fact that the U.S. has the worst record in responding to the crisis. Scientists have been warning of a pandemic for years, insistently so since the SARS epidemic of 2003, also caused by a coronavirus, for which vaccines were developed but did not proceed beyond the pre-clinical level. That was the time to begin to put in place rapid-response systems in preparation for an outbreak and to set aside spare capacity that would be needed. Initiatives could also have been undertaken to develop defenses and modes of treatment for a likely recurrence with a related virus.

But scientific understanding is not enough. There has to be someone to pick up the ball and run with it. That option was barred by the pathology of the contemporary socioeconomic order. Market signals were clear: There’s no profit in preventing a future catastrophe. The government could have stepped in, but that’s barred by reigning doctrine: “Government is the problem,” Reagan told us with his sunny smile, meaning that decision-making has to be handed over even more fully to the business world, which is devoted to private profit and is free from influence by those who might be concerned with the common good. The years that followed injected a dose of neoliberal brutality to the unconstrained capitalist order and the twisted form of markets it constructs.

The depth of the pathology is revealed clearly by one of the most dramatic — and murderous — failures: the lack of ventilators that is one the major bottlenecks in confronting the pandemic. The Department of Health and Human Services foresaw the problem, and contracted with a small firm to produce inexpensive, easy-to-use ventilators. But then capitalist logic intervened. The firm was bought by a major corporation, Covidien, which sidelined the project, and, “In 2014, with no ventilators having been delivered to the government, Covidien executives told officials at the [federal] biomedical research agency that they wanted to get out of the contract, according to three former federal officials. The executives complained that it was not sufficiently profitable for the company.”

Doubtless true. Neoliberal logic then intervened, dictating that the government could not act to overcome the gross market failure, which is now causing havoc. As The New York Times gently put the matter, “The stalled efforts to create a new class of cheap, easy-to-use ventilators highlight the perils of outsourcing projects with critical public-health implications to private companies; their focus on maximizing profits is not always consistent with the government’s goal of preparing for a future crisis.”

“The lunatic minister of health in Apartheid #Israel, the one who said #Covid_19 was a sign of #Armageddon and the #Messiah arriving in April; just confirmed positive for the virus along with his wife.”

• Israeli Doctors Demand Health Minister Be Replaced By Professional (YNet)

Israeli doctors on Sunday called on the government to replace Health Minister Yaakov Litzman with a medical professional in the wake of coronavirus crisis in the country. In an open letter some to Prime Minister Benjamin Netanyahu and his future coalition partner Benny Gantz, the heads of hospital departments and senior medical officials expressed their dissatisfaction with Litzman’s conduct during the COVID-19 epidemic and urged to replace him with someone who has the necessary experience. Netanyahu and Gantz are in the midst of unity talks in an effort to agree on a coalition government to address the coronavirus pandemic emergency.

Sources familiar with the negotiations told Ynet the replacement of Litzman is not currently on the table. “We have nothing against outgoing Health Minister Litzman and have great respect for him,” said Professor Yoram Kluger, Rambam Hospital’s chief of surgery who was behind the initiative. “But, in light of the dire state Israel’s healthcare system and an emergency on the scope of a pandemic, health workers can no longer agree to be cast aside by other considerations.”

Extremely long by Whitney Webb. And then there are at least 3 parts. Maybe somebody actually has the time to read it.

• All Roads Lead To Dark Winter (Whitney Webb & Raul Diego)

In late June 2001, the U.S. military was preparing for a “Dark Winter.” At Andrews Air Force Base in Camp Springs, Maryland, several Congressmen, a former CIA director, a former FBI director, government insiders and privileged members of the press met to conduct a biowarfare simulation that would precede both the September 11 attacks and the 2001 Anthrax attacks by a matter of months. It specifically simulated the deliberate introduction of smallpox to the American public by a hostile actor.

The simulation was a collaborative effort led by the Johns Hopkins Center for Civilian Biodefense Strategies (part of the Johns Hopkins Center for Health Security) in collaboration with the Center for Strategic and International Studies (CSIS), the Analytic Services (ANSER) Institute for Homeland Security and the Oklahoma National Memorial Institute for the Prevention of Terrorism. The concept, design and script of the simulation were created by Tara O’Toole and Thomas Inglesby of the Johns Hopkins Center along with Randy Larsen and Mark DeMier of ANSER.

The name for the exercise derives from a statement made by Robert Kadlec, who participated in the script created for the exercise, when he states that the lack of smallpox vaccines for the U.S. populace means that “it could be a very dark winter for America.” Kadlec, a veteran of the George W. Bush administration and a former lobbyist for military intelligence/intelligence contractors, is now leading HHS’ Covid-19 response and led the Trump administration’s 2019 “Crimson Contagion” exercises, which simulated a crippling pandemic influenza outbreak in the U.S. that had first originated in China. Kadlec’s professional history, his decades-old obsession with apocalyptic bioweapon attack scenarios and the Crimson Contagion exercises themselves are the subject of Part III of this series.

It must be possible to run the Automatic Earth on people’s kind donations. These are no longer the times when ads pay for all you read, your donations have become an integral part of it. It has become a two-way street; and isn’t that liberating, when you think about it?

Thanks everyone for your wonderful and generous donations over the past days.

Make your own mask in 2 minutes. Instructions here.

Support us in virustime. Help the Automatic Earth survive. It’s good for you.