Mattia Preti The Adoration of the Shepherds 1660-99

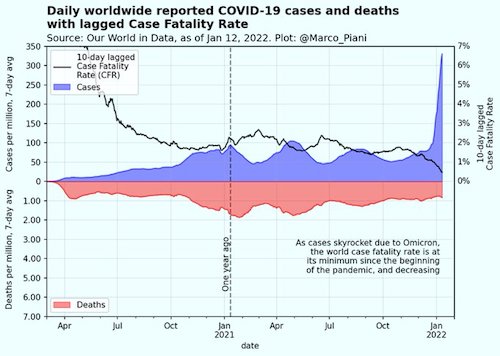

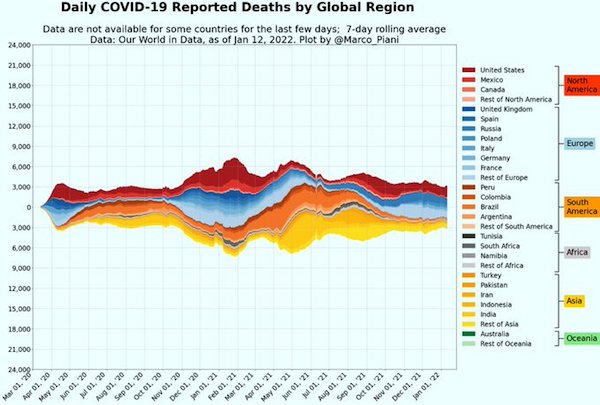

World CFR is at its lowest since the beginning of the pandemic, and decreasing.

Glenn Beck Great Reset

Glenn Beck tells Tucker about "The Great Reset" pic.twitter.com/B6x6x5VF0k

— Wittgenstein (@backtolife_2022) January 12, 2022

Malone Bannon

Conspiracy theory… pic.twitter.com/a7JUqhYGgg

— BacktoLife (@backtolife_2019) January 13, 2022

Valencia

Police officers in Valencia: "We are with the people, not with corrupt politicians. We are in contact with Portugal, Italy, France, Austria, Switzerland, Sweden, Germany and Holland to unite all the police in Europe! Away with the health passport!" pic.twitter.com/JRgttOA2g6

— The Juggernaut (@TheJuggernaut88) January 12, 2022

In Greece.

• The Pandemic Will Probably Be Over In March (K.)

Dr Christopher Murray is considered internationally as the “guru” of projections on the course of the Covid-19 pandemic. He is the director of the Institute for Health Metrics and Evaluation at the University of Washington and has developed models on the evolution of the pandemic for various countries in the world – including Greece. Dr Murray predicts that about half of the Greek population will be infected with the Omicron variant and believes the peak of the wave will come in mid-January, not at the end, as projected by initial studies. He also believes that the end of the pandemic will come in March, as soon as Omicron is completely gone, and recommends reopening schools as long as there are enough teachers. But his main conclusion is the need to stop dramatizing the pandemic, saying that it does not make sense to focus on the number of cases. He argues that the key figures are the number of hospital admissions, especially to intensive care units.

What is your prognosis as to how long the pandemic will last? Well, as far as we can understand from Omicron, we think that it’s so transmissible it will move through the population in Greece and in each country that it shows up in in a pretty short period from introduction to peak in four to six weeks. So most of the Omicron wave should happen in the month of January in Greece. What percentage of the population do you expect to get infected with this variant? Well, we expect that probably as much as half of the population or more will get infected with Omicron, and that’s despite vaccination levels and past infection with other variants of Covid. So a very large fraction of both Greece but also the world should get Omicron.

So is there any sense in trying to control Omicron, really? Well, what do we know about Omicron? We know that it’s very transmissible; it can infect people that have been previously infected; in terms of infection, it can break through in those that are vaccinated or even those that have had a booster. But it is much less severe than past variances, maybe 90% or 95% less severe. So huge numbers are coming, but much less severe. There still will be pressure on the health system, because of the very big number of infections and a smaller fraction going to hospital. So it’s really going to be hard to control infection. But there still will be some consequences on the population.

Do you expect hospitalizations to go up? We expect hospitalizations to go up, but nothing like past waves, and from what we’ve seen in South Africa now in the United Kingdom and in some of the earlier states in the US, even amongst those that end up in hospital, it’s also 80% to 90% less severe, so many fewer are ending up in the ICU, even amongst those that go to hospital. So all encouraging signs about severity, but just the sheer numbers – half of the population – getting Omicron means that we will see an increase in hospitalizations.

Have you observed any kind of strange effects from Omicron – things you didn’t expect? I think when it first emerged in November – and we had no real data about severity – there was tremendous concern that we would see this nightmare of mass transmission, and then slightly less severe than Delta, and hospitals would be overwhelmed as the death rate would soar. That hasn’t happened fortunately. It’s turned out to be much less severe and today we’re not really seeing anything particularly unusual except this fact that 80% to 90% of people who get infected have no symptoms at all. So that makes a really big difference in terms of impact on the population.

Is this in a way the beginning of the end of the pandemic, because everybody has been saying that at some point it will become like a flu. A severe flu perhaps, but a flu. Are we reaching that point now with Omicron? You know it’s a great question and I think very hard to answer in a strictly scientific way. But many people do think that, because there’ll be so many people infected with Omicron, it’ll give a big boost to the immunity level of populations that it will take a new variant to emerge before we see after the Omicron wave more transmission. So it may be the thing that brings us to the point where we go to an endemic stage, where Covid doesn’t go away, but we should see it may become that seasonal disease that we’ve been expecting for quite some time.

Endemic or pandemic?

• UK ‘Closest of Any Country’ to Exiting COVID-19 Pandemic (ET)

The UK is the closest of any country in the northern hemisphere to exiting the COVID-19 pandemic and seeing it become endemic, an expert has said. Professor David Heymann, from the London School of Hygiene and Tropical Medicine (LSHTM), said the UK is probably one of the countries with the highest levels of population immunity. Talking at a Chatham House online briefing on Tuesday, Heymann said that countries in the northern hemisphere have “varying stages of the pandemic,” and the UK is probably “the closest to any country of being out of the pandemic if it isn’t already out of the pandemic and having the disease as endemic.” He said population immunity is already high and “seems to be keeping the virus and its variants at bay, not causing serious illness or death.”

Heymann cited the Office for National Statistics as saying that about 95 percent of the population in England and a little less in other parts of the UK already have antibodies either from vaccination or from natural infection. The CCP (Chinese Communist Party) virus, which caused the COVID-19 pandemic, is now “functioning more like an endemic coronavirus than one that is a pandemic,” he said. The leading expert said there would be resurgences of COVID-19 in the future and more variants will arise, though it was not clear of what severity. “We’re fortunate in that we have vaccines which can be modified very rapidly, and put into production very rapidly to deal with an escapee,” he said.

We need a flu passport.

• Covid Is Now Killing Half As Many People Per Day As A Bad Flu Year (DM)

Daily Covid deaths are currently running at less than half the rate expected in a bad flu year, MailOnline analysis suggests as experts claim the UK is finally on the brink of beating the pandemic. There are growing calls for No10 to learn to live with Covid rather than focus on halting the spread of the virus now there is such a big disconnect between infections and deaths. Right now just 130 people are dying from the coronavirus every day in England at what is believed to be the peak of the Omicron outbreak, compared to 1,300 last January before vaccines were widely available. Daily deaths have barely moved since the start of autumn, despite infection rates more than quadrupling over the same time following the emergence of the ultra-transmissible variant.

For comparison, Government estimates show there were more than 400 influenza deaths per day at the peak of the last bad flu season in 2017/18, and almost 300 daily fatalities the previous year. Just like this winter, hospitals were forced to cancel routine operations and patients were told to steer clear of A&E units during both of those outbreaks. Professor Paul Hunter, an infectious disease expert from the University of East Anglia, said the figures showed that the burden of Covid is now comparable to flu. He told MailOnline Covid would ‘almost certainly’ get weaker every year as people develop natural immunity and eventually become a common cold that kills only the very vulnerable further down the line. ‘Once we’re past this Omicron peak — excluding another unexpected variant that reverses all of our progress — then we’ll be close to the point of endemic,’ Professor Hunter added.

Different from UK. Still, none of them are Omicron.

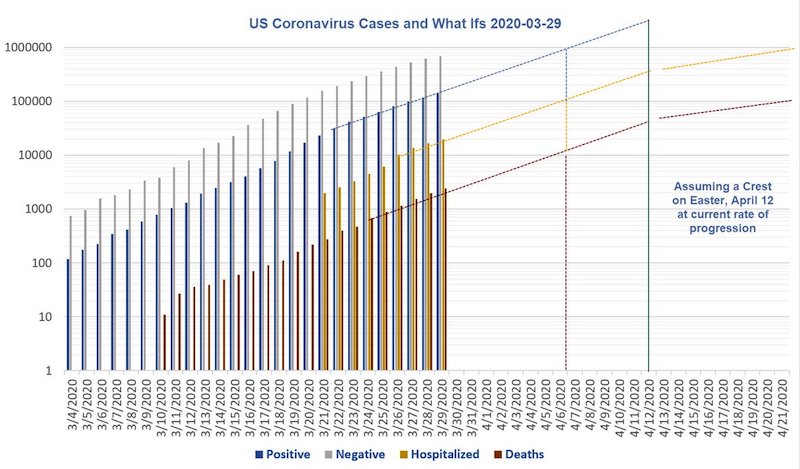

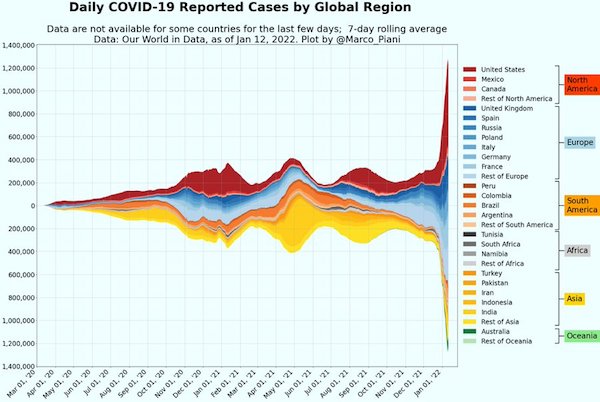

• COVID Deaths Jump 40% As US Continues To See More Than 1 Million Cases A Day

Deaths involving patients with COVID increased by 40% over the past week, according to the CDC. But as it happens, almost all of the deaths reported involve patients infected with delta, not the omicron variant which is now responsible for nearly all COVID cases. On average, the US reported about 1,600 cases a day last week, up from about 1,150 the week before, said CDC Director Dr. Rochelle Walensky. The US has continued to report more than 1 million cases a day, according to Johns Hopkins, with a record-breaking 1.35 million reported yesterday alone. Walensky, who spoke during a White House COVID Response Team briefing, said she believes these deaths are just “left over” fatalities from the delta wave – nothing to worry about.

Of course, there’s no way the CDC can truly know this for certain. The government’s COVID policies are mostly just grasping at straws. Though they would never admit that. So, why is it so hard to believe that delta alone is accounting for these deaths? Well, for one, the government believes the omicron variant accounts for 98.3% of all new cases. Public health officials will monitor “deaths over the next several weeks to see the impact of omicron on mortality,” Walenksy said during the briefing. “Given the sheer number of cases, we may see deaths from omicron, but I suspect the deaths we’re seeing now are still from delta.” Of course, while Walensky delivered the news with her characteristic alarmism, we feel it’s important to take a beat and put it all in context. See the chart. Deaths are nowhere near the highs from last winter.

“..91% less risk of death, with zero patients requiring ventilators..”

• CDC-Backed Study Shows Differences Between Delta And Omicron (RT)

While a study out of southern California shows the Omicron variant of the coronavirus is much milder than the Delta, US health authorities continue to insist on vaccination, boosters and masking due to “strained” hospitals. CDC director Rochelle Walensky shared on Wednesday the results of the latest study backed by the agency, showing the disparity between the two variants of the SARS-CoV-2 virus. A team of scientists from the University of California, Berkeley, healthcare provider Kaiser Permanente and the CDC analyzed data from almost 70,000 people in southern California and plugged it into their models. The pre-print results of their study were published on MedRXiv on Tuesday. Walensky tweeted that the study showed Omicron represented 53% less risk of symptomatic hospitalization, 74% less risk of intensive care admission, and 91% less risk of death, with zero patients requiring ventilators.

NEW: Study on severity of those infected with the #OmicronVariant compared to the #DeltaVariant:

⬇️53% less risk of symptomatic hospitalization

⬇️74% less risk of ICU admission

⬇️91% less risk of death

0⃣Omicron patients required mechanical ventilation

https://t.co/to2swFYF5Q pic.twitter.com/LZYf0t3CGY— Rochelle Walensky, MD, MPH (@CDCDirector) January 12, 2022

This is based on the study that analyzed 52,297 people who tested positive for Omicron and 16,982 with Delta between November 30, 2021 and January 1, 2022. Of those, 235 (0.5%) were hospitalized with Omicron and 222 (1.3%) with Delta infections. During a period of both variants circulating, presumed Omicron infections “were associated with substantially reduced risk of severe clinical endpoints and shorter durations of hospital stay,” according to the study. Walensky wasn’t quite taking a victory lap, however, warning in a follow-up tweet that Omicron may be less severe, but is “much more transmissible.” “We are seeing the unprecedented impact,” the CDC director said, pointing to over a million positive tests in a single day and “99% of counties with high transmission [and] strained healthcare systems.” “Protect against Covid-19: get vaccinated + boosted, wear a mask & stay home if sick,” she added.

“You insisted on attributing every decline of a wave solely to your actions, and so through false propaganda “you overcame the plague.”

• Ministry of Health, It’s Time To Admit Failure (Prof. Ehud Qimron )

Udi Qimron, head of the Department of Microbiology and Immunology at Tel Aviv University and a leading Israeli immunologist, has taken the opportunity posed by the collapsing narrative to release this open letter to the authorities (this is a mechanical translation from the original Hebrew):

Ministry of Health, it’s time to admit failure

In the end, the truth will always be revealed, and the truth about the coronavirus policy is beginning to be revealed. When the destructive concepts collapse one by one, there is nothing left but to tell the experts who led the management of the pandemic – we told you so. Two years late, you finally realize that a respiratory virus cannot be defeated and that any such attempt is doomed to fail. You do not admit it, because you have admitted almost no mistake in the last two years, but in retrospect it is clear that you have failed miserably in almost all of your actions, and even the media is already having a hard time covering your shame. You refused to admit that the infection comes in waves that fade by themselves, despite years of observations and scientific knowledge.

You insisted on attributing every decline of a wave solely to your actions, and so through false propaganda “you overcame the plague.” And again you defeated it, and again and again and again. You refused to admit that mass testing is ineffective, despite your own contingency plans explicitly stating so (“Pandemic Influenza Health System Preparedness Plan, 2007,” p. 26). You refused to admit that recovery is more protective than a vaccine, despite previous knowledge and observations showing that non-recovered vaccinated people are more likely to be infected than recovered people. You refused to admit that the vaccinated are contagious despite the observations. Based on this, you hoped to achieve herd immunity by vaccination — and you failed in that as well.

You insisted on ignoring the fact that the disease is dozens of times more dangerous for risk groups and older adults, than for young people who are not in risk groups, despite the knowledge that came from China as early as 2020. You refused to adopt the “Great Barrington Declaration,” signed by more than 60,000 scientists and medical professionals, or other common-sense programs. You chose to ridicule, slander, distort and discredit them. Instead of the right programs and people, you have chosen professionals who lack relevant training for pandemic management (physicists as chief government advisers, veterinarians, security officers, media personnel, and so on).

You have not set up an effective system for reporting side effects from the vaccines and reports on side effects have even been deleted from your Facebook page. Doctors avoid linking side effects to the vaccine, lest you persecute them as you did to some of their colleagues. You have ignored many reports of changes in menstrual intensity and menstrual cycle times. You hid data that allows for objective and proper research (for example, you removed the data on passengers at Ben Gurion Airport). Instead, you chose to publish non-objective articles together with senior Pfizer executives on the effectiveness and safety of vaccines.

Twitter thread. More at the link.

• Israel Is A Trailer Now In Many Ways (Gal.G.)

Hi followers from around the world, I feel that we need to take a moment and explain to you what is happening in #Israel today. Everything is so fast & crazy, but as we’ve said many times, Israel is a trailer now in many ways, and if you want time to prepare – read carefully. There is complete chaos in Israel today. The Omicron did not scare parents enough to vaccinate the 5-plus-year-olds, nor did the vaccine teams that came to the schools do the job. So the madness goes up a gear. You are all probably familiar with Macron’s bullying speech. This speech was a whistle calling on all fascists in the public sphere to wake up and call together for our government – “Be Macron” and to embitter the lives of the unvaccinated.

Opinion columns were published one after another – calling for distancing, excluding, marking, degrading, complicating and also imprisoning away from society “the unvaccinated”. And this was just the ground of incitement on which everything rests, the preparation of society. Voices began to address covid in a military-security language, school safety authorities (supposed to protect children from enemy harm) were directed to address dialogue with *parents*, and principals asked parents to treat the school as a closed military area (from them) For a few days there seemed to be HOPE, more people “woke up” to realize that the demand for a 4th booster didn’t make sense, In MSM & medical consensus suddenly they questioned the policy and necessity of the Green Pass, raise possibility that the omicron would naturally V us

Suddenly, overnight, there was again a sharp change in language in public discourse – MSM began to treat any criticism of COVID policy and/or opposition to the vaccine as *national security* offenses in Israel punishable by death or life imprisonment. It is unprecedented and very staggering. It also affects the scope of the critical voices. Then – the regulations and rules and the press releases – did not stop changing. For a moment, malls closed for unvaxxed, a moment later they opened, only to close again in another way. The same goes for education, health services, state borders and more. Most of the public service’s offices – are opened only with Green Pass. The courts are silent and supporting this policy. * As a lawyer- I lost all remaining trust in the legal system that I was a part of for many years and full heartedly believed in despite criticism.

The first?! Still took two years though.

• Danish Newspaper Apologizes For Not Questioning Official COVID Narratives (ZH)

In August, Germany’s top newspaper, Bild, apologized for the outlet’s fear-driven Covid coverage – with special message to children, who were told “that they were going to murder their grandma.” Now, a newspaper in Denmark has publicly apologized for reporting government narratives surrounding the Covid-19 pandemic without questioning them. “We failed,” reads the article’s headline from tabloid Ekstra Bladet, which goes on to admit that “For ALMOST two years, we – the press and the population – have been almost hypnotically preoccupied with the authorities’ daily coronavirus figures. “(translated).

“WE HAVE STARED at the oscillations of the number pendulum when it came to infected, hospitalized and died with corona. And we have been given the significance of the pendulum’s smallest movements laid out by experts, politicians and authorities, who have constantly warned us about the dormant corona monster under our beds. A monster just waiting for us to fall asleep so it can strike in the gloom and darkness of the night.

THE CONSTANT mental alertness has worn out tremendously on all of us. That is why we – the press – must also take stock of our own efforts. And we have failed.

WE HAVE NOT been vigilant enough at the garden gate when the authorities were required to answer what it actually meant that people are hospitalized with corona and not because of corona. Because it makes a difference. A big difference. Exactly, the official hospitalization numbers have been shown to be 27 percent higher than the actual figure for how many there are in the hospital, simply because they have corona. We only know that now.

OF COURSE, it is first and foremost the authorities who are responsible for informing the population correctly, accurately and honestly. The figures for how many are sick and died of corona should, for obvious reasons, have been published long ago, so we got the clearest picture of the monster under the bed.

IN ALL, the messages of the authorities and politicians to the people in this historic crisis leave much to be desired. And therefore they lie as they have ridden when parts of the population lose confidence in them.

ANOTHER example: The vaccines are consistently referred to as our ‘superweapon’. And our hospitals are called ‘superhospitals’. Nevertheless, these super-hospitals are apparently maximally pressured, even though almost the entire population is armed with a super-weapon. Even children have been vaccinated on a huge scale, which has not been done in our neighboring countries.

IN OTHER WORDS, there is something here that does not deserve the term ‘super’. Whether it’s the vaccines, the hospitals, or a mixture of it all, is every man’s bid. But at least the authorities’ communication to the population in no way deserves the term ‘super’. On the contrary.”

“..because not everyone in the world has the same access to vaccines.”

• WHO Says Vaccine Mandates Should Be ‘Last Resort’ (SMH)

The WHO on Wednesday said vaccination status should not be used to disqualify people from travelling internationally and governments should only use vaccine mandates as a “last resort”. The comments came in response to questions from The Sydney Morning Herald and The Age about the ongoing row surrounding world’s No.1 men’s tennis player Novak Djokovic. Only vaccinated people are currently eligible to enter Australia after the country’s border reopened on a limited basis late last year. A few hotel quarantine spaces are maintained for the non-vaccinated and those given exemptions. Australia and other jurisdictions around the world have also introduced vaccine passports or apps to allow entry to major events, restaurants and other facilities. They are also now required for workers in some professions.

Djokovic, who has refused to be vaccinated, successfully sought entry to Australia based on claims that a December COVID-19 infection qualified him for an exemption. He was blocked by Australian Border Force officials, but the Federal Circuit Court overturned the cancellation of his visa. Federal Immigration Minister Alex Hawke is now considering whether to use his discretionary ministerial powers to deport the Serbian. The situation in effect means Australian Open spectators will have to be vaccinated to watch Djokovic, despite the player himself remaining unvaccinated. Dr Mike Ryan, executive director of WHO’s Health Emergencies Program, said vaccine mandates should be used with caution and only when a government facing a severe outbreak has failed to persuade its population to get jabbed.

“We see mandates as a last resort … in the face of a large epidemic,” he said. “So yes, there are circumstances in which vaccine mandates are supported by WHO but, again, it is subjected to the basic principle that the best way to get people vaccinated is to inform them, to educate, to have a dialogue and to address people’s genuine concerns. “We always ask that those mandates be clear, be explicit, be time-limited and at the same time … governments continue to explain to people why they’re doing things and continue to try and convince people of the benefits of vaccine rather than reverting to mandates as a single approach.” The director of WHO’s Department of Immunisation, Vaccines and Biologicals, Katherine O’Brien, added that no one should be denied access to international travel based on their vaccination status because not everyone in the world has the same access to vaccines.

“Such unprecedented vaccines normally take twelve years to develop, with only a 2% success rate, but these vaccines were developed and brought to market in less than a year.”

• SARS-COV-2 Vaccines and Neurodegenerative Disease (Seneff)

People don’t realize that these vaccines are vastly different from the many childhood vaccines we are now used to getting early in life. I find it shocking that the vaccine developers and the government officials across the globe are wrecklessly pushing these vaccines on an unsuspecting population. Together with Dr. Greg Nigh, I recently published a peer-reviewed paper on the technology behind the mRNA vaccines and the many potentially unknown consequences to health . Such unprecedented vaccines normally take twelve years to develop, with only a 2% success rate, but these vaccines were developed and brought to market in less than a year. As a consequence, we have no direct knowledge of any effects that the vaccines might have on our health over the long term.

However, knowledge about how these vaccines work, how the immune system works and how neurodegenerative diseases come about can be brought to bear on the problem in order to predict potential devastating future consequences of the vaccines. The mRNA in these vaccines codes for the spike protein normally synthesized by the SARS-CoV-2 virus. However, both the mRNA and the protein it produces have been changed from the original version in the virus with the intent to increase rate of production of the protein in an infected cell and the durability of both the mRNA and the spike protein it codes for. Additional ingredients like cationic lipids and polyethylene glycol are also toxic with unknown consequences. The vaccines were approved for emergency use based on grossly inadequate studies to evaluate safety and effectiveness.

Our paper showed that there are several mechanisms by which these vaccines could lead to severe disease, including autoimmune disease, neurodegenerative diseases, vascular disorders (hemorrhaging and blood clots) and possibly reproductive issues. There is also the risk that the vaccines will accelerate the emergence of new strains of the virus that are no longer sensitive to the antibodies produced by the vaccines. When people are immune compromised (e.g., taking chemotherapy for cancer), the antibodies they produce may not be able to keep the virus in check because the immune system is too impaired. Just as in the case of antibiotic resistance, new strains evolve within an infected immune-compromised person’s body that produce a version of the spike protein that no longer binds with the acquired antibodies.

These new strains quickly come to dominate over the original strain, especially when the general population is heavily vaccinated with a vaccine that is specific to the original strain. This problem is likely going to necessitate the repeated rollout of new versions of the vaccine at periodic intervals that people will have to receive to induce yet another round of antibody production in an endless game of cat and mouse. Like the mRNA vaccines, the DNA vaccines are based on novel biotech gene editing techniques that are brand new, so they too are a massive experiment unleashed on a huge unsuspecting population, with unknown consequences.

“..original antigenic sin can occur either with infection or with vaccination. In the case of SARS-CoV-2, the evidence is that it does not occur with infection.”

• NY Times Finally Acknowledges ‘Original Antigenic Sin’ (Hammond)

As the New York Times describes it, “original antigenic sin” is when “the immune system’s response is tailored to the first version of the virus, and its responses to subsequent variants are much less powerful.” The Omicron variant has many mutations in its spike protein, so “antibodies made for the original version of the virus struggle to recognize the latest version.” There are “clues” that original antigenic sin could be a real problem with COVID-19 vaccines, vaccinologist Amy Sherman told the Times. However, the way the Times describes original antigenic sin, it makes it sounds as though it refers simply to a mismatch between the antigen component of the vaccine and circulating strains of the virus. But the term does not simply mean that there is a mismatch. The Times makes it sound as though a mismatch were the definition of original antigenic sin, but that is wrong.

There can be a mismatch between the vaccine antigen and circulating variants without the occurrence of original antigenic sin. What “original antigenic sin” refers to is not just an antigenic mismatch but a phenomenon in which the original priming of the immune system prejudices any subsequent immune response due to reexposure to a different strain of the virus in way that results in suboptimal immunity as compared to the immune response that otherwise would have occurred had the host been immunologically naïve. In the absence of an original antigenic sin phenomena, circulating antibodies from vaccination might not protect against infection because of a mismatch between those antibodies and the circulating strain, but the immune system would nevertheless relearn from the infection and mount newly adapted immune responses that are optimized for the infecting strain of the virus.

Original antigenic sin is when the immune system produces ineffectual immune responses to the newly infecting variant because it is stuck in a mode of producing immune responses specific to the antigen from the initial immunologic priming. To reiterate specifically in the context of COVID-19 vaccines, if original antigenic sin occurs, it means not only that the immune responses from vaccination are a mismatch to a newly infecting variant, but also that the immune system fails to adequately adapt its responses to the new variant. It is stuck mounting responses to the spike protein of an extinct strain of the coronavirus, and so the immune response to any subsequent viral exposures will always be suboptimal.

Depending on the virus, original antigenic sin can occur either with infection or with vaccination. In the case of SARS-CoV-2, the evidence is that it does not occur with infection. Natural immunity is not only robust and durable, but also broad and adaptive. There is long-term immunological memory with evolution of antibody-producing cells to generate higher affinity antibodies with increased capability of neutralizing whatever variant. Even if, as with Omicron, a variant emerges that partially escapes the neutralizing capability of existing antibodies, it is likely that the immune system will update itself and start adapting to more effectively fight off the infecting strain.

Didn’t get the memo that vaccines don’t stop infection or transmission.

• Ronald McDonald House To Evict Families With Unvaccinated Young Children (PM)

The Ronald McDonald House in Vancouver British Columbia allegedly served an eviction notice on unvaccinated children with serious illness including cancer and their parents. Austin Furgason, from Kelowna, British Columbia, the father of a 4-year-old boy with leukemia who has been undergoing treatment since October, posted the video to Facebook showing a letter from Ronald McDonald House Charities – British Columbia & Yukon that made the announcement of the evictions. A GoFundMe has been set up to help the family with costs. He wrote, “All tenants, adults and children over the age of 5 who are not vaccinated are out by the end of January. How absolutely wicked and vile.” “They are evicting my son with leukemia and any other children or adults who are suffering with sick children into the snow.”

Furgason added, “The Covid cult is far more dangerous than Covid. If they will evict families with cancer, what won’t they do.” The letter in the video, which was provided to True North dated January 10, 2022, said that everyone five years and older unvaccinated against the coronavirus can no longer stay at the facilities. “Beginning January 17, 2022, everyone five years and older who are working, staying or visiting our facilities (both the House at 4567 Heather St. Vancouver and at the Family Room in Surrey Memorial Hospital) must show proof of full vaccination (two doses), in addition to completing our existing screening, unless an Accommodation has been sought and has been explicitly approved and granted by RMHC (Ronald McDonald House Charities) in writing.”

Families already in the facility have a grace period to get at least one dose of the vaccine which ends on January 31. Fergason told True North on Tuesday night, “My wife Lindsey was crying on the bed. I told her, I’m going to go ask the manager about this because this isn’t even real.” “I said, this couldn’t be real.”

Vancouver

The Ronald McDonald House in Canada will evict all tenants, adults and children over the age of five, who are not vaccinated by the end of January.

The father of a young boy with leukemia responds.

"This is some kind of crazy evil like I've never seen in my life." pic.twitter.com/MQaoegqSKo

— The Vigilant Fox (@VigilantFox) January 12, 2022

“Quebec has been a laboratory for COVID-19 restrictions and authoritarian measures.”

• Quebec Judge Removes Unvaccinated Father’s Right To Visit Child (WT)

“[…] it would normally have been in the child’s best interest to have contact with his father, but not in his best interest to have contact with him if he is unvaccinated and opposed to health measures in the current epidemiological context”, judge Jean-Sébastien Vaillancourt wrote in his December 23rd opinion. The mother and father had a previously agreed-upon visitation schedule, but their agreement was taken in front of the courts after the father asked for one additional day with his 12-year old child during the holidays. The mother opposed the additional day and asked the court to revoke entirely the father’s visitation rights after learning that he had not received the COVID-19 vaccine. The mother added that he was a “conspiracy theorist”.

The mother and the judge used to father’s opposition against the current COVID-19 restrictions against him: “excerpts from Mr.’s Facebook page produced by Ms. reveal that he does indeed appear to be opposed to vaccines and health measures”, the judge wrote. The mother argued that she lived with her boyfriend and two other young children, therefore the father endangered them by not being vaccinated and risking bringing COVID into the household. Despite the ludicrous argument, the judge agreed in his decision: “Under these circumstances, it is not in the best interests of any of the three children for Mr. to be able to exercise access to [his 12-year-old] at this time.”

In Canada and around the world, the rights of unvaccinated individuals have been slowly degrading. In most Canadian provinces, unvaccinated individuals are not allowed in restaurants or public events. Recently, the Quebec government said it is considering requiring proof of vaccination at grocery stores and pharmacies that also offer at-home delivery. The Quebec government has also announced it would put a “significant” tax on the unvaccinated, possibly leading to criminal offenses and prison if unpaid. Quebec has been a laboratory for COVID-19 restrictions and authoritarian measures. This new judgment shows that the mentality has also infiltrated the court system.

“The governments involved all knew before the shots were released that they were dangerous and would become worthless.”

• I…TOLD…. YOU…. SO! (Denninger)

We knew the *******s would not work and were harmful. We didn’t think so, we knew so, and further we knew that someone who had been infected was at least in part protected from said harm by the mechanism infection uses. I pointed all this out without having what Veritas has now published merely by deduction. We knew in September of 2020 there was a risk issue with the spike in the circulation that was not in most cases present from natural infection and we knew by December of 2020 it was singularly dangerous. It is now confirmed that DARPA and THE GOVERNMENT knew this and proceeded to purchase and deploy the shots anyway.

We also knew that there were other fingers in the pie including American ones before *****-19 was announced to exist because the transfer agreement with a US University was known to exist more than a year ago and it was executed in 2019 before *****-19 was claimed to have “emerged” in China. How can you do something that requires a thing before the second thing happens? You can’t, ergo, the government and the private organizations knew damned well ***** existed before the agreement was signed.

So now have what I’ve maintained all along is in in official government-documented form: The virus was man-made. Ecohealth tried to get funding through DARPA and was told to go to Hell because it violated the constraint on gain-of-function research. Fauci didn’t give a **** and his part of the NIH funded it. BOTH THE UNITED STATES AND CHINA created the virus; it was a joint and intentional project, not rogue actors in Wuhan or Beijing who were responsible. There were people in both China and here in the US (along with presumably other nations) who were involved. They all knew damn well what happened and all of them have lied for the last 2+ years about it. That almost-certainly includes both Trump and Biden, incidentally.

The governments involved all knew before the shots were released that they were dangerous and would become worthless. They knew that natural infection did not, in most cases, carry the same risk because the virus never gets into the bloodstream in other than severe and fatal cases but there is no way to avoid that risk with an injection. We now know this factually from clinical experience (and in fact knew in the early part of 2020) — viremia does not happen in other than severe and fatal cases and yet you can’t give someone an injection without the injected material winding up in the blood in some amount.

The governments also knew that *****-19 itself was not dangerous most of the time to healthy individuals and they knew why. It was deliberately engineered that way in an attempt, this paper alleges, as an experiment to be inoculated intentionally into bats in an attempt to see whether doing so could cut off future zoonotic events. Whether the experiment went wrong by accident or intent is not known, but that it was taking place and both our government and China knew about it, along with knowing that it should not be very dangerous to most people is now established as fact.

Wait till you meet Zuckerberg’s lawyers.

• Lawsuit Aiming To Break Up Facebook Group Meta Can Go Ahead – US Court (G.)

The US competition watchdog can proceed with a breakup lawsuit against Facebook’s owner, a federal judge has ruled. Mark Zuckerberg’s Meta, the parent of Facebook, Instagram and WhatsApp, had asked a court to dismiss an antitrust complaint brought by the Federal Trade Commission (FTC) for the second time. However, Judge James Boasberg said on Tuesday that the FTC’s revised lawsuit should be allowed to proceed. “Ultimately, whether the FTC will be able to prove its case and prevail at summary judgment and trial is anyone’s guess. The court declines to engage in such speculation and simply concludes that at this motion-to-dismiss stage, where the FTC’s allegations are treated as true, the agency has stated a plausible claim for relief,” wrote Boasberg, of the US District Court for the District of Columbia.

The FTC, under the new chair, Lina Khan, wants to force Meta to sell its photo-sharing app Instagram and its messaging service WhatsApp in one of the biggest challenges the government has brought against a tech company in decades. Its lawsuit accuses Meta of pursuing a “course of anti-competitive conduct”. The FTC originally sued Facebook during the Trump administration, and its complaint was rejected by the court in June last year. The agency filed an amended complaint in August, adding more detail on the accusation that the social media company had crushed or bought rivals. Meta’s platforms are used by 2.8 billion people around the world on a daily basis.

Boasberg said this time round the FTC had been “far more robust and detailed” in presenting its case. He wrote: “The agency has also explained that Facebook not only possesses monopoly power but that it has wilfully maintained that power through anti-competitive conduct – specifically, the acquisitions of Instagram and WhatsApp.”

Collapse

https://twitter.com/i/status/1481221337943314433

Cartels

Do you know why Third World countries don't have vaccine mandates? Here's the answer in this 60 second video sent to me by Jessica Rose. pic.twitter.com/8ZViPbCIy9

— Steve Kirsch (@stkirsch) January 13, 2022

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.