DPC Post and Montgomery, corner of Market, San Francisco post quake Apr 1906

Courtesy of Tyler Durden comes a 22,000+ word ‘essay’ from Mark Blyth and Eric Lonergan at the Council on Foreign Relations (yes, those fine folks) on how and why swaths of dough should be handed to the man in the street. But that’s not what the CFR stands for, so this calls for deconstruction, if not demolition.

It might be a really good idea if money were handed out to the real economy instead of a bunch of banks. It might be better if central banks would just leave the economy be. But that’s not what the CFRs of the planet want: they want governments and central bankers in every aspect of our lives.

They want full control. And they pretty much already have it. If they offer us free money on top, we’ll sing their praises in temples. But we’ll come to regret the whole thing more than we have any idea of. We can do just fine if they just stay out. Still, once you’ve granted people power over others, especially large numbers of them, they’ll be very reluctant to let it go.

And they’ll end up squeezing the living daylights out of you and yours. It’s how nature works. These tendencies and instincts don’t stop of their own accord, they need to be stopped from some place outside of themselves.

Print Less but Transfer More: Why Central Banks Should Give Money Directly to the People

Today, most economists agree that like Japan in the late 1990s, the global economy is suffering from insufficient spending, a problem that stems from a larger failure of governance.

Questions right off the bat: Isn’t ‘insufficient spending, whatever it may mean, a problem that stems from people not having enough to spend? What exactly does it have to do with governance? Isn’t it just as likely that governance is the cause of not having enough to spend?

And how would one define ‘insufficient spending’ to begin with? Is this where people can’t buy enough food for their children, or is it where GDP growth fails to meet economists’ models? And don’t tell me those are the same thing.

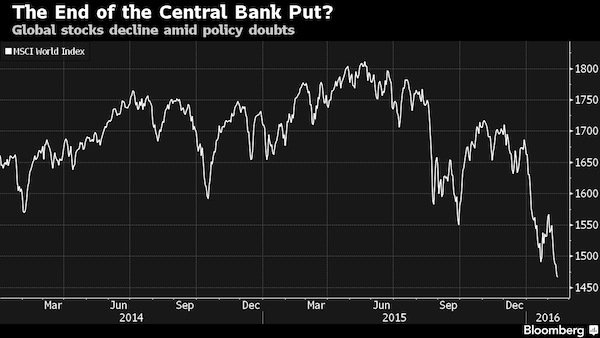

Central banks, including the U.S. Federal Reserve, have taken aggressive action, consistently lowering interest rates such that today they hover near zero. They have also pumped trillions of dollars’ worth of new money into the financial system. Yet such policies have only fed a damaging cycle of booms and busts, warping incentives and distorting asset prices, and now economic growth is stagnating while inequality gets worse.

It’s well past time, then, for U.S. policymakers – as well as their counterparts in other developed countries – to consider a version of Friedman’s helicopter drops. In the short term, such cash transfers could jump-start the economy. Over the long term, they could reduce dependence on the banking system for growth and reverse the trend of rising inequality.

First of all: why should policymakers do anything at all? Why shouldn’t they just retract from the markets other than in a regulatory sense, meant to protect the weak from the rich, and prey from predators? What role do central banks or governments have in that?

Is all we can take from this that what they’ve done is simply the wrong policy, and now they should switch to another, thought up by economists? Why do we need any such policy? Why isn’t that the first and central question? Am I missing something?

Next, note, in the following, how the authors entirely avoid the question whether governments and/or central banks SHOULD try to boost spending; for them, that’s a done deal.

In theory, governments can boost spending in two ways: through fiscal policies (such as lowering taxes or increasing government spending) or through monetary policies (such as reducing interest rates or increasing the money supply). But over the past few decades, policymakers in many countries have come to rely almost exclusively on the latter.

Presidents and prime ministers need approval from their legislatures to pass a budget; that takes time [..] Many central banks, by contrast, are politically independent and can cut interest rates with a single conference call. Moreover, there is simply no real consensus about how to use taxes or spending to efficiently stimulate the economy.

Yeah, but why would we want central banks to cut interest rates with a phone call? What good does that do anyone other than those who already make money like water?

Low interest rates reduce the cost of borrowing and drive up the prices of stocks, bonds, and homes. But stimulating the economy in this way is expensive and inefficient, and can create dangerous bubbles – in real estate, for example – and encourage companies and households to take on dangerous levels of debt.

Well, yes, low rates suck in people into borrowing for homes they can’t afford, making those same homes even less affordable. Not rocket science. And they kill those same people’s pension plans.

And that’s what the Oracle describes here:

That is precisely what happened during Alan Greenspan’s tenure as Fed chair, from 1997 to 2006 [..] Greenspan was completely honest about what he was doing. In testimony to Congress in 2002, he explained how Fed policy was affecting ordinary Americans:

“Particularly important in buoying spending [are] the very low levels of mortgage interest rates, which [encourage] households to purchase homes, refinance debt and lower debt service burdens, and extract equity from homes to finance expenditures. Fixed mortgage rates remain at historically low levels and thus should continue to fuel reasonably strong housing demand and, through equity extraction, to support consumer spending as well.”

Translation: How to suck in all the greater fools you can find, since there’s money to be squeezed out of them and at the same time they’ll believe the economy is doing fine, for a while longer.

Greenspan’s model crashed and burned when the housing market imploded in 2008. Yet nothing has really changed since then. The United States merely patched its financial sector back together and resumed the same policies that created 30 years of financial bubbles. Consider what Bernanke did with his policy of “quantitative easing.” Bernanke aimed to boost stock and bond prices in the same way that Greenspan had lifted home values. Their ends were ultimately the same: to increase consumer spending.

Really? That’s what Bernanke was shooting for? Increase consumer spending? And Greenspan too? You sure they weren’t just trying to boost bank profits? And no, they’re not even remotely alike.

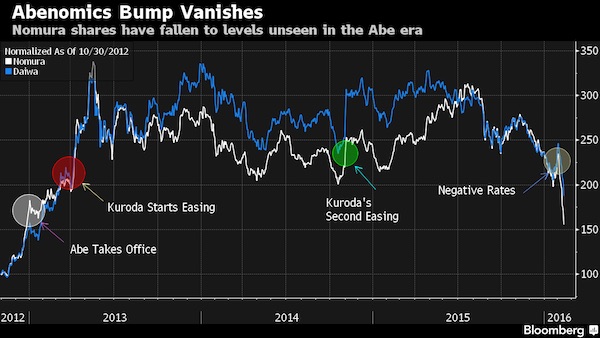

Higher asset prices have encouraged a modest recovery in spending, but at great risk to the financial system and at a huge cost to taxpayers. Yet other governments have still followed Bernanke’s lead. Japan’s central bank, for example, has tried to use its own policy of quantitative easing to lift its stock market. So far, however, Tokyo’s efforts have failed to counteract the country’s chronic underconsumption. In the eurozone, the European Central Bank has attempted to increase incentives for spending by making its interest rates negative, charging commercial banks 0.1% to deposit cash. But there is little evidence that this policy has increased spending.

I don’t think Japan followed Bernanke, it’s the other way around. That neither increased spending is obvious. That neither aimed to achieve that is less so, but it does fit the evidence (just not the PR).

Know what would be scary? if these policies HAVE increased spending, and we’re still where we are today. That would mean we’re in far deeper doo than we ever considered.

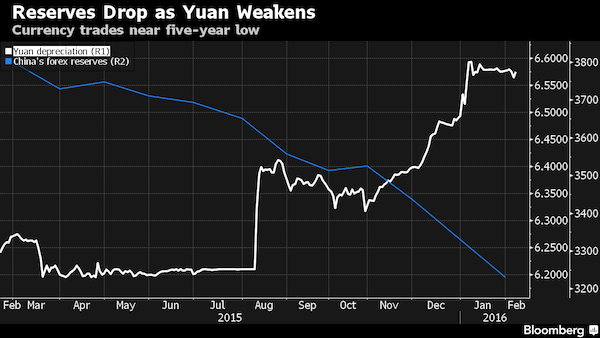

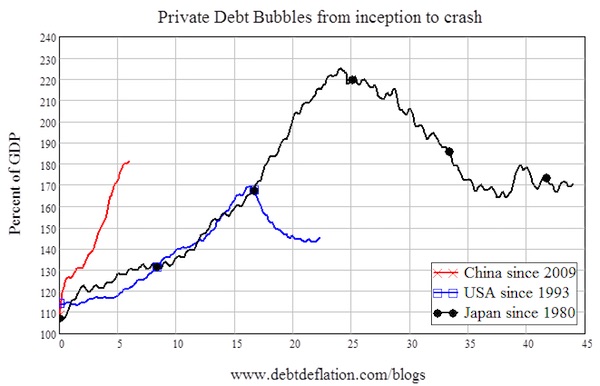

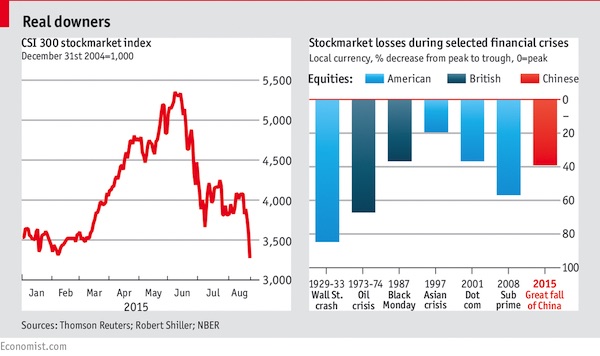

China is already struggling to cope with the consequences of similar policies, which it adopted in the wake of the 2008 financial crisis. To keep the country’s economy afloat, Beijing aggressively cut interest rates and gave banks the green light to hand out an unprecedented number of loans.

What will be the result in China? All out civil war, or just very many very bloody local battles? The jury’s still out, but things ain’t looking good.

The broader global economy, meanwhile, may have already entered a bond bubble and could soon witness a stock bubble. Housing markets around the world, from Tel Aviv to Toronto, have overheated. Many in the private sector don’t want to take out any more loans; they believe their debt levels are already too high. That’s especially bad news for central bankers: when households and businesses refuse to rapidly increase their borrowing, monetary policy can’t do much to increase their spending.

They don’t just believe it; their debts are too high. What happened to make debt a matter of faith?

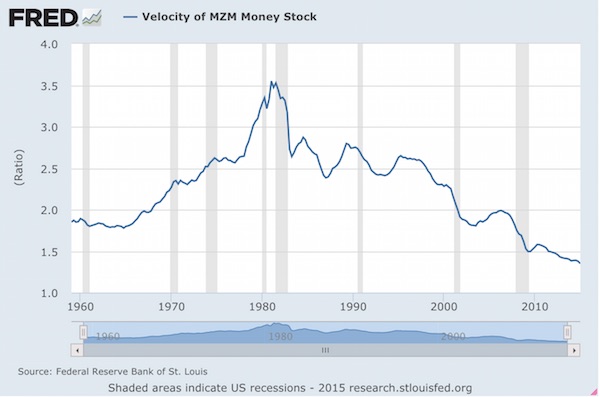

Over the past 15 years, the world’s major central banks have expanded their balance sheets by around $6 trillion, primarily through quantitative easing and other so-called liquidity operations. Yet in much of the developed world, inflation has barely budged. To some extent, low inflation reflects intense competition in an increasingly globalized economy. But it also occurs when people and businesses are too hesitant to spend their money, which keeps unemployment high and wage growth low. In the eurozone, inflation has recently dropped perilously close to zero.

Why do we want inflation (or, what these people really mean, rising prices)? What use is it? If prices rise, we have less debt? So we can create more of it? What an infantile model that looks to be, and yet everyone wants a share.

As for “low inflation occurs when people and businesses are too hesitant to spend their money”, that’s dead on (but gets lost among all the other jibber jabber): the inflation rate is directly – we’re talking umbilical cord – connected to spending, which is connected to what people actually possess, not what ‘authorities’ or banks allow them to borrow, that’s just a passing phase.

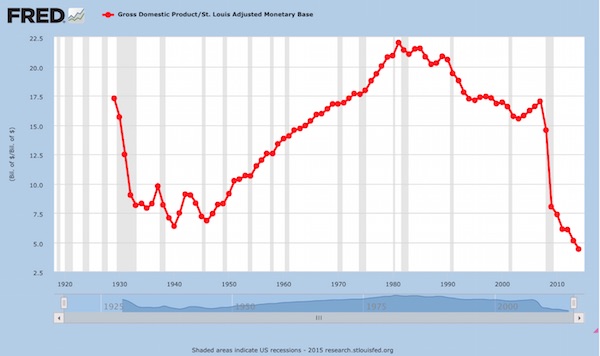

This so-called “rising prices ‘inflation'” is low because the velocity of money is at about historical lows. And it is because people have gotten a lot poorer over the past decade. Getting them deeper into debt won’t fix that. How is that still not clear?

Governments must do better. Rather than trying to spur private-sector spending through asset purchases or interest-rate changes, central banks, such as the Fed, should hand consumers cash directly. In practice, this policy could take the form of giving central banks the ability to hand their countries’ tax-paying households a certain amount of money.

“Handing consumers cash directly” hardly seems a job for a central bank, but it’s sure better than handing it to banks directly.

The government could distribute cash equally to all households or, even better, aim for the bottom 80% of households in terms of income. Targeting those who earn the least would have two primary benefits. For one thing, lower-income households are more prone to consume, so they would provide a greater boost to spending. For another, the policy would offset rising income inequality.

Now we’re talking. Though I fail to see how you could maintain a healthy economy by just handing out money. Other than a basic income for every citizen, but that’s a whole other concept altogether.

Such an approach would represent the first significant innovation in monetary policy since the inception of central banking, yet it would not be a radical departure from the status quo. Most citizens already trust their central banks to manipulate interest rates. And rate changes are just as redistributive as cash transfers. When interest rates go down, for example, those borrowing at adjustable rates end up benefiting, whereas those who save – and thus depend more on interest income – lose out.

No they’re not; “rate changes are just as redistributive as cash transfers” only for those who borrow.

[..] … critics warn that such helicopter drops could cause inflation. The transfers, however, would be a flexible tool. Central bankers could ramp them up whenever they saw fit and raise interest rates to offset any inflationary effects, although they probably wouldn’t have to do the latter: in recent years, low inflation rates have proved remarkably resilient, even following round after round of quantitative easing.

Wait, the idea evolves into something where a veiled wizard yanks a crank whenever (s)he see fit, and controls everybody’s lives that way. How scary does it get?

… the recurring financial panics of the past few decades have encouraged many lower-income economies to increase savings – in the form of currency reserves – as a form of insurance. That means they have been spending far less than they could, starving their economies of investments in [..]

When people save, they spend less than they could. This is distorted, if not perverse. We should push everyone to spend all they have, and then get them to borrow so they spend more than they have? So no-one will have any savings left, but instead be indebted? That’s an economic model?

… throughout the developed world, increased life expectancies have led some private citizens to focus on saving for the longer term (think Japan). As a result, middle-aged adults and the elderly have started spending less on goods and services. These structural roots of today’s low inflation will only strengthen in the coming years, as global competition intensifies, fears of financial crises persist, and populations in Europe and the United States continue to age. If anything, policymakers should be more worried about deflation, which is already troubling the eurozone.

There is no need, then, for central banks to abandon their traditional focus on keeping demand high and inflation on target. Cash transfers stand a better chance of achieving those goals than do interest-rate shifts and quantitative easing, and at a much lower cost. Because they are more efficient, helicopter drops would require the banks to print much less money. By depositing the funds directly into millions of individual accounts – spurring spending immediately – central bankers wouldn’t need to print quantities of money equivalent to 20% of GDP.

Ha! We’re finally getting to the core of the issue!

The transfers’ overall impact would depend on their so-called fiscal multiplier, which measures how much GDP would rise for every $100 transferred. In the United States, the tax rebates provided by the Economic Stimulus Act of 2008, which amounted to roughly 1% of GDP, can serve as a useful guide: they are estimated to have had a multiplier of around 1.3. That means that an infusion of cash equivalent to 2% of GDP would likely grow the economy by about 2.6%. Transfers on that scale – less than 5% of GDP – would probably suffice to generate economic growth.

Win-win. Right?

[..] … instead of trying to drag down the top, governments could boost the bottom. Central banks could issue debt and use the proceeds to invest in a global equity index, a bundle of diverse investments with a value that rises and falls with the market, which they could hold in sovereign wealth funds. The Bank of England, the European Central Bank, and the Federal Reserve already own assets in excess of 20% of their countries’ GDPs, so there is no reason why they could not invest those assets in global equities on behalf of their citizens.

After around 15 years, the funds could distribute their equity holdings to the lowest-earning 80% of taxpayers. The payments could be made to tax-exempt individual savings accounts, and governments could place simple constraints on how the capital could be used.

Wait! 15 years? Where did that come from? I thought you were going to give people money to spend tomorrow morning?! Moreover, how does this prevent the funds from being annihilated through falling markets? And who will manage the money? Goldman Sachs anyone?

For example, beneficiaries could be required to retain the funds as savings or to use them to finance their education, pay off debts, start a business, or invest in a home. Such restrictions would encourage the recipients to think of the transfers as investments in the future rather than as lottery winnings.

A 15 year wait would not immediately boost spending, I would venture. By the time the funds would be available, the economy could well be all but gone. Let alone the funds, you geniuses.

Best of all, the system would be self-financing. Most governments can now issue debt at a real interest rate of close to zero. If they raised capital that way or liquidated the assets they currently possess, they could enjoy a 5% real rate of return – a conservative estimate, given historical returns and current valuations. Thanks to the effect of compound interest, the profits from these funds could amount to around a 100% capital gain after just 15 years.

Say a government issued debt equivalent to 20% of GDP at a real interest rate of zero and then invested the capital in an index of global equities. After 15 years, it could repay the debt generated and also transfer the excess capital to households. This is not alchemy. It’s a policy that would make the so-called equity risk premium – the excess return that investors receive in exchange for putting their capital at risk – work for everyone.

This all, obviously, depends on the potential returns of the equities the funds are invested in. Alchemy or not. What happens when the return is negative?

As things currently stand, the prevailing monetary policies have gone almost completely unchallenged, with the exception of proposals by Keynesian economists such as Lawrence Summers and Paul Krugman, who have called for government-financed spending on infrastructure and research. Such investments, the reasoning goes, would create jobs while making the United States more competitive. And now seems like the perfect time to raise the funds to pay for such work: governments can borrow for ten years at real interest rates of close to zero. The problem with these proposals is that infrastructure spending takes too long to revive an ailing economy.

But a fund that takes 15 years to pay out does not take ‘too long to revive an ailing economy’?

[..] large, long-term investments are needed. But they shouldn’t be rushed. [..] Governments should thus continue to invest in infrastructure and research, but when facing insufficient demand, they should tackle the spending problem quickly and directly. [..]

Those who don’t like the idea of cash giveaways, however, should imagine that poor households received an unanticipated inheritance or tax rebate. An inheritance is a wealth transfer that has not been earned by the recipient, and its timing and amount lie outside the beneficiary’s control. Although the gift may come from a family member, in financial terms, it’s the same as a direct money transfer from the government. Poor people, of course, rarely have rich relatives and so rarely get inheritances – but under the plan being proposed here, they would, every time it looked as though their country was at risk of entering a recession.

So, your government hands you a gift, and then yanks it right out your hands again, with the promise to take care of it better than you ever could. How’s that different from what we already have?

Unless one subscribes to the view that recessions are either therapeutic or deserved, there is no reason governments should not try to end them if they can, and cash transfers are a uniquely effective way of doing so. [..] in contrast to interest-rate cuts, cash transfers would affect demand directly, without the side effects of distorting financial markets and asset prices.

But your guys idea is not to transfer anything to the people. You want people to spend more than they would have because there’s a pot of gold waiting for them beneath a 15 year rainbow.

They would also would help address inequality – without skinning the rich.

What, we don’t want to skin the rich?

By the way, how much money would you CFR guys want to hand out? Did you mean 20% of GDP for one year, or would you prefer 20 years? Just asking.

Read the whole thing. Hussman’s bright.

• Fed Policy and the Growing Gap Between Wall Street and Main Street (Hussman)

When the majority of Americans examine the world around them, they see a stock market at record highs and modest apparent improvement in the economy, but they also have the sense that something remains terribly wrong, and they can’t quite put their finger on it. According to a recent survey by the Federal Reserve, 40% of American families report that they are “just getting by,” and 60% of families do not have sufficient savings to cover even 3 months of expenses. Even Fed Chair Janet Yellen seemed puzzled last week by the contrast between a gradually improving unemployment rate and persistently sluggish real wage growth. We would suggest that much of this perplexity reflects the application of incorrect models of the world. Before the 15th century, people gazed at the sky, and believed that other planets would move around the Earth, stop, move backwards for a bit, and then move forward again. Their model of the world – that the Earth was the center of the universe – was the source of this confusion.

Similarly, one of the reasons that the economy seems so confusing at present is that our policy makers are dogmatically following models that have very mixed evidence in reality. Several factors contribute to the broad sense that something in the economy is not right despite exuberant financial markets and a lower rate of unemployment. In our view, the primary factor is two decades of Fed-encouraged misallocation of capital to speculative uses, coupled with the crash of two bubbles (and we suspect a third on the way). This repeated misallocation of investment resources has contributed to a thinning of our capital base that would not have occurred otherwise. The Fed has repeatedly followed a policy course that sacrifices long-term growth by encouraging speculative malinvestment out of impatience for short-term gain. Sustainable repair will only emerge from undistorted, less immediate, but more efficient capital allocation.

In recent years, the U.S. has experienced a collapse in labor participation and weak growth in labor compensation, coupled with an increasingly lopsided distribution of whatever benefits the recent economic recovery has generated. This is not well-explained by Phillips Curves or simplistic appeals to “insufficient demand,” and it is unlikely to be improved by endless monetary “stimulus” (the targets that clearly occupy the Fed’s thinking). While our economic challenges can be largely traced to more than a decade of persistent Fed-enabled misallocation of capital, most of the costs of this misallocation have fallen on labor because of a) shifting composition of labor demand that has resulted from an increasing share of international trade with countries with heavy populations of relatively unskilled labor; and b) economic features that increasingly create a “winner-take-all” distribution of economic gains.

Read more …

Because it is.

• Why “S&P 2000” Is A Fed Manufactured Mirage (Stockman)

That 4% market correction was quick and virtually painless. Not missing a beat after the market briefly tested 1900, the dip buyers came roaring back—- gunning for the 2000 marker on the S&P 500, confident that longs were not selling and that shorts had long ago been obliterated. Needless to say, bubblevision had its banners ready to crawl triumphantly across the screen. When the algos finally did print the magic 2000 number, it represented a 200% gain from the March 2009 lows. And to complete the symmetry, the S&P 500 thereby clocked in at exactly 20X LTM reported earnings based on consistent historical pension accounting. The bulls said not to worry because the market is still “cheap” – like it always is, until it isn’t. Yet now more than ever is the time to keep the champagne corked. The stock charts show an outsized skunk in the woodpile, while the economic data completely belie the sizzling gains in risk asset prices that have been racked up during the last 65 months.

Even more crucially, the Wall Street casino’s puppeteers at the Fed more or less admitted at Jackson Hole that they are utterly lost in Keynesian voodoo. To put it generously, Yellen’s speech amounted to a vaporous word cloud wrapped in incoherent double-talk. In this context, Lance Roberts recently published a stock chart that shows why “S&P 2000? is yet another signal that a giant financial train wreck is waiting to happen. For a fleeting moment six years ago, the thundering 50% plunge of the stock indices caused a crisis of confidence in the Wall Street casino that had been fostered over two decades by Greenspan and Bernanke. During that short season of trauma and disbelief, the idea briefly resonated that prosperity cannot be built on towering mountains of debt and egregious stimulation and manipulation of financial markets by the central bank.

Read more …

That’s a very benign way of putting it.

• Slowing Home Sales Show U.S. Market Lacks Momentum (Bloomberg)

The pace of new-home sales fell to the slowest in four months in July, signaling U.S. real estate lacks the vigor to propel faster growth in the economy. Purchases unexpectedly declined 2.4% to a 412,000 annualized pace, weaker than the lowest estimate of economists surveyed by Bloomberg, Commerce Department data showed today in Washington. June purchases were revised up to a 422,000 rate after a May gain that was also bigger than previously estimated. Housing has advanced in fits and starts this year as tight credit and slow wage growth kept some prospective buyers from taking advantage of historically low borrowing costs. Bigger job and income gains, along with a further slowdown in price appreciation, would help make properties more affordable. “It’s a little bit disappointing,” said Thomas Simons, an economist at Jefferies LLC and the top forecaster of new-home purchases over the past two years, according to data compiled by Bloomberg. “The new-home sales data have no traction whatsoever and don’t seem to be gaining at all.”

Read more …

You mean, like Detroit?

• US Bank Liquidity Rule Said to Exclude Municipal Bonds (Bloomberg)

Municipal bonds will be excluded from the group of easily sellable assets that banks can use to show they’re able to survive a credit crunch, according to a person familiar with the rule. Regulators including the Federal Reserve are set to approve a final liquidity rule on Sept. 3. The most recent draft bars debt issued by states and municipalities from being listed as high-quality assets that could help sustain a bank through a 30-day squeeze, said the person, speaking on condition of anonymity because the process isn’t public. Hoping to head off the kind of vulnerability seen during the 2008 credit crisis, the Fed, Office of the Comptroller of the Currency and Federal Deposit Insurance Corp. based their rule on an accord reached by the 27-nation Basel Committee on Banking Supervision. An initial version proposed last year, which called for a 2017 implementation, was toughest on banks with more than $250 billion in assets or major global reach.

The regulations could weigh on prices in the $3.7 trillion municipal bond market by giving banks less incentive to buy bonds that finance schools, roads and public works. Fitch Ratings in January said that an exclusion could lead banks to begin cutting their holdings in the market. “Over time there would be less demand for municipal securities,” said Michael Decker, a managing director who tracks municipal securities regulations for the Securities Industry and Financial Markets Association. “The result would be higher borrowing costs for state and local governments.” Wells Fargo held the most municipal bonds among the four largest U.S. banks, with $47.3 billion on June 30, according to regulatory filings. The bank didn’t say how much was included in its liquidity tally. Wells Fargo said in May that it was compliant with the international rule and was awaiting the U.S. version.

Read more …

Where is that new cabinet?

• Economic Malaise Sparks Political Crisis in France (BW)

A heavy rain fell on François Hollande as he spoke in Brittany on the 70th anniversary of the liberation of Paris on Monday, leaving the French president with a drenched raincoat and fogged-up glasses. The weather is predicted to clear, but the forecast for Hollande’s presidency is looking more and more ominous. Facing an open rebellion within their ruling Socialist Party, Hollande and Prime Minister Manuel Valls dissolved the cabinet today and said they’ll name a new government within 24 hours. They acted after Economy Minister Arnaud Montebourg accused the government over the weekend of bowing to the pro-austerity “obsessions” of German Chancellor Angela Merkel. Montebourg and others on the Socialists’ left wing are speaking out against Hollande’s plan to pare government spending and cut taxes on business—an approach that they say will further undermine France’s stagnant economy.

Montebourg didn’t give Hollande and Valls time to fire him; he announced today that he had resigned, in a speech blasting the government for “absurd” policies. Culture Minister Aurélie Filippetti said she’d also step aside, and some other ministers who’ve sided with Montebourg are likely to be replaced as well. Yet the shake-up actually could make things worse. “The reshuffle will probably worsen the internal divisions” within the ruling party, says Antonio Barroso of Teneo Intelligence in London. Although the Socialists still have a majority in Parliament, “rogue deputies could start voting against some of the upcoming economic measures.” Montebourg, meanwhile, will continue to speak out as he positions himself to run for president in 2017, Barroso predicts.

Divisions within the Socialists, along with Hollande’s record-low 17% popularity rating in an Ipsos poll conducted last week, could make it increasingly difficult for him to govern. “One wonders what majority he will have to pass laws, notably the budget,” scheduled to be voted on in the fall, Ipsos’s Brice Teinturier told the FranceTV public television network. “The unhappiness is real and powerful.” Ironically, the debate over austerity in France is exploding just as European Central Bank President Mario Draghi is softening his position on budget-cutting. Speaking in Jackson Hole, Wyo., last week, Draghi expressed concern over slow growth in the euro zone, saying it was time to move to a “more growth-friendly composition of fiscal policies.”

Read more …

• Hollande Replaces Cabinet as EU Austerity Rebellion Stirs (Bloomberg)

French President Francois Hollande’s firing of malcontent minister Arnaud Montebourg risks unleashing the ruling Socialist Party’s chief critic of budget cuts, adding to an austerity backlash stirring across Europe. Montebourg, 51, industry minister for the past two years, will not be part of the new team Hollande names today after he publicly criticized the president for “slavish” and “dogmatic” deficit reduction that he said stokes unemployment. The dismissal of a top minister underlines the political crisis confronting Hollande as he seeks to balance European Union pressure to reduce the deficit with domestic demands to revive a stalled economy. It also exposes a wider rift in Europe as Italy uses its six-month presidency of the 28-nation EU to make a stand against a German-led drive to clamp down on spending.

“The backlash against austerity has taken some time to arrive, but this is it,” Antonio Barroso, an analyst at Teneo Intelligence in London, said by phone. “Of course Montebourg has done this for his personal ambition, but his timing is good: The mood on this is shifting at the European level.” With an approval rating of just 17 percent and faced with record-high French unemployment levels, Hollande’s room for maneuver is shrinking as he slips into the second half of his five-year mandate. His purge of Montebourg from the cabinet merely moves the chief austerity critic from his side into the open, according to Arthur Goldhammer, co-chairman of the French Study Group at Harvard University’s Center for European Studies. “The breach in the Socialist Party is now an open bleeding wound,” Goldhammer said in a blog posting. “Hollande can push out Montebourg but not the problem he represents.”

Read more …

Notice how this is presented as beneficial.

• Europe Bank Cleanup Driving $1.72 Trillion of Asset Sales (Bloomberg)

Europe’s largest banks are finally putting hundreds of billions of dollars of unwanted assets up for sale amid mounting competition among buyers and regulatory pressure. A wave of deals could be a boon to the region’s economy if the banks free up capital to increase lending. Banks led by London-based Barclays and including UniCredit in Milan and Credit Suisse in Zurich, have shunted more businesses, bad loans and spoiled investments into units to be sold or wound down. Such assets jumped by 65% since the end of 2013, to more than $1.72 trillion, according to data compiled by Bloomberg. “The list of deals coming in across the asset classes and markets at this point is higher than it’s ever been,” said Jody Gunderson, a senior managing director at CarVal Investors LLC in Minneapolis. Banks are “driven by regulatory considerations to sell, but also market pressures for them to get back to the business of trying to produce good profits.”

Tougher capital rules have made some once-lucrative bond businesses less attractive, while regulatory scrutiny has pushed lenders to admit that soured loans won’t be repaid. Selling bad debts and underperforming operations frees up funds firms can use to increase lending. That’s important for European economies stuck in the doldrums six years after a credit squeeze and a raft of bank bailouts spilled over into a sovereign-debt crisis. “Stronger banks will be good for credit in Europe,” Paul Tucker, a former deputy governor of the Bank of England, said in an interview in Salzburg, Austria. “Weak banks don’t lend.” [..]

Europe’s efforts to clean up and recapitalize its biggest banks lagged behind those in the U.S., where the Treasury Department set up the $700 billion Troubled Asset Relief Program in October 2008 after the housing-market meltdown and collapse of Lehman. “The U.S. forced its banks to take money, while we in Europe thought we could sit it out, and we still are in many places,” said Hans-Peter Burghof, a professor of banking and finance at the University of Hohenheim in Stuttgart, Germany. “U.S. banks had an easier time disposing of assets, which is why they’re in a better situation today.” The $1.72 trillion of loans, shareholdings and securitized products up for sale or slated to be wound down at the 23 European banks with the largest such holdings rose from about $1.04 trillion at the end of 2013, when 21 firms disclosed such information. The assets amount to about 7.9% of their combined $21.7 trillion balance sheet. Those figures are in addition to $817.6 billion of holdings at entities backed by taxpayers in Spain, Ireland, Belgium, France, Germany, Austria and the Netherlands, which are winding down banks that have failed since the 2008 credit crunch.

Read more …

• China’s Falling Real-Estate Prices Trigger Protests, Clashes (MarketWatch)

The sharp drop in China’s housing prices has led to an outburst of anger among property owners, leading to violent clashes in some cases, according to local media reports Tuesday. In one case, scores of property owners surrounded a Shanghai sales office of Greentown China to protest the developer’s 25% cut to prices within a five-day period, according to a report on the NetEase news portal site. Protesters held banners with slogans such as “You cheated us!” and “300,000 yuan [$48,750] worth of assets evaporate within five days — years of work in vain!” according to photographs of the demonstration posted on the site.

The report quoted a sales manager from Greentown as saying that the price-cut was aimed to boost sales and “cope with competition” from rival China Vanke, the nation’s largest residential property developer. In other Chinese cities, such confrontations between buyers and developers have turned violent. In the eastern city of Jinan, banner-carrying owners blocked a street to protest another 25% price cut for a local housing development, this one conducted over the space of two weeks, according to the local-government-run Life Daily newspaper. The protesters clashed with a group of counter-protestors suspected to have been hired by local developers, injuring some of the demonstrators and forcing the police to break up the fight, 163.com said in a separate report.

Read more …

• ‘Sponsored By West IS Will Become A Nightmare For The Entire World’ (RT)

ISIS is worse than Al-Qaeda, it is not going to stay just in Syria and Iraq, they are going to come everywhere where they can create violence, havoc, and they would do anything, Imam Syed Soharwardy of Calgary told RT.

RT: The Islamic State is conducting a massive PR campaign in the Western world. How effective is it, in your opinion?

Syed Soharwardy: The ISIS campaign of recruitment in the Western world has been very successful. They have very successfully recruited hundreds and thousands of young Canadians, Europeans, and Americans. From my own city, Calgary, three young Muslim men have died in Iraq and Syria within the last two months. So it is quite disturbing and alarming, they have been very successful.

RT: The number of Westerners joining the Islamic State is growing month by month. How much danger is the UK and Europe in now that many of these jihadists have returned home?

SS: I think ISIS is a big danger to the entire world. I do not think there are only 50 British people fighting; I think more people from Britain have been fighting there. More than 100 Canadians are fighting for ISIS in Syria and Iraq, I am not sure how many Americans are there. The number is in the hundreds of thousands of people from the Western world who are fighting there, and they are not going to stay in Syria and Iraq. Al-Qaeda was created in Afghanistan and we can see now what kind of destruction and atrocities they carried out around the world. Similarly, ISIS is worse than Al-Qaeda and they are not going to stay just in Syria and Iraq, they are going to come everywhere where they can create violence, havoc, and they would do anything. My biggest concern is that they have been very successful in recruiting people from the Western world and they will be the one who will be fighting for them.

Read more …

• Turkey Struggles As ‘Lone Gatekeeper’ Against IS Recruitment (Reuters)

As Islamic State insurgents threaten the Turkish border from Syria, Turkey is struggling to staunch the flow of foreign jihadists to the militant group, having not so long ago allowed free access to those who would join its neighbor’s civil war. Thousands of foreign fighters from countries including Turkey, Britain, parts of Europe and the United States are believed to have joined the Islamist militants in their self-proclaimed caliphate, carved out of eastern Syria and western Iraq, according to diplomats and Turkish officials. The militants, who seized an air base in northeast Syria on Sunday as they surge northwards, are trying to secure control of the area bordering Turkey above the city of Raqqa, their major stronghold, in a bid to further ease the passage of foreign fighters and supplies, sources close to Islamic State said.

Some of the foreign fighters in their midst reached Syria via Turkey, entering the region on flights to Istanbul or Turkey’s Mediterranean resorts, their Western passports giving them cover among the millions of tourists arriving each month in one of the world’s most visited countries. From Turkey, crossing the 900 km (560-mile) frontier into northern Syria was long relatively straightforward, as the Turkish authorities maintained an open border policy in the early stages of the Syrian uprising to allow refugees out and support to the moderate Syrian opposition in. That policy now appears to have been a miscalculation and has drawn accusations, strongly denied by the Turkish government, that it has supported militant Islamists, inadvertently or otherwise, in its enthusiasm to help Syrian rebels topple President Bashar al-Assad. [..] “Thousands of Europeans have entered Turkey en route to Syria, and a large number of them we believe have joined extremist groups,” said one European diplomat in Ankara, describing Turkey as a “top security priority” for the EU.

Read more …

• Islamic State Now Resembles the Taliban With Oil Fields (Bloomberg)

With its reign of terror over a large population and ability to self-finance on a staggering scale, the extremist group that beheaded American journalist James Foley resembles the Taliban with oil wells. The Islamic State, which now controls an area of Iraq and Syria larger than the U.K., may be raising more than $2 million a day in revenue from oil sales, extortion, taxes and smuggling, according to U.S. intelligence officials and anti-terrorism finance experts. Unlike other extremist groups’ reliance on foreign donations that can be squeezed by sanctions, diplomacy and law enforcement, the Islamic State’s predominantly local revenue stream poses a unique challenge to governments seeking to halt its advance and undermine its ability to launch terrorist attacks that in time might be aimed at the U.S. and Europe.

“The Islamic State is probably the wealthiest terrorist group we’ve ever known,” said Matthew Levitt, a former U.S. Treasury terrorism and financial intelligence official who now is director of the counterterrorism and intelligence program at the Washington Institute for Near East Policy. “They’re not as integrated with the international financial system, and therefore not as vulnerable” to sanctions, anti-money laundering laws and banking regulations.

Read more …

What else can they say?

• Saudi Arabia And Iran Sound Petrol Price Warning For Motorists (Telegraph)

Oil superpowers Saudi Arabia and Iran have warned that recent declines in crude prices will be short lived. It is an ominous sign for motorists in the UK who were hoping that recent declines in the cost of a gallon of petrol would be sustained. Iran’s Petroleum Minister Bijan Namdar Zanganeh said on Tuesday that the current weakness in oil prices, which have resulted in Brent crude falling by almost 13pc to a low around $100 per barrel, will soon be reversed. “The downward crude oil price will not live long due to seasonal fluctuations,” Zanganeh was quoted as saying by an Iranian state news agency. Petrol prices in the UK have come down sharply in recent weeks in line with falling crude prices and a supermarket price war at the pumps.

The AA said last week that the average price of petrol across the UK was 129.71p a litre and diesel 133.74p, the lowest since February 2011. Although UK petrol and diesel are heavily taxed, prices on the forecourts do fluctuate in line with international oil prices. Zanganeh’s remarks followed comments made by al-Falih, chief executive of Saudi Aramco, the world’s largest state-owned oil company, which suggested that prices would have to remain around current levels to sustain enough investment to meet future demand. “To tap these increasingly expensive oil resources, oil prices will need to be healthy enough to attract needed investments,” al-Falih was quoted as saying at an industry conference by Reuters. “Long-term prices will be underpinned by more expensive marginal barrels.”

Read more …

People dying, California quadrupled.

• Guatemala Declares State Of Emergency Amid Central America Drought (IBT)

Guatemala’s government declared a state of emergency in the majority of its provinces, which have been affected by one of the country’s worst droughts. The dry spell has mainly affected local staples like corn and beans, and could cost the country millions of dollars in agricultural losses. President Otto Perez Molina declared a state of emergency on Monday in 16 of its 22 provinces, which are home to nearly 236,000 families, most of whom are dependent on agriculture, according to Associated Press. Molina’s announcement will have to be approved by the country’s legislature before the government can authorize emergency assistance and humanitarian aid for people in the affected regions.

“At a cabinet meeting this Monday, we signed a governmental decree that declares a State of Calamity in 17 departments as a result of the effects on agriculture of the prolonged drought,” Molina said in a tweet, according to Xinhua. In a later tweet, Molina modified the number of affected provinces to 16. Guatemala would need nearly $60 million to tackle the food shortage that the country is facing, Xinhua reported, citing the country’s agriculture minister Elmer Lopez, and added that the emergency plan is expected to be put in place by October. Although the rainy season in the Central American country typically lasts from May through October, rains have been absent since the beginning of June, Xinhua reported.

Read more …

Not nearly enough; WHO is losing control.

• WHO Seeks $430 Million For Coordinated Fight Against Ebola (Bloomberg)

More than $430 million will be needed to bring the worst Ebola outbreak on record under control, according to a draft document laying out the World Health Organization’s battle strategy. The plan sets a goal of reversing the trend in new cases within two months, and stopping all transmission in six to nine months. It requires funding by governments, development banks, the private sector and in-kind contributions, according to the document obtained by Bloomberg News.

The current outbreak, which has killed 1,427 people in Liberia, Guinea, Sierra Leone and Nigeria, may soon exceed all previous Ebola outbreaks combined. The sum now being sought is six times more than the $71 million the WHO suggested was needed in a plan published less than a month ago. There is reason to be concerned “about whether the proposed resources would be adequate,” said Barry Bloom, a public health professor at Harvard University who also questioned whether the funds would be made available fast enough, and whether the organization’s latest plan “would ensure the expertise from WHO that is needed.”

Read more …